Marché de l'imagerie dentaire CBCT en Amérique du Nord, par type (systèmes, détecteurs et logiciels), champ de vision (grand, moyen et petit), type d'appareil (position du patient) (debout, assis et couché), application ( implants dentaires , endodontie, dentisterie générale, chirurgie buccale et maxillo-faciale, orthodontie, troubles de l'articulation temporo-mandibulaire (ATM), parodontie, dentisterie légale et autres), utilisateur final (hôpitaux et cliniques dentaires, universités et instituts de recherche, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'imagerie dentaire CBCT en Amérique du Nord

La prévalence croissante des infections et des troubles dentaires dans la région et l'augmentation de la population de tous les groupes d'âge renforcent la demande du marché. L'augmentation des dépenses de santé pour de meilleurs services de santé est également attribuée à la croissance du marché. Les principaux acteurs du marché se concentrent fortement sur les lancements de produits pendant cette période cruciale. En outre, le gouvernement et les organismes de réglementation soutiennent les acteurs du marché avec l'approbation des produits en raison de l'émergence croissante. Le marché est en croissance au cours de l'année de prévision en raison de l'augmentation du nombre d'acteurs du marché et de la disponibilité des produits consommables d'imagerie. Le marché est favorable et vise à réduire la progression des troubles dentaires.

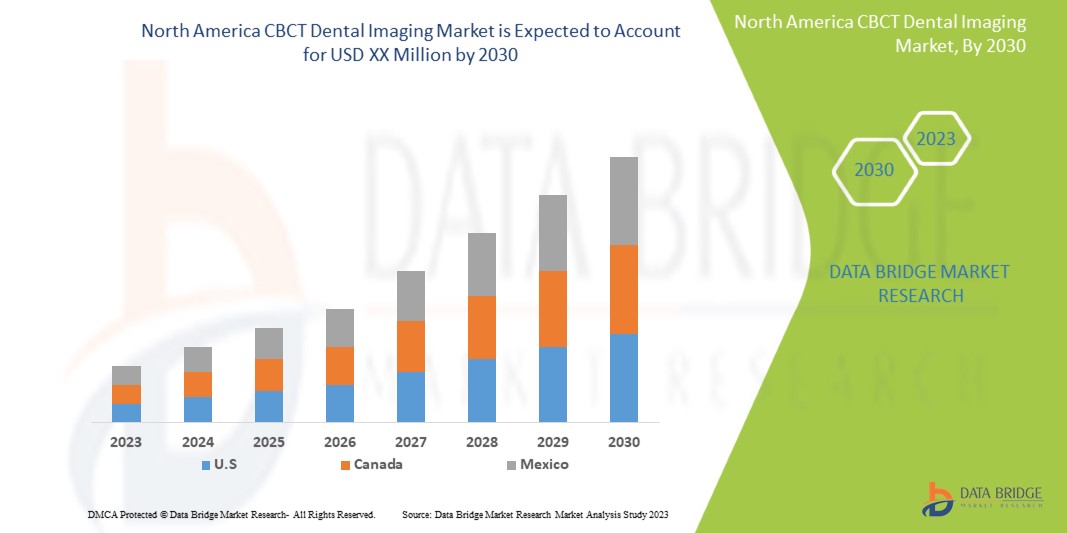

Data Bridge Market Research analyse que le marché nord-américain de l'imagerie dentaire CBCT devrait croître à un TCAC de 11,0 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (systèmes, détecteurs et logiciels), champ de vision (grand, moyen et petit), type d'appareil (position du patient) (debout, assis et couché), application (implants dentaires, endodontie, dentisterie générale, chirurgie buccale et maxillo-faciale, orthodontie, troubles de l'articulation temporo-mandibulaire (ATM), parodontie, dentisterie légale et autres), utilisateur final (hôpitaux et cliniques dentaires, universités et instituts de recherche et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Carestream Health., Cefla sc, Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, (filiale Dental Imaging Technologies Corporation), VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl, ASAHIROENTGEN IND.CO., LTD., Owandy Radiology et PINGSENG Healthcare, entre autres |

Définition du marché

La tomodensitométrie volumique à faisceau conique (CBCT) en imagerie dentaire est un type particulier d'appareil à rayons X utilisé dans les situations où les radiographies dentaires classiques ne suffisent pas. Elle n'est pas couramment utilisée car l'exposition aux radiations de ce scanner est nettement supérieure à celle des radiographies dentaires classiques. Elle utilise un type spécial de technologie pour générer des images tridimensionnelles (3D) des structures dentaires, des tissus mous et des voies nerveuses en un seul scan.

