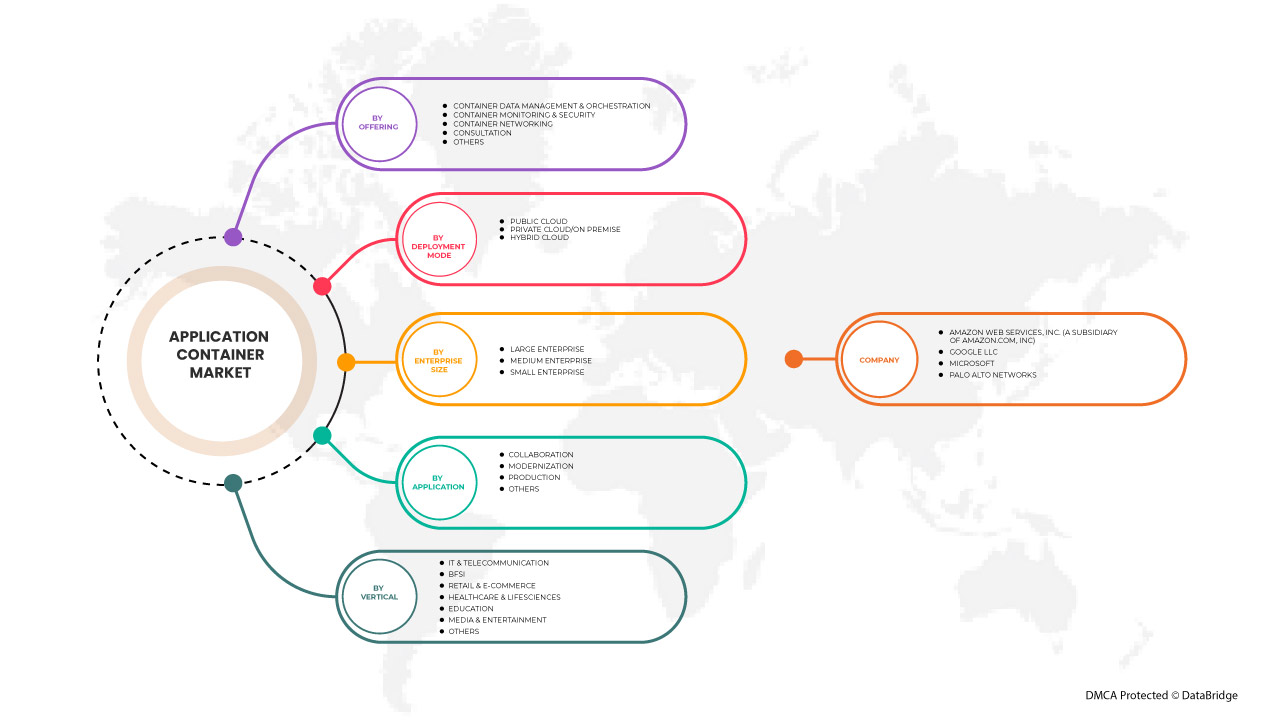

Marché des conteneurs d'applications en Amérique du Nord, par offre (gestion et orchestration des données des conteneurs, surveillance et sécurité des conteneurs, mise en réseau des conteneurs, consultation et autres), mode de déploiement (cloud public, cloud privé/sur site et cloud hybride), taille de l'entreprise (petite entreprise, moyenne entreprise et grande entreprise), application (collaboration, modernisation, production et autres), vertical (informatique et télécommunications, BFSI , vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des conteneurs d'applications en Amérique du Nord

Un conteneur d'application est un composant CDB facultatif créé par l'utilisateur qui stocke des données et des métadonnées pour un ou plusieurs back-ends d'application. Un CDB comprend zéro ou plusieurs conteneurs d'application. Dans un conteneur d'application, une application est l'ensemble nommé et versionné de données et de métadonnées communes stockées dans la racine de l'application. Dans ce contexte d'un conteneur d'application, le terme « application » signifie « définition d'application principale ». Par exemple, l'application peut inclure des définitions de tables, de vues et de packages.

