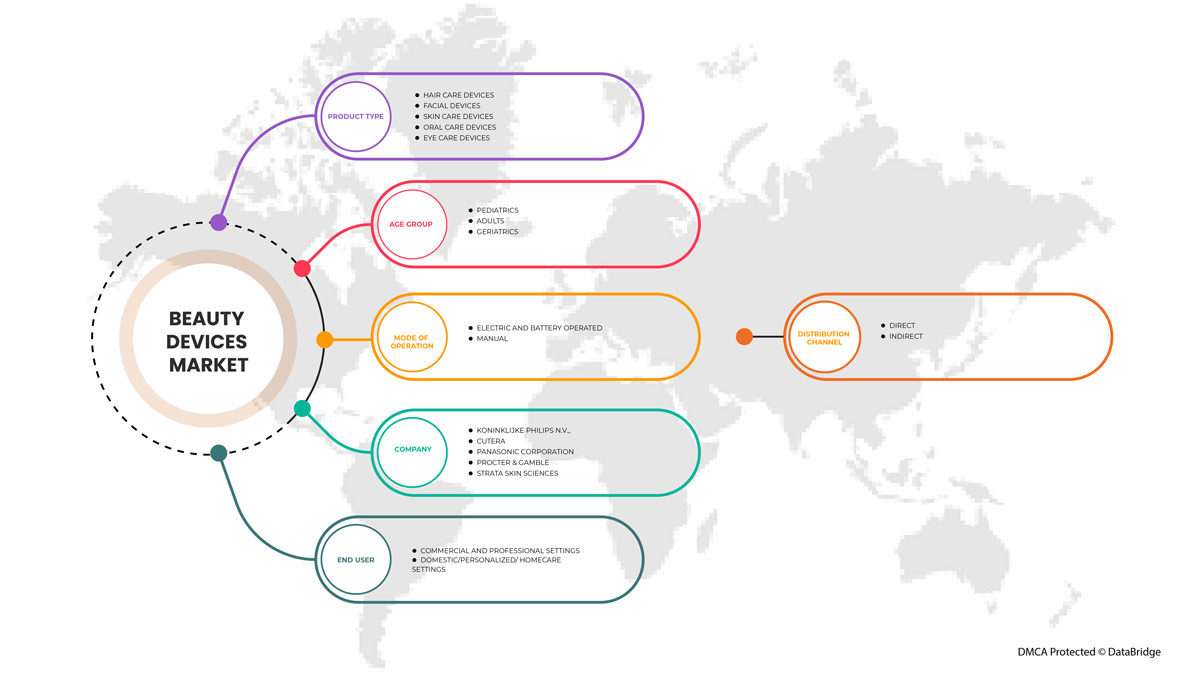

Marché des appareils de beauté en Amérique du Nord par type de produit ( appareils de soins capillaires , appareils faciaux , appareils de soins de la peau , appareils de soins bucco-dentaires et appareils de soins oculaires), groupe d'âge (pédiatrie, adulte et gériatrie), mode de fonctionnement (électrique et à piles et manuel), utilisateur final (environnements commerciaux et professionnels et environnements domestiques/personnalisés/de soins à domicile), canal de distribution (direct et indirect), tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des appareils de beauté en Amérique du Nord

La prise de conscience croissante de la peau chez les hommes comme chez les femmes a accéléré la demande d'appareils de beauté. Les problèmes liés à la peau tels que les plis, l'acné, la pigmentation, les rides ainsi que les cicatrices de brûlures dues aux accidents sont extrêmement courants chez les personnes qui nécessitent un traitement approprié pour améliorer l'apparence de la peau.

