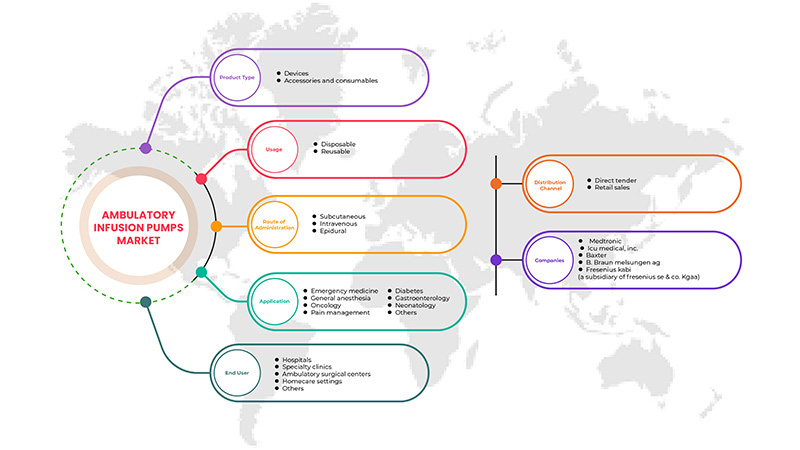

Marché des pompes à perfusion ambulatoires en Amérique du Nord, par type de produit (dispositifs, accessoires et consommables), utilisation (jetable et réutilisable), voie d'administration (sous-cutanée, intraveineuse et péridurale), application (médecine d'urgence, anesthésie générale, gestion de la douleur , oncologie, diabète , gastroentérologie, néonatologie, autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire , établissements de soins à domicile et autres), canal de distribution (appel d'offres direct et ventes au détail), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché des pompes à perfusion ambulatoires en Amérique du Nord

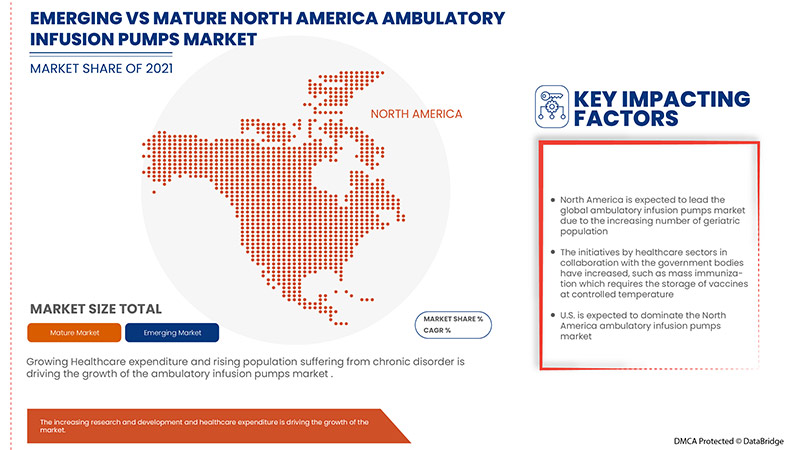

Les principaux facteurs à l’origine de la croissance de ce marché sont l’augmentation de la population gériatrique, la prévalence croissante de maladies chroniques telles que le cancer et le diabète, et les résultats positifs pour les patients dans un environnement domestique moins coûteux. Les développements technologiques continus et les nouvelles applications des pompes ambulatoires à domicile entraînent une augmentation de leur utilisation. Récemment, les pompes ambulatoires ont été utilisées pour administrer divers médicaments afin de traiter diverses maladies et affections, du diabète à la douleur chronique. Ce mode d’administration implique généralement l’utilisation d’une aiguille ou d’un cathéter sous la peau pour administrer des médicaments, des produits sanguins, des nutriments ou des solutions hydratantes par voie intraveineuse, sous-cutanée, péridurale/intrathécale, percutanée, intraplaie, intrahépatique ou d’autres voies parentérales.