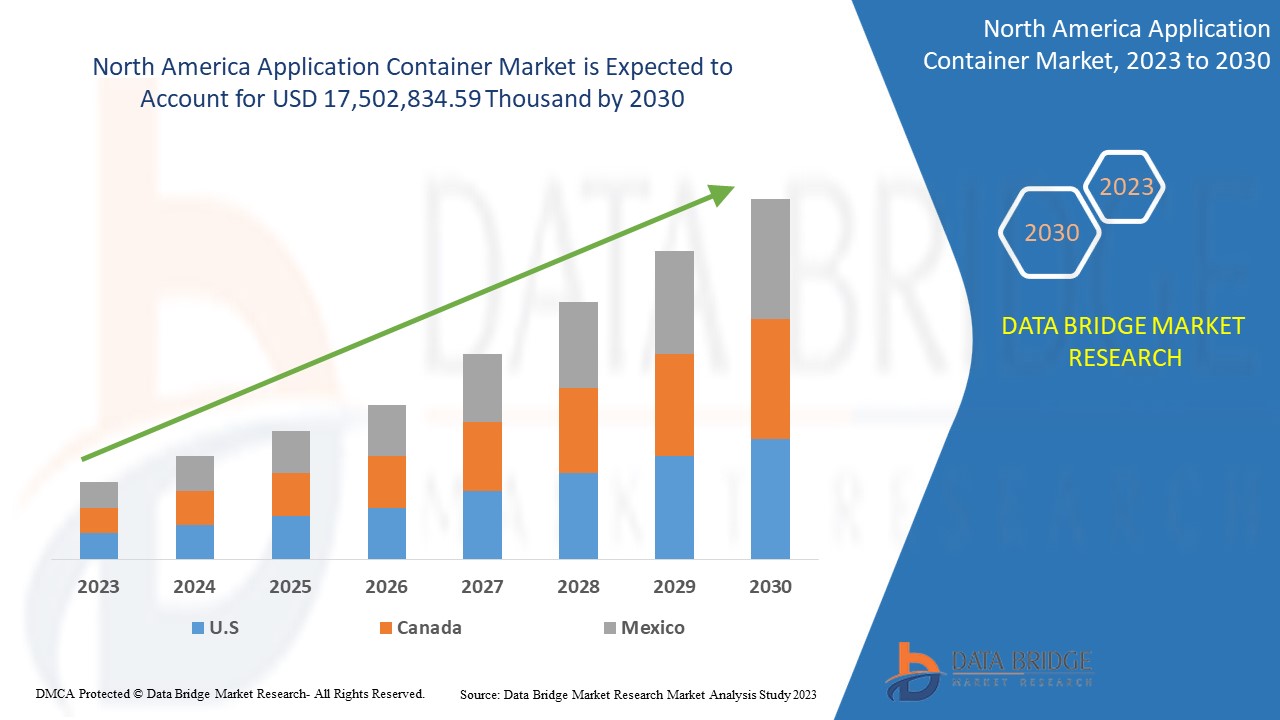

Selon les analyses de Data Bridge Market Research, le marché des conteneurs d'applications devrait atteindre la valeur de 17 502 834,59 milliers USD d'ici 2030, à un TCAC de 33,2 % au cours de la période de prévision. « Gestion et orchestration des données des conteneurs » représente le segment d'offre le plus important sur le marché des conteneurs d'applications en raison des développements technologiques rapides visant à commercialiser l'utilisation des conteneurs d'applications. Le rapport sur le marché des conteneurs d'applications couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en milliers d'unités, prix en dollars américains |

|

Segments couverts |

Par offre (gestion et orchestration des données des conteneurs, surveillance et sécurité des conteneurs, mise en réseau des conteneurs, consultation et autres), mode de déploiement (cloud public, cloud privé/sur site et cloud hybride ), taille de l'entreprise (petite entreprise, moyenne entreprise et grande entreprise), application (collaboration, modernisation, production et autres), vertical (informatique et télécommunications, BFSI, vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Amazon Web Services, Inc. (une filiale d'Amazon.com, Inc), Google LLC, Microsoft, Palo Alto Networks, SUSE, Hewlett Packard Enterprise Development LP, Broadcom, VMware, Inc., Alibaba Group Holding Limited, IBM Corporation, Cisco Systems, Inc., Portworx, Joyent, Portainer, WEAVEWORKS. |