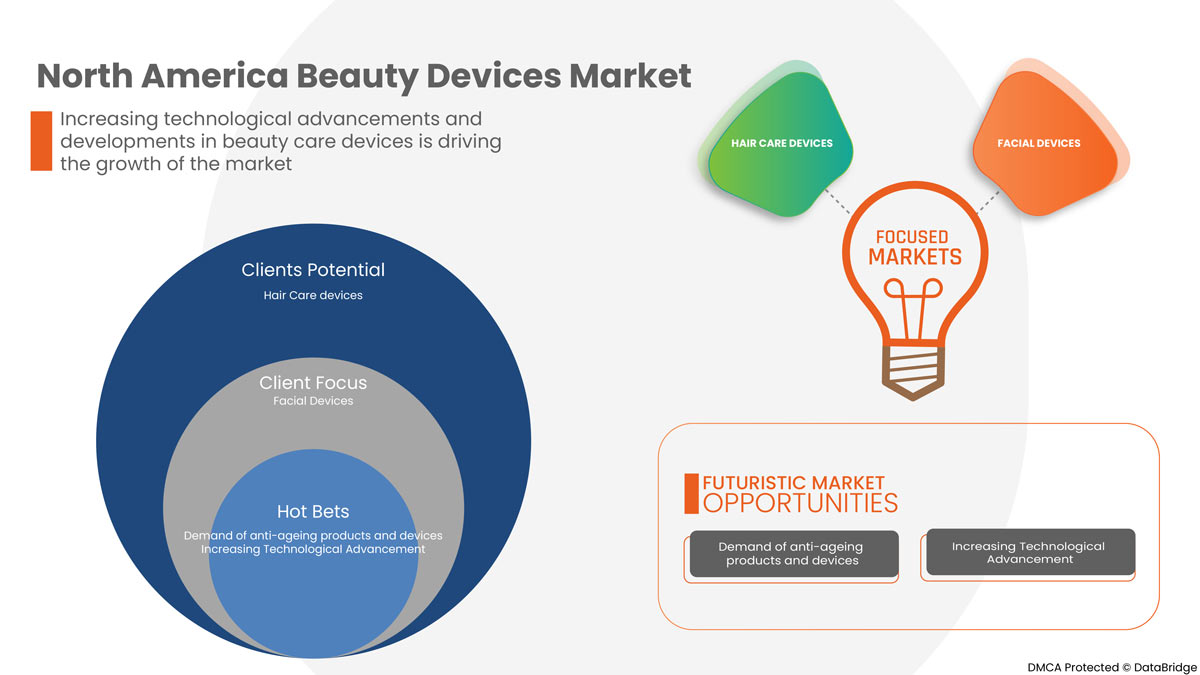

Le marché des appareils de beauté connaît une croissance au cours de l'année de prévision en raison de plusieurs raisons telles que la sensibilisation croissante des consommateurs à leur apparence esthétique et à l'amélioration de leur mode de vie. Parallèlement à cela, les fabricants sont engagés dans des activités de R&D pour lancer de nouveaux produits de pointe basés sur une technologie innovante sur le marché des appareils de beauté.

