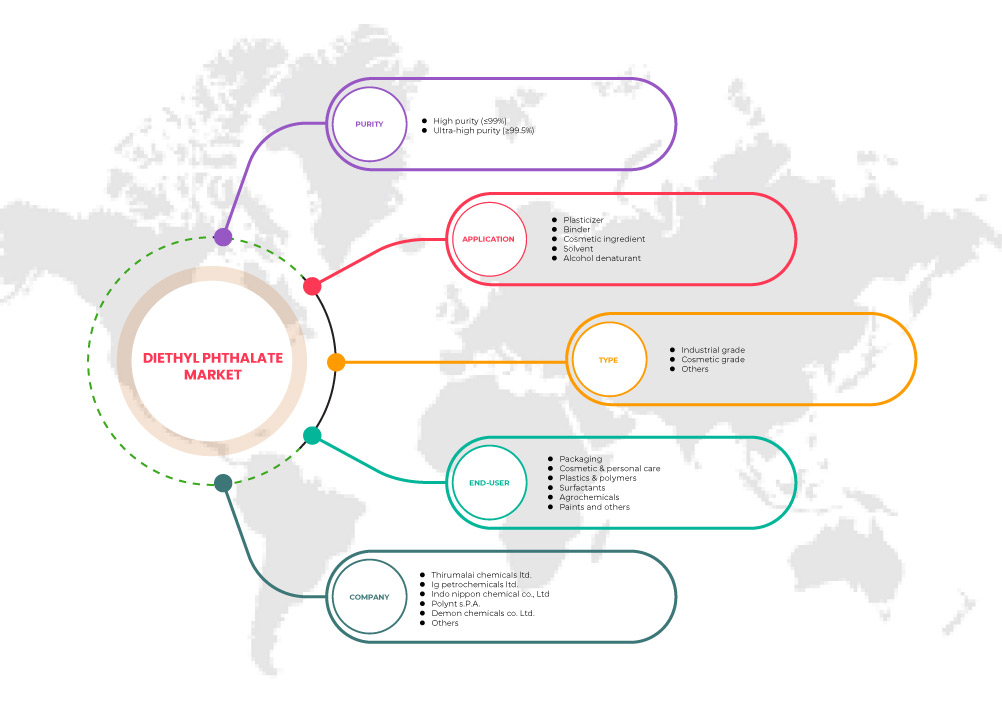

Marché du phtalate de diéthyle en Amérique du Nord, par pureté (haute pureté (≤ 99 %) et ultra haute pureté (≥ 99,5 %), type (qualité industrielle, qualité cosmétique et autres), application (plastifiant, liant, ingrédient cosmétique, solvant et dénaturant d'alcool), utilisateur final (emballage, cosmétiques et soins personnels, plastiques et polymères, tensioactifs, produits agrochimiques , peintures et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché du phtalate de diéthyle en Amérique du Nord

Le marché du phtalate de diéthyle devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,8% au cours de la période de prévision de 2023 à 2030 et devrait atteindre 126 547,12 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché du phtalate de diéthyle est la consommation croissante de cosmétiques et de produits de soins personnels des industries cosmétiques et la demande croissante de phtalate de diéthyle de l'industrie du plastique.

Le rapport sur le marché du phtalate de diéthyle fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par pureté (haute pureté (≤ 99 %) et ultra haute pureté (≥ 99,5 %), type (qualité industrielle, qualité cosmétique et autres), application (plastifiant, liant, ingrédient cosmétique, solvant et dénaturant d'alcool), utilisateur final (emballage, cosmétiques et soins personnels, plastiques et polymères, tensioactifs, produits agrochimiques, peintures et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Français Thirumalai Chemicals Ltd, IG Petrochemicals Ltd., TCI Chemicals (India) Pvt. Ltd., Indo Nippon Chemical Co., Ltd., Agro Extracts Limited., Maharashtra Aldehydes & Chemicals Ltd., MaaS Pharma Chemicals, Nishant Organics Pvt. Ltd., Spectrum Chemical, LobaChemie Pvt. Ltd., Polynt SpA, KLJ Group, Demon Chemicals Co., Ltd, PCIPL, West India Chemical International, entre autres. |