Définition du marché

Un conteneur d'application est un package autonome tout-en-un pour une application logicielle. L'application logicielle offre une dépendance pour différentes opérations commerciales, y compris les binaires d'application et les composants matériels. L'application conteneurisée comprend diverses fonctionnalités telles que la gestion des données, la surveillance, la mise en réseau et la consultation. Ces fonctionnalités peuvent être déployées via différents modes de déploiement pour la collaboration ou la modernisation des opérations commerciales. Ce logiciel permet aux organisations d'utilisateurs finaux d'améliorer leurs compétences de base telles que la sécurité, la connectivité réseau, les relations clients et la surveillance des services de bout en bout, optimisant ainsi l'utilisation des ressources et réduisant les coûts d'exploitation.

Dynamique du marché des conteneurs d'applications

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

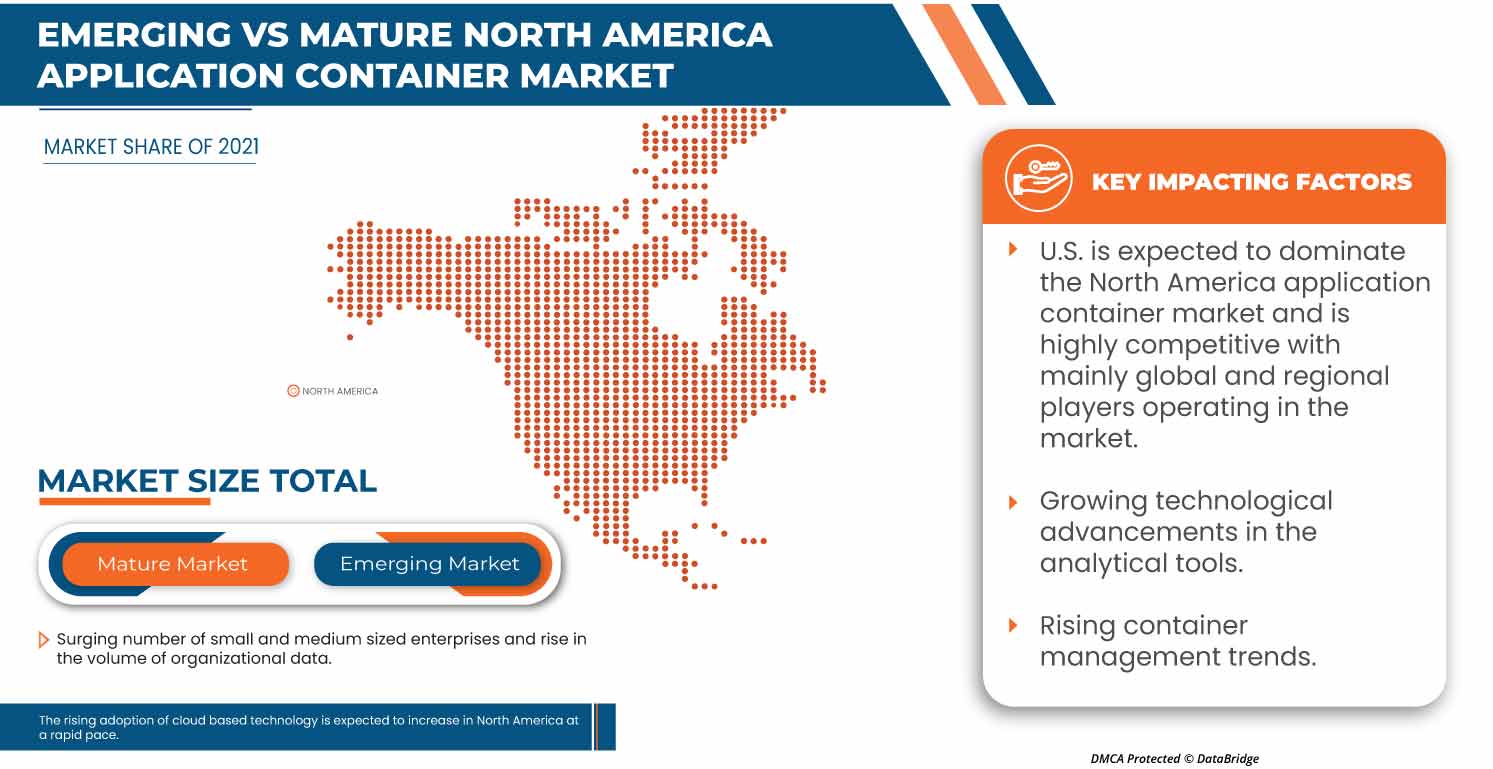

- Augmentation du volume des données organisationnelles

