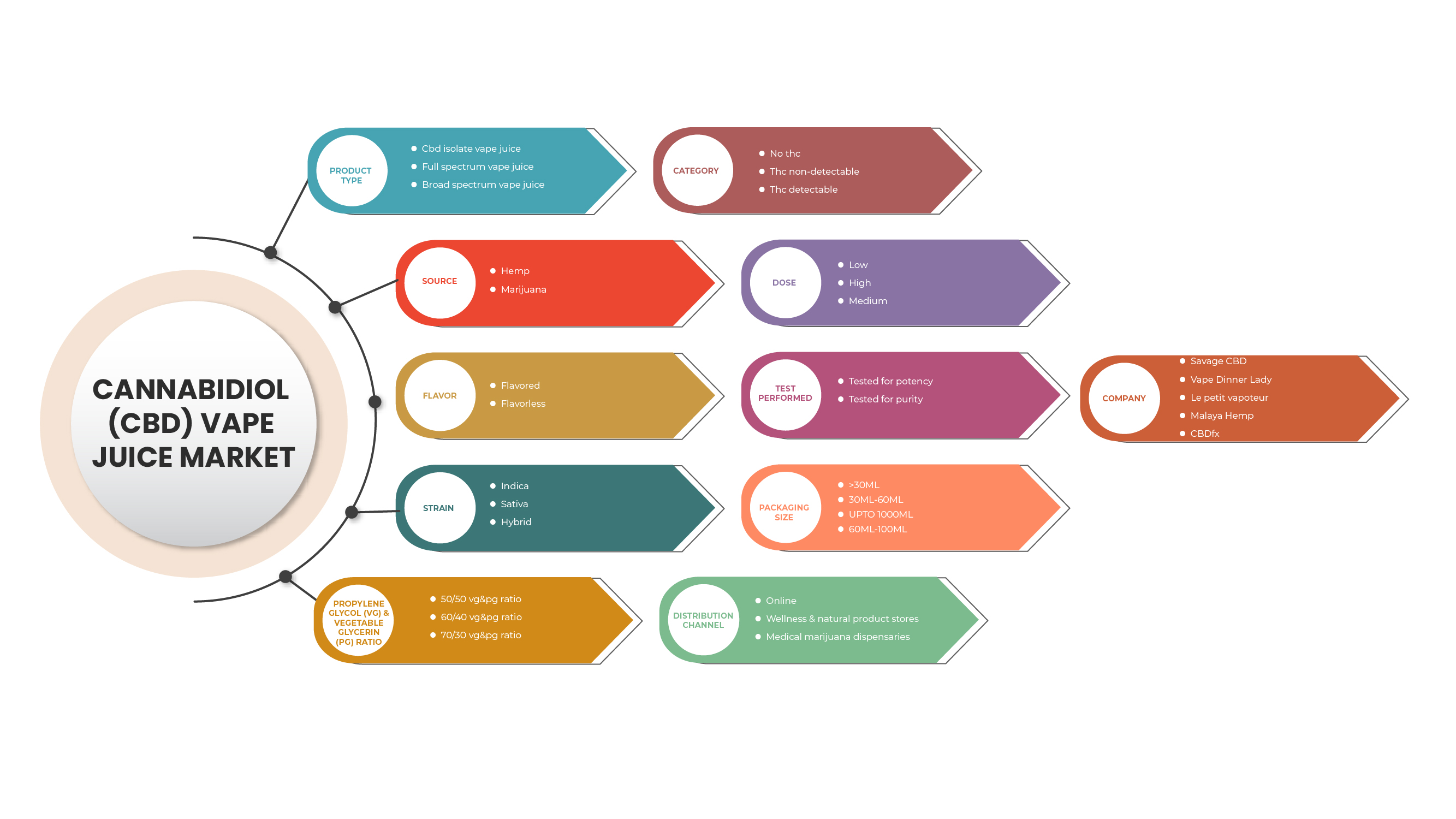

North America Cannabidiol (CBD) Vape Juice Market, By Product Type (Full Spectrum Vape Juice, Broad Spectrum Vape Juice, CBD Isolate Vape Juice), Source (Hemp and Marijuana), Strain (Indica, Sativa And Hybrid), Propylene Glycol (VG) & Vegetable Glycerin (PG) Ratio (50/50 VG&PG Ratio, 60/40 VG&PG Ratio, 70/30 VG&PG Ratio), Category (THC Detectable, THC Non-Detectable, and No THC), Dose (High, Medium and Low), Flavour (Flavoured and Flavourless), Test Performed (Tested For Potency and Tested For Purity), Packaging Size (30ML, 30ML-60ML, 60ML-100ML, UPTO 1000ML), Distribution Channel (Online, Wellness & Natural Product Stores and Medical Marijuana Dispensaries)-Industry Trends and Forecast to 2029.

