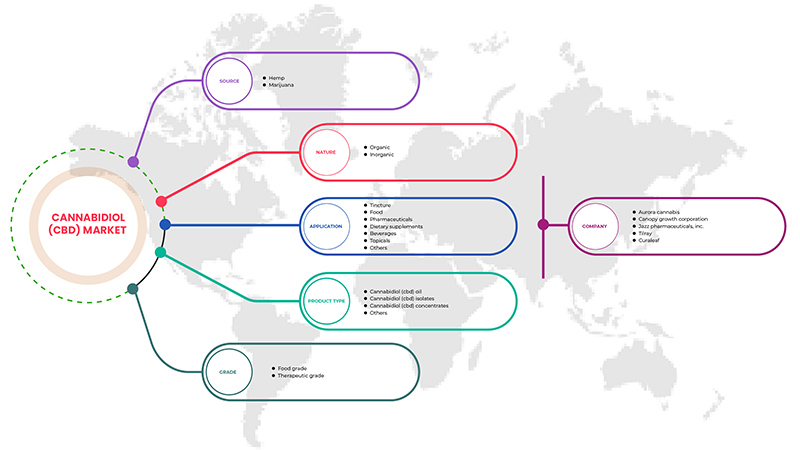

Marché nord-américain du cannabidiol (CBD) par source (chanvre et marijuana), qualité (qualité alimentaire et qualité thérapeutique), nature (organique et inorganique), application (teinture, aliments, boissons, produits pharmaceutiques, produits topiques, compléments alimentaires et autres), type de produit (huile de CBD, concentrés de CBD, isolats de CBD et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché du cannabidiol (CBD) en Amérique du Nord

