North America Consumer Electronics Packaging Market

Taille du marché en milliards USD

TCAC :

%

USD

9.20 Billion

USD

24.12 Billion

2024

2032

USD

9.20 Billion

USD

24.12 Billion

2024

2032

| 2025 –2032 | |

| USD 9.20 Billion | |

| USD 24.12 Billion | |

|

|

|

|

Marché nord-américain de l'emballage de produits électroniques grand public, par type (boîtes en carton ondulé, boîtes en carton, plateaux thermoformés, blisters et coques, emballages de protection, sacs, sachets, films, emballages en mousse, sachets à bulles d'air et autres), matériau d'emballage (plastique, papier, papier d'aluminium, cellulose et autres), couche (emballage primaire, emballage secondaire et emballage tertiaire), technologie (emballage actif, emballage intelligent, emballage sous atmosphère modifiée, emballage antimicrobien, emballage aseptique et autres), technologie d'impression (flexographie, gravure et autres), canal de distribution (commerce électronique, supermarchés/hypermarchés, magasins spécialisés et autres) et application (téléphones portables, ordinateurs, téléviseurs, décodeurs DTH et décodeurs, système de musique, imprimantes, scanners et photocopieurs, consoles de jeux et jouets, caméscopes et appareils photo, appareils électroniques portables, adaptateurs multimédias numériques et autres) - Tendances et prévisions de l'industrie jusqu'en 2032.

Taille du marché de l'emballage de l'électronique grand public

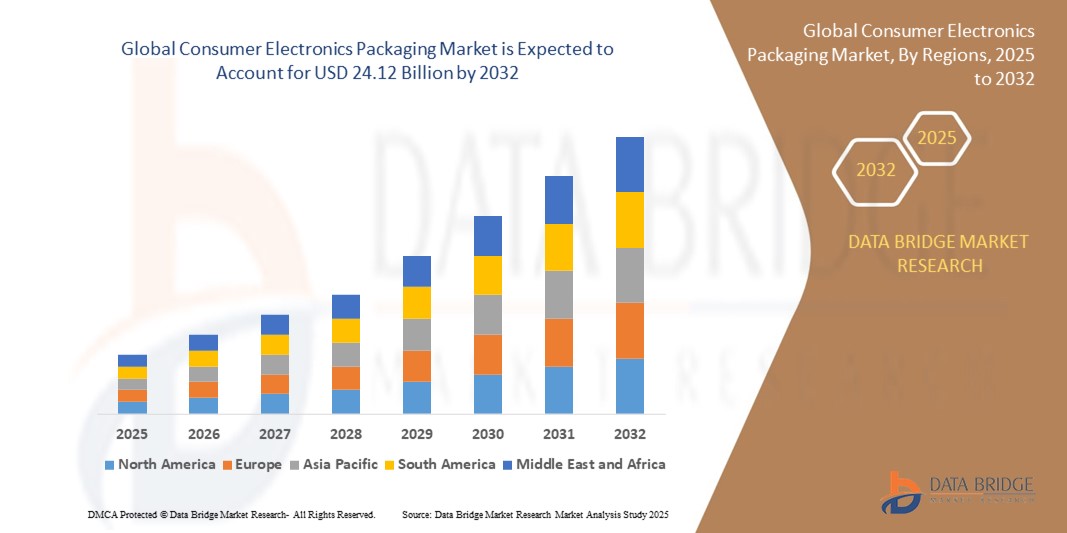

- La taille du marché nord-américain des emballages de produits électroniques grand public était évaluée à 9,20 milliards USD en 2024 et devrait atteindre 24,12 milliards USD d'ici 2032 , à un TCAC de 12,80 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante d'électronique grand public, l'adoption croissante de solutions d'emballage durables et les progrès des technologies d'emballage adaptées au commerce électronique et à la distribution au détail.

