North America Bee Products Market

Taille du marché en milliards USD

TCAC :

%

USD

3.19 Billion

USD

6.14 Billion

2024

2032

USD

3.19 Billion

USD

6.14 Billion

2024

2032

| 2025 –2032 | |

| USD 3.19 Billion | |

| USD 6.14 Billion | |

|

|

|

|

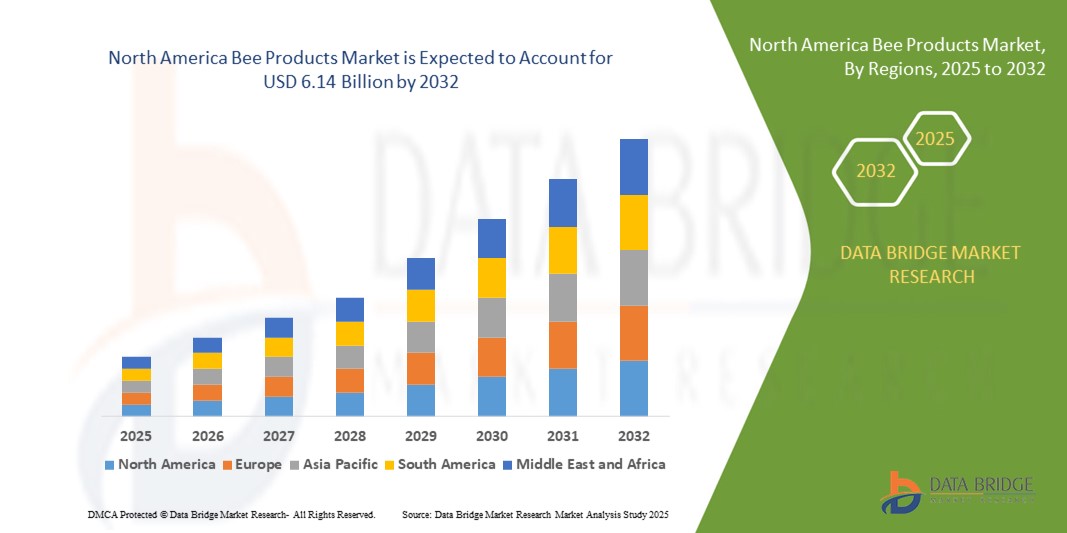

Segmentation du marché nord-américain des produits apicoles, par type (miel, cire d'abeille, propolis, gelée royale, venin d'abeille et autres), nature (biologique et conventionnelle), canal de distribution (indirect et direct) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des produits apicoles en Amérique du Nord

- La taille du marché des produits apicoles en Amérique du Nord était évaluée à 3,19 milliards USD en 2024 et devrait atteindre 6,14 milliards USD d'ici 2032 , à un TCAC de 8,53 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de compléments de santé naturels, la sensibilisation accrue aux bienfaits médicinaux des produits dérivés des abeilles et l'utilisation croissante du miel, de la propolis et de la gelée royale dans les aliments fonctionnels, les cosmétiques et les produits pharmaceutiques.

- La croissance est également soutenue par la popularité croissante de l'apithérapie et l'intérêt croissant des consommateurs pour les produits stimulant l'immunité et anti-âge dérivés de sources naturelles.

Analyse du marché des produits apicoles en Amérique du Nord

- Le marché nord-américain des produits apicoles connaît une croissance constante grâce à la préférence croissante des consommateurs pour les ingrédients naturels et de qualité. Des produits comme le miel, le pollen d'abeille, la gelée royale et la cire d'abeille gagnent en popularité grâce à leurs propriétés antioxydantes, antibactériennes et anti-inflammatoires.

- L'essor de l'agriculture biologique, la croissance de l'industrie du bien-être et l'intégration des produits de la ruche dans les formules de nutrition sportive et de soins de la peau stimulent encore davantage l'expansion du marché. Avec la montée en puissance du développement durable et de la sensibilisation à l'environnement, la demande de produits de la ruche issus de sources éthiques et traçables devrait augmenter.

