North America Containerized Data Center Market

Taille du marché en milliards USD

TCAC :

%

USD

7.71 Billion

USD

31.24 Billion

2025

2033

USD

7.71 Billion

USD

31.24 Billion

2025

2033

| 2026 –2033 | |

| USD 7.71 Billion | |

| USD 31.24 Billion | |

|

|

|

|

Marché des centres de données conteneurisés en Amérique du Nord, par offre (matériel et services), propriété (location/externalisation et achat), taille du conteneur (20 pieds, 40 pieds et 60 pieds), type de conteneur (conteneur personnalisé, conteneur compact tout-en-un et conteneur autonome), taille de l'organisation (grande organisation et petite et moyenne organisation), application (greenfield, brownfield et mise à niveau et consolidation), utilisateur final (banque, services financiers et assurances (BFSI), soins de santé, informatique et télécommunications, vente au détail et commerce électronique, énergie et services publics, gouvernement, médias et divertissement, éducation, armée et défense et autres), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché des centres de données conteneurisés en Amérique du Nord

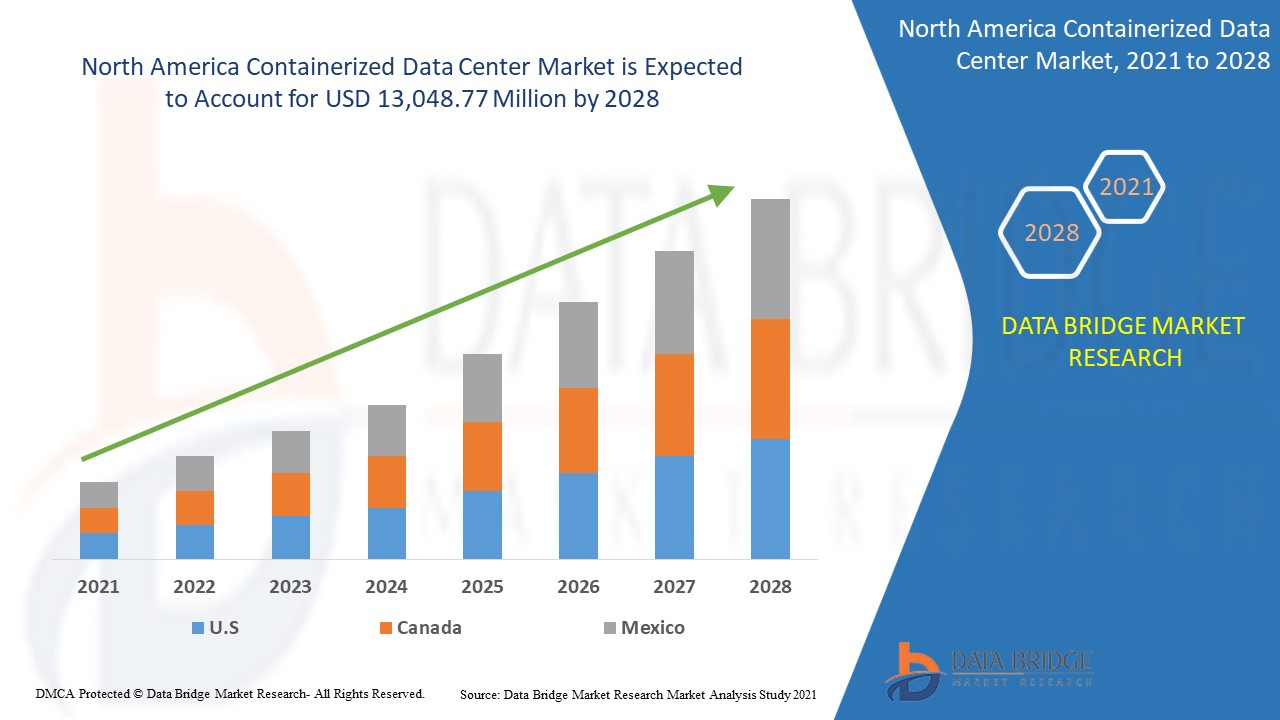

Le marché des centres de données conteneurisés devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 19,1 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 13 048,77 millions USD d'ici 2028. La croissance croissante de l'infrastructure informatique et de la numérisation constitue un facteur de croissance majeur pour le marché des centres de données conteneurisés.

Les centres de données peuvent être considérés comme des installations qui aident à centraliser les opérations et les équipements informatiques d'une organisation pour stocker, diffuser et traiter les données et les applications. Les centres de données sont essentiels à la continuité des opérations quotidiennes car ils abritent les actifs les plus critiques et les plus exclusifs de l'organisation.

Les économies de coûts réalisées grâce à l'intégration de centres de données conteneurisés constituent un facteur majeur de croissance du marché des centres de données conteneurisés. Les complications techniques associées au déploiement des technologies de centres de données conteneurisés constituent un frein majeur pour le marché des centres de données conteneurisés. Le grand espace occupé par les centres de données traditionnels en dur et donc un besoin de centres de données conteneurisés à petite échelle sont en train d'être créés, ce qui constitue une fenêtre d'opportunité majeure pour la croissance du marché des centres de données conteneurisés. Le risque de sécurité élevé associé aux centres de données conteneurisés constitue un défi majeur pour la croissance du marché des centres de données conteneurisés.