- La sensibilisation croissante des consommateurs aux matériaux d'emballage respectueux de l'environnement, associée à l'essor du secteur du commerce électronique, positionne l'emballage des produits électroniques grand public comme un élément essentiel de la sécurité des produits et de l'attrait de la marque, stimulant considérablement l'expansion du marché.

Analyse du marché de l'emballage de l'électronique grand public

- Les emballages de produits électroniques grand public, conçus pour protéger et améliorer l'attrait des appareils tels que les téléphones portables, les ordinateurs et les appareils portables, sont un élément essentiel de la chaîne d'approvisionnement, offrant une protection des produits, des opportunités de marque et une durabilité dans les environnements de vente au détail et de commerce électronique.

- La forte demande d'emballages pour l'électronique grand public est alimentée par la croissance rapide de l'industrie de l'électronique grand public, l'accent croissant mis sur les matériaux durables et recyclables et le besoin de solutions d'emballage robustes pour soutenir l'essor du commerce électronique.

- Les États-Unis ont dominé le marché nord-américain de l'emballage de produits électroniques grand public avec la plus grande part de revenus de 38,9 % en 2024, grâce à une forte consommation d'électronique grand public, une infrastructure d'emballage avancée et la présence d'acteurs majeurs de l'industrie.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain de l'emballage de produits électroniques grand public au cours de la période de prévision, propulsé par l'urbanisation croissante, la demande croissante de produits électroniques grand public et l'adoption croissante de solutions d'emballage respectueuses de l'environnement.

- Le segment des boîtes en carton ondulé détenait la plus grande part de revenus du marché, soit 29,4 % en 2024, grâce à leur polyvalence, leur rentabilité et leurs qualités de protection supérieures pour le transport sûr des appareils électroniques, en particulier dans les secteurs du commerce électronique et de la vente au détail.

Portée du rapport et segmentation du marché de l'emballage de produits électroniques grand public

|

Attributs |

Informations clés sur le marché de l'emballage de l'électronique grand public |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de l'emballage de produits électroniques grand public

« Adoption croissante de solutions d'emballage durables et écologiques »

- Le marché nord-américain de l'emballage des produits électroniques grand public connaît une tendance significative vers l'intégration de matériaux d'emballage durables et respectueux de l'environnement.

- Les entreprises utilisent de plus en plus de plastiques biodégradables, de papier recyclé et de carton pour réduire leur impact environnemental et s'aligner sur les préférences des consommateurs en matière de durabilité.

- Des conceptions d'emballage avancées, telles que le dimensionnement et l'allègement, sont utilisées pour minimiser l'utilisation de matériaux tout en maintenant la protection des appareils électroniques.

- Par exemple, des acteurs majeurs tels que Mondi et DS Smith développent des solutions innovantes, telles que des plateaux en papier recyclables et des boîtes en carton ondulé écologiques, pour répondre à la demande croissante d'emballages durables.

- Cette tendance renforce l’attrait des solutions d’emballage pour les consommateurs soucieux de l’environnement et aide les entreprises à se conformer aux réglementations environnementales strictes aux États-Unis et au Canada.

- Les emballages durables soutiennent également les efforts de promotion de l'image de marque, car les entreprises exploitent des conceptions respectueuses de l'environnement pour différencier leurs produits sur un marché concurrentiel.

Dynamique du marché de l'emballage de l'électronique grand public

Conducteur

« Demande croissante de solutions de commerce électronique et d'emballage de protection »

- L'essor du commerce électronique, en particulier aux États-Unis et au Canada, est un moteur majeur du marché de l'emballage de produits électroniques grand public, alimenté par la popularité croissante de la vente au détail en ligne de produits électroniques tels que les smartphones, les ordinateurs portables et les appareils portables.

- Les solutions d'emballage, telles que les boîtes en carton ondulé et les inserts en mousse, sont essentielles pour garantir la sécurité des produits pendant l'expédition, en protégeant les appareils fragiles des dommages mécaniques et des facteurs environnementaux.

