North America Biopesticides Market

Taille du marché en milliards USD

TCAC :

%

USD

3.25 Billion

USD

9.68 Billion

2025

2033

USD

3.25 Billion

USD

9.68 Billion

2025

2033

| 2026 –2033 | |

| USD 3.25 Billion | |

| USD 9.68 Billion | |

|

|

|

|

Segmentation du marché des biopesticides en Amérique du Nord, par type (bioinsecticides, biofongicides, bionématicides, bioherbicides et autres), source (microbienne, biochimique et insectes), forme (sèche et liquide), application (application foliaire, fertirrigation, traitement du sol, traitement des semences et autres), catégorie (agriculture et horticulture), cultures (fruits et légumes, céréales, oléagineux et légumineuses, gazon et plantes ornementales et autres cultures) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des biopesticides en Amérique du Nord

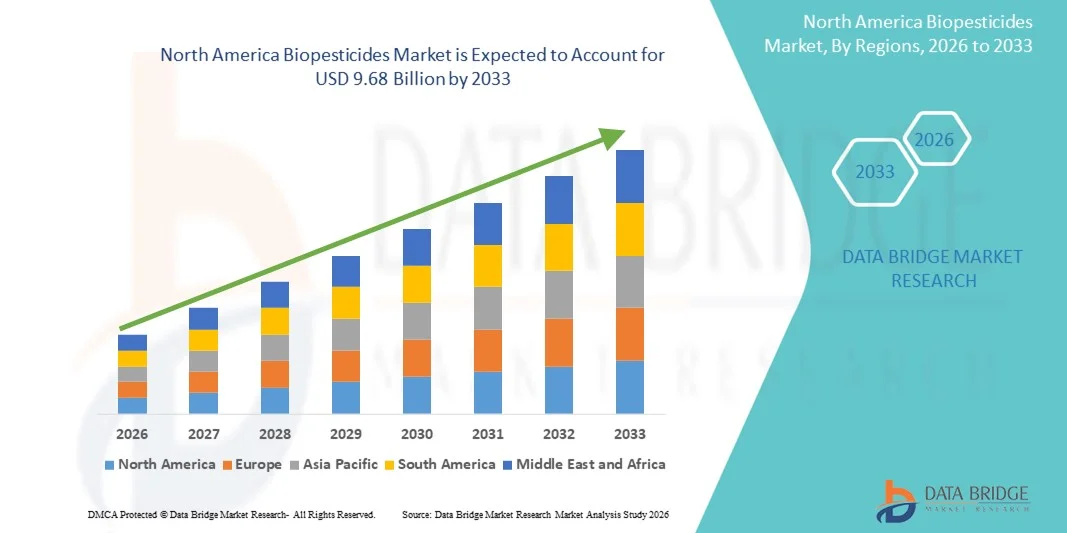

- Le marché des biopesticides était évalué à 3,25 milliards de dollars en 2025 et devrait atteindre 9,68 milliards de dollars d'ici 2033 , avec un TCAC de 14,60 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande mondiale croissante d'aliments biologiques, les préoccupations environnementales accrues et le soutien gouvernemental aux pratiques agricoles durables.

- La prise de conscience croissante des agriculteurs quant aux effets néfastes des pesticides chimiques et la tendance grandissante à la lutte intégrée contre les ravageurs (LIR) accélèrent encore l'adoption des biopesticides.

Analyse du marché des biopesticides en Amérique du Nord

- Le marché des biopesticides connaît une forte croissance, soutenue par l'adoption croissante de pratiques agricoles durables et par la demande de solutions de protection des cultures respectueuses de l'environnement.

- Les biopesticides, dérivés de matières naturelles telles que les animaux, les plantes, les bactéries et certains minéraux, gagnent en popularité en raison de leur faible toxicité, de leur impact environnemental réduit et de leur action ciblée.

- Le marché américain des biopesticides a généré la plus grande part de revenus en 2025, grâce à l'adoption croissante des bioinsecticides, des biofongicides et des bioherbicides pour les grandes cultures, les fruits et les légumes.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché nord-américain des biopesticides, en raison de la sensibilisation accrue à la protection biologique des cultures, de l'expansion des cultures à haute valeur ajoutée et spécialisées, et des initiatives gouvernementales favorisant une agriculture durable. La préférence croissante pour des solutions agricoles biologiques et respectueuses de l'environnement stimule l'adoption des biopesticides au Canada.

