North America Composite Bearings Market

Taille du marché en milliards USD

TCAC :

%

USD

1.73 Billion

USD

2.85 Billion

2025

2033

USD

1.73 Billion

USD

2.85 Billion

2025

2033

| 2026 –2033 | |

| USD 1.73 Billion | |

| USD 2.85 Billion | |

|

|

|

|

Segmentation du marché nord-américain des paliers composites, par type de produit (matrice fibreuse et matrice métallique), matériau (composite de polytétrafluoroéthylène (PTFE) et composite de polyoxyméthylène (POM)), forme (bagues cylindriques, bagues à bride, plaques de glissement, rondelles de butée et rondelles à bride), canal de distribution (hors ligne et en ligne), application (construction et mines, automobile, aérospatiale, agriculture, secteur maritime, énergies renouvelables, agroalimentaire, équipements de fitness, pétrole et gaz, industrie hydraulique et autres) - Tendances et prévisions du secteur jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des roulements composites en Amérique du Nord ?

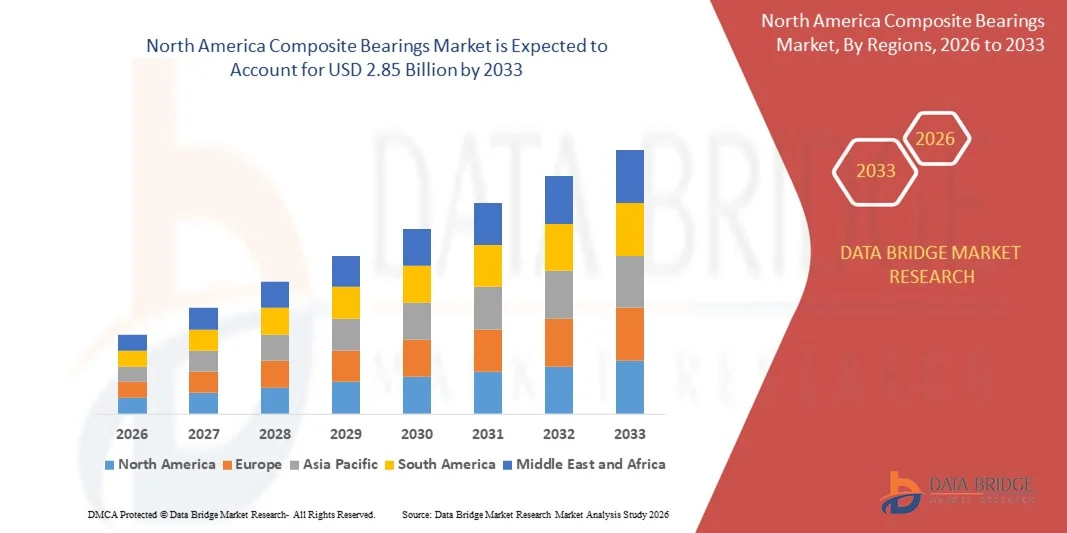

- Le marché nord-américain des roulements composites était évalué à 1,73 milliard de dollars américains en 2025 et devrait atteindre 2,85 milliards de dollars américains d'ici 2033 , avec un TCAC de 6,4 % au cours de la période de prévision.

- La préférence croissante pour les composants légers dans divers secteurs industriels stimule le marché des roulements composites. Toutefois, le coût élevé des matières premières et de la production devrait freiner ce marché au cours de la période de prévision.

- L'industrialisation rapide des économies émergentes offre de nouvelles opportunités au marché des paliers composites. Atteindre le niveau de précision souhaité en matière de conception et de fabrication représente un défi pour ce marché.

Quels sont les principaux enseignements du marché des roulements composites ?

- L'adoption croissante de solutions de roulements légers, résistants à la corrosion et sans entretien dans les secteurs de l'automobile, de l'aérospatiale, des machines industrielles et des énergies renouvelables crée d'importantes opportunités de croissance pour le marché des roulements composites.

- Les fabricants sont confrontés à des défis liés au coût élevé des matières premières, à la complexité des procédés de fabrication et à la validation des performances dans des conditions d'exploitation extrêmes, ce qui pourrait freiner la croissance du marché malgré une demande croissante.