Définition du marché

Le phtalate de diéthyle est un composé chimique qui appartient à la famille des esters phtaliques et est un ester diéthylique de l'acide phtalique. Le phtalate de diéthyle est un liquide incolore, clair et légèrement plus dense que l'eau. Le phtalate de diéthyle n'est pas facilement inflammable. Dans l'industrie, le phtalate de diéthyle est également connu sous le nom de solvanol. Le phtalate de diéthyle est généralement synthétisé via les procédés Ald-Ox ou Oxo. Le phtalate de diéthyle peut également être synthétisé en faisant réagir l'anhydride phtalique avec de l'éthanol en présence d'acide sulfurique concentré comme catalyseur. La pureté du phtalate de diéthyle varie généralement de 98 % à 99,5 %.

Dynamique du marché du phtalate de diéthyle

Conducteurs

- Augmentation de la consommation de cosmétiques et de produits de soins personnels

La consommation de produits cosmétiques et de soins personnels a connu une augmentation significative en raison de l'importance croissante accordée par les individus à la santé de la peau et à l'hygiène personnelle. La jeune génération connaît l'importance des soins de la peau et a commencé à utiliser à grande échelle des cosmétiques et des produits personnels tels que des vernis à ongles, des laques pour cheveux, des lotions après-rasage, des nettoyants et des shampoings. Les produits anti-âge et de protection solaire ont une base d'utilisateurs élevée car les consommateurs sont de plus en plus conscients de leur apparence et des rayons nocifs du soleil. De plus, l'augmentation de l'économie et le développement du mode de vie ont entraîné une augmentation des dépenses consacrées aux soins personnels, en particulier chez les femmes. Ces produits cosmétiques et de soins personnels en développement se sont développés au fil des ans et à l'avenir. De plus, les avancées technologiques dans les produits personnels stimuleront le marché du phtalate de diéthyle en Amérique du Nord dans les années à venir.

- Demande croissante de phtalate de diéthyle de la part de l'industrie des plastiques et des polymères

Le phtalate de diéthyle est utilisé dans l'industrie des polymères et des plastiques pour rendre le produit final plus flexible. L'industrialisation accélérée, l'augmentation des revenus, l'évolution des modes de vie et l'application accrue de produits à base de polymères dans la vie quotidienne ont provoqué l'essor de l'industrie des polymères. Les polymères sont utilisés dans les soins de santé, l'agriculture, l'habillement, le logement, l'ameublement, l'électronique et la construction. Un plastifiant ou un assouplissant est une substance ou un matériau incorporé dans un matériau (généralement un plastique ou un élastomère) pour augmenter sa flexibilité, sa maniabilité ou sa distensibilité. Un plastifiant peut réduire la viscosité à l'état fondu, abaisser la température de la transition de second ordre ou abaisser le module d'élasticité de la masse fondue.

- Adoption des phtalates de diéthyle dans les techniques agricoles modernes

Le phtalate de diéthyle est utilisé dans les produits agrochimiques pour éloigner les insectes et les parasites des cultures. En raison de l'augmentation des attaques d'insectes sur les cultures, la demande d'insecticides augmente également. Des ingrédients inertes tels que le phtalate de diéthyle sont utilisés dans les pesticides appliqués aux animaux pour la production alimentaire. Cela devrait à son tour favoriser l'utilisation du phtalate de diéthyle dans les insecticides et les pesticides, ce qui contribue généralement à la croissance des revenus des agriculteurs.

De plus, ces esters d'acide phtalique ne se contentent pas de s'infiltrer dans les engrais et les pesticides à partir des emballages, ils sont également utilisés comme solvants dans de nombreux pesticides. Dans l'agriculture moderne, on utilise massivement des tuyaux en PVC. Pour fabriquer ces tuyaux en PVC, on utilise du phtalate de diéthyle comme plastifiant.

