North America B2b Air Care Market

Taille du marché en milliards USD

TCAC :

%

USD

1,830,395.30 Billion

USD

2,591,955.35 Billion

2022

2030

USD

1,830,395.30 Billion

USD

2,591,955.35 Billion

2022

2030

| 2023 –2030 | |

| USD 1,830,395.30 Billion | |

| USD 2,591,955.35 Billion | |

|

|

|

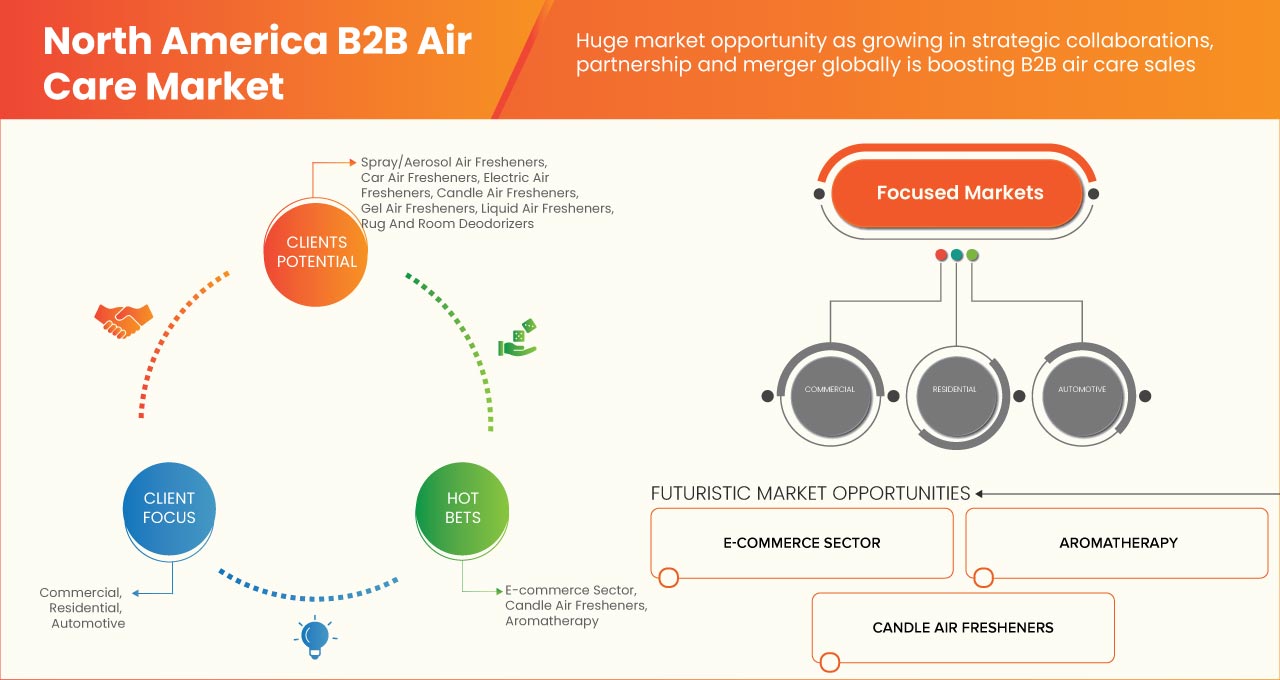

Marché nord-américain des produits d'entretien de l'air B2B, par type de produit (désodorisants électriques, désodorisants à bougie, désodorisants liquides, désodorisants en gel, désodorisants en spray/aérosol, désodorisants pour tapis et pièces, désodorisants pour voiture et autres), parfum (floral, fruité, vanille, épices et herbes et autres), prix (bas, moyen et élevé), utilisateur final (résidentiel, commercial, automobile et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché B2B des produits de nettoyage de l'air en Amérique du Nord

Ces dernières années, le marché nord-américain des produits de parfumerie B2B a connu une explosion de nouveaux systèmes de distribution et de produits de parfumerie. Ces produits ont influencé le secteur de l'aromathérapie et ont mis davantage l'accent sur la création d'une atmosphère parfaite pour toutes les occasions. Le développement de sprays désodorisants, non aérosols et aérosols, ainsi que de produits à mèche air-liquide ou de gels désodorisants, offrent une variété de produits destinés à différents types de consommateurs ou de produits industriels qui peuvent assurer une diffusion de parfum à long terme.