- Le segment des bioinsecticides représentait la plus grande part de revenus du marché (37,4 %) en 2025, principalement grâce à leur action ciblée contre les ravageurs et à leur impact minimal sur les organismes non ciblés. La résistance croissante des ravageurs aux produits chimiques conventionnels a incité les agriculteurs à adopter les bioinsecticides comme alternative durable. De plus, le soutien réglementaire aux solutions de protection des cultures respectueuses de l'environnement et la demande croissante de produits biologiques renforcent encore la position dominante de ce segment.

Portée du rapport et segmentation du marché des biopesticides en Amérique du Nord

|

Attributs |

Aperçu du marché des biopesticides en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

• Marrone Bio Innovations (États-Unis) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des biopesticides en Amérique du Nord

Adoption croissante de solutions de protection des cultures respectueuses de l'environnement

- L'intérêt croissant pour une agriculture durable et respectueuse de l'environnement influence fortement le marché des biopesticides, les agriculteurs privilégiant de plus en plus les produits qui minimisent les résidus chimiques et préservent la santé des sols. Les biopesticides gagnent en popularité grâce à leur capacité à cibler les ravageurs et les agents pathogènes sans nuire aux organismes bénéfiques, ce qui favorise leur utilisation dans la culture des céréales, des fruits, des légumes et des cultures à haute valeur ajoutée. Cette tendance encourage les fabricants à innover en développant de nouvelles formulations adaptées à l'évolution des pratiques agricoles.

- La prise de conscience croissante de l'importance de la santé des sols, de la qualité des rendements agricoles et des pratiques agricoles respectueuses de l'environnement a accéléré la demande de biopesticides pour les grandes cultures, l'horticulture et les cultures sous serre. Les agriculteurs et les entreprises agroalimentaires soucieux de l'environnement recherchent activement des produits d'origine naturelle, incitant les marques à privilégier l'approvisionnement et les procédés de production durables. Cette tendance a également favorisé les collaborations entre les fournisseurs d'ingrédients et les fabricants de produits agrochimiques afin d'améliorer l'efficacité de la lutte antiparasitaire et la sécurité des cultures.

- Les tendances en matière de développement durable et de conformité réglementaire influencent les décisions d'achat, les fabricants privilégiant les solutions de biopesticides traçables, écologiques et certifiées. Ces facteurs permettent aux marques de se différencier sur un marché concurrentiel et d'instaurer un climat de confiance avec les agriculteurs, tout en favorisant l'adoption de la certification biologique et d'un étiquetage respectueux de l'environnement. Les entreprises déploient de plus en plus de campagnes de sensibilisation pour mettre en avant ces avantages et encourager l'adoption de ces pratiques.

- Par exemple, en 2024, les principaux fabricants de biopesticides ont élargi leur gamme de produits en lançant de nouvelles formulations microbiennes, biochimiques et bionématicides. Ces lancements répondaient à la demande croissante de solutions de gestion des ravageurs écologiques et efficaces, distribuées via les coopératives agricoles, la grande distribution et les plateformes en ligne. Commercialisés comme sans danger pour les sols, les cultures et les insectes utiles, ces produits ont renforcé la confiance des agriculteurs et favorisé leur adoption répétée.

- Alors que la demande en biopesticides est en croissance, le développement durable du marché repose sur des efforts constants en matière de R&D, une production rentable et le maintien de performances fonctionnelles comparables à celles des pesticides chimiques. Les fabricants s'attachent également à améliorer l'extensibilité de la production, la fiabilité de la chaîne d'approvisionnement et à développer des solutions innovantes qui concilient coût, efficacité et durabilité afin de favoriser une adoption plus large.

Dynamique du marché des biopesticides en Amérique du Nord

Conducteur

Préférence croissante pour des solutions de protection des cultures durables et respectueuses de l'environnement

- La préférence croissante des agriculteurs pour des solutions de lutte antiparasitaire naturelles et respectueuses de l'environnement est un moteur essentiel du marché des biopesticides. Les fabricants remplacent de plus en plus les pesticides chimiques par des alternatives microbiennes, biochimiques et botaniques afin de répondre aux exigences de durabilité, d'améliorer la sécurité des cultures et de se conformer aux normes réglementaires. Cette tendance stimule également la recherche de nouvelles sources naturelles pour la production de biopesticides, favorisant ainsi la diversification des produits.

