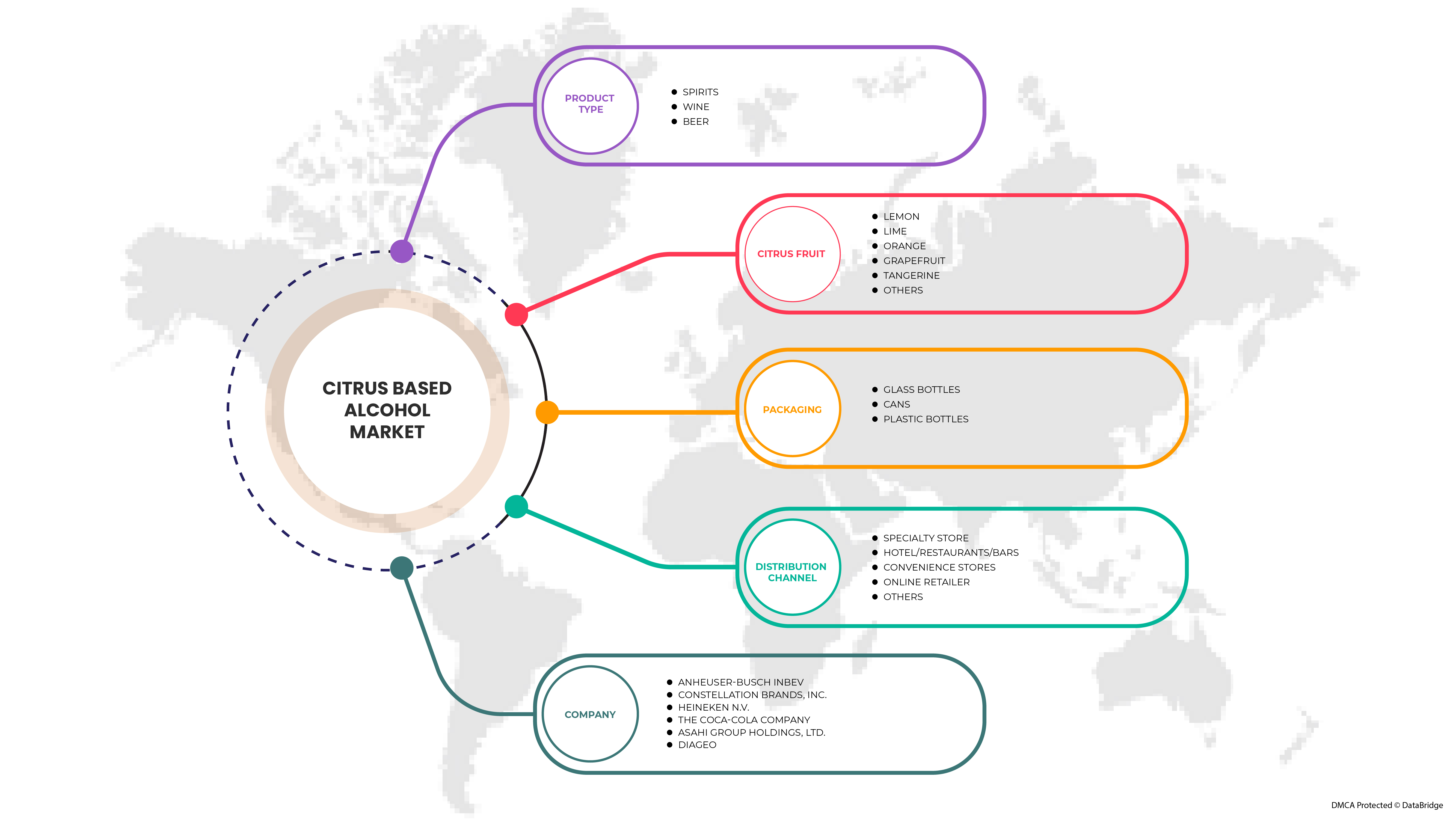

Marché nord-américain des alcools à base d'agrumes par type de produit (spiritueux, vin et bière), agrumes ( citron , citron vert, orange, pamplemousse, mandarine et autres), emballage ( bouteilles en verre , canettes et bouteilles en plastique), canal de distribution (magasins spécialisés, hôtels/restaurants/bars, dépanneurs, détaillants en ligne et autres), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché des boissons alcoolisées à base d'agrumes en Amérique du Nord

Le marché des alcools à base d'agrumes devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,8 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 076,18 millions USD d'ici 2029. Le principal facteur à l'origine de la croissance du marché des alcools à base d'agrumes est la tendance croissante des spiritueux artisanaux et l'adoption d'ingrédients rentables.

