North America Base Station Analyser Market

Taille du marché en milliards USD

TCAC :

%

USD

410.60 Million

USD

649.51 Million

2025

2033

USD

410.60 Million

USD

649.51 Million

2025

2033

| 2026 –2033 | |

| USD 410.60 Million | |

| USD 649.51 Million | |

|

|

|

|

Segmentation du marché nord-américain des analyseurs de stations de base, par type de produit (portables et de table), fonctionnalités (analyseur de spectre, analyseur de câbles et d'antennes, wattmètre, analyseur de signaux, récepteur GPS, scanner de canaux et autres), solutions (installation, maintenance, optimisation et extension), réseaux (GSM, LTE, 5G NR et CDMA), connectivité (Bluetooth, Wi-Fi et autres), utilisateurs finaux (informatique et télécommunications, semi-conducteurs et électronique, aérospatiale et défense et autres) - Tendances et prévisions du secteur jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des analyseurs de stations de base en Amérique du Nord ?

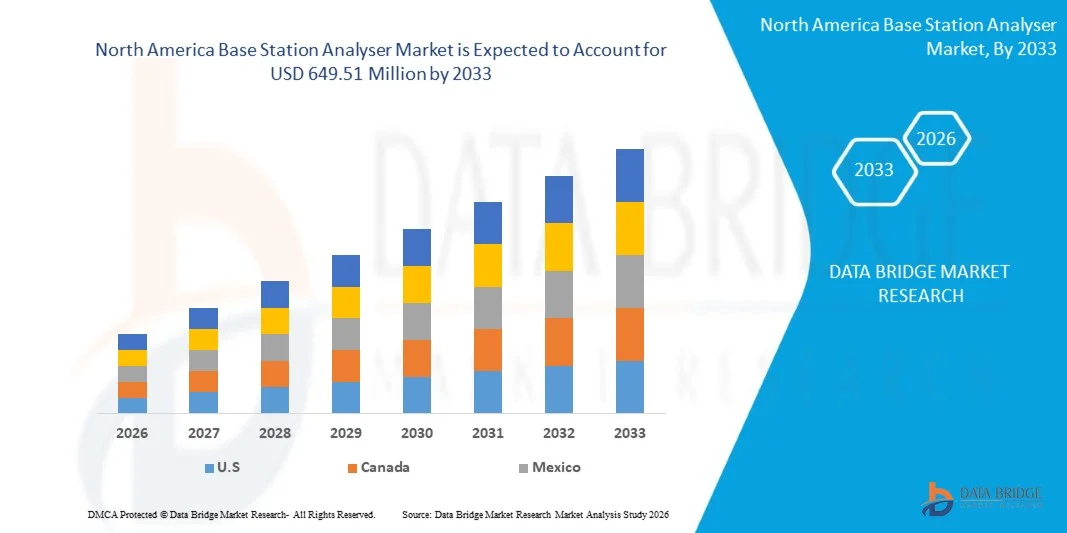

- Le marché nord-américain des analyseurs de stations de base était évalué à 410,60 millions de dollars américains en 2025 et devrait atteindre 649,51 millions de dollars américains d'ici 2033 , avec un TCAC de 5,9 % au cours de la période de prévision.

- La demande croissante du secteur des télécommunications stimule la croissance du marché. L'Amérique du Nord a connu une forte croissance de l'adoption des analyseurs de stations de base grâce à l'émergence de jeunes entreprises en Chine, en Inde, au Japon et dans d'autres pays. L'adoption tardive par le secteur de la défense dans la région a permis à ce segment démographique d'atteindre le taux de croissance le plus élevé.

Quels sont les principaux enseignements du marché des analyseurs de stations de base ?

- Le marché des analyseurs de stations de base connaît une croissance soutenue en raison de la complexité croissante des réseaux et de la demande grandissante de diagnostics de signaux précis pour les infrastructures de télécommunications modernes.

- Les fabricants se concentrent sur des analyseurs compacts et multifonctionnels offrant des tests en temps réel, ce qui aide les opérateurs à maintenir la qualité du signal et à réduire les temps d'arrêt du réseau.

- Aux États-Unis, le marché des analyseurs de stations de base a dominé la région Amérique du Nord avec une part de revenus de 39,96 % en 2025, grâce à d'importants travaux de réaménagement urbain, à l'expansion des infrastructures résidentielles et commerciales et à la restauration des autoroutes, des ponts et des installations industrielles vieillissantes.

