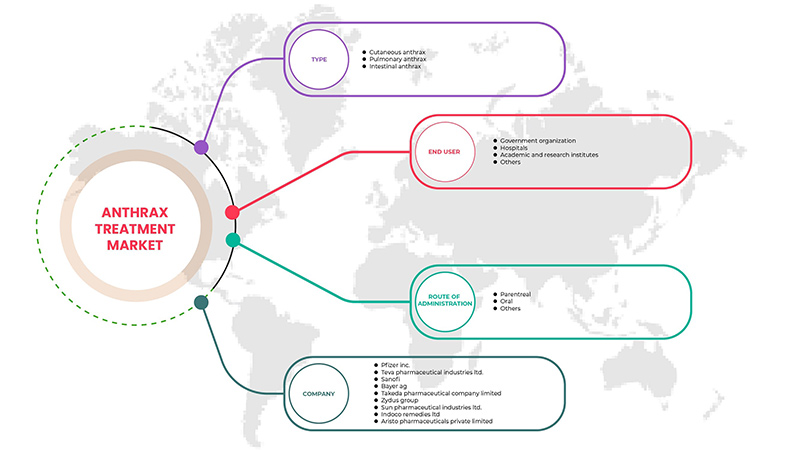

Marché du traitement de l'anthrax en Amérique du Nord, par type ( anthrax cutané , anthrax pulmonaire et anthrax intestinal), voie d'administration (orale, parentérale et autres), utilisateur final (organisme gouvernemental, hôpitaux, instituts universitaires et de recherche, et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché du traitement de l'anthrax en Amérique du Nord

Le marché nord-américain du traitement de l'anthrax est stimulé par des facteurs tels que l'incidence croissante des infections bactériennes , l'augmentation du financement de la recherche et le développement de nouvelles thérapies pour le traitement de l'anthrax et les produits en cours de développement qui augmentent sa demande ainsi que l'augmentation des investissements dans la recherche et le développement qui conduisent à la croissance du marché. Actuellement, les dépenses de santé ont augmenté dans les pays développés et émergents, ce qui devrait créer un avantage concurrentiel pour les fabricants qui souhaitent développer des produits nouveaux et innovants.

L'augmentation du nombre de personnes souffrant de l'anthrax dans le monde est l'un des principaux facteurs de croissance du marché du traitement de l'anthrax. L'augmentation du soutien financier aux chercheurs pour le développement de nouvelles interventions et l'augmentation de la menace d'exposition au Bacillus anthracis parmi les populations civiles et les forces militaires accélèrent la croissance du marché. L'augmentation du nombre de programmes de recherche et développement et l'augmentation des partenariats public-privé pour faciliter les développements de nouveaux traitements innovants et efficaces influencent davantage le marché. Cependant, le coût élevé associé au traitement et à la procédure ainsi que les réglementations gouvernementales strictes pour l'approbation des produits devraient entraver la croissance du marché du traitement de l'anthrax.

Le rapport sur le marché du traitement de l'anthrax en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché , les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. L'évolutivité et l'expansion commerciale des unités de vente au détail dans les pays en développement de diverses régions et le partenariat avec les fournisseurs pour une distribution sûre de machines et de produits pharmaceutiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

