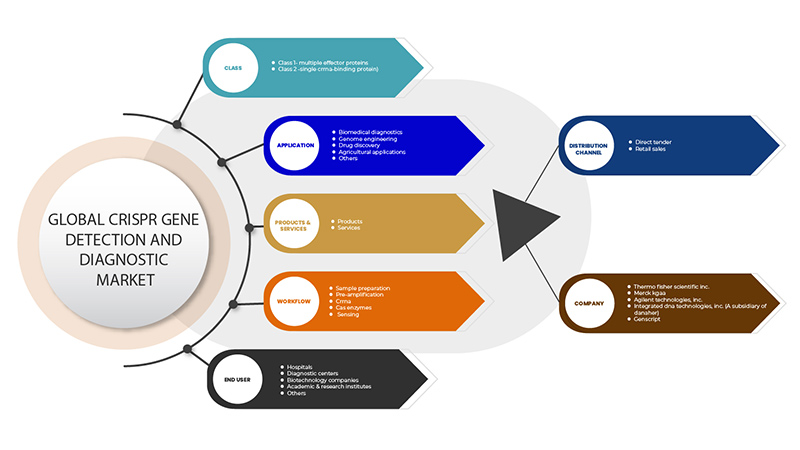

North America CRISPR Gene Detection and Diagnostic Market, By Class (Class 1- Multiple Effector Proteins and Class 2 -Single CrRNA-Binding Protein), Products & Services (Products and Services), Application (Biomedical Diagnostics, Genome Engineering, Drug Discovery, Agricultural Applications and Others), Workflow (Sample Preparation, Pre-Amplification, CrRNA, Cas Enzymes and Sensing), End User (Hospitals, Diagnostic Centers, Biotechnology Companies, Academic and Research Institutes and Others), Distribution Channel (Direct Tender, Retail Sales) Industry Trends and Forecast to 2029

Market Definition and Insights

CRISPR is clustered regularly interspaced short palindromic repeats and is a tool for genome editing, it allows researchers to alter DNA sequences and modify gene function easily. It has many potential applications, including correcting genetic defects and treating and preventing the spread of diseases. CRISPR-based diagnostics have been used for many biomedical applications, such as sensing nucleic-acid-based biomarkers of infectious and non-infectious diseases and detecting genetic diseases. The assay kits in CRISPR are composed of two components: a protein called Cas9 and a guide RNA, a string of nucleic acid molecules with a certain genetic code.

This CRISPR-Cas9 system has been modified for use in mammalian cells. We can either knock out specific genes by introducing a guide sequence (sgRNA) specific to our gene of interest by introducing frameshift mutations via Non-Homologous End Joining (NHEJ) or generate knock-in mutations.

CRISPR-Cas 9 systems have extended the scope of diagnostics and services in gene and cell therapies. Pharmaceutical companies invest heavily in R&D to develop new products, with a surge of gene and cell therapy agents entering early development. The market players investing would allow producing safe and effective treatments for patients in serious need.

