North America Artificial Turf Market

Taille du marché en milliards USD

TCAC :

%

USD

1.40 Billion

USD

5.90 Billion

2024

2032

USD

1.40 Billion

USD

5.90 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 5.90 Billion | |

|

|

|

|

Segmentation du marché nord-américain du gazon artificiel, par matière première (nylon, polypropylène, polyéthylène, polyamides, jute, caoutchouc, etc.), matériaux de remplissage (à base de pétrole, remplissage organique, remplissage de sable (silice), etc.), hauteur de poils (moins de 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm et plus de 100 mm), canal de distribution (vente directe/B2B, commerce électronique, magasins spécialisés, commerces de proximité, etc.), utilisateur final (ménages, sports et loisirs, restaurants, hôtels, aéroports, bureaux commerciaux, zones pour animaux, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du gazon artificiel en Amérique du Nord

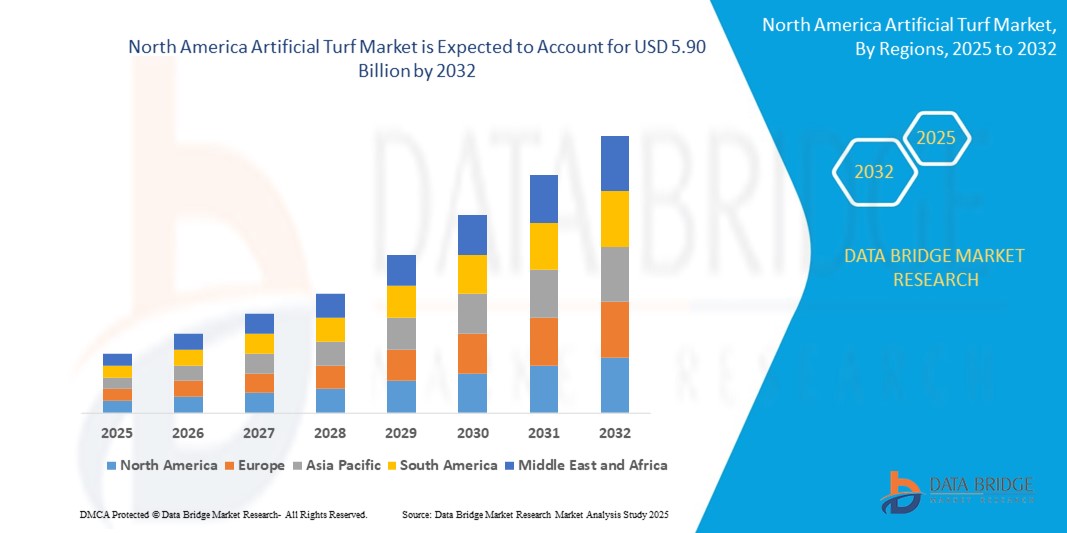

- La taille du marché du gazon artificiel en Amérique du Nord était évaluée à 1,40 milliard USD en 2024 et devrait atteindre 5,90 milliards USD d'ici 2032 , à un TCAC de 19,70 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de solutions d’aménagement paysager nécessitant peu d’entretien dans les installations sportives, les pelouses résidentielles et les espaces commerciaux.

- Les préoccupations environnementales croissantes et les efforts de conservation de l'eau encouragent le passage du gazon naturel au gazon artificiel, en particulier dans les régions confrontées à une pénurie d'eau et à des coûts d'entretien élevés.

Analyse du marché du gazon artificiel en Amérique du Nord

- Le marché nord-américain du gazon synthétique connaît une croissance constante, les installations sportives et les écoles adoptant de plus en plus les surfaces synthétiques pour leur durabilité et leur faible entretien. Cette évolution reflète une tendance plus générale vers des terrains de jeu économiques et résistants aux intempéries, pour diverses applications.

- L'innovation dans la technologie des fibres et les matériaux de remplissage améliore les performances du gazon, offrant des textures plus réalistes et de meilleures caractéristiques de sécurité. Ces avancées aident les fabricants à répondre aux attentes des utilisateurs professionnels et amateurs.

- Le marché américain du gazon artificiel détenait la plus grande part de revenus en Amérique du Nord en 2024, grâce à une forte demande pour les pelouses résidentielles, les paysages commerciaux et les installations sportives.

- Le Canada devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché du gazon artificiel en Amérique du Nord en raison de l'augmentation des investissements dans le développement urbain, de l'importance croissante accordée aux alternatives écologiques et de l'utilisation accrue du gazon artificiel dans les espaces récréatifs publics, les écoles et les terrains de jeux municipaux.

- Le polyéthylène détient la plus grande part de revenus du marché en 2024, grâce à son excellente durabilité, sa douceur et sa résistance aux UV, ce qui en fait un choix privilégié pour les pelouses résidentielles et les terrains de sport.