- Les États-Unis, en tant que marché dominant, bénéficient d'une infrastructure de commerce électronique robuste et d'une forte demande des consommateurs en matière d'électronique, ce qui entraîne le besoin d'emballages durables et visuellement attrayants.

- Le Canada, le marché à la croissance la plus rapide, connaît une expansion rapide du commerce électronique, ce qui augmente encore la demande d'emballages de protection tels que les sachets à bulles d'air et les plateaux thermoformés.

- La croissance de la technologie 5G et des appareils compatibles IoT accroît également le besoin d'emballages spécialisés pour prendre en charge l'électronique avancée, améliorant ainsi les expériences de déballage et la valeur de la marque.

Retenue/Défi

« Coûts élevés des technologies d'emballage avancées et conformité réglementaire »

- L'investissement initial élevé requis pour les technologies d'emballage avancées, telles que les emballages intelligents et les emballages antimicrobiens, peut constituer un obstacle important, en particulier pour les petits fabricants sur le marché nord-américain.

- L'intégration de matériaux et de technologies durables, tels que l'emballage actif ou l'impression flexographique, dans les lignes de production existantes est complexe et coûteuse

- Les préoccupations en matière de sécurité des données et de conformité environnementale posent également des défis, car les systèmes d'emballage intelligents peuvent collecter des données sur les produits ou les consommateurs, ce qui soulève des problèmes de confidentialité et exige le respect de réglementations strictes aux États-Unis et au Canada.

- Le paysage réglementaire fragmenté en Amérique du Nord, notamment en ce qui concerne le recyclage et les plastiques à usage unique, complique les opérations des fabricants et augmente les coûts de conformité.

- Ces facteurs peuvent décourager l’adoption, en particulier dans les segments sensibles aux coûts, et limiter la croissance du marché dans les régions soumises à un contrôle réglementaire élevé ou à des contraintes économiques.

Portée du marché de l'emballage de l'électronique grand public

Le marché est segmenté en fonction du type, du matériau d'emballage, de la couche, de la technologie, de la technologie d'impression, du canal de distribution et de l'application.

- Par type

En Amérique du Nord, le marché de l'emballage des produits électroniques grand public se segmente en boîtes en carton ondulé, boîtes en carton, plateaux thermoformés, blisters et emballages à double coque, emballages de protection, sacs, sachets, films, emballages en mousse, sachets à bulles d'air, etc. En 2024, le segment des boîtes en carton ondulé détenait la plus grande part de marché, avec 29,4 %, grâce à leur polyvalence, leur rentabilité et leurs excellentes qualités de protection pour le transport sécurisé des appareils électroniques, notamment dans le e-commerce et la vente au détail. Leur caractère écologique, leur caractère recyclable et leur fabrication à partir de matériaux renouvelables, favorisent leur adoption.

Le segment des boîtes en carton devrait connaître la croissance la plus rapide, soit 13,2 % entre 2025 et 2032, grâce à la demande croissante de solutions d'emballage durables et à leur capacité à offrir une impression de haute qualité pour la valorisation de la marque. L'essor du e-commerce et la préférence des consommateurs pour des emballages écologiques et esthétiques pour des produits tels que les smartphones et les objets connectés stimulent cette croissance.

- Par matériau d'emballage

En Amérique du Nord, le marché de l'emballage des produits électroniques grand public se segmente en fonction des matériaux d'emballage : plastique, papier, feuille d'aluminium, cellulose, etc. Le plastique dominait le marché avec une part de marché de 44,1 % en 2024, grâce à sa légèreté, sa durabilité et sa polyvalence, qui permettent de personnaliser les formes pour protéger les appareils électroniques des facteurs environnementaux tels que l'humidité. Son utilisation répandue dans les blisters et les emballages à clapet confirme sa domination.