Ce rapport sur le marché des centres de données conteneurisés fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché des centres de données conteneurisés, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des centres de données conteneurisés

Le marché des centres de données conteneurisés est segmenté en sept segments notables qui sont basés sur l'offre, la propriété, la taille du conteneur, le type de conteneur, la taille de l'organisation, l'application et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de l'offre, le marché des centres de données conteneurisés a été segmenté en matériel et services. En 2021, le segment du matériel domine le segment de l'offre, car le centre de données nécessite l'installation de composants informatiques de base tels que des serveurs, des racks, des systèmes d'alimentation et de refroidissement pour son fonctionnement.

- Sur la base de la propriété, le marché des centres de données conteneurisés a été segmenté en location/externalisation et achat. En 2021, le segment de l'achat domine le marché car les centres de données conteneurisés sont rentables, économiques et évolutifs.

- Sur la base de la taille du conteneur, le marché des centres de données conteneurisés a été segmenté en 20 pieds, 40 pieds et 60 pieds. En 2021, les centres de données conteneurisés de 20 pieds constituent le segment dominant, car la petite taille du conteneur rend la mise en place du centre de données assez facile et peut même être installé dans des espaces encombrés.

- Sur la base du type de conteneur, le marché des centres de données conteneurisés a été segmenté en conteneur personnalisé, conteneur compact tout-en-un et conteneur autonome. En 2021, le segment des conteneurs compacts tout-en-un domine car il ne nécessite aucune infrastructure ni aucun composant supplémentaire pour fonctionner.

- En fonction de la taille de l'entreprise, le marché des centres de données conteneurisés a été segmenté en grandes entreprises et en petites et moyennes entreprises. En 2021, le segment des grandes entreprises est devenu le segment dominant, car les grandes entreprises disposent de fonds et d'espace suffisants pour acheter et mettre en place le centre de données conteneurisé.

- Sur la base des applications, le marché des centres de données conteneurisés a été segmenté en greenfield, brownfield et upgrade & consolidation. En 2021, le segment greenfield domine car il offre à l'organisation un niveau élevé de contrôle qualité sur la fabrication et la vente de produits et services.

- Sur la base de l'utilisateur final, le marché des centres de données conteneurisés a été segmenté en services bancaires, services financiers et assurances (BFSI), soins de santé , informatique et télécommunications, vente au détail et commerce électronique, énergie et services publics, gouvernement , médias et divertissement, éducation, armée et défense et autres. En 2021, le secteur de l'informatique et des télécommunications est le segment dominant car le secteur dépend entièrement de l'infrastructure numérique pour son fonctionnement.

Analyse du marché des centres de données conteneurisés en Amérique du Nord au niveau des pays

Le marché des centres de données conteneurisés en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par pays, offre, propriété, taille du conteneur, type de conteneur, taille de l'organisation, application et utilisateur final comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des centres de données conteneurisés en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché des centres de données conteneurisés en Amérique du Nord en raison de la forte présence des leaders du marché dans la région. L'Amérique du Nord est fortement pénétrée par l'adoption de technologies avancées et le gouvernement a lancé un certain nombre d'initiatives pour accroître la croissance de la numérisation. Les entreprises se transforment numériquement et une grande quantité de données est générée qui doit être stockée et traitée à l'aide de centres de données.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Demande croissante de centres de données conteneurisés

Le marché des centres de données conteneurisés vous fournit également une analyse de marché détaillée pour chaque pays, la croissance de l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique dans les centres de données conteneurisés et les changements dans les scénarios réglementaires avec leur soutien au marché des centres de données conteneurisés. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché des centres de données conteneurisés

Le paysage concurrentiel du marché des centres de données conteneurisés fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des centres de données conteneurisés en Amérique du Nord.

Les principaux acteurs couverts dans le rapport sur le marché des centres de données conteneurisés en Amérique du Nord sont Rittal GmbH & Co. KG, Huawei Technologies Co., Ltd., Vertiv Group Corp., Delta Power Solutions, IBM Corporation, Cisco, Atos SE, Fuji Electric Co., Ltd., Schneider Electric, DC-Datacenter-Group GmbH, ZTE Corporation, Canovate, RZ-Products GmbH, American Portwell Technology, Inc., PCX Corporation, LLC, entre autres acteurs nationaux. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux développements de produits sont également initiés par les entreprises du monde entier, ce qui accélère également la croissance du marché des centres de données conteneurisés.

Par exemple,

- En janvier 2019, Cisco a présenté une série d'innovations dans les domaines du réseau, de l'hyperconvergence, de la sécurité et de l'automatisation. Parmi elles figurent ACI disponible dans AWS et Azure, HyperFlex for Branch et CloudCenter Suite. AWS et Azure sont une solution de réseau pour le centre de données qui s'intègre aux hyperviseurs et aux infrastructures de conteneurs. Ce lancement de produit a permis à l'entreprise de renforcer son portefeuille de produits.

Les partenariats, les coentreprises et d'autres stratégies permettent d'accroître la part de marché de l'entreprise grâce à une couverture et une présence accrues. Elles offrent également aux organisations l'avantage d'améliorer leur offre de centres de données conteneurisés grâce à une gamme de tailles élargie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.