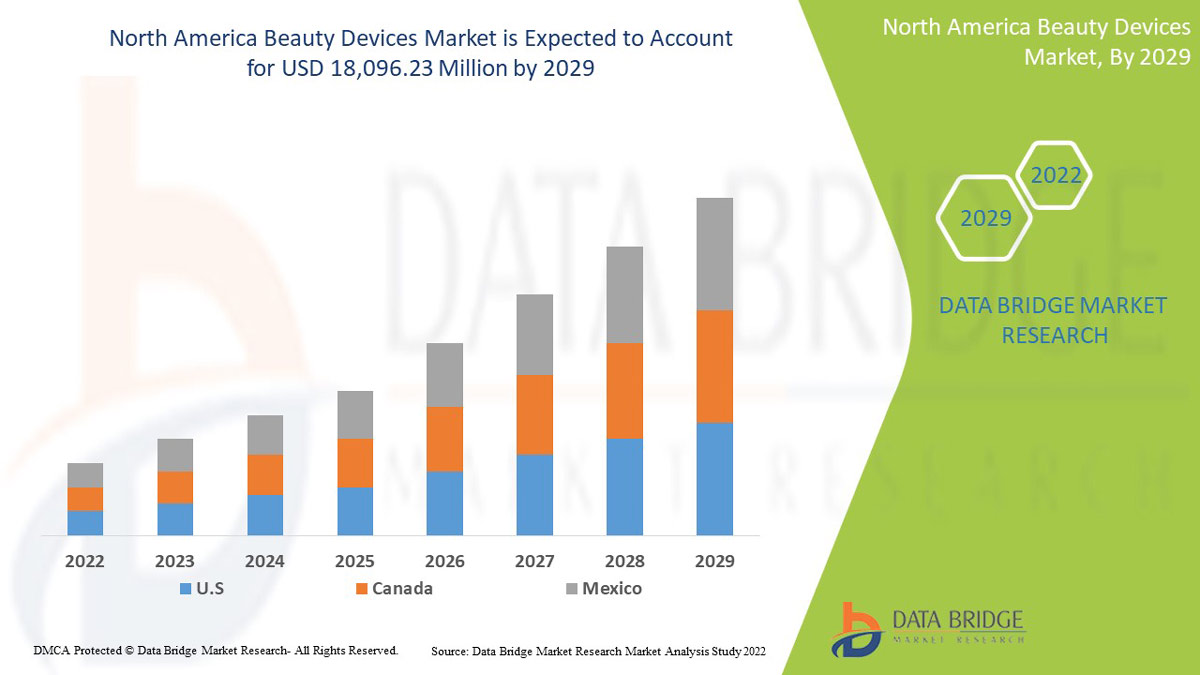

Le marché des appareils de beauté en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 13,5 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 18 096,23 millions USD d'ici 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type de produit (appareils de soins capillaires, appareils pour le visage, appareils de soins de la peau, appareils de soins bucco-dentaires et appareils de soins oculaires), groupe d'âge (pédiatrie, adulte et gériatrie), mode de fonctionnement (électrique, à piles et manuel), utilisateur final (environnements commerciaux et professionnels et environnements domestiques/personnalisés/de soins à domicile), canal de distribution (direct et indirect). |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips NV, Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC, STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera, Merz North America, Inc., Panasonic Corporation, Procter & Gamble, entre autres. |

Définition du marché des appareils de beauté en Amérique du Nord

La beauté est la caractéristique essentielle des femmes comme des hommes. Les appareils de beauté sont utilisés dans divers types de problèmes liés à l'apparence esthétique, notamment les cheveux, le visage, la peau, la bouche et les yeux. Les appareils de beauté sont extrêmement bénéfiques pour le traitement des problèmes liés à la beauté. Différents types d'appareils de beauté tels que les appareils de soins capillaires, les appareils de soins du visage, les appareils de soins de la peau, les appareils de soins bucco-dentaires et les appareils de soins des yeux sont commercialisés sur le marché et sont utilisés pour améliorer l'apparence esthétique.

Les appareils de thérapie par lumière/LED et photo-rajeunissement sont une forme de système de beauté qui utilise une bande étroite et une énergie lumineuse LED non thermique pour activer les processus cellulaires naturels du corps afin de favoriser le rajeunissement et la réparation de la peau. L'anti-âge est l'un des plus grands défis liés aux problèmes de beauté, les cas d'anti-âge augmentent très rapidement, tandis que les appareils de beauté ciblent les multiples signes d'anti-âge et réduisent l'apparence d'un large éventail de signes de vieillissement, notamment les rides ou les ridules. L'industrie de la beauté est fragmentée par l'introduction de produits basés sur une technologie de pointe sur le marché qui sont largement adoptés par les utilisateurs finaux.

Dynamique du marché des appareils de beauté en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