Les données organisationnelles décrivent les caractéristiques centrales des organisations, notamment les processus internes, les structures, les actions de l'entreprise, les statistiques sur les employés et bien d'autres. De nos jours, la documentation des informations existantes d'une organisation est très demandée. Cette documentation ne se fait pas par des méthodes traditionnelles, mais de manière moderne, en étant stockée sous forme électronique plutôt que sur papier. La documentation des processus de chaque organisation est devenue courante ces dernières années car elle est associée à de nombreux avantages pour différents cas, tels que la stratégie de recrutement, la veille commerciale, les aperçus sectoriels et bien d'autres. Les données d'entreprise peuvent également soutenir et informer les efforts de surveillance en créant des flux d'actualités sur les événements importants et en aidant à repérer les tendances au sein des entreprises.

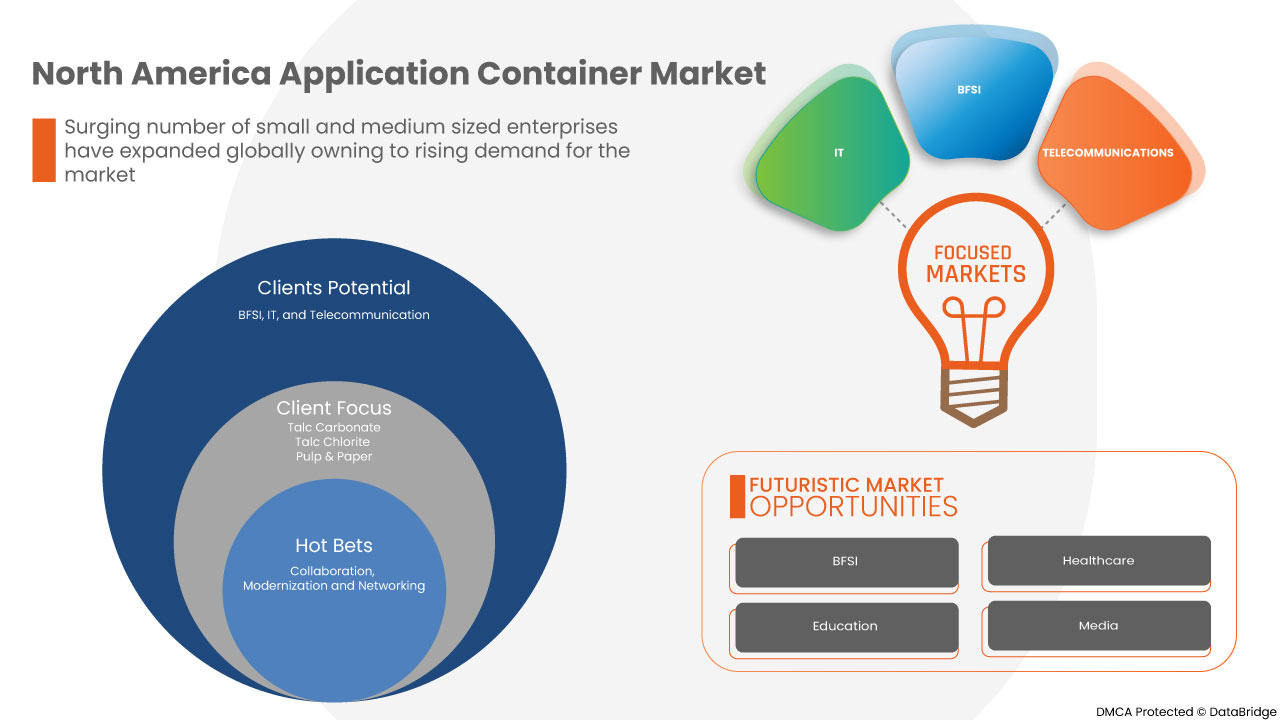

- Augmentation du nombre de petites et moyennes entreprises

Les petites et moyennes entreprises (PME) sont des entreprises indépendantes comptant moins de salariés et qui jouent un rôle majeur dans la croissance économique. De plus, les PME représentent 60 à 70 % de l'emploi dans la plupart des pays. Les grandes entreprises réduisant leurs effectifs et externalisant leurs activités, cette fonction a accru la croissance des revenus des PME.

