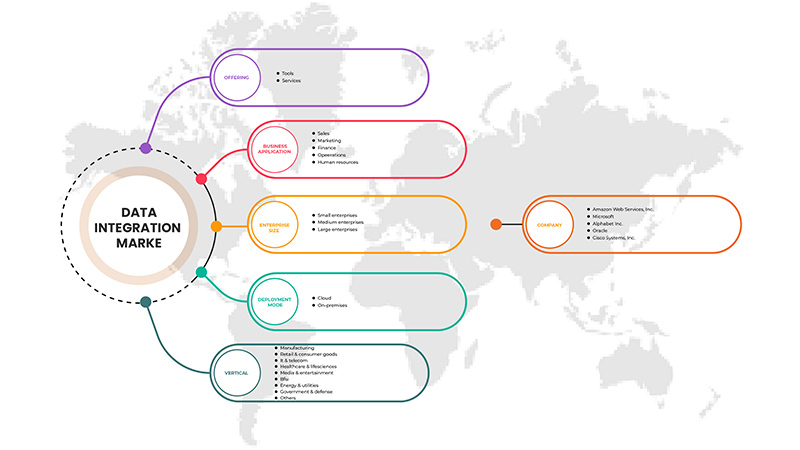

Marché de l'intégration de données en Amérique du Nord, par offre (outils, services), application métier (ventes, marketing, finances, opérations, ressources humaines), taille de l'entreprise (petite entreprise, moyenne entreprise, grande entreprise), mode de déploiement (sur site, cloud), vertical (fabrication, santé et sciences de la vie, informatique et télécommunications, médias et divertissement, vente au détail et biens de consommation, BFSI , énergie et services publics, gouvernement et défense, et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché

Le programme de conformité de l'intégration des données est un ensemble de réglementations ou de règles qu'une institution financière, des entreprises telles que des grandes, des petites et des moyennes entreprises doivent suivre pour éviter la perte de données. Les divers problèmes liés à l'intégration des données obligent le gouvernement et diverses autorités à renforcer la réglementation en raison des menaces liées aux données liées au transfert de données. Alors que l'intégration des données augmente l'utilisation de l'intégration de données hybride, les réglementations et la conformité de plus en plus strictes liées à l'intégration des données augmentent également la demande d'intégration de données sur le marché. Cependant, le coût élevé des logiciels d'intégration de données freine la croissance du marché.