- L'élargissement des applications des biopesticides aux céréales, aux fruits, aux légumes, aux légumineuses, aux gazons et aux cultures ornementales stimule la croissance du marché. Ces biopesticides contribuent à améliorer le rendement, la qualité et la durée de conservation des cultures tout en préservant des pratiques respectueuses de l'environnement, permettant ainsi aux agriculteurs de répondre aux exigences de durabilité. L'adoption croissante des pratiques de lutte intégrée contre les ravageurs (LIR) à l'échelle mondiale renforce encore cette tendance.

- Les fabricants de produits agrochimiques et de semences promeuvent activement les formulations à base de biopesticides par le biais de l'innovation produit, de campagnes marketing et de certifications. Ces efforts sont soutenus par la préférence croissante des agriculteurs pour des solutions de protection des cultures durables, sûres et de haute qualité, et encouragent également les partenariats entre fournisseurs et entreprises agroalimentaires afin d'améliorer la performance des produits et de réduire l'impact environnemental.

- Par exemple, en 2023, les principales entreprises agrochimiques ont fait état d'une intégration accrue de biopesticides microbiens et biochimiques dans leurs solutions de protection des cultures. Cette expansion faisait suite à une demande plus forte de produits de lutte antiparasitaire non toxiques, écologiques et efficaces, favorisant ainsi la réutilisation des produits et la différenciation sur le marché. Les entreprises ont également mis l'accent sur la durabilité et la traçabilité dans leurs campagnes promotionnelles afin de renforcer la confiance et la fidélité des agriculteurs.

- Bien que les tendances croissantes en matière de développement durable soutiennent la croissance, leur adoption à plus grande échelle dépend de l'optimisation des coûts, de la disponibilité des ingrédients et de procédés de production adaptables. Investir dans l'efficacité de la chaîne d'approvisionnement, l'approvisionnement durable et les technologies de formulation avancées sera essentiel pour répondre à la demande mondiale et maintenir un avantage concurrentiel.

Retenue/Défi

Coût plus élevé et sensibilisation limitée par rapport aux pesticides conventionnels

- Le coût relativement plus élevé des biopesticides par rapport aux pesticides chimiques conventionnels demeure un obstacle majeur, limitant leur adoption par les agriculteurs sensibles aux prix. Le coût plus élevé des matières premières, la complexité des méthodes de production et de formulation contribuent à cette hausse des prix. De plus, la disponibilité fluctuante des ingrédients microbiens ou botaniques certifiés peut affecter la stabilité des coûts et la pénétration du marché.

- La sensibilisation et la compréhension des agriculteurs restent inégales, notamment dans les régions où les pesticides conventionnels prédominent. Le manque de connaissances sur les avantages fonctionnels des biopesticides freine leur adoption pour certaines cultures. Cela explique également leur adoption plus lente dans les zones où la formation agricole sur les biopesticides est minimale.

- Les difficultés liées à la chaîne d'approvisionnement et à la distribution freinent également la croissance du marché, car les biopesticides nécessitent un approvisionnement auprès de producteurs certifiés et le respect de normes de qualité strictes. La complexité logistique et la durée de conservation plus courte de certains produits microbiens ou biochimiques augmentent les coûts opérationnels. Les entreprises doivent investir dans des réseaux de stockage, de manutention et de transport adéquats afin de préserver l'intégrité des produits.

- Par exemple, en 2024, les distributeurs de bioinsecticides et de biofongicides ont constaté un ralentissement de leur adoption, dû à des prix plus élevés et à une connaissance limitée de leur efficacité par rapport aux alternatives chimiques. Les exigences de stockage et le respect des certifications biologiques ou écologiques constituaient des obstacles supplémentaires. Certains détaillants ont également limité l'espace en rayon réservé aux biopesticides haut de gamme, ce qui a affecté leur visibilité et leurs ventes.