Le segment du papier devrait connaître la croissance la plus rapide entre 2025 et 2032, portée par la demande croissante des consommateurs et des autorités réglementaires pour des matériaux durables et recyclables. Le passage du plastique aux emballages à base de papier, notamment pour les boîtes en carton ondulé et en carton, s'inscrit dans les préoccupations environnementales et les tendances éco-responsables du secteur électronique.

- Par couche

En Amérique du Nord, le marché de l'emballage des produits électroniques grand public est segmenté en couches : emballages primaires, emballages secondaires et emballages tertiaires. En 2024, le segment de l'emballage primaire détenait la plus grande part de chiffre d'affaires, soit 63,7 %. Il enveloppe directement les produits électroniques et offre une protection essentielle contre les dommages physiques et les facteurs environnementaux. Son rôle dans l'amélioration de l'esthétique des produits et de l'expérience utilisateur renforce encore sa domination.

Le segment des emballages secondaires devrait connaître une forte croissance entre 2025 et 2032, portée par l'essor du e-commerce, qui nécessite des couches de protection supplémentaires pour une expédition et un stockage sûrs. Les emballages secondaires personnalisables soutiennent également l'image de marque et améliorent l'expérience de déballage, contribuant ainsi à sa croissance.

- Par technologie

Sur le plan technologique, le marché nord-américain de l'emballage des produits électroniques grand public est segmenté en emballages actifs, emballages intelligents, emballages sous atmosphère modifiée, emballages antimicrobiens et emballages aseptiques, entre autres. Le segment de l'emballage intelligent détenait la plus grande part de chiffre d'affaires du marché, soit 38,2 % en 2024, grâce à l'intégration de fonctionnalités intelligentes telles que les codes QR, les capteurs et les puces NFC pour l'authentification et le suivi des produits, ainsi que pour une meilleure interaction avec les consommateurs.

Le segment des emballages actifs devrait connaître une croissance significative entre 2025 et 2032, car il offre des solutions pour prolonger la durée de conservation des produits et protéger les appareils électroniques sensibles des facteurs environnementaux tels que l'humidité et la température, en particulier pour les appareils de grande valeur tels que les appareils portables et les appareils photo.

- Par la technologie d'impression

En Amérique du Nord, le marché de l'emballage des produits électroniques grand public est segmenté en fonction des technologies d'impression : flexographie, héliogravure et autres. Le segment de l'impression flexographique dominait le marché avec une part de marché de 60,8 % en 2024, grâce à sa rentabilité, à ses encres à séchage rapide et à sa compatibilité avec l'impression sur des surfaces poreuses telles que les boîtes en carton ondulé. Son utilisation répandue dans les emballages électroniques grand volume confirme sa domination.

Le segment de l'impression hélio devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à sa capacité à produire des graphiques détaillés et de haute qualité pour les emballages haut de gamme, en particulier pour les produits électroniques grand public tels que les smartphones et les téléviseurs, où l'image de marque et l'esthétique sont essentielles.

- Par canal de distribution

En fonction des canaux de distribution, le marché nord-américain de l'emballage des produits électroniques grand public est segmenté entre le commerce électronique, les supermarchés/hypermarchés, les magasins spécialisés et autres. Le e-commerce détenait la plus grande part de chiffre d'affaires du marché, avec 52,3 % en 2024, grâce à la croissance rapide de la vente en ligne de produits électroniques grand public, nécessitant des emballages durables et protecteurs pour une livraison en toute sécurité. Les États-Unis, grâce à leur solide infrastructure de e-commerce, dominent ce segment.

Le segment des magasins spécialisés devrait connaître une croissance rapide de 14,5 % entre 2025 et 2032, tirée par la demande croissante d'emballages haut de gamme qui améliorent la présentation des produits en magasin et s'alignent sur les préférences des consommateurs pour des expériences de déballage de marque et de haute qualité.