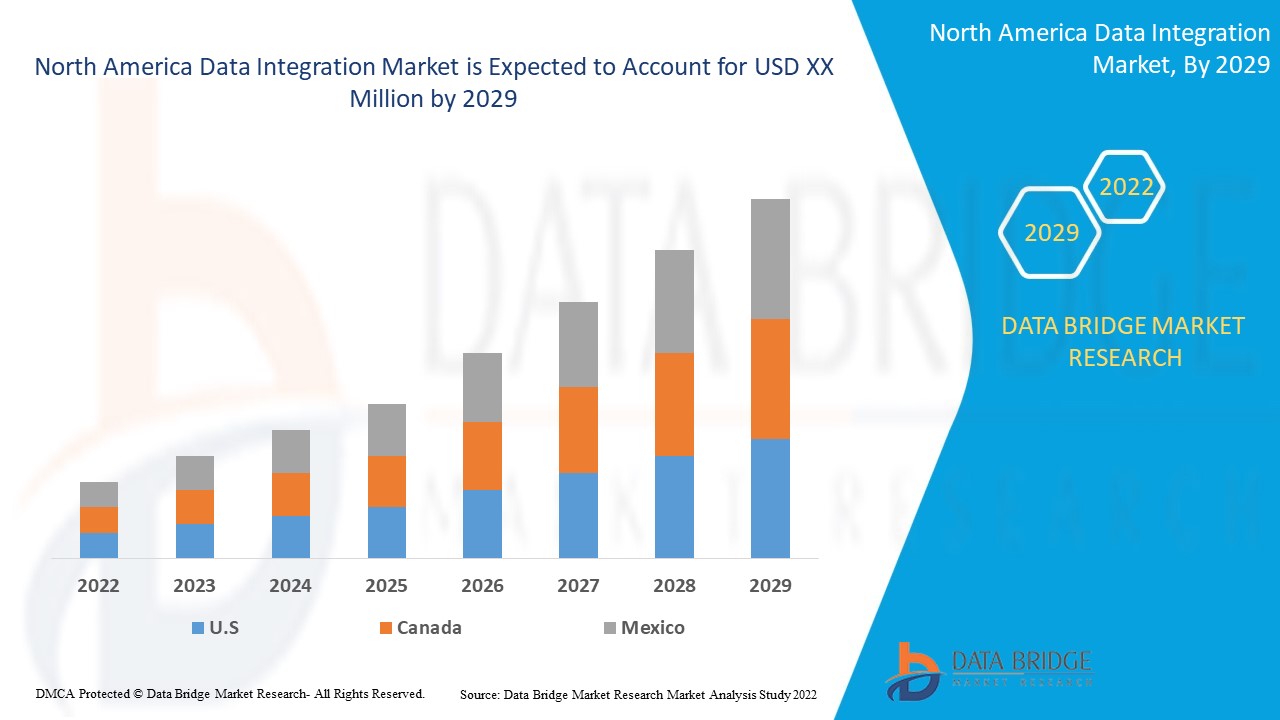

Data Bridge Market Research analyse que le marché de l'intégration de données croîtra à un TCAC de 15,1 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par offre (outils, services), application métier (ventes, marketing, finances, opérations, ressources humaines), taille de l'entreprise (petite entreprise, moyenne entreprise, grande entreprise), mode de déploiement (sur site, cloud), secteur vertical (fabrication, santé et sciences de la vie, informatique et télécommunications, médias et divertissement, vente au détail et biens de consommation, BFSI, énergie et services publics, gouvernement et défense, et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation (filiale de Hitachi, Ltd.), Salesforce, Inc., Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. entre autres |

Définition du marché

L'intégration des données est le processus de combinaison de données provenant de différentes sources en une vue unique et unifiée. L'intégration commence par le processus d'ingestion et comprend des étapes telles que le nettoyage, le mappage ETL et la transformation. L'intégration des données permet en fin de compte aux outils d'analyse de produire des informations commerciales efficaces et exploitables. Les organisations s'orientent de plus en plus vers les données, mais les sources de données sont plus distribuées et fragmentées que jamais. En connectant les systèmes contenant des données précieuses et en les intégrant dans tous les services et sites, les organisations sont en mesure d'obtenir un stockage et un accès aux données en un seul point, ainsi que la disponibilité et la qualité des données.

Dynamique du marché de l'intégration des données

Conducteurs

- Utilisation croissante de l’intégration de données hybrides

L'intégration de données hybrides est utilisée depuis peu en raison de sa capacité à connecter des applications, des fichiers de données et des partenaires commerciaux sur des systèmes cloud et sur site. L'utilisation de données hybrides pour l'intégration de données a pour objectif de se concentrer principalement sur l'élément du modèle de déploiement. L'intégration de données est devenue une solution majeure de transfert de réseau et de données de la source à la destination. Chaque année, des milliards de dollars sont transférés et ces données sont protégées par un logiciel d'intégration de données implémenté dans les systèmes.

- Des réglementations et une conformité de plus en plus strictes en matière d'intégration des données

Le programme de conformité de l'intégration des données est un ensemble de réglementations ou de règles qu'une institution financière, des entreprises telles que les grandes, les petites et les moyennes entreprises doivent suivre pour éviter la perte de données. Les divers problèmes liés à l'intégration des données obligent le gouvernement et diverses autorités à renforcer la réglementation en raison des menaces pesant sur les données liées au transfert de données.

- Demande croissante d'outils et de logiciels d'intégration de données

Les institutions financières, les technologies de l'information, les hôpitaux, les télécommunications, l'armée et le secteur de la défense doivent quotidiennement transférer des données qui nécessitent une protection accrue en raison de la confidentialité, de la sensibilité et de la confidentialité des données. Les outils d'intégration de données utilisés dans les institutions financières exploitent la puissance des données en mouvement pour offrir des expériences client personnalisées, atténuer de manière proactive les cyber-risques et favoriser la conformité réglementaire.