- Pour relever ces défis, il faudra une production rentable, des réseaux de distribution élargis et des initiatives de formation ciblées pour les agriculteurs et les entreprises agroalimentaires. La collaboration avec les coopératives agricoles, les organismes de certification et les fournisseurs de technologies peut contribuer à libérer le potentiel de croissance à long terme du marché mondial des biopesticides. Par ailleurs, le développement de formulations compétitives et très efficaces, ainsi que le renforcement des stratégies marketing axées sur les avantages en matière de durabilité, seront essentiels à une adoption généralisée.

Portée du marché des biopesticides en Amérique du Nord

Le marché est segmenté en fonction du type, de la source, de la forme, de l'application, de la catégorie et des cultures.

- Par type

Le marché nord-américain des biopesticides est segmenté, selon leur type, en bioinsecticides, biofongicides, bionématicides, bioherbicides et autres. En 2025, le segment des bioinsecticides représentait la plus grande part de marché (37,4 %), principalement grâce à leur action ciblée sur les ravageurs et leur impact minimal sur les organismes non ciblés. La résistance croissante des ravageurs aux produits chimiques conventionnels a incité les agriculteurs à adopter les bioinsecticides comme alternative durable. Par ailleurs, le soutien réglementaire aux solutions de protection des cultures respectueuses de l'environnement et la demande croissante de produits biologiques contribuent à la position dominante de ce segment.

Le segment des bionématicides devrait connaître la croissance la plus rapide entre 2026 et 2033, en raison des préoccupations croissantes concernant la santé des sols et les effets néfastes des nématicides de synthèse. Les bionématicides offrent une alternative plus sûre pour la protection des racines et gagnent en popularité dans les programmes de lutte intégrée contre les ravageurs (LIR), notamment dans les régions à forte production de fruits et légumes. La sensibilisation accrue des agriculteurs aux pratiques agricoles durables et au maintien de la fertilité des sols contribue également à la croissance de ce segment. Par ailleurs, les initiatives gouvernementales encourageant les alternatives écologiques en agriculture devraient stimuler la pénétration du marché des bionématicides.

- Par source

Selon leur origine, le marché nord-américain des biopesticides se divise en trois segments : microbiens, biochimiques et insecticides. Le segment microbien dominait le marché en 2025, grâce à la large disponibilité de souches microbiennes telles que Bacillus thuringiensis et Trichoderma. Ces micro-organismes sont largement utilisés sur diverses cultures en raison de leur efficacité prouvée, de leur facilité de formulation et de leur compatibilité avec les autres intrants agricoles. De plus, la recherche en cours permet de découvrir de nouvelles souches microbiennes ciblant des ravageurs et des pathogènes spécifiques, améliorant ainsi l’efficacité des produits. Ce segment bénéficie également de réseaux de distribution performants et d’une sensibilisation accrue des agriculteurs aux solutions de protection des cultures respectueuses de l’environnement.

Le segment biochimique devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'utilisation accrue d'extraits de plantes et de phéromones. Ces substances offrent des mécanismes uniques de lutte contre les ravageurs sans nuire aux insectes bénéfiques ni aux pollinisateurs. Les innovations en matière de techniques d'extraction et de stabilisation permettent d'obtenir des produits biochimiques plus puissants et plus efficaces sur le long terme. L'essor de l'agriculture de précision et des stratégies de lutte intégrée (IPM) favorise également l'adoption des biopesticides. Par ailleurs, les organismes de réglementation accordent des autorisations favorables aux solutions biochimiques, renforçant ainsi leur potentiel de marché.

- Par formulaire

Selon leur forme, le marché nord-américain des biopesticides se divise en deux segments : les produits secs et les produits liquides. En 2025, le segment des produits liquides détenait la part de marché la plus importante, grâce à sa facilité d’application via différents systèmes de distribution tels que la pulvérisation foliaire, la fertirrigation et l’arrosage du sol. Les formulations liquides offrent également une absorption plus rapide et une meilleure efficacité de lutte antiparasitaire dans diverses conditions environnementales. Ce segment bénéficie par ailleurs des progrès réalisés dans les technologies de pulvérisation et les systèmes d’irrigation automatisés, qui améliorent la précision et minimisent le gaspillage de produit. La préférence croissante des agriculteurs pour les formulations prêtes à l’emploi et les produits à haute solubilité contribue également à l’adoption des biopesticides liquides.

