Marché des logiciels automobiles en Amérique du Nord, par offre (solutions et services), taille de l'organisation (organisations à grande échelle, organisation à moyenne échelle et organisation à petite échelle), couche logicielle (système d'exploitation, middleware et logiciel d'application), utilitaire EV (gestion de la charge, gestion de la batterie et V2G), type de véhicule (voitures particulières, véhicules électriques , véhicules utilitaires légers et poids lourds), utilisateur final (ADAS et systèmes de sécurité, systèmes de communication, systèmes d'infodivertissement, système de contrôle et de confort de la carrosserie, gestion du moteur et groupe motopropulseur, gestion du véhicule et télématique, conduite autonome, application IHM et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des logiciels automobiles en Amérique du Nord

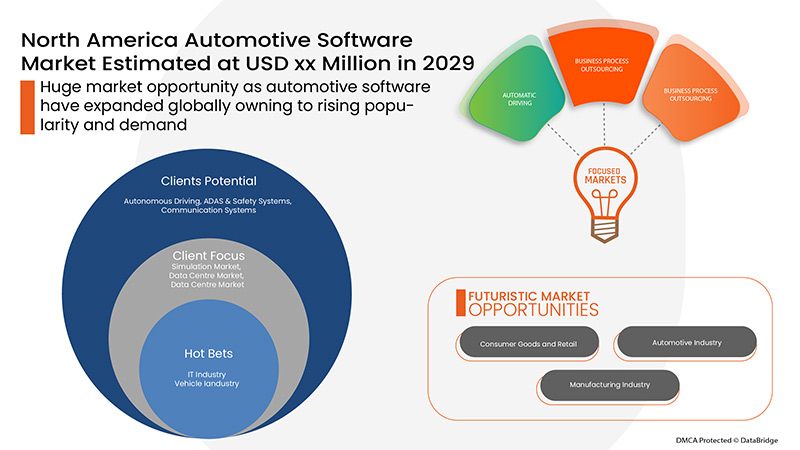

Les fournisseurs de services ont continuellement cherché des moyens d'augmenter la précision du travail, d'améliorer les services, la sécurité et de travailler avec une technologie croissante. L'exigence pour ces raisons est satisfaite par la mise en œuvre du logiciel automobile car ils sont utilisés pour fournir des services améliorés, ininterrompus, gratuits et opportuns dans les opérations industrielles. Les logiciels automobiles dans diverses industries sont largement utilisés en raison de la demande croissante d'expérience client. Ils permettent aux industries d'améliorer leurs opérations et leur productivité. Les logiciels automobiles aident les utilisateurs finaux en fournissant de meilleures solutions automatisées sans intervention humaine et offrent une meilleure expérience de conduite. Le marché nord-américain des logiciels automobiles est en phase de croissance rapide en raison de la demande croissante d'électrifications dans les véhicules, ce qui stimule la demande de logiciels automobiles. Les entreprises lancent même de nouveaux produits pour gagner une plus grande part de marché.

