Marché nord-américain des communications audio critiques, par type de produit (matériel et services), connectivité (sans fil et filaire), utilisation finale (sécurité publique, transport, exploitation minière, services publics et autres) – Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des communications audio critiques en Amérique du Nord

Les solutions de communication audio critiques sont un mode de communication utilisé dans les situations critiques telles que les urgences, les catastrophes et les pannes. Les systèmes et technologies de communication critiques ont récemment gagné en popularité auprès des consommateurs en raison de l'importance croissante de la protection des villes, des organisations et des sites patrimoniaux critiques contre les activités criminelles, les urgences, les catastrophes et autres. La communication critique joue un rôle essentiel pour répondre à ces demandes du consommateur. C'est l'une des principales raisons de cette croissance.

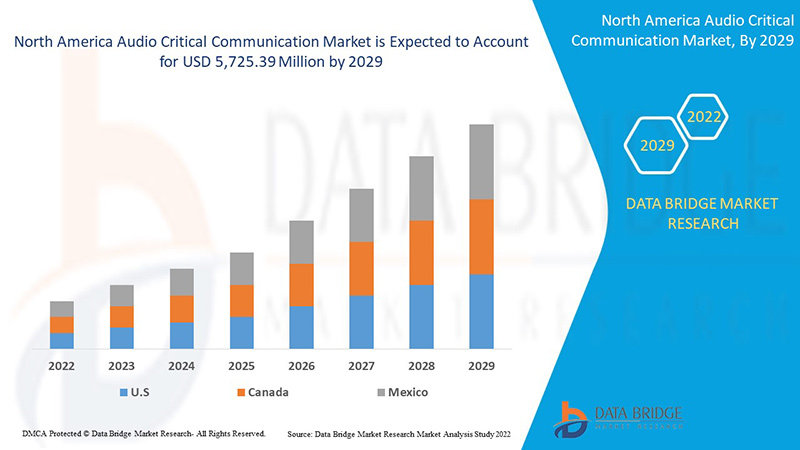

Selon les analyses de Data Bridge Market Research, le marché des communications critiques audio devrait atteindre la valeur de 5 725,39 millions USD d'ici 2029, à un TCAC de 7,3 % au cours de la période de prévision. Le « matériel » représente le segment système le plus important sur le marché des communications critiques audio. Le rapport sur le marché des communications critiques audio couvre également en profondeur l'analyse des prix, les études de cas et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Valeurs en millions USD |

|

Segments couverts |

Par type de produit (matériel et services), connectivité (sans fil et filaire), utilisation finale (sécurité publique, transport, exploitation minière, services publics et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord |

|

Acteurs du marché couverts |

Motorola Solutions, Inc., L3Harris Technologies, Inc., Hytera Communications Corporation Limited, EFJohnson Technologies., Leonardo SpA, Zenitel Group, Flottweg SE, Telstra, Ascom Holding AG, Nokia, Mentura Group Oy, Tait Communications, Secure Land Communications (Airbus / SLC), Simoco Wireless Solutions, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T, ZTE Corporation, Cobham Satcom, Inmarsat North America Limited, entre autres |

Définition du marché

Les solutions de communication audio critiques sont un mode de communication utilisé dans les situations critiques telles que les urgences, les catastrophes et les pannes. Les communications critiques comprennent les systèmes de télécommunication mobile et radio et d'autres appareils qui assurent une communication fiable et sécurisée dans toutes les situations. Il existe différents modes de communication critiques, tels que les communications critiques pour l'entreprise, les communications critiques pour la mission, les communications critiques pour la sécurité et les communications critiques pour la sécurité, en fonction des différents modes utilisés par votre organisation. Les communications critiques peuvent être vitales dans un large éventail de tâches et d'activités critiques pour la sécurité, telles que les opérations de levage, les interventions d'urgence et la coordination entre différentes parties.