- Au Mexique, le marché des analyseurs de stations de base devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 11,98 %, entre 2026 et 2033, sous l'effet d'une urbanisation accélérée, de l'expansion de la construction résidentielle et industrielle et des investissements publics dans les projets d'infrastructures routières, de métro et de retenue d'eau.

- Le segment des appareils portables a dominé le marché avec une part estimée à 53,6 % en 2025, grâce à leur facilité de transport, leur déploiement rapide et leur adéquation aux tests sur le terrain, aux inspections de sites et au dépannage en milieu urbain et isolé.

Portée du rapport et segmentation du marché des analyseurs de stations de base

|

Attributs |

Analyseur de station de base : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des analyseurs de stations de base ?

« Évolution croissante vers des analyseurs de stations de base performants, durables et à séchage rapide »

- Le marché des analyseurs de stations de base connaît une adoption croissante de matériaux avancés, à durcissement rapide, renforcés par des polymères et des fibres, conçus pour une stabilité structurelle accrue, une réduction des temps d'arrêt des projets et une durée de vie plus longue dans le cadre de la réparation et de la maintenance des infrastructures.

- Les fabricants proposent des mortiers de réparation écologiques, à faible retrait, à forte adhérence et résistants aux sulfates, offrant une maniabilité, une résistance à la corrosion et une durabilité supérieures pour diverses applications industrielles, commerciales et résidentielles.

- L'accent croissant mis sur la construction durable, avec des granulats recyclés, des ciments à faible teneur en carbone et des formulations sans COV, favorise une adoption respectueuse de l'environnement à l'échelle mondiale.

- Par exemple, des entreprises telles que Sika, MAPEI, Saint-Gobain Weber, Fosroc et MC-Bauchemie développent des mortiers à prise rapide et à haute résistance, offrant une meilleure adhérence, une protection accrue contre la corrosion et des performances durables pour les ponts, les tunnels, les bâtiments et les infrastructures industrielles.

- La demande croissante en matière d'entretien des infrastructures, de réparations préventives et de restauration des bâtiments vieillissants stimule l'utilisation de ces services aux États-Unis, en Europe et en Amérique du Nord.

- Face à la nécessité croissante de solutions de réparation durables et efficaces pour les infrastructures vieillissantes, les analyseurs de stations de base demeureront essentiels pour une construction durable et des coûts de cycle de vie réduits.

Quels sont les principaux moteurs du marché des analyseurs de stations de base ?

- L'augmentation des investissements mondiaux dans la rénovation des infrastructures, notamment les autoroutes, les ponts, les tunnels et les installations industrielles, stimule considérablement la demande d'analyseurs de stations de base.

- Par exemple, en 2025, Sika, MAPEI et Fosroc ont élargi leurs gammes de mortiers modifiés aux polymères et renforcés de fibres afin de soutenir des projets de réhabilitation à grande échelle en Europe et en Amérique du Nord.

- La prise de conscience croissante de la durabilité structurelle, de la prévention de la corrosion et de la protection à long terme des actifs encourage l'adoption de matériaux de réparation haute performance présentant une résistance à la compression et des propriétés d'adhérence supérieures.

- Les innovations technologiques, telles que les systèmes cimentaires nano-modifiés, les formulations résistantes aux fissures et les mortiers à faible teneur en carbone, améliorent l'efficacité des réparations et la durée de vie.

- L'intensification des travaux de construction liés à la rénovation urbaine, à la modernisation des sites industriels et aux projets de villes intelligentes renforce encore la croissance du marché.

- Soutenu par des normes de qualité plus strictes, des cycles de vie prolongés pour les structures vieillissantes et des initiatives de construction durable, le marché des analyseurs de stations de base devrait connaître une forte expansion à long terme.

Quel facteur freine la croissance du marché des analyseurs de stations de base ?

- Le coût élevé des mortiers haut de gamme, des additifs spéciaux et de la main-d'œuvre qualifiée limite leur adoption par les petits entrepreneurs et les projets à petit budget.

- Entre 2024 et 2025, la hausse des prix du ciment, des polymères, de la silice et d'autres charges haute performance a augmenté les coûts de production de plusieurs marques mondiales.