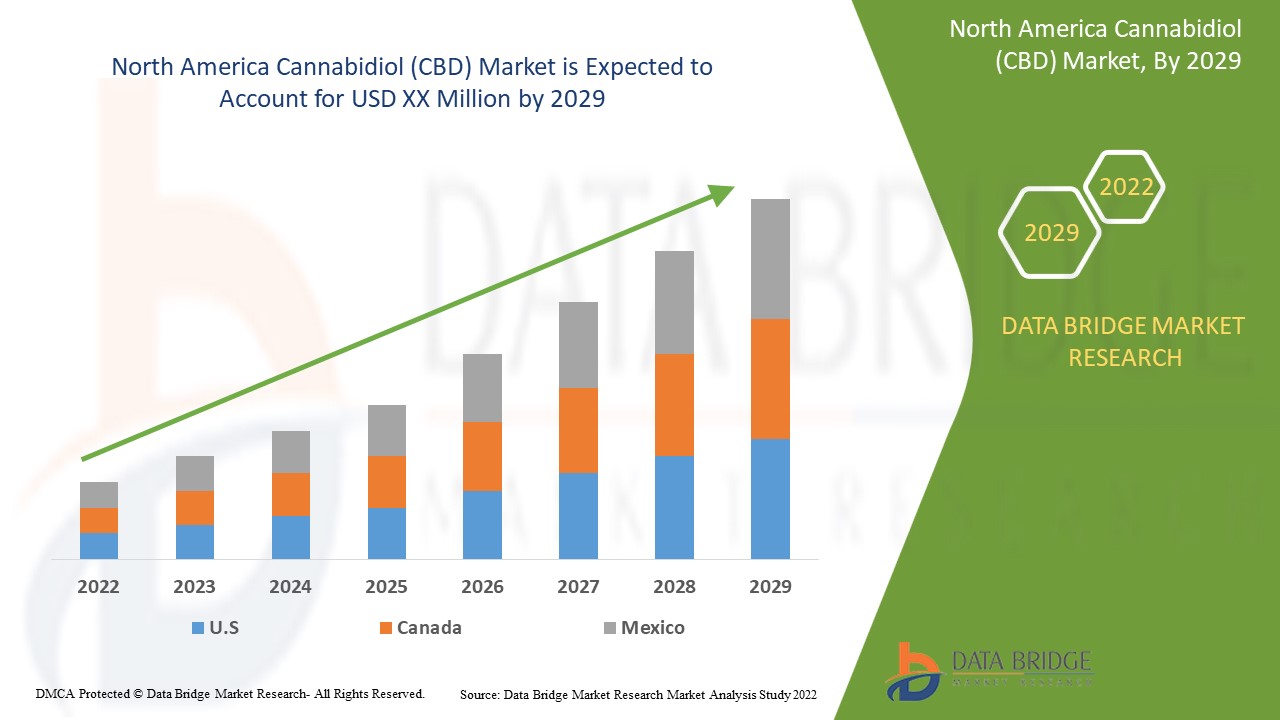

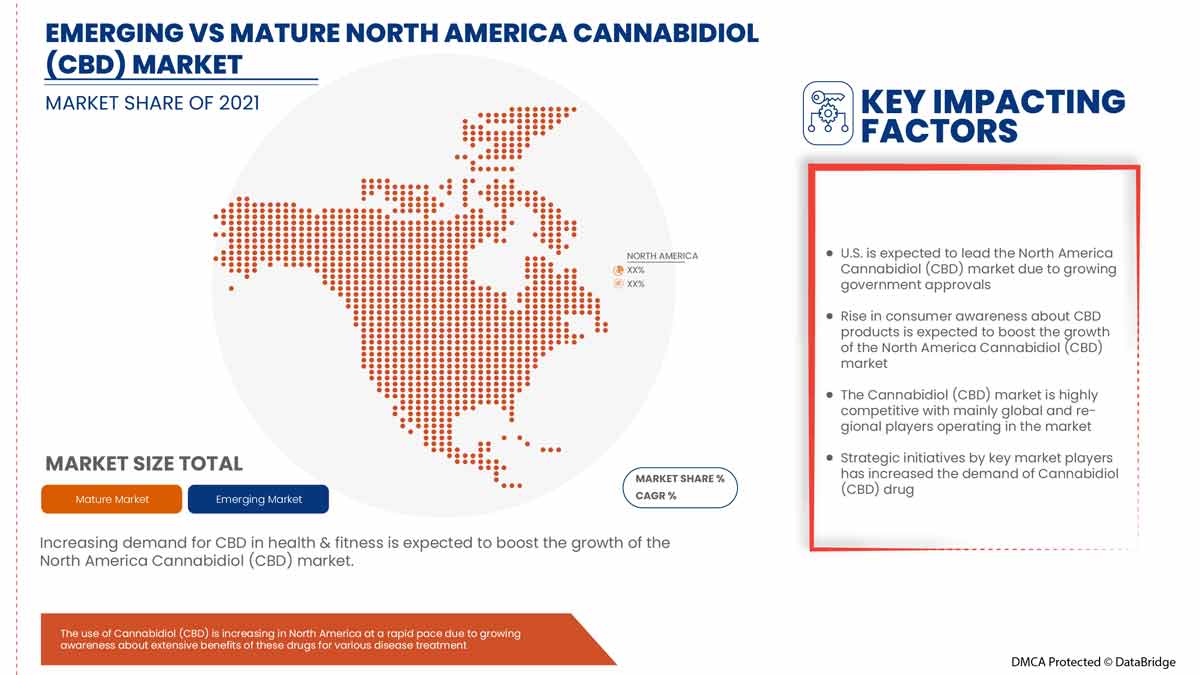

Le marché nord-américain du cannabidiol (CBD) devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 28,7 % au cours de la période de prévision de 2022 à 2029. Les avancées technologiques dans les traitements médicamenteux au cannabidiol (CBD), l'essor du secteur de la santé sont d'autres facteurs qui stimulent la croissance du marché nord-américain du cannabidiol (CBD) au cours de la période de prévision.

Cependant, les effets secondaires associés à l'huile de CBD et aux produits contrefaits et synthétiques disponibles sur le marché freineront la croissance du marché. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché nord-américain du cannabidiol (CBD).