Des outils tels que les lacs de données sont utilisés dans l'intégration des données pour l'analyse en temps réel et la détection des fraudes. Les données sont intégrées dans des services cloud modernes pour la visualisation et la création de rapports sur les données. Ces outils aident également à analyser les transactions en temps réel pour détecter les transactions frauduleuses et envoyer des notifications.

- Demande croissante d'intégration basée sur les applications

L'intégration basée sur les applications est devenue une partie importante des systèmes d'intégration de données. Les secteurs tels que la banque, la médecine, l'informatique et les télécommunications, la fabrication, la vente au détail et les biens de consommation, les médias et le divertissement préfèrent les méthodes d'intégration basées sur les applications afin de garder un œil sur les transactions suspectes et les délits financiers des clients. Les logiciels d'intégration d'applications combinent et améliorent les flux de données entre deux applications logicielles distinctes. Les entreprises utilisent souvent des logiciels d'intégration d'applications pour créer un pont entre une nouvelle application cloud et une ancienne application hébergée sur site, permettant à un large éventail d'applications conçues indépendamment de fonctionner ensemble.

Opportunités

-

Adoption croissante de l'intégration des données par divers services tels que les opérations et les finances

L'intégration de données est un système autonome ou semi-autonome qui analyse les données ou le contenu à l'aide de techniques et d'outils sophistiqués, ce qui est assez différent de la veille économique traditionnelle. Ces analyses permettent une analyse plus approfondie avec laquelle le système prédit et génère des recommandations. Les analyses avancées dans les solutions d'intégration de données peuvent jouer un rôle essentiel dans la détection des activités de transaction, le stockage de données provenant de différentes sources, entre autres. De plus, les analyses avancées peuvent jouer un rôle essentiel dans la surveillance avancée des transactions.

-

Intégration de l'IA et du ML dans le développement de solutions d'intégration de données

L'intégration des données est devenue une méthode de transfert de données très importante pour l'analyse des données par les entreprises afin de tirer des conclusions significatives à partir des données brutes historiques. Selon l'enquête, l'intégration des données est utilisée par 65 % des entreprises dans le monde. Il existe divers autres problèmes tels que la perte de données, la distorsion du signal, la capacité de stockage des plateformes utilisées pour l'intégration des données.

Retenue/Défi

- Coût élevé du logiciel d'intégration de données

L'intégration des données liées à la solution logicielle doit garantir qu'un appareil installé avec un logiciel d'intégration différent est capable de détecter les activités suspectes associées au transfert de virus impliquant des données, à la fraude et au financement du terrorisme et de signaler aux autorités compétentes. Une solution logicielle d'intégration de données ne doit pas seulement se concentrer sur l'efficacité des systèmes internes, mais doit également se concentrer sur les capacités de détection. Les composants clés des systèmes d'intégration de données sont l'atténuation des données, l'intégration des applications d'entreprise, la gestion des données de base et l'agrégation des données. La conception de systèmes d'intégration de données peut être une tâche difficile car la complexité impliquée dans la conception de plusieurs modules est très élevée.

Impact du COVID-19 sur le marché de l'intégration des données

La période de confinement et de verrouillage pendant la crise du COVID-19 a montré l'importance d'une connectivité Internet fiable et de bonne qualité dans les grandes industries. Une connexion à haut débit dans les grandes industries a ouvert la possibilité d'un télétravail efficace, de maintenir des habitudes de divertissement et de garder des contacts étroits. Le trafic de données dans tous les réseaux a considérablement augmenté pendant la période de pandémie. Le COVID-19 a augmenté la demande d'intégration de données sur le marché. Les réseaux fixes à large bande ont gagné en popularité pour maintenir le monde connecté. Le trafic a augmenté de 30 à 40 % du jour au lendemain, principalement grâce au travail dans les grandes industries (vidéoconférence et collaboration, VPN), à l'apprentissage dans les grandes industries (vidéoconférence et collaboration, plateformes d'apprentissage en ligne) et au divertissement (jeux en ligne, streaming vidéo, médias sociaux). De plus, l'offre limitée et la pénurie de logiciels ont considérablement affecté l'intégration des données sur le marché. Le flux de nouveaux équipements, tels que les ordinateurs, les serveurs, les commutateurs et les équipements sur site client (CPE) s'est complètement arrêté ou est retardé, avec des délais de livraison allant jusqu'à 12 mois pour différents articles.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans l'intégration des données. Grâce à cela, les entreprises apporteront au marché une intégration avancée des données.