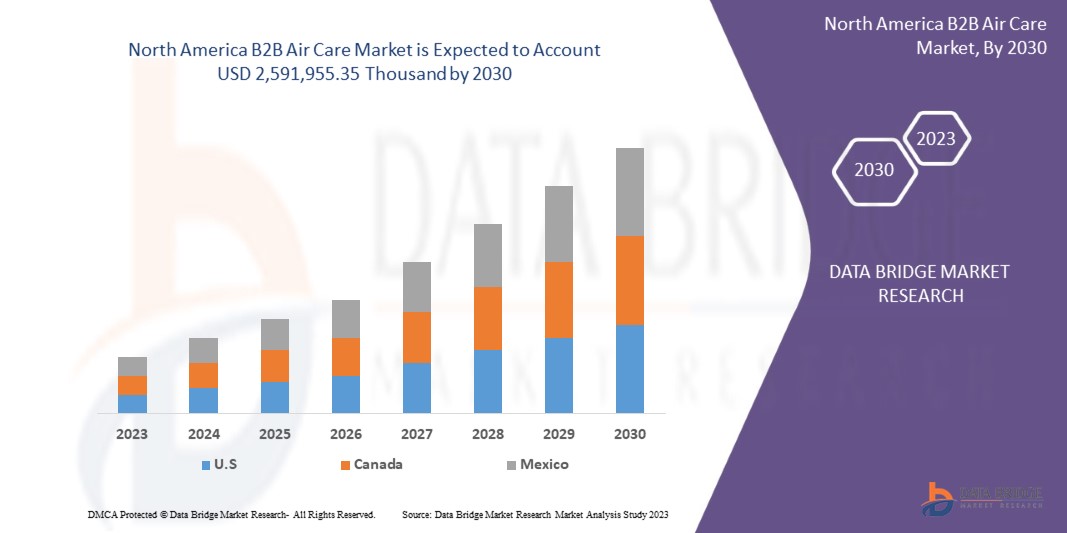

Français Data Bridge Market Research analyse que le marché nord-américain des produits de traitement de l'air était évalué à 1 830 395,30 milliers USD en 2022 et devrait atteindre 2 591 955,35 milliers USD d'ici 2030, enregistrant un TCAC de 4,5 % au cours de la période de prévision de 2023 à 2030. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario de marché, le rapport de marché organisé par l'équipe de recherche sur le marché Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production, une analyse des brevets et des avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par type de produit (désodorisants électriques, désodorisants à bougie, désodorisants liquides, désodorisants en gel, désodorisants en spray/aérosol, désodorisants pour tapis et pièces, désodorisants pour voiture et autres), parfum (floral, fruité, vanille , épices et herbes et autres), prix (bas, moyen et élevé), utilisateur final (résidentiel, commercial, automobile et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

SC Johnson & Son Inc., CAR-FRESHNER, Air Delights, Inc., Rexair LLC, BEAUMONT PRODUCTS, INC., BALEV CORPORATION EOOD, Procter & Gamble, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, WD-40 Company., Newell Brands, Hamilton Beach Brands Holding Company., et Godrej Consumer Products Limited |

Définition du marché

Les produits de désodorisation se présentent sous différentes formes, comme les diffuseurs, les gels, les bougies, les aérosols parfumés, les vaporisateurs à pompe et les diffuseurs à brancher. Ces produits sont utilisés pour éliminer les mauvaises odeurs intérieures et pour offrir des expériences olfactives agréables. Un assainisseur d'air est un produit majeur qui émet généralement du parfum pour éliminer les odeurs désagréables dans une pièce. Il se compose de plusieurs ingrédients tels que des propulseurs, des parfums et des solvants tels que les éthers de glycol , l'huile minérale et le 2-butoxyéthanol qui aident à neutraliser une odeur désagréable.

Dynamique du marché B2B des produits de climatisation en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- URBANISATION RAPIDE À L'ÉCHELLE MONDIALE

L'urbanisation connaît une croissance rapide et crée une demande durable en produits de nettoyage de l'air. En raison de l'augmentation de la population, le nombre de consommateurs augmente également. Les données de la Banque mondiale montrent que 4,4 milliards d'habitants vivent dans des villes du monde entier. En raison de la sensibilisation accrue de la population urbaine aux produits de nettoyage de l'air, la demande de produits de nettoyage de l'air augmente considérablement. Par conséquent, elle devrait agir comme un facteur moteur majeur de la croissance du marché nord-américain de nettoyage de l'air b2b.

