Marché des membranes céramiques en Amérique du Nord, par matériau (alumine, oxyde de zirconium, titane, silice, autres), application (traitement de l'eau et des eaux usées, aliments et boissons, produits pharmaceutiques, biotechnologie , autres), technologie (ultrafiltration, microfiltration, nanofiltration, autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des membranes céramiques en Amérique du Nord

La demande croissante de membranes céramiques dans les secteurs du traitement de l'eau et des eaux usées, de l'alimentation et des boissons, de l'industrie pharmaceutique et biotechnologique est un facteur important pour le marché nord-américain des membranes céramiques. L'accent croissant mis sur la durabilité, la qualité et l'efficacité des membranes dans le processus de filtration devrait propulser la croissance du marché des membranes céramiques.

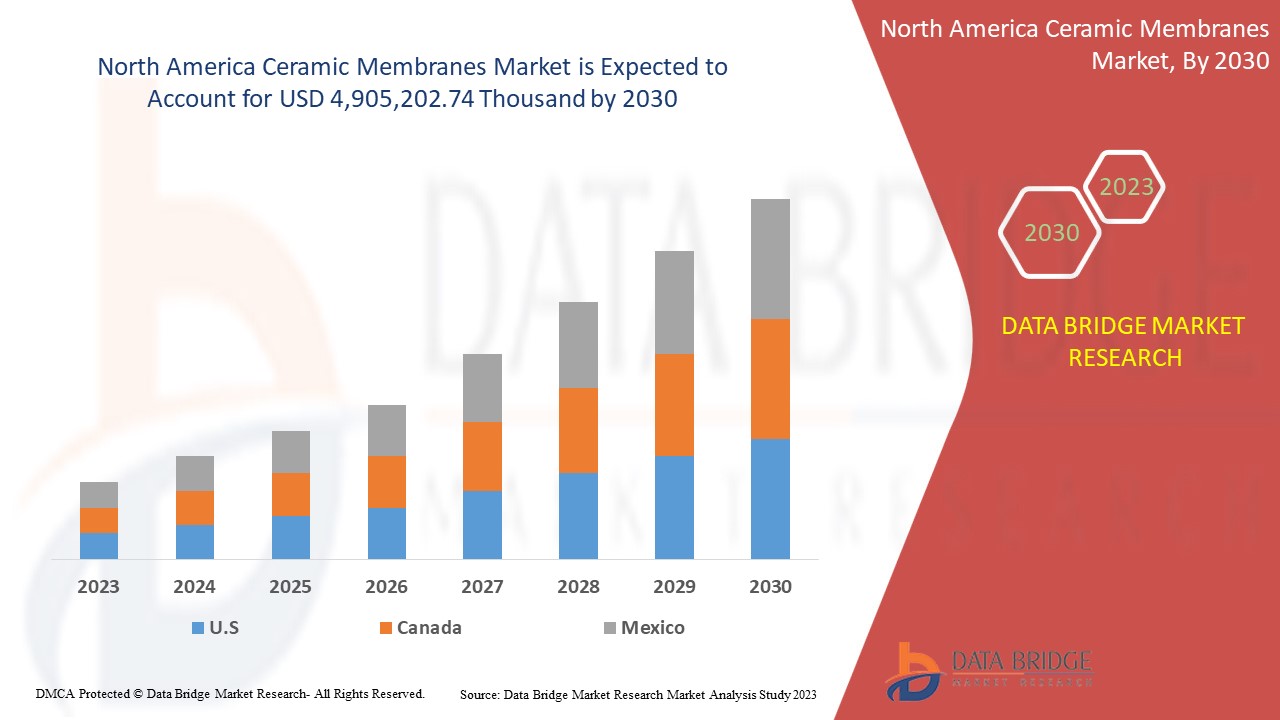

Le marché des membranes céramiques devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 12,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 4 905 202,74 milliers USD d'ici 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par matériau (alumine, oxyde de zirconium, titane, silice, autres), application (traitement de l'eau et des eaux usées, alimentation et boissons, produits pharmaceutiques, biotechnologie, autres), technologie (ultrafiltration, microfiltration, nanofiltration, autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord |

|

Acteurs du marché couverts |

Français TAMI Industries, atech innovations gmbh, GEA Group Aktiengesellschaft, Nanostone, LiqTech Holding A/S, Qua Group LLC., TORAY INDUSTRIES, INC., SIVA Unit., METAWATER. CO., LTD., KERAFOL Ceramic Films GmbH & Co. KG, Aquatech International LLC., Paul Rauschert GmbH & Co. KG., HYDRASYST, Membratec SA et Mantec Filtration. |