Opportunités

- Utilisation croissante du phtalate de diéthyle pour produire des plastifiants pour l'industrie automobile

Dans le monde d'aujourd'hui, il existe un besoin urgent de réduire le poids et la consommation de carburant. Par conséquent, les phtalates de diéthyle sont utilisés dans les plastiques automobiles comme l'un des principaux matériaux. Un tiers d'un véhicule automobile moyen est constitué de plastique, notamment les tableaux de bord, les capots de moteur, les sièges, les panneaux muraux intérieurs, les carburateurs, les poignées, l'isolation des câbles, les revêtements de caisse de camion et bien d'autres. Le polypropylène, le chlorure de polyvinyle, le polystyrène, le polycarbonate et le polyéthylène sont quelques-uns des plastiques utilisés dans la construction de véhicules automobiles. Le phtalate de diéthyle est l'un des plastifiants les plus utilisés pour fabriquer ces plastiques et polymères. Ils rendent le plastique plus flexible. De plus, le DEP est un matériau biodégradable et est également utilisé dans la fabrication de pièces automobiles et de tubes utilisés dans le traitement et le diagnostic médicaux.

- Expansion de l'industrie de l'emballage

Dans l'industrie de l'emballage, le papier bulle et les films plastiques sont quelques-uns des matériaux d'emballage utilisés. Pour fabriquer de tels matériaux, des plastifiants tels que le phtalate de diéthyle sont utilisés efficacement en grandes quantités. Le phtalate de diéthyle est utilisé comme plastifiant pour les films et feuilles en plastique d'ester de cellulose tels que les applications photographiques, les emballages sous blister et les rubans adhésifs ainsi que les articles moulés et extrudés. Par conséquent, la demande de phtalate de diéthyle augmentera dans les années à venir à mesure que l'industrie de l'emballage se développe, ce qui devrait offrir des opportunités lucratives pour la croissance du marché du phtalate de diéthyle en Amérique du Nord.

Contraintes/Défis

- Disponibilité d'alternatives aux phtalates de diéthyle sur le marché

Le phtalate de diéthyle est largement utilisé dans les cosmétiques , les biens de consommation, les plastiques et les polymères et l'industrie de l'emballage. Cependant, en raison des réglementations, des problèmes environnementaux et de santé, la disponibilité et l'utilisation de divers substituts du phtalate de diéthyle ont augmenté. L'huile de soja époxydée (ESBO) est utilisée comme plastifiant et compatibilisant avec le phtalate de diéthyle. L'ESBO a également trouvé son application comme plastifiant dans les joints des pots en verre et agit également comme stabilisateur pour diminuer la dégradation UV du chlorure de polyvinyle. De même, les trimellitates ont également été utilisés comme substitut au phtalate de diéthyle qui sont utilisés dans les revêtements muraux, les emballages et les revêtements de sol. Dans les produits cosmétiques, l'acétyl tributyle citrate est utilisé comme plastifiant dans les produits cosmétiques et dans les applications PVC.

- Risques associés à l’utilisation excessive et à long terme du phtalate de diéthyle

L'alimentation est l'une des principales sources de consommation de phtalates de diéthyle par les consommateurs. Les matériaux d'emballage alimentaire tels que les gants utilisés lors de la préparation des aliments et les outils et matériaux en plastique vinylique peuvent laisser échapper ces produits chimiques dans les aliments. Le phtalate de diéthyle, lorsqu'il est libéré dans les sources d'eau, affecte la vie marine. Par conséquent, la présence de cette toxine nocive dans les poissons et autres créatures marines nuit directement à la santé humaine lorsque ces produits de la mer sont consommés. L'utilisation de produits de soins personnels, de revêtements de sol et muraux en vinyle a tendance à libérer du phtalate de diéthyle en grandes quantités. Une telle exposition quotidienne à des produits chimiques peut avoir des effets néfastes sur la santé non seulement des adultes, mais aussi des enfants en début de croissance.