Dynamique du marché de la communication critique audio

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

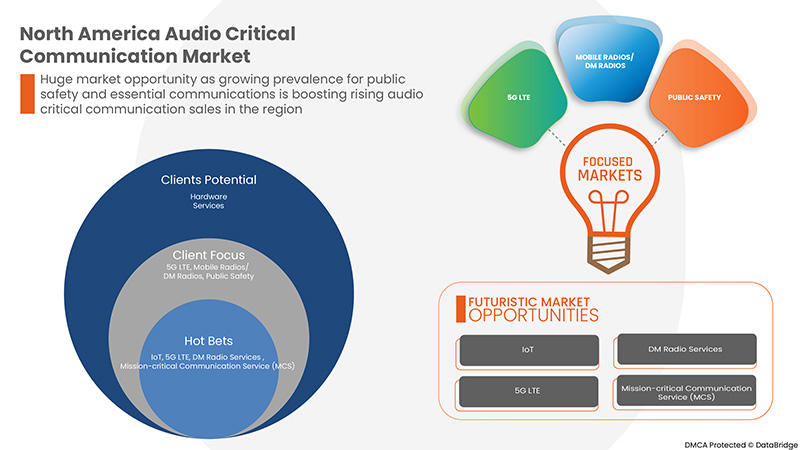

- Tendance vers l'IoT critique pour la mission et la numérisation du secteur

Ces dernières années, l'écosphère de l'IoT a connu une évolution progressive. Cette écosphère est desservie par divers composants électroniques standard, c'est-à-dire le matériel intégré à divers logiciels. L'importance de l'utilisation de ces technologies à l'ère de l'IoT est une nécessité absolue pour le marché nord-américain des communications audio critiques. Avec les progrès technologiques, les entreprises s'orientent également vers la numérisation pour répondre à la demande croissante des consommateurs en matière de capacités avancées dans le secteur des communications.

- Augmentation de la pénétration des smartphones, tablettes et ordinateurs portables dans la communication critique

Les téléphones portables numériques sans fil modernes doivent fonctionner comme un véritable centre de communication qui apporte une large gamme de fonctionnalités intelligentes au secteur de la téléphonie mobile. Celles-ci incluent la navigation sur le Web, la messagerie électronique, le PDA sans fil, la fonction de mémo vocal, la radiomessagerie bidirectionnelle, le répondeur et le système de positionnement nord-américain (GPS) dans une seule entité.

- Solutions de communication par satellite protégées pour les communications critiques

La communication par satellite est un type de télécommunication moderne dans lequel des satellites artificiels assurent des liaisons de communication entre différents points de la Terre. Les communications par satellite jouent un rôle important dans de nombreuses industries pour la continuité des activités et la gestion des urgences dans divers secteurs d'activité tels que le pétrole et le gaz , l'IoT, la santé, le gouvernement, le maritime, l'exploitation minière, etc. De plus, les communications par satellite sont diverses applications commerciales, gouvernementales et militaires. Selon le Forum économique mondial en 2020, 2 666 satellites opérationnels tournent autour de la Terre, dont 1 007 satellites sont utilisés uniquement pour les services de communication et 446 pour l'observation de la Terre et 97 à des fins de navigation/GPS.

- Menaces à la cybersécurité et à la confidentialité dans les communications critiques

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont une faiblesse que les pirates exploitent pour effectuer des actions non autorisées au sein d'un système. Selon la récente enquête sur la cybersécurité maritime menée par Safety at Sea et BIMCO, au cours des 12 mois précédant février 2020, 31 % des organisations ont été victimes de cyberattaques, ce qui représente une augmentation de 9 % par rapport à 2019. Selon un autre rapport publié par Robert Rizika, responsable des opérations nord-américaines chez Naval Dome, les cyberattaques sur la technologie opérationnelle (OT) de l'industrie maritime ont augmenté de 900 %, passant de 50 % en 2017 à 120 % et 310 % en 2018 et 2019 respectivement.