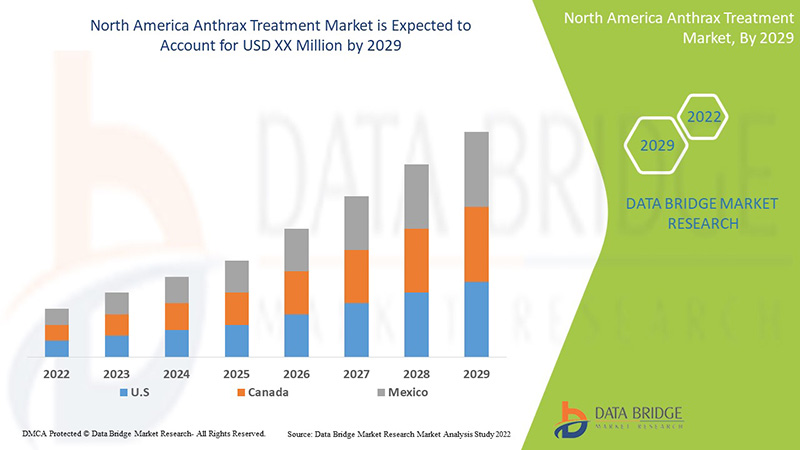

Le marché nord-américain du traitement de l'anthrax est favorable et vise à réduire la progression de la maladie. Data Bridge Market Research analyse que le marché nord-américain du traitement de l'anthrax connaîtra un TCAC de 4,2 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (anthrax cutané, anthrax pulmonaire et anthrax intestinal), voie d'administration (orale, parentérale et autres), utilisateur final (organisme gouvernemental, hôpitaux, instituts universitaires et de recherche et autres) Tendances et prévisions de l'industrie jusqu'en 2029 |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Alembic Pharmaceuticals, Integrated Bio Therapeutics Inc., Sun Pharmaceutical Industries Ltd., Zydus Group, Bayer AG, Pfizer Inc., EMERGENT, Sanofi, Elusys Therapeutics, Lupin, Soligenix, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., INDOCO REMEDIES LTD., Paratek Pharmaceuticals, Inc., BlueWillow Biologics., Altimmune, entre autres |

Dynamique du marché du traitement de l'anthrax en Amérique du Nord

Définition du marché

L'anthrax est provoqué par une bactérie appelée Bacillus anthracis (B. anthracis). Il s'agit principalement d'une maladie qui touche le bétail et qui s'infecte en ingérant des spores présentes dans le sol. Les humains sont généralement infectés par l'anthrax en manipulant des produits provenant d'animaux infectés, comme du cuir ou de la laine, ou en inhalant des spores d'anthrax provenant de produits animaux infectés. Ils peuvent également être infectés en mangeant de la viande insuffisamment cuite provenant d'animaux infectés. L'anthrax ne se transmet pas d'une personne à une autre.

Il existe trois formes cliniques d'infection à l'anthrax. L'anthrax cutané est le plus courant, représentant plus de 95 % des cas signalés. On estime que 2 000 cas d'anthrax cutané surviennent chaque année dans le monde et résultent de l'entrée de spores par des écorchures cutanées.

Le diagnostic différentiel de l'anthrax comprend, en fonction des caractéristiques cliniques, des échantillons pertinents tels que la PCR , la coloration de Gram et les cultures, à partir du sang, du liquide pleural, du site d'ulcération, du liquide céphalorachidien et des selles. Un certain nombre de techniques sont disponibles. La plupart des tests sont basés sur la détection de l'organisme entier, des antigènes de l'organisme ou de l'acide nucléique de l'organisme par l'une des techniques suivantes : méthodes conventionnelles basées sur la culture ; détection immunologique ; tests basés sur les acides nucléiques ; détection basée sur les ligands ; et biocapteurs.

Conducteurs

- Augmentation de la prévalence des infections à l'anthrax

L'incidence des infections bactériennes augmente dans le monde entier. L'anthrax est une infection bactérienne causée par Bacillus anthracis, une bactérie aérobie sporulée à Gram positif. Selon la voie d'entrée des spores de B. anthracis, elle se manifeste principalement sous forme d'infection cutanée, pulmonaire ou gastro-intestinale. Une tache noire caractéristique et croûteuse se développe ensuite sur la zone cutanée affectée et, après quelques semaines, commence à se détacher et finit par tomber, laissant une cicatrice. Le déroulement de ces événements est si caractéristique que le diagnostic n'est pas souvent manqué par les médecins connaissant la maladie, même si c'est rare. L'anthrax pulmonaire est le plus mortel des trois types d'anthrax dans lesquels les spores une fois inhalées germent dans les ganglions lymphatiques trachéobronchiques et se multiplient. L'anthrax est une maladie dangereuse qui affecte à la fois les humains et les animaux. Il s'agit d'une infection mortelle causée par Bacillus anthracis. Ainsi, cette incidence et cette prévalence croissantes des infections à l’anthrax ont créé un besoin d’approches diagnostiques plus sensibles, capables de détecter une infection en faible volume.