À l’ère de l’urbanisation, le monde est confronté à des problèmes d’air pollué et impur. Il existe toujours un besoin d’air propre et agréable à respirer, ce qui augmente à mesure que les niveaux de pollution augmentent dans diverses régions du globe. Par conséquent, la demande de produits d’entretien de l’air domestique devrait également augmenter régulièrement.

- ADOPTION CROISSANTE DES PRODUITS DE TRAITEMENT DE L'AIR DANS LE SECTEUR AUTOMOBILE

La demande du secteur automobile, en particulier du segment des véhicules utilitaires, est en augmentation. Il existe toujours un besoin d'éliminateur d'odeurs dans tout véhicule. À mesure que la demande du secteur automobile augmente, elle augmente finalement la demande d'éliminateurs d'odeurs dans les voitures et devrait avoir un impact positif sur la croissance du marché nord-américain des produits de nettoyage de l'air B2B.

En octobre 2022, l'India Brand Equity Foundation (IBEF) a publié un rapport concernant la demande croissante du secteur automobile. Dans ce rapport, ils ont mentionné qu'en Inde, la production totale de véhicules de tourisme , de trois-roues et de deux-roues était de 2 191 090 unités. Cela prouve que la pénétration du secteur automobile augmente quotidiennement dans les pays en développement et devrait entraîner une croissance positive pour le marché nord-américain des soins de l'air b2b

Restrictions

- EFFETS DES PRODUITS DE TRAITEMENT DE L'AIR SUR L'ENVIRONNEMENT

Si des émissions directes de désodorisants sont combinées à des éléments (comme l'ozone) déjà présents dans l'air, elles peuvent contribuer à la formation de composés organiques volatils (COV). Par exemple, ce désodorisant ou éliminateur d'odeurs, qui crée des émissions, peut se mélanger aux molécules naturellement présentes dans l'air intérieur, comme l'ozone, pour créer des polluants. De plus, les articles parfumés ont été liés à la pollution environnementale, ce qui devrait restreindre le marché nord-américain des produits de soins de l'air b2b. Dans un autre rapport de l'Université du Massachusetts à Amherst, ils précisent que certains produits de désodorisants sont décrits comme « verts » (comme biologiques ou entièrement naturels), mais ces termes manquent de définitions réglementaires ou chimiques lorsqu'ils sont utilisés avec des désodorisants. Ils ont fait référence à certaines études comparant les émissions de différents désodorisants, qui ont révélé que tous les désodorisants, indépendamment des allégations « vertes », émettent des composés potentiellement dangereux. De plus, les émissions des désodorisants « verts » ne se sont pas révélées significativement différentes de celles des autres désodorisants.

Opportunité

- CROISSANCE RAPIDE DANS LE SECTEUR COMMERCIAL ET RÉSIDENTIEL

Le secteur commercial et résidentiel connaît une croissance phénoménale. Désodorisants et éliminateurs d'odeurs utilisés dans les bâtiments résidentiels. Une croissance accrue du secteur résidentiel renforce en fin de compte la croissance du marché nord-américain des soins de l'air b2b. L'ESRB, une organisation responsable de la politique macroprudentielle concernant le système financier de l'Union européenne (UE), a publié un rapport en novembre 2018 concernant les vulnérabilités du secteur immobilier commercial de l'UE. Dans ce rapport, ils ont mentionné que plusieurs pays de l'UE connaissent une combinaison de croissance des prix à deux chiffres dans le secteur résidentiel. Un autre rapport de l'Agence internationale de l'énergie (AIE) a mentionné qu'en 2021, l'exploitation des bâtiments représentait 30 %. Cela indique que la croissance du secteur résidentiel est immense et devrait être une raison de la croissance du marché nord-américain des soins de l'air b2b.

Défi

- MANQUE DE SENSIBILISATION DES CONSOMMATEURS AUX PRODUITS DE DÉGRADATION DE L'AIR DANS LA RÉGION ASIE-PACIFIQUE

Les consommateurs ne sont pas suffisamment sensibilisés aux produits de désodorisation et à la pollution intérieure. En 2014, l'Université Jimma a publié une étude de cas concernant une enquête sur la sensibilisation des consommateurs aux problèmes de santé liés aux assainisseurs d'air. Dans cette étude de cas, ils ont mentionné le manque de sensibilisation des consommateurs aux produits de désodorisation, ce qui tend à la pollution intérieure à long terme. Ils ont également ajouté qu'il existe un manque d'informations sur les produits de désodorisation et leurs ingrédients, ce qui implique des problèmes de santé. Cela indique que le manque de sensibilisation des consommateurs aux produits de désodorisation devrait remettre en cause la croissance du marché nord-américain des désodorisants B2B.