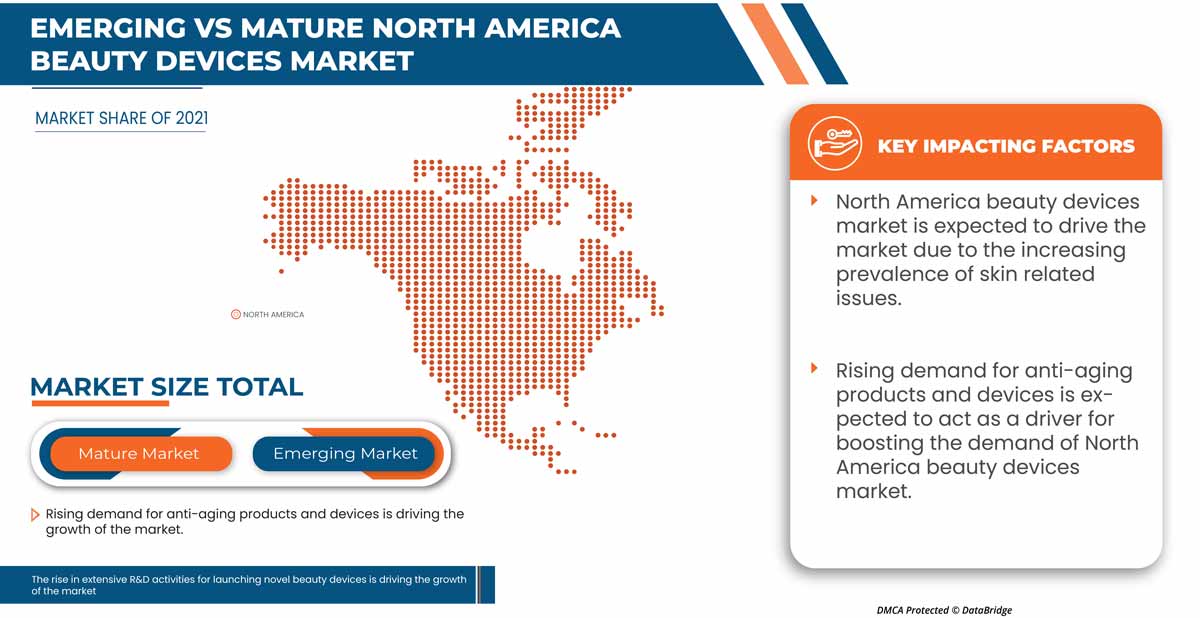

Demande croissante de produits et d'appareils anti-âge

L'anti-âge est un type de processus biologique complexe qui est influencé par la combinaison de facteurs exogènes ou extrinsèques et endogènes ou intrinsèques. La lutte contre le vieillissement est l'un des plus grands défis auxquels sont confrontées les populations liées aux problèmes de beauté tels que la fermeté de la peau, la perte de cheveux, les rides anti-âge et les problèmes de soins bucco-dentaires, entre autres. Il existe une large gamme d'appareils de beauté commercialisés sur le marché qui sont utilisés pour minimiser l'effet de l'anti-âge sur la beauté de la population vieillissante.

La population âgée augmente très rapidement et les appareils de beauté ciblent les multiples signes anti-âge et réduisent l'apparence d'un large éventail de signes de vieillissement, notamment les rides ou les ridules, ce qui fait que la demande croissante de produits et d'appareils anti-âge propulse la demande du marché.

Prévalence croissante des problèmes de peau

Les problèmes de peau sont généralement parmi les problèmes les plus courants observés dans les établissements de soins primaires. Selon l'étude du Centre national d'information sur la biotechnologie, la prévalence des problèmes de peau était de 34 % chez les personnes de moins de 18 à 44 ans et elle augmentait à 49,4 % chez les personnes de 65 ans et plus. L'acné est un type de maladie cutanée universelle qui touche 79 à 95 % de la population adolescente.

Selon l'Association médicale américaine, entre 40 et 50 millions de personnes souffrent d'acné aux États-Unis. Selon le rapport, 40 à 54 % des femmes et des hommes de plus de 25 ans aux États-Unis souffrent d'acné faciale à divers degrés, et 12 % des femmes et 3 % des hommes souffrent d'acné faciale clinique qui persiste à un âge moyen.

L'utilisation d'appareils de soins de beauté pour la peau apporte des avantages supplémentaires pour l'apparence de la peau. Les appareils de beauté sont utilisés pour améliorer la santé et l'apparence de la peau, ce qui explique la prévalence croissante des problèmes liés à la peau qui stimule la demande du marché.

Les problèmes de peau tels que les plis, l'acné, la pigmentation, les rides ainsi que les cicatrices de brûlures accidentelles sont extrêmement courants chez les humains. Selon l'Association of American Academy of Dermatology, l'acné est la maladie de peau la plus courante aux États-Unis. Chaque année, l'acné touche environ 50 millions de personnes aux États-Unis. Environ 5,1 millions de personnes recherchent un traitement contre l'acné chaque année. Environ 85 % des personnes âgées de 12 à 24 ans connaissent l'apparition d'une acné mineure.