- Les États-Unis ont dominé le marché nord-américain des paliers composites avec une part de revenus estimée à 45,6 % en 2025, grâce à une adoption industrielle généralisée, à la vigueur des secteurs de l'automobile et des machines, et à une utilisation importante dans la construction, les énergies renouvelables et les applications liées aux équipements lourds.

- Le Mexique devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,7 %, entre 2026 et 2033, grâce à l'adoption croissante des roulements composites dans les secteurs de l'automobile, de la construction et des machines industrielles.

- Le segment des composites à matrice fibreuse a dominé le marché avec une part estimée à 63,1 % en 2025, grâce à sa légèreté, son excellente résistance à la corrosion, ses propriétés autolubrifiantes et sa haute résistance à l'usure.

Portée du rapport et segmentation du marché des roulements composites

|

Attributs |

Roulements composites : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des roulements composites ?

Tendance croissante vers des roulements composites légers, sans entretien et haute performance

- Le marché des paliers composites connaît une demande croissante de solutions de paliers légers, résistants à la corrosion et autolubrifiants dans les secteurs de l'automobile, de l'aérospatiale, des machines industrielles et des énergies renouvelables.

- Les fabricants développent de plus en plus de roulements en polymère renforcé de fibres , revêtus de PTFE et composites métal-polymère afin d'améliorer la résistance à l'usure, la capacité de charge et la durée de vie opérationnelle.

- L'accent croissant mis sur la réduction de la maintenance, l'efficacité énergétique et la fiabilité des équipements accélère l'adoption des roulements composites dans les environnements d'exploitation difficiles et soumis à des charges élevées.

- Par exemple, des entreprises telles que SKF, Schaeffler, Trelleborg, GGB et RBC Bearings élargissent leurs gammes de roulements composites pour les véhicules électriques, les éoliennes, l'automatisation industrielle et les engins lourds.

- L'utilisation croissante de paliers composites dans les véhicules électriques, la robotique, les systèmes aérospatiaux et les équipements de traitement des fluides stimule une expansion soutenue du marché.

- Alors que les industries privilégient la durabilité, la réduction du poids et l'optimisation du coût du cycle de vie, les roulements composites resteront des composants essentiels des systèmes mécaniques de nouvelle génération.

Quels sont les principaux moteurs du marché des roulements composites ?

- La demande croissante de solutions de roulements sans entretien et sans lubrification pour réduire les temps d'arrêt et les coûts d'exploitation dans les secteurs industriels et automobiles

- Par exemple, au cours de la période 2024-2025, des fabricants de premier plan tels que SKF, Schaeffler et Trelleborg ont introduit des solutions de roulements composites avancées conçues pour des conditions de charge élevées et de températures extrêmes.

- L'adoption croissante des véhicules électriques , des systèmes d'énergie éolienne et des équipements de fabrication automatisés stimule la demande de roulements légers et performants.

- Les progrès réalisés dans le domaine des sciences des matériaux, du génie des polymères et des techniques de fabrication améliorent la résistance, la résistance à l'usure et la durée de vie des roulements.

- L'importance croissante accordée au développement durable et à l'efficacité énergétique encourage le remplacement des paliers métalliques traditionnels par des alternatives composites.

- Soutenu par la croissance de l'automatisation industrielle et le développement des infrastructures, le marché des roulements composites devrait connaître une croissance soutenue à long terme.

Quel facteur freine la croissance du marché des roulements composites ?

- Les coûts plus élevés des matériaux et de la fabrication associés aux polymères avancés, aux fibres et à la fabrication de précision peuvent limiter leur adoption dans les applications sensibles aux coûts.

- Entre 2024 et 2025, la volatilité des prix des matières premières et les perturbations des chaînes d'approvisionnement ont eu un impact sur les coûts de production des fabricants de roulements composites.

- Les limitations de performance sous des charges de choc extrêmes ou des conditions de désalignement peuvent restreindre l'utilisation dans certaines applications exigeantes.

- Le manque de sensibilisation des petits fabricants aux avantages à long terme et aux économies sur le coût du cycle de vie freine leur pénétration du marché.

- La concurrence des paliers métalliques traditionnels et des alternatives à bas coût exerce une pression sur les prix.

- Pour relever ces défis, les entreprises se concentrent sur l'optimisation des coûts, les conceptions spécifiques aux applications et la sensibilisation des clients afin d'accroître l'adoption des paliers composites.