Définition du marché

Les membranes céramiques sont des membranes artificielles fabriquées à partir de matériaux inorganiques. Les membranes céramiques sont utilisées dans des industries telles que la filtration et le traitement des liquides. La plupart des industries où les membranes céramiques sont utilisées comprennent l'alimentation et les boissons, les produits pharmaceutiques, la biotechnologie et le traitement de l'eau et des eaux usées. Les facteurs de croissance du marché comprennent la demande croissante des industries pharmaceutiques et du traitement de l'eau et des eaux usées.

Dynamique du marché des membranes céramiques

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de membranes céramiques de la part des industries agroalimentaires

L'industrie agroalimentaire est l'une des plus grandes industries où les membranes céramiques sont utilisées en raison de leurs nombreux avantages tels que leurs propriétés filtrantes et leur activité antibactérienne. De plus, leur grande efficacité de séparation et leur bonne stabilité chimique rendent les membranes céramiques encore plus indispensables pour les industries agroalimentaires.

Les membranes céramiques peuvent surmonter les limites des membranes polymères. Pour cette raison, la plupart des industries agroalimentaires, en particulier les fabricants de produits laitiers, se tournent vers l'application de membranes céramiques plutôt que vers d'autres services de membranes. Le besoin de membranes céramiques chez les fabricants standard pour une mise à niveau qualitative augmente au fil du temps.

De plus, les applications techniques dans lesquelles les membranes céramiques sont utilisées comprennent la concentration et la purification des édulcorants, les protéines laitières concentrées et les protéines laitières isolées. La filtration à flux croisés par membranes céramiques est utilisée dans plusieurs industries pour purifier les produits aqueux. Par exemple, la production de vin, de bière, de jus de fruits et de légumes. La séparation cellulaire dans la production d'acides aminés et la production d'acide lactique dans les industries laitières ont également connu des avancées technologiques de nos jours, et les membranes céramiques ont également été utilisées dans ces secteurs.

Pour répondre à la forte demande, les industries agroalimentaires se développent et étendent rapidement leur production. Dans cette tendance à la hausse, la demande de membranes céramiques dans leurs industries augmente également, ce qui devrait stimuler le marché des membranes céramiques dans les années à venir. Ainsi, il existe une demande croissante de membranes céramiques de la part des industries agroalimentaires pour divers facteurs uniques, ce qui devrait stimuler la demande et les ventes sur le marché nord-américain des membranes céramiques.

- Demande croissante de membranes céramiques de la part des industries de purification de l'eau

La croissance rapide de la population et l'augmentation du volume des eaux usées font de la nécessité de services de purification de l'eau et de traitement des eaux usées une priorité. Les membranes céramiques sont l'une des principales applications du processus de purification de l'eau. Grâce à plusieurs facteurs bénéfiques, notamment une résistance mécanique élevée et une résistance chimique à la température, les membranes céramiques sont utilisées dans le traitement de l'eau et des eaux usées.

Les membranes céramiques sont utilisées dans le traitement de l'eau, notamment dans le traitement des eaux usées et des eaux usées municipales et dans le traitement des eaux usées industrielles. Les eaux usées industrielles telles que les eaux usées produites par les industries pétrolières et textiles, ainsi que les eaux usées d'impression et de teinture, doivent être traitées régulièrement. Avec l'industrialisation croissante des industries de traitement de l'eau sur le marché nord-américain, la demande de membranes céramiques augmente également, ce qui peut stimuler le marché nord-américain des membranes céramiques à l'avenir. Quelques exemples de domaines de traitement de l'eau où les membranes céramiques peuvent être utilisées sont l'eau d'injection des champs pétrolifères, l'eau de l'industrie papetière, le lixiviat des décharges, les eaux usées de l'huile de palme, les eaux usées du dioxyde de titane et bien d'autres.