En outre, ces entreprises se sont traditionnellement concentrées sur les marchés intérieurs, mais d’autres se tournent vers l’Amérique du Nord. En Amérique du Nord, ces PME sont principalement le fruit de liens et de regroupements interentreprises. Cependant, le réseautage permet aux PME de s’associer à des organisations plus importantes, mais les données et les opérations commerciales doivent être numériques et intégrées.

Opportunités

- Augmentation de l'adoption des technologies basées sur le cloud

La numérisation est l’un des facteurs favorisant le déploiement du cloud dans les opérations commerciales, qui présente de nombreux avantages et nécessite une maintenance adéquate ainsi que des équipements et infrastructures supplémentaires pour gérer correctement le système de travail. Ainsi, ce processus comprend la gestion des données collectées, la sauvegarde, le traitement, l’analyse, le partage et la mise en œuvre de nombreuses autres opérations. Cependant, la numérisation simplifie et automatise les opérations de travail de base de l’entreprise, mais crée un besoin de technologie et d’infrastructure avancées.

La numérisation est ainsi soutenue par le déploiement d'applications basées sur le cloud. Cela a créé une énorme demande de gestion des données dans le monde entier et un besoin d'intégration des données et de politique de confidentialité. En conséquence, l'adoption de la numérisation a joué un rôle de premier plan dans l'accélération de la croissance économique du pays et pourrait donner du pouvoir aux générations actuelles et futures.

- Tendances croissantes en matière de gestion des conteneurs

La gestion des conteneurs est associée à divers avantages et est gérée par les administrateurs informatiques des organisations qui peuvent démarrer, arrêter et redémarrer le fonctionnement des conteneurs. Ainsi, elle comprend l'orchestration et les planificateurs, les outils de sécurité, le stockage, les systèmes de gestion de réseau virtuel et la surveillance.

Le système de gestion des conteneurs automatise l'orchestration, la gestion des journaux, la surveillance, la mise en réseau, l'équilibrage de charge, les tests et la gestion des secrets. Ces avantages soutiendront le processus de travail des organisations car ils stimulent l'utilisation des solutions de gestion des conteneurs.

Retenue/défi

- Manque de main d'œuvre qualifiée et d'expertise technologique

De plus, les experts doivent comprendre le processus de travail et la technologie d'intégration avec les processus métier. L'amélioration du processus via le conteneur d'application implique la gestion des données, la saisie des données et l'analyse sur la base d'un ensemble de formules préprogrammées développées dans le logiciel en fonction des exigences des utilisateurs et du projet.

Le problème majeur associé au conteneur d'applications est la gestion appropriée des données par l'utilisateur ou le professionnel chargé de gérer les données liées à l'application. La gestion du logiciel par l'utilisateur nécessite un ensemble de compétences qui permettent de gérer correctement les données liées au logiciel. La conteneurisation des applications implique une gestion et une planification stratégiques, des compétences techniques essentielles que les utilisateurs doivent développer et exceller dans la réalisation des objectifs organisationnels.

Impact post-COVID-19 sur le marché des conteneurs d'applications

La COVID-19 a eu un impact considérable sur le marché des conteneurs d'applications, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles produisant des biens essentiels. Le gouvernement a pris des mesures strictes, telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises confrontées à cette pandémie sont les services essentiels autorisés à ouvrir et à exécuter les processus.

La croissance du marché nord-américain des conteneurs d'applications s'accroît à mesure que l'automatisation dans le secteur automobile a augmenté la demande de divers produits liés aux conteneurs d'applications. Ces services sont largement utilisés dans la surveillance des données et le stockage des données sur une plate-forme cloud. Par conséquent, les progrès technologiques croissants dans les outils d'analyse au cours de la période de prévision. Cependant, des facteurs tels que les risques élevés d'urgence liés à l'étalement des conteneurs d'applications freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fournisseurs de services prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le conteneur d'application. Les entreprises mettront sur le marché des contrôleurs avancés et précis.