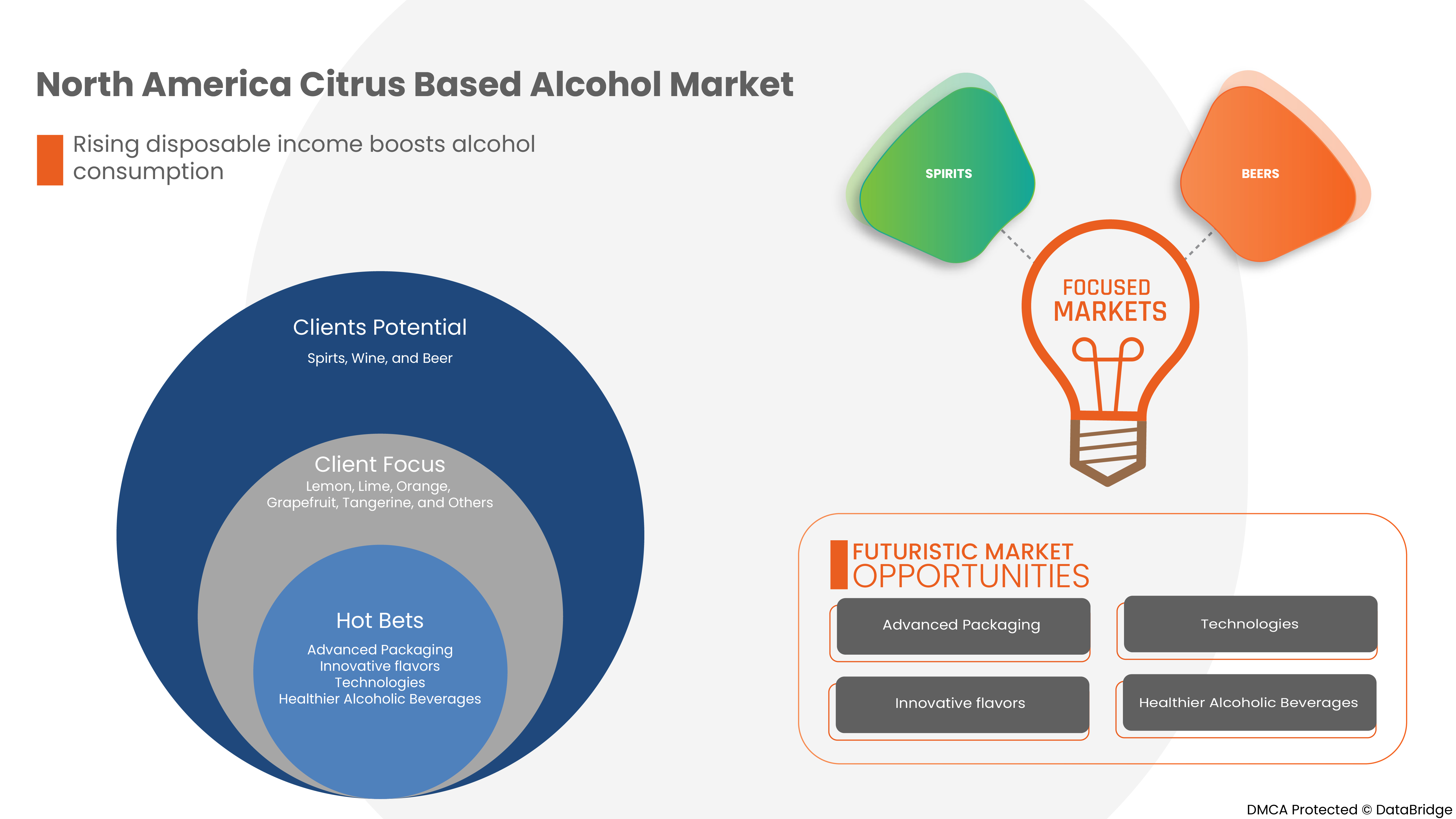

La demande et la popularité croissantes des spiritueux artisanaux et l'adoption d'ingrédients rentables constituent un moteur important du marché nord-américain des alcools à base d'agrumes. L'augmentation du revenu disponible stimule la consommation d'alcool, et la sensibilisation croissante des consommateurs aux bienfaits des arômes d'agrumes pour la santé devrait propulser la croissance du marché nord-américain des alcools à base d'agrumes.

Le rapport sur le marché des alcools à base d'agrumes fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions de dollars américains |

|

Segments couverts |

Par type de produit (spiritueux, vin et bière), agrumes ( citron , citron vert, orange, pamplemousse, mandarine et autres), emballage ( bouteilles en verre , canettes et bouteilles en plastique), canal de distribution (magasins spécialisés, hôtels/restaurants/bars, supérettes, détaillants en ligne et autres). |

|

Pays couverts |

États-Unis, Canada, Mexique. |

|

Acteurs du marché couverts |

Anheuser-Busch InBev, Constellation Brands, Inc., Heineken NV, The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Busch Companies, LLC., The BOSTON BEER COMPANY, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED, Accolade Wines Limited., WILLIAM GRANT & SONS, Carlsberg Breweries A/S, Halewood Artisanal Spirits, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, KALS Distilleries Private Limited, Bacardi Limited |

Définition du marché