Market Analysis and Insights

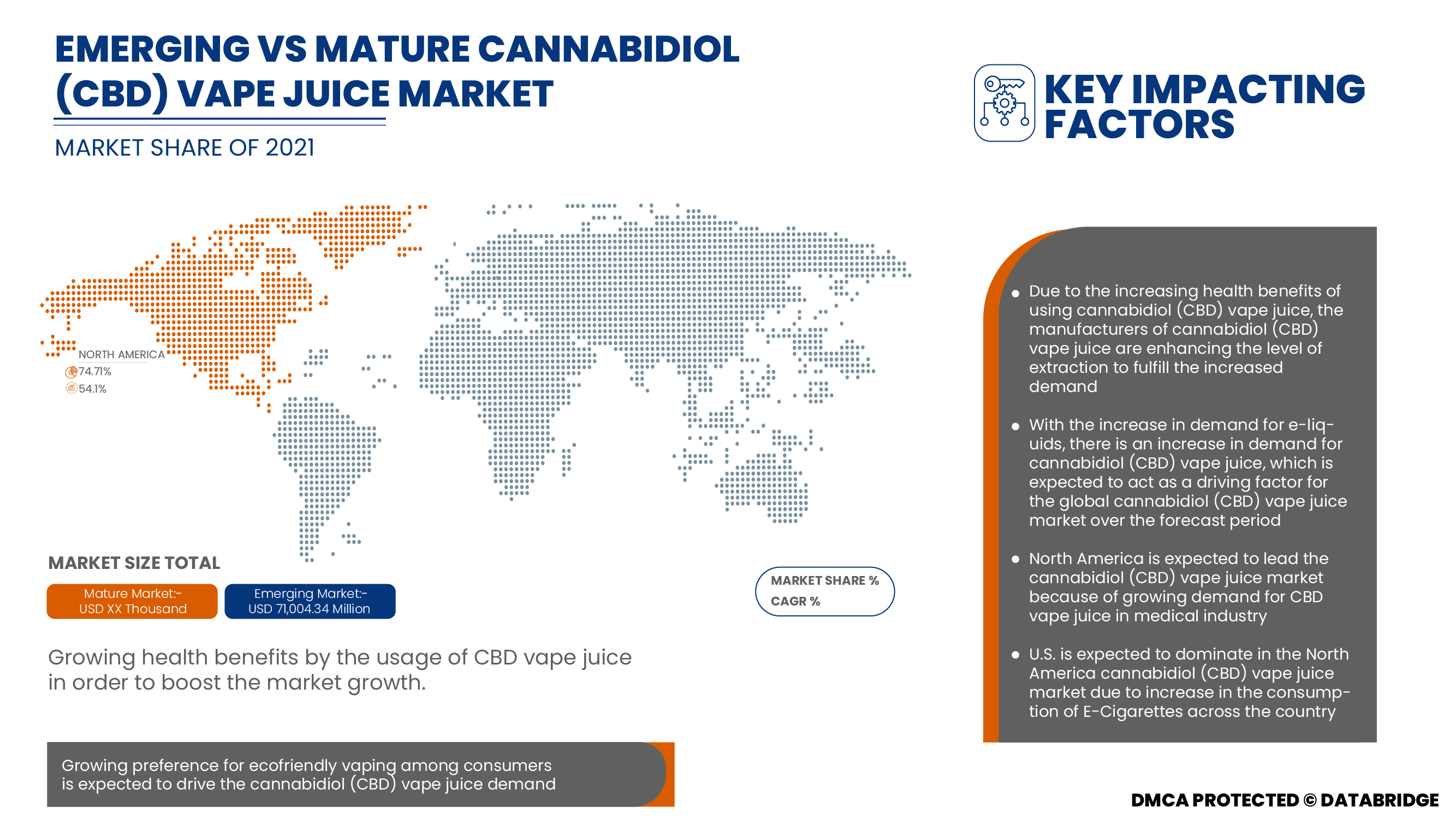

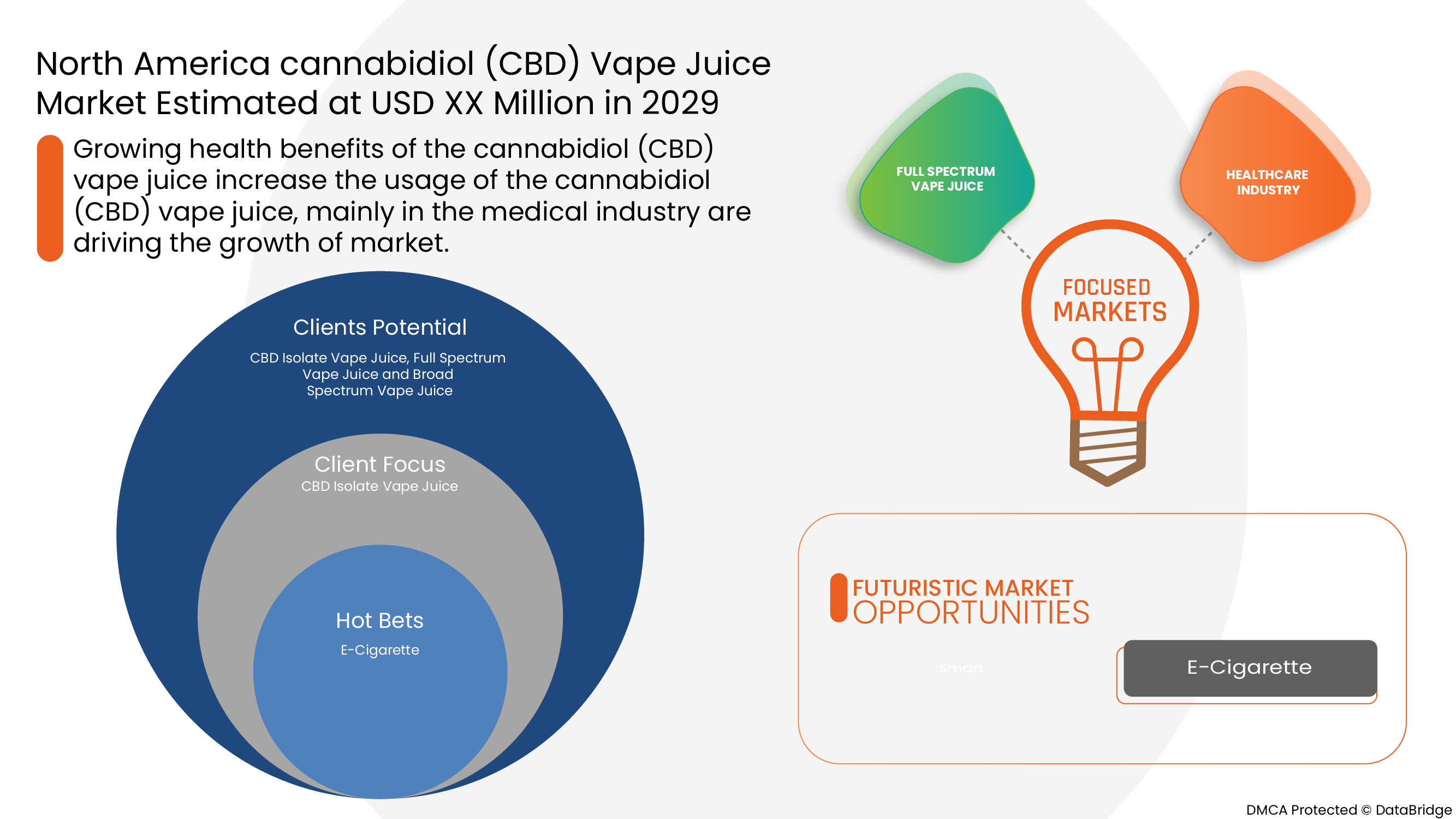

Rising disposable income, growing consumption per capita, and changing the dietary style of consumers across the globe are the major factors fostering the growth of the North America cannabidiol (CBD) vape juice market. Changing lifestyle and rising awareness about cannabidiol (CBD) vape juice's health benefits are other factors that may act as market growth determinants. Increasing demand for e-liquid and e-cigarettes will further create lucrative opportunities for growth in the North America cannabidiol (CBD) vape juice market.

However, the availability of low-cost alternative vape juices may hamper the market growth rate. Also, stringent government regulations will further restrain the market growth rate. Health risks of CBD vape juice, such as lung injury, may pose a major challenge for the market growth.