- Par application

En fonction des applications, le marché nord-américain de l'emballage des produits électroniques grand public est segmenté en téléphones portables, ordinateurs, téléviseurs, décodeurs DTH et décodeurs numériques, chaînes hi-fi, imprimantes, scanners et photocopieurs, consoles de jeux et jouets, caméscopes et appareils photo, objets connectés, adaptateurs multimédias numériques, etc. Le segment des téléphones portables a dominé le marché avec une part de marché de 42,6 % en 2024, porté par le volume élevé des ventes de smartphones et le besoin d'emballages sur mesure et protecteurs, au design haut de gamme, pour valoriser la marque et améliorer l'expérience client.

Le segment des appareils électroniques portables devrait connaître la croissance la plus rapide de 15,8 % entre 2025 et 2032, alimentée par la demande croissante de montres connectées et de trackers de fitness, qui nécessitent un emballage compact, protecteur et visuellement attrayant pour garantir la sécurité des produits et la différenciation du marché.

Analyse régionale du marché de l'emballage de produits électroniques grand public

- Les États-Unis ont dominé le marché nord-américain de l'emballage de produits électroniques grand public avec la plus grande part de revenus de 38,9 % en 2024, grâce à une forte consommation d'électronique grand public, une infrastructure d'emballage avancée et la présence d'acteurs majeurs de l'industrie.

- Les consommateurs privilégient les emballages qui garantissent la sécurité du produit, améliorent l'expérience utilisateur et répondent aux préoccupations environnementales, en particulier dans les régions à forte pénétration du commerce électronique et aux préférences diverses des consommateurs.

- La croissance est soutenue par les progrès des technologies d'emballage, telles que les emballages intelligents et actifs, ainsi que par l'adoption croissante dans les segments OEM et du marché secondaire.

Aperçu du marché américain de l'emballage des produits électroniques grand public

Les États-Unis dominent le marché nord-américain de l'emballage des produits électroniques grand public, affichant la plus forte part de chiffre d'affaires en 2024. Cette situation est portée par une forte demande du e-commerce et une sensibilisation croissante des consommateurs aux avantages des emballages durables. La tendance à la présentation haut de gamme des produits et le renforcement des réglementations favorisant l'utilisation de matériaux écologiques stimulent l'expansion du marché. L'intégration de solutions d'emballage avancées, telles que les blisters et les emballages intelligents, dans les produits électroniques grand public tels que les téléphones portables et les ordinateurs, complète les ventes OEM et après-vente, créant ainsi un écosystème de marché dynamique.

Aperçu du marché canadien de l'emballage des produits électroniques grand public

Le Canada devrait connaître la croissance la plus rapide du marché nord-américain de l'emballage des produits électroniques grand public, stimulée par la demande croissante d'emballages protecteurs et esthétiques en milieu urbain et suburbain. L'intérêt croissant pour les solutions d'emballage durables, comme les boîtes en carton ondulé et le carton recyclables, encourage leur adoption. L'évolution de la réglementation favorisant les matériaux d'emballage écologiques et la croissance du commerce électronique influencent encore davantage les choix des consommateurs, en conciliant fonctionnalité et conformité.

Part de marché des emballages pour l'électronique grand public

L'industrie de l'emballage de produits électroniques grand public est principalement dirigée par des entreprises bien établies, notamment :

- JYX GmbH (Chine)

- DuPont (États-Unis)

- AMETEK, Inc. (États-Unis)

- JOHNSBYRNE (États-Unis)

- Pregis LLC (États-Unis)

- Universal Protective Packaging, Inc. (États-Unis)

- Dordan Manufacturing Company (États-Unis)

- UFP Technologies, Inc. (États-Unis)

- Stora Enso (Finlande)

- Smurfit Kappa (Irlande)

- Mondi (Autriche)

- DS Smith (Royaume-Uni)

- Sealed Air (États-Unis)

- Sonoco Products Company (États-Unis)

- WestRock Company (États-Unis)

- PAPIER METTLER KG (Allemagne)

- GY Packaging (Chine)

- Emballage New-Tech (États-Unis)

- Maco PKG (États-Unis)

Quels sont les développements récents sur le marché nord-américain de l’emballage de produits électroniques grand public ?