- Manque de capacité de spectre disponible pour les services de communication critiques

Le spectre désigne les plages de fréquences radio invisibles que les signaux sans fil parcourent sur un support donné. Ces signaux, en raison de signaux alloués, nous permettent de passer des appels depuis nos appareils mobiles, d'identifier nos amis sur les plateformes de médias sociaux et d'obtenir des indications sur une destination et un emplacement sur les appareils mobiles. Les fréquences que nous utilisons pour les communications sans fil font partie du spectre électromagnétique. Le spectre électromagnétique complet s'étend de 3 Hz à 300 EHz. La partie utilisée pour les communications sans fil se situe dans les plages d'environ 20 KHz à 300 GHz

Impact post-COVID-19 sur le marché des communications audio critiques

La COVID-19 a eu un impact majeur sur le marché des communications audio critiques, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des communications audio critiques augmente en raison des politiques gouvernementales visant à stimuler le commerce international après la pandémie. De plus, les préoccupations croissantes concernant la sécurité publique et les investissements gouvernementaux augmentent la demande de communications audio critiques sur le marché. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le marché de la communication audio critique. Grâce à cela, les entreprises apporteront des solutions avancées et précises au marché. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développement récent

- En juin 2022, Motorola Solutions, Inc. a lancé le MXP7000, un appareil portable de communication tout-en-un pour les missions critiques. La principale caractéristique de cet appareil était ses communications voix et données unifiées TETRA et 4G LTE pour améliorer la connaissance de la situation, la sécurité et la productivité des forces armées et de la sécurité publique. Grâce à cela, l'entreprise a gagné la confiance de ses consommateurs en proposant des produits innovants

- En juin 2021, L3Harris Technologies, Inc. a lancé la radio XL Extreme 400 P25, une solution de communication essentielle. La principale caractéristique de cet ensemble radio était sa durabilité, car il a été spécialement conçu pour résister aux normes les plus rigoureuses jamais soumises aux radios portables. Cette entreprise a élargi ses parts de marché et a gagné la confiance de ses consommateurs.

Portée du marché nord-américain des communications audio critiques

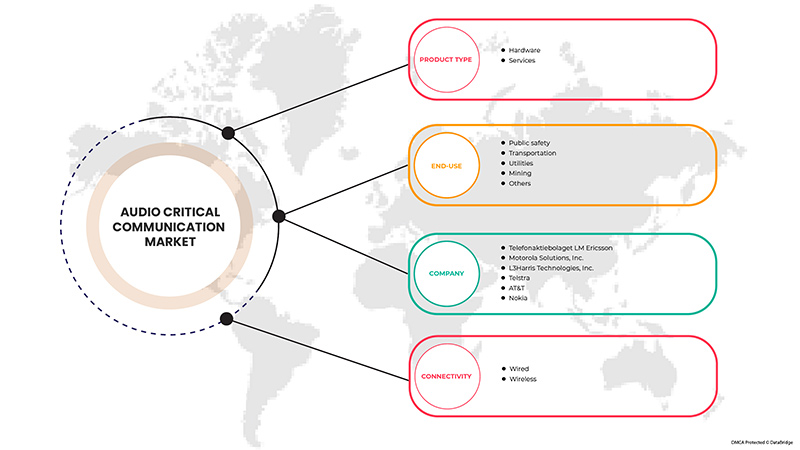

Le marché des communications audio critiques est segmenté en fonction du type de produit, de la connectivité et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type de produit

- Matériel

- Services

Sur la base du type de produit, le marché nord-américain des communications audio critiques est segmenté en matériel et services.

Par connectivité

- Sans fil

- Câblé

Sur la base de la connectivité, le marché nord-américain des communications audio critiques a été segmenté en sans fil et filaire.

Par utilisation finale

- Sécurité publique

- Transport

- Exploitation minière

- Utilitaires

- Autres

Sur la base de l'utilisation finale, le marché nord-américain des communications audio critiques a été segmenté en sécurité publique, transports, mines, services publics et autres.

Analyse/perspectives régionales du marché de la communication critique audio

Le marché des communications critiques audio est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de produit, connectivité et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des communications critiques audio sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent le marché des communications audio critiques et devraient être le marché nord-américain des communications audio critiques qui connaîtra la croissance la plus rapide. Le marché américain des communications audio critiques devrait connaître la croissance la plus rapide de la région.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la communication critique audio

Le paysage concurrentiel du marché des communications critiques audio fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des communications critiques audio.