Les rides du visage sont l'un des signes les plus notables des problèmes liés à la peau. Les hommes et les femmes présentent des modèles de rides différents en fonction du mode de vie et des facteurs physiologiques. Une large gamme d'appareils de soins de la peau tels que les appareils de thérapie par lumière/LED et photo-rajeunissement, les appareils de réduction de la cellulite, les appareils d'élimination de l'acné, les appareils à oxygène et à vapeur, les rouleaux dermiques, les appareils de nettoyage et les appareils intelligents sont utilisés pour améliorer l'apparence de la peau. C'est pourquoi la prévalence croissante des problèmes liés à la peau agit comme un moteur pour stimuler la demande du marché des appareils de beauté en Amérique du Nord.

OPPORTUNITÉS

Augmentation des dépenses consacrées aux soins de beauté

Selon les données des membres de l'Aesthetic Society, les Américains ont dépensé plus de 6 milliards USD en procédures chirurgicales esthétiques et plus de 3 milliards USD en procédures esthétiques non chirurgicales en 2020. L'augmentation des dépenses de beauté est due à plusieurs raisons telles que l'amélioration du mode de vie des personnes et la demande croissante d'appareils de beauté pour améliorer leur apparence.

L'augmentation des dépenses de beauté augmentera le processus d'adoption d'appareils de beauté avancés qui amélioreront le profil du produit en tant que leader du marché, pour cette raison, l'augmentation des dépenses de beauté agit comme une opportunité pour stimuler la demande du marché des appareils de beauté en Amérique du Nord.

RESTRICTIONS/DÉFIS

Coût élevé des appareils de beauté

Les appareils de beauté modernes basés sur la technologie aident à tonifier et à raffermir les muscles du visage. Ces appareils sont également utilisés pour réduire l'apparence des rides et des ridules. Les consommateurs peuvent utiliser les appareils de beauté à domicile.

Les appareils de beauté offrent une variété d'options explosées pour traiter de nombreux types de problèmes liés à la beauté, tels que les soins de la peau, des cheveux et des soins bucco-dentaires, entre autres. Mais parallèlement à cela, les appareils de beauté sont très chers à l'achat, en raison du coût élevé des appareils de beauté qui freine la demande sur le marché des appareils de beauté en Amérique du Nord.

Développements récents

- En janvier 2021, Candela Corporation, l'un des principaux fabricants mondiaux de dispositifs médicaux esthétiques, a annoncé la disponibilité du système Frax Pro, un dispositif fractionné non ablatif approuvé par la FDA pour le resurfaçage cutané avec les applicateurs Frax 1550 et Frax 1940. Cela a aidé l'entreprise à élargir son portefeuille de produits esthétiques sur le marché nord-américain.

- En juin 2021, Cutera a annoncé le lancement de l'appareil de microneedling par radiofréquence (RF) Secret, Secret PRO. L'appareil offrirait aux praticiens une approche multicouche du rajeunissement de la peau, en utilisant l'application de resurfaçage cutané au CO2 « UltraLight » pour cibler l'épiderme. Cela a aidé l'entreprise à élargir son portefeuille de produits.

Portée du marché des appareils de beauté en Amérique du Nord

Le marché nord-américain des appareils de beauté est segmenté en type de produit, tranche d'âge, mode de fonctionnement, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ DES APPAREILS DE BEAUTÉ EN AMÉRIQUE DU NORD, PAR TYPE DE PRODUIT

- APPAREILS DE SOINS CAPILLAIRES

- APPAREILS FACIAUX

- APPAREILS DE SOINS DE LA PEAU

- DISPOSITIFS DE SOINS BUCCO-DENTAIRES

- APPAREILS DE SOINS DES YEUX

Sur la base du type de produit, le marché nord-américain des appareils de beauté est segmenté en appareils de soins capillaires, appareils pour le visage, appareils de soins de la peau, appareils de soins bucco-dentaires et appareils de soins oculaires.