Comment le marché des roulements composites est-il segmenté ?

Le marché est segmenté en fonction du type de produit, du matériau, de la forme, du canal de distribution et de l'application .

- Par type de produit

Le marché des paliers composites est segmenté, selon le type de produit, en paliers composites à matrice de fibres et paliers composites à matrice métallique. Le segment des paliers composites à matrice de fibres a dominé le marché en 2025, avec une part de marché estimée à 63,1 %, grâce à leur légèreté, leur excellente résistance à la corrosion, leurs propriétés autolubrifiantes et leur haute résistance à l'usure. Ces paliers sont largement utilisés dans les secteurs de l'automobile, de l'aérospatiale, des énergies renouvelables et de l'automatisation industrielle, où la réduction du poids et un fonctionnement sans entretien sont essentiels. Leurs excellentes propriétés d'amortissement des vibrations et de réduction du bruit favorisent également leur adoption dans les machines de précision.

Le segment des composites à matrice métallique devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par la demande croissante de roulements capables de résister à des charges élevées, des températures élevées et des environnements d'exploitation difficiles. Leur utilisation accrue dans les machines lourdes, les engins de chantier et les applications pétrolières et gazières accélère cette croissance. Face aux exigences industrielles de durabilité et de résistance structurelle accrues, les roulements en composite à matrice métallique gagnent du terrain à l'échelle mondiale.

- Par matériau

Selon le matériau utilisé, le marché se divise en paliers composites en polytétrafluoroéthylène (PTFE) et en polyoxyméthylène (POM). En 2025, le segment des paliers composites en PTFE représentait la part la plus importante, soit environ 58,7 %, grâce à ses excellentes propriétés autolubrifiantes, son faible coefficient de frottement, sa résistance chimique et ses performances supérieures en fonctionnement à sec. Les paliers composites en PTFE sont largement utilisés dans les secteurs de l'automobile, de l'aérospatiale, des systèmes hydrauliques et des machines de transformation alimentaire, où un fonctionnement sans lubrification et une propreté irréprochable sont essentiels.

Le segment des composites POM devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide entre 2026 et 2033, grâce à son rapport coût-efficacité avantageux, sa haute résistance mécanique, sa stabilité dimensionnelle et sa facilité d'usinage. Son adoption croissante dans les équipements grand public, les machines agricoles et les applications industrielles générales soutient cette croissance. Les fabricants recherchant des performances optimales à des coûts compétitifs, la demande de roulements en composite POM devrait fortement augmenter.

- Par formulaire

Le marché des paliers composites est segmenté selon leur forme en bagues cylindriques, bagues à bride, plaques de glissement, rondelles de butée et rondelles à bride. Le segment des bagues cylindriques dominait le marché en 2025 avec une part de 36,9 %, grâce à leur utilisation répandue dans les systèmes de suspension automobile, les engins de chantier, les vérins hydrauliques et les équipements industriels. Leur conception simple, leur capacité de charge élevée et leur facilité d'installation en font le choix privilégié dans de nombreux secteurs.

Le segment des plaques de glissement devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, porté par la demande croissante des secteurs du génie civil, des ponts, des installations d'énergies renouvelables et des applications industrielles lourdes. Les plaques de glissement offrent une excellente répartition des charges, un faible frottement et une longue durée de vie, même en cas de mouvements oscillatoires. Les rondelles de butée et les bagues à bride connaissent également une croissance soutenue, grâce à la demande croissante de solutions de roulement compactes et adaptées aux besoins spécifiques de chaque application.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en canaux hors ligne et en ligne. Le canal de distribution hors ligne dominait le marché avec une part estimée à 68,4 % en 2025, grâce à une forte dépendance aux relations directes avec les fournisseurs, aux partenariats avec les équipementiers, aux distributeurs agréés et aux réseaux d'approvisionnement industriels. Les utilisateurs finaux privilégient les canaux hors ligne pour les conseils techniques, les solutions personnalisées, les achats en gros et la garantie de la qualité des produits, notamment pour les applications industrielles critiques.