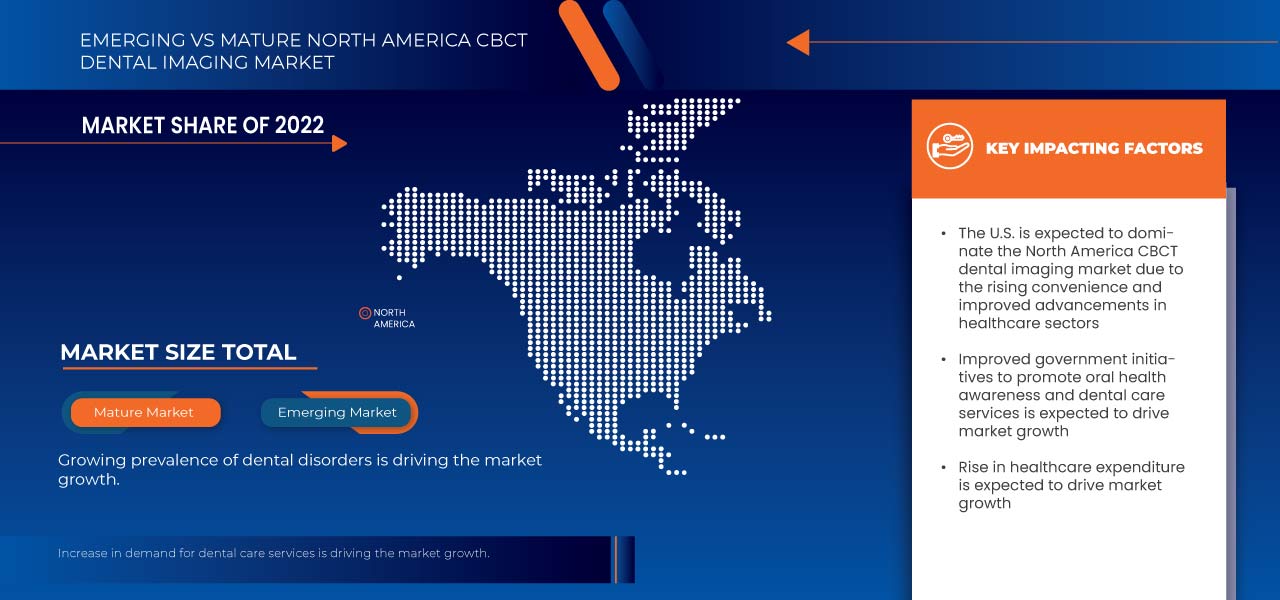

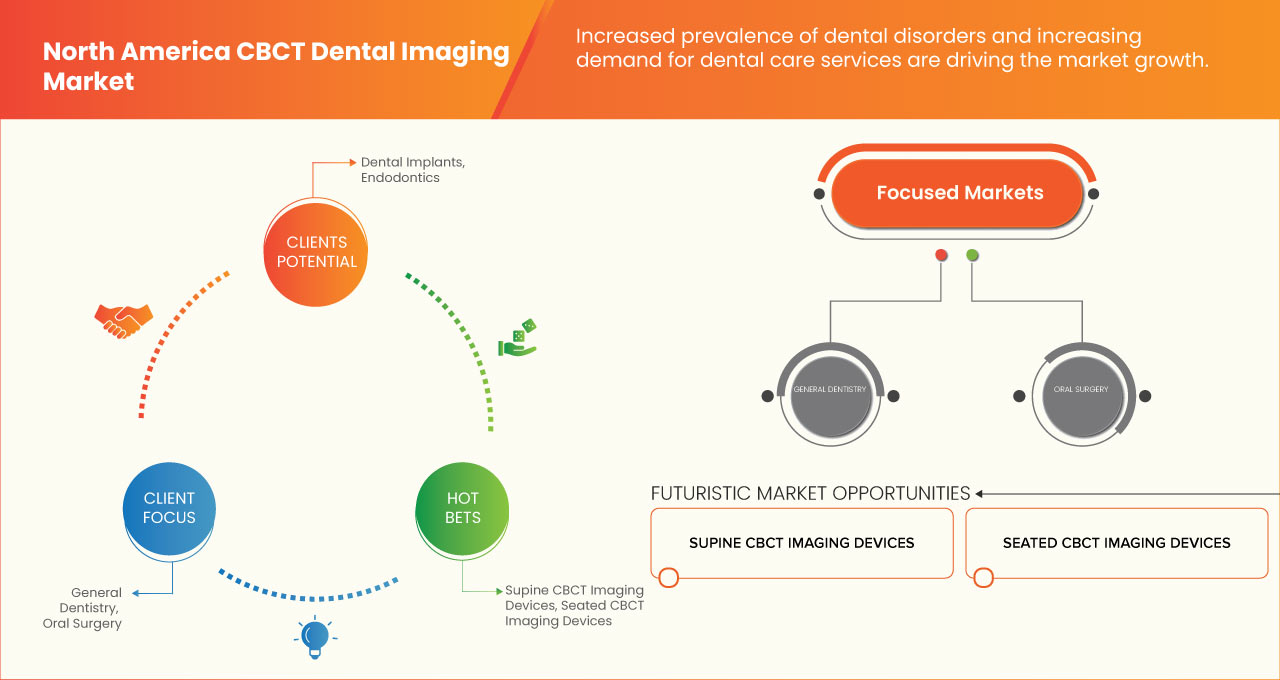

La prévalence croissante des troubles dentaires, la demande croissante de services de soins dentaires et les progrès des technologies et logiciels d'imagerie dentaire CBCT sont les principaux facteurs à l'origine de la croissance du marché. En outre, les initiatives gouvernementales visant à promouvoir la sensibilisation à la santé bucco-dentaire et les services de soins dentaires stimulent la croissance du marché.

Dynamique du marché de l'imagerie dentaire CBCT en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- Prévalence croissante des troubles dentaires et demande croissante de services de soins dentaires

Ces dernières années, la prévalence des maladies dentaires a augmenté, ce qui a entraîné une augmentation de la demande de services dentaires. Plusieurs facteurs sont à l'origine de cette tendance, notamment le vieillissement de la population, une mauvaise hygiène bucco-dentaire, l'alimentation, le mode de vie, une sensibilisation accrue et les progrès technologiques et de l'innovation.