- En février 2025, Siemens Digital Industries Software a dévoilé un flux de travail automatisé certifié pour la technologie de packaging InFO (Integrated Fan-Out) de TSMC, marquant une avancée significative dans la conception et la fabrication de semi-conducteurs. Ce flux de travail s'appuie sur les logiciels Innovator3D IC, Xpedition Package Designer, HyperLynx DRC et Calibre nmDRC de Siemens pour prendre en charge les variantes InFO_oS et InFO_PoP. Ces outils permettent une intégration haute densité, une vérification précise des règles de conception et une production rationalisée, répondant ainsi à la demande croissante de composants électroniques compacts et performants pour les applications d'IA, de calcul haute performance et mobiles.

- En janvier 2024, INEOS Styrolution a lancé le Zylar® EX350, un nouveau matériau méthacrylate de méthyle butadiène styrène (MBS) spécialement conçu pour les bandes porteuses des encapsulations de composants électroniques. Conçu pour l'extrusion, le Zylar EX350 offre un équilibre parfait entre rigidité et robustesse, permettant des conceptions de poches plus profondes et plus rigides que les mélanges GPPS/SBC traditionnels. Cela améliore la stabilité des composants, réduit les erreurs de sélection lors de l'assemblage et améliore la transparence des inspections par caméra. Ce lancement répond à la demande croissante de matériaux d'emballage polyvalents, performants et durables dans l'industrie électronique.

- En décembre 2023, PwC US a acquis la quasi-totalité des actifs de Surfaceink, une société californienne de conception et d'ingénierie de produits, réputée pour son expertise dans les projets d'électronique grand public et d'Internet des objets (IoT). Cette opération stratégique renforce la capacité de PwC à assurer le développement de produits de bout en bout, en combinant l'expertise de Surfaceink en conception matérielle, acoustique et prototypage avec les services de conseil et de transformation numérique de PwC. Cette acquisition s'inscrit dans l'objectif plus large de PwC : aider ses clients à réinventer leurs modèles économiques grâce à des solutions technologiques et pilotées par l'humain, notamment la conception d'emballages, l'optimisation de la chaîne d'approvisionnement et l'innovation de produits connectés.

- En novembre 2023, le gouvernement américain a lancé une initiative stratégique dans le cadre du programme CHIPS for America afin de renforcer les capacités du pays en matière de conditionnement avancé des semi-conducteurs. Ce plan prévoit un financement pouvant atteindre 1,6 milliard de dollars pour soutenir le développement d'une industrie nationale du conditionnement sûre, résiliente et à haut volume. Cet effort s'inscrit dans le cadre plus large du Programme national de fabrication de conditionnement avancé (NAPMP), qui vise à garantir que les puces à nœuds avancés fabriquées aux États-Unis soient également conditionnées localement, réduisant ainsi la dépendance aux installations étrangères et renforçant la sécurité de la chaîne d'approvisionnement.

- En septembre 2023, Sandvik Coromant a développé ses capacités d'emballage intelligent en lançant un nouvel outil basé sur l'IA visant à améliorer l'efficacité de l'emballage des outils coupants industriels. Cette innovation s'inscrit dans la stratégie globale de transformation numérique de Sandvik, qui intègre l'IA et l'apprentissage automatique pour rationaliser les flux de production et réduire la complexité opérationnelle. Cet outil favorise l'automatisation de la prise de décision, améliore la précision du choix des outils et simplifie le flux de données entre les étapes de production. En intégrant l'intelligence artificielle dans les processus d'emballage, Sandvik aide les fabricants à réduire les déchets, à accroître la productivité et à répondre à la demande croissante de solutions durables et connectées sur le marché nord-américain.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.