Le segment des biopesticides secs devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à sa longue durée de conservation, ses coûts de transport réduits et son adéquation aux applications de traitement des semences, notamment pour les céréales et les légumineuses. Les formulations sèches sont également plus faciles à stocker et à manipuler, ce qui simplifie la logistique dans les régions agricoles isolées. L'adoption croissante des enrobages et des méthodes d'application par granulés améliore l'efficacité des biopesticides secs. Par ailleurs, les jeunes entreprises agricoles et les semenciers intègrent de plus en plus les biopesticides secs dans leurs solutions intégrées de protection des cultures.

- Sur demande

Selon le mode d'application, le marché nord-américain des biopesticides se segmente en application foliaire, fertirrigation, traitement du sol, traitement des semences et autres. Le segment de l'application foliaire dominait le marché en 2025, grâce à son efficacité pour la lutte antiparasitaire immédiate et à sa faible persistance dans l'environnement. Cette méthode est couramment utilisée en arboriculture fruitière et maraîchère, où les dégâts visibles causés par les ravageurs affectent directement la valeur des récoltes. Ce segment bénéficie du développement d'équipements de pulvérisation de haute précision et de drones automatisés qui améliorent la couverture et l'efficacité. De plus, les recherches sur la compatibilité des formulations garantissent que les produits foliaires n'endommagent pas les cultures et n'affectent pas leur croissance.

Le segment du traitement des semences devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue à la protection des cultures dès les premiers stades de développement, à la rentabilité et à la compatibilité avec les pratiques agricoles durables. Les traitements de semences offrent également une protection à long terme contre les pathogènes et ravageurs du sol, réduisant ainsi le besoin d'applications chimiques répétées. L'adoption croissante des semences hybrides et génétiquement modifiées favorise l'intégration des biopesticides. Ce segment bénéficie de partenariats entre les entreprises semencières et les fabricants de biopesticides pour la distribution de semences prétraitées aux agriculteurs.

- Par catégorie

Le marché nord-américain des biopesticides est segmenté, selon la catégorie, en agriculture et horticulture. Le segment agricole détenait la plus grande part de marché en 2025, grâce à l'adoption croissante des biopesticides pour les grandes cultures telles que les céréales et les légumineuses. Les agriculteurs ont de plus en plus recours aux biopesticides pour respecter les normes réglementaires et réduire les résidus chimiques. Par ailleurs, les grandes exploitations agricoles investissent dans des solutions biopesticides afin d'améliorer leur durabilité et de se conformer aux exigences à l'exportation. Les services de vulgarisation agricole et les programmes de soutien gouvernementaux encouragent également l'utilisation des biopesticides en agriculture conventionnelle.

Le secteur horticole devrait connaître la croissance la plus rapide entre 2026 et 2033, notamment grâce à la culture sous serre et aux cultures à haute valeur ajoutée telles que les baies et les légumes-feuilles, où la qualité et la sécurité des produits sont primordiales. Les techniques d'application de précision et l'agriculture en environnement contrôlé favorisent une utilisation efficace des biopesticides en horticulture. La demande croissante des consommateurs pour des fruits et légumes biologiques et sans pesticides stimule davantage leur adoption dans ce secteur. La collaboration avec les fournisseurs de technologies horticoles permet également de proposer des solutions de biopesticides sur mesure.

- Par cultures

Le marché nord-américain des biopesticides est segmenté, selon le type de culture, en fruits et légumes, céréales, oléagineux et légumineuses, gazon et plantes ornementales, et autres cultures. Le segment des fruits et légumes dominait le marché en 2025, en raison des réglementations strictes à l'exportation concernant les résidus chimiques et de la demande croissante de produits biologiques. Par ailleurs, les cultures à haute valeur ajoutée, soumises à des normes de qualité exigeantes, bénéficient grandement des biopesticides, ce qui explique leur préférence par rapport aux alternatives chimiques. Les campagnes de sensibilisation et les incitations gouvernementales en faveur de l'agriculture biologique contribuent également à la croissance du marché dans cette catégorie de cultures.