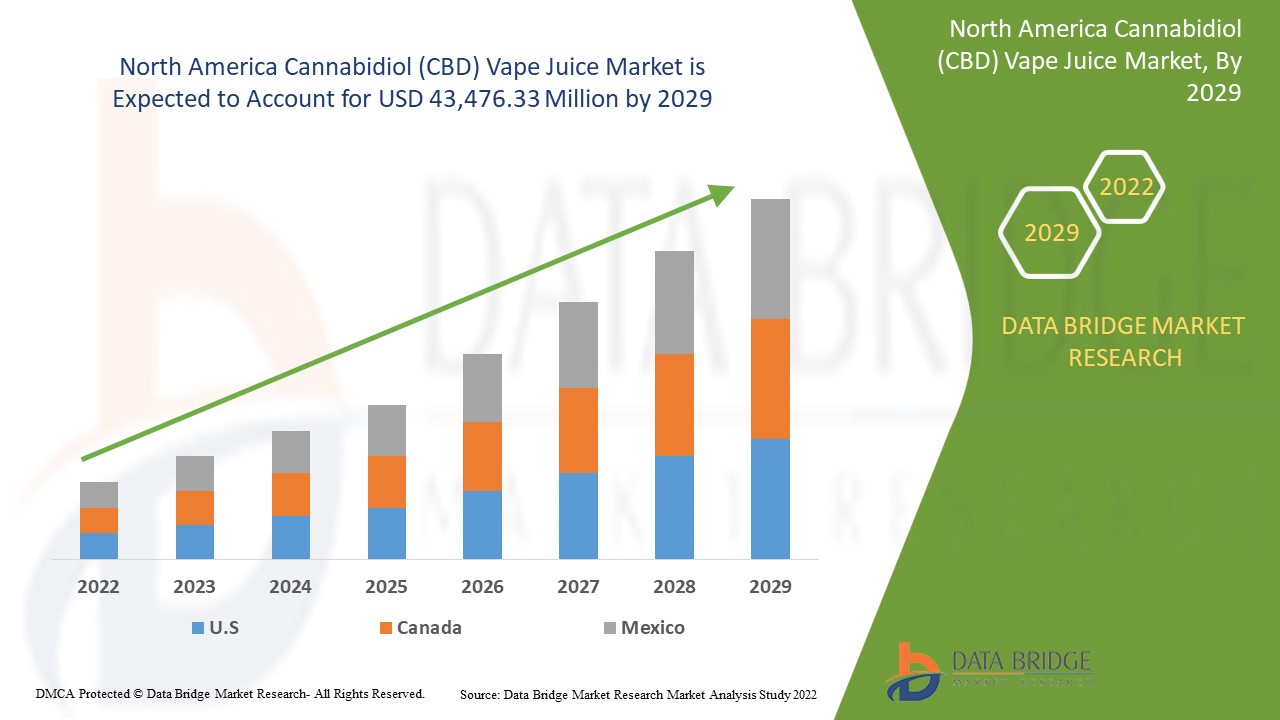

Data Bridge Market Research analyses that the North America cannabidiol (CBD) vape juice market is estimated to reach USD 43,476.33 million in 2029 and will grow at a CAGR of 54.1% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Product Type (Full Spectrum Vape Juice, Broad Spectrum Vape Juice, CBD Isolate Vape Juice), Source (Hemp and Marijuana), Strain (Indica, Sativa And Hybrid), Propylene Glycol (VG) & Vegetable Glycerin (PG) Ratio (50/50 VG&PG Ratio, 60/40 VG&PG Ratio, 70/30 VG&PG Ratio), Category (THC Detectable, THC Non-Detectable, and No THC), Dose (High, Medium and Low), Flavour (Flavoured and Flavourless), Test Performed (Tested For Potency and Tested For Purity), Packaging Size (>30ML, 30ML-60ML, 60ML-100ML, UPTO 1000ML), Distribution Channel (Online, Wellness & Natural Product Stores and Medical Marijuana Dispensaries) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

CBDfx, HempBombs, Koi CBD, Savage CBD, ERTH WELLNESS, Hemplucid, VaporFi, JustCBD, NU-X CBD, Pure CBD Vapors, Vape Dinner Lady, CBD GENESIS, Malaya Hemp, Blue Moon Hemp, FUSION CBD PRODUCTS, entre autres |

Définition du marché :

Les e-liquides CBD, également connus sous le nom d'e-liquides CBD ou d'huile de CBD, sont des liquides contenant du CBD utilisés dans les cigarettes électroniques. Ces liquides sont vaporisés par la cigarette électronique. Lorsque les consommateurs inhalent le e-liquide, le cannabidiol (CBD) pénètre dans leurs poumons, infusant le CBD dans la circulation sanguine. Les e-liquides CBD contiennent quelques ingrédients simples tels que le PG (propylène glycol), le VG (glycérine végétale), l'extrait de CBD et les arômes utilisés dans les e-liquides .

Dynamique du marché des e-liquides au cannabidiol (CBD) en Amérique du Nord

Conducteurs

-

Augmentation des bienfaits pour la santé grâce à l'utilisation de jus de vape au cannabidiol (CBD)

Le jus de vape au cannabidiol (CBD) est fabriqué à partir d'extrait non intoxicant de marijuana ou de chanvre, qui est principalement prescrit pour soulager les douleurs tenaces. Parallèlement à cela, le jus de vape au cannabidiol (CBD) aide à traiter les problèmes d'anxiété qui sont devenus parmi les êtres humains de nos jours en raison du niveau de stress accru. Les avantages récréatifs des plantes de marijuana à partir desquelles le jus de vape au cannabidiol (CBD) est extrait contribuent à améliorer la qualité du jus de vape au cannabidiol (CBD).

En raison des avantages croissants pour la santé liés à l’utilisation du jus de vape au cannabidiol (CBD), les fabricants de jus de vape au cannabidiol (CBD) améliorent le niveau d’extraction pour répondre à la demande accrue.

-

Demande croissante de jus de vape au cannabidiol (CBD) dans l'industrie médicale

Le jus de vape au cannabidiol (CBD) a été considéré comme le produit le plus avancé dans le traitement de l'épilepsie. Le CBD est également utilisé pour l'anxiété, la douleur et les troubles musculaires appelés dystonie, maladie de Parkinson, maladie de Crohn et de nombreuses autres affections. L'avantage thérapeutique du jus de vape au cannabidiol (CBD) implique le potentiel des terpènes et d'autres composés phytochimiques du cannabis, qui offrent divers avantages pour la santé. Les agences médicales étudient les bienfaits naturels du CBD. Le jus de vape au cannabidiol (CBD) est considéré comme un remède naturel qui est considéré comme puissant et sûr pour le traitement de divers problèmes de santé.