Impact post-COVID-19 sur le marché B2B des produits de climatisation en Amérique du Nord

L'industrie nord-américaine des produits de soins de l'air B2B a noté une baisse progressive de la demande en raison du confinement et des lois gouvernementales COVID-19, les installations de fabrication et les services étant fermés. Même le développement privé et public a été annulé. De plus, l'industrie a également été affectée par l'arrêt de la chaîne d'approvisionnement, en particulier des matières premières utilisées dans le processus de fabrication des produits de soins de l'air. Les réglementations gouvernementales strictes pour différentes industries, les restrictions sur le commerce et le transport ont été quelques-uns des principaux facteurs qui ont freiné la croissance du marché des produits de soins de l'air B2B dans le monde en 2020 et au cours des deux premiers trimestres de 2021. Comme la production de produits de soins de l'air B2B a ralenti en raison des restrictions imposées par les gouvernements du monde entier, la production n'a pas répondu à la demande au cours des trois premiers trimestres de 2020. De plus, une forte demande/exigence pour les produits de soins de l'air B2B dans le secteur automobile et résidentiel a été observée. Cependant, à mesure que les autorités gouvernementales commencent à lever ces confinements imposés, le marché nord-américain des produits de soins de l'air B2B devrait se redresser en conséquence.

Développement récent

- En juin 2022, SC Johnson & Son Inc. a annoncé un partenariat avec North America Fund. Ce partenariat a aidé l'entreprise à améliorer ses finances et, à terme, à avoir un impact positif sur la croissance du marché nord-américain des soins de l'air B2B

- En août 2020, CAR–FRESHENER Corporation a collaboré avec Julius Sämann Ltd. Cette collaboration a aidé l'entreprise à améliorer ses finances et, en fin de compte, à avoir un impact positif sur la croissance du marché nord-américain des produits de nettoyage de l'air B2B

Portée du marché B2B des produits de nettoyage de l'air en Amérique du Nord

Le marché nord-américain des produits de nettoyage de l'air B2B est segmenté en fonction du type de produit, du parfum, du prix et de l'utilisateur final. La croissance de ces segments vous aidera à analyser les segments de faible croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type de produit

- Désodorisants électriques

- Désodorisants à bougies

- Désodorisants liquides

- Désodorisants en gel

- Désodorisants en spray/aérosol

- Désodorisants pour tapis et pièces

- Désodorisants pour voiture

- Autres

Sur la base du type de produit, le marché nord-américain des produits de nettoyage de l'air B2B est segmenté en assainisseurs d'air électriques, assainisseurs d'air à bougie, assainisseurs d'air liquides, assainisseurs d'air en gel, assainisseurs d'air en spray/aérosol, désodorisants pour tapis et pièces, assainisseurs d'air pour voiture et autres.

Par parfum

- Floral

- Fruité

- Vanille

- Épices et herbes

- Autres

Sur la base du parfum, le marché nord-américain des produits de parfumerie B2B est segmenté en parfums floraux, fruités, vanille, épices et herbes et autres

Par prix

- Faible

- Moyen

- Haut

Sur la base du prix, le marché nord-américain des soins de l'air B2B est segmenté en bas, moyen et haut.

Par utilisateur final

- Résidentiel

- Commercial

- Automobile

- Autres

Sur la base de l'utilisateur final, le marché nord-américain de l'assainissement de l'air B2B est segmenté en résidentiel, commercial, automobile et autres.

Analyse/perspectives régionales du marché B2B de l'air conditionné en Amérique du Nord

Le marché nord-américain des soins de l’air B2B est analysé et des informations sur la taille du marché et les tendances sont fournies par région, produit, canal de distribution, données démographiques et gamme de prix, comme indiqué ci-dessus.

Le marché nord-américain des soins de l'air B2B est en outre segmenté entre les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région Amérique du Nord en raison de la forte demande de produits de traitement de l'air. En outre, la croissance rapide du secteur commercial et résidentiel devrait servir de facteur moteur à la croissance du marché.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché du secteur B2B de l'air conditionné en Amérique du Nord

Le paysage concurrentiel du marché B2B de l'air conditionné en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché B2B de l'air conditionné en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des produits de nettoyage de l'air B2B sont SC Johnson & Son Inc., CAR-FRESHNER, Air Delights, Inc., Rexair LLC, BEAUMONT PRODUCTS, INC., BALEV CORPORATION EOOD, Procter & Gamble, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, WD-40 Company., Newell Brands, Hamilton Beach Brands Holding Company., et Godrej Consumer Products Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA B2B AIR CARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 PRODUCT TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.2 GOVERNMENT’S ROLE