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par source (chanvre et marijuana), qualité (qualité alimentaire et qualité thérapeutique), nature (biologique et inorganique), application (teinture, aliments, boissons, produits pharmaceutiques, produits topiques, compléments alimentaires et autres), type de produit (huile de CBD, concentrés de CBD, isolats de CBD et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Français Certains des principaux acteurs opérant sur le marché nord-américain du cannabidiol (CBD) sont CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads entre autres. |

Définition du marché du cannabidiol (CBD)

Le cannabidiol (CBD) est un composé chimique présent dans la plante de cannabis sativa et extrait du chanvre ou du cannabis, généralement du chanvre en raison de sa teneur naturellement élevée en cannabidiol (CBD). Il présente plusieurs avantages dans le traitement de l'anxiété et des crises d'épilepsie et dans la réduction de la douleur. En raison de ses propriétés curatives, la demande de CBD à des fins de santé et de bien-être est élevée, ce qui est le principal facteur qui stimule le marché. De tous les cannabinoïdes, le cannabidiol est le plus largement utilisé à des fins thérapeutiques en raison de l'absence d'effets psychoactifs. Dans de nombreuses applications médicales, l'huile de cannabidiol est utilisée, comme le traitement de l'anxiété et de la dépression, le soulagement du stress, la prévention du diabète, le soulagement de la douleur, le soulagement des symptômes du cancer et l'inflammation. En raison de l'adoption croissante de produits à base de CBD pour traiter les maladies, le marché nord-américain devrait croître à un rythme lucratif au cours de la période de prévision. L'huile de cannabidiol est de plus en plus utilisée pour fabriquer des produits de soin de la peau pour traiter l'acné et les rides. Sephora, par exemple, a récemment introduit une gamme de soins de la peau au cannabidiol ou au CBD dans ses magasins. De même, Ulta Beauty envisage de lancer une gamme de produits à base de cannabidiol. Plusieurs nouvelles entreprises entrent également sur le marché des produits cosmétiques à base de cannabidiol.

En outre, les gouvernements de différents pays ainsi que les principaux acteurs du marché des cannabinoïdes investissent dans des activités de recherche et développement. Le CBD serait un traitement efficace contre diverses maladies neurologiques, dont l'épilepsie, selon plusieurs essais cliniques.

Dynamique du marché

Conducteurs

- Demande croissante de CBD dans le domaine de la santé et du fitness

La sensibilisation croissante des consommateurs à la santé et à la forme physique contribuera à une croissance rapide du marché du CBD. L’augmentation du revenu disponible des consommateurs ainsi que la légalisation du cannabis médicinal devraient avoir un impact positif sur la demande de cannabidiol dans ce secteur.

De plus, les produits à base de CBD sont utilisés pour soulager divers problèmes tels que l'anxiété/le stress, le sommeil/l'insomnie, la douleur chronique, la migraine, les soins de la peau, les crises d'épilepsie, les douleurs et inflammations articulaires, les troubles neurologiques et bien d'autres. Le traitement de la douleur chronique a gagné en popularité en raison des avantages supplémentaires offerts par le CBD lorsqu'il est utilisé. La demande de produits à base de cannabidiol (CBD) a augmenté ces dernières années en raison de ses applications médicales répandues et de son traitement contre la douleur. Le CBD aide à réduire la douleur chronique en agissant sur divers processus biologiques de l'organisme. De plus, le CBD possède des propriétés antioxydantes, anti-inflammatoires et analgésiques. Par conséquent, les produits à base de CBD réduisent l'anxiété ressentie par les personnes souffrant de douleurs chroniques. Ainsi, la demande croissante de CBD dans le traitement de la douleur chronique augmente la croissance du marché. Cela aide également les gens à maintenir leur santé et leur forme physique, tout en évitant la douleur qui peut survenir pendant les activités de remise en forme.