Certains des principaux acteurs opérant sur le marché des communications critiques audio sont Motorola Solutions, Inc., L3Harris Technologies, Inc., Hytera Communications Corporation Limited, EFJohnson Technologies., Leonardo SpA, Zenitel Group, Flottweg SE, Telstra, Ascom Holding AG, Nokia, Mentura Group Oy, Tait Communications, Secure Land Communications (Airbus / SLC), Simoco Wireless Solutions, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., AT&T, ZTE Corporation, Cobham Satcom, Inmarsat Global Limited, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDY

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL ADVANCEMENT

4.4 VALUE CHAIN ANALYSIS

4.5 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCLINATION TOWARDS MISSION CRITICAL IOT & DIGITIZATION OF THE SECTOR

5.1.2 INCREASE IN PENETRATION OF SMARTPHONES, TABLETS AND LAPTOPS IN CRITICAL COMMUNICATION

5.1.3 PROTECTED SATELLITE COMMUNICATION SOLUTIONS FOR CRITICAL COMMUNICATION

5.1.4 EMERGENCE OF 4G/5G LTE BROADBAND CONNECTIVITY

5.1.5 ADVENT OF AI IN CRITICAL COMMUNICATION SERVICES

5.2 RESTRAINTS

5.2.1 CYBER SECURITY & PRIVACY THREATS IN CRITICAL COMMUNICATION

5.2.2 LACK OF AVAILABLE SPECTRUM CAPACITY FOR CRITICAL COMMUNICATION SERVICE

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR MISSION-CRITICAL COMMUNICATION SERVICE (MCS) FOR BUSINESS

5.3.2 GROWING PREVALENCE FOR PUBLIC SAFETY AND ESSENTIAL COMMUNICATIONS

5.3.3 INCREASING DEMAND FOR DM RADIO SERVICES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN SYSTEMS INCORPORATING TRUNKING AND DIGITAL CAPABILITIES

5.4.2 LATENCY & ACCESSIBILITY ISSUES FACED IN MISSION-CRITICAL COMMUNICATION SERVICE

6 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 INFRASTRUCTURE EQUIPMENT

6.2.2 COMMAND AND CONTROL SYSTEMS

6.2.3 END-USE DEVICES

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 INTEGRATION SERVICES

6.3.2.2 MAINTENANCE AND SUPPORT SERVICES

6.3.2.3 CONSULTING SERVICES

7 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 WIRELESS

7.3 WIRED

8 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 PUBLIC SAFETY

8.2.1 HARDWARE

8.2.1.1 INFRASTRUCTURE EQUIPMENT

8.2.1.2 COMMAND AND CONTROL SYSTEMS

8.2.1.3 END-USE DEVICES

8.2.2 SERVICES

8.2.2.1 MANAGED SERVICES

8.2.2.2 PROFESSIONAL SERVICES

8.2.2.2.1 INTEGRATION SERVICES

8.2.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.2.2.2.3 CONSULTING SERVICES

8.3 TRANSPORTATION

8.3.1 HARDWARE

8.3.1.1 INFRASTRUCTURE EQUIPMENT

8.3.1.2 COMMAND AND CONTROL SYSTEMS

8.3.1.3 END-USE DEVICES

8.3.2 SERVICES

8.3.2.1 MANAGED SERVICES

8.3.2.2 PROFESSIONAL SERVICES

8.3.2.2.1 INTEGRATION SERVICES

8.3.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.3.2.2.3 CONSULTING SERVICES

8.4 MINING

8.4.1 HARDWARE

8.4.1.1 INFRASTRUCTURE EQUIPMENT

8.4.1.2 COMMAND AND CONTROL SYSTEMS

8.4.1.3 END-USE DEVICES

8.4.2 SERVICES

8.4.2.1 MANAGED SERVICES

8.4.2.2 PROFESSIONAL SERVICES

8.4.2.2.1 INTEGRATION SERVICES

8.4.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.4.2.2.3 CONSULTING SERVICES