À mesure que les gens vieillissent, ils sont plus sujets aux problèmes dentaires tels que la carie dentaire, les maladies des gencives et la perte de dents. Cela est dû à plusieurs facteurs, notamment les changements dans les niveaux d'hormones, la diminution de la production de salive et un système immunitaire affaibli. Le vieillissement de la population a augmenté la demande de services dentaires, en particulier les procédures de restauration et d'esthétique.

Une mauvaise hygiène bucco-dentaire est un autre facteur important qui affecte la prévalence des maladies dentaires. Malgré les progrès réalisés en matière de santé bucco-dentaire, de nombreuses personnes négligent leur santé bucco-dentaire. Le fait de ne pas se brosser les dents et d’utiliser le fil dentaire régulièrement peut entraîner une accumulation de plaque dentaire, qui peut entraîner des caries, des maladies des gencives et une mauvaise haleine.

- Progrès dans les technologies et logiciels d'imagerie dentaire CBCT

L'une des avancées les plus importantes de la technologie d'imagerie CBCT est la résolution accrue des images. Les images à plus haute résolution permettent un diagnostic plus précis et plus exact des maladies liées aux dents et aux mâchoires. Cela est particulièrement utile en dentisterie implantaire car cela permet une meilleure visualisation de la structure osseuse et de la position des dents, ce qui peut aider à déterminer le placement optimal des implants dentaires.