- Améliorer les approbations et réglementations gouvernementales pour les produits à base de CBD

Les réglementations gouvernementales sont strictes et les produits à base de CBD nécessitent des approbations strictes avant d'être commercialisés et fournis sur le marché local et international, ce qui limite la croissance du marché. Cependant, avec le temps, ces restrictions ont été assouplies et l'acceptation des produits raffinés à base de CBD s'est accrue, combinée à la légalisation croissante de la marijuana et des produits dérivés de la marijuana pour diverses applications. Cela stimulera la croissance et la demande sur le marché.

De plus, la présence de grands fabricants de produits CBD à travers le monde a incité le gouvernement et d'autres organismes de réglementation tels que la Food and Drug Administration (FDA) aux États-Unis, l'Union européenne en Europe, etc. à assouplir les restrictions pour le CBD et les produits à base de CBD.

Retenue

-

Coût élevé des produits à base de CBD

Le CBD est un choix populaire et holistique pour les personnes aux prises avec la douleur, l'inflammation et les problèmes de sommeil. Le CBD étant un nouveau produit avec moins de recherche et développement et ayant été récemment réglementé et approuvé, le prix du CBD est donc sujet à des fluctuations. La production de chanvre est devenue légale en 2018, ce qui a eu un impact sur le prix des produits CBD. En conséquence, divers produits CBD ont connu une certaine inflation de prix.

De plus, de nombreux agriculteurs se tournent vers la culture et la vente de chanvre utilisé pour fabriquer des produits à base de CBD, mais malgré la popularité croissante de ce produit, il présente ses propres défis agricoles. Tout d'abord, le passage à une nouvelle culture entraîne de nouvelles dépenses. Le moyen le plus efficace de récolter du chanvre est d'utiliser une moissonneuse-batteuse. Cependant, les agriculteurs qui ont déjà cultivé des cultures qui ne nécessitent pas de moissonneuse-batteuse, comme les fraises, ne peuvent pas se permettre d'acheter une moissonneuse-batteuse tout de suite. Par conséquent, ils doivent embaucher des personnes pour les aider à récolter le chanvre, ce qui fait grimper les prix globaux des produits car la matière première devient coûteuse.

De plus, la culture du chanvre nécessite plus de temps et de travail et les agriculteurs doivent inspecter leurs cultures de près au fur et à mesure de leur croissance. De plus, une fois récolté, l'extraction du cannabidiol est un processus difficile et coûteux. Les transformateurs et les extracteurs de CBD doivent utiliser soit de l'éthanol, soit du dioxyde de carbone supercritique (extraction au CO2). Le processus d'extraction et de raffinage nécessite des machines spéciales et prend beaucoup de temps, ce qui augmente le coût du CBD. Ainsi, tous ces facteurs s'additionnent aux coûts des produits à base de CBD, les rendant beaucoup plus coûteux que d'autres produits, ce qui est susceptible de limiter la demande du marché.

Opportunité

-

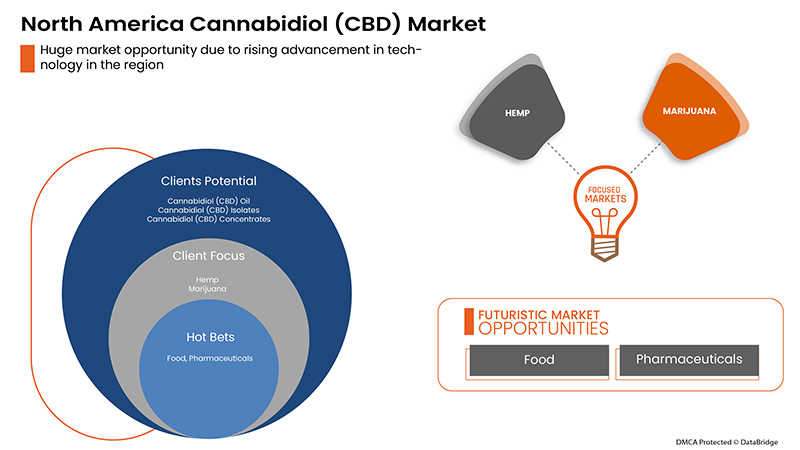

Augmenter les investissements dans le développement de nouveaux produits à base de CBD

Avec la tendance croissante à fournir des produits innovants et raffinés sur le marché, les fabricants dépensent des sommes importantes en recherche et développement pour la production de nouveaux produits à base de CBD. Les huiles, les teintures, les concentrés, les capsules, les solutions topiques telles que les esclaves, les baumes à lèvres, les lotions et les produits comestibles tels que les produits de boulangerie, le café, les chocolats, les gommes et les bonbons font partie des produits à base de CBD qui sont très demandés.