Développements récents

- En novembre 2022, Datadog a signalé l'augmentation de l'adoption du système de gestion des conteneurs Kubernetes. Aujourd'hui, près de la moitié des organisations de conteneurs utilisent Kubernetes pour déployer et gérer les conteneurs dans un écosystème en pleine croissance.

- En mars 2022, l'ABSL a constaté l'essor de la numérisation et des technologies modernes, augmentant le besoin d'analyse de données. L'analyse de données est souvent utilisée pour prendre des décisions technologiques, trouver de nouvelles stratégies de marché et des opportunités de croissance pour l'entreprise.

Portée du marché des conteneurs d'applications en Amérique du Nord

Le marché des conteneurs d'applications en Amérique du Nord est segmenté en fonction de l'offre, du mode de déploiement, de la taille de l'entreprise, de l'application et du secteur vertical. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Gestion et orchestration des données des conteneurs

- Surveillance et sécurité des conteneurs

- Mise en réseau de conteneurs

- Consultation

- Autres

Sur la base de l'offre, le marché des conteneurs d'applications en Amérique du Nord est segmenté en gestion et orchestration des données des conteneurs, surveillance et sécurité des conteneurs, mise en réseau des conteneurs, consultation et autres.

Mode de déploiement

- Cloud public

- Cloud privé/sur site

- Cloud hybride

Sur la base du mode de déploiement, le marché des conteneurs d'applications en Amérique du Nord a été segmenté en cloud public, cloud privé/sur site et cloud hybride.

Taille de l'entreprise

- Grande entreprise

- Moyenne entreprise

- Petite entreprise

Sur la base de la taille de l’entreprise, le marché des conteneurs d’applications en Amérique du Nord a été segmenté en grandes entreprises, moyennes entreprises et petites entreprises.

Application

- Collaboration

- Modernisation

- Production

- Autres

Sur la base des applications, le marché des conteneurs d'applications en Amérique du Nord a été segmenté en collaboration, modernisation, production et autres.

Verticale

- Informatique et télécommunications

- BFSI

- Commerce de détail et e-commerce,

- Santé et sciences de la vie

- Éducation

- Médias et divertissement

- Autres

Sur la base de la verticale, le marché des conteneurs d'applications en Amérique du Nord a été segmenté en informatique et télécommunications, BFSI, vente au détail et commerce électronique, soins de santé et sciences de la vie, éducation, médias et divertissement, et autres.

Analyse/perspectives régionales du marché des conteneurs d'applications

Le marché des conteneurs d’applications est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, offre, mode de déploiement, taille de l’entreprise, application et vertical, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des conteneurs d’applications en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent la région Amérique du Nord en raison de l’augmentation continue des investissements financiers dans la technologie des conteneurs.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des conteneurs d'applications

Le paysage concurrentiel du marché des conteneurs d'applications en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des conteneurs d'applications.

Certains des principaux acteurs opérant sur le marché des conteneurs d'applications en Amérique du Nord sont Amazon Web Services, Inc. (une filiale d'Amazon.com, Inc), Google LLC, Microsoft, Palo Alto Networks, SUSE, Hewlett Packard Enterprise Development LP, Broadcom, VMware, Inc., Alibaba Group Holding Limited, IBM Corporation, Cisco Systems, Inc., Portworx, Joyent, Portainer et WEAVEWORKS.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA APPLICATION CONTAINER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP WINNING STRATEGIES BY COMPANIES

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 ECOSYSTEM MARKET MAP

4.4 TECHNOLOGICAL TRENDS

4.5 VALUE CHAIN ANALYSIS

4.6 BRAND ANALYSIS

5 REGIONAL SUMMARY

5.1 SUMMARY WRITE-UP (NORTH AMERICA)

5.2 SUMMARY WRITE-UP (EUROPE)

5.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

5.4 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

5.5 SUMMARY WRITE-UP (SOUTH AMERICA)

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN VOLUME OF ORGANIZATIONAL DATA