Avec le besoin croissant de traitement et de purification de l'eau, la demande et l'application de membranes céramiques augmentent également. Cette tendance à la hausse devrait stimuler la croissance du marché dans un avenir proche. Par conséquent, la demande croissante des industries de purification et de traitement de l'eau devrait stimuler la croissance du marché nord-américain des membranes céramiques dans les années à venir.

Opportunités

- Applications des membranes céramiques dans différentes industries

Les membranes céramiques sont utilisées dans de nombreux secteurs industriels. Les diverses applications de la technologie des membranes céramiques rendent son utilisation polyvalente. Différentes industries telles que les industries du textile, de l'alimentation et des boissons, de la chimie et du papier utilisent des membranes céramiques pour la filtration, entre autres. Les industries pharmaceutiques sont l'un des principaux consommateurs de la technologie des membranes céramiques. En raison de leur activité antibactérienne et antimicrobienne, les membranes céramiques ont été utilisées à diverses fins d'assainissement.

De plus, l'efficacité de la séparation de tout type de substance particulière d'un liquide à l'aide de membranes céramiques a été utilisée dans l'industrie alimentaire et des boissons. Pour cette raison, les membranes céramiques sont de plus en plus demandées dans les industries alimentaire, des boissons et pharmaceutiques. Le besoin croissant de traitement de l'eau pour atteindre les objectifs durables crée une opportunité pour le marché nord-américain des membranes céramiques en raison des nombreuses applications des membranes céramiques dans le traitement des eaux usées.

- Progrès technologiques dans la science des membranes céramiques

La technologie influence considérablement le marché nord-américain des membranes céramiques, en termes de mise à jour des anciennes méthodes et de découverte de nouvelles façons de fabriquer la technologie céramique avec une qualité améliorée et une réduction des coûts. L'innovation continue dans ce segment et sa tendance croissante peuvent conduire le marché nord-américain des membranes céramiques à faire face à une croissance extrême dans un avenir proche. Tous les segments tels que les produits pharmaceutiques, la biotechnologie et la technologie de traitement de l'eau doivent absolument s'appuyer sur les progrès de la technologie céramique. La technologie des membranes céramiques présente plusieurs limites, telles que la fragilité, la faible ductilité, entre autres. Cependant, les chercheurs et la communauté scientifique travaillent dur pour surmonter ces limites. Par exemple, pour le traitement des eaux usées municipales, la technologie des membranes céramiques plates a été utilisée. Par conséquent, une opportunité est en train d'être créée pour le marché nord-américain des membranes céramiques. Ainsi, les récentes avancées scientifiques et technologiques apportent un soutien constant au marché des membranes céramiques pour se développer.

Contraintes/Défis

- Un investissement coûteux pour la fabrication de membranes céramiques

L'un des freins à la croissance du marché nord-américain des membranes céramiques est son coût de production. Le coût d'investissement associé à la fabrication de membranes céramiques est plus élevé que celui d'autres types de membranes similaires. Les usines de traitement des eaux ont besoin de systèmes de membranes pour filtrer les particules contaminantes des eaux usées. Cependant, en ce qui concerne l'installation de membranes céramiques, le nombre d'installations complètes dans les industries de traitement des eaux est vraiment faible. Par conséquent, le coût associé à l'installation ou à la fabrication de membranes céramiques peut limiter la croissance du marché nord-américain des membranes céramiques.