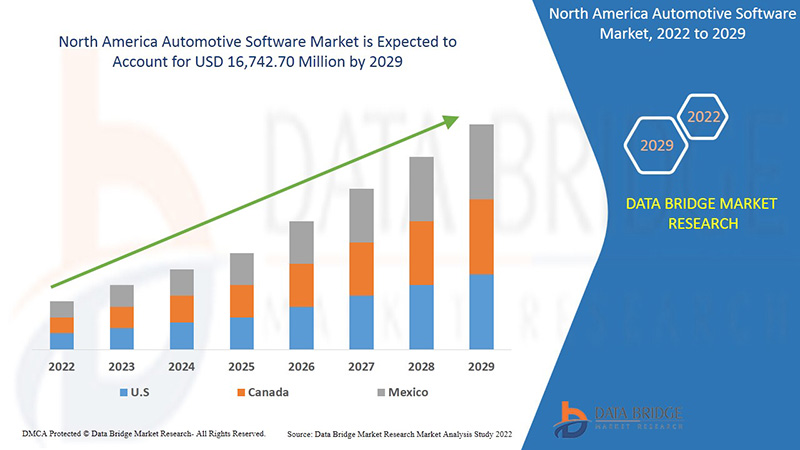

Selon les analyses de Data Bridge Market Research, le marché des logiciels automobiles devrait atteindre une valeur de 16 742,70 millions USD d'ici 2029, à un TCAC de 17,6 % au cours de la période de prévision. Les « services d'Amérique du Nord » représentent le segment d'offre le plus important sur le marché des logiciels automobiles. Le service d'Amérique du Nord fournit des informations précises qui sont utilisées pour développer un réseau IoT de haute précision. Le rapport sur le marché des logiciels automobiles couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par offre (solutions et services), taille de l'organisation (organisations à grande échelle, organisation à moyenne échelle et organisation à petite échelle), couche logicielle (système d'exploitation, intergiciel et logiciel d'application), utilitaire EV (gestion de la charge, gestion de la batterie et V2G), type de véhicule (voitures particulières, véhicules électriques, véhicules utilitaires légers et poids lourds), utilisateur final (ADAS et systèmes de sécurité, systèmes de communication, systèmes d'infodivertissement, contrôle de la carrosserie et système de confort, gestion du moteur et groupe motopropulseur, gestion du véhicule et télématique, conduite autonome, application IHM et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord |

|

Acteurs du marché couverts |

LUXOFT, UNE SOCIÉTÉ DE TECHNOLOGIE DXC, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre autres. |

Définition du marché

L'industrie automobile comprend un large éventail d'entreprises et d'organisations impliquées dans la conception, le développement, la fabrication, la commercialisation et la vente de véhicules automobiles. C'est l'une des plus grandes industries du monde en termes de chiffre d'affaires. C'est également l'industrie qui dépense le plus en recherche et développement. NXP propose une large gamme d'outils logiciels automobiles conçus pour vous aider à simplifier et à réduire le temps nécessaire à la construction d'ECU basés sur des microcontrôleurs NXP (MCU). Cela comprend des logiciels d'exécution et intégrés, des logiciels, des boîtes à outils compatibles MATLAB/Simulink, un large éventail de pilotes, de bibliothèques, de piles et de logiciels de chargeur de démarrage. NXP fournit également des outils d'initialisation de MCU et un support de génération de code automatique pour les couches d'abstraction de microcontrôleur AUTOSAR (MCAL) et les systèmes d'exploitation (OS). Notre équipe dédiée d'ingénieurs professionnels peut étendre vos capacités en fournissant des formations, des conseils, des services de développement et de personnalisation sur un large éventail d'espaces d'application et de technologies.

Dynamique du marché des logiciels automobiles

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Augmentation de l'adoption des fonctions ADAS dans les automobiles

L'industrie automobile a connu d'énormes développements, mais les systèmes avancés d'aide à la conduite (ADAS) constituent l'une des évolutions majeures. Ce système garantit davantage de mesures de sécurité pour les véhicules, ce qui explique l'augmentation de la demande d'ADAS d'année en année. Cette innovation technologique pour l'industrie automobile a créé une popularité pour la sécurité et les avantages associés au nouveau système, ce qui a créé une demande d'adoption de l'électronique intégrée via des applications logicielles.

- Augmentation du nombre de véhicules connectés

De nos jours, les véhicules connectés semblent être une nouvelle norme dans l'industrie automobile, équipés de fonctionnalités intelligentes et pratiques. Les véhicules sont équipés de cartes SIM ou de chipsets avec accès Internet et d'applications pour véhicules fonctionnant via des smartphones, ce qui permet de contrôler à distance les fonctions d'un véhicule telles que le verrouillage/déverrouillage des portes, la climatisation, la localisation du véhicule et de nombreuses autres fonctionnalités.

- Demande croissante de véhicules électriques

Les véhicules électriques (VE) sont conçus pour être une technologie prometteuse pour parvenir à un transport durable avec zéro émission de carbone, un faible bruit et une efficacité élevée. De plus, les véhicules électriques ont évolué au 19e siècle, mais en raison du manque de progrès technologique, les véhicules à moteur à combustion interne ont connu une demande énorme par rapport aux véhicules électriques.

Les véhicules électriques sont fortement intégrés aux logiciels automobiles et présentent divers avantages qui sont concentrés par divers pays et formulent des réglementations et des politiques pour stimuler les véhicules électriques qui aident à contrôler les émissions de carbone et à éviter le réchauffement de l'Amérique du Nord.

- Protocoles standards inappropriés pour le développement de plateformes logicielles

Les progrès technologiques augmentent d'année en année, ce qui entraîne l'évolution de meilleurs logiciels automobiles sans un ensemble particulier de normes pour les développements de logiciels, ce qui conduit à une variété de protocoles et d'interfaces utilisateur qui peuvent être difficiles à intégrer dans les opérations, ce qui conduit à restreindre le marché des logiciels automobiles.