La demande croissante a entraîné une augmentation du nombre d’essais visant à étudier l’impact du CBD sur certains problèmes de santé, ce qui devrait permettre de développer de nouveaux produits et d’accroître la demande dans les années à venir. En outre, de nombreuses entreprises achètent des huiles de CBD en vrac et fabriquent des produits infusés au CBD. De plus, de nombreux détaillants de produits de santé et de bien-être proposent des produits à base de CBD, tels que Rite Aid, CVS Health et Walgreens Boots Alliance.

De plus, avec l'assouplissement des réglementations et l'approbation des produits à base de cannabis, les entreprises investissent des sommes considérables dans le développement de produits et la modernisation de la production de matières premières, ce qui les aidera également à réduire les coûts tout en répondant à la demande croissante du marché. Le développement de nouveaux produits et l'augmentation des activités de recherche et développement ainsi que diverses décisions stratégiques prises par les principaux fabricants du marché offriront des opportunités lucratives pour la croissance du marché du CBD en Amérique du Nord.

Défi

- Effets secondaires associés à l'huile de CBD

Le cannabidiol est bien connu pour sa capacité à guérir une variété de maladies, notamment l'anxiété, les crises d'épilepsie, les problèmes neurologiques, les nausées liées au cancer, les douleurs chroniques, etc. Cependant, étant utile pour une variété de maladies médicales, diverses études et recherches menées par de nombreuses organisations ont montré que les médicaments à base de CBD peuvent également avoir des effets négatifs.

Certains des effets secondaires fréquemment ressentis par les consommateurs comprennent la bouche sèche, la somnolence, l’hypotension artérielle et les étourdissements. Le CBD est également connu pour augmenter le taux de Coumadin (un anticoagulant) dans le corps, ce qui peut interagir avec d’autres médicaments et provoquer des effets secondaires négatifs. Ces facteurs pourraient entraver l’adoption future du CBD à des fins thérapeutiques.

De plus, le manque de fiabilité de la pureté et du dosage du CBD dans des produits tels que l'huile de CBD est une autre source d'inquiétude. Une concentration élevée d'huile de CBD peut également avoir des effets nocifs sur la santé des consommateurs. Dans certains cas, une utilisation excessive d'huile de CBD peut également augmenter les enzymes hépatiques, ce qui est un marqueur d'inflammation du foie. Le cytochrome P450 (CYP450) est une enzyme que l'organisme utilise pour décomposer certains médicaments. L'huile de CBD peut bloquer le CYP450. Cela signifie que la prise d'huile de CBD avec ces médicaments pourrait leur donner un effet plus fort que nécessaire ou les empêcher d'agir du tout.

De plus, les compléments alimentaires contenant du CBD et un mélange d’ingrédients à base de plantes peuvent ne pas être sans danger pour tout le monde, car de nombreuses plantes peuvent interagir avec les médicaments couramment prescrits. Tous ces effets secondaires peuvent varier d’une personne à l’autre, car des effets secondaires mineurs pour certains peuvent s’avérer graves pour d’autres. Cela peut constituer un défi pour la demande croissante de produits à base de CBD sur le marché du CBD en Amérique du Nord.

Impact post-COVID-19 sur le marché nord-américain du cannabidiol (CBD)

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales, tant de la part des professionnels de la santé que du grand public, pour des raisons de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement constant d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact important sur le marché nord-américain du cannabidiol (CBD).