4.2.1 ANALYST RECOMMENDATIONS

4.3 PESTEL ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 LEGAL FACTORS

4.3.5 TECHNOLOGICAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 RAW MATERIAL COVERAGE

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 PRODUCTION CONSUMPTION ANALYSIS

4.7.1 PRODUCTION CONSUMPTION

4.7.2 PRODUCTION CAPACITY

4.8 IMPORT-EXPORT SCENARIO

4.9 PRICE INDEX

4.1 PORTER'S FIVE FORCES ANALYSIS

4.11 VENDOR SELECTION CRITERIA

4.12 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID URBANIZATION NORTH AMERICALY

5.1.2 INCREASING ADOPTION OF AIR CARE PRODUCTS IN THE AUTOMOTIVE SECTOR

5.1.3 RISING DEMAND FOR CANDLE AIR FRESHENERS

5.1.4 INCREASING DISPOSAL INCOME OF CONSUMERS

5.1.5 INCREASING INNOVATIONS IN AIR FRESHENERS

5.2 RESTRAINTS

5.2.1 EFFECTS OF AIR CARE PRODUCTS ON THE ENVIRONMENT

5.2.2 HIGH PRODUCTION COST OF AIR CARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RAPID GROWTH IN THE COMMERCIAL AND RESIDENTIAL SECTOR

5.3.2 SURGE IN STRATEGIC COLLABORATIONS, PARTNERSHIPS, AND MERGER

5.3.3 RISING DEMAND FOR THE E-COMMERCE SECTOR

5.3.4 RISE IN CONSUMER PREFERENCE TOWARD AROMATHERAPY

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS TOWARDS AIR CARE PRODUCTS IN THE ASIA-PACIFIC REGION

5.4.2 HEALTH PROBLEMS ASSOCIATED WITH AIR CARE PRODUCTS

6 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 SPRAY/AEROSOL AIR FRESHENERS

6.2.1 FLORAL

6.2.2 VANILLA

6.2.3 FRUITY

6.2.4 SPICES AND HERBS

6.2.5 OTHERS

6.3 CAR AIR FRESHENERS

6.3.1 FLORAL

6.3.2 VANILLA

6.3.3 FRUITY

6.3.4 SPICES AND HERBS

6.3.5 OTHERS

6.4 ELECTRIC AIR FRESHENERS

6.4.1 FLORAL

6.4.2 VANILLA

6.4.3 FRUITY

6.4.4 SPICES AND HERBS

6.4.5 OTHERS

6.5 CANDLE AIR FRESHENERS

6.5.1 FRUITY

6.5.2 SPICES AND HERBS

6.5.3 VANILLA

6.5.4 FLORAL

6.5.5 OTHERS

6.6 GEL AIR FRESHENERS

6.6.1 FRUITY

6.6.2 VANILLA

6.6.3 FLORAL

6.6.4 SPICES AND HERBS

6.6.5 OTHERS

6.7 LIQUID AIR FRESHENERS

6.7.1 FLORAL

6.7.2 VANILLA

6.7.3 FRUITY

6.7.4 SPICES AND HERBS

6.7.5 OTHERS

6.8 RUG AND ROOM DEODORIZERS

6.8.1 FLORAL

6.8.2 VANILLA

6.8.3 FRUITY

6.8.4 SPICES AND HERBS

6.8.5 OTHERS

6.9 OTHERS

7 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE

7.1 OVERVIEW

7.2 FLORAL

7.3 VANILLA

7.4 FRUITY

7.5 SPICES & HERBS

7.6 OTHERS

8 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA B2B AIR CARE MARKET, BY END USER

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 OFFICES

9.2.2 BUILDINGS

9.2.3 OTHERS

9.3 RESIDENTIAL

9.3.1 BEDROOMS

9.3.2 WASHROOMS

9.3.3 OTHERS

9.4 AUTOMOTIVE

9.4.1 PRIVATE CARS

9.4.2 COMMERCIAL CARS

9.5 OTHERS

10 NORTH AMERICA B2B AIR CARE MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA B2B AIR CARE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILINGS

13.1 RECKITT BENCKISER GROUP PLC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 BRAND PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 S.C. JOHNSON & SON INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 BRAND PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 PROCTOR & GAMBLE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 BRAND PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NEWELL BRANDS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 BRAND PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 HENKEL AG & CO. KGAA

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 BRAND PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AIR DELIGHT

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BALEV CORPORATION EOOD

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BEAUMONT PRODUCTS, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 BRAND PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CAR-FRESHNER

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 GODREJ CONSUMER PRODUCTS LIMITED

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HAMILTON BEACH BRANDS HOLDING COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 BRAND PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 REXAIR LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 WD-40 COMPANY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 BRAND PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 AIR FRESHENER IMPORT DATA AND ITS HS CODE FOR THE U.S.