6.1.2 SURGING NUMBER OF SMALL AND MEDIUM-SIZED ENTERPRISES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS IN ANALYTICAL TOOLS

6.1.4 RISE IN NEED FOR BUSINESS AGILITY AND COORDINATION

6.2 RESTRAINTS

6.2.1 HIGH CHANCES OF EMERGENCY FOR APPLICATION CONTAINER SPRAWL

6.2.2 UNRELIABLE INFRASTRUCTURE IN DEVELOPING COUNTRIES

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF CLOUD-BASED TECHNOLOGY

6.3.2 RISING CONTAINER MANAGEMENT TRENDS

6.3.3 UPSURGE IN THE ADOPTION OF SOFTWARE ALGORITHMS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED WORKFORCE AND TECHNOLOGICAL EXPERTISE

6.4.2 LACK OF SECURITY CONCERNS

7 NORTH AMERICA APPLICATION CONTAINER MARKET, BY OFFERING

7.1 OVERVIEW

7.2 CONTAINER DATA MANAGEMENT & ORCHESTRATION

7.3 CONTAINER MONITORING & SECURITY

7.4 CONTAINER NETWORKING

7.5 CONSULTATION

7.6 OTHERS

8 NORTH AMERICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 PUBLIC CLOUD

8.3 PRIVATE CLOUD/ON PREMISE

8.4 HYBRID CLOUD

9 NORTH AMERICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 MEDIUM ENTERPRISE

9.4 SMALL ENTERPRISE

10 NORTH AMERICA APPLICATION CONTAINER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 COLLABORATION

10.3 MODERNIZATION

10.4 PRODUCTION

10.5 OTHERS

11 NORTH AMERICA APPLICATION CONTAINER MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 IT & TELECOMMUNICATION

11.2.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.2.2 CONTAINER MONITORING & SECURITY

11.2.3 CONTAINER NETWORKING

11.2.4 CONSULTATION

11.2.5 OTHERS

11.3 BFSI

11.3.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.3.2 CONTAINER MONITORING & SECURITY

11.3.3 CONTAINER NETWORKING

11.3.4 CONSULTATION

11.3.5 OTHERS

11.4 RETAIL & E-COMMERCE

11.4.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.4.2 CONTAINER MONITORING & SECURITY

11.4.3 CONTAINER NETWORKING

11.4.4 CONSULTATION

11.4.5 OTHERS

11.5 HEALTHCARE & LIFESCIENCES

11.5.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.5.2 CONTAINER MONITORING & SECURITY

11.5.3 CONTAINER NETWORKING

11.5.4 CONSULTATION

11.5.5 OTHERS

11.6 EDUCATION

11.6.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.6.2 CONTAINER MONITORING & SECURITY

11.6.3 CONTAINER NETWORKING

11.6.4 CONSULTATION

11.6.5 OTHERS

11.7 MEDIA & ENTERTAINMENT

11.7.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.7.2 CONTAINER MONITORING & SECURITY

11.7.3 CONTAINER NETWORKING

11.7.4 CONSULTATION

11.7.5 OTHERS

11.8 OTHERS

11.8.1 CONTAINER DATA MANAGEMENT & ORCHESTRATION

11.8.2 CONTAINER MONITORING & SECURITY

11.8.3 CONTAINER NETWORKING

11.8.4 CONSULTATION

11.8.5 OTHERS

12 NORTH AMERICA APPLICATION CONTAINER MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA APPLICATION CONTAINER MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMAZON WEB SERVICES, INC. (A SUBSIDIARY OF AMAZON.COM, INC.)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GOOGLE LLC (A SUBSIDIARY OF ALPHABET INC.)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MICROSOFT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SERVICE PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 PALO ALTO NETWORKS.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SUSE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALIBABA GROUP HOLDING LIMITED

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SERVICE PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ATOS SE

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 SERVICE PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 BROADCOM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SERVICE PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 CISCO SYSTEMS, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SERVICE PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 D2IQ, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DOCKER INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 IBM CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 JOYENT (ACQUIRED BY SAMSUNG)

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MIRANTIS, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ORACLE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 PORTAINER

15.17.1 COMPANY SNAPSHOT

15.17.2 SERVICE PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 PORTWORX

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 PUPPET, INC. (ACQUIRED BY PREFORCE)