Les alcools à base d'agrumes sont principalement produits à partir d'agrumes tels que le citron, le citron vert, le pamplemousse et l'orange. En raison de leur saveur et de leur forte acidité, les agrumes sont devenus une partie intégrante des boissons alcoolisées, notamment de la bière et des spiritueux tels que le vin, le rhum et le gin, et sont utilisés pour équilibrer les cocktails. De même, l'alcool d'agrumes est utilisé comme base et additif aromatique dans la production d'alcool. Les boissons alcoolisées à base d'agrumes héritent du profil nutritionnel des agrumes à partir desquels elles sont produites, comme le citron, le citron vert, l'orange, le pamplemousse, la mandarine et d'autres. Les agrumes sont riches en vitamine C, un puissant antioxydant qui protège les cellules des dommages causés par les radicaux libres et joue un rôle important dans la prévention de maladies telles que le diabète, le cancer et les maladies neurologiques.

Les spiritueux artisanaux sont principalement développés en utilisant l'infusion des saveurs des fruits. L'innovation qui découle des spiritueux artisanaux est par ailleurs sans équivalent dans l'industrie des boissons. Les produits artisanaux sont considérés comme plus créatifs, plus agiles et plus spécialisés par le consommateur avec tant de variété et d'art. Cette croissance croissante des spiritueux artisanaux contribue à la croissance de l'alcool à base d'agrumes en incorporant des agrumes dans leurs produits de distillerie. En plus des agrumes, l'alcool est infusé de diverses épices, notamment de la cannelle, de la vanille, du gingembre, du poivre et d'autres pour améliorer le goût et l'arôme. Cette adoption des ingrédients et des agrumes est à la fois plus saine et plus rentable pour la production de spiritueux.