Opportunités

- Incidence croissante des troubles psychologiques

On observe une augmentation des cas de troubles psychologiques tels que les troubles anxieux, notamment le trouble panique, les troubles obsessionnels compulsifs, les phobies et la dépression.

Les troubles psychologiques se caractérisent par une perte d'intérêt ou de plaisir, de la tristesse, des sentiments de culpabilité ou de faible estime de soi, une mauvaise concentration, des troubles du sommeil ou de l'appétit et de la fatigue. Les personnes dépressives peuvent également présenter de multiples troubles physiques sans cause physique apparente. La dépression peut être récurrente ou durable. En outre, la dépression peut nuire à la capacité des personnes à fonctionner à l'école ou au travail et à faire face à la vie quotidienne. Dans les cas les plus graves, la dépression peut conduire au suicide.

Par exemple,

- Selon l'Organisation mondiale de la santé (OMS), environ 264 millions de personnes dans le monde souffrent de dépression. Les femmes sont plus touchées que les hommes.

- Innovations technologiques dans le vapotage

Depuis le début, l'industrie du vapotage a connu des innovations régulières qui ont permis aux fabricants de lancer ou de développer de nouveaux produits. La technologie de vapotage moderne crée désormais les expériences de vapotage les plus fluides grâce à des améliorations telles que le Bluetooth, l'activation vocale et de meilleures batteries. Les fabricants de produits et les leaders de l'industrie ont cherché à améliorer constamment l'expérience de vapotage.

Voici quelques-unes des innovations les plus récentes en matière de technologie de vapotage :

Pod vaping - Le pod vaping est devenu la plus grande tendance dans l'industrie du vapotage, avec de nouveaux appareils de vapotage à dosettes produits par les fabricants, catalysant la consommation de jus de vapotage au cannabidiol (CBD).

Contraintes/Défis

- Risques pour la santé liés aux cigarettes électroniques

Les cigarettes électroniques produisent plusieurs substances chimiques dangereuses pour le corps humain, notamment l'acétaldéhyde , l'acroléine et le formaldéhyde . Ces aldéhydes peuvent provoquer des maladies pulmonaires, ainsi que des maladies cardiovasculaires (cardiaques)

Les cigarettes électroniques contiennent également de l'acroléine, un herbicide principalement utilisé pour tuer les mauvaises herbes. Il peut provoquer des lésions pulmonaires aiguës et une bronchopneumopathie chronique obstructive (BPCO) . La BPCO est une maladie pulmonaire inflammatoire chronique qui provoque une obstruction du flux d'air dans les poumons. Elle peut également provoquer de l'asthme et un cancer du poumon.

Ainsi, les effets indésirables de l’utilisation régulière de cigarettes électroniques pourraient remettre en cause le marché nord-américain des e-liquides au cannabidiol (CBD).

- Lésion pulmonaire grave liée au vapotage

Les inquiétudes sanitaires liées au vapotage ont atteint un niveau sans précédent dans le monde entier au cours des dernières années. Depuis août 2019, les Centers for Disease Control and Prevention (CDC), la Food and Drug Administration (FDA) des États-Unis, les services de santé des États et locaux et d'autres partenaires cliniques et de santé publique s'attaquent aux lésions pulmonaires associées au vapotage (VAPI), également appelées lésions pulmonaires associées à l'utilisation de cigarettes électroniques ou de produits de vapotage (EVALI), qui sont une maladie respiratoire aiguë ou subaiguë caractérisée par un spectre de signes clinicopathologiques imitant diverses maladies pulmonaires.

Ainsi, en conclusion, en raison de l’augmentation des lésions pulmonaires graves liées au vapotage, les lésions pulmonaires associées à l’utilisation de cigarettes électroniques ou de produits de vapotage (EVALI) entraveront la croissance du jus de vapotage CBD sur le marché nord-américain du jus de vapotage CBD.

Impact post-COVID-19 sur le marché nord-américain des e-liquides au cannabidiol (CBD)

Après la pandémie, la demande de jus de vape au cannabidiol (CBD) a augmenté car il n'y aura plus de restrictions de mouvement, donc l'approvisionnement en produits sera facile. De plus, la tendance croissante à essayer de nouvelles saveurs pour les cigarettes électroniques, en particulier parmi la population jeune, propulsera la croissance du marché.

Développements récents

- En décembre 2021, Pure CBD Vapors a acquis Cloud9Hemp.com, une marque basée à Nashville spécialisée dans les produits à base de CBD (cannabidiol). Cette acquisition a permis à l'entreprise d'élargir son portefeuille de produits

- En octobre 2021, Koi CBD a lancé une nouvelle gamme de produits à base de chanvre de classe mondiale, à spectre complet et delta 8. Les produits sont des teintures, des gummies, ainsi que des jus de vape. Ce lancement a aidé l'entreprise à élargir son portefeuille de produits

Portée du marché nord-américain des e-liquides au cannabidiol (CBD)

Le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en type de produit, source, saveur, souche, rapport propylène glycol (VG) et glycérine végétale (PG), catégorie, dose, tests effectués, taille de l'emballage et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance maigres dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Type de produit

- Liquide pour vapotage à spectre complet

- Liquide pour vapotage à large spectre

- Jus de vapotage à base d'isolat de CBD

En fonction du type de produit, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en e-liquides à spectre complet, e-liquides à large spectre et e-liquides isolés au CBD.