MARCHÉ DES APPAREILS DE BEAUTÉ EN AMÉRIQUE DU NORD, PAR GROUPE D'ÂGE

- Pédiatrie

- Adulte

- Gériatrie

Sur la base de la tranche d'âge, le marché nord-américain des appareils de beauté est segmenté en pédiatrie, adulte et gériatrie.

MARCHÉ DES APPAREILS DE BEAUTÉ EN AMÉRIQUE DU NORD, PAR MODE DE FONCTIONNEMENT

- Électrique et à batterie

- Manuel

Sur la base du mode de fonctionnement, le marché nord-américain des appareils de beauté est segmenté en appareils électriques, à piles et manuels.

MARCHÉ DES APPAREILS DE BEAUTÉ EN AMÉRIQUE DU NORD, PAR UTILISATEUR FINAL

- Cadres commerciaux et professionnels

- Cadres de soins domestiques/personnalisés/à domicile

Le marché nord-américain des appareils de beauté est segmenté en environnements commerciaux et professionnels et environnements domestiques/personnalisés/de soins à domicile.

MARCHÉ DES APPAREILS DE BEAUTÉ EN AMÉRIQUE DU NORD, PAR CANAL DE DISTRIBUTION

- Direct

- Indirect

Sur la base du canal de distribution, le marché nord-américain des appareils de beauté est segmenté en direct et indirect.

Analyse du paysage concurrentiel et des parts de marché des appareils de beauté en Amérique du Nord

Le paysage concurrentiel du marché des appareils de beauté en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des appareils de beauté en Amérique du Nord.

Les principales entreprises présentes sur le marché des appareils de beauté en Amérique du Nord sont Nu Skin, CANDELA CORPORATION, Curallux LLC, FOREO, Koninklijke Philips NV, Conair Corporation, Lumenis Be Ltd, Cynosure, Sciton, Inc., Fotona, Procter & Gamble, LUTRONIC, STRATA Skin Sciences, NuFACE, Spectrum Brands, Inc., Cutera, Merz North America, Inc., Panasonic Corporation, Procter & Gamble, entre autres.

Méthodologie de recherche : Marché des appareils de beauté en Amérique du Nord

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des tailles d'échantillon importantes. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché de l'entreprise, les normes de mesure, l'Amérique du Nord par rapport à la région et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BEAUTY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LIFELINE CURVE, BY PRODUCT TYPE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 NORTH AMERICA BEAUTY DEVICES MARKET: PRICING ANALYSIS

4.4 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA BEAUTY DEVICE MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES

6.1.2 INCREASING PREVALENCE OF SKIN RELATED ISSUES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS

6.1.4 EXTENSIVE R&D ACTIVITIES FOR LAUNCHING NOVEL BEAUTY DEVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF BEAUTY DEVICES