- Des problèmes techniques tels qu'une préparation de surface inadéquate, un mélange incorrect et une application défectueuse peuvent compromettre l'intégrité structurelle, augmentant ainsi le besoin de main-d'œuvre qualifiée.

- Le manque de connaissances sur la durabilité des matériaux, les normes de compatibilité et les protocoles de test dans les marchés émergents freine l'adoption.

- La concurrence des matériaux de réparation bon marché, sans marque et de qualité inférieure exerce une pression sur les prix et réduit la différenciation des solutions certifiées.

- Pour surmonter ces défis, les entreprises mettent l'accent sur les programmes de formation, les formulations économiques, les outils d'application avancés et les initiatives de sensibilisation afin d'étendre l'adoption mondiale des analyseurs de stations de base de haute qualité.

Comment le marché des analyseurs de stations de base est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de la fonctionnalité, de la solution, du réseau, de la connectivité et de l'utilisateur final .

• Par type de produit

Selon le type de produit, le marché se divise en analyseurs portables et analyseurs de table. Le segment des analyseurs portables a dominé le marché avec une part estimée à 53,6 % en 2025, grâce à leur facilité de transport, leur déploiement rapide et leur adéquation aux tests sur le terrain, aux inspections de sites et au dépannage en milieu urbain comme en zones reculées. Les analyseurs portables offrent une mesure du signal en temps réel, une connectivité polyvalente et une installation rapide, ce qui en fait le choix privilégié des ingénieurs réseau et des techniciens de terrain.

Le segment des appareils de table devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à une adoption croissante dans les environnements de laboratoire, les centres de R&D des télécommunications et les installations d'étalonnage de haute précision nécessitant des fonctionnalités avancées, une analyse multibande et des capacités de capture de données approfondies.

• Par fonctionnalité

Le marché des analyseurs de stations de base est segmenté en analyseurs de spectre, analyseurs de câbles et d'antennes, wattmètres, analyseurs de signaux, récepteurs GPS, scanners de canaux et autres. Le segment des analyseurs de spectre dominait le marché en 2025 avec une part de 41,2 %, grâce à son rôle crucial dans la surveillance des fréquences, la détection des interférences et les tests de conformité.

Le segment des scanners de canaux devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, sous l'effet du déploiement croissant de réseaux multibandes et multi-opérateurs et du besoin d'une évaluation rapide des canaux dans les architectures LTE, 5G et les architectures de réseau à venir.

• Par solution

En fonction de la solution proposée, le marché est segmenté en installation, maintenance, optimisation et extension. Le segment de la maintenance dominait le marché en 2025 avec une part de 45,7 %, grâce aux inspections, étalonnages et réparations fréquents des infrastructures de stations de base visant à garantir une disponibilité réseau continue.

Le segment de l'optimisation devrait enregistrer la croissance la plus rapide entre 2026 et 2033, les opérateurs de télécommunications investissant de plus en plus dans l'amélioration des performances du réseau, la gestion du trafic et l'efficacité du spectre, notamment avec le déploiement des technologies LTE et 5G NR.

• Par réseau

Le marché est segmenté en réseaux GSM, LTE, 5G « New Radio » (NR) et CDMA. La LTE dominait le marché avec une part de 39,8 % en 2025, grâce à son adoption mondiale généralisée et à la modernisation des réseaux existants.

Le segment 5G NR devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce au déploiement massif de l'infrastructure 5G, aux exigences de latence ultra-faible et à l'expansion vers les villes intelligentes, la connectivité IoT et les applications d'automatisation industrielle.

• Par connectivité

Le marché des analyseurs de stations de base est segmenté en Bluetooth, Wi-Fi et autres. Le Wi-Fi dominait le marché avec une part de 48,1 % en 2025, grâce à son utilisation intensive dans les tests de réseaux intérieurs et extérieurs, la mesure de la qualité du signal et la détection des interférences.

Le segment Bluetooth devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, alimenté par l'adoption croissante des appareils IoT basse consommation, des objets connectés portables et des solutions de communication à courte portée nécessitant une analyse précise du signal dans les déploiements commerciaux et industriels.

• Par l'utilisateur final

Le marché des analyseurs de stations de base est segmenté en quatre secteurs : technologies de l’information et télécommunications, semi-conducteurs et électronique, aérospatiale et défense, et autres. Le segment des technologies de l’information et des télécommunications dominait le marché en 2025 avec une part de 44,5 %, sous l’impulsion des besoins d’expansion, de maintenance et d’optimisation des réseaux des opérateurs télécoms mondiaux.

