North America Anti Nuclear Antibody Test Market

Taille du marché en milliards USD

TCAC :

%

USD

1.63 Billion

USD

4.42 Billion

2025

2033

USD

1.63 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.63 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Segmentation du marché nord-américain des tests d'anticorps antinucléaires, par type d'anticorps (antigènes nucléaires extractibles (ENA), anti-ADN double brin et histones, anticorps anti-DFS70, anti-PM-SCL, anticorps anti-centromères, anti-SP100 et autres), par produit (instruments, consommables et réactifs, et services), par technique (ELISA, immunofluorescence indirecte (IIF), test de Western blot, microréseau d'antigènes, techniques sur gel, dosage multiplex, cytométrie en flux, hémagglutination passive (PHA) et autres), par application (maladies auto-immunes et maladies infectieuses), par utilisateur final (hôpitaux, laboratoires, centres de diagnostic, instituts de recherche et autres), par canal de distribution (appel d'offres direct, vente au détail, distributeurs tiers et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des tests d'anticorps antinucléaires en Amérique du Nord

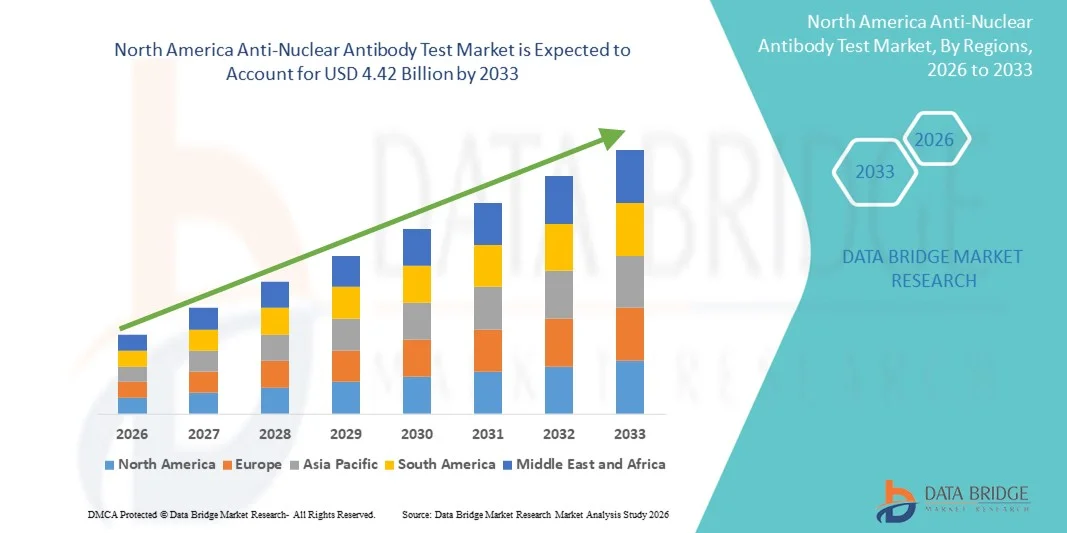

- Le marché nord-américain des tests d'anticorps antinucléaires était évalué à 1,63 milliard de dollars américains en 2025 et devrait atteindre 4,42 milliards de dollars américains d'ici 2033 , avec un TCAC de 13,30 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des maladies auto-immunes, la sensibilisation accrue à un diagnostic précoce et précis, et les progrès constants des technologies de tests de laboratoire, ce qui conduit à une plus grande adoption des tests d'anticorps antinucléaires (ANA) dans les hôpitaux, les laboratoires de diagnostic et les cliniques spécialisées.

- De plus, la demande croissante de solutions de diagnostic rentables, fiables et rapides pour les maladies auto-immunes telles que le lupus, la polyarthrite rhumatoïde et la sclérodermie fait du test des anticorps antinucléaires un outil de dépistage de première intention essentiel dans les services de soins courants et spécialisés. Ces facteurs convergents accélèrent l'adoption des solutions de test des anticorps antinucléaires, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché des tests d'anticorps antinucléaires en Amérique du Nord

- Les tests d'anticorps antinucléaires (AAN), utilisés pour détecter les auto-anticorps associés aux maladies auto-immunes, deviennent des outils de plus en plus essentiels dans les diagnostics modernes, tant dans les hôpitaux que dans les laboratoires spécialisés, en raison de leur rôle crucial dans l'identification précoce et le suivi des maladies auto-immunes systémiques.