- Le marché américain des produits de la ruche représentait la plus grande part en Amérique du Nord en 2024, stimulé par la demande croissante d'alternatives naturelles aux médicaments conventionnels et par la sensibilisation croissante aux ingrédients fonctionnels à base d'abeilles.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché des produits apicoles en Amérique du Nord en raison d'une sensibilisation croissante aux bienfaits pour la santé des produits dérivés des abeilles, des initiatives gouvernementales de soutien à l'apiculture durable et des opportunités d'exportation croissantes.

- Le miel a représenté la plus grande part de marché en 2024, grâce à son utilisation répandue dans l'alimentation et les boissons, la médecine naturelle et les soins de la peau. Son positionnement comme édulcorant naturel et stimulant immunitaire a largement contribué à sa consommation croissante dans les pays développés comme en développement. Ses propriétés multifonctionnelles en font un incontournable des cuisines familiales, des produits de bien-être et des applications thérapeutiques, confirmant ainsi sa domination sur le marché.

Portée du rapport et segmentation du marché des produits apicoles en Amérique du Nord

|

Attributs |

Informations clés sur le marché des produits apicoles en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

• Nature Nate's Honey Co. (États-Unis) • Savannah Bee Company (États-Unis) |

|

Opportunités de marché |

• Expansion des produits de la ruche dans la nutrition sportive et les boissons fonctionnelles |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des produits apicoles en Amérique du Nord

Demande accrue de produits apicoles fonctionnels et médicinaux

- La préférence croissante des consommateurs pour des solutions de santé naturelles et fonctionnelles transforme le marché des produits apicoles. Le miel, la gelée royale, la propolis et le pollen d'abeille suscitent un intérêt accru en raison de leurs propriétés antioxydantes, antibactériennes et immunostimulantes. Ces produits sont de plus en plus utilisés dans les compléments alimentaires et les remèdes naturels à visée préventive.

- Sur les marchés développés comme émergents, les ingrédients issus des abeilles sont intégrés aux nutraceutiques, aux soins personnels et aux formulations thérapeutiques. Cette demande est également soutenue par le mouvement bien-être et la sensibilisation croissante aux produits clean label, sans produits chimiques, offrant des bienfaits holistiques.

- L'essor de l'apithérapie, qui utilise les produits de la ruche à des fins thérapeutiques, stimule également l'innovation dans les secteurs pharmaceutique et de la médecine alternative. Les consommateurs se tournent vers les formules à base d'abeilles pour traiter des affections telles que l'inflammation, les infections et la santé cutanée, contribuant ainsi à la diversification des applications des produits.

- Par exemple, en 2023, plusieurs marques de bien-être aux États-Unis ont lancé des sprays pour la gorge à base de propolis et des toniques immunitaires ciblant la prévention des maladies saisonnières, gagnant ainsi une forte popularité auprès des segments de consommateurs soucieux de leur santé.

- Alors que le marché est en pleine expansion, la réussite repose sur une standardisation, une traçabilité et une assurance qualité durables des produits. Les entreprises doivent privilégier un approvisionnement éthique et un étiquetage transparent pour préserver la confiance des consommateurs et répondre à la demande croissante de produits apicoles haut de gamme et fonctionnels.

Dynamique du marché des produits apicoles en Amérique du Nord

Conducteur

Préférence croissante pour les produits de santé et de soins personnels naturels

• L'évolution vers des solutions naturelles et sans produits chimiques stimule considérablement l'adoption des produits apicoles dans les secteurs alimentaire, cosmétique et pharmaceutique. Les consommateurs recherchent de plus en plus des produits perçus comme sûrs, efficaces et durables, conformes à l'origine naturelle et aux vertus thérapeutiques des ingrédients apicoles tels que le miel, la cire d'abeille et la gelée royale.

Dans l'industrie de la beauté et des soins personnels, la cire d'abeille et le miel sont largement utilisés dans les soins bio pour la peau, les lèvres et les cheveux, en raison de leurs propriétés hydratantes, anti-inflammatoires et antimicrobiennes. Cette tendance se retrouve également dans les compléments alimentaires à base de propolis et de pollen, pour renforcer l'immunité et la vitalité.

Le soutien réglementaire aux systèmes de médecine traditionnelle et naturelle renforce encore la portée du marché. L'inclusion croissante d'ingrédients issus de l'abeille dans les listes de produits approuvés et les catégories d'aliments fonctionnels favorise une acceptation et une distribution plus larges.