Une autre amélioration est l'augmentation de la cadence de tir. Avec les nouveaux appareils CBCT, les images sont obtenues en 5 à 10 secondes, ce qui réduit l'exposition du patient aux radiations et améliore l'efficacité du cabinet dentaire. Cela est particulièrement utile pour les patients qui ont du mal à rester assis pendant de longues périodes ou qui ont besoin de plusieurs examens.

De plus, les nouveaux développements logiciels ont facilité le traitement et l'analyse des images CBCT. Les logiciels d'imagerie 3D permettent une meilleure visualisation des images et les appareils de mesure peuvent mesurer avec précision les structures et les distances des images. Cela permet aux dentistes de diagnostiquer et de planifier plus facilement le traitement de diverses maladies.

OPPORTUNITÉ

- Adoption croissante de la dentisterie numérique

La dentisterie numérique désigne l'utilisation des technologies numériques dans la pratique dentaire, du diagnostic et de la planification du traitement à la fabrication des obturations dentaires. Avec les progrès de la technologie, la dentisterie numérique est devenue plus courante ces dernières années.

Certains des avantages de l’adoption de la dentisterie numérique sont les suivants :

- Précision améliorée : les technologies numériques telles que les scanners intrabuccaux, l'imagerie 3D et les logiciels de conception assistée par ordinateur (CAO) fournissent aux dentistes des mesures extrêmement précises et exactes des dents et des gencives d'un patient. Cela contribue à améliorer la qualité de la planification du traitement et de la préparation des obturations dentaires.

- Une meilleure expérience pour le patient : la dentisterie numérique réduit le besoin d'empreintes dentaires traditionnelles, qui peuvent être inconfortables et déroutantes pour les patients. Les scanners intrabuccaux permettent une reproduction numérique rapide et pratique, rendant l'expérience plus agréable pour les patients.

Ainsi, l’adoption croissante de la dentisterie numérique devrait constituer une opportunité de croissance du marché.

RETENUE/DÉFI

- Manque de professionnels qualifiés pour exploiter les systèmes d'imagerie dentaire CBCT

La pénurie de compétences a déjà des répercussions sur le pays, un nombre croissant de personnes étant obligées d'attendre plus de six mois pour bénéficier de soins dentaires. Il existe une pénurie de professionnels qualifiés dans le domaine de l'imagerie dentaire CBCT dans les pays émergents ou en développement en raison des progrès techniques, des infrastructures de base et de plusieurs autres facteurs.

Le manque de professionnels qualifiés est en partie dû à la formation rigoureuse requise pour devenir un professionnel dentaire ainsi qu'à la concurrence sur le marché du travail. De plus, les dentistes qualifiés ont besoin de davantage d'assistants dentaires officiellement formés et agréés pour aider à maintenir et à accroître l'accès aux soins de santé bucco-dentaire afin d'utiliser et d'exécuter des systèmes technologiques avancés tels que les systèmes d'imagerie dentaire CBCT.

Les pays émergents manquent de professionnels qualifiés qui ne peuvent pas utiliser efficacement les nouvelles technologies. Cela pourrait créer un défi pour l'émergence de nouvelles technologies sur le marché, car ces pays retardent l'apparition des avancées technologiques sur le marché.

Impact post-COVID-19 sur le marché nord-américain de l'imagerie dentaire CBCT

La lourde charge de la COVID-19 sur les systèmes de santé du monde entier a suscité des inquiétudes parmi les oncologues médicaux quant à l'impact de la COVID-19 sur l'imagerie dentaire CBCT. Nous avons étudié l'impact de la COVID-19 sur l'imagerie dentaire CBCT avant et après l'ère de la COVID-19 dans cette étude de cohorte rétrospective. Pendant la pandémie, l'imagerie dentaire CBCT a diminué avec des stades légèrement plus avancés des troubles dentaires, et il y a eu une augmentation significative de la chirurgie dentaire et de l'imagerie comme premier traitement définitif et une diminution du traitement systémique et de la chirurgie par rapport à l'ère pré-COVID-19. Par rapport à la période pré-COVID-19, il n'y a pas eu de retard significatif dans le début de l'imagerie et du traitement dentaires pendant la pandémie.