- La demande croissante de tests ANA est principalement due à la prévalence mondiale croissante de maladies telles que le lupus érythémateux systémique, la polyarthrite rhumatoïde et la sclérodermie, ainsi qu'à une sensibilisation accrue des professionnels de la santé et des patients à l'importance d'un dépistage précoce et précis des maladies auto-immunes.

- Les États-Unis ont dominé le marché des tests d'anticorps antinucléaires avec la plus grande part de revenus (34,6 %) en 2025, grâce à une infrastructure de santé avancée, des taux de dépistage élevés, des systèmes de remboursement performants et la présence d'importantes entreprises de diagnostic.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des tests d'anticorps antinucléaires au cours de la période de prévision, avec un TCAC de 11,8 %. Cette croissance est attribuable à l'amélioration de l'accès aux soins de santé, à l'expansion des réseaux de laboratoires de diagnostic, à une sensibilisation accrue aux maladies auto-immunes et à l'augmentation des investissements publics dans les infrastructures de santé.

- Le segment des maladies auto-immunes représentait la plus grande part de revenus du marché, soit environ 58,9 %, en 2025, sous l'effet de la prévalence mondiale croissante de maladies telles que le lupus érythémateux systémique, la polyarthrite rhumatoïde, le syndrome de Sjögren et la sclérodermie.

Portée du rapport et segmentation du marché des tests d'anticorps antinucléaires

|

Attributs |

Principaux enseignements du marché des tests d'anticorps antinucléaires |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché des tests d'anticorps antinucléaires en Amérique du Nord

Importance croissante accordée au dépistage précoce des maladies auto-immunes et à l'adoption de diagnostics avancés

- Une tendance majeure et croissante sur le marché nord-américain des tests d'anticorps antinucléaires (ANA) est l'importance accrue accordée au dépistage précoce des maladies auto-immunes et inflammatoires systémiques telles que le lupus érythémateux systémique, la polyarthrite rhumatoïde et la sclérodermie. Cet intérêt clinique grandissant stimule fortement la demande de tests ANA fiables et de haute précision dans les domaines du diagnostic et de la recherche.

- Par exemple, un nombre croissant d'hôpitaux et de laboratoires de diagnostic en Amérique du Nord intègrent des plateformes de test ANA avancées, basées sur l'immunofluorescence et le test immuno-enzymatique (ELISA), afin d'améliorer la sensibilité de détection et de réduire le délai d'obtention des résultats. Cette intégration généralisée renforce le rôle des tests ANA dans le dépistage systématique et le diagnostic précoce des maladies auto-immunes.

- L'adoption de systèmes d'automatisation de laboratoire améliorés et de tests à haut débit permet également aux laboratoires de gérer des volumes de tests plus importants tout en maintenant une précision constante des résultats. Certaines plateformes avancées sont désormais capables de détecter simultanément plusieurs profils d'auto-anticorps, offrant ainsi une vision plus complète de l'activité auto-immune sous-jacente et permettant des décisions cliniques plus ciblées.

- La collaboration croissante entre les laboratoires cliniques, les instituts de recherche et les entreprises pharmaceutiques favorise le développement et l'adoption de kits de test ANA avancés. Grâce à ces collaborations, les professionnels de santé peuvent améliorer le suivi des maladies, analyser plus efficacement la réponse au traitement et optimiser la prise en charge globale des patients atteints de maladies auto-immunes.

- Cette évolution vers des outils de diagnostic des maladies auto-immunes plus efficaces, sensibles et fiables redéfinit les attentes en matière de dépistage précoce et de prise en charge à long terme. Par conséquent, les entreprises spécialisées en immunodiagnostic développent de plus en plus de kits de test ANA améliorés, conçus pour fournir des résultats cohérents, reproductibles et cliniquement précis, aussi bien en milieu hospitalier qu'en laboratoire de référence.