- Problèmes de performances dus à la fragilité des membranes céramiques

Les membranes céramiques sont constituées de petits substrats poreux qui servent de support aux membranes fines et denses. Malgré plusieurs facteurs bénéfiques tels que la stabilité chimique et thermique, ces membranes peuvent présenter des fissures sous-critiques. Il a été observé que, en particulier en raison de leur sensibilité, les membranes céramiques agissent comme un composant très cassant et que la croissance des fissures à l'intérieur peut augmenter. En raison des différences de dilatation thermique, les membranes céramiques peuvent agir comme une substance très cassante. De plus, en plus de leur fragilité, les membranes céramiques présentent une ductilité, une résistance à la traction et d'autres problèmes connexes négligeables. Par conséquent, cet inconvénient majeur peut freiner la croissance du marché des membranes céramiques en Amérique du Nord dans les années à venir.

Développement récent

- En octobre 2022, METAWATER CO., LTD. a annoncé sa nouvelle commande reçue de PWNT, Pays-Bas. Cette commande concerne des membranes céramiques pour les usines de traitement des eaux de Hampton Loade au Royaume-Uni. Une fois terminée, elle deviendra la plus grande usine de traitement des eaux à membranes céramiques au monde. Cette annonce suscitera davantage d'attention de la part des clients et de valeur de marque pour l'entreprise

- En septembre 2022, la technologie des membranes d'ultrafiltration en céramique Nanostone a obtenu l'approbation du règlement 31 au Royaume-Uni pour une utilisation dans le traitement de l'eau potable au Royaume-Uni. Elle contribue à améliorer la qualité de l'eau potable. Cette approbation aide l'entreprise à présenter de meilleures normes parmi ses concurrents

Portée du marché des membranes en céramique

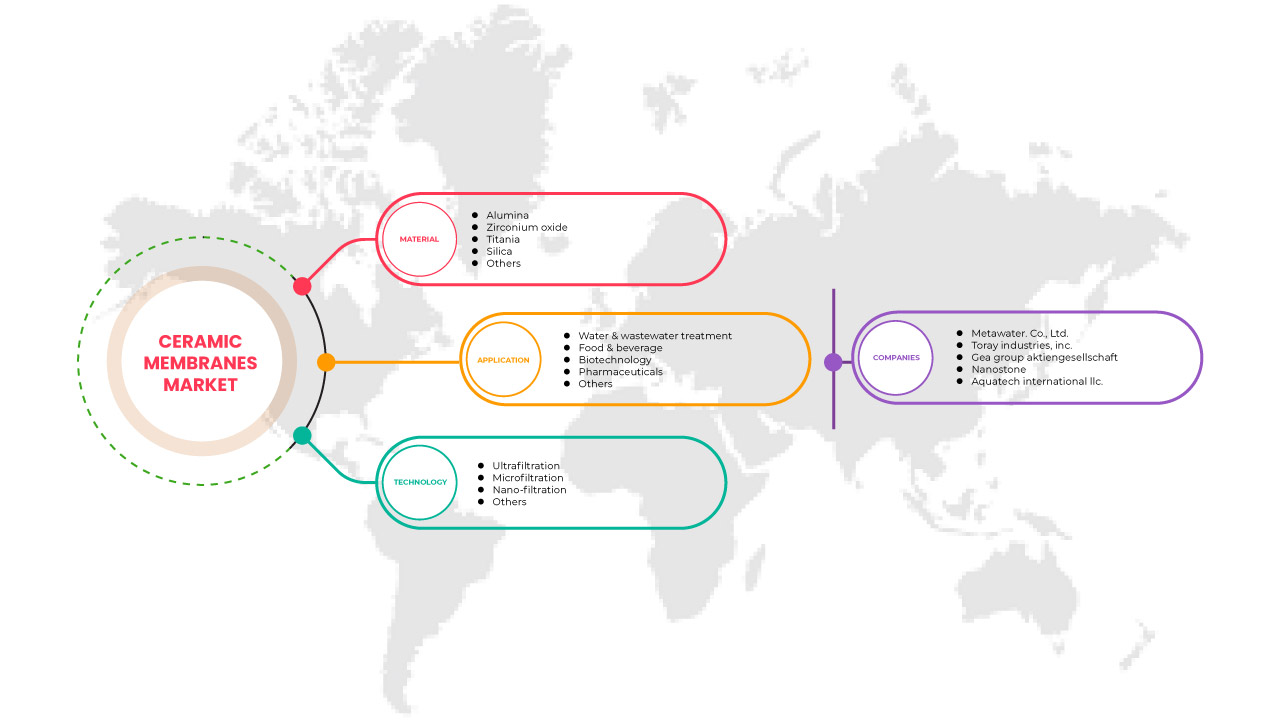

Le marché des membranes céramiques est catégorisé en fonction du matériau, de l'application et de la technologie. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Matériel