Cependant, pendant la pandémie, nous avons observé un retard dans les interventions chirurgicales dentaires. La COVID-19 semble avoir eu un impact significatif sur les diagnostics et les schémas de traitement de l’imagerie dentaire par CBCT. De nombreux dentistes craignent que le nombre de patients nouvellement diagnostiqués avec des troubles dentaires augmente au cours de l’année à venir. Cette recherche est toujours en cours et davantage d’informations seront recueillies et analysées pour mieux comprendre l’impact global de la pandémie de COVID-19 sur la population de patients de l’imagerie dentaire par CBCT.

Développements récents

- En octobre 2022, Carestream Dental LLC. a annoncé son partenariat avec Overjet, le leader du secteur de l'intelligence artificielle (IA) dentaire. Ce partenariat permet aux clients de Carestream Dental LLC. d'accéder à l'outil d'analyse radiographique basé sur l'IA d'Overjet qui détecte la carie, quantifie la perte osseuse et met en évidence d'autres domaines préoccupants. Ce partenariat a permis d'élargir le portefeuille de produits et d'augmenter les revenus de l'entreprise.

- En mars 2021, Air Techniques a annoncé son partenariat avec SICAT, qui comprend un partenariat logiciel pour les utilisateurs de ProVecta 3D Prime CBCT et les hottes nasales à protoxyde d'azote FlowStar/circuits de récupération FlowStar. L'entreprise estime que cela contribuerait à apporter une véritable solution hybride numérique pour le tout nouveau capteur intraoral SensorX et les scanners tactiles ScanX Duo.