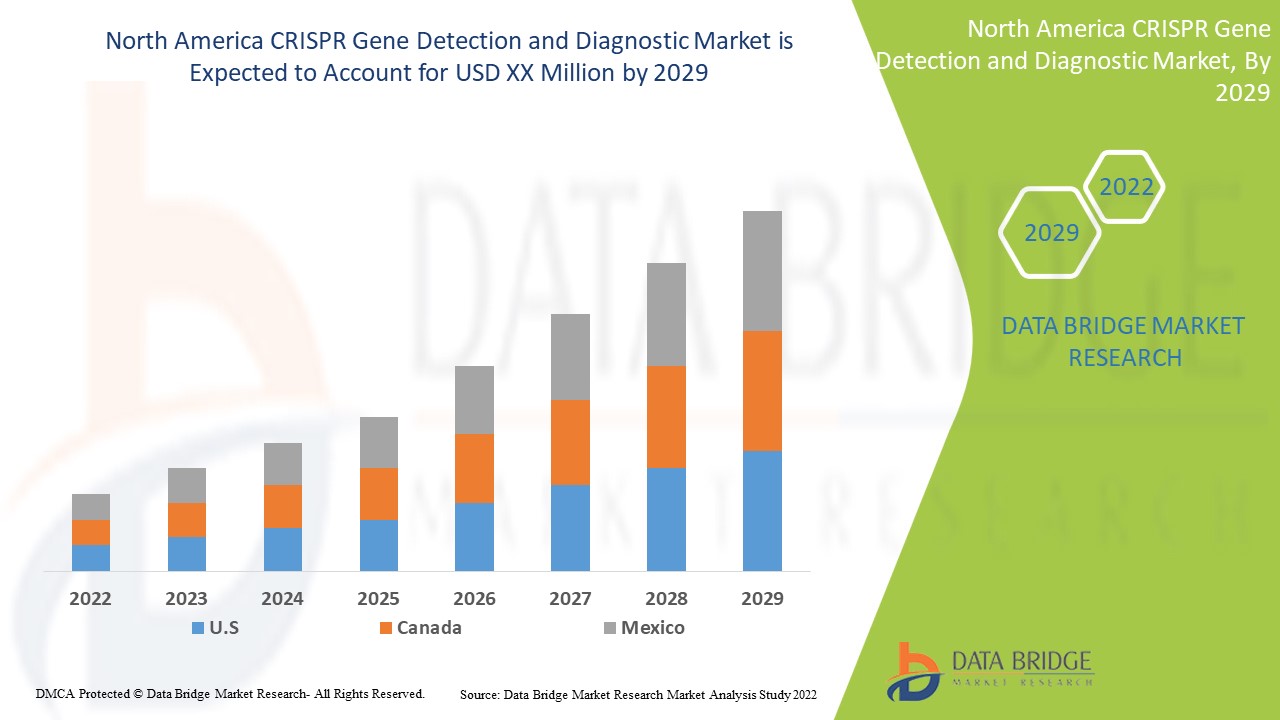

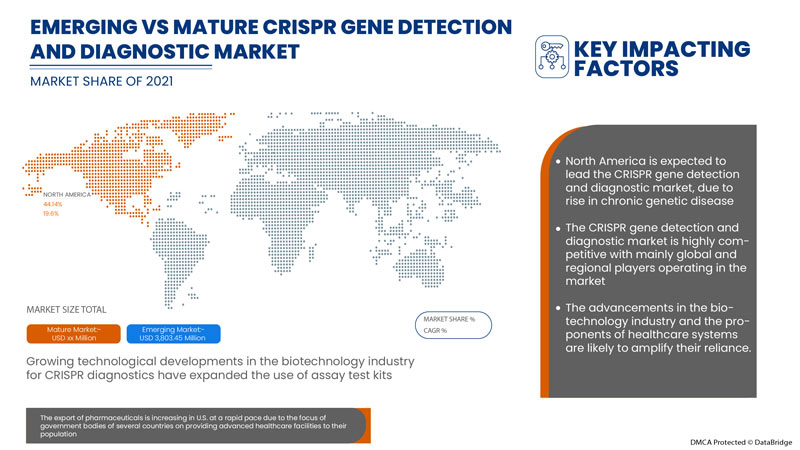

The North America CRISPR gene detection and diagnostic is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the CRISPR gene detection and diagnostic market will grow at a CAGR of 19.6 % during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par classe (Classe 1 - Protéines effectrices multiples et Classe 2 - Protéine de liaison unique à l'ARNrCr), Produits et services (Produits et services.), Application (Diagnostics biomédicaux, Ingénierie du génome, Découverte de médicaments, Applications agricoles et autres.), Flux de travail (Préparation d'échantillons, Préamplification, ARNrCr, Enzymes Cas et détection.), Utilisateur final (Hôpitaux, Centres de diagnostic, Sociétés de biotechnologie, Instituts universitaires et de recherche et autres) Canal de distribution (Appel d'offres direct, Ventes au détail) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

GenScript, OriGene Technologies, Inc., Applied StemCell, GeneCopoeia, Inc., Agilent Technologies, Inc., Synthego, BioVision Inc., Hera Biolabs, Cellecta, Inc., New England Biolabs, 10x Genomics, addgene CasTag Biosciences, Merck KGaA, Integrated DNA Technologies, Inc. (une filiale de Danaher), Thermo Fisher Scientific Inc. entre autres |

Dynamique du marché nord-américain de la détection et du diagnostic des gènes CRISPR

Conducteurs

- Augmentation de la prévalence et de l’incidence des maladies chroniques

Les maladies chroniques sont des problèmes de santé courants, un adulte sur trois en souffre. Les maladies chroniques ont des répercussions sur la santé et la qualité de vie de nombreux citoyens.