Les principaux facteurs susceptibles d’entraver la croissance du marché sont le coût élevé associé aux systèmes de pompes à perfusion ambulatoires.

Le rapport sur le marché des pompes à perfusion ambulatoires fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché , d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

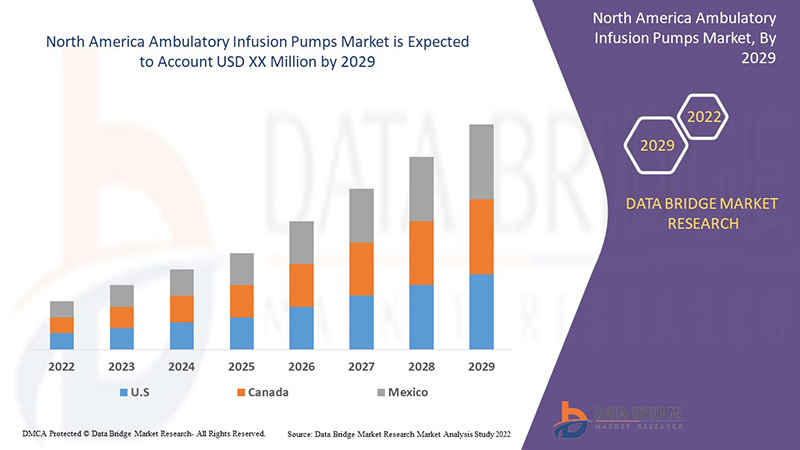

Data Bridge Market Research analyse que le marché des pompes à perfusion ambulatoires croîtra à un TCAC de 10,7 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (dispositifs, accessoires et consommables), utilisation (jetable et réutilisable), voie d'administration (sous-cutanée, intraveineuse et péridurale), application (médecine d'urgence, anesthésie générale, gestion de la douleur , oncologie, diabète , gastroentérologie, néonatologie, autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire , établissements de soins à domicile et autres), canal de distribution (appel d'offres direct et vente au détail) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (une filiale de Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, entre autres. |

Définition du marché

Dispositif médical qui administre des liquides, tels que des nutriments et des médicaments, dans le corps d'un patient en quantités contrôlées. Les pompes à perfusion sont largement utilisées dans les milieux cliniques tels que les hôpitaux, les maisons de retraite et à domicile. Une pompe à perfusion est actionnée par un utilisateur formé, qui programme le débit et la durée de l'administration de liquide via une interface logicielle intégrée. Les pompes à perfusion offrent des avantages significatifs par rapport à l'administration manuelle de liquides, notamment la possibilité d'administrer des liquides en très petits volumes et la possibilité d'administrer des liquides à des débits programmés avec précision ou à des intervalles automatisés. Elles peuvent administrer des nutriments ou des médicaments, tels que l'insuline ou d'autres hormones, des antibiotiques, des médicaments de chimiothérapie et des analgésiques.

Les systèmes de pompe à perfusion sont un traitement actif visant à contrôler la médication en petites quantités dans différents contextes tels que les hôpitaux, les cliniques et même à domicile. Il est utilisé pour administrer une quantité contrôlée de médicaments très lentement dans la circulation sanguine sur une période donnée. Il peut être utilisé dans des environnements stationnaires et mobiles pour administrer des analgésiques, des antibiotiques, des médicaments de chimiothérapie et des liquides hydratants.

Dynamique du marché des pompes à perfusion ambulatoires

Conducteurs

- Augmentation de la population gériatrique

L'âge augmente avec l'augmentation du nombre de patients âgés admis dans les hôpitaux en raison de la prévalence croissante des maladies chroniques. L'âge est un facteur de risque important pour toute progression de la maladie, car l'âge est un paramètre essentiel qui affecte les mécanismes biologiques fondamentaux. Les maladies chroniques telles que le cancer surviennent énormément dans la population gériatrique, avec près de 60 % des cancers survenant dans la tranche d'âge de la population gériatrique de plus de 65 ans. Le cancer est un véritable défi dans la population gériatrique, car en raison des facteurs liés à l'âge, la population gériatrique souffre déjà de nombreux problèmes de santé. Cela indique la demande croissante de pompes à perfusion de la part de la population gériatrique.