- Manque d’infrastructures de connectivité

L’investissement pour le développement de la connectivité des véhicules comprend l’infrastructure qui soutient la technologie et l’exploitation. Cela comprend les villes et les routes intelligentes dotées d’une cartographie à haute fréquence ou basée sur la vision qui facilitera le bon fonctionnement de la conduite autonome équipée de systèmes de conduite autonome avec la nécessité d’informations actualisées pour une meilleure navigation des véhicules et une meilleure connectivité.

- Besoin d'une maintenance importante du logiciel

La mise à jour régulière du logiciel permet le développement d'une nouvelle architecture logicielle qui conduit à des changements dans l'interface, les protocoles et la technologie qui pourraient ne pas intégrer les opérations avec les anciens composants mécaniques et entraîner des problèmes d'utilisation qui entravent la sécurité et la connectivité des véhicules.

Ainsi, il est très clair que la maintenance des logiciels automobiles est limitée à un certain niveau au-delà duquel le coût de maintenance augmente rapidement en raison de la maintenance d'autres composants et dispositifs connexes sans lesquels le véhicule peut être déclaré impropre et dangereux à l'utilisation.

Impact de la pandémie de COVID-19 sur le marché des logiciels automobiles

La COVID-19 a eu un impact majeur sur le marché des logiciels automobiles, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des logiciels automobiles est due à l'augmentation de l'utilisation d'équipements électroniques dans les véhicules et également à la promotion par de nombreuses organisations gouvernementales de l'utilisation de véhicules électriques pour réduire les émissions. Cependant, le COVID-19 a eu un effet négatif sur le marché des logiciels automobiles, car les ventes de véhicules dans de nombreux pays ont été interrompues et la plupart des entreprises ont dû fermer temporairement leurs activités pendant près d'un mois.

De plus, après la situation de pandémie, les consommateurs n'étaient pas disposés à acheter de nouveaux véhicules en raison de la perturbation de l'économie dans de nombreux pays, ce qui a directement affecté la croissance des ventes d'automobiles et a eu un impact sur la croissance du marché des logiciels automobiles.

Développement récent

- En janvier 2022, Aptiv a annoncé une collaboration avec Sophia Velastegui. Cette collaboration a été annoncée pour accélérer les technologies des logiciels de mobilité. Les entreprises tireront parti de leur expertise en intelligence artificielle (IA) pour le développement de produits. L'entreprise sera en mesure de commercialiser et d'élargir son portefeuille de produits avec des produits améliorés.

- En juin 2019, Alphabet Inc. a annoncé l'acquisition de Looker pour 2,6 milliards de dollars. Cette acquisition a permis à l'entreprise d'améliorer ses offres de plateformes de business intelligence, d'applications de données et d'analyses intégrées, permettant ainsi à ses clients de mener à bien leur transformation numérique.

Portée du marché des logiciels automobiles en Amérique du Nord

Le marché des logiciels automobiles est segmenté en fonction des offres, de la taille de l'entreprise, de la couche logicielle, de l'utilitaire EV, du type de véhicule et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- Services

Sur la base de l’offre, le marché nord-américain des logiciels automobiles est segmenté en solutions et services.

Taille de l'organisation

- Organisations à grande échelle

- Organisations de taille moyenne

- Organisations à petite échelle

Sur la base de la taille de l'organisation, le marché nord-américain des logiciels automobiles a été segmenté en organisations à grande échelle, organisations à moyenne échelle et organisations à petite échelle.

Couche logicielle

- Systèmes d'exploitation

- Intergiciel

- Logiciel d'application

Sur la base de la couche logicielle, le marché nord-américain des logiciels automobiles a été segmenté en systèmes d'exploitation, intergiciels et logiciels d'application.

Type de véhicule

- Voitures de tourisme

- Véhicules électriques

- Véhicules utilitaires légers

- Véhicules lourds

Sur la base du type de véhicule, le marché nord-américain des logiciels automobiles a été segmenté en voitures particulières, véhicules électriques, véhicules utilitaires légers et véhicules lourds.

Utilitaire EV

- Gestion de la charge

- Gestion de la batterie

- V2G

Sur la base de l'utilité des véhicules électriques, le marché nord-américain des logiciels automobiles a été segmenté en gestion de charge, gestion de batterie et V2G.