Dynamique du marché des boissons alcoolisées à base d'agrumes

Conducteurs

- Tendance croissante des spiritueux artisanaux et adoption d'ingrédients rentables

Alors que l’industrie des boissons continue de se développer, l’essor des spiritueux artisanaux, parmi les bières et les cidres artisanaux, ne peut être ignoré. Du rhum au gin, « il existe de nombreux spiritueux artisanaux, en ligne et en magasin, qui incarnent tous quelque chose de différent. À tel point que beaucoup préfèrent les spiritueux artisanaux aux marques commerciales plus traditionnelles, ce qui est également probablement dû à la tendance des consommateurs à acheter localement auprès de petites distilleries et brasseries. La demande rapide de spiritueux artisanaux de qualité supérieure due à l’évolution des attitudes culturelles de la population jeune et aisée contribue largement à la croissance du marché mondial des spiritueux artisanaux. Les consommateurs de spiritueux artisanaux préfèrent les produits fabriqués à partir d’arômes naturels ou biologiques, tandis que les petits distillateurs se différencient par des ingrédients authentiques triés sur le volet, tels que l’eau de source et les céréales sans OGM, et des combinaisons de saveurs uniques. Le rhum artisanal le plus populaire est le rhum épicé, infusé de diverses épices, notamment de la cannelle, du gingembre, de la vanille, de la muscade et du poivre. Cette adoption des ingrédients est plus saine et rentable pour la production de spiritueux artisanaux.

- L'augmentation du revenu disponible stimule la consommation d'alcool

Mais de nos jours, l'alcool est devenu plus abordable dans la majorité des pays, en raison de l'augmentation du revenu disponible des citoyens. L'évolution du revenu réel a été plus importante que celle du prix relatif de l'alcool. Cela montre que la croissance du revenu réel a été le principal moteur de l'accessibilité. La croissance de l'alcool est importante pour la tranche d'âge de 18 à 80 ans, en particulier chez les jeunes. L'augmentation de l'emploi et de la hausse du revenu disponible, associées à la baisse du taux de chômage, stimulent la demande d'alcool. Dans le monde moderne, partout, les gens ont besoin d'alcool pour profiter de leurs journées et de leurs nuits pendant leurs vacances, leurs fêtes et aussi leurs loisirs. Le secteur informatique se développe et les gens essaient de devenir plus sociables entre collègues. Cette socialisation nécessite principalement de l'alcool. Afin de faciliter cela, l'alcool n'est pas seulement disponible dans les magasins ou les boutiques d'alcool, les hôtels et restaurants haut de gamme sont désireux d'intégrer des spiritueux artisanaux à leur offre.

- Sensibilisation croissante des consommateurs aux bienfaits des arômes d'agrumes pour la santé

Les boissons alcoolisées aromatisées aux agrumes sont de plus en plus populaires auprès de la plupart des gens dans le monde en raison de leurs multiples bienfaits pour la santé et de leur capacité à rehausser le goût. Les agrumes, comme les citrons et les oranges, sont riches en vitamine C, un puissant antioxydant qui protège les cellules des dommages causés par les radicaux libres. La production osseuse, la guérison du tissu conjonctif et la santé des gencives nécessitent principalement de la vitamine C que l'on obtient grâce aux boissons aromatisées aux agrumes. La vitamine C présente dans les agrumes aide également à prévenir les rides, la peau sèche due au vieillissement et les dommages causés par le soleil. De plus, elle catalyse également la production de collagène, qui est vital pour la santé de la peau.

Opportunités

- La demande en arômes d'alcool innovants augmente

Il existe de nombreuses façons d'améliorer une boisson alcoolisée pure en utilisant des arômes de fruits. Les huiles d'agrumes sont largement utilisées pour aromatiser les boissons. Ce fruit appartient à la famille des Rutacées et se compose d'environ 140 tribus et 1300 espèces, telles que : le citron vert, le pamplemousse, les oranges, le citron jaune, les mandarines, le pomelo, la bergamote et le cédrat. Les huiles d'agrumes sont stockées dans les feuilles, les écorces et le jus. Les terpènes, les sesquiterpènes, les aldéhydes, les alcools, les esters et les stérols font partie des nombreux produits chimiques présents dans ces excellentes huiles essentielles. Ils sont également connus sous le nom de mélanges d'hydrocarbures, de produits chimiques contenant de l'oxygène et de composés résiduels non volatils. Les arômes d'agrumes sont populaires dans les boissons, en particulier la bière de blé. L'un des produits de fermentation de la bière de blé sont les esters qui donnent le goût et l'arôme du fruit à la bière elle-même, de sorte qu'ils s'accordent parfaitement avec les saveurs d'agrumes et cachent presque la saveur et l'arôme fournis par le houblon. Les cocktails à la bière les plus populaires sont mélangés à des agrumes tels que du citron, du jus d'orange ou des arômes.