Avec la capacité d'administrer des liquides en très petite quantité dans un environnement contrôlé directement dans la circulation sanguine, la demande de systèmes de pompes à perfusion augmente dans le système de santé mondial. Le besoin croissant de traitements appropriés augmente proportionnellement la demande de soins, de services et de technologies pour prévenir et traiter des maladies, notamment les maladies cardiovasculaires, les accidents vasculaires cérébraux, le cancer, les maladies respiratoires chroniques et d'autres complications. Avec l'âge croissant et la prévalence croissante des maladies chroniques, la demande de diagnostic précoce des maladies augmente également. La demande de soins, de services et de technologies augmente pour traiter les maladies chroniques chez les personnes âgées. Ainsi, l'augmentation de la population gériatrique devrait stimuler la croissance du marché des pompes à perfusion ambulatoires.

- Progrès technologiques croissants dans le système de pompes à perfusion

Les progrès technologiques dans le domaine des soins de santé et des services cliniques sont désormais accessibles. Les avancées technologiques dans le domaine des pompes à perfusion permettent de prévenir les erreurs de médication et de réduire les préjudices causés aux patients. Ces avancées se traduisent par une amélioration des résultats cliniques grâce à une technologie de surveillance des patients qui permet d'informer et de guider les décisions de traitement des cliniciens.

La technologie se diversifie et joue un rôle dans presque tous les processus du secteur de la santé, comme la possibilité d'erreurs de médication en raison d'une augmentation de la charge de morbidité, l'enregistrement des patients pour la gestion des données et les tests de laboratoire pour les équipements d'auto-soins, ce qui en fait le prochain facteur de stimulation pour les systèmes de pompes à perfusion, les accessoires et le marché des logiciels. L'innovation et les progrès technologiques ont mis à niveau les systèmes de pompes à perfusion dans tous les domaines, y compris des fonctionnalités avancées telles qu'une précision, une mobilité, une flexibilité et un choix différents de canaux automatiques fluides. Les progrès technologiques apportent de nombreux avantages pour l'efficacité des procédures conduisant à une sécurité accrue des patients. Par conséquent, les avancées technologiques croissantes dans les systèmes de pompes à perfusion devraient stimuler le marché des pompes à perfusion ambulatoires.

Opportunités

- Augmentation de l'incidence des maladies chroniques

La prévalence élevée des maladies chroniques due à la croissance rapide de la population et des infections est observée à l'échelle mondiale. Les facteurs de risque individuels, les facteurs environnementaux, le manque d'activité physique et les modes de vie humains sont les principaux facteurs qui contribuent à l'augmentation de l'incidence des maladies. L'évaluation des troubles entraînera en outre une forte demande d'études cliniques par différentes voies d'administration de médicaments dans le corps humain. L'augmentation de l'incidence de maladies telles que les maladies cardiovasculaires et le cancer a entraîné une augmentation de la demande de dispositifs de pompe à perfusion intraveineuse.

Contraintes/Défis

- Effets secondaires associés au système de pompes à perfusion

L'utilisation croissante des pompes à perfusion avec les progrès technologiques est devenue une pratique courante dans les hôpitaux pour administrer des liquides critiques aux patients. Cependant, il existe encore peu d'études de recherche visant à réduire les erreurs et à améliorer l'utilisation des pompes à perfusion qui entraînent des événements indésirables dans le système. Les divers problèmes qui y sont associés peuvent être des erreurs logicielles ou des erreurs humaines.