L'augmentation du nombre de personnes souffrant de l'anthrax dans le monde est l'un des principaux facteurs de croissance du marché du traitement de l'anthrax. L'augmentation du soutien financier aux chercheurs pour le développement de nouvelles interventions et l'augmentation de la menace d'exposition au Bacillus anthracis parmi les populations civiles et les forces militaires accélèrent la croissance du marché. L'augmentation du nombre de programmes de recherche et développement et l'augmentation des partenariats public-privé pour faciliter les développements de nouveaux traitements innovants et efficaces influencent davantage le marché.

- Augmenter le financement de la recherche et le développement de nouvelles thérapies pour la population soumise au traitement de l'anthrax

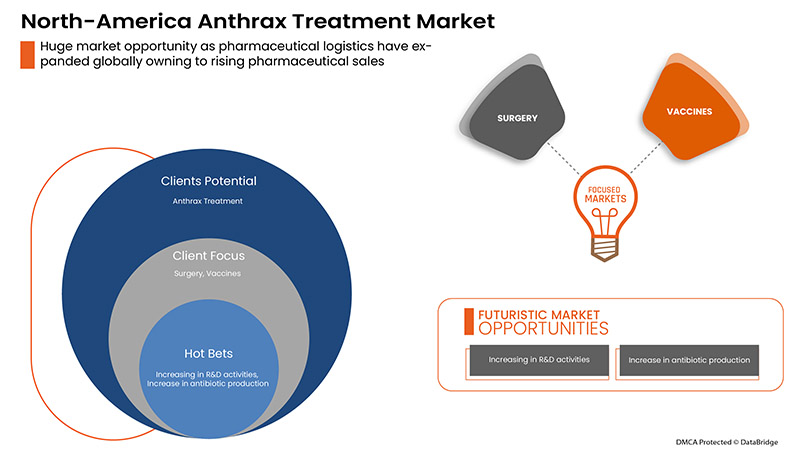

La recherche et le développement sont indispensables pour adapter les procédures aux différents types de patients. La demande de traitement contre l'anthrax augmente dans le monde entier et dans tous les pays. C'est pourquoi les entreprises se concentrent en permanence sur la recherche et le développement afin de réussir à fournir un traitement efficace aux patients. Ces dernières années, de nombreuses approches diagnostiques ont été mises au point pour faire progresser le diagnostic, et beaucoup sont conçues pour détecter même le plus petit volume de parasite dans le corps humain.

Ces nouvelles approches en matière de diagnostic vont faire progresser le marché. Avec l'augmentation du financement de la recherche et le développement de nouvelles thérapies pour le traitement de l'anthrax, il existe plusieurs antibiotiques nouveaux et préexistants, ainsi que des inhibiteurs de toxines qui se sont révélés de plus en plus prometteurs et qui ciblent à la fois la croissance bactérienne et la production de toxines pour lutter efficacement contre la bactérie de l'anthrax.

Les entreprises étant constamment engagées dans des activités de développement, de plus en plus de produits innovants sont lancés sur le marché. Les nouveaux outils développés ont l'efficacité de détecter une infection bactérienne dans des intervalles de temps plus courts avec un taux d'efficacité plus élevé, ce qui permet aux consommateurs d'obtenir un traitement approprié au bon moment. Ainsi, cela signifie que l'augmentation de la recherche et du développement devrait être le moteur de la croissance du marché du traitement de l'anthrax en Amérique du Nord

Opportunités

- Lancement de produit en hausse

L'infection humaine se produit généralement par contact avec des animaux ou des produits animaux infectés et peut se manifester par une infection cutanée, par inhalation ou gastro-intestinale. L'incidence mondiale de l'anthrax est généralement en augmentation. Par conséquent, le nombre croissant de patients atteints de cette maladie dans le monde exige des produits de traitement de l'anthrax hautement efficaces et avancés pour minimiser le risque de décès dû à la maladie du charbon. De plus, les systèmes de santé des pays développés privilégient les produits de traitement de l'anthrax avancés présentant moins de facteurs de risque. De ce fait, les principaux acteurs du marché sont très concentrés sur le lancement de nouveaux produits.