Utilisateur final

- Systèmes ADAS et de sécurité

- Systèmes de communication

- Systèmes d'infodivertissement

- Gestion du moteur et groupe motopropulseur

- Gestion de véhicules et télématique

- Système de contrôle et de confort du corps

- Conduite autonome

- Application IHM

- Autres

Sur la base de l'utilisateur final, le marché nord-américain des logiciels automobiles a été segmenté en systèmes ADAS et de sécurité, systèmes de communication, systèmes d'infodivertissement, gestion du moteur et groupe motopropulseur, gestion du véhicule et télématique, contrôle de la carrosserie et système de confort, conduite autonome, application IHM et autres.

Analyse/perspectives régionales du marché des logiciels automobiles

Le marché des logiciels automobiles est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, offre, type de véhicule, couche logicielle, utilitaire EV, taille de l'organisation et industrie d'utilisation finale, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des logiciels automobiles sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent la région Amérique du Nord en raison de l’essor des systèmes de conduite autonome et de l’augmentation du développement de solutions de luxe pour les véhicules.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des logiciels automobiles

Le paysage concurrentiel du marché des logiciels automobiles fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des logiciels automobiles.

Certains des principaux acteurs opérant sur le marché des logiciels automobiles sont LUXOFT, A DXC TECHNOLOGY COMPANY, Vector Informatik GmbH, Sigma Software, NVIDIA Corporation, Aptiv, Elektrobit, KPIT, NXP Semiconductors, aiMotive, Siemens, Intellias, Hexagon AB, OXBOTICA, Lynx Software Technologies, Renesas Electronics Corporation, Intel Corporation, Blackberry Limited, Airbiquity Inc., Green Hills Software, Robert Bosch GmbH, Wind River Systems, Inc., Alphabet Inc., Autonet Mobile, Inc, MONTAVISTA SOFTWARE LLC., Microsoft entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP AUTOMOTIVE SOFTWARE COMPANIES

4.1.1 CASE STUDIES-

4.1.2 IDENTIFYING THE PROBLEM:

4.1.3 SOLUTION:

4.1.4 IDENTIFYING THE PROBLEM:

4.1.5 SOLUTIONS:

4.1.6 RND (RESEARCH AND DEVELOPMENT) AND NRE (NON-RECURRING ENGINEERING) STRUCTURES ON VARIED DEVELOPMENT PHASES ON TOP PLAYERS