- ALUMINE

- OXYDE DE ZIRCONIUM

- TITANIE

- SILICE

- AUTRES

Sur la base du matériau, le marché des membranes céramiques est classé en alumine, oxyde de zirconium, titane, silice et autres.

Application

- TRAITEMENT DE L'EAU ET DES EAUX USÉES

- ALIMENTS ET BOISSONS

- BIOTECHNOLOGIE

- MÉDICAMENTS

- AUTRES

Sur la base de l'application, le marché des membranes céramiques est classé en traitement de l'eau et des eaux usées, alimentation et boissons, biotechnologie, produits pharmaceutiques et autres.

Technologie

- ULTRAFILTRATION

- MICROFILTRATION

- NANO-FILTRATION

- AUTRES

Sur la base de la technologie, le marché des membranes céramiques est classé en ultrafiltration, microfiltration, nanofiltration et autres.

Analyse/perspectives régionales du marché des membranes céramiques

Le marché des membranes céramiques est segmenté en fonction du matériau, de l’application et de la technologie.

Les pays couverts dans le rapport sur le marché des membranes céramiques sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

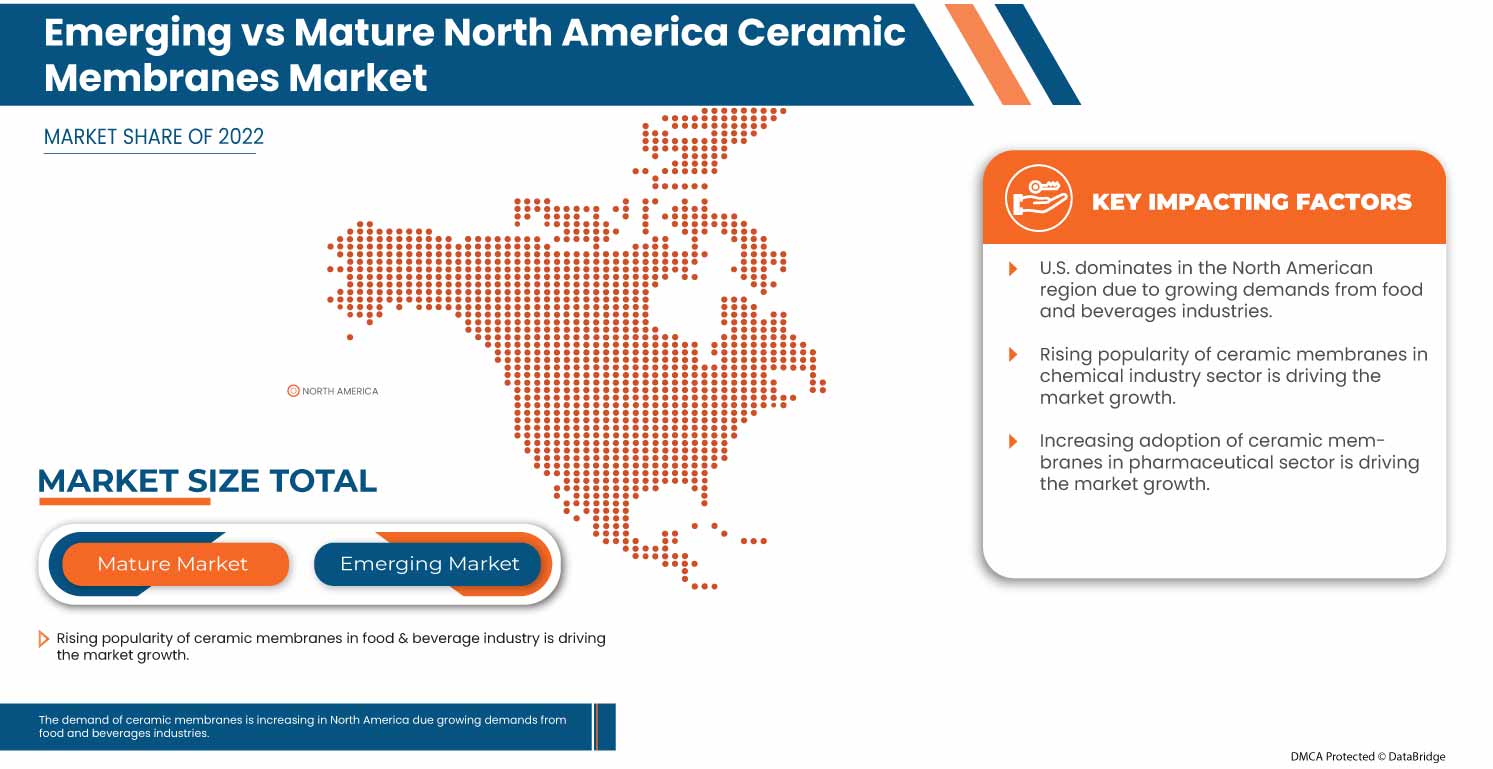

En Amérique du Nord, les États-Unis devraient dominer le marché en raison des technologies émergentes dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des membranes en céramique

Le paysage concurrentiel du marché des membranes céramiques fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des membranes céramiques.

Français Certains des principaux acteurs du marché opérant sur le marché sont TAMI Industries, atech innovations gmbh, GEA Group Aktiengesellschaft, Nanostone, LiqTech Holding A/S, Qua Group LLC., TORAY INDUSTRIES, INC., SIVA Unit., METAWATER. CO., LTD., KERAFOL Ceramic Films GmbH & Co. KG, Aquatech International LLC., Paul Rauschert GmbH & Co. KG., HYDRASYST, Membratec SA et Mantec Filtration.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CERAMIC MEMBRANE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 CERAMIC MEMBRANE MATERIAL LIFE LINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 DBMR VENDOR SHARE ANALYSIS