- L'accent croissant mis par le fabricant clé sur la mise à niveau des technologies existantes

Le marché des boissons alcoolisées connaît une transition rapide avec l'augmentation de la consommation de boissons alcoolisées à base d'agrumes. La technique de production de boissons alcoolisées fermentées aux agrumes telles que le vin d'agrumes et l'eau-de-vie d'agrumes appartient au domaine de la transformation en profondeur des agrumes, utilise les agrumes comme matière première et adopte les étapes suivantes : pressage du jus, centrifugation, repos et clarification, régulation du rapport sucre-acide et fermentation primaire à basse température, post-fermentation, filtrage et vieillissement, mélange, congélation et filtrage, pasteurisation éclair à ultra haute température et remplissage thermique pour obtenir le vin fermenté aux agrumes ; puis, le vin fermenté aux agrumes de type sec subit les processus de distillation, de fabrication, de filtrage, de vieillissement, de mélange, de congélation et de filtrage pour obtenir l'eau-de-vie d'agrumes inventée. Ladite eau-de-vie d'agrumes est claire et transparente, possède un parfum d'agrumes et une couleur naturelle, et a un goût riche et plein au palais. De plus, d'autres technologies existantes sont disponibles pour la fabrication des boissons alcoolisées à base d'agrumes.

Contraintes/Défis

- Volatilité des prix des agrumes

Les agrumes ou les prix des matières premières jouent un rôle majeur sur le marché des alcools à base d'agrumes en raison de l'utilisation de l'arôme d'agrumes dans l'alcool, des boissons considérablement plus saines et plus savoureuses sont produites et vendues sur le marché. L'augmentation de la consommation d'alcool dans le monde augmente également la consommation de boissons alcoolisées à base d'agrumes, en raison de leur mélange naturel d'agrumes aromatisés aux fruits. La principale matière première de base pour la production d'alcools à base d'agrumes est les agrumes. Les agrumes comprennent les oranges, les citrons, les citrons verts et les pamplemousses. Malgré le fait que ces agrumes soient largement disponibles sur le marché, le taux d'inflation de plusieurs pays, les conditions climatiques, les lois et droits d'importation et d'exportation, la volatilité des prix des produits pétroliers utilisés pour le transport et d'autres facteurs ont un impact significatif et provoquent des fluctuations de prix.

- Des règles strictes visant à limiter la consommation d'alcool

Les principales politiques strictes utilisées pour réduire la consommation d'alcool comprennent l'utilisation par plusieurs « pays » de la fiscalité pour cibler les prix de l'alcool, comme la taxe unitaire, la taxe spécifique (volumétrique) et d'autres taxes d'accise sur l'alcool. En plus de ces taxes, certains gouvernements s'intéressent de plus en plus au prix unitaire minimum (MUP). Le MUP est un outil politique qui fixe un prix plancher obligatoire par unité d'alcool ou boisson standard, ciblant les boissons alcoolisées bon marché. Plusieurs pays, dont le Canada, ont mis en œuvre le MUP. La disponibilité de l'alcool peut être limitée pour influencer la consommation, limitant ainsi la possibilité pour les gens d'acheter et de consommer de l'alcool. Par exemple, au Tamil Nadu, en Inde, les heures d'ouverture des magasins d'alcool sont de 12 h à 22 h.

- Inquiétudes croissantes concernant les effets nocifs des arômes artificiels sur la santé

Les arômes artificiels n'ont aucune valeur nutritionnelle. Ils n'apportent aucun bénéfice pour la santé grâce aux vitamines et minéraux essentiels. Ils ont des effets nocifs sur la santé humaine. Les principaux effets d'une consommation élevée de boissons alcoolisées aromatisées sont un risque élevé de cancer et d'autres maladies comme l'hypertension artérielle, les maladies cardiaques, les accidents vasculaires cérébraux, les maladies du foie, l'affaiblissement du système immunitaire, etc.