Ainsi, les lancements de produits en pleine croissance fournissent des produits de traitement médical hautement efficaces et avancés pour une meilleure expérience du patient. Les lancements de nouveaux produits attirent l'attention sur l'entreprise et créent la présence de l'entreprise sur le marché nord-américain. Le facteur bénéfique fondamental du lancement de produit est l'accélération de la croissance commerciale de l'entreprise. Alors que les lancements de nouveaux produits créent le flux de revenus pour l'entreprise et le flux de revenus qui s'établit avec le lancement du produit peut persister pendant de nombreuses années. En raison de cela, on estime que les lancements de nouveaux produits devraient constituer une formidable opportunité pour les acteurs du marché d'accroître leur croissance commerciale sur le marché du traitement de l'anthrax.

Contraintes/Défis

- Coût élevé du traitement

Le coût du produit joue un rôle majeur sur le marché. De nombreuses options de diagnostic sont disponibles sur le marché, mais en raison de leur coût élevé, la plupart des gens ont tendance à éviter de se faire diagnostiquer. Les approches diagnostiques étant désormais plus sensibles et plus spécifiques, le coût du test a également augmenté. Le coût élevé de la procédure est dû aux différents points de contrôle des traitements ainsi qu'à l'utilisation de modalités de haute technologie pour effectuer ces procédures. Le coût des appareils technologiques avancés étant élevé, le coût de la procédure augmente proportionnellement, ce qui devrait freiner la demande du marché.

De plus, les infections asymptomatiques doivent passer par des tests très spécifiques pour l'identification des bactéries qui sont coûteux. Étant donné le coût élevé du diagnostic de l'anthrax, on s'attend à ce qu'il freine la croissance du marché. Comme le coût des traitements d'identification est trop élevé, il empêche les médecins et les patients de s'adapter à une solution de haute qualité et efficace. Désormais, le coût élevé des procédures de traitement a un impact négatif sur le coût du traitement global. Par conséquent, il limitera la demande future de traitement dans les pays à revenu faible et intermédiaire. Cela suggère que les procédures coûteuses devraient agir comme un frein à la croissance du marché du traitement de l'anthrax en Amérique du Nord.

Développement récent

- En juin 2022, Emergent BioSolutions Inc. a annoncé que la Food and Drug Administration (FDA) des États-Unis a accepté d'examiner la demande de licence de produit biologique (BLA) pour AV7909, un nouveau candidat vaccin contre l'anthrax évalué pour la prophylaxie post-exposition de la maladie après une exposition suspectée ou confirmée à Bacillus anthracis chez les personnes âgées de 18 à 65 ans avec des médicaments antibactériens recommandés.

- En janvier 2022, Alembic Pharmaceuticals Limited a annoncé que la société avait reçu l'approbation finale de la Food & Drug Administration (USFDA) des États-Unis pour sa demande abrégée de nouveau médicament (ANDA) pour les comprimés à libération retardée d'hyclate de doxycycline USP, 75 mg, 100 mg, 150 mg et 200 mg, qui sont utilisés uniquement pour traiter ou prévenir les infections dont il est prouvé ou fortement suspecté qu'elles sont causées par des bactéries sensibles. Cela se traduit par une expansion du portefeuille de produits de la société.

Segmentation du marché du traitement de l'anthrax en Amérique du Nord

Le marché nord-américain du traitement de l'anthrax est classé en trois segments notables en fonction du type, de la voie d'administration et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Taper

- Charbon cutané

- Charbon pulmonaire

- Charbon intestinal

Sur la base du type, le marché nord-américain du traitement de l’anthrax est segmenté en anthrax cutané, anthrax pulmonaire et anthrax intestinal.

Voie d'administration

- Charbon cutané

- Charbon pulmonaire

- Charbon intestinal

Sur la base de la voie d’administration, le marché nord-américain du traitement de l’anthrax est segmenté en voie orale, parentérale et autres.

Utilisateur final

- Organisation gouvernementale

- Hôpitaux

- Instituts universitaires et de recherche,

- Autres

Sur la base de l'utilisateur final, le marché nord-américain du traitement de l'anthrax est segmenté en organisations gouvernementales, hôpitaux, instituts universitaires et de recherche et autres.