Portée du rapport et segmentation du marché du gazon artificiel en Amérique du Nord

|

Attributs |

Aperçu du marché du gazon artificiel en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché du gazon artificiel en Amérique du Nord

« Préférence croissante pour les solutions de gazon durables et écologiques »

- Les fabricants se concentrent sur les matériaux recyclables et les remplissages non toxiques pour répondre à la préférence croissante des consommateurs pour des solutions durables, comme le montrent les marques proposant des produits de gazon sans plomb et entièrement recyclables aux États-Unis.

- Le gazon artificiel est adopté dans les zones sujettes à la sécheresse comme la Californie et certaines régions d'Australie, où les parcs publics et les paysages résidentiels remplacent le gazon naturel pour préserver les ressources en eau.

- Les installations sportives, notamment les principaux stades de football européens et les terrains de sport scolaires au Japon, installent de plus en plus de systèmes de gazon biosourcé ou partiellement recyclé pour réduire l'impact environnemental.

- L'augmentation des certifications de bâtiments écologiques, telles que LEED et BREEAM, encourage l'utilisation de solutions d'aménagement paysager respectueuses de l'environnement, poussant les promoteurs immobiliers à choisir du gazon artificiel conforme aux objectifs de durabilité.

Dynamique du marché du gazon artificiel en Amérique du Nord

Conducteur

« Demande croissante de solutions d'aménagement paysager nécessitant peu d'entretien »

- Le marché du gazon artificiel est en pleine croissance en raison de la demande croissante d'options d'aménagement paysager nécessitant un minimum d'entretien et de maintenance.

- Contrairement au gazon naturel, le gazon artificiel élimine le besoin d'arrosage, de tonte et de traitements chimiques réguliers, ce qui permet d'économiser du temps et des ressources.

- Il offre une solution durable et visuellement cohérente qui convient aux environnements résidentiels, commerciaux, institutionnels et sportifs

- Les régions pauvres en eau adoptent de plus en plus le gazon synthétique pour réduire la consommation d'eau et les dépenses d'entretien

- Par exemple, le Département de l'eau et de l'électricité de Los Angeles offre une remise de 5 $ par pied carré aux clients qui remplacent leur pelouse par un aménagement paysager durable, encourageant ainsi l'adoption du gazon artificiel comme mesure d'économie d'eau.

Retenue/Défi

« Préoccupations environnementales et sanitaires liées aux matériaux synthétiques »

- Les préoccupations environnementales et sanitaires deviennent un défi majeur sur le marché du gazon artificiel en raison de la présence de produits chimiques et de microplastiques dans les matériaux de gazon traditionnels.

- Les gazons synthétiques fabriqués avec des miettes de caoutchouc, souvent issues de pneus recyclés, peuvent libérer des substances nocives dans le sol et l'air au fil du temps.

- Les préoccupations en matière de sécurité augmentent, en particulier pour les enfants et les athlètes régulièrement exposés à ces surfaces dans les terrains de jeux, les écoles et les arènes sportives.

- La recyclabilité limitée et l'accumulation dans les décharges du gazon artificiel usé suscitent un examen réglementaire et public dans de nombreuses régions.

- Par exemple, des municipalités aux Pays-Bas et aux États-Unis, comme le comté de Montgomery, dans le Maryland, ont introduit des réglementations ou proposé des interdictions sur le remplissage en caoutchouc granulé pour répondre aux préoccupations en matière de santé et de contamination liées aux systèmes de gazon synthétique.

Portée du marché nord-américain du gazon artificiel

Le marché nord-américain du gazon artificiel est segmenté en fonction de la matière première, des matériaux de remplissage, de la hauteur des poils, du canal de distribution et de l'utilisateur final.

- Par matière première

En fonction des matières premières, le marché nord-américain du gazon artificiel est segmenté en nylon, polypropylène, polyéthylène, polyamides, jute et caoutchouc, entre autres. Le polyéthylène a représenté la plus grande part de marché en 2024, grâce à son excellente durabilité, sa souplesse et sa résistance aux UV, ce qui en fait un choix privilégié pour les pelouses résidentielles et les terrains de sport.

Le nylon devrait connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032, en raison de sa grande résilience et de sa capacité à conserver sa forme sous un trafic piétonnier intense, ce qui le rend adapté aux applications commerciales et sportives.

- Par matériaux de remplissage

En fonction du matériau de remplissage, le marché nord-américain du gazon artificiel est segmenté en deux catégories : à base de pétrole, organique, de sable (silice) et autres matériaux de remplissage. En 2024, le remplissage à base de pétrole domine le marché grâce à son prix abordable et à ses propriétés d'absorption des chocs, améliorant ainsi la sécurité sur les surfaces sportives.

Le remplissage organique devrait connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032, alimenté par la demande croissante d'alternatives écologiques et non toxiques dans les régions soucieuses de l'environnement.