CRISPR est l'abréviation de « clustered regular interspaced short palindromic repeats » (répétitions palindromiques courtes groupées et régulièrement espacées). Ces dernières années, CRISPR est devenu un outil incontournable pour l'édition génétique, qui est utilisée pour modifier les séquences spécifiques d'ADN dans une cellule. CRISPR est très utilisé dans la recherche et le traitement de la maladie de Huntington, de la dystrophie musculaire, du cancer et de l'hypercholestérolémie.

Par exemple,

- En 2021, les données de NORD - National Organization for Rare Disorders, Inc. ont indiqué l'incidence diagnostiquée de la dystrophie musculaire de Duchenne (DMD). La dystrophie musculaire de Duchenne (DMD) est une maladie génétique fréquente, qui touche 1 naissance masculine sur 3 500 dans le monde

- Hausse des investissements dans la recherche et le développement

Les technologies d'édition génétique, telles que le système CRISPR-Cas 9, ont élargi le champ d'application des diagnostics et des services dans le domaine des thérapies géniques et cellulaires. Les sociétés pharmaceutiques investissent massivement dans la R&D pour développer de nouveaux produits, avec une augmentation du nombre d'agents de thérapie génique et cellulaire entrant dans les premières phases de développement. Les acteurs du marché qui investissent permettraient d'atteindre l'objectif de produire des traitements sûrs et efficaces pour les patients qui en ont sérieusement besoin.

Par exemple,

- En février 2022, Synthego a levé 200 millions de dollars pour investir dans la recherche et le développement afin de stimuler le développement de médicaments basés sur CRISPR, de la recherche en phase précoce à la clinique. Synthego utilisera le montant de l'investissement issu du financement de série E pour accélérer la création de diagnostics et de services CRISPR

Disponibilité de financement pour le diagnostic génétique CRISPR

Les diagnostics et la recherche génétiques CRISPR sont financés par le budget du National Institute of Health (NIH). Le secteur privé finance également la détection et la recherche génétiques CRISPR, mais cet investissement intervient généralement plus tard, pendant la phase de test et de développement, puis pendant la recherche fondamentale initiale. L'édition du génome étant un domaine si nouveau, un organisme gouvernemental impartial doit les superviser ; la FDA est prudente et minutieuse, mais elle lutte sans cesse pour obtenir des financements, réalisant un investissement à long terme qui aligne le paiement sur les futurs bénéficiaires potentiels., renforcera encore la croissance du marché de la détection et du diagnostic génétiques CRISPR.