Source

- Chanvre

- Marijuana

Selon la source, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en chanvre et en marijuana.

Souche

- Indica

- Sativa

- Hybride

En fonction de la variété, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en indica, sativa et hybride.

Rapport propylène glycol (VG) et glycérine végétale (PG)

- Rapport VG&PG 50/50

- Rapport VG&PG 60/40

- Rapport VG/PG 70/30

Sur la base du rapport propylène glycol (VG) et glycérine végétale (PG), le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en rapport 50/50 VG&PG, rapport 60/40 VG&PG, rapport 70/30 VG&PG.

Catégorie

- THC détectable

- THC non détectable

- Sans THC

En fonction de la catégorie, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en THC détectable, THC non détectable et sans THC.

Dose

- Haut

- Moyen

- Faible

En fonction de la dose, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en dose élevée, moyenne et faible.

Saveur

- Parfumé

- Sans saveur

En fonction de la saveur, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en e-liquides aromatisés et sans saveur.

Tests effectués

- Testé pour la puissance

- Testé pour la pureté

Sur la base des tests effectués, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en testé pour la puissance et testé pour la pureté.

Taille de l'emballage

- >30ML

- 30ML-60ML

- 60ML-100ML

- JUSQU'À 1000ML

En fonction de la taille de l'emballage, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en > 30 ML, 30 ML-60 ML, 60 ML-100 ML, JUSQU'À 1 000 ML.

Canal de distribution

- En ligne

- Magasins de produits de bien-être et naturels

- Dispensaires de marijuana médicale

En fonction du canal de distribution, le marché nord-américain des e-liquides au cannabidiol (CBD) est segmenté en magasins en ligne, magasins de produits de bien-être et naturels et dispensaires de marijuana à des fins médicales.

Analyse/perspectives régionales du marché des e-liquides au cannabidiol (CBD) en Amérique du Nord

Le marché nord-américain des e-liquides au cannabidiol (CBD) est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, source, saveur, souche, rapport propylène glycol (PG) et glycérine végétale (VG), catégorie, dose, test effectué, taille de l'emballage et canal de distribution comme référencé ci-dessus.

Certains des pays couverts par le marché nord-américain du jus de vape au cannabidiol (CBD) sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des e-liquides au cannabidiol (CBD) en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision. Cela est dû à l'utilisation croissante des cigarettes électroniques au sein de la population.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du jus de vapotage au cannabidiol (CBD) en Amérique du Nord

Le paysage concurrentiel du marché des e-liquides au cannabidiol (CBD) en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'accent mis par les entreprises sur le marché des e-liquides au cannabidiol (CBD) en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des e-liquides au cannabidiol (CBD) sont CBDfx, HempBombs, Koi CBD, Savage CBD, ERTH WELLNESS, Hemplucid, VaporFi, JustCBD, NU-X CBD, Pure CBD Vapors, Vape Dinner Lady, CBD GENESIS, Malaya Hemp, Blue Moon Hemp, FUSION CBD PRODUCTS, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale contre régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS' DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER LEVEL TREND

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF CANNABIDIOL CBD VAPE JUICE MARKET

4.5.1 INDUSTRY TRENDS

4.6 FUTURE PERSPECTIVE

4.7 MEETING CONSUMER REQUIREMENT

4.8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: NEW PRODUCT LAUNCH STRATEGY