• Par exemple, en 2022, plusieurs entreprises nutraceutiques nord-américaines ont lancé des capsules et des sprays buccaux à base de propolis, répondant ainsi à la demande croissante des consommateurs pour des stimulants immunitaires naturels. Ces lancements ont été soutenus par une préférence croissante pour les compléments alimentaires « clean label » et par une distribution élargie en pharmacies et en magasins de bien-être. Ce développement a renforcé la présence de la propolis sur le marché comme complément alimentaire grand public dans la région.

• Alors que les préférences naturelles propulsent le marché vers l'avant, garantir l'authenticité et gérer les risques de falsification sera essentiel pour la confiance à long terme et la croissance durable

Retenue/Défi

Menaces liées à l'effondrement des colonies et à l'instabilité environnementale

L'un des principaux freins au marché des produits apicoles est la menace croissante du syndrome d'effondrement des colonies (SEC) et de la dégradation de l'environnement. Le déclin des populations d'abeilles dû à l'utilisation de pesticides, à la perte d'habitats et au changement climatique a un impact significatif sur la disponibilité des matières premières et la durabilité des filières apicoles.

Les fluctuations climatiques affectent les cycles de floraison et la disponibilité du nectar, ce qui réduit les rendements en miel et perturbe les activités apicoles. Cette imprévisibilité limite la régularité de la qualité et du volume des produits, ce qui pose des défis aux producteurs qui dépendent d'un approvisionnement stable pour une production à grande échelle.

Les apiculteurs, notamment dans les régions en développement, sont également confrontés à des défis liés à la gestion des maladies, à l'exposition aux pesticides et à un accès limité aux pratiques apicoles modernes. Ces problèmes affectent la capacité de production et limitent leur capacité à répondre à la demande croissante de l'industrie et des consommateurs.

• Par exemple, en 2023, plusieurs coopératives apicoles nord-américaines ont signalé une forte baisse de leur production de miel en raison de conditions de sécheresse extrême dans certaines régions des États-Unis et du Canada. Ce stress environnemental a entraîné une diminution de la disponibilité du nectar, affectant directement la santé des colonies et la production de miel. Cette pénurie a exercé une pression sur les chaînes d'approvisionnement en miel biologique et de spécialité, entraînant une augmentation des importations et une volatilité des prix dans les circuits de vente au détail et en gros.

• Pour atténuer ces risques, les parties prenantes doivent investir dans des pratiques apicoles durables, dans la recherche sur les souches d’abeilles résistantes aux maladies et dans une meilleure conservation des écosystèmes afin de garantir l’approvisionnement à long terme et la stabilité du marché.

Portée du marché nord-américain des produits apicoles

Le marché est segmenté en fonction du type, de la nature et du canal de distribution.

- Par type

En Amérique du Nord, le marché des produits apicoles se segmente en fonction de leur type : miel, cire d'abeille, propolis, gelée royale, venin d'abeille, etc. En 2024, le miel a représenté la plus grande part de marché, grâce à son utilisation répandue dans l'alimentation et les boissons, la médecine naturelle et les soins de la peau. Son positionnement comme édulcorant naturel et stimulant immunitaire a largement contribué à sa consommation croissante dans les pays développés comme en développement. Ses propriétés multifonctionnelles en font un incontournable des cuisines familiales, des produits de bien-être et des applications thérapeutiques, confirmant ainsi sa domination sur le marché.

Le segment de la propolis devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son intégration croissante dans les nutraceutiques et les produits de soins personnels. Ses propriétés anti-inflammatoires, antivirales et antimicrobiennes stimulent une forte demande auprès des consommateurs soucieux de leur santé et des marques de bien-être. L'essor du développement de produits fonctionnels, notamment de formules renforçant l'immunité et de produits de soins de la peau, devrait accélérer l'adoption de la propolis sur les marchés mondiaux.

- Par nature

En Amérique du Nord, le marché des produits apicoles se divise en deux catégories : biologique et conventionnel. Le segment conventionnel représentait la plus grande part de chiffre d'affaires en 2024, grâce à sa large disponibilité et à son prix inférieur à celui des produits certifiés biologiques. Les produits apicoles conventionnels sont principalement achetés par les fabricants de produits alimentaires, pharmaceutiques et cosmétiques de grande consommation, grâce à la stabilité de leurs chaînes d'approvisionnement et à leur rentabilité.