Développements récents

- En février, Spectrum Chemical Mfg. Corporation a reçu le prix GE Distinguished Partner Award pour les marchés appliqués pour la deuxième année consécutive. Ce prix aidera l'entreprise à obtenir une reconnaissance à plus grande échelle.

- En décembre, PCIPL est à nouveau recommandé pour la prestigieuse certification ISO. L'orientation processus de l'entreprise, si peu commune parmi la plupart des sociétés de distribution, nous a donné cet avantage et nous aide non seulement dans notre activité, mais aussi à obtenir la reconnaissance d'organismes professionnels de grande renommée comme TUV SUD.

Portée du marché du phtalate de diéthyle

Le marché du phtalate de diéthyle est classé en fonction du type de pureté, du type, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de pureté

- Haute pureté (≤99%)

- Pureté ultra élevée (≥ 99,5 %)

Sur la base de la pureté, le marché du phtalate de diéthyle est segmenté en haute pureté (≤ 99 %) et ultra-haute pureté (≥ 99,5 %).

Par type

- Qualité industrielle

- Qualité cosmétique

- Autres

Sur la base du type, le marché du phtalate de diéthyle est segmenté en qualité industrielle, qualité cosmétique et autres.

Application

- Plastifiant

- Liant

- Ingrédient cosmétique

- Solvant

- Dénaturant d'alcool

Sur la base de l’application, le marché du phtalate de diéthyle est segmenté en plastifiant, liant, ingrédient cosmétique, solvant et dénaturant d’alcool.

Utilisateur final

- Conditionnement

- Cosmétiques et soins personnels

- Plastiques et polymères

- Tensioactifs

- Produits agrochimiques

- Peintures

- Autres

Sur la base de l'utilisateur final, le marché du phtalate de diéthyle est segmenté en emballage, cosmétiques et soins personnels, plastiques et polymères, tensioactifs, produits agrochimiques, peintures et autres.

Analyse/perspectives régionales du marché du phtalate de diéthyle

Le marché du phtalate de diéthyle est segmenté en fonction du type de pureté, du type, des applications et de l’utilisateur final.

Les pays présents sur le marché du phtalate de diéthyle sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché du phtalate de diéthyle en raison de la demande croissante de phtalate de diéthyle comme plastifiant pour produire des plastiques pour l’industrie automobile.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du phtalate de diéthyle

Le paysage concurrentiel du marché du phtalate de diéthyle fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du phtalate de diéthyle.

Certains des principaux acteurs du marché opérant sur le marché sont Thirumalai Chemicals Ltd, IG Petrochemicals Ltd., TCI Chemicals (India) Pvt. Ltd., Indo Nippon Chemical Co., Ltd., Agro Extracts Limited., Maharashtra Aldehydes & Chemicals Ltd., MaaS Pharma Chemicals, Nishant Organics Pvt. Ltd., Spectrum Chemical, LobaChemie Pvt. Ltd., Polynt SpA, KLJ Group, Demon Chemicals Co., Ltd, PCIPL, West India Chemical International, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA DIETHYL PHTHALATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS

5.1.2 RISING DEMAND FOR DIETHYL PHTHALATE FROM THE PLASTIC & POLYMER INDUSTRY

5.1.3 ADOPTION OF DIETHYL PHTHALATES IN MODERN AGRICULTURAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HAZARDS ASSOCIATED WITH EXCESSIVE AND LONG-TERM USE OF DIETHYL PHTHALATE

5.2.2 STRICT REGULATIONS REGARDING THE TOXICITY OF DIETHYL PHTHALATE

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF DIETHYL PHTHALATE TO PRODUCE PLASTICIZERS FOR THE AUTOMOTIVE INDUSTRY