Portée et taille du marché du cannabidiol (CBD) en Amérique du Nord

Le marché nord-américain du cannabidiol (CBD) est segmenté en fonction de la source, de la qualité, de l'application, du type de produit et de la nature. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR SOURCE

- CHANVRE

- MARIJUANA

Sur la base de la source, le marché nord-américain du cannabidiol (CBD) est segmenté en chanvre et en marijuana.

PAR TYPE DE PRODUIT

- HUILE DE CBD

- ISOLATS DE CBD

- CONCENTRÉS DE CBD

- AUTRES

Sur la base du type de produit, le marché nord-américain du cannabidiol (CBD) est segmenté en huile de CBD, concentrés de CBD, isolats de CBD et autres

PAR NATURE

- ORGANIQUE

- INORGANIQUE

Sur la base de la nature, le marché nord-américain du cannabidiol (CBD) est segmenté en organique et inorganique.

PAR GRADE

- QUALITÉ ALIMENTAIRE

- QUALITÉ THÉRAPEUTIQUE

Sur la base de la qualité, le marché nord-américain du cannabidiol (CBD) est segmenté en qualité alimentaire et qualité thérapeutique.

SUR DEMANDE

- Teinture

- Nourriture

- Boissons

- Pharmaceutique

- Sujets d'actualité

- Compléments alimentaires

- Autres

Sur la base de l'application, le marché nord-américain du cannabidiol (CBD) est segmenté en teinture, aliments, boissons, produits pharmaceutiques, produits topiques, compléments alimentaires et autres.

Analyse du marché du cannabidiol (CBD) en Amérique du Nord au niveau des pays

Le marché du cannabidiol (CBD) est analysé et des informations sur la taille du marché sont fournies par source, qualité, application, type de produit et nature.

Les pays couverts par le rapport sur le marché du cannabidiol (CBD) sont les États-Unis, le Canada et le Mexique.

En 2022, les États-Unis dominent le marché grâce à la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient connaître une croissance grâce à l'augmentation des progrès technologiques dans les traitements médicamenteux.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le marché du cannabidiol (CBD) vous fournit également une analyse de marché détaillée pour chaque pays en termes de croissance du secteur de la santé. De plus, il fournit des informations détaillées sur les services et traitements de santé, l'impact des scénarios réglementaires et les paramètres de tendance concernant le marché du cannabidiol (CBD).

Analyse du paysage concurrentiel et des parts de marché du cannabidiol (CBD) en Amérique du Nord

Le paysage concurrentiel du marché du cannabidiol (CBD) en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers les produits à base de cannabidiol (CBD).

Français Les principales entreprises qui s'occupent du marché du cannabidiol (CBD) sont CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads entre autres.

Les alliances stratégiques telles que les fusions, les acquisitions et les accords entre les principaux acteurs du marché devraient encore accélérer la croissance des produits à base de cannabidiol (CBD).

Par exemple,

- En mai 2022, Canopy Growth Corporation et Lemurian, Inc., un producteur californien d'extraits de cannabis de haute qualité et pionnier de la technologie de vapotage propre, ont annoncé avoir conclu des accords définitifs accordant à Canopy Growth, par l'intermédiaire d'une filiale à 100 %, le droit d'acquérir, dès l'autorisation fédérale du THC aux États-Unis ou plus tôt au choix de Canopy Growth, jusqu'à 100 % du capital social en circulation de Jetty. Cela a aidé l'entreprise à développer ses activités sur le marché.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CANNABIDIOL (CBD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 BENCHMARKING ANALYSIS

4.2 CBD PRODUCTS, INCLUDING CANNABINOIDS (IN %)

4.3 CBD RAW MATERIAL DEVELOPMENT TREND

4.3.1 MORE CONTROLLED CBD LEVELS:

4.3.2 CBD AND GENETICS:

4.3.3 ADVANCEMENTS MADE IN EXTRACTION:

4.3.4 NANOTECHNOLOGY

4.3.5 CONCLUSION

4.4 COMPANY POSITIONING GRID

4.4.1 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

4.4.1.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.3 COMPANY SHARE ANALYSIS: EUROPE