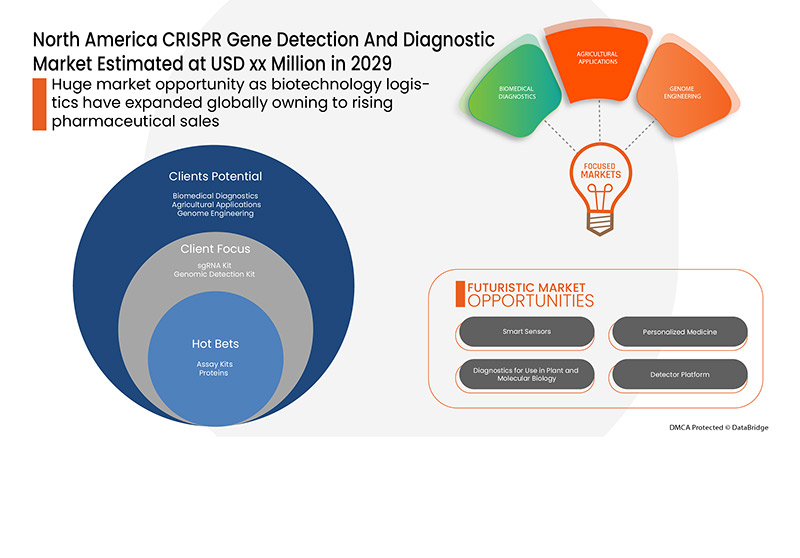

En outre, les progrès dans le domaine du diagnostic génétique CRISPR, les initiatives croissantes des organisations publiques et privées pour sensibiliser le public et le financement croissant du gouvernement sont les facteurs qui permettront d'élargir le marché de la détection génétique CRISPR. D'autres facteurs tels que l'augmentation de la demande de thérapies efficaces et la sensibilisation croissante au diagnostic rapide auront un impact positif sur le taux de croissance du marché de la détection et du diagnostic génétiques CRISPR. En outre, le revenu disponible élevé, le nombre croissant de maladies chroniques et l'évolution des modes de vie entraîneront l'expansion du marché de la détection et du diagnostic génétiques CRISPR.

Opportunités

- L'augmentation des dépenses de santé

De plus, l'augmentation des activités de recherche et développement et l'augmentation des investissements du gouvernement et des organisations privées stimuleront de nouvelles opportunités pour le taux de croissance du marché.

- Initiative stratégique des acteurs du marché

La demande de détection et de diagnostic génétique CRISPR a augmenté aux États-Unis en raison du traitement rapide des maladies chroniques. Ces facteurs favorables augmentent le besoin de médicaments et, pour répondre à la demande du marché, les acteurs mineurs et majeurs du marché utilisent diverses stratégies.

Les principaux acteurs tentent également d’élaborer des stratégies spécifiques, telles que des lancements de produits, des acquisitions, des approbations, des extensions et des partenariats, pour assurer le bon fonctionnement de l’entreprise, éviter les risques et augmenter la croissance à long terme des ventes du marché.

Par exemple,

- En mai 2021, Horizon Discovery Ltd. a élargi son portefeuille de modulation génétique avec le premier ARN guide synthétique unique et le répresseur dcas9 en instance de brevet pour l'interférence CRISPR à Waltham. L'expansion du portefeuille a augmenté les ventes et les revenus du portefeuille d'ARN guide synthétique dans la région des États-Unis et du Royaume-Uni et a renforcé la collaboration avec les acteurs du marché

En outre, le lancement de thérapies efficaces et la poursuite des essais cliniques offriront des opportunités bénéfiques pour le marché de la détection et du diagnostic des gènes CRISPR au cours de la période de prévision 2022-2029. En outre, les besoins non satisfaits importants en matière de technologies de santé actuelles et les développements en la matière augmenteront le taux de croissance du marché de la détection et du diagnostic des gènes CRISPR à l'avenir.

Contraintes/Défis

Cependant, le coût élevé des diagnostics CRISPR et les risques encourus lors de leur utilisation entraveront le taux de croissance du marché de la détection et du diagnostic des gènes CRISPR. De plus, les risques encourus lors de l'utilisation des appareils IRM entraveront la croissance du marché de la détection et du diagnostic des gènes CRISPR. Le manque d'expertise et de réglementations qualifiées posera un défi supplémentaire au marché au cours de la période de prévision mentionnée ci-dessus.

- Augmentation du coût des diagnostics basés sur CRISPR

Le vaste potentiel des thérapies basées sur CRISPR a un coût. Les thérapies d'édition génomique maximale nécessitent un temps de développement et de production accru, ce qui entraîne une augmentation des coûts. En outre, les kits d'analyse et les médicaments liés à la détection et au diagnostic des gènes CRISPR sont applicables à une grande partie de la population. Ces coûts sont répercutés sur les patients. Par conséquent, le coût élevé actuel devrait afficher une tendance à la baisse à l'avenir.

Par exemple,

- En juillet 2021, selon Integrated DNA Technologies, Inc., le premier test de diagnostic basé sur CRISPR disponible dans le commerce pour le SRAS-CoV-2, incluant la transcription inverse LAMP (RT-LAMP) comme préamplification, est actuellement disponible au prix de 30,15 USD par réaction.