- La demande de solutions de test ANA avancées continue de croître dans les hôpitaux, les centres de diagnostic et les cliniques spécialisées, car les systèmes de santé privilégient un diagnostic précis, de meilleurs résultats pour les patients et une prise en charge efficace à long terme des maladies auto-immunes.

Dynamique du marché des tests d'anticorps antinucléaires en Amérique du Nord

Conducteur

Prévalence croissante des maladies auto-immunes et sensibilisation accrue au diagnostic

- La prévalence croissante des maladies auto-immunes, associée à une sensibilisation accrue au diagnostic précoce et à la prise en charge de ces maladies, est un moteur important du marché des tests d'anticorps antinucléaires (ANA). Le nombre de consultations en rhumatologie augmente, ce qui stimule la demande de tests ANA comme outil de diagnostic primaire.

- Par exemple, ces dernières années, les autorités sanitaires et les associations médicales ont souligné l'importance du dépistage précoce des maladies auto-immunes, encourageant les médecins généralistes et les spécialistes à inclure le test ANA dans les protocoles diagnostiques des patients présentant des symptômes chroniques inexpliqués tels que fatigue, douleurs articulaires et inflammation. Ces initiatives devraient soutenir une croissance soutenue du marché au cours de la période prévisionnelle.

- Face à une prise de conscience accrue des patients concernant les maladies chroniques et de longue durée, on observe une préférence croissante pour les analyses sanguines complètes permettant d'identifier les anomalies sous-jacentes du système immunitaire. Les tests ANA constituent une première étape cruciale dans le diagnostic de l'activité auto-immune, ce qui en fait un élément essentiel des démarches diagnostiques.

- De plus, le développement des cliniques de rhumatologie spécialisées et des laboratoires de diagnostic améliore l'accès aux tests ANA. L'augmentation des investissements dans les infrastructures de santé et les capacités des laboratoires permet une plus grande disponibilité de ces tests dans les régions urbaines et semi-urbaines.

- L'utilisation croissante des tests ANA dans la recherche clinique, le développement de médicaments et le suivi des maladies auto-immunes contribue également à la croissance soutenue du marché. Les entreprises pharmaceutiques s'appuient de plus en plus sur ces tests lors des essais cliniques pour évaluer l'éligibilité des patients et l'efficacité des traitements dans les études liées à l'immunité.

Retenue/Défi

Préoccupations concernant l'interprétation des tests et les coûts élevés du diagnostic

- Les difficultés d'interprétation des résultats du test ANA constituent un obstacle majeur à son adoption à plus grande échelle. En effet, des résultats positifs pouvant parfois apparaître chez des personnes en bonne santé, une mauvaise interprétation risque d'engendrer une anxiété inutile, un diagnostic erroné ou des examens complémentaires, ce qui freine la vigilance des cliniciens et des patients quant à une utilisation exclusive de ce test.

- Par exemple, la variabilité des résultats des tests, liée aux techniques de laboratoire, à la qualité des réactifs et à l'interprétation subjective des tests d'immunofluorescence, a entraîné des incohérences dans certains cas. Cette variabilité peut compliquer la prise de décision clinique et réduire la confiance accordée à l'utilisation exclusive des tests ANA sans preuves diagnostiques complémentaires.

- Relever ces défis grâce à des protocoles de test standardisés, une meilleure formation des professionnels de laboratoire et une précision accrue des analyses est essentiel pour renforcer la confiance entre les professionnels de santé. De plus, le coût relativement élevé des méthodes de test ANA avancées, notamment pour les systèmes multiplex ou automatisés, peut en limiter l'accès aux petits cabinets médicaux et aux établissements de santé aux ressources limitées, en particulier dans les régions en développement. Si des options de test de base existent, les plateformes plus complètes et très sensibles restent souvent hors de portée financière de nombreux établissements.