6.2.2 SIDE EFFECTS AND ALLERGIES ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

6.3 OPPORTUNITIES

6.3.1 INCREASING APPEARANCE CONSCIOUSNESS AND AWARENESS

6.3.2 INCREASING BEAUTY EXPENDITURE

6.4 CHALLENGES

6.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF BEAUTY DEVICES

6.4.2 PRODUCT RECALL

7 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HAIR CARE DEVICES

7.2.1 HAIR REMOVAL DEVICES

7.2.1.1 LASER DEVICES

7.2.1.2 TRIMERS

7.2.1.3 SHAVERS

7.2.1.4 EPILATORS

7.2.1.5 OTHERS

7.2.2 HAIR GROWTH DEVICES

7.2.3 OTHERS

7.3 FACIAL DEVICES

7.3.1 CLEANING DEVICES

7.3.1.1 FACIAL CLEANING BRUSH

7.3.1.2 CLEANING MASSAGER

7.3.1.3 OTHERS

7.3.2 WHITENING DEVICES

7.3.3 MASSAGE DEVICES

7.3.4 OTHER FACIAL DEVICES

7.4 SKIN CARE DEVICES

7.4.1 CLEANSING DEVICES

7.4.2 ACNE TREATMENT DEVICES

7.4.3 ANTI AGING DEVICES

7.4.4 DERMAL ROLLERS

7.4.5 REJUVENATION DEVICES

7.4.6 LIGHT/LED & PHOTO REJUVENATION THERAPY DEVICES

7.4.7 CELLULITE REDUCTION DEVICES

7.4.8 SKIN TEXTURE TONE ENHANCEMENT

7.4.9 OXYGEN & STEAMER DEVICES

7.4.10 OTHERS

7.5 ORAL CARE DEVICES

7.5.1 TOOTHBRUSHES & ACCESSORIES

7.5.1.1 MANUAL TOOTHBRUSHES

7.5.1.2 ELECTRIC TOOTHBRUSHES

7.5.1.3 BATTERY POWERED TOOTHBRUSHES

7.5.1.4 REPLACEMENT TOOTHBRUSH HEAD

7.5.2 OTHERS

7.6 EYE CARE DEVICES

8 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 ADULT

8.2.1 FEMALE

8.2.2 MALE

8.3 GERIATRICS

8.3.1 FEMALE

8.3.2 MALE

8.4 PEDIATRICS

8.4.1 FEMALE

8.4.2 MALE

9 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

9.1 OVERVIEW

9.2 ELECTRIC AND BATTERY OPERATED

9.2.1 POCKET-SIZED/HANDHELD DEVICE

9.2.2 FIXED

9.3 MANUAL

9.3.1 POCKET-SIZED/HANDHELD DEVICE

9.3.2 FIXED

10 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL AND PROFESSIONAL SETTINGS

10.2.1 MEDICAL SPA

10.2.2 BEAUTY SPA

10.2.3 CLINICAL

10.3 DOMESTIC/PERSONALIZED/HOMECARE SETTINGS

11 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 STORE BASED RETAILING

11.3.1.1 MODERN TRADE

11.3.1.2 DEPARTMENTAL STORES

11.3.1.3 SPECIALTY STORE

11.3.1.4 OTHERS

11.3.2 NON-STORE BASED RETAILING

11.3.2.1 MULTIBRAND ONLINE SHOP

11.3.2.2 COMPANY WEBSITE

12 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 PROCTER & GAMBLE

15.1.1 COMPANY SNAPSHOT

15.1.2 RECENT FINANCIALS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 KONINKLIJKE PHILIPS N.V.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 PANASONIC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CONAIR CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 FOREO

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BAUSCH HEALTH COMPANIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CANDELA CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CURALLUX LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CUTERA

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 CYNOSURE. INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DD KARMA LLC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOTONA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 HITACHI POWER SEMICONDUCTOR DEVICE, LTD (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 LUTRONIC

15.14.1 COMPANY SNAPSHOT

15.14.2 RECENT FINANCIALS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LIGHTSTIM

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LUMENIS BE LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MERZ NORTH AMERICA, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 NU SKIN

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 PHOTOMEDEX

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 PURE DAILY CARE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SCITON, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPECTRUM BRANDS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 STRATA SKIN SCIENCE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SILKN

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SINCLAIR

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 UNILEVER

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

15.27 VENUS CONCEPT

15.27.1 COMPANY SNAPSHOT

15.27.2 RECENT FINANCIALS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 2 DEVICES WITH BEAUTY PURPOSE LISTED IN FDA MEDICAL DEVICE CLASSIFICATION DATABASE

TABLE 3 SIDE EFFECTS ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

TABLE 4 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 U.S. BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 U.S. ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 36 U.S. GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 37 U.S. PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 38 U.S. BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 U.S. BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 58 CANADA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 59 CANADA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 CANADA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CANADA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CANADA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 MEXICO BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 78 MEXICO GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MEXICO COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 MEXICO BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 MEXICO INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BEAUTY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BEAUTY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BEAUTY DEVICES MARKET: REGIONAL VS COUNRTY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BEAUTY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BEAUTY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BEAUTY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA BEAUTY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES AND GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS ARE EXPECTED TO DRIVE THE NORTH AMERICA BEAUTY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HAIR CARE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BEAUTY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BEAUTY DEVICES MARKET

FIGURE 14 NUMBER OF AESTHETIC PROCEDURES PERFORMED, U.S., 2020

FIGURE 15 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 20 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2021

FIGURE 24 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2021

FIGURE 28 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BEAUTY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA BEAUTY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.