North America Data Center Cooling Market

Taille du marché en milliards USD

TCAC :

%

USD

18.25 Billion

USD

56.62 Billion

2024

2032

USD

18.25 Billion

USD

56.62 Billion

2024

2032

| 2025 –2032 | |

| USD 18.25 Billion | |

| USD 56.62 Billion | |

|

|

|

|

Segmentation du marché du refroidissement des centres de données en Amérique du Nord, par type (centre de données d'entreprise, centre de données Edge), solutions (climatisation, unités de refroidissement, tours de refroidissement, système économiseur, système de refroidissement liquide, climatisation de salle informatique (CRAC) et traitement d'air de salle informatique (CRAH), unités de contrôle, autres), service (conseil et formation, installation et déploiement, maintenance et assistance), type de refroidissement (refroidissement par salle, refroidissement par rack, refroidissement par rangée), taille de l'organisation (grande taille d'organisation, petite et moyenne organisation) - Tendances et prévisions de l'industrie jusqu'en 2032.

Analyse du marché du refroidissement des centres de données

Ces dernières années, le refroidissement des centres de données a été largement utilisé par les opérateurs de centres de données en raison de ses nombreuses caractéristiques telles que la nature rentable, économe en énergie et respectueuse de l'environnement. On constate une augmentation de l'utilisation des réseaux 4G LTE en raison de l'augmentation du nombre de centres de données. L'augmentation du nombre d'installations de centres de données favorise la croissance rapide du refroidissement des centres de données dans le monde entier. En outre, l'évolution continue vers les services cloud génère une demande de technologie de refroidissement respectueuse de l'environnement, ce qui stimulera la demande de refroidissement des centres de données