- Bien que les progrès technologiques et la concurrence entre les fabricants contribuent progressivement à la baisse des coûts, les contraintes budgétaires des systèmes de santé publique et les difficultés de remboursement peuvent encore limiter leur utilisation à grande échelle. De nombreux professionnels de santé doivent trouver un juste équilibre entre l'accessibilité financière et la précision diagnostique lorsqu'ils choisissent des solutions de test ANA pour une utilisation de routine.

- Pour assurer la croissance durable du marché mondial des tests d'anticorps antinucléaires, il est essentiel de surmonter ces défis grâce à une meilleure standardisation, au développement de produits rentables, à une formation accrue des cliniciens et à un financement amélioré des soins de santé.

Portée du marché des tests d'anticorps antinucléaires en Amérique du Nord

Le marché est segmenté en fonction du type d'anticorps, du produit, de la technique, de l'application, de l'utilisateur final et du canal de distribution.

- Par type d'anticorps

Le marché des tests d'anticorps antinucléaires est segmenté, selon le type d'anticorps, en antigènes nucléaires extractibles (ENA), anti-ADN double brin et histones, anticorps anti-DFS70, anti-PM-SCL, anticorps anti-centromères, anti-SP100 et autres. Le segment des anti-ADN double brin et histones a représenté la plus grande part de marché en termes de revenus, soit environ 36,8 % en 2025, grâce à son rôle crucial dans le diagnostic des maladies auto-immunes systémiques telles que le lupus érythémateux systémique (LES). Ces anticorps sont largement utilisés en milieu hospitalier et dans les laboratoires de diagnostic en raison de leur haute spécificité et de leur importance clinique. La sensibilisation accrue des médecins, la grande précision des tests et leur intégration systématique dans les bilans auto-immuns ont également contribué à la domination de ce segment. La prévalence mondiale croissante du lupus et de la polyarthrite rhumatoïde favorise également leur adoption. Par ailleurs, l'amélioration de la sensibilité et de la standardisation des tests a renforcé la confiance dans les résultats, encourageant ainsi une utilisation clinique plus large.

Le segment des tests anti-ENA devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 10,7 %, entre 2026 et 2033, grâce à ses applications croissantes dans la détection de nombreuses maladies du tissu conjonctif, telles que le syndrome de Sjögren, la sclérodermie et la polymyosite. Les panels ENA permettent la détection précoce et la différenciation de maladies auto-immunes complexes, ce qui les rend particulièrement précieux pour le diagnostic avancé. L'adoption croissante des plateformes multiplex et la disponibilité de panels de tests ENA complets stimulent cette croissance. Par ailleurs, l'augmentation des investissements dans le secteur de la santé, le développement des infrastructures de diagnostic et l'intensification des programmes de dépistage dans les pays en développement accélèrent la demande. L'intégration des tests ENA aux plateformes automatisées améliore également l'efficacité, contribuant ainsi à leur croissance rapide.

- Sous-produit

Le marché est segmenté, selon le type de produit, en instruments, consommables et réactifs, et services. Le segment des consommables et réactifs représentait la plus grande part de revenus en 2025, soit environ 47,3 %, car ces produits sont indispensables à chaque test réalisé. Le besoin récurrent en réactifs, tampons, anticorps et kits de dosage assure à ce segment un revenu stable pour les fabricants. L'augmentation du nombre de tests, la prévalence croissante des maladies auto-immunes et l'expansion des réseaux de laboratoires ont fortement stimulé la demande. Par ailleurs, les progrès constants réalisés dans la formulation des réactifs et la fiabilité des kits ont renforcé leur utilisation en diagnostic de routine. La tendance des hôpitaux et des laboratoires à internaliser les tests soutient également la croissance à long terme de ce segment.

Le segment des services devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 11,2 %, entre 2026 et 2033, sous l'effet de la tendance croissante à externaliser les tests de diagnostic vers des laboratoires spécialisés. Le manque d'infrastructures internes dans les petits hôpitaux et cliniques favorise le recours à des prestataires de services tiers. L'expansion des chaînes de services de diagnostic et les investissements dans les laboratoires à haut débit alimentent cette croissance rapide. Par ailleurs, l'essor de la médecine personnalisée et la demande croissante de services d'interprétation de tests avancés jouent un rôle crucial. L'intégration numérique et les modèles de tests à distance contribuent également à améliorer l'accessibilité et à développer ce segment.