Analyse/perspectives régionales du marché du traitement de l'anthrax

Le marché nord-américain du traitement de l’anthrax est analysé et des informations sur la taille du marché et les tendances sont fournies par type, voie d’administration et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le rapport sur le traitement de l’anthrax sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché en raison des progrès technologiques croissants dans les régions en développement.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du traitement de l'anthrax

Le paysage concurrentiel du marché du traitement de l'anthrax en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché du traitement de l'anthrax.

Certains acteurs du marché sont Alembic Pharmaceuticals, Integrated Bio Therapeutics Inc., Sun Pharmaceutical Industries Ltd., Zydus Group, Bayer AG, Pfizer Inc., EMERGENT, Sanofi, Elusys Therapeutics, Lupin, Soligenix, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., INDOCO REMEDIES LTD., Paratek Pharmaceuticals, Inc., BlueWillow Biologics., Altimmune, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Amérique du Nord vs région et fournisseur. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ANTHRAX TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 DEMOGRAPHIC TRENDS-

4.4 EPIDEMIOLOGY AND DEMOGRAPHICS-

4.4.1 INCIDENCE

4.4.2 DEVELOPED COUNTRIES-

4.4.3 DEVELOPING COUNTRIES-

4.5 PATIENT ENROLMENT STRATEGIES-

4.6 PATIENT FLOW DIAGRAM FOR ANTHRAX INFECTION-

4.7 CURRENT STATE OF ANTHRAX VACCINES

4.8 NORTH AMERICA ANTIBIOTIC CONSUMPTION RATES INCREASED BY 46 PERCENT IN THE LAST TWO DECADES, ACCORDING TO THE FIRST STUDY TO PROVIDE LONGITUDINAL ESTIMATES FOR HUMAN ANTIBIOTIC CONSUMPTION COVERING 204 COUNTRIES FROM 2000 TO 2018.

4.9 NORTH AMERICA ANTIBIOTIC CONSUMPTION AND PROJECTED CONSUMPTION-

5 THE M&A IN THE ANTHRAX MARKET INDICATES AN UPCOMING LONG RUN IN VACCINE DEVELOPMENT AROUND THE GLOBE. CURRENT AND SOME OF LAST YEAR’S ACQUISITION BETWEEN LEADERS AND SMALL SIZE PHARMACEUTICAL SHOWS THE CONTINUOUS DEVELOPMENT IN THE COMPANY’S PIPELINE FOR ANTHRAX TREATMENT.

6 NORTH AMERICA ANTHRAX TREATMENT MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING INCIDENCE OF ANTHRAX INFECTION

7.1.2 INCREASE IN RESEARCH FUNDING AND THE DEVELOPMENT OF NOVEL THERAPIES FOR THE TREATMENT OF ANTHRAX

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN TREATMENT PROCEDURE

7.1.4 STRATEGIC INITIATIVES ADOPTED BY MARKET PLAYERS

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH ANTHRAX DIAGNOSTIC TREATMENT