Par exemple,

- En juin 2022, Salesforce étend Mulesoft, une solution unifiée d'automatisation, d'intégration et d'API pour automatiser facilement les flux de travail. Cette solution a été étendue afin d'intégrer des systèmes et des données complexes. Cette extension de la solution a eu lieu pour faciliter la standardisation des processus d'automatisation et d'intégration

Ainsi, le COVID-19 a augmenté la demande d’intégration de données sur le marché, mais l’offre limitée et la pénurie de logiciels ont considérablement affecté le processus d’intégration de données sur le marché.

Développements récents

- En juin 2022, TIBCO Software Inc. a relancé sa plateforme TIBCO Analytics Forum (TAF) pour sa base de consommateurs. La plateforme aidera les entreprises à se connecter, à s'unifier et à prédire en toute confiance les résultats commerciaux. La plateforme contribuera à l'intégration des données et à l'expansion de leur portefeuille de solutions. Cela attirera davantage de nouveaux clients pour l'entreprise

- En mai 2022, Informatica Inc. a lancé la plateforme Intelligent Data Management Cloud (IDMC) pour les services financiers afin de dynamiser le cycle de vie des données des entreprises. La solution a été lancée par l'entreprise pour améliorer l'expérience client en termes de données. L'entreprise pourra élargir son portefeuille de solutions pour de nouveaux clients

Portée du marché mondial de l'intégration des données

Le marché de l’intégration de données est segmenté en fonction de l’offre, de l’application métier, de la taille de l’entreprise, du mode de déploiement et du secteur vertical.

Offre

- Outils

- Services

Sur la base de l’offre, le marché mondial de l’intégration de données est segmenté en outils et services.

Demande d'entreprise

- Ventes

- Commercialisation

- Opérations

- Finance

- Ressources humaines

Sur la base des applications commerciales, le marché mondial de l’intégration de données est segmenté en ventes, marketing, opérations, finances et ressources humaines.

Taille de l'entreprise

- Grandes entreprises

- Moyennes entreprises

- Petites entreprises

Sur la base de la taille de l’entreprise, le marché mondial de l’intégration de données est segmenté en grandes entreprises, moyennes entreprises et petites entreprises.

Mode de déploiement

- Nuage

- Sur site

Sur la base du modèle de déploiement, le marché mondial de l’intégration de données est segmenté en cloud et sur site.

Verticale

- Informatique et Télécom

- Santé et sciences de la vie

- Commerce de détail et biens de consommation, médias et divertissement

- BFSI, Énergie et services publics

- Gouvernement et défense

- Autres

Sur la base de la verticale, le marché mondial de l'intégration de données est segmenté en informatique et télécommunications, santé et sciences de la vie, vente au détail et biens de consommation, médias et divertissement, BFSI, énergie et services publics, gouvernement et défense, et autres.

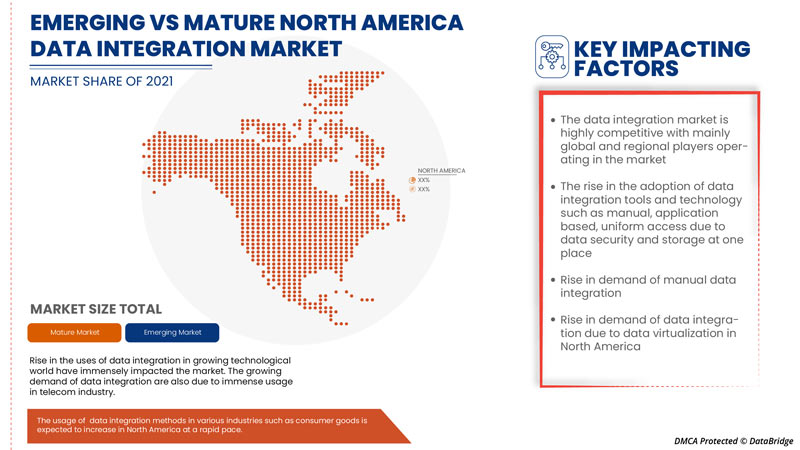

Marché de l'intégration des données en Amérique du Nord

Le marché de l’intégration de données est analysé et des informations et tendances du marché sont fournies sur la base de l’offre, de l’application commerciale, de la taille de l’entreprise, du mode de déploiement et du secteur vertical comme référencé ci-dessus.