- Par la technique

Selon la technique utilisée, le marché est segmenté en ELISA, immunofluorescence indirecte (IFI), test de Western blot, microarrays d'antigènes, techniques sur gel, dosage multiplex, cytométrie en flux, hémagglutination passive (HAP) et autres. Le segment de l'immunofluorescence indirecte (IFI) dominait le marché avec une part de revenus de près de 41,5 % en 2025, car il demeure la méthode de référence pour la recherche d'auto-anticorps (ANA) à l'échelle mondiale. L'IFI offre une sensibilité élevée pour la détection d'un large éventail d'auto-anticorps et permet une visualisation claire des profils, essentielle à l'interprétation diagnostique. La plupart des recommandations cliniques continuent de préconiser l'IFI comme méthode de dépistage de première intention. Son adoption généralisée dans les laboratoires hospitaliers et un remboursement important renforcent encore sa position dominante.

Le segment des tests multiplex devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 12,4 %, entre 2026 et 2033, grâce à sa capacité à détecter simultanément plusieurs anticorps. Cette technique réduit considérablement les délais d'obtention des résultats, améliore l'efficacité des flux de travail et diminue les coûts globaux des tests. L'adoption croissante des plateformes automatisées et la demande grandissante de tests à haut débit dans les grands laboratoires accélèrent sa croissance. De plus, les progrès technologiques et l'intégration d'outils d'analyse basés sur l'IA améliorent la précision et favorisent l'adoption de cette technique par les cliniciens.

- Sur demande

Selon leur application, le marché des tests d'anticorps antinucléaires (ANA) se divise en deux segments : les maladies auto-immunes et les maladies infectieuses. Le segment des maladies auto-immunes représentait la plus grande part de marché (environ 58,9 %) en 2025, sous l'effet de la prévalence mondiale croissante de pathologies telles que le lupus érythémateux systémique, la polyarthrite rhumatoïde, le syndrome de Sjögren et la sclérodermie. Les tests ANA jouent un rôle crucial dans le diagnostic et le suivi clinique de ces maladies et sont donc prescrits de façon routinière dans les hôpitaux et les cliniques spécialisées. La sensibilisation accrue des patients et des médecins, l'amélioration de l'accès aux programmes de dépistage précoce et l'importance accrue accordée à l'identification rapide des maladies stimulent considérablement la demande. Par ailleurs, les progrès constants dans la découverte de biomarqueurs et la recherche en cours sur les pathologies auto-immunes ont renforcé la valeur clinique des tests ANA pour le suivi de l'évolution de la maladie, l'évaluation de la réponse au traitement et la prise en charge à long terme des patients.

Le segment des maladies infectieuses devrait connaître la croissance annuelle composée la plus rapide, soit environ 9,6 %, entre 2026 et 2033. Cette croissance s'explique par les recherches récentes qui mettent en lumière la relation complexe entre les infections et les dérèglements du système immunitaire. L'intérêt accru porté à la compréhension des réponses immunitaires, notamment suite à des épidémies virales de grande ampleur et aux complications post-infectieuses, a renforcé la pertinence clinique des tests ANA. Par ailleurs, l'intégration de ces tests dans des panels immunologiques et diagnostiques complets, ainsi que l'augmentation des investissements mondiaux dans la recherche sur les maladies infectieuses et les programmes de surveillance, contribuent à l'expansion rapide de ce segment.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, laboratoires, centres de diagnostic, instituts de recherche et autres. Le segment des hôpitaux dominait le marché avec une part d'environ 39,4 % en 2025, grâce à une forte fréquentation et à la disponibilité de plateformes de diagnostic intégrées au sein des établissements hospitaliers. Les tests ANA sont couramment réalisés dans le cadre des bilans cliniques de routine pour les maladies auto-immunes et inflammatoires chroniques. La présence de professionnels de santé qualifiés, de laboratoires de pointe et d'environnements de soins multidisciplinaires garantit la précision des tests et l'interprétation des résultats. Par ailleurs, les investissements publics continus dans les infrastructures de santé, la modernisation des hôpitaux et le développement des services spécialisés renforcent la position de leader de ce segment.