4.8.1 NEW LAUNCHES EMPHASIZING THE HEALTH BENEFITS OF CBD VAPE JUICE

4.8.2 NEW LAUNCHES BY CBD PRODUCTS BY REFINING-

4.8.3 NEW LAUNCHES BY EMPHASIZING NEW VAPING TECHNOLOGIES-

4.8.4 NEW LAUNCHES BY EMPHASIZING DIFFERENT FLAVORS-

4.8.5 NEW LAUNCHES BY LINE EXTENSION-

4.8.6 LAUNCHES-

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: PROMOTIONAL ACTIVITIES

4.10.1 PROMOTING BY EMPHASIZING HEALTH BENEFITS OF CBD VAPE JUICE

4.10.2 PROMOTING BY CREATING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH

4.10.3 PROMOTING BY EMPHASIZING NEW VAPING TECHNOLOGIES-

4.10.4 PROMOTING BY EMPHASIZING DIFFERENT FLAVORS-

4.10.5 PROMOTING THROUGH CBD SEO (SEARCH ENGINE OPTIMIZATION) -

4.11 SUPPLY CHAIN OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

4.11.1 RAW MATERIAL PROCUREMENT

4.11.2 MANUFACTURING

4.11.3 MARKETING AND DISTRIBUTION

4.11.4 END USERS

4.12 FACTORS INFLUENCING PURCHASE DECISION

4.12.1 SHOPPING BEHAVIOUR AND DYNAMICS

4.12.2 HEALTH BENEFITS-

4.12.3 RESEARCH

4.12.4 IMPULSIVE

4.12.5 ONLINE ADVERTISEMENT

5 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: REGULATIONS

5.1 REGULATIONS IN EUROPE

5.1.1 UNITED KINGDOM

5.1.2 DENMARK:

5.1.3 SPAIN:

5.1.4 SWEDEN:

5.1.5 AUSTRIA:

5.1.6 FRANCE:

5.1.7 ITALY:

5.2 REGULATIONS IN NORTH AMERICA

5.2.1 U.S.

5.2.2 CANADA

5.2.3 MEXICO

5.3 REGULATIONS IN SOUTH AMERICA

5.3.1 BRAZIL

5.3.2 ARGENTINA

5.4 REGULATIONS IN MIDDLE EAST AFRICA

5.4.1 SOUTH AFRICA

5.4.2 ISRAEL

5.5 REGULATIONS IN ASIA-PACIFIC

5.5.1 CHINA

5.5.2 INDIA

5.5.3 JAPAN

5.5.4 SOUTH KOREA

5.5.5 HONG KONG

5.5.6 MALAYSIA

5.5.7 PHILIPPINES

5.5.8 THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING HEALTH BENEFITS BY THE USAGE OF CANNABIDIOL (CBD) VAPE JUICE