2.14 IMPORT-EXPORT DATA

2.15 SECONDARY SOURCES

2.16 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 VENDOR SELECTION CRITERIA

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT'S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 IMPORT EXPORT SCENARIO

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA CERAMIC MEMBRANE MARKET

4.7 RAW MATERIAL SOURCING ANALYSIS

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CERAMIC MEMBRANES FROM THE FOOD AND BEVERAGES INDUSTRIES

5.1.2 RISING DEMAND FOR CERAMIC MEMBRANES FROM WATER PURIFICATION INDUSTRIES

5.1.3 INCREASING DEMAND FOR CERAMIC MEMBRANES FROM PHARMACEUTICAL INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH-COST INVESTMENT FOR MANUFACTURING CERAMIC MEMBRANES

5.2.2 PERFORMANCE ISSUES DUE TO THE BRITTLENESS OF CERAMIC MEMBRANES

5.3 OPPORTUNITIES

5.3.1 APPLICATIONS OF CERAMIC MEMBRANES IN DIFFERENT INDUSTRIES

5.3.2 TECHNOLOGICAL ADVANCEMENTS IN CERAMIC MEMBRANE SCIENCE

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVES SUCH AS POLYMERIC MEMBRANES

6 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 ALUMINA

6.3 ZIRCONIUM OXIDE

6.4 TITANIA

6.5 SILICA

6.6 OTHERS

7 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 WATER & WASTEWATER TREATMENT

7.3 FOOD & BEVERAGE

7.4 PHARMACEUTICALS

7.5 BIOTECHNOLOGY

7.6 OTHERS

8 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 ULTRAFILTERATION

8.3 MICROFILTERATION

8.4 NANO-FILTERATION

8.5 OTHERS

9 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA CERAMIC MEMBRANES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.2 ANNOUNCEMENTS

10.3 DEVELOPMENT

10.4 PROJECT

10.5 TECHNOLOGY

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 METAWATER. CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 SWOT