Le segment des centres de diagnostic devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, d'environ 10,9 %, entre 2026 et 2033, porté par la demande croissante de services de diagnostic spécialisés, fiables et économiques. Ces centres s'attachent à réduire les délais d'exécution grâce à l'utilisation de technologies automatisées et de plateformes de test avancées. Leur présence grandissante dans les zones urbaines, périurbaines et même les régions mal desservies améliore considérablement l'accès aux tests ANA. Par ailleurs, des collaborations stratégiques avec des hôpitaux, des cliniques et des instituts de recherche renforcent leur position sur le marché et accélèrent la croissance de ce segment.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs, ventes au détail, distributeurs tiers et autres. Le segment des appels d'offres directs détenait la plus grande part de marché, soit environ 44,6 % en 2025, grâce aux achats groupés effectués par les hôpitaux publics, les organismes de santé publique et les grands groupes de soins de santé. Ce canal garantit la maîtrise des coûts, des contrats d'approvisionnement à long terme et une disponibilité constante des produits. Les fabricants bénéficient d'une demande stable, tandis que les établissements de santé profitent de meilleurs prix et d'une meilleure assurance qualité. De plus, les appels d'offres directs réduisent les marges des intermédiaires, permettant ainsi aux établissements d'allouer leurs ressources plus efficacement. Le nombre croissant de programmes de diagnostic financés par l'État et d'initiatives nationales de dépistage des maladies renforce encore la position dominante de ce segment.

Le segment des distributeurs tiers devrait connaître la croissance annuelle composée la plus rapide, d'environ 11,5 %, entre 2026 et 2033. Cette croissance s'explique par l'expansion continue de leur couverture régionale et l'amélioration de l'efficacité globale de la chaîne d'approvisionnement. Leurs réseaux locaux bien établis permettent une disponibilité plus rapide des produits et un meilleur service dans les zones rurales et sous-développées, auparavant mal desservies par les fabricants. Le recours croissant aux distributeurs pour la gestion des stocks, le maintien de la chaîne du froid et la livraison du dernier kilomètre renforce considérablement leur rôle sur le marché des tests ANA. De plus, les distributeurs tiers proposent souvent des solutions intégrées incluant le support technique, la formation et le service après-vente, ce qui améliore la satisfaction et la fidélisation de la clientèle. Le nombre croissant de petits et moyens laboratoires de diagnostic ne disposant pas de capacités d'approvisionnement directes contribue également à cette dépendance.

Analyse régionale du marché des tests d'anticorps antinucléaires en Amérique du Nord

- L'Amérique du Nord a dominé le marché des tests d'anticorps antinucléaires avec la plus grande part de revenus (41,8 %) en 2025, grâce à une infrastructure de santé avancée, un volume élevé de tests de diagnostic, des cadres de remboursement solides et la présence d'importantes entreprises de diagnostic.

- La région bénéficie d'une adoption généralisée des méthodes de dépistage avancées des anticorps antinucléaires (AAN), notamment l'immunofluorescence indirecte (IFI) et les tests ELISA. La prévalence croissante des maladies auto-immunes telles que le lupus, la polyarthrite rhumatoïde et le syndrome de Sjögren a encore accru la demande de dépistage systématique et précoce des AAN.

- Le leadership de la région est également renforcé par une forte sensibilisation des médecins et des patients, des réseaux de laboratoires bien établis et des progrès technologiques constants dans le domaine des tests immunologiques. Les systèmes hospitaliers et de laboratoires de diagnostic intégrés d'Amérique du Nord garantissent un accès rapide aux tests et un suivi précis de la maladie, faisant du test ANA une composante essentielle de la prise en charge des maladies auto-immunes.