Le marché de l’intégration de données en Amérique du Nord couvre des pays tels que les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché de l'intégration de données en Amérique du Nord, car l'intégration de données hybride est utilisée ces derniers temps en raison de sa capacité à connecter des applications, des fichiers de données et des partenaires commerciaux sur des systèmes cloud et sur site. Le programme de conformité de l'intégration des données est également un ensemble de réglementations ou de règles qu'une institution financière, des entreprises telles que les grandes entreprises, les petites entreprises et les moyennes entreprises doivent suivre pour éviter la perte de données et la croissance du pays sur le marché de l'intégration de données en Amérique du Nord.

La section pays du rapport sur le marché de l'intégration des données fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'intégration des données

Le paysage concurrentiel du marché de l'intégration de données fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché de l'intégration de données.

Certains des principaux acteurs opérant sur le marché de l'intégration de données en Amérique du Nord sont Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation (filiale de Hitachi, Ltd.), Salesforce, Inc. , Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DATA INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 CASE STUDIES

4.2.1 ARCHITECTURE CREATION & VALIDATION

4.3 TECHNOLOGICAL TRENDS

4.3.1 RISE OF HYBRID INTEGRATION

4.3.2 BLOCKCHAIN IN DATA AND ANALYTICS

4.3.3 APIS AT THE CENTER STAGE OF BUSINESS PERFORMANCE

4.3.4 PROLIFERATION OF IOT

4.4 VALUE CHAIN FOR NORTH AMERICA DATA INTEGRATION MARKET

5 REGULATIONS

5.1 OVERVIEW

5.1.1 EUROPE

5.1.2 CHINA

5.1.3 INDIA

5.1.4 AUSTRALIA

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE USE OF HYBRID DATA INTEGRATION

7.1.2 INCREASE IN THE STRINGENT REGULATIONS AND COMPLIANCE RELATED TO DATA INTEGRATION

7.1.3 GROWTH IN THE DEMAND FOR DATA INTEGRATION TOOLS AND SOFTWARE

7.1.4 GROWTH IN THE DEMAND FOR APPLICATION-BASED INTEGRATION

7.1.5 RISE IN BIG DATA AND CLOUD COMPUTING TECHNOLOGIES

7.2 RESTRAINTS

7.2.1 HIGH DATA INTEGRATION SOFTWARE COST

7.2.2 LACK OF STORAGE CAPACITY IN CLOUD

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE ADOPTION OF DATA INTEGRATION BY VARIOUS DEPARTMENTS SUCH AS OPERATION AND FINANCE