Les effets secondaires associés aux systèmes de pompe à perfusion comprennent des problèmes logiciels, une conception d'interface utilisateur inadéquate, des composants cassés, des erreurs d'alarme, des pannes de batterie et une carbonisation ou des chocs.

- Coût élevé lié au système de pompes à perfusion

Les patients atteints de maladies chroniques telles que le syndrome de détresse respiratoire aiguë doivent être hospitalisés pendant de longues périodes, avec une monétarisation et un recours régulier à la ventilation, ce qui nécessite une quantité importante de ressources de santé, ce qui fait que la plupart des patients qui ne peuvent pas se permettre un séjour à long terme et sortent de l'hôpital dès les premières étapes du traitement. Mais cela augmente les possibilités et les susceptibilités à de nouvelles complications en cas d'infections, ce qui exige des ressources de santé et des traitements supplémentaires.

Le coût élevé du traitement est dû aux différents points de contrôle du traitement ainsi qu'à l'utilisation de modalités de haute technologie pour effectuer ces procédures de traitement. Les soins hospitaliers augmentent encore le coût des interventions de pompe à perfusion. Le coût des pompes à perfusion innovantes et avancées étant élevé, le coût du traitement augmente proportionnellement, ce qui fait que le coût élevé associé à l'utilisation des systèmes de pompes à perfusion devrait restreindre le marché des pompes à perfusion ambulatoires.

Développements récents

- En mars 2022, Fresenius Kabi a annoncé l'acquisition d'Ivenix, Inc., une société de technologie médicale spécialisée dans les systèmes de perfusion de technologies avancées. Cela contribue à accélérer la croissance stratégique dans les domaines biopharmaceutiques et Medtech, ce qui se traduit par l'expansion du marché vaste et en pleine croissance de la thérapie par perfusion.

- En février 2022, le système de perfusion Plum 360 d'ICU Medical, Inc. a de nouveau reçu la distinction Best in KLAS en tant que pompe intelligente la plus performante intégrée au DME. Cette désignation Best in KLAS est basée sur les commentaires de milliers de prestataires de soins de santé aux États-Unis et au Canada et résulte de comparaisons côte à côte approfondies des performances des pompes intelligentes IV dans plusieurs catégories, notamment la culture, la fidélité, les opérations, le produit, la relation et la valeur.

Segmentation du marché des pompes à perfusion ambulatoires

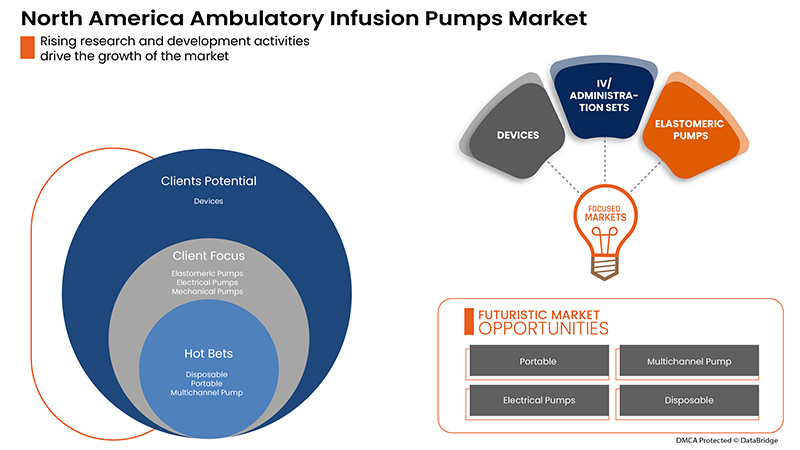

Le marché des pompes à perfusion ambulatoires est classé en six segments notables qui sont basés sur le type de produit, l'utilisation, la voie d'administration, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Appareils

- Accessoires et consommables

Sur la base du type de produit, le marché des pompes à perfusion ambulatoires est segmenté en appareils, accessoires et consommables.