Taille du marché du refroidissement des centres de données en Amérique du Nord

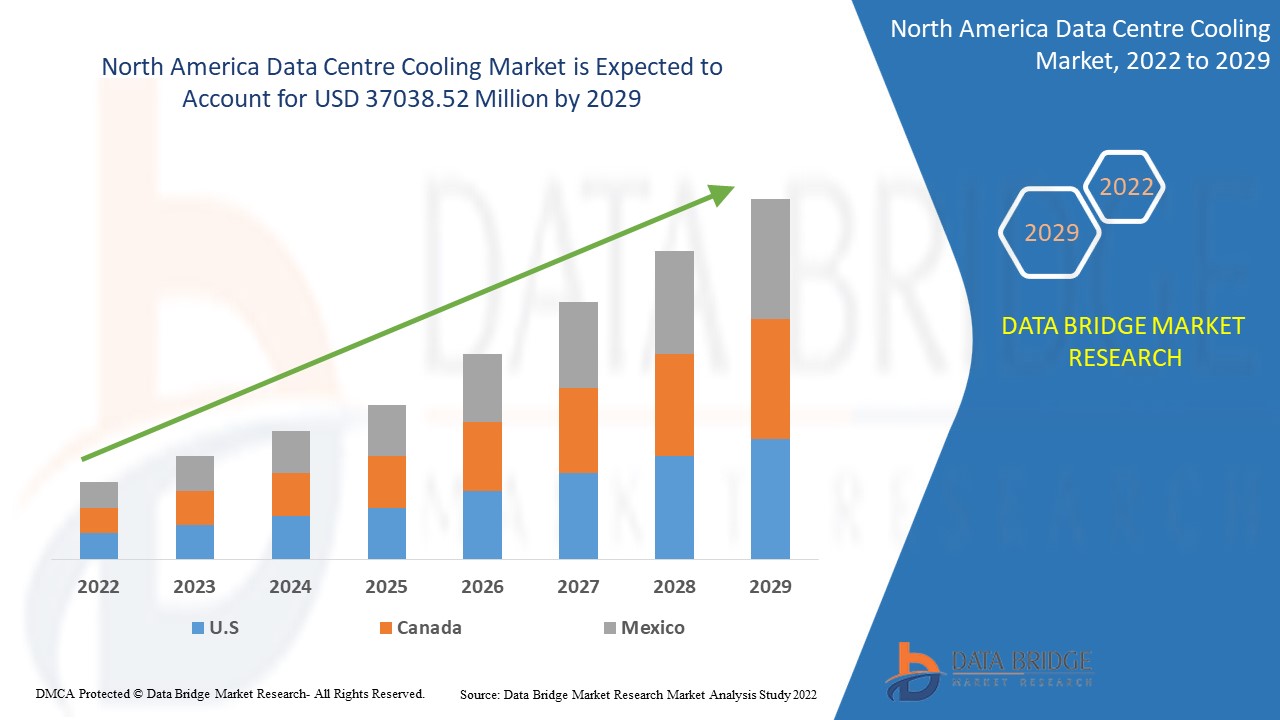

La taille du marché du refroidissement des centres de données en Amérique du Nord a été évaluée à 18,25 milliards USD en 2024 et devrait atteindre 56,62 milliards USD d'ici 2032, avec un TCAC de 15,20 % au cours de la période de prévision de 2025 à 2032.

Portée du rapport et segmentation du marché

|

Attributs |

Informations clés sur le marché du refroidissement des centres de données |

|

Segmentation |

|

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Principaux acteurs du marché |

Schneider Electric (France), Vertiv Group Corp. (États-Unis), STULZ GMBH (Allemagne), Eaton (États-Unis), FUJITSU (Japon), Rittal GmbH & Co. KG (Allemagne), Daikin Applied (États-Unis), Black Box Corporation (États-Unis), ALFA LAVAL (Suède), Nortek Air Solutions, LLC (États-Unis), Airedale Air Conditioning (Royaume-Uni), 3M (États-Unis), Coolcentric (États-Unis), Delta Power Solutions (Inde) et EcoCooling (Royaume-Uni) |

|

Opportunités de marché |

|

Définition du marché du refroidissement des centres de données

Le refroidissement des centres de données est défini comme l'ensemble des processus, équipements, outils collectifs et techniques qui contribuent à garantir une température de fonctionnement parfaite au sein d'un centre de données. Les opérateurs de centres de données utilisent des solutions de refroidissement pour maintenir la température dans les centres de données dans une limite autorisée. Les centres de données fonctionnent efficacement 24 heures sur 24, 7 jours sur 7, pour traiter de gros volumes de données.

Marché du refroidissement des centres de données

Conducteurs

- Innovations technologiques

La numérisation des dossiers médicaux des clients sous forme de dossiers médicaux électroniques entraîne une augmentation des données. La modernisation des systèmes d'exploitation existants et les dernières innovations en matière d'équipements médicaux, telles que les améliorations des systèmes de réponse aux patients, la gestion du personnel et autres, génèrent une multitude de données qui augmentent la demande de centres de données. Ce besoin et cette demande de centres de données devraient stimuler la demande de refroidissement des centres de données et stimuler le taux de croissance du marché.

- Multiplier les initiatives favorables des autorités gouvernantes

Les initiatives favorables des autorités gouvernementales du monde entier visant à promouvoir la prolifération du cloud stimulent la demande de centres de données et créent par conséquent des débouchés pour le marché du refroidissement des centres de données. Par exemple, les Émirats arabes unis (EAU) ont financé de nombreux projets liés au cloud computing tels que Smart Dubai ou Smart Abu Dhabi. Ces projets visaient à accélérer la transformation numérique des entreprises tout en favorisant la croissance économique du pays. De telles initiatives de différents gouvernements stimuleront la demande de centres de données à l'échelle mondiale, augmentant ainsi le besoin de solutions de refroidissement.

Opportunités

- Des investissements plus importants liés à la numérisation

La numérisation croissante contribue à créer l’impact le plus significatif et, par conséquent, à réaliser d’énormes investissements dans les technologies de la santé. Par exemple, TVM Capital Healthcare a augmenté en juillet 2020 un deuxième fonds de capital de croissance axé sur les investissements dans le Golfe. Ce nouveau fonds se concentrera principalement sur les pays du CCG, mais aussi sur l’Arabie saoudite. L’entreprise cherchera à investir dans tous les domaines des soins de santé, à l’exception des hôpitaux généraux. Cela a encore augmenté la génération de dossiers de données des patients, ce qui a accru la demande de technologies de refroidissement des centres de données dans cette région.