Le segment bio devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la sensibilisation croissante des consommateurs aux produits sans produits chimiques et à l'approvisionnement durable. La demande de miel, de cire d'abeille et de gelée royale certifiés biologiques augmente sur les marchés soucieux de leur santé et de l'environnement. Les produits apicoles biologiques gagnent en popularité dans la grande distribution haut de gamme et la vente directe, les acheteurs recherchant de plus en plus d'ingrédients traçables et issus de sources éthiques.

- Par canal de distribution

En termes de canaux de distribution, le marché nord-américain des produits apicoles est segmenté en canaux directs et indirects. Le segment indirect a dominé le marché en 2024 grâce à la forte présence des supermarchés, des pharmacies, des magasins d'aliments naturels et des plateformes de commerce électronique. Ces points de vente garantissent un large accès aux consommateurs et contribuent à des volumes de ventes élevés, notamment pour le miel conditionné, les sprays à la propolis et les compléments alimentaires à base d'abeilles.

Le segment de la vente directe devrait connaître la croissance la plus rapide entre 2025 et 2032, porté par la popularité croissante des modèles de vente directe de la ferme au consommateur et des marques de produits apicoles artisanaux. Les apiculteurs et les producteurs spécialisés privilégient de plus en plus la vente directe via les plateformes en ligne, les marchés de producteurs et les formules d'abonnement. Cela permet une plus grande transparence des produits, des prix plus élevés et un engagement client renforcé, alimentant ainsi la croissance de ce segment.

Analyse régionale du marché des produits apicoles en Amérique du Nord

- Le marché américain des produits de la ruche représentait la plus grande part en Amérique du Nord en 2024, stimulé par la demande croissante d'alternatives naturelles aux médicaments conventionnels et par la sensibilisation croissante aux ingrédients fonctionnels à base d'abeilles.

- La solide infrastructure de vente au détail du pays et la préférence pour les produits certifiés biologiques ont encouragé une adoption à grande échelle dans les segments des nutraceutiques et des soins personnels.

- L'intérêt des consommateurs pour l'approvisionnement durable et les pratiques apicoles éthiques a également alimenté la différenciation des produits, les marques mettant l'accent sur la traçabilité et la pureté

- De plus, les campagnes de marketing stratégiques et les innovations de produits dans le domaine du miel aromatisé, des suppléments infusés au pollen d'abeille et des gammes de soins de la peau continuent d'élargir les opportunités de marché aux États-Unis.

Aperçu du marché des produits apicoles au Canada

Le marché canadien des produits de la ruche devrait connaître sa croissance la plus rapide de 2025 à 2032, soutenu par la préférence croissante des consommateurs pour les produits de santé biologiques, naturels et locaux. Les consommateurs canadiens adoptent le miel, la propolis et la gelée royale dans leur routine bien-être quotidienne, notamment pour leurs bienfaits sur la santé immunitaire et les soins de la peau. Le secteur agricole robuste du pays, combiné à une forte tradition apicole, favorise la production et l'approvisionnement nationaux de produits de la ruche de haute qualité. De plus, la demande croissante de produits propres et durables encourage les marques locales à proposer des options peu transformées et issues de sources éthiques. La réglementation gouvernementale favorable et le potentiel d'exportation croissant vers les marchés américain et européen renforcent encore la position du Canada dans la chaîne de valeur mondiale des produits de la ruche.

Part de marché des produits apicoles en Amérique du Nord

L’industrie des produits apicoles en Amérique du Nord est principalement dirigée par des entreprises bien établies, notamment :

• Nature Nate's Honey Co. (États-Unis)

• Bee Maid Honey Limited (Canada)

• Comvita USA (États-Unis)

• Beeyond the Hive (États-Unis)

• Dutch Gold Honey (États-Unis

) • Savannah Bee Company (États-Unis)

• Really Raw Honey (États-Unis)

• Wedderspoon Organic (États-Unis)

• Crockett Honey Co. (États-Unis)

• GloryBee (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.