Segmentation du marché de l'imagerie dentaire CBCT en Amérique du Nord

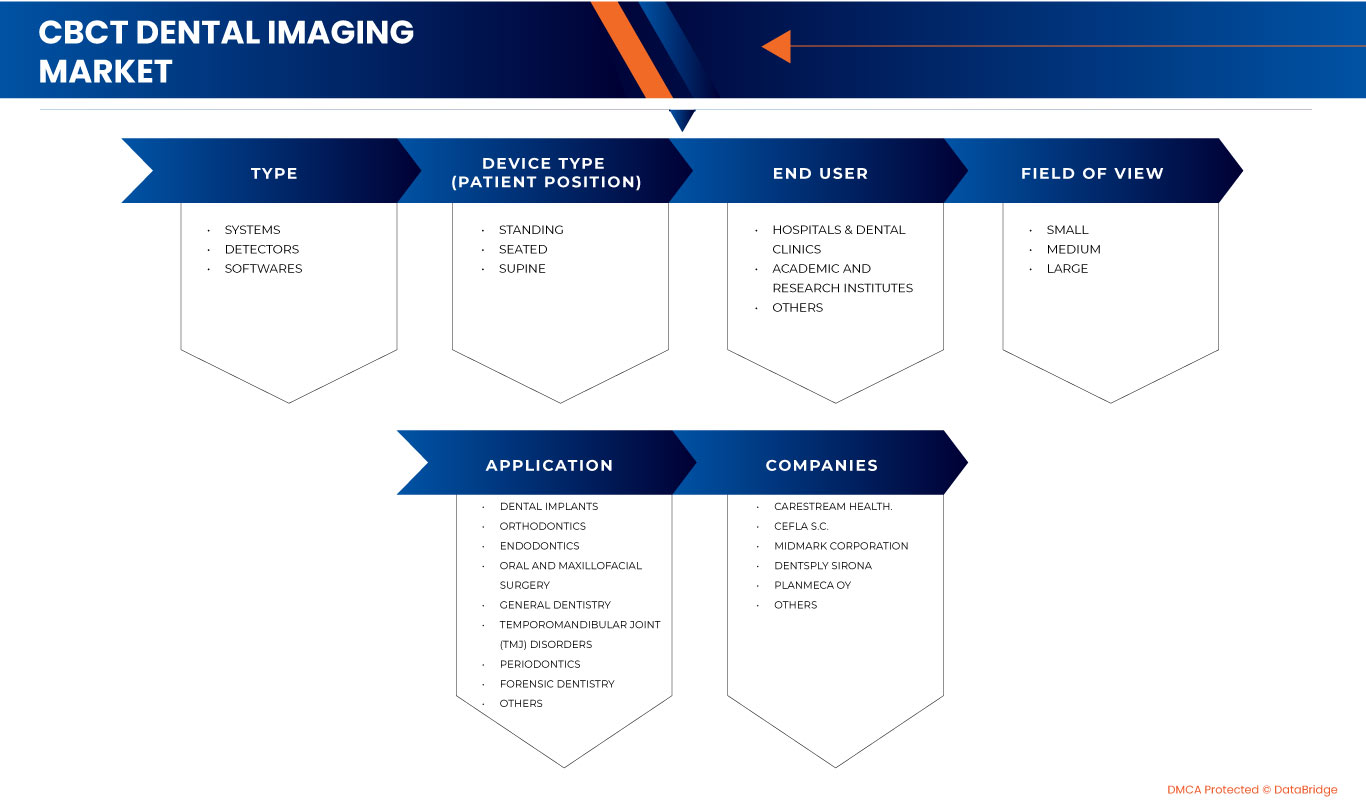

Le marché nord-américain de l'imagerie dentaire CBCT est segmenté en cinq segments notables en fonction du type, du champ de vision, du type d'appareil (position du patient), de l'application et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Systèmes

- Détecteurs

- Logiciels

Sur la base du type, le marché est segmenté en systèmes, détecteurs et logiciels.

Champ de vision

- Petit

- Moyen

- Grand

Sur la base du champ de vision, le marché est segmenté en grand, moyen et petit.

Type d'appareil (position du patient)

- Debout

- Assis

- Couché

En fonction du type d'appareil (position du patient), le marché est segmenté en position debout, assise et couchée.

Application

- Implants dentaires

- Orthodontie

- Endodontie

- Chirurgie buccale et maxillo-faciale

- Dentisterie générale

- Troubles de l'articulation temporo-mandibulaire (ATM)

- Parodontie

- Dentisterie médico-légale

- Autres

Sur la base de l'application, le marché est segmenté en implants dentaires, endodontie, dentisterie générale, chirurgie buccale et maxillo-faciale, orthodontie, troubles de l'articulation temporo-mandibulaire (ATM), parodontie, dentisterie légale et autres.

Utilisateur final

- Hôpitaux et cliniques dentaires

- Enseignement et Instituts de Recherche

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en hôpitaux et cliniques dentaires, universités et instituts de recherche, et autres.

Analyse/perspectives régionales du marché de l'imagerie dentaire CBCT en Amérique du Nord

Le marché de l’imagerie dentaire CBCT en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies en fonction du type, du champ de vision, du type d’appareil (position du patient), de l’application et de l’utilisateur final.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché de l’imagerie dentaire CBCT en Amérique du Nord en raison de l’augmentation des dépenses de santé et de la forte prévalence des maladies dentaires observées dans le pays.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'imagerie dentaire CBCT en Amérique du Nord

Le paysage concurrentiel du marché nord-américain de l'imagerie dentaire CBCT fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché sont Carestream Health., Cefla sc, Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, DEXIS (filiale de Dental Imaging Technologies Corporation), VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl., ASAHIROENTGEN IND.CO., LTD., Owandy Radiology, SORDEX et PINGSENG Healthcare, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PATENT ANALYSIS

4.4 STRATEGIC INITIATIVES

5 NORTH AMERICA CBCT DENTAL IMAGING MARKET, REGULATIONS

5.1 REGULATORY SCENARIO IN THE U.S

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF DENTAL DISORDERS AND INCREASING DEMAND FOR DENTAL CARE SERVICES

6.1.2 ADVANCEMENTS IN CBCT DENTAL IMAGING TECHNOLOGIES AND SOFTWARE

6.1.3 GOVERNMENT INITIATIVES TO PROMOTE ORAL HEALTH AWARENESS AND DENTAL CARE SERVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF CBCT DENTAL IMAGING SYSTEMS AND PROCEDURES