8.5 UTILITIES

8.5.1 HARDWARE

8.5.1.1 INFRASTRUCTURE EQUIPMENT

8.5.1.2 COMMAND AND CONTROL SYSTEMS

8.5.1.3 END-USE DEVICES

8.5.2 SERVICES

8.5.2.1 MANAGED SERVICES

8.5.2.2 PROFESSIONAL SERVICES

8.5.2.2.1 INTEGRATION SERVICES

8.5.2.2.2 MAINTENANCE AND SUPPORT SERVICES

8.5.2.2.3 CONSULTING SERVICES

8.6 OTHERS

9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY GEOGRAPHY

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 TELEFONAKTIEBOLAGET LM ERICSSON

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCTS PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 MOTOROLA SOLUTIONS, I.N.C.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCTS PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 L3HARRIS TECHNOLOGIES, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 SOLUTIONS PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 TELSTRA

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCTS PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 AT&T

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCTS PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 NOKIA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 SOLUTIONS PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 HUAWEI TECHNOLOGIES CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT & SOLUTION PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 LEONARDO S.P.A.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCTS PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 ZTE CORPORATION

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCTS PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 ASCOM HOLDING AG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 SOLUTIONS PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 COBHAM SATCOM

12.11.1 COMPANY SNAPSHOT

12.11.2 SOLUTION PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 EFJOHNSON TECHNOLOGIES.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCTS PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 HYTERA COMMUNICATIONS CORPORATION LIMITED

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCTS PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 INMARSAT NORTH AMERICA LIMITED

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCTS PORTFOLIO

12.14.3 RECENT DEVELOPMENTS

12.15 MENTURA GROUP OY

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCTS PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 SECURE LAND COMMUNICATIONS (AIRBUS / SLC)

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCTS PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SIMOCO WIRELESS SOLUTIONS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCTS PORTFOLIO

12.17.3 RECENT DEVELOPMENTS

12.18 TAIT COMMUNICATIONS

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCTS PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 ZENITEL GROUP

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCTS PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 VARIOUS AUDIO CRITICAL COMMUNICATION REGULATORY STANDARDS.

TABLE 2 FREQUENCY ALLOCATION

TABLE 3 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WIRELESS IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA WIRED IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA OTHERS IN AUDIO CRITICAL COMMUNICATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 62 U.S. AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 63 U.S. PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 84 CANADA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 85 CANADA PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 106 MEXICO AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO PUBLIC SAFETY IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO TRANSPORTATION IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO MINING IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO UTILITIES IN AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HARDWARE IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO PROFESSIONAL SERVICES IN AUDIO CRITICAL COMMUNICATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: DBMRMARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 11 EMERGENCE OF 4G/5G LTE BROAD BAND CONNECTIVITY IS EXPECTED TO DRIVE NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 TECHNOLOGICAL TRENDS IN AUDIO CRITICAL COMMUNICATIONS

FIGURE 15 VALUE CHAIN FOR AUDIO CRITICAL COMMUNICATION MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET

FIGURE 17 ADVANTAGES OF ADOPTING IOT TECHNOLOGIES IN CRITICAL COMMUNICATIONS BUSINESS

FIGURE 18 TOP 10 COUNTRIES WITH SMARTPHONE (IN MILLIONS)

FIGURE 19 TOTAL NUMBER OF ACTIVE COMMERCIAL SATELLITES IN EARTH'S ORBIT

FIGURE 20 ADVANTAGE OF 5G COMMUNICATION

FIGURE 21 ADVANTAGE OF AI CRITICAL COMMUNICATION CONSULTING SERVICES

FIGURE 22 ADVANTAGE OF AI CRITICAL COMMUNICATION CONSULTING SERVICES

FIGURE 23 MISSION CRITICAL SERVICES SCENARIO

FIGURE 24 OPTIMUM SCENARIO LATENCY IN 5G, 4G

FIGURE 25 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY PRODUCT TYPE, 2021

FIGURE 26 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY CONNECTIVITY, 2021

FIGURE 27 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET, BY END-USE, 2021

FIGURE 28 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 NORTH AMERICA AUDIO CRITICAL COMMUNICATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.