- Une prévalence élevée de troubles liés à la consommation d'alcool (TCA)

Les causes des troubles liés à la consommation d'alcool semblent être une combinaison de facteurs génétiques, d'événements survenus dans la petite enfance et de tentatives de soulagement de la douleur émotionnelle. Les personnes sont plus susceptibles de développer un trouble lié à la consommation d'alcool si elles consomment souvent de l'alcool en grande quantité ou si elles commencent à boire tôt dans la vie, si elles ont subi un traumatisme, comme des abus physiques ou sexuels, si elles ont des antécédents familiaux de troubles liés à la consommation d'alcool, si elles ont des problèmes de santé mentale, comme le deuil, l'anxiété, la dépression, les troubles de l'alimentation et le syndrome de stress post-traumatique. Elles ont subi un pontage gastrique pour des problèmes de poids.

- Disponibilité de substituts aux agrumes

Il existe de nombreuses alternatives au jus d'agrumes frais pour équilibrer nos cocktails, et elles se présentent sous la forme d'acides naturels. Celui que vous connaissez probablement est l'acide citrique. Il en existe cependant plusieurs autres : l'acide malique (présent dans les pommes, les abricots, les pêches), l'acide tartrique (raisins, bananes) et l'acide lactique (produits laitiers), pour n'en citer que quelques-uns. De plus, les vinaigres, les mélasses et le verjus peuvent apporter des types d'acidité et d'acidité différents de ceux des agrumes et des acides en poudre. L'utilisation d'un pourcentage incroyablement faible d'acide permet de stabiliser les sirops et les jus, qui ont une dégradation naturelle de la saveur, et d'augmenter considérablement leur durée de conservation.

Développement récent

- En octobre 2021, selon Craft Spirits, SunDaze, les cocktails en canettes prêts à boire aux agrumes, a annoncé son lancement en Californie du Sud dans les établissements PinkDot et Total Wine du comté de Los Angeles et dans tout le pays (là où c'est légal) via une expédition directe au consommateur en ligne. Ce lancement intensifiera les opérations de l'entreprise sur le marché nord-américain.

- En juillet 2022, selon le magazine Spirits Business, la distillerie Shakespeare basée au Royaume-Uni a lancé une vodka aux agrumes dans le cadre de sa gamme en édition limitée Distillery Special. Cette vodka aux agrumes a de fortes saveurs d'oranges et de citrons frais, pelés à la main à la distillerie.

Portée du marché des alcools à base d'agrumes

Le marché des alcools à base d'agrumes est classé en fonction du type de produit, des agrumes, de l'emballage et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Esprits

- Vin

- Bière

Sur la base du type de produit, le marché des alcools à base d'agrumes est classé en trois segments, à savoir la bière, le vin et les spiritueux.

Agrumes

- Citron

- Citron vert

- Orange

- Pamplemousse

- Tangerine

- Autres

Sur la base des agrumes, le marché des alcools à base d'agrumes est classé en six segments, à savoir le citron, le citron vert, l'orange, le pamplemousse, la mandarine et autres.

Conditionnement

- Bouteilles en verre

- Canettes

- Bouteilles en plastique

Sur la base de l'emballage, le marché des alcools à base d'agrumes est classé en trois segments, à savoir les bouteilles en verre, les canettes et les bouteilles en plastique.

Canal de distribution

- Magasins spécialisés

- Hôtel/Restaurants/Bars

- Magasins de proximité

- Détaillant en ligne

- Autres

Sur la base du canal de distribution, le marché des alcools à base d'agrumes est classé en cinq segments, à savoir les magasins spécialisés, les hôtels/restaurants/bars, les dépanneurs, les détaillants en ligne et autres.

Analyse/perspectives régionales du marché des boissons alcoolisées à base d'agrumes

Le marché des alcools à base d’agrumes est segmenté en fonction du type de produit, des agrumes, de l’emballage et du canal de distribution.