Aperçu du marché américain des tests d'anticorps antinucléaires

Le marché américain des tests d'anticorps antinucléaires (ANA) a généré la plus grande part de revenus en 2025, porté par la prévalence croissante des maladies auto-immunes et la forte présence d'infrastructures de diagnostic de pointe. L'utilisation généralisée des technologies d'immunofluorescence et ELISA, conjuguée à des dépenses de santé élevées et à des politiques de remboursement favorables, continue de soutenir l'adoption massive des tests ANA. Par ailleurs, les recherches en cours sur les biomarqueurs auto-immuns, l'accent mis sur le diagnostic précoce et le développement de la médecine personnalisée contribuent significativement à la croissance soutenue du marché aux États-Unis.

Aperçu du marché canadien des tests d'anticorps antinucléaires

Le marché canadien des tests d'anticorps antinucléaires devrait connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 11,8 %. Cette croissance est attribuable à l'amélioration de l'accès aux soins de santé, à l'expansion des infrastructures de laboratoires de diagnostic, à une sensibilisation accrue aux maladies auto-immunes et à l'augmentation des investissements publics dans le développement des soins de santé. L'importance croissante accordée au dépistage précoce des maladies, conjuguée à l'expansion des activités de recherche et à une plus grande disponibilité des technologies immunodiagnostiques avancées, accélère l'adoption des tests ANA dans les hôpitaux, les centres de diagnostic et les instituts de recherche.

Part de marché des tests d'anticorps antinucléaires en Amérique du Nord

Le secteur des tests d'anticorps antinucléaires est principalement dominé par des entreprises bien établies, notamment :

• F. Hoffmann-La Roche Ltd. (Suisse)

• Abbott (États-Unis)

• Siemens Healthineers (Allemagne)

• Danaher Corporation (États-Unis)

• bioMérieux SA (France)

• Thermo Fisher Scientific Inc. (États-Unis)

• Becton, Dickinson and Company (États-Unis)

• QuidelOrtho Corporation (États-Unis)

• Werfen (Espagne)

• EUROIMMUN AG (Allemagne)

• Bio-Rad Laboratories, Inc. (États-Unis)

• Inova Diagnostics (États-Unis)

• Trinity Biotech (Irlande)

• Genway Biotech, Inc. (États-Unis)

• Arlington Scientific, Inc. (États-Unis)

• Erba Diagnostics (Allemagne)

• Hycor Biomedical LLC (États-Unis)

• Diagnostic Automation, Inc. (États-Unis)

• Creative Diagnostics (États-Unis)

• Snibe Diagnostic (Chine)

Dernières évolutions du marché nord-américain des tests d'anticorps antinucléaires

- En mars 2021, le marché mondial des tests ANA a connu une adoption accrue des plateformes ELISA automatisées et d'immunofluorescence indirecte (IFI) dans les hôpitaux et les laboratoires de diagnostic, améliorant ainsi la précision et réduisant les erreurs humaines dans le dépistage des maladies auto-immunes.

- En juillet 2022, plusieurs grandes entreprises de diagnostic ont augmenté leurs capacités de production de kits de test ANA, sous l'impulsion d'une sensibilisation accrue aux maladies auto-immunes telles que le lupus érythémateux systémique, la polyarthrite rhumatoïde et la sclérodermie, notamment en Amérique du Nord et en Europe.

- En avril 2023, EUROIMMUN a introduit des profils de tests ANA améliorés, permettant aux laboratoires de détecter un spectre plus large d'auto-anticorps avec une plus grande précision, favorisant ainsi un diagnostic plus précoce et une meilleure prise en charge des patients atteints de maladies auto-immunes.

- En août 2024, Thermo Fisher Scientific a lancé des plateformes de test ANA automatisées améliorées, dotées d'une sensibilité accrue et de flux de travail de laboratoire rationalisés, permettant des délais d'exécution plus rapides pour les centres de test à volume élevé.

- En janvier 2025, les analystes du secteur ont fait état d'une augmentation continue de l'adoption des tests ANA, due à la prévalence croissante des maladies auto-immunes dans le monde et à l'importance accrue accordée au diagnostic précoce et au suivi des maladies.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.