Usage

- Jetable

- Réutilisable

Sur la base de l’utilisation, le marché des pompes à perfusion ambulatoires est segmenté en jetables et réutilisables.

Voie d'administration

- Intraveineux

- Sous-cutané

- Épidurale

Sur la base de la voie d’administration, le marché des pompes à perfusion ambulatoires est segmenté en intraveineuse, sous-cutanée et péridurale.

Application

- Gestion de la douleur

- Diabète

- Oncologie

- Néonatologie

- Gastroentérologie

- Anesthésie générale

- Médecine d'urgence

- Autres

Sur la base de l'application, le marché des pompes à perfusion ambulatoires est segmenté en gestion de la douleur, diabète, oncologie, néonatalogie, gastro-entérologie, anesthésie générale, médecine d'urgence et autres.

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Cadres de soins à domicile

- autres

Sur la base de l’utilisateur final, le marché mondial des pompes à perfusion ambulatoires est segmenté en hôpitaux, établissements de soins à domicile, centres de chirurgie ambulatoire, cliniques spécialisées et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base des canaux de distribution, le marché des pompes à perfusion ambulatoires est segmenté en appels d’offres directs et ventes au détail.

Analyse/perspectives régionales sur les pompes à perfusion ambulatoires

Les pompes à perfusion ambulatoires sont analysées et des informations sur la taille du marché et les tendances sont fournies par type de produit, utilisation, voie d'administration, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur les pompes à perfusion ambulatoires sont les États-Unis, le Canada et le Mexique.

L'Amérique du Nord devrait dominer le marché en raison des avancées technologiques croissantes dans le domaine des systèmes de pompes à perfusion. Les États-Unis devraient dominer le marché en raison de la forte prévalence de divers troubles chroniques et aigus chez les Américains.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des pompes à perfusion ambulatoires

Le paysage concurrentiel des pompes à perfusion ambulatoires fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des pompes à perfusion ambulatoires.

Certains des principaux acteurs opérant sur ce marché sont B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (une filiale de Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse de la part de marché Amérique du Nord vs région et fournisseur. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE GERIATRIC POPULATION

6.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN INFUSION PUMPS SYSTEM

6.1.3 RISING DEMAND FOR AMBULATORY PUMPS IN HOME CARE SETTINGS

6.1.4 INCREASE IN THE NUMBER OF SURGERIES

6.2 RESTRAINS

6.2.1 HIGH COST LINKED WITH INFUSION PUMPS SYSTEM

6.2.2 SIDE-EFFECTS ASSOCIATED WITH INFUSION PUMPS SYSTEM

6.3 OPPORTUNITIES

6.3.1 INCREASING INCIDENCE OF CHRONIC DISEASES

6.3.2 RISING ARTIFICIAL INTELLIGENCE TO AUTOMATE DRUG INFUSIONS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.3.4 INCREASED REIMBURSEMENT POLICIES