Le canal de distribution en ligne devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à la digitalisation croissante des achats industriels, au développement des plateformes de commerce électronique B2B et à un meilleur accès aux roulements composites standardisés. Les PME privilégient de plus en plus les achats en ligne, séduites par des prix compétitifs, des délais de livraison plus courts et une plus grande disponibilité des produits. À mesure que les chaînes d'approvisionnement numériques se développent, les canaux en ligne joueront un rôle croissant dans l'expansion du marché.

- Sur demande

Selon l'application, le marché des paliers composites se segmente en construction et mines, automobile, aérospatiale, agriculture, secteur maritime, énergies renouvelables, agroalimentaire, équipements de fitness, pétrole et gaz, hydraulique et autres. Le segment automobile dominait le marché en 2025 avec une part de 31,5 %, porté par l'adoption croissante de ces paliers dans les systèmes de suspension, les composants de direction, les systèmes de freinage et les véhicules électriques. La conception allégée, la réduction des coûts de maintenance et l'amélioration du rendement énergétique contribuent fortement à la demande dans ce secteur.

Le segment des énergies renouvelables devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par le développement des installations éoliennes et solaires à l'échelle mondiale. Les paliers composites sont de plus en plus utilisés dans les systèmes d'orientation des éoliennes, les mécanismes de lacet et les systèmes de suivi solaire en raison de leur durabilité et de leur résistance aux environnements difficiles. L'augmentation des investissements dans les infrastructures d'énergie propre continue d'accélérer l'adoption des énergies renouvelables dans toutes les applications.

Quelle région détient la plus grande part du marché des roulements composites ?

- Les États-Unis ont dominé le marché nord-américain des paliers composites avec une part de marché estimée à 45,6 % en 2025, grâce à une large adoption industrielle, à la vigueur des secteurs de l'automobile et des machines, et à une utilisation intensive dans la construction, les énergies renouvelables et les engins lourds. La demande croissante de paliers composites légers, sans entretien et performants dans les principaux secteurs industriels continue de consolider la position dominante des États-Unis sur ce marché.

- L'accent mis de plus en plus sur l'efficacité énergétique, la réduction du bruit et la durabilité dans les applications industrielles, automobiles et aérospatiales stimule considérablement l'adoption des paliers composites aux États-Unis. Une infrastructure de production solide, des centres de R&D de pointe et la collaboration avec les équipementiers renforcent encore davantage le marché régional.

Analyse du marché canadien des roulements composites

Au Canada, la croissance du marché est tirée par les secteurs de l'automobile, de la construction et des énergies renouvelables, où les paliers composites sont largement utilisés dans les machines lourdes, les éoliennes et les équipements industriels en raison de leur résistance à l'usure, de leur faible frottement et de leur fonctionnement sans entretien. L'adoption croissante de solutions écoénergétiques, conjuguée aux incitations gouvernementales et aux programmes de modernisation industrielle, favorise l'expansion du marché. La collaboration entre les fabricants et les équipementiers locaux accélère encore davantage cette adoption.

Analyse du marché des roulements composites au Mexique

Le Mexique devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,7 %, entre 2026 et 2033, grâce à l'adoption croissante des paliers composites dans les secteurs de l'automobile, de la construction et des machines industrielles. L'augmentation des investissements dans le secteur manufacturier, les projets d'énergies renouvelables et la modernisation des infrastructures stimule la demande de solutions composites à base de fibres et de matrices métalliques. La croissance industrielle axée sur l'exportation, l'adoption croissante des véhicules électriques et les partenariats entre fabricants locaux et internationaux contribuent également à l'expansion du marché à long terme.

Quelles sont les principales entreprises du marché des roulements composites ?

L'industrie des paliers composites est principalement dominée par des entreprises bien établies, notamment :

- SKF (Suède)

- Schaeffler AG (Allemagne)

- Trelleborg AB (Suède)

- RBC Bearings Incorporated (États-Unis)

- SGL Carbone (Allemagne)

- Société Polygon (États-Unis)

- Huntsman International LLC (États-Unis)

- HyComp LLC (États-Unis)

- GGB (États-Unis)

- Rexnord Corporation (États-Unis)

- Tenneco Inc. (États-Unis)

- Fabrication de qualité dans le Pacifique, Inc. (États-Unis)

- Technologie FTL (États-Unis)

- Rheinmetall Automotive AG (Allemagne)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.