7.2.2 FALSE DATA INTERPRETATION

7.3 OPPORTUNITIES

7.3.1 RISING PRODUCT LAUNCHES

7.3.2 RISING GOVERNMENT INITIATIVES

7.3.3 IMPROVING A BETTER HEALTHCARE SYSTEM

7.4 CHALLENGES

7.4.1 LACK OF AWARENESS AMONG PEOPLE ABOUT ANTHRAX INFECTION

7.4.2 LACK OF SKILLED PROFESSIONALS

8 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY TYPE

8.1 OVERVIEW

8.2 CUTANEOUS ANTHRAX

8.2.1 ANTIBIOTICS

8.2.1.1 BY DRUGS

8.2.1.1.1 CIPROFLOXACIN

8.2.1.1.2 LEVOFLOXACIN

8.2.1.1.3 DOXYCYCLINE

8.2.1.1.4 AMPICILLIN

8.2.1.1.5 OTHERS

8.2.1.2 BY PRODUCT TYPES

8.2.1.2.1 GENERICS

8.2.1.2.2 BRANDED

8.2.1.2.2.1 CIPRO

8.2.1.2.2.2 LEVO

8.2.1.2.2.3 DOXY

8.2.1.2.2.4 AMPICI

8.2.1.2.2.5 OTHERS

8.2.2 ANTITOXINS

8.2.2.1 RAXIBACUMAB

8.2.2.2 OBILTOXAXIMAB (ANTHIM)

8.2.2.3 ANTHRACIL (ANTHRAX IMMUNE GLOBULIN INTRAVENOUS)

8.2.2.4 OTHERS

8.2.3 VACCINES

8.2.3.1 RAXIBACUMAB

8.2.4 SURGERY

8.3 PULMONARY ANTHRAX

8.3.1 ANTIBIOTICS

8.3.1.1 BY DRUGS

8.3.1.1.1 CIPROFLOXACIN

8.3.1.1.2 LEVOFLOXACIN

8.3.1.1.3 DOXYCYCLINE

8.3.1.1.4 AMPICILLIN

8.3.1.1.5 OTHERS

8.3.1.2 BY PRODUCT TYPES

8.3.1.2.1 GENERICS

8.3.1.2.2 BRANDED

8.3.1.2.2.1 CIPRO

8.3.1.2.2.2 LEVO

8.3.1.2.2.3 DOXY

8.3.1.2.2.4 AMPICI

8.3.1.2.2.5 OTHERS

8.3.2 ANTITOXINS

8.3.2.1 RAXIBACUMAB

8.3.2.2 OBILTOXAXIMAB (ANTHIM)

8.3.2.3 ANTHRACIL (ANTHRAX IMMUNE GLOBULIN INTRAVENOUS)

8.3.2.4 OTHERS

8.3.3 VACCINES

8.3.3.1 RAXIBACUMAB

8.3.3.2 SURGERY

8.4 INTESTINAL ANTHRAX

8.4.1 ANTIBIOTICS

8.4.1.1 BY DRUGS

8.4.1.1.1 CIPROFLOXACIN

8.4.1.1.2 LEVOFLOXACIN

8.4.1.1.3 DOXYCYCLINE

8.4.1.1.4 AMPICILLIN

8.4.1.1.5 OTHERS

8.4.1.2 BY PRODUCT TYPES

8.4.1.2.1 GENERICS

8.4.1.2.2 BRANDED

8.4.1.2.2.1 CIPRO

8.4.1.2.2.2 LEVO

8.4.1.2.2.3 DOXY

8.4.1.2.2.4 AMPICI

8.4.1.2.2.5 OTHERS

8.4.2 ANTITOXINS

8.4.2.1 RAXIBACUMAB

8.4.2.2 OBILTOXAXIMAB (ANTHIM)

8.4.2.3 ANTHRACIL (ANTHRAX IMMUNE GLOBULIN INTRAVENOUS)

8.4.2.4 OTHERS

8.4.3 VACCINES

8.4.3.1 RAXIBACUMAB

8.4.3.2 SURGERY

9 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 PARENTERAL

9.3 ORAL

9.4 OTHERS

10 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY END USER

10.1 OVERVIEW

10.2 GOVERNMENT ORGANIZATION

10.3 HOSPITALS

10.4 ACADEMIC AND RESEARCH

10.5 OTHERS

11 NORTH AMERICA VIRTUAL REALITY MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA ANTHRAX TREATMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BAYER AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 PFIZER INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 TEVA PHARMACEUTICAL INDUSTRIES LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 SANOFI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ALEMBIC PHARMACEUTICALS LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 ALTIMMUNE

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 ARISTO PHARMACEUTICALS PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BLUEWILLOW BIOLOGICS.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 DEINOVE

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EMERGENT

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 ELUSYS THERAPEUTICS INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GC BIOPHARMA CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 INDOCO REMEDIES LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGRATED BIOTHERAPEUTICS, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LUPIN.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 PARATEK PHARMACEUTICALS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 PORTON BIOPHARMA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SOLIGENIX

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

14.21 ZYDUS GROUP

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 POPULATION AT RISK (IN MILLIONS) BY REGION, LAND USE AND OCCUPATIONAL EXPOSURE, 2020-