4.1.7 ALPHABET INC.

4.1.8 NXP SEMICONDUCTORS

4.1.9 MICROSOFT

4.1.10 NVIDIA CORPORATION

4.2 TREND ANALYSIS:

4.2.1 ADVANCED CONNECTIVITY

4.2.2 ARTIFICIAL INTELLIGENCE

4.2.3 AUTONOMOUS DRIVING

4.2.4 SAFETY ENHANCEMENTS

4.2.5 AUGMENTED REALITY

4.2.6 PRICING ANALYSIS

5 PORTER’S FIVE FORCES MODEL

6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

6.1 ASIA-PACIFIC

6.2 EUROPE

6.3 NORTH AMERICA

6.4 THE MIDDLE EAST AND AFRICA

6.5 SOUTH AMERICA

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES

8.1.2 RISE IN THE NUMBER OF CONNECTED VEHICLES

8.1.3 RISING DEMAND FOR ELECTRIC VEHICLES

8.2 RESTRAINTS

8.2.1 IMPROPER STANDARD PROTOCOLS FOR THE DEVELOPMENT OF SOFTWARE PLATFORMS

8.2.2 LACK OF CONNECTIVITY INFRASTRUCTURES

8.2.3 NEED FOR HIGH MAINTENANCE OF SOFTWARE

8.3 OPPORTUNITIES

8.3.1 RISE IN THE POTENTIAL FOR ARTIFICIAL INTELLIGENCE

8.3.2 REQUIREMENT OF CONNECTIVITY FOR BETTER FLEET MANAGEMENT

8.3.3 UPSURGE OF ELECTRONIC APPLICATIONS IN VEHICLES

8.4 CHALLENGES

8.4.1 LACK OF QUALITY AND SECURITY CONCERNS

8.4.2 EXPONENTIAL GROWTH OF SOFTWARE COSTS FOR VEHICLES

8.4.3 RISE IN COMPLEXITY FOR THE DEVELOPMENT

9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING

9.1 OVERVIEW

9.2 SERVICES

9.2.1 INTEGRATION & IMPLEMENTATION

9.2.2 DESIGNING

9.2.3 TESTING

9.2.3.1 UNIT TESTING

9.2.3.2 SYSTEM TESTING

9.2.3.3 INTEGRATION TESTING

9.2.3.4 VALIDATION & VERIFICATION

9.2.4 OTHERS

9.3 SOLUTION

10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE SCALE ORGANIZATIONS

10.3 MEDIUM SCALE ORGANIZATIONS

10.4 SMALL SCALE ORGANIZATIONS

11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.2.1 HATCHBACK

11.2.2 SEDAN

11.2.3 COMPACT

11.2.4 OTHERS

11.3 ELECTRIC VEHICLES

11.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

11.3.2 HYBRID ELECTRIC VEHICLES (HEVS)

11.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

11.4 LIGHT COMMERCIAL VEHICLES

11.4.1 MINIVANS

11.4.2 PICK-UP TRUCKS

11.4.3 AUTORICKSHAWS

11.4.4 OTHERS

11.5 HEAVY DUTY VEHICLES

11.5.1 EXCAVATOR

11.5.2 SUPER LOADER

11.5.3 CRANES

11.5.4 OTHERS

12 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER

12.1 OVERVIEW

12.2 OPERATING SYSTEM

12.3 APPLICATION SOFTWARE

12.4 MIDDLEWARE

13 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY

13.1 OVERVIEW

13.2 CHARGING MANAGEMENT

13.3 BATTERY MANAGEMENT

13.4 V2G

14 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USE

14.1 OVERVIEW

14.2 ADAS & SAFETY SYSTEMS

14.2.1 PASSENGER CARS

14.2.1.1 HATCHBACK

14.2.1.2 SEDAN

14.2.1.3 COMPACT

14.2.1.4 OTHERS

14.2.2 ELECTRIC VEHICLES

14.2.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.2.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.2.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.2.3 LIGHT COMMERCIAL VEHICLES

14.2.3.1 MINIVANS

14.2.3.2 PICK-UP TRUCKS

14.2.3.3 AUTORICKSHAWS

14.2.3.4 OTHERS

14.2.4 HEAVY DUTY VEHICLES

14.2.4.1 EXCAVATOR

14.2.4.2 SUPER LOADER

14.2.4.3 CRANES

14.2.4.4 OTHERS

14.3 COMMUNICATION SYSTEMS

14.3.1 PASSENGER CARS

14.3.1.1 HATCHBACK

14.3.1.2 SEDAN

14.3.1.3 COMPACT

14.3.1.4 OTHERS

14.3.2 ELECTRIC VEHICLES

14.3.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.3.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.3.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.3.3 LIGHT COMMERCIAL VEHICLES

14.3.3.1 MINIVANS

14.3.3.2 PICK-UP TRUCKS

14.3.3.3 AUTORICKSHAWS

14.3.3.4 OTHERS

14.3.4 HEAVY DUTY VEHICLES

14.3.4.1 EXCAVATOR

14.3.4.2 SUPER LOADER

14.3.4.3 CRANES

14.3.4.4 OTHERS

14.4 INFOTAINMENT SYSTEMS

14.4.1 PASSENGER CARS

14.4.1.1 HATCHBACK

14.4.1.2 SEDAN

14.4.1.3 COMPACT

14.4.1.4 OTHERS

14.4.2 ELECTRIC VEHICLES

14.4.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.4.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.4.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.4.3 LIGHT COMMERCIAL VEHICLES

14.4.3.1 MINIVANS

14.4.3.2 PICK-UP TRUCKS

14.4.3.3 AUTORICKSHAWS

14.4.3.4 OTHERS

14.4.4 HEAVY DUTY VEHICLES

14.4.4.1 EXCAVATOR

14.4.4.2 SUPER LOADER

14.4.4.3 CRANES

14.4.4.4 OTHERS

14.5 VEHICLE MANAGEMENT & TELEMATICS SYSTEMS

14.5.1 PASSENGER CARS

14.5.1.1 HATCHBACK

14.5.1.2 SEDAN

14.5.1.3 COMPACT

14.5.1.4 OTHERS

14.5.2 ELECTRIC VEHICLES

14.5.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.5.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.5.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.5.3 LIGHT COMMERCIAL VEHICLES