6.2.2 LIMITED REIMBURSEMENT POLICIES FOR CBCT DENTAL IMAGING PROCEDURES

6.2.3 STRINGENT REGULATIONS AND GUIDELINES FOR THE USE OF CBCT DENTAL IMAGING

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF DIGITAL DENTISTRY

6.3.2 INCREASING INVESTMENTS IN RESEARCH AND DEVELOPMENT OF CBCT DENTAL IMAGING SYSTEMS AND SOFTWARE

6.3.3 EXPANSION OF DENTAL CARE SERVICES IN REMOTE AND UNDERSERVED AREAS THROUGH MOBILE CBCT DENTAL IMAGING UNITS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO OPERATE CBCT DENTAL IMAGING SYSTEMS

6.4.2 LACK OF AWARENESS REGARDING DENTAL HEALTH IN EMERGING COUNTRIES

7 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 SYSTEMS

7.3 DETECTORS

7.3.1 IMAGE INTENSIFIER DETECTOR (IID)

7.3.2 FLAT PANEL DETECTOR (FPD)

7.3.2.1 CAESIUM IODIDE (CSI-TL)

7.3.2.2 GADOLINIUM OXYSULFIDE

7.4 SOFTWARES

8 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY FIELD OF VIEW

8.1 OVERVIEW

8.2 LARGE

8.3 MEDIUM

8.4 SMALL

9 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY DEVICE TYPE (PATIENT POSITION)

9.1 OVERVIEW

9.2 STANDING

9.3 SEATED

9.4 SUPINE

10 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DENTAL IMPLANTS

10.3 ENDODONTICS

10.4 GENERAL DENTISTRY

10.5 ORAL AND MAXILLOFACIAL SURGERY

10.6 ORTHODONTICS

10.7 TEMPOROMANDIBULAR JOINT (TMJ) DISORDERS

10.8 PERIODONTICS

10.9 FORENSIC DENTISTRY

10.1 OTHERS

11 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 ACADEMIC AND RESEARCH INSTITUTES

11.4 OTHERS

12 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARESTREAM HEALTH.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 CEFLA S.C.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MIDMARK CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DENTSPLY SIRONA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PLANMECA OY

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ACTEON

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ASAHIROENTGEN IND.CO.,LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AIRTECHNIQUES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CARESTREAM DENTAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DENTAL IMAGING TECHNOLOGIES CORPORATION.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DURR DENTAL SE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FONA SRL

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GENORAY CO. LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 J. MORITA TOKYO MFG. CORP.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 KEVO DENTAL

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 OWANDY RADIOLOGY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PINGSENG HEALTHCARE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PREXION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TAKARA BELMONT CORP

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VATECH

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (VOLUME)

TABLE 3 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 4 NORTH AMERICA SYSTEMS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA DETECTORS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA DETECTORS IN CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA FLAT PANEL DETECTORS (FPD) IN CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SOFTWARES IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY FIELD OF VIEW, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA LARGE IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MEDIUM IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SMALL IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY DEVICE TYPE (PATIENT POSITION), 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA STANDING IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SEATED IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SUPINE IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DENTAL IMPLANTS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ENDODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA GENERAL DENTISTRY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL AND MAXILLOFACIAL SURGERY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ORTHODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA TEMPOROMANDIBULAR JOINT (TMJ) DISORDERS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PERIODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FORENSIC DENTISTRY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA HOSPITALS & DENTAL CLINICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CBCT DENTAL IMAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CBCT DENTAL IMAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CBCT DENTAL IMAGING MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA CBCT DENTAL IMAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SEGMENTATION

FIGURE 11 THE GROWING PREVALENCE OF DENTAL DISORDERS AND INCREASING DEMAND FOR DENTAL CARE SERVICES IS EXPECTED TO DRIVE THE NORTH AMERICA CBCT DENTAL IMAGING MARKET

FIGURE 12 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CBCT DENTAL IMAGING MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CBCT DENTAL IMAGING MARKET

FIGURE 14 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, 2022

FIGURE 15 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 LOBAL CBCT DENTAL IMAGING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, 2022

FIGURE 19 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, LIFELINE CURVE

FIGURE 22 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), 2022

FIGURE 23 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), CAGR (2023-2030)

FIGURE 25 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), LIFELINE CURVE

FIGURE 26 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, 2022

FIGURE 27 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE (2023-2030)

FIGURE 39 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.