Les pays présents sur le marché des alcools à base d'agrumes sont les États-Unis, le Canada et le Mexique

En Amérique du Nord, les États-Unis devraient dominer le marché en raison de l’augmentation du revenu disponible des consommateurs.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des boissons alcoolisées à base d'agrumes

Le paysage concurrentiel du marché des alcools à base d'agrumes fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des alcools à base d'agrumes.

Français Certains des principaux acteurs du marché opérant sur le marché sont Anheuser-Busch InBev, Constellation Brands, Inc., Heineken NV, The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Bush Companies, LLC., The BOSTON BEER COMPANY, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED., Accolade Wines Limited., WILLIAM GRANT & SONS, Carlsberg Breweries A/S, Halewood Artisanal Spirits, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, KALS Distilleries Private Limited, Bacardi Limited et entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent les grilles de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, les grilles de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CITRUS BASED ALCOHOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.2 GROWTH STRATEGIES OF THE KEY MARKET PLAYERS

4.3 IMPACT OF THE ECONOMY ON MARKET

4.3.1 IMPACT ON PRICE

4.3.2 IMPACT ON SUPPLY CHAIN

4.3.3 IMPACT ON SHIPMENT

4.3.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT

4.6 FOB & B2B PRICES – NORTH AMERICA CITRUS BASED ALCOHOL MARKET

4.7 B2B PRICES – NORTH AMERICA CITRUS BASED ALCOHOL MARKET

4.8 VALUE CHAIN ANALYSIS:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS

6.1.2 RISING DISPOSABLE INCOME BOOSTS ALCOHOL CONSUMPTION

6.1.3 GROWING AWARENESS REGARDING THE HEALTH BENEFITS OF CITRUS FLAVORS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY IN CITRUS FRUITS

6.2.2 STRICT RULES AIMED AT LIMITING ALCOHOL CONSUMPTION

6.2.3 GROWING CONCERNS ABOUT THE HARMFUL EFFECTS OF ARTIFICIAL FLAVORS ON HEALTH

6.3 OPPORTUNITIES

6.3.1 SOARING DEMAND FOR INNOVATIVE ALCOHOL FLAVORS

6.3.2 INCREASING FOCUS OF THE KEY MANUFACTURER TO UPGRADE THE EXISTING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 A HIGH PREVALENCE OF ALCOHOL USE DISORDER (AUD)