14.5.3.1 MINIVANS

14.5.3.2 PICK-UP TRUCKS

14.5.3.3 AUTORICKSHAWS

14.5.3.4 OTHERS

14.5.4 HEAVY DUTY VEHICLES

14.5.4.1 EXCAVATOR

14.5.4.2 SUPER LOADER

14.5.4.3 CRANES

14.5.4.4 OTHERS

14.6 ENGINE MANAGEMENT & POWERTRAIN

14.6.1 PASSENGER CARS

14.6.1.1 HATCHBACK

14.6.1.2 SEDAN

14.6.1.3 COMPACT

14.6.1.4 OTHERS

14.6.2 ELECTRIC VEHICLES

14.6.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.6.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.6.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.6.3 LIGHT COMMERCIAL VEHICLES

14.6.3.1 MINIVANS

14.6.3.2 PICK-UP TRUCKS

14.6.3.3 AUTORICKSHAWS

14.6.3.4 OTHERS

14.6.4 HEAVY DUTY VEHICLES

14.6.4.1 EXCAVATOR

14.6.4.2 SUPER LOADER

14.6.4.3 CRANES

14.6.4.4 OTHERS

14.7 BODY CONTROL & COMFORT SYSTEM

14.7.1 PASSENGER CARS

14.7.1.1 HATCHBACK

14.7.1.2 SEDAN

14.7.1.3 COMPACT

14.7.1.4 OTHERS

14.7.2 ELECTRIC VEHICLES

14.7.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.7.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.7.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.7.3 LIGHT COMMERCIAL VEHICLES

14.7.3.1 MINIVANS

14.7.3.2 PICK-UP TRUCKS

14.7.3.3 AUTORICKSHAWS

14.7.3.4 OTHERS

14.7.4 HEAVY DUTY VEHICLES

14.7.4.1 EXCAVATOR

14.7.4.2 SUPER LOADER

14.7.4.3 CRANES

14.7.4.4 OTHERS

14.8 HMI APPLICATION

14.8.1 PASSENGER CARS

14.8.1.1 HATCHBACK

14.8.1.2 SEDAN

14.8.1.3 COMPACT

14.8.1.4 OTHERS

14.8.2 6.2.2 ELECTRIC VEHICLES

14.8.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.8.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.8.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.8.3 LIGHT COMMERCIAL VEHICLES

14.8.3.1 MINIVANS

14.8.3.2 PICK-UP TRUCKS

14.8.3.3 AUTORICKSHAWS

14.8.3.4 OTHERS

14.8.4 HEAVY DUTY VEHICLES

14.8.4.1 EXCAVATOR

14.8.4.2 SUPER LOADER

14.8.4.3 CRANES

14.8.4.4 OTHERS

14.9 AUTONOMOUS DRIVING

14.9.1 PASSENGER CARS

14.9.1.1 HATCHBACK

14.9.1.2 SEDAN

14.9.1.3 COMPACT

14.9.1.4 OTHERS

14.9.2 ELECTRIC VEHICLES

14.9.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.9.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.9.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.9.3 LIGHT COMMERCIAL VEHICLES

14.9.3.1 MINIVANS

14.9.3.2 PICK-UP TRUCKS

14.9.3.3 AUTORICKSHAWS

14.9.3.4 OTHERS

14.9.4 HEAVY DUTY VEHICLES

14.9.4.1 EXCAVATOR

14.9.4.2 SUPER LOADER

14.9.4.3 CRANES

14.9.4.4 OTHERS

14.1 OTHERS

14.10.1 PASSENGER CARS

14.10.1.1 HATCHBACK

14.10.1.2 SEDAN

14.10.1.3 COMPACT

14.10.1.4 OTHERS

14.10.2 ELECTRIC VEHICLES

14.10.2.1 BATTERY ELECTRIC VEHICLES (BEVS)

14.10.2.2 HYBRID ELECTRIC VEHICLES (HEVS)

14.10.2.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

14.10.3 LIGHT COMMERCIAL VEHICLES

14.10.3.1 MINIVANS

14.10.3.2 PICK-UP TRUCKS

14.10.3.3 AUTORICKSHAWS

14.10.3.4 OTHERS

14.10.4 HEAVY DUTY VEHICLES

14.10.4.1 EXCAVATOR

14.10.4.2 SUPER LOADER

14.10.4.3 CRANES

14.10.4.4 OTHERS

15 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 APTIV

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ALPHABET INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 NXP SEMICONDUCTORS.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MICROSOFT