Le segment des semi-conducteurs et de l'électronique devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à l'utilisation croissante d'analyseurs de stations de base dans les laboratoires de R&D, la validation des puces, les tests 5G et la caractérisation des composants haute fréquence.

Quelle région détient la plus grande part du marché des analyseurs de stations de base ?

- Aux États-Unis, le marché des analyseurs de stations de base a dominé la région Amérique du Nord avec une part de revenus de 39,96 % en 2025, grâce à d'importants travaux de réaménagement urbain, à l'expansion des infrastructures résidentielles et commerciales et à la restauration des autoroutes, des ponts et des installations industrielles vieillissantes.

- L'augmentation des investissements publics dans les initiatives de villes intelligentes, la modernisation des transports et les projets d'infrastructures côtières stimule encore davantage la demande de mortiers de réparation haute performance à base de ciment, d'époxy et de fibres.

- Les méthodes d'application mécanisées, les formulations à prise rapide et les solutions écologiques sont de plus en plus adoptées dans les projets de construction publics et privés, consolidant ainsi la position de leader des États-Unis sur le marché nord-américain des analyseurs de stations de base.

Analyse du marché des stations de base au Canada

Au Canada, la demande d'analyseurs de stations de base est soutenue par l'expansion urbaine, la modernisation des réseaux de transport et la rénovation des installations industrielles. Les mortiers cimentaires, époxy et modifiés aux polymères sont largement utilisés dans la construction de ponts, d'autoroutes, de tunnels et de bâtiments commerciaux afin d'assurer leur durabilité, leur résistance à la fissuration et leur conformité aux normes de construction. Les techniques de projection mécanisées, les formulations renforcées de fibres à haute résistance et les mortiers prêts à l'emploi améliorent l'efficacité des projets. Les programmes d'infrastructure financés par le gouvernement, les initiatives de réaménagement urbain et la sensibilisation croissante aux normes de sécurité des structures favorisent encore davantage leur adoption sur le marché canadien.

Analyse du marché des stations de base au Mexique (pays à la croissance la plus rapide)

Au Mexique, le marché des analyseurs de stations de base devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 11,98 %, entre 2026 et 2033. Cette croissance est alimentée par une urbanisation accélérée, l'expansion de la construction résidentielle et industrielle, ainsi que par les investissements publics dans les infrastructures routières, métropolitaines et hydrauliques. L'utilisation intensive de mortiers cimentaires, époxy et renforcés de fibres garantit une durabilité à long terme, une résistance à la fissuration et une réhabilitation structurelle rapide. Les méthodes d'application mécanisées, les solutions de réparation prêtes à l'emploi et les formulations écologiques optimisent l'efficacité opérationnelle. La croissance du secteur de la construction privée, la modernisation des installations industrielles et l'importance accrue accordée à la maintenance préventive stimulent la pénétration du marché, faisant du Mexique le pays à la croissance la plus rapide sur le marché nord-américain des analyseurs de stations de base.

Quelles sont les principales entreprises du marché des analyseurs de stations de base ?

Le secteur des analyseurs de stations de base est principalement dominé par des entreprises bien établies, notamment :

- RIGOL TECHNOLOGIES, Co. Ltd. (Chine)

- Keysight Technologies (États-Unis)

- Good Will Instrument Co., Ltd. (Taïwan)

- Tektronix, Inc. (États-Unis)

- Rohde & Schwarz (Allemagne)

- Anritsu (Japon)

- Oiseau (États-Unis)

- Services de télécommunications Savitri (Inde)

- HUBER+SUHNER (Suisse)

- VIAVI Solutions Inc. (États-Unis)

- B&K Precision Corporation (États-Unis)

- Solutions de tests de sécurité Narda (Allemagne)

- Technologie Saluki (Chine)

Quels sont les développements récents sur le marché mondial des analyseurs de stations de base ?

- En octobre 2020, Keysight Technologies, Inc. a annoncé une nouvelle solution de test haute performance pour stations de base 5G, basée sur l'émetteur-récepteur vectoriel multibande 5G S9130A de Keysight (VXT), qui permet aux fabricants d'équipements de réseau (NEM) et aux fournisseurs de petites cellules d'accélérer la validation des produits mmWave conformément aux dernières spécifications 3GPP.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.