TABLE 2 AIR FRESHENER IMPORT DATA AND ITS HS CODE FOR INDIA

TABLE 3 AIR FRESHENER EXPORT DATA AND ITS HS CODE FOR INDIA

TABLE 4 PRICE RANGE OF THE AIR CARE PRODUCTS

TABLE 5 VARIOUS B2B AIR CARE REGULATORY STANDARDS ARE AS FOLLOWS:

TABLE 6 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 8 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 9 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 11 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 14 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 17 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 20 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 23 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 26 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RUG AND ROOM DEODORIZER IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 29 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 32 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA FLORAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA FLORAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 35 NORTH AMERICA VANILLA IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA VANILLA IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 37 NORTH AMERICA FRUITY IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA FRUITY IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 39 NORTH AMERICA SPICES & HERBS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA SPICES & HERBS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 41 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 43 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA LOW IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEDIUM IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA HIGH IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 49 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 50 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 52 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 55 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA OTHERS IN B2B AIR CARE MARKET, BY REGION, 2021-2030 (THOUSAND UNIT)

TABLE 61 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNIT)

TABLE 63 NORTH AMERICA B2B AIR CARE MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 64 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 66 NORTH AMERICA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 67 NORTH AMERICA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 76 NORTH AMERICA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 77 NORTH AMERICA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 80 NORTH AMERICA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 81 NORTH AMERICA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 86 U.S. B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 87 U.S. SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 96 U.S. B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 97 U.S. B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 100 U.S. B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 101 U.S. COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 106 CANADA B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 107 CANADA SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 110 CANADA CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 111 CANADA GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 112 CANADA LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 113 CANADA RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 114 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 115 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 116 CANADA B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 117 CANADA B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 118 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 119 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 120 CANADA B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 121 CANADA COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 CANADA RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 CANADA AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (THOUSAND UNIT)

TABLE 126 MEXICO B2B AIR CARE MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 127 MEXICO SPRAY/AEROSOL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO CAR AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 129 MEXICO ELECTRIC AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 130 MEXICO CANDLE AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 131 MEXICO GEL AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 132 MEXICO LIQUID AIR FRESHENERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 133 MEXICO RUG AND ROOM DEODORIZERS IN B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 134 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (USD THOUSAND)

TABLE 135 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (THOUSAND UNIT)

TABLE 136 MEXICO B2B AIR CARE MARKET, BY FRAGRANCE, 2021-2030 (ASP)

TABLE 137 MEXICO B2B AIR CARE MARKET, BY PRICE, 2021-2030 (USD THOUSAND)

TABLE 138 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 139 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (THOUSAND UNIT)

TABLE 140 MEXICO B2B AIR CARE MARKET, BY END USER, 2021-2030 (ASP)

TABLE 141 MEXICO COMMERCIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 MEXICO RESIDENTIAL IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 MEXICO AUTOMOTIVE IN B2B AIR CARE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA B2B AIR CARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA B2B AIR CARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA B2B AIR CARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA B2B AIR CARE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA B2B AIR CARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA B2B AIR CARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA B2B AIR CARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA B2B AIR CARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA B2B AIR CARE MARKET: SEGMENTATION

FIGURE 10 RAPID URBANIZATION IS EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA B2B AIR CARE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 ELECTRIC AIR FRESHENERS ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA B2B AIR CARE MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA B2B AIR CARE MARKET

FIGURE 13 NORTH AMERICA B2B AIR CARE MARKET: BY PRODUCT TYPE, 2022

FIGURE 14 NORTH AMERICA B2B AIR CARE MARKET: FRAGRANCE, 2022

FIGURE 15 NORTH AMERICA B2B AIR CARE MARKET: BY PRICE, 2022

FIGURE 16 NORTH AMERICA B2B AIR CARE MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA B2B AIR CARE MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA B2B AIR CARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA B2B AIR CARE MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 22 NORTH AMERICA B2B AIR CARE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.