4.4.1.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

4.4.2 COMPANY’S CURRENT VENDORS

4.5 OVERALL VOLUME (KILO TONS) & QUANTITY OF COMPLETED TRANSACTIONS: NORTH AMERICA CANNABIDIOL (CBD) MARKET

4.6 LIST OF COUNTRIES THAT LEGALIZED CANNABIDIOL (CBD)

4.7 REGULATION COVERAGE

4.8 IMPORT & EXPORT REGULATION

4.8.1 IMPORT REGULATIONS

4.8.2 EXPORT REGULATIONS

4.9 IMPORT STANDARDS

4.1 GOVERNMENT POLICIES

4.11 QUALIFICATION/CERTIFICATION REQUIRED

4.12 NORTH AMERICA CANNABIDIOL (CBD) MARKET: PRICING ANALYSIS & DEAL PRICING

4.13 RAW MATERIAL EXTRACTOR POSITIONING GRID

4.13.1 KEY EXTRACTION

4.13.2 LINE CAPABILITY

4.14 TECHNOLOGICAL ADVANCEMENTS:

4.15 VENDOR/ DISTRIBUTOR SHARE ANALYSIS

4.16 VENDOR/DISTRIBUTOR KEY BUYERS

5 CLIMATE CHANGE SCENARIO: NORTH AMERICA CANNABIDIOL (CBD) MARKET

5.1 ENVIRONMENT CONCERNS-

5.2 INDUSTRY RESPONSE-

5.3 GOVERNMENT INITIATIVES

5.4 ANALYST RECOMMENDATIONS

6 SUPPLY CHAIN OF THE NORTH AMERICA CANNABIDIOL (CBD) MARKET

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN DEMAND FOR CBD IN HEALTH & FITNESS

7.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

7.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

7.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AS WELL AS RECREATIONAL USE