Le segment des gazons et des plantes ornementales devrait connaître la croissance la plus rapide entre 2026 et 2033, notamment dans les régions développées où l'esthétique végétale et les pratiques d'aménagement paysager respectueuses de l'environnement gagnent du terrain. Les biopesticides utilisés dans ce segment permettent de lutter contre les ravageurs tout en préservant l'attrait visuel et la sécurité environnementale. Leur utilisation croissante sur les terrains de golf, dans les parcs et les projets d'aménagement paysager urbains stimule la croissance. Les progrès technologiques en matière d'équipement d'application et de stabilité des formulations favorisent également la pénétration du marché des gazons et des plantes ornementales.

Analyse régionale du marché des biopesticides en Amérique du Nord

- Le marché américain des biopesticides a généré la plus grande part de revenus en 2025, grâce à l'adoption croissante des bioinsecticides, des biofongicides et des bioherbicides pour les grandes cultures, les fruits et les légumes.

- Les agriculteurs privilégient une gestion durable des ravageurs afin de se conformer aux normes réglementaires, de réduire les résidus chimiques et de répondre à la demande des consommateurs en produits biologiques.

- Cette adoption généralisée est soutenue par des incitations gouvernementales, des investissements importants en R&D dans de nouvelles formulations de biopesticides et une forte collaboration entre les entreprises agrochimiques et les distributeurs.

Aperçu du marché canadien des biopesticides

Le marché canadien des biopesticides devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une sensibilisation accrue à l'agriculture écologique et la demande de cultures biologiques de haute qualité. Les agriculteurs intègrent de plus en plus de biopesticides microbiens et biochimiques à leurs programmes de lutte intégrée contre les ravageurs afin d'améliorer les rendements et de garantir la protection de l'environnement. Les politiques gouvernementales favorisant une agriculture durable, conjuguées à l'expansion des réseaux de distribution et aux initiatives de recherche sur des solutions biopesticides avancées, contribuent également à la croissance de ce marché.

Part de marché des biopesticides en Amérique du Nord

L'industrie des biopesticides en Amérique du Nord est principalement dominée par des entreprises bien établies, notamment :

• Marrone Bio Innovations (États-Unis)

• Certis USA LLC (États-Unis)

• Valent BioSciences Corporation (États-Unis)

• Island IPM (États-Unis)

• BioWorks, Inc. (États-

Unis) • AgBiTech (États-Unis)

• Andermatt USA (États-Unis)

• BioSafe Systems (États-Unis)

• Novozymes Biologicals (

États-Unis) • Lallemand Plant Care (États-Unis)

• Gowan Company (États-Unis)

• T. Stanes & Company (États-Unis)

• Terramera Inc. (Canada)

• Nufarm Americas Inc (États-Unis)

• Stockton Products (États-Unis)

Dernières évolutions du marché des biopesticides en Amérique du Nord

- En juin 2025, BioWorks Inc. a lancé PRINCIPLE WP, un bioinsecticide formulé à base de Beauveria bassiana, ciblant des ravageurs tels que les thrips, les pucerons et les aleurodes. Conçu pour les cultures en serre et en plein champ, ce produit offre aux agriculteurs américains et canadiens une solution de gestion des ravageurs efficace et durable, favorisant des pratiques agricoles respectueuses de l'environnement et améliorant la productivité des cultures.

- En décembre 2024, UPL Corp (États-Unis) a lancé NIMAXXA, un traitement de semences bionématicide à base de micro-organismes pour le soja et le maïs. Ce produit offre un triple avantage : il supprime les nématodes, améliore la santé des racines et favorise l’absorption des nutriments, soutenant ainsi les initiatives d’agriculture durable et stimulant l’adoption de solutions de protection biologique des cultures sur le marché américain.

- En juillet 2024, Andermatt Group AG a fait l'acquisition de BioTEPP Inc., une société canadienne reconnue pour son biopesticide à base de granulovirus Virosoft CP4 ciblant le carpocapse des pommes. Cette acquisition renforce la présence d'Andermatt en Amérique du Nord, élargit son portefeuille de solutions de protection biologique des cultures et favorise une plus large adoption de solutions de lutte antiparasitaire écologiques pour les principales cultures fruitières.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.