7.3.2 INTEGRATION OF AI AND ML IN DEVELOPING DATA INTEGRATION SOLUTIONS

7.4 CHALLENGES

7.4.1 HIGH COMPLEXITY INVOLVED IN DATA INTEGRATION

7.4.2 DATA THREATS INVOLVED IN DATA INTEGRATION SOFTWARE

8 NORTH AMERICA DATA INTEGRATION MARKET, BY OFFERING

8.1 OVERVIEW

8.2 TOOLS

8.3 SERVICES

8.3.1 PROFESSIONAL SERVICES

8.3.2 MANAGED SERVICES

9 NORTH AMERICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION

9.1 OVERVIEW

9.2 SALES

9.3 MARKETING

9.4 FINANCE

9.5 OPERATIONS

9.6 HUMAN RESOURCES

10 NORTH AMERICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISE

10.3 MEDIUM ENTERPRISE

10.4 SMALL ENTERPRISE

11 NORTH AMERICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE

11.1 OVERVIEW

11.2 CLOUD

11.3 ON-PREMISES

12 NORTH AMERICA DATA INTEGRATION MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 IT & TELECOM

12.2.1 TOOLS

12.2.2 SERVICES

12.2.2.1 PROFESSIONAL SERVICES

12.2.2.2 MANAGED SERVICES

12.3 MANUFACTURING

12.3.1 TOOLS

12.3.2 SERVICES

12.3.2.1 PROFESSIONAL SERVICES

12.3.2.2 MANAGED SERVICES

12.4 HEALTHCARE & LIFESCIENCES

12.4.1 TOOLS

12.4.2 SERVICES

12.4.2.1 PROFESSIONAL SERVICES

12.4.2.2 MANAGED SERVICES

12.5 MEDIA & ENTERTAINMENT

12.5.1 TOOLS

12.5.2 SERVICES

12.5.2.1 PROFESSIONAL SERVICES

12.5.2.2 MANAGED SERVICES

12.6 RETAIL & CONSUMER GOODS

12.6.1 TOOLS

12.6.2 SERVICES

12.6.2.1 PROFESSIONAL SERVICES

12.6.2.2 MANAGED SERVICES

12.7 ENERGY & UTILITIES

12.7.1 TOOLS

12.7.2 SERVICES

12.7.2.1 PROFESSIONAL SERVICES

12.7.2.2 MANAGED SERVICES

12.8 BFSI

12.8.1 TOOLS

12.8.2 SERVICES

12.8.2.1 PROFESSIONAL SERVICES

12.8.2.2 MANAGED SERVICES

12.9 GOVERNMENT & DEFENSE

12.9.1 TOOLS

12.9.2 SERVICES

12.9.2.1 PROFESSIONAL SERVICES

12.9.2.2 MANAGED SERVICES

12.1 OTHERS

12.10.1 TOOLS

12.10.2 SERVICES

12.10.2.1 PROFESSIONAL SERVICES

12.10.2.2 MANAGED SERVICES

13 NORTH AMERICA DATA INTEGRATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DATA INTEGRATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AMAZON WEB SERVICES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ALPHABET INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 ORACLE CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 INDUSTRIAL SOLUTION PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 CISCO SYSTEMS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTION PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIAN CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADEPTIA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DENODO TECHNOLOGIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 HITACHI VANTARA CORPORATION (SUBSIDIARY OF HITACHI, LTD.)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 IBM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SOLUTION PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 INFORMATICA INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 KPMG LLP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 PRECISELY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 SALESFORCE, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 SAS INSTITUTE INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT & SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SAP SE

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SERVICES PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SOFTWARE AG

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SNAPLOGIC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 TALEND

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TIBCO SOFTWARE INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA TOOLS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SALES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MARKETING IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA FINANCE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OPERATIONS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HUMAN RESOURCES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA LARGE ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEDIUM ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SMALL ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CLOUD IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ON-PREMISES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA IT & TELECOM IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA MANUFACTURING IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BFSI IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA DATA INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.S. DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 76 U.S. DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 77 U.S. IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.S. MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.S. ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.S. BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 CANADA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 100 CANADA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 101 CANADA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 CANADA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CANADA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CANADA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 CANADA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 CANADA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 CANADA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 MEXICO DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 125 MEXICO IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA DATA INTEGRATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DATA INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DATA INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DATA INTEGRATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DATA INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DATA INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DATA INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DATA INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DATA INTEGRATION MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DATA INTEGRATION MARKET: SEGMENTATION

FIGURE 11 RISE IN DEMAND FOR DATA INTEGRATION TOOLS IS EXPECTED TO DRIVE NORTH AMERICA DATA INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TRANSCEIVERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA DATA INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA DATA INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA DATA INTEGRATION MARKET

FIGURE 15 NORTH AMERICA DATA INTEGRATION MARKET: BY OFFERING, 2021

FIGURE 16 NORTH AMERICA DATA INTEGRATION MARKET: BY BUSINESS APPLICATION, 2021

FIGURE 17 NORTH AMERICA DATA INTEGRATION MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 18 NORTH AMERICA DATA INTEGRATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 NORTH AMERICA DATA INTEGRATION MARKET: BY VERTICAL, 2021

FIGURE 20 NORTH AMERICA DATA INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA DATA INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA DATA INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA DATA INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA DATA INTEGRATION MARKET: BY OFFERING (2022-2029)

FIGURE 25 NORTH AMERICA DATA INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.