7.2 RESTRAINTS

7.2.1 HIGH COST OF CBD PRODUCTS

7.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

7.3 OPPORTUNITIES

7.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

7.3.2 GROWING MEDICAL APPLICATIONS OF CBD

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

7.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

8 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 CANNABIDIOL (CBD) OIL

9.2.1 CARBON DIOXIDE EXTRACTION

9.2.2 STEAM DISTILLATION

9.2.3 SOLVENT EXTRACTION

9.2.4 OTHERS

9.3 CANNABIDIOL (CBD) ISOLATES

9.4 CANNABIDIOL (CBD) CONCENTRATES

9.5 OTHERS

10 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY NATURE

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY GRADE

11.1 OVERVIEW

11.2 FOOD GRADE

11.3 THERAPEUTIC GRADE

12 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TINCTURE

12.3 FOOD

12.3.1 CHOCOLATE & CONFECTIONERY

12.3.1.1 CANDY

12.3.1.2 CHOCOLATE

12.3.1.3 CHEWS

12.3.1.4 GUMMIES

12.3.1.5 OTHERS

12.3.2 HONEY

12.3.3 DAIRY BASED EDIBLE

12.3.3.1 MILK

12.3.3.2 ICE CREAM

12.3.3.3 OTHERS

12.3.4 SAUCES AND SEASONINGS

12.3.5 BAKERY EDIBLE

12.3.5.1 COOKIES AND BISCUITS

12.3.5.2 BROWNIES

12.3.5.3 OTHERS

12.3.6 OTHERS

12.3.7 PHARMACEUTICALS

12.3.7.1 DRAVET SYNDROME

12.3.7.2 MULTIPLE SCLEROSIS DRUG APPLICATIONS

12.3.7.3 NEUROLOGICAL DRUG APPLICATIONS

12.3.7.4 CANCER DRUG APPLICATIONS

12.3.7.5 OTHERS

12.3.8 DIETARY SUPPLEMENTS

12.3.8.1 CAPSULES

12.3.8.2 GUMMIES

12.3.8.3 OTHERS

12.3.9 BEVERAGES

12.3.9.1 NON-ALCOHOLIC BEVERAGES

12.3.9.1.1 ENERGY DRINKS

12.3.9.1.2 SOFT DRINKS

12.3.9.1.3 RTD COFFEE

12.3.9.1.4 TEA

12.3.9.1.5 SPARKLING WATER

12.3.9.1.6 OTHERS

12.3.9.2 FLAVORED DRINKS

12.3.9.2.1 ORANGE

12.3.9.2.2 LEMON

12.3.9.2.3 BERRIES

12.3.9.2.4 COCONUT

12.3.9.2.5 OTHERS

12.3.9.3 ALCOHOLIC BEVERAGES

12.3.9.3.1 BEER

12.3.9.3.2 WINE

12.3.9.3.3 OTHERS

12.3.9.4 OTHERS

12.3.10 TOPICAL

12.3.10.1 LOTION

12.3.10.2 SALVE

12.3.10.3 LIP BALM

12.3.10.4 OTHERS

12.3.11 OTHERS

12.3.11.1 VAPES

12.3.11.2 CIGARETTES

12.3.11.3 SPA AND RECREATION

13 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CURALEAF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TILRAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JAZZ PHARMACEUTICALS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CANOPY GROWTH CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AURORA CANNABIS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CHARLOTTE’S WEB.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CV SCIENCES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DIAMOND CBD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ELIXINOL WELLNESS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ENDOCA.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FREEDOM LEAF, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GAIA HERBS HEMP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GREEN ROADS.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GROFF NORTH AMERICA HEMPLEX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HEXO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HEALTHY FOOD INGREDIENTS, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ISODIOL INTERNATIONAL INC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 JOY ORGANICS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KAZMIRA

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KOI CBD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MEDICAL MARIJUANA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 EVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 MEDTERRA CBD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NULEAF NATURALS, LLC

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 PHOENA HOLDINGS INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 THE CRONOS GROUP

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 VIVO CANNABIS INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 BENCHMARK ANALYSIS

TABLE 2 AVERAGE VOLUME TREND FOR NORTH AMERICA CANNABIDIOL (CBD) MARKET (KILO TONS)

TABLE 3 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 4 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HEMP IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MARIJUANA IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CANNABIDIOL (CBD) ISOLATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CANNABIDIOL (CBD) CONCETRATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA INORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FOOD GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA THERAPEUTIC GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA TINCTURE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FOOD IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA FOOD IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PHARMACEUTICALS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 U.S. CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 61 U.S. CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 U.S. CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 63 U.S. CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.S. OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 77 CANADA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 79 CANADA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 CANADA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 CANADA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 CANADA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 CANADA TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 CANADA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 CANADA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MEXICO CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 MEXICO CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 97 MEXICO CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 MEXICO FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 MEXICO TOPICALS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 MEXICO DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 MEXICO OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CANNABIDIOL (CBD) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA CANNABIDIOL (CBD) MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE INCREASING DEMAND FOR CANNABIDIOL (CBD) DUE TO ITS HEALING PROPERTIES AND HEALTH AND WELLNESS PURPOSES IS HIGH, WHICH IS THE MAJOR FACTOR DRIVING THE MARKET IS EXPECTED TO DRIVE THE NORTH AMERICA CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEMP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 14 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 15 EUROPE CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 16 SOUTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 17 NORTH AMERICA CANNABIDIOL (CBD) MARKET: VENDOR/ DISTRIBUTOR SHARE ANALYSIS (%)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CANNABIDIOL (CBD) MARKET

FIGURE 19 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2021

FIGURE 20 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 24 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 28 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY NATURE, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY NATURE, LIFELINE CURVE

FIGURE 31 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 32 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY GRADE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY GRADE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 36 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 NORTH AMERICA CANNABIDIOL (CBD) MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA CANNABIDIOL (CBD) MARKET: BY SOURCE (2022-2029)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.