6.4.2 AVAILABILITY OF SUBSTITUTES FOR CITRUS

7 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPIRITS

7.2.1 DISTILLED SPIRITS

7.2.1.1 VODKA

7.2.1.2 WHISKEY

7.2.1.3 RUM

7.2.1.3.1 LIGHT RUM

7.2.1.3.2 GOLD RUM

7.2.1.3.3 DARK RUM

7.2.1.3.4 OVER-PROOF RUM

7.2.1.3.5 SPICED RUM

7.2.1.3.6 CACHACA

7.2.1.3.7 FLAVORED RUM

7.2.1.4 TEQUILA

7.2.1.4.1 BLANCO

7.2.1.4.2 REPOSADO

7.2.1.4.3 ANEJO

7.2.1.4.4 EXTRA-ANEJO

7.2.1.5 BRANDY

7.2.1.5.1 COGNAC

7.2.1.5.2 ARMAGNAC

7.2.1.5.3 SPANISH BRANDY

7.2.1.5.4 AMERICAN BRANDY

7.2.1.5.5 GRAPPA

7.2.1.5.6 EAU-DE-VIE

7.2.1.5.7 FLAVORED BRANDY

7.2.1.6 GIN

7.2.1.6.1 LONDON DRY GIN

7.2.1.6.2 PLYMOUTH GIN

7.2.1.6.3 OLD TOM GIN

7.2.1.6.4 GENEVER

7.2.1.6.5 NEW AMERICAN

7.2.2 NON-DISTILLED SPIRITS

7.3 WINE

7.3.1 RED WINE

7.3.1.1 CABERNET SAUVIGNON

7.3.1.2 PINOT NOIR

7.3.1.3 ZINFANDEL

7.3.1.4 SYRAH

7.3.2 WHITE WINE

7.3.2.1 CHARDONNAY

7.3.2.2 RIESLING

7.3.2.3 PINOT GRIS

7.3.2.4 SAUVIGNON BLANC

7.3.3 ROSE WINE

7.3.4 SPARKLING WINE

7.3.5 DESSERT WINE

7.4 BEER

7.4.1 ALE

7.4.1.1 BROWN ALE

7.4.1.2 PALE ALE

7.4.1.3 INDIA PALE ALE

7.4.1.4 SOUR ALE

7.4.2 LAGER

7.4.3 PORTER

7.4.4 STOUT

7.4.5 WHEAT

7.4.6 PILSNER

8 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT

8.1 OVERVIEW

8.2 LEMON

8.3 LIME

8.4 ORANGE

8.5 GRAPEFRUIT

8.6 TANGERINE

8.7 OTHERS

9 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 GLASS BOTTLES

9.3 CANS

9.4 PLASTIC BOTTLES

10 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 HOTEL/RESTAURANTS/BARS

10.4 CONVENIENCE STORES

10.5 ONLINE RETAILERS

10.6 OTHERS

11 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 AGREEMENTS

12.6 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CONSTELLATION BRANDS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HEINEKEN N.V.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THE COCA-COLA COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ASHAHI GROUP HOLDINGS, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ANHEUSER-BUSCH COMPANIES, LLC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 THE BOSTON BEER COMPANY

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 DIAGEO

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BEAM SUNTORY INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ACCOLADE WINES LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BACARDI LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BROWN-FORMAN

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 CARLSBERG BREWERIES A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EDRINGTON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HALEWOOD ARTISANAL SPIRITS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 KALS DISTILLERIES PRIVATE LIMITED.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PERNOD RICARD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 RADICO KHAITAN LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SUNTORY HOLDINGS LIMITED

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 UNITED BREWERIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 WILLIAM GRANT & SONS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 3 NORTH AMERICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 5 NORTH AMERICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 13 NORTH AMERICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 18 NORTH AMERICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA LEMON IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LIME IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ORANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA GRAPEFRUIT IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TANGERINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA GLASS BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CANS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PLASTIC BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SPECIALTY STORES RANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HOTEL/RESTAURANTS/BARS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA CONVENIENCE STORES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ONLINE RETAILERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (MILLION LITRES)

TABLE 39 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 ORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 41 NORTH AMERICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 U.S. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 57 U.S. SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 58 U.S. DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 59 U.S. RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 60 U.S. TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 61 U.S. BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 62 U.S. GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 63 U.S. WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 U.S. RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 65 U.S. WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 66 U.S. BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 U.S. ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 69 U.S. CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 70 U.S. CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 CANADA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 73 CANADA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 CANADA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 CANADA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 76 CANADA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 77 CANADA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 78 CANADA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 79 CANADA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 80 CANADA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 81 CANADA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 82 CANADA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 CANADA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 85 CANADA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 CANADA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 89 MEXICO SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 MEXICO DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 MEXICO RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 94 MEXICO GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 97 MEXICO WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 98 MEXICO BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 99 MEXICO ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 101 MEXICO CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 102 MEXICO CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CITRUS BASED ALCOHOL MARKET

FIGURE 2 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: SEGMENTATION

FIGURE 13 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS IS EXPECTED TO DRIVE NORTH AMERICA CITRUS BASED ALCOHOL MARKET IN THE FORECAST PERIOD

FIGURE 14 SPIRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CITRUS BASED ALCOHOL MARKET IN 2022 & 2029

FIGURE 15 SUPPLY CHAIN ANALYSIS – NORTH AMERICA CITRUS BASED ALCOHOL MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA CITRUS BASED ALCOHOL MARKET

FIGURE 17 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY CITRUS FRUIT, 2021

FIGURE 19 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY PACKAGING, 2021

FIGURE 20 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 NORTH AMERICA CITRUS BASED ALCOHOL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.