De plus, l’exigence d’une approche de refroidissement modulaire des centres de données et l’émergence de la technologie de refroidissement liquide augmentent les opportunités bénéfiques pour les principaux acteurs du marché au cours de la période de prévision de 2025 à 2032.

Restrictions

- Problèmes liés au refroidissement des centres de données

Le besoin d'infrastructures spécialisées et les coûts d'investissement élevés devraient freiner la croissance du marché du refroidissement des centres de données. De plus, les problèmes de refroidissement en cas de panne de courant et la réduction des émissions de carbone constitueront le principal défi à la croissance du marché du refroidissement des centres de données au cours de la période de prévision 2025-2032.

Ce rapport sur le marché du refroidissement des centres de données fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché du refroidissement des centres de données, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Portée du marché du refroidissement des centres de données

Le marché du refroidissement des centres de données est segmenté en fonction du type, des solutions, du service, du type de refroidissement et de la taille de l'organisation. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Centre de données d'entreprise

- Centre de données Edge

Solutions

- Climatisation

- Unités de réfrigération

- Tours de refroidissement

- Système économiseur

- Système de refroidissement liquide

- Climatisation de la salle informatique (CRAC)

- Unités de contrôle de l'unité de traitement d'air de la salle informatique (CRAH)

- Autres

Service

- Conseil et formation

- Installation et déploiement

- Maintenance et support

Type de refroidissement

- Refroidissement par pièce

- Refroidissement basé sur un rack

- Refroidissement par rangée

Taille de l'organisation

- Grande organisation

- Petites et moyennes organisations

Analyse régionale du marché du refroidissement des centres de données

Le marché du refroidissement des centres de données est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, solutions, type de refroidissement, service et taille de l'organisation comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché du refroidissement des centres de données sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché du refroidissement des centres de données grâce à une infrastructure de soutien et à une offre de produits solide des fournisseurs de solutions. Le marché nord-américain du refroidissement des centres de données est en pleine expansion en raison de l'adoption croissante de la technologie IoT par les entreprises, qui stimule la demande pour un stockage accru des données et le soutien de solutions de connectivité réseau solides, qui stimulent la croissance du marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché du refroidissement des centres de données

Le paysage concurrentiel du marché du refroidissement des centres de données fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du refroidissement des centres de données.

Les leaders du marché du refroidissement des centres de données opérant sur le marché sont :

- Schneider Electric (France)

- Vertiv Group Corp. (États-Unis)

- STULZ GMBH (Allemagne)

- Eaton (États-Unis)

- FUJITSU (Japon)

- Rittal GmbH & Co. KG (Allemagne)

- Daikin Applied (États-Unis)

- Black Box Corporation (États-Unis)

- ALFA LAVAL (Suède)

- Nortek Air Solutions, LLC (États-Unis)

- Airedale Air Conditioning (Royaume-Uni)

- 3M (États-Unis)

- Coolcentric (États-Unis)

- Delta Power Solutions (Inde)

- EcoCooling (Royaume-Uni)

Dernières évolutions sur le marché du refroidissement des centres de données

- Vertiv Holdings Co. lancera le Vertiv VRC-S en septembre 2020. Cette technologie est un rack intégré à un équipement de support d'infrastructure. Le produit intègre une unité de distribution d'alimentation en rack (rPDU), un système de refroidissement de rack autonome Vertiv VRC et une unité de distribution d'alimentation en rack (rPDU) et renferme un rack informatique de taille standard.

- En juillet 2020, Asetek collaborera avec Hewlett Packard Enterprise (HPE). Cette collaboration vise à fournir des solutions de refroidissement liquide de centre de données haut de gamme dans les systèmes HPE Apollo. Ces systèmes sont des systèmes à hautes performances et à densité optimisée destinés aux exigences de l'intelligence artificielle (IA) et du calcul haute performance (HPC).

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.