Le rapport sur le marché de la détection et du diagnostic des gènes CRISPR fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la détection et du diagnostic des gènes CRISPR, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Analyse épidémiologique des patients

Selon une étude de Globocan, en 2020, le cancer du sein a eu une incidence élevée de cas, environ 11,7 %, suivi du cancer du poumon avec 11,40 %, du cancer colorectal avec 10,00 %, et du cancer du col de l'utérus et de l'œsophage avec un nombre de cas incidents moins élevé.

Le marché de la détection et du diagnostic des gènes CRISPR vous fournit également une analyse de marché détaillée pour l'analyse des patients, le pronostic et les traitements. La prévalence, l'incidence, la mortalité et les taux d'adhésion sont quelques-unes des variables de données disponibles dans le rapport. Les analyses d'impact directes ou indirectes de l'épidémiologie sur la croissance du marché sont analysées pour créer un modèle statistique multivarié de cohorte plus robuste pour prévoir le marché pendant la période de croissance.

Impact du COVID-19 sur le marché de la détection et du diagnostic génétiques CRISPR

La COVID-19 a eu un impact négatif sur le marché. Les confinements et l’isolement pendant les pandémies compliquent la gestion du diagnostic et du traitement. Le manque d’accès aux établissements de santé pour les soins de routine et l’administration des médicaments affectera davantage le marché. L’isolement social augmente le stress, le désespoir et le soutien social, ce qui peut entraîner une réduction de l’observance des médicaments anticonvulsivants pendant la pandémie.

Développement récent

- En août 2020, SHERLOCK BIOSCIENCES a annoncé une collaboration avec Dartmouth-Hitchcock Health pour mener l'essai clinique du kit de diagnostic SHERLOCK pour le Sars-CoV-2. Le kit a reçu l'approbation d'urgence de l'autorisation d'utilisation d'urgence (EUA) de la Food and Drug Administration (FDA) des États-Unis.

Portée du marché nord-américain de la détection et du diagnostic des gènes CRISPR

Le marché de la détection et du diagnostic des gènes CRISPR est segmenté en six segments : classe, produits et services, application, flux de travail, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Classe

- Classe 1 – Protéines à effecteurs multiples

- Classe 2 - Protéine de liaison à un seul ARNr

Sur la base de la classe, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en classe 1 - protéines effectrices multiples et classe 2 - protéine de liaison unique à l'ARNc.

Produits et services

- Produits

- Services

Sur la base des produits et services, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en produits et services.

Application

- Diagnostic biomédical

- Ingénierie génomique

- Découverte de médicaments

- Applications agricoles

- Autres

Sur la base de l'application, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en diagnostics biomédicaux, ingénierie du génome, découverte de médicaments, applications agricoles et autres.

Flux de travail

- Préparation des échantillons

- Pré-amplification

- ARNr

- Enzymes Cas

- Détection

Sur la base du flux de travail, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en préparation d'échantillons, préamplification, CrRNA, enzymes Cas et détection.

Utilisateur final

- Hôpitaux

- Centres de diagnostic

- Sociétés de biotechnologie

- Instituts universitaires et de recherche

- Autres

Sur la base de l'utilisateur final, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en hôpitaux, centres de diagnostic, sociétés de biotechnologie, instituts universitaires et de recherche et autres.

Canal de distribution

- Appels d'offres directs

- Ventes au détail

Sur la base du canal de distribution, le marché de la détection et du diagnostic des gènes CRISPR est segmenté en appels d’offres directs et ventes au détail.

Analyse/perspectives régionales du marché de la détection et du diagnostic des gènes CRISPR

Le marché nord-américain de détection et de diagnostic de gènes CRISPR est analysé et des informations et tendances sur la taille du marché sont fournies par régions, classe, produits et services, application, flux de travail, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché de la détection et du diagnostic des gènes CRISPR sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché de la détection et du diagnostic des gènes CRISPR en raison de l’augmentation des dépenses de santé.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic et de la détection des gènes CRISPR

Le paysage concurrentiel du marché nord-américain de la détection et du diagnostic des gènes CRISPR fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la détection et du diagnostic des gènes CRISPR.