6.4 CHALLENGE

6.4.1 LACK OF SKILLED HEALTHCARE PROFESSIONALS

6.4.2 STRINGENT GOVERNMENT REGULATION

7 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DEVICES

7.2.1 BY PRODUCT

7.2.1.1 ELASTOMERIC PUMPS

7.2.1.1.1 MULTICHANNEL PUMP

7.2.1.1.2 SINGLE CHANNEL PUMP

7.2.1.2 ELECTRICAL PUMPS

7.2.1.2.1 MULTICHANNEL PUMP

7.2.1.2.2 SINGLE CHANNEL PUMP

7.2.1.3 MECHANICAL PUMPS

7.2.1.3.1 MULTICHANNEL PUMP

7.2.1.3.2 SINGLE CHANNEL PUMP

7.2.1.4 OTHER PUMPS

7.2.2 BY MODALITY

7.2.2.1 PORTABLE

7.2.2.2 WEARABLE

7.3 ACCESSORIES AND CONSUMABLES

7.3.1 IV/ADMINISTRATION SETS

7.3.2 TUBING & EXTENSION

7.3.3 INFUSION CATHETERS

7.3.4 INSULIN RESERVOIR OR CARTRIDGES

7.3.5 CANNULAS

7.3.6 NEEDLELESS CONNECTORS

7.3.7 BATTERY

7.3.8 OTHERS

8 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE

8.1 OVERVIEW

8.1.1 DISPOSABLE

8.1.2 DEVICES

8.1.3 ACCESSORIES AND CONSUMABLES

8.2 REUSABLE

8.2.1 DEVICES

8.2.2 ACCESSORIES AND CONSUMABLES

9 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 INTRAVENOUS

9.3 SUBCUTANEOUS

9.4 EPIDURAL

10 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 PAIN MANAGEMENT

10.2.1 DEVICES

10.2.2 ACCESSORIES AND CONSUMABLES

10.3 DIABETES

10.3.1 DEVICES

10.3.2 ACCESSORIES AND CONSUMABLES

10.4 ONCOLOGY

10.4.1 DEVICES

10.4.2 ACCESSORIES AND CONSUMABLES

10.5 NEONATOLOGY

10.5.1 DEVICES

10.5.2 ACCESSORIES AND CONSUMABLES

10.6 GASTROENTEROLOGY

10.6.1 DEVICES

10.6.2 ACCESSORIES AND CONSUMABLES

10.7 GENERAL ANESTHESIA

10.7.1 DEVICES

10.7.2 ACCESSORIES AND CONSUMABLES

10.8 EMERGENCY MEDICINE

10.8.1 DEVICES

10.8.2 ACCESSORIES AND CONSUMABLES

10.9 OTHERS

11 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 HOMECARE SETTINGS

11.4 AMBULATORY SURGICAL CENTERS

11.5 SPECIALTY CLINICS

11.6 OTHERS

12 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MEDTRONIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ICU MEDICAL

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 BAXTER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 B. BRAUN MELSUNGEN AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO.KGAA)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 BD

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACE-MEDICAL

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVNS.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 EITAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 INTRA PUMP INFUSION SYSTEMS.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KORU MEDICAL SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 MOOG INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MICREL MEDICAL DEVICES SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 WALKMED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 WOODLEY EQUIPMENT COMPANY LTD

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 12 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA INTRAVENOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SUBCUTANEOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA EPIDURAL IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HOSPITALS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HOMECARE SETTINGS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SPECIALTY CLINICS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIRECT TENDER IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL SALES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 50 NORTH AMERICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 56 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 U.S. AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 73 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 74 U.S. ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 U.S. ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 U.S. MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 U.S. DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 78 U.S. ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 80 U.S. ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 81 U.S. AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 U.S. DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 83 U.S. REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 84 U.S. AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 U.S. AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 CANADA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 98 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 99 CANADA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 CANADA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 CANADA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 CANADA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 103 CANADA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 105 CANADA ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 106 CANADA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 107 CANADA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 108 CANADA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 109 CANADA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 112 CANADA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 CANADA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, BY VOLUME, 2020-2029 (UNITS)

TABLE 123 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, ASP 2020-2029 (USD)

TABLE 124 MEXICO ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 MEXICO ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 MEXICO MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 MEXICO DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 MEXICO ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, VOLUME 2020-2029 (UNITS)

TABLE 130 MEXICO ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP 2020-2029 (USD)

TABLE 131 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 MEXICO REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMIRATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 MEXICO DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 138 MEXICO ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 139 MEXICO NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 144 MEXICO AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 10 THE RISING PREVALENCE OF CHRONIC DISEASES, AS WELL AS GROWING GERIATRIC POPULATION, IS DRIVING THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND, CHALLENGES OF NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET

FIGURE 13 RECENT YEAR HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 14 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2021

FIGURE 19 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 23 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2021

FIGURE 31 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA AMBULATORY INFUSION PUMPS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.