12.1.6 RECENT DEVELOPMENT

12.2 TORAY INDUSTRIES, INC. (2022)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 SWOT

12.2.6 RECENT DEVELOPMENTS

12.3 GEA GROUP AKTIENGESELLSCHAFT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 SWOT

12.3.6 RECENT DEVELOPMENTS

12.4 NANOSTONE

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 SWOT

12.4.5 RECENT UPDATES

12.5 AQUATECH INTERNATIONAL LLC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENTS

12.6 A-TECH INNOVATION GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT UPDATES

12.7 HYDRASYST

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT UPDATES

12.8 KERAFOL CERAMIC FILMS GMBH & CO. KG

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 LIQTECH HOLDING A/S (2022)

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 SWOT

12.9.5 RECENT DEVELOPMENTS

12.1 MANTEC FILTRATION

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT UPDATES

12.11 MEMBRATEC SA

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT UPDATES

12.12 PAUL RAUSCHERT GMBH & CO.KG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT UPDATES

12.13 QUA GROUP LLC.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 SWOT

12.13.4 RECENT UPDATES

12.14 SIVA UNIT

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 SWOT

12.14.4 RECENT UPDATES

12.15 TAMI INDUSTRIES

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 SWOT

12.15.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CERAMIC WARES FOR LABORATORY, CHEMICAL OR OTHER TECHNICAL USES, PORCELAIN OR CHINA (EXCLUDING REFRACTORY CERAMIC GOODS, ELECTRICAL DEVICES, INSULATORS AND OTHER ELECTRICAL INSULATING FITTINGS); HS CODE – 690911 (USD THOUSAND)

TABLE 3 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ALUMINA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA ZIRCONIUM OXIDE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA TITANIA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SILICA IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA FOOD & BEVERAGE IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PHARMACEUTICALS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA BIOTECHNOLOGY IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ULTRAFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA MICROFILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA NANO-FILTERATION IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY COUNTRY, 2021-2030 (PRICE)

TABLE 23 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 25 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 26 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 30 U.S. CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 31 U.S. CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 33 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 34 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 35 CANADA CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 36 CANADA CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 37 CANADA CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 38 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 39 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 40 MEXICO CERAMIC MEMBRANE MARKET, BY MATERIAL, 2021-2030 (PRICE)

TABLE 41 MEXICO CERAMIC MEMBRANE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 MEXICO CERAMIC MEMBRANE MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA CERAMIC MEMBRANE MARKET

FIGURE 2 NORTH AMERICA CERAMIC MEMBRANE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CERAMIC MEMBRANE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CERAMIC MEMBRANE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CERAMIC MEMBRANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CERAMIC MEMBRANE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA CERAMIC MEMBRANE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA LIFE LINE CURVE

FIGURE 9 NORTH AMERICA CERAMIC MEMBRANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA CERAMIC MEMBRANE MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA CERAMIC MEMBRANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA CERAMIC MEMBRANE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA CERAMIC MEMBRANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 NORTH AMERICA CERAMIC MEMBRANE MARKET: SEGMENTATION

FIGURE 15 GROWING DEMAND FOR CERAMIC MEMBRANES ACROSS VARIOUS INDUSTRIES IS EXPECTED TO DRIVE NORTH AMERICA CERAMIC MEMBRANE MARKET IN THE FORECAST PERIOD

FIGURE 16 ALUMINA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CERAMIC MEMBRANE MARKET IN 2023 & 2030

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA CERAMIC MEMBRANES MARKET

FIGURE 19 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY MATERIAL, 2022

FIGURE 20 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY APPLICATION, 2022

TABLE 10 NORTH AMERICA WATER & WASTEWATER TREATMENT IN CERAMIC MEMBRANE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

FIGURE 21 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY TECHNOLOGY, 2022

FIGURE 22 NORTH AMERICA CERAMIC MEMBRANE MARKET: SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2022)

FIGURE 24 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA CERAMIC MEMBRANE MARKET: BY MATERIAL (2023 & 2030)

FIGURE 27 NORTH AMERICA CERAMIC MEMBRANES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.