Français Certains des principaux acteurs opérant sur le marché de la détection et du diagnostic de gènes CRISPR sont GenScript, OriGene Technologies, Inc., Applied StemCell, GeneCopoeia, Inc., Agilent Technologies, Inc., Synthego, BioVision Inc., Hera Biolabs, Cellecta, Inc., New England Biolabs, 10x Genomics, addgene CasTag Biosciences, Merck KGaA, Integrated DNA Technologies, Inc. (Une filiale de Danaher), Thermo Fisher Scientific Inc. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 CLASS SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INTELLECTUAL PROPERTY LANDSCAPE (PATENT LANDSCAPE)

6 EPIDEMIOLOGY

7 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: REGULATORY SCENARIO

8 PIPELINE ANALYSIS FOR NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, OF CRISPR DIAGNOSTICS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

9.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT

9.1.3 AVAILABILITY OF FUNDING FOR CRISPR GENE DIAGNOSTICS

9.1.4 RISE IN GMP-CERTIFICATION APPROVALS FOR CRISPR GENE DIAGNOSTIC

9.1.5 RISE IN CLINICAL TRIALS FOR CRISPR BASED DIAGNOSTICS

9.2 RESTRAINTS

9.2.1 RISE IN COST OF CRISPR BASED DIAGNOSTICS

9.2.2 RISKS FACED WHILE USING CRISPR DIAGNOSIS

9.2.3 ETHICAL CONCERNS RELATED TO CRISPR GENE DETECTION AND DIAGNOSTIC RESEARCH

9.2.4 AVAILABILITY OF ALTERNATIVES

9.3 OPPORTUNITIES

9.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

9.3.2 RISE IN HEALTHCARE EXPENDITURE

9.3.3 EMERGENCE OF TECHNOLOGICAL ADVANCEMENTS IN CRISPR BASED DIAGNOSTICS

9.4 CHALLENGES

9.4.1 LACK OF SKILLED PROFESSIONALS REQUIRED FOR CRISPR DIAGNOSTICS

9.4.2 STRINGENT REGULATIONS

10 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS

10.1 OVERVIEW

10.2 CLASS-2 SINGLE CRRNA-BINDING PROTEIN

10.2.1 BIOMEDICAL DIAGNOSTICS

10.2.2 AGRICULTURAL APPLICATIONS

10.2.3 GENOME ENGINEERING

10.2.4 DRUG DISCOVERY

10.2.5 OTHERS

10.3 CLASS-1 MULTIPLE EFFECTOR PROTEINS

11 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES

11.1 OVERVIEW

11.2 PRODUCTS

11.2.1 ASSAY KITS

11.2.1.1 SGRNA KIT

11.2.1.2 GENOMIC DETECTION KIT

11.2.1.3 OTHERS

11.2.2 PROTEINS

11.2.2.1 CAS9

11.2.2.2 CPF1

11.2.2.3 OTHERS

11.2.3 PLASMID AND VECTOR

11.2.4 LIBRARY

11.2.5 CONTROL KITS

11.2.6 DELIVERY SYSTEM PRODUCTS

11.2.7 DESIGN TOOLS

11.2.8 GENOMIC RNA

11.2.9 HDR BLOCKERS

11.2.9.1 AZIDOTHYMIDINE

11.2.9.2 TRIFLUOROTHYMIDINE

11.2.9.3 OTHERS

11.2.9.4 OTHERS

11.3 SERVICES

11.3.1 G-RNA DESIGN

11.3.2 CELL LINE ENGINEERING

11.3.3 MICROBIAL GENE EDITING

11.3.4 DNA SYNTHESIS

11.3.5 OTHERS

12 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BIOMEDICAL DIAGNOSTICS

12.2.1 CANCER

12.2.2 BLOOD DISORDERS

12.2.3 HEREDITARY DISORDERS

12.2.4 MUSCULAR DYSTROPHY

12.2.5 AIDS

12.2.6 NEURODEGENERATIVE CONDITION

12.2.7 OTHERS

12.3 AGRICULTURAL APPLICATIONS

12.4 GENOME ENGINEERING

12.4.1 CELL LINE ENGINEERING

12.4.2 HUMAN STEM CELLS

12.5 DRUG DISCOVERY

12.6 OTHERS

13 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW

13.1 OVERVIEW

13.2 CRRNA

13.3 CAS ENZYME

13.4 PRE-AMPLIFICATION

13.4.1 PCR

13.4.2 LAMP

13.4.3 RPA

13.5 SAMPLE PREPARATION

13.6 SENSING

13.6.1 FLUORESCENT PROBES

13.6.2 COLORIMETRIC

14 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOTECHNOLOGY COMPANIES

14.3 ACADEMIC AND RESEARCH INSTITUTES

14.4 DIAGNOSTIC CENTERS

14.5 HOSPITALS

14.6 OTHERS

15 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 RETAIL SALES

16 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 THERMO FISHER SCIENTIFIC INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 MERCK KGA

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 AGILENT TECHNILOGIES, INC

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 GENSCRIPT

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 10 X GENOMICS

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 APPLIED STEM CELL

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 ADDGENE

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 BIOVISION INC.

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 CELLECTA, INC

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 CAS TAG BIOSCIENCES

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GENECOPOEIA, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 HORIZON DISCOVERY LTD

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HERA BIOLABS