15.19.1 COMPANY SNAPSHOT

15.19.2 SERVICE PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TELEFONAKTIEBOLAGET LM ERICSSON

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SERVICE PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 VIRTUOZZO

15.21.1 COMPANY SNAPSHOT

15.21.2 SERVICE PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 VMWARE, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 SERVICE PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 WEAVEWORKS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 THE GIVEN TOP 5 COMPANIES' BRAND ANALYSIS ARE

TABLE 2 NORTH AMERICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA CONTAINER DATA MANAGEMENT & ORCHESTRATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA CONTAINER MONITORING & SECURITY IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA CONTAINER NETWORKING IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA CONSULTATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA PUBLIC CLOUD IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA PRIVATE CLOUD/ON PREMISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA HYBRID CLOUD IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA LARGE ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA MEDIUM ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA SMALL ENTERPRISE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA COLLABORATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MODERNIZATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PRODUCTION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA BFSI IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA EDUCATION IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA OTHERS IN APPLICATION CONTAINER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA APPLICATION CONTAINER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 CANADA RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 CANADA HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 CANADA EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 CANADA MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 CANADA OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 MEXICO APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD THOUSAND)

TABLE 75 MEXICO APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2021-2030 (USD THOUSAND)

TABLE 76 MEXICO APPLICATION CONTAINER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 MEXICO APPLICATION CONTAINER MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 78 MEXICO IT & TELECOMMUNICATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 MEXICO BFSI IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 MEXICO RETAIL & E-COMMERCE IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 MEXICO HEALTHCARE & LIFESCIENCES IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 MEXICO EDUCATION IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 MEXICO MEDIA & ENTERTAINMENT IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 MEXICO OTHERS IN APPLICATION CONTAINER MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA APPLICATION CONTAINER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA APPLICATION CONTAINER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA APPLICATION CONTAINER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA APPLICATION CONTAINER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA APPLICATION CONTAINER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA APPLICATION CONTAINER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA APPLICATION CONTAINER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA APPLICATION CONTAINER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA APPLICATION CONTAINER MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA APPLICATION CONTAINER MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA APPLICATION CONTAINER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA APPLICATION CONTAINER MARKET: SEGMENTATION

FIGURE 13 SURGING NUMBER OF SMALL AND MEDIUM-SIZED ENTERPRISES IS BOOSTING THE GROWTH OF THE NORTH AMERICA APPLICATION CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 CONTAINER DATA MANAGEMENT & ORCHESTRATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA APPLICATION CONTAINER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 CONTAINER ECOSYSTEM MARKET MAP

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA APPLICATION CONTAINER MARKET

FIGURE 17 VOLUME OF DATA CULTURE IN ORGANIZATION ACROSS WORLDWIDE

FIGURE 18 REGISTERED MSME’S IN INDIA IN FY 2022

FIGURE 19 CHANGES IN VARIOUS AGILITY FACTORS FOR ORGANIZATION

FIGURE 20 RATE OF ADOPTION OF PUBLIC CLOUD FOR BUSINESS OPERATIONS

FIGURE 21 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 22 NORTH AMERICA APPLICATION CONTAINER MARKET, BY OFFERING, 2022

FIGURE 23 NORTH AMERICA APPLICATION CONTAINER MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 24 NORTH AMERICA APPLICATION CONTAINER MARKET, BY ENTERPRISE SIZE, 2022

FIGURE 25 NORTH AMERICA APPLICATION CONTAINER MARKET: BY APPLICATION, 2022

FIGURE 26 NORTH AMERICA APPLICATION CONTAINER MARKET: BY VERTICAL, 2022

FIGURE 27 NORTH AMERICA APPLICATION CONTAINER MARKET: SNAPSHOT (2022)

FIGURE 28 NORTH AMERICA APPLICATION CONTAINER MARKET: BY COUNTRY (2022)

FIGURE 29 NORTH AMERICA APPLICATION CONTAINER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 30 NORTH AMERICA APPLICATION CONTAINER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 31 NORTH AMERICA APPLICATION CONTAINER MARKET: BY OFFERING (2023-2030)

FIGURE 32 NORTH AMERICA APPLICATION CONTAINER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.