TABLE 2 VACCINES IN DEVELOPMENT

TABLE 3 ANTIBIOTIC CONSUMPTION ESTIMATES BY GBD SUPER-REGION AND GBD REGION, FOR THE YEAR 2018-

TABLE 4 COUNTRY DATA OF ANTIBIOTICS CONSUMPTION-

TABLE 5 RECENT M&A IN ANTHRAX MARKET-

TABLE 6 ANTIBIOTICS MEDICINES

TABLE 7 FDA REQUIRES THE FOLLOWING SCENARIO BEFORE A DRUG IS APPROVED

TABLE 8 NORTH AMERICA ANTHRAX TREATMENT MARKET, TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CUTANEOUS ANTHRAX IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CUTANEOUS ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ANTIBIOTICS IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA BY PRODUCT TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ANTITOXIN IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA VACCINES IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PULMONARY ANTHRAX IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PULMONARY ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ANTIBIOTICS IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BY PRODUCT TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ANTITOXIN IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA VACCINES IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA INTESTINAL ANTHRAX IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA INTESTINAL ANTHRAX IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ANTIBIOTICS IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA BY PRODUCT TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ANTITOXIN IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA VACCINES IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PARENTERAL IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA ORAL IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA GOVERNMENT ORGANIZATION IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITALS IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ACADEMIC AND RESEARCH IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA OTHERS IN ANTHRAX TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CUTANEOUS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 45 NORTH AMERICA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 46 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 47 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 48 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 49 NORTH AMERICA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 50 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 51 NORTH AMERICA BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 52 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 53 NORTH AMERICA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 54 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 55 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 56 NORTH AMERICA VACCINE IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 57 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 58 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 59 NORTH AMERICA PULMONARY ANTHRAX IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 60 NORTH AMERICA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 61 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 62 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 63 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 64 NORTH AMERICA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 65 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 66 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 67 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 68 NORTH AMERICA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 69 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 70 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 71 NORTH AMERICA VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 72 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 73 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 74 NORTH AMERICA INTESTINAL ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 76 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 77 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 78 NORTH AMERICA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 79 NORTH AMERICA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 80 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 81 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 82 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 83 NORTH AMERICA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 84 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 85 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 86 NORTH AMERICA VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 87 NORTH AMERICA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 88 NORTH AMERICA BRANDED TYPES ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (ASP)

TABLE 89 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATIONS, 2020- 2029 (USD MILLION)

TABLE 90 NORTH AMERICA ANTHRAX TREATMENT MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 91 U.S. ANTHRAX TREATMENT MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 92 U.S. CUTANEOUS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 93 U.S. ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 94 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 95 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 96 U.S. BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 97 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 98 U.S. BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 99 U.S. ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 100 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 101 U.S. VACCINE IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 102 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 103 U.S. PULMONARY ANTHRAX IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 104 U.S. ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 105 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 106 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 107 U.S. BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 108 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 109 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 110 U.S. ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 111 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 112 U.S. VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 113 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 114 U.S. INTESTINAL ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 115 U.S. ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 116 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 117 U.S. BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 118 U.S. BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 119 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 120 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 121 U.S. ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 122 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 123 U.S. VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 124 U.S. BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 125 U.S. ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATIONS, 2020- 2029 (USD MILLION)

TABLE 126 U.S. ANTHRAX TREATMENT MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 127 CANADA ANTHRAX TREATMENT MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 128 CANADA CUTANEOUS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 129 CANADA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 130 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 131 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 132 CANADA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 133 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 134 CANADA BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 135 CANADA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 136 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 137 CANADA VACCINE IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 138 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 139 CANADA PULMONARY ANTHRAX IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 140 CANADA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 141 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 142 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 143 CANADA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 144 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 145 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 146 CANADA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 147 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 148 CANADA VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 149 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 150 CANADA INTESTINAL ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 151 CANADA ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 152 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 153 CANADA BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 154 CANADA BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 155 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 156 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 157 CANADA ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 158 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 159 CANADA VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 160 CANADA BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 161 CANADA ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATIONS, 2020- 2029 (USD MILLION)