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 NEW ENGLAND BIOLABS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 ORIGENE TECHNOLOGIES, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SYNTHEGO

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 TAKARA BIO INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

19.19 TOOLGEN, INC.

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 PIPELINE ANALYSIS FOR NORTH AMERICA CRISPR GENE THERAPEUTICS

TABLE 2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CLASS-1 MULTIPLE EFFECTOR PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA AGRICULTURAL APPLICATIONS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA DRUG DISCOVERYIN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CRRNA IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CAS ENZYME IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PRE-AMPLIFICATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA SAMPLE PREPARATION IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SENSING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA BIOTECHNOLOGY COMPANIES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA DIAGNOSTIC CENTERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HOSPITALS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIRECT TENDER IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA RETAIL SALES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 57 U.S. CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 59 U.S. PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 U.S. GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.S. BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 68 U.S. PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 69 U.S. SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 70 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 U.S. CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 73 CANADA CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 75 CANADA PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 CANADA GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 84 CANADA PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 85 CANADA SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 86 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 CANADA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY CLASS, 2020-2029 (USD MILLION)

TABLE 89 MEXICO CLASS-2 SINGLE CRRNA-BINDING PROTEIN IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 91 MEXICO PRODUCTS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO ASSAY KITS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO HDR BLOCKERS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 MEXICO PROTEINS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO SERVICES IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 MEXICO GENOME ENGINEERING IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO BIOMEDICAL DIAGNOSTICS IN CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PRE-AMPLIFICATION IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 101 MEXICO SENSING IN GENE DETECTION AND DIAGNOSTIC MARKET, BY WORKFLOW, 2020-2029 (USD MILLION)

TABLE 102 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 MEXICO CRISPR GENE DETECTION AND DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN CRISPR DIAGNOSTICS, AND GOVERNMENT FUNDING FOR THE DEVELOPMENT OF CRISPR DETECTION KITS ARE EXPECTED TO DRIVE THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 TO 2029

FIGURE 13 CLASS SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET FROM 2022 & 2029

FIGURE 14 NORTH AMERICA CRISPR GENE PATENT SCENARIO, BY APPLICATION

FIGURE 15 CRISPR PATENT LANDSCAPE AND NUMBER OF APPLICATIONS OF NEW PATENT FAMILIES FILED WORLDWIDE, 2001 TO 2019

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET

FIGURE 17 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 18 PREVALENCE OF HUNTINGTON’S DISEASE IN 2019

FIGURE 19 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2021

FIGURE 20 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 24 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2021

FIGURE 32 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY WORKFLOW, LIFELINE CURVE

FIGURE 35 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2021

FIGURE 36 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 40 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: BY CLASS (2022-2029)

FIGURE 48 NORTH AMERICA CRISPR GENE DETECTION AND DIAGNOSTIC MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.