6.1.2 GROWING DEMAND FOR CANNABIDIOL (CBD) VAPE JUICE IN THE MEDICAL INDUSTRY

6.1.3 RISING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH

6.1.4 SURGING DEMAND FOR E-LIQUID

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT REGULATIONS

6.2.2 VAPING-RELATED SEVERE LUNG INJURY

6.2.3 LEGALIZATION OF CBD VAPE JUICE IN SEVERAL EUROPEAN COUNTRIES

6.3 OPPORTUNITIES

6.3.1 INCREASING AWARENESS, EFFICIENT DISTRIBUTION CHANNEL, AND EASY AVAILABILITY

6.3.2 GROWING INCIDENCE OF PSYCHOLOGICAL DISORDERS

6.3.3 GROWING PREFERENCE FOR ECO-FRIENDLY VAPING AMONG CONSUMERS

6.3.4 TECHNOLOGICAL INNOVATIONS IN VAPING

6.4 CHALLENGES

6.4.1 HIGH COST OF CBD VAPE PRODUCTS

6.4.2 HEALTH RISKS OF E-CIGARETTES

7 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CBD ISOLATE VAPE JUICE

7.2.1 CBD ISOLATE VAPE JUICE, BY SOURCE

7.2.1.1 HEMP

7.2.1.2 MARIJUANA

7.2.2 CBD ISOLATE VAPE JUICE, BY FLAVOR

7.2.2.1 FLAVORED

7.2.2.1.1 FRUIT FLAVORS

7.2.2.1.2 OTHER FLAVORS

7.2.2.2 FLAVORLESS

7.3 FULL SPECTRUM VAPE JUICE

7.3.1 FULL SPECTRUM VAPE JUICE, BY SOURCE

7.3.1.1 HEMP

7.3.1.2 MARIJUANA

7.3.2 FULL SPECTRUM VAPE JUICE, BY FLAVOR

7.3.2.1 FLAVORED

7.3.2.1.1 FRUIT FLAVORS

7.3.2.1.2 OTHER FLAVORS

7.3.2.2 FLAVORLESS

7.4 BROAD SPECTRUM VAPE JUICE

7.4.1 BROAD SPECTRUM VAPE JUICE, BY SOURCE

7.4.1.1 HEMP

7.4.1.2 MARIJUANA

7.4.2 BROAD SPECTRUM VAPE JUICE, BY FLAVOR

7.4.2.1 FLAVORED

7.4.2.1.1 FRUIT FLAVORS

7.4.2.1.2 OTHER FLAVORS

7.4.2.2 FLAVORLESS

8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN

9.1 OVERVIEW

9.2 INDICA

9.3 SATIVA

9.4 HYBRID

10 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO

10.1 OVERVIEW

10.2 50/50 VG&PG RATIO

10.3 60/40 VG&PG RATIO

10.4 70/30 VG&PG RATIO

11 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 NO THC

11.3 THC NON-DETECTABLE

11.4 THC DETECTABLE

12 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE

12.1 OVERVIEW

12.2 LOW

12.3 HIGH

12.4 MEDIUM

13 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 FRUIT FLAVORS

13.2.1.1 WATERMELON

13.2.1.2 MANGO

13.2.1.3 STRAWBERRY

13.2.1.4 BLUEBERRY

13.2.1.5 PINEAPPLE

13.2.1.6 APPLE

13.2.1.7 RASPBERRY

13.2.1.8 PEACH

13.2.1.9 LIME

13.2.1.10 BANANA

13.2.1.11 COCONUT

13.2.1.12 OTHERS

13.2.2 OTHER FLAVORS

13.2.2.1 MINT

13.2.2.2 TOBACCO

13.2.2.3 KUSH

13.2.2.4 CHOCOLATE

13.2.2.5 CHESSECAKE

13.2.2.6 LEMONADE

13.2.2.7 TOFFEE

13.2.2.8 PINA COLADA

13.2.2.9 VANILLA

13.2.2.10 OTHERS

13.3 FLAVORLESS

14 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED

14.1 OVERVIEW

14.2 TESTED FOR POTENCY

14.3 TESTED FOR PURITY

15 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE

15.1 OVERVIEW

15.2 >30ML

15.3 30ML-60ML

15.4 UPTO 1000ML

15.5 60ML-100ML

16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 ONLINE

16.3 WELLNESS & NATURAL PRODUCT STORES

16.4 MEDICAL MARIJUANA DISPENSARIES

17 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 COMPANY LANDSCAPE: NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 SAVAGE CBD

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 VAPE DINNER LADY

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 LE PETIT VAPOTEUR

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 MALAYA HEMP

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 CBDFX

20.5.1 COMPANY SNAPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 BLUE MOON HEMP

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CBD GENESIS

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 ERTH WELLNESS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 FUSION CBD PRODUCTS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 HEMPBOMBS

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 HEMPLUCID

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 JUSTCBD

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 KOI CBD

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 MARRY JANE

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 NU-X CBD

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 PASO

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 PURE CBD VAPORS

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 VAPORFI

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF EUROPEAN COUNTRIES WITH LEGALITY STATUS OF CANNABIDIOL (CBD) VAPE JUICE

TABLE 2 PRICES OF THE CANNABIDIOL (CBD) VAPE JUICE

TABLE 3 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HEMP IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MARIJUANA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA INDICA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SATIVA IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HYBRID IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 50/50 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA 60/40 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA 70/30 VG&PG RATIO IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA NO THC IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA THC NON-DETECTABLE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA THC DETECTABLE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA LOW IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA HIGH IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIUM IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA FRUIT FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA FLAVORLESS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TESTED FOR POTENCY IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA TESTED FOR PURITY IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA >30ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA 30ML-60ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA UPTO 1000ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA 60ML-100ML IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ONLINE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA WELLNESS & NATURAL PRODUCT STORES IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MEDICAL MARIJUANA DISPENSARIES IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 78 U.S. FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 U.S. BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 81 U.S. BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 82 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 84 U.S. CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 85 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 86 U.S. NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 87 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 88 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 89 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 91 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 92 U.S. FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 U.S. FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 96 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 97 U.S. CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 100 CANADA FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 101 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 102 CANADA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 103 CANADA BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 104 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 106 CANADA CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 107 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 CANADA NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 109 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 110 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 111 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 113 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 CANADA FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 CANADA FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 CANADA OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 118 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 119 CANADA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO FULL SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 123 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FULL SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 124 MEXICO BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO BROAD SPECTRUM VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 126 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY BROAD SPECTRUM FLAVOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO CBD ISOLATE VAPE JUICE IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY ISOLATE FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 MEXICO NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY STRAIN, 2020-2029 (USD MILLION)

TABLE 132 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2020-2029 (USD MILLION)

TABLE 133 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 134 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DOSE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 136 MEXICO FLAVORED IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 137 MEXICO FRUIT FLAVOR IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 138 MEXICO OTHER FLAVORS IN CANNABIDIOL (CBD) VAPE JUICE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 139 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY TESTS PERFORMED, 2020-2029 (USD MILLION)

TABLE 140 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY PACKAGING SIZE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO CANNABIDIOL (CBD) VAPE JUICE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SEGMENTATION

FIGURE 9 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 10 GROWING HEALTH BENEFITS FROM THE USAGE OF CBD VAPE JUICE AND RISING AWARENESS ABOUT THE NEGATIVE IMPACTS OF TOBACCO SMOKING ON HEALTH ARE EXPECTED TO LEAD TO THE GROWTH OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET IN THE FORECAST PERIOD

FIGURE 11 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 13 SUPPLY CHAIN OF NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET

FIGURE 15 SYMPTOMS OF DEPRESSION AMONG ADULTS IN U.S. (IN %), 2020

FIGURE 16 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY SOURCE, 2021

FIGURE 18 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY STRAIN, 2021

FIGURE 19 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PROPYLENE GLYCOL (PG) & VEGETABLE GLYCERIN (VG) RATIO, 2021

FIGURE 20 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY CATEGORY, 2021

FIGURE 21 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY DOSE, 2021

FIGURE 22 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY FLAVOR, 2021

FIGURE 23 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY TESTS PERFORMED, 2021

FIGURE 24 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PACKAGING SIZE, 2021

FIGURE 25 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 31 NORTH AMERICA CANNABIDIOL (CBD) VAPE JUICE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.