TABLE 162 CANADA ANTHRAX TREATMENT MARKET, BY END USER, 2020- 2029 (USD MILLION)

TABLE 163 MEXICO ANTHRAX TREATMENT MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 164 MEXICO CUTANEOUS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 165 MEXICO ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 166 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 167 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 168 MEXICO BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 169 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 170 MEXICO BRANDED IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 171 MEXICO ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 172 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 173 MEXICO VACCINE IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 174 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 175 MEXICO PULMONARY ANTHRAX IN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 176 MEXICO ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 177 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 178 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 179 MEXICO BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 180 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 181 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 182 MEXICO ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 183 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 184 MEXICO VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 185 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 186 MEXICO INTESTINAL ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 187 MEXICO ANTIBIOTIC ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 188 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 189 MEXICO BY DRUGS ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 190 MEXICO BY PRODUCT TYPE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 191 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 192 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 193 MEXICO ANTITOXIN ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 194 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 195 MEXICO VACCINE ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 196 MEXICO BRANDED ANTHRAX TREATMENT MARKET, BY TYPE, 2020- 2029 (UNITS)

TABLE 197 MEXICO ANTHRAX TREATMENT MARKET, BY ROUTE OF ADMINISTRATIONS, 2020- 2029 (USD MILLION)

TABLE 198 MEXICO ANTHRAX TREATMENT MARKET, BY END USER, 2020- 2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA ANTHRAX TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTHRAX TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTHRAX TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTHRAX TREATMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTHRAX TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTHRAX TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ANTHRAX TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ANTHRAX TREATMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA ANTHRAX TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ANTHRAX TREATMENT MARKET: SEGMENTATION

FIGURE 11 MIDDLE EAST & AFRICA IS ANTICIPATED TO DOMINATE THE ANTHRAX TREATMENT MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING INCIDENCE AND PREVALENCE OF ANTHRAX INFECTIONS ARE EXPECTED TO DRIVE THE NORTH AMERICA ANTHRAX TREATMENT MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTHRAX TREATMENT MARKET IN 2022 & 2029

FIGURE 14 NORTH AMERICA DISTRIBUTION OF OUTBREAKS BY COUNTRY AND GEOGRAPHIC LOCATIONS OF ANTHRAX EVENTS-

FIGURE 15 PATHOPHYSIOLOGY OF ANTHRAX-

FIGURE 16 FLOW CHART FOR SUSPECTED ANTHRAX EXPOSURE-

FIGURE 17 GC BIOPHARMA ANTHRAX CANDIDATE GC1109 IS IN PHASE 2 (NCT01624532).

FIGURE 18 BA-ISTAB IS A FUSION OF A B. ANTHRACIS SPECIFIC CWT WITH A POTENT MONOCLONAL ANTIBODY THAT NEUTRALIZE ANTHRAX TOXIN (PA).

FIGURE 19 TWO ROUTES BY WHICH VACCINATION CAN REDUCE INCIDENCE OF AMR-

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ANTHRAX TREATMENT MARKET

FIGURE 21 NORTH AMERICA ANTHRAX TREATMENT MARKET : TYPE, 2021

FIGURE 22 NORTH AMERICA ANTHRAX TREATMENT MARKET : TYPE, 2022-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA ANTHRAX TREATMENT MARKET : TYPE, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA ANTHRAX TREATMENT MARKET : TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY ROUTE OF ADMINISTRATION, 2021

FIGURE 26 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY END USER, 2021

FIGURE 30 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 31 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY END USER, CAGR (2022-2029)

FIGURE 32 NORTH AMERICA ANTHRAX TREATMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA ANTHRAX TREATMENT MARKET: SNAPSHOT (2021)

FIGURE 34 NORTH AMERICA ANTHRAX TREATMENT MARKET: BY COUNTRY (2021)

FIGURE 35 NORTH AMERICA ANTHRAX TREATMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 NORTH AMERICA ANTHRAX TREATMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 NORTH AMERICA ANTHRAX TREATMENT MARKET: BY TYPE (2022-2029)

FIGURE 38 NORTH AMERICA ANTHRAX TREATMENT MARKET: COMPANY SHARE 2021(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.