5.3.2 EXPANSION OF THE PACKAGING INDUSTRY

5.4 CHALLENGE

5.4.1 AVAILABILITY OF ALTERNATIVES TO DIETHYL PHTHALATES IN THE MARKET

6 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY

6.1 OVERVIEW

6.2 HIGH PURITY (≤99%)

6.3 ULTRA HIGH PURITY (≥99.5%)

7 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE

7.1 OVERVIEW

7.2 INDUSTRIAL GRADE

7.3 COSMETIC GRADE

7.4 OTHERS

8 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PLASTICIZER

8.3 BINDER

8.4 COSMETIC INGREDIENT

8.5 SOLVENT

8.6 ALCOHOL DENATURANT

9 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER

9.1 OVERVIEW

9.2 PACKAGING

9.3 COSMETIC & PERSONAL CARE

9.3.1 COSMETIC & PERSONAL CARE, BY TPE

9.3.1.1 BATH PRODUCTS

9.3.1.2 PERFUMES

9.3.1.3 HAIR CARE

9.3.1.4 NAIL ENAMEL & REMOVERS

9.3.1.5 SKIN CARE PRODUCTS

9.3.1.6 PERSONAL HYGIENE

9.3.1.7 OTHERS

9.4 PLASTICS & POLYMERS

9.5 SURFACTANTS

9.6 AGROCHEMICALS

9.7 PAINTS

9.8 OTHERS

10 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 AWARDS

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 THIRUMALAI CHEMICALS LTD.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 I G PETROCHEMICALS LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 INDO NIPPON CHEMICAL CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 POLYNT S.P.A.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 DEMON CHEMICALS CO. LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 AGRO EXTRACTS LIMITED.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 KLJ GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 LOBACHEMIE PVT. LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAHARASHTRA ALDEHYDES & CHEMICALS LTD.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 MAAS PHARMA CHEMICALS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 NISHANT ORGANICS PVT. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

13.12 PCIPL

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

13.13 SPECTRUM CHEMICAL

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 TCI CHEMICALS (INDIA) PVT. LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATES

13.15 WEST INDIA CHEMICAL INTERNATIONAL

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ACYCLIC POLYCARBOXYLIC ACIDS, THEIR ANHYDRIDES, HALIDES, PEROXIDES, PEROXYACIDS AND THEIR HALOGENATED; HS CODE – 291719 (USD THOUSAND)

TABLE 3 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 5 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 7 NORTH AMERICA ULTRA HIGH PURITY (≥99.5%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA HIGH PURITY (≤99%) IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA INDUSTRIAL GRADE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA COSMETIC GRADEIN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PLASTICIZER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA BINDER IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA COSMETIC INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SOLVENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ALCOHOL DENATURANT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PACKAGING IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA PLASTICS & POLYMERS INGREDIENT IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SURFACTANTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA AGROCHEMICALS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA PAINTS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN DIETHYL PHTHALATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 30 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 32 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 38 U.S. DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 44 CANADA DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (USD THOUSAND)

TABLE 49 MEXICO DIETHYL PHTHALATE MARKET, BY PURITY, 2021-2030 (TONS)

TABLE 50 MEXICO DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO DIETHYL PHTHALATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO DIETHYL PHTHALATE MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 53 MEXICO COSMETIC & PERSONAL CARE IN DIETHYL PHTHALATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA DIETHYL PHTHALATE MARKET

FIGURE 2 NORTH AMERICA DIETHYL PHTHALATE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DIETHYL PHTHALATE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DIETHYL PHTHALATE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DIETHYL PHTHALATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA DIETHYL PHTHALATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA DIETHYL PHTHALATEMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA DIETHYL PHTHALATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA DIETHYL PHTHALATE MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA DIETHYL PHTHALATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA DIETHYL PHTHALATEMARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA DIETHYL PHTHALATE MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMPTION OF COSMETICS AND PERSONAL CARE PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA DIETHYL PHTHALATE MARKET IN THE FORECAST PERIOD

FIGURE 15 HIGH PURITY (≤99%) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DIETHYL PHTHALATE MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA DIETHYL PHTHALATE MARKET

FIGURE 17 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY, 2022

FIGURE 18 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY END-USER, 2022

FIGURE 21 NORTH AMERICA DIETHYL PHTHALATE MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA DIETHYL PHTHALATE MARKET: BY PURITY (2023-2030)

FIGURE 26 NORTH AMERICA DIETHYL PHTHALATE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.