- Par hauteur de pile

En fonction de la hauteur des fibres, le marché nord-américain du gazon synthétique se répartit en trois catégories : moins de 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm et plus de 100 mm. Le segment 30-50 mm a représenté la plus grande part de chiffre d'affaires en 2024, plébiscité pour son aspect naturel et son équilibre entre confort et durabilité, et largement utilisé dans les espaces verts résidentiels et commerciaux.

Les hauteurs de poils plus longues, supérieures à 70 mm, devraient connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032, en particulier pour les applications sportives et de loisirs nécessitant un amorti amélioré.

- Par canal de distribution

En fonction des canaux de distribution, le marché nord-américain du gazon synthétique se divise en ventes directes (B2B), commerce électronique, magasins spécialisés, commerces de proximité, etc. En 2024, le segment des ventes directes (B2B) a dominé, porté par les achats en gros auprès des organisations sportives et des projets commerciaux.

Le commerce électronique devrait connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032, car les consommateurs préfèrent de plus en plus les achats en ligne pour leur commodité et l'accès à une large gamme de produits.

- Par utilisateur final

En Amérique du Nord, le marché du gazon synthétique est segmenté selon l'utilisateur final : ménages, sports et loisirs, restaurants, hôtels, aéroports, bureaux commerciaux, espaces pour animaux de compagnie, etc. En 2024, les ménages ont représenté la plus grande part des revenus, grâce à l'adoption croissante du gazon synthétique pour les aménagements paysagers nécessitant peu d'entretien.

Le segment des sports et des loisirs devrait connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032, avec des investissements croissants dans les infrastructures sportives et une popularité croissante des terrains en gazon synthétique dans le monde entier.

Analyse régionale du marché nord-américain du gazon artificiel

- Le marché américain du gazon artificiel détenait la plus grande part de revenus en Amérique du Nord en 2024, grâce à une forte demande pour les pelouses résidentielles, les paysages commerciaux et les installations sportives.

- Les efforts croissants de conservation de l'eau dans des États comme la Californie et l'Arizona accélèrent le passage des solutions de gazon naturel aux solutions de gazon synthétique.

- Le secteur du sport joue un rôle essentiel, le gazon artificiel étant largement adopté dans les stades et les terrains d'entraînement en raison de son faible entretien et de sa facilité d'utilisation par tous les temps.

- Les progrès technologiques en matière de qualité des fibres et de matériaux de remplissage améliorent la durabilité, la sécurité et l'esthétique, soutenant ainsi davantage l'expansion du marché à travers le pays.

Aperçu du marché canadien du gazon artificiel

Le Canada devrait connaître le taux de croissance le plus rapide au cours de la période de prévision de 2025 à 2032. Cette croissance est principalement attribuable à l'urbanisation croissante et à l'augmentation des investissements dans les parcs publics, les terrains de jeux scolaires et les infrastructures récréatives. De plus, la sensibilisation croissante à l'environnement et les initiatives gouvernementales favorisant la conservation de l'eau encouragent les utilisateurs résidentiels et commerciaux à adopter des solutions de gazon synthétique. Le climat froid du pays renforce cette tendance, car le gazon synthétique offre une option d'aménagement paysager durable, écologique et facile d'entretien, qui reste fonctionnelle toute l'année.

Part de marché du gazon artificiel en Amérique du Nord

L'industrie du gazon artificiel en Amérique du Nord est principalement dirigée par des entreprises bien établies, notamment :

- Dow (États-Unis)

- Act Global (filiale de BIG) (États-Unis)

- SpectraTurf, Inc. (États-Unis)

- EnvyLawn (États-Unis)

- XGrass (États-Unis)

- Matrix Turf (États-Unis)

- Shawgrass (États-Unis)

- Gazon synthétique international (États-Unis)

Derniers développements sur le marché nord-américain du gazon artificiel

- En février 2024, Act North America célèbre 20 ans d'innovation, impactant plus de 90 pays grâce à des solutions inclusives et durables. Reconnue de la NFL à la FIFA, Act North America maintient son engagement envers l'amélioration de la performance, de la sécurité et du bien-être des communautés. Tournée vers l'avenir, Act North America réaffirme sa volonté de relever les défis actuels et de bâtir un avenir durable.

- En octobre 2021, Sport Group et BASF se sont associés pour lancer un revêtement de sol extérieur écologique en Infinergy. Ce matériau est durable et respectueux de l'environnement. Sport Group l'installera dans des aires de jeux et des installations sportives du monde entier. Il s'inscrit dans le cadre de leurs efforts pour créer des espaces de jeu et d'exercice plus sûrs et plus durables.

- En juin 2021, Victoria PLC a acquis Cali. Cette acquisition permettra d'élargir l'offre de produits de Cali, de lui donner accès à de nouveaux marchés et de garantir un soutien financier et une infrastructure opérationnelle. Cali continuera de fonctionner de manière autonome, en maintenant son engagement envers l'excellence, le développement durable et la satisfaction client.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.