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NVIDIA CORPORATION.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AIMOTIVE

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 AIRBIQUITY INC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AUTONET MOBILE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BLACKBERRY LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ELEKTROBIT

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GREEN HILLS SOFTWARE

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HEXAGON AB

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 INTEL CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 INTELLIAS

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 KPIT

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LUXOFT, A DXC TECHNOLOGY COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 LYNX SOFTWARE TECHNOLOGIES

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 1.1RECENT DEVELOPMENT

18.18 MONTAVISTA SOFTWARE, LLC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 OXBOTICA

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RENESAS ELECTRONICS CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 ROBERT BOSCH GMBH

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIEMENS

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 SIGMA SOFTWARE

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 VECTOR INFORMATIK GMBH

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENTS

18.25 WIND RIVER SYSTEMS, INC.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 THE BELOW TABLE CLEARLY SHOWS THE OEM INVESTING SOFTWARE RESEARCH AND DEVELOPMENT AND ACCORDINGLY, THE COMPANIES FACE DISRUPTION IN COMPETING WITH THE MARKET PLAYERS.

TABLE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOLUTION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MEDIUM SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE , 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OPERATING SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA APPLICATION SOFTWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MIDDLEWARE IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CHARGING MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA BATTERY MANAGEMENT IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA V2G IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER , 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BODY CONTROL & COMFORT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 107 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NORTH AMERICA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 112 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NORTH AMERICA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 117 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 NORTH AMERICA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 122 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NORTH AMERICA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 127 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NORTH AMERICA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 NORTH AMERICA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 NORTH AMERICA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.S. AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 142 U.S. SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.S. TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 U.S. AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 U.S. ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 150 U.S. AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 151 U.S. AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 152 U.S. AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 U.S. ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 154 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 U.S. LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 U.S. COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 U.S. INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 164 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 U.S. VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 169 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 U.S. ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 U.S. BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 179 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 U.S. HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 184 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 U.S. AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 189 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 U.S. OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 U.S. ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 CANADA AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 199 CANADA SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 CANADA TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 202 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 CANADA AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 207 CANADA AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 208 CANADA AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 CANADA AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 210 CANADA ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 CANADA LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CANADA COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 216 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 219 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 CANADA INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 221 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 CANADA VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 CANADA ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 231 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 CANADA BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 CANADA HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 241 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 CANADA AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 246 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 CANADA OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 251 CANADA PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 CANADA ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 CANADA LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 CANADA HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 MEXICO SERVICES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MEXICO TESTING IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 259 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 MEXICO ELECTRIC VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY SOFTWARE LAYER, 2020-2029 (USD MILLION)

TABLE 264 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY EV UTILITY, 2020-2029 (USD MILLION)

TABLE 265 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 266 MEXICO AUTOMOTIVE SOFTWARE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 MEXICO ADAS & SAFETY SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 268 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 MEXICO LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 MEXICO COMMUNICATION SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 273 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 MEXICO INFOTAINMENT SYSTEMS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 MEXICO VEHICLE MANAGEMENT & TELEMATICS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 283 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MEXICO ENGINE MANAGEMENT & POWERTRAIN IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 288 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 289 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 MEXICO BODY CONTROL & COMFORT SYSTEM IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 293 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 MEXICO HMI APPLICATION IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 298 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 MEXICO AUTONOMOUS DRIVING IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 303 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 MEXICO OTHERS IN AUTOMOTIVE SOFTWARE MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 308 MEXICO PASSENGER CARS IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 309 MEXICO ELECTRIC VEHICLE IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 310 MEXICO LIGHT COMMERCIAL VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 311 MEXICO HEAVY DUTY VEHICLES IN AUTOMOTIVE SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SEGMENTATION

FIGURE 11 RISE IN ADOPTION OF ADAS FEATURES IN AUTOMOBILES IS EXPECTED TO DRIVE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 OFFERING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 AUTOMOTIVE AI MARKET SIZE

FIGURE 16 WORLDWIDE ELECTRONIC SYSTEM CAGR (IN %)

FIGURE 17 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY VEHICLE TYPE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY SOFTWARE LAYER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY EV UTILITY, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET, BY END USER

FIGURE 23 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE SOFTWARE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.