North America Aesthetic Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

8.06 Billion

USD

18.71 Billion

2024

2032

USD

8.06 Billion

USD

18.71 Billion

2024

2032

| 2025 –2032 | |

| USD 8.06 Billion | |

| USD 18.71 Billion | |

|

|

|

|

Segmentation du marché des dispositifs esthétiques en Amérique du Nord, par produits (produits d'esthétique faciale, dispositifs de remodelage corporel , implants cosmétiques, dispositifs d'esthétique cutanée, dispositifs d'épilation et autres), matières premières (polymères, biomatériaux et métaux), utilisateurs finaux (hôpitaux, cliniques dermatologiques, cliniques, instituts de recherche universitaires et privés et autres), canal de distribution (vente directe et au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des dispositifs esthétiques en Amérique du Nord

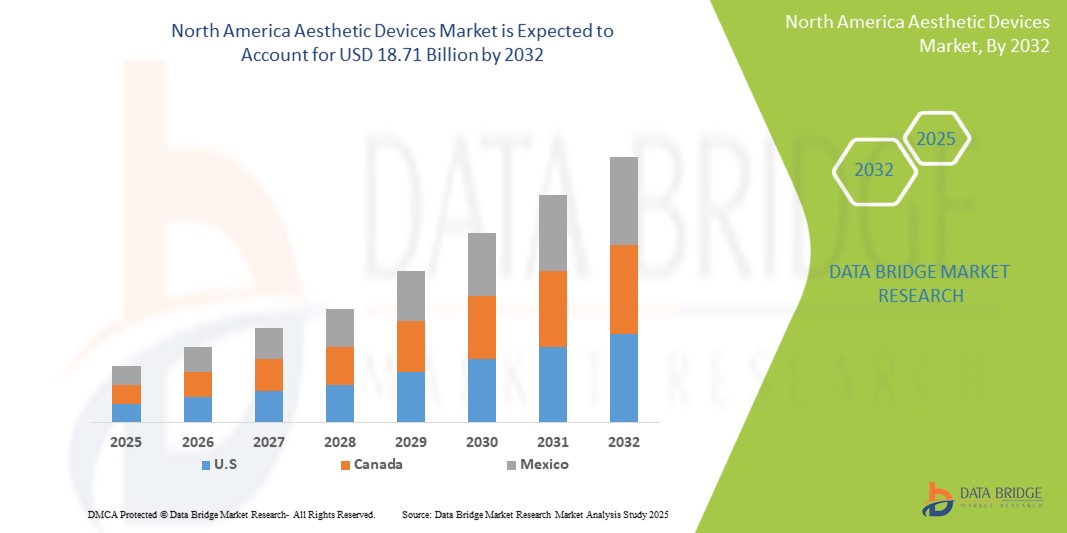

- La taille du marché des dispositifs esthétiques en Amérique du Nord était évaluée à 8,06 milliards USD en 2024 et devrait atteindre 18,71 milliards USD d'ici 2032 , à un TCAC de 11,10 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la demande croissante de procédures esthétiques mini-invasives et par la sensibilisation croissante aux options d'amélioration esthétique auprès de divers groupes de consommateurs. Les progrès technologiques ont amélioré la sécurité, l'efficacité et la variété des dispositifs esthétiques disponibles, favorisant leur adoption plus large dans les cliniques et les centres de bien-être.

- De plus, l'influence croissante des réseaux sociaux et l'importance accordée à l'apparence physique incitent de plus en plus de personnes à recourir à des traitements esthétiques, favorisant ainsi une croissance constante du marché. Les consommateurs recherchent de plus en plus des solutions non chirurgicales offrant une guérison plus rapide et des résultats naturels.

Analyse du marché nord-américain des dispositifs esthétiques

- Les appareils esthétiques connaissent une forte adoption partout en Amérique du Nord, stimulée par la demande croissante de procédures cosmétiques peu invasives et non invasives, la sensibilisation croissante à l'esthétique personnelle et l'augmentation des revenus disponibles.

- L'influence croissante des réseaux sociaux, l'intérêt croissant pour les traitements anti-âge et les avancées technologiques en matière de laser, d'ultrasons et de radiofréquence stimulent la demande de solutions esthétiques. Les cliniques dermatologiques, les spas médicaux et les hôpitaux d'Amérique du Nord investissent de plus en plus dans des plateformes esthétiques multifonctionnelles pour améliorer la précision des traitements, réduire les temps d'arrêt et élargir leur offre de services.

- Les États-Unis ont dominé le marché des dispositifs esthétiques en Amérique du Nord, représentant la plus grande part des revenus de 87,6 % en 2024. Cette domination est attribuée aux dépenses élevées des consommateurs en procédures cosmétiques, à la disponibilité généralisée d'appareils avancés et à la présence de marques esthétiques reconnues mondialement dont le siège social est aux États-Unis. L'innovation continue, de solides campagnes de marketing et une large base de praticiens formés renforcent encore le leadership du pays.

- Le Canada devrait connaître la croissance la plus rapide sur le marché nord-américain des dispositifs esthétiques, avec un TCAC estimé à 6,8 % entre 2025 et 2032. Cette croissance est stimulée par l'acceptation croissante des interventions esthétiques non chirurgicales, l'expansion des prestataires de services esthétiques en milieu urbain et suburbain, et des procédures réglementaires favorables à l'approbation des dispositifs. La sensibilisation croissante de la population vieillissante et l'essor du tourisme médical contribuent également à l'expansion du marché.

- Le segment des polymères détenait la plus grande part de marché, avec 47,6 % en 2024, grâce à leur large application dans divers dispositifs esthétiques, grâce à leur flexibilité, leur légèreté et leur biocompatibilité. Ces matériaux sont largement utilisés dans les implants cosmétiques, les produits de comblement dermique et divers dispositifs de traitement cutané.

Portée du rapport et segmentation du marché des dispositifs esthétiques en Amérique du Nord

|

Attributs |

Aperçu du marché des dispositifs esthétiques en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des dispositifs esthétiques en Amérique du Nord

Progrès dans les technologies mini-invasives et les solutions centrées sur le patient

- Une tendance importante et croissante sur le marché nord-américain des dispositifs esthétiques est l'innovation continue dans les technologies de traitement mini-invasives et non invasives, visant à améliorer le confort des patients et à réduire les délais de récupération. Ces avancées favorisent leur adoption par les cliniciens et les patients en quête de solutions esthétiques efficaces et moins invasives.

- Par exemple, les appareils laser et ultrasons de pointe sont améliorés pour offrir un traitement ciblé avec un minimum d'effets secondaires, permettant aux patients de reprendre rapidement leurs activités normales. Des appareils tels que le système laser Cynosure Elite+ et la technologie ultrasonore Ultherapy illustrent cette évolution vers des procédures esthétiques plus sûres et plus efficaces.

- L'accent croissant mis sur la personnalisation centrée sur le patient a conduit les fabricants à développer des dispositifs adaptables à chaque type de peau, pathologie et objectif thérapeutique. Par exemple, l'utilisation d'outils d'imagerie et de diagnostic avancés permet aux praticiens de personnaliser les plans de traitement, améliorant ainsi les résultats et la satisfaction des patients.

- L'intégration de plateformes multifonctionnelles combinant diverses modalités de traitement – telles que la radiofréquence, le laser et la cryothérapie – au sein d'un même appareil gagne également en popularité. Cela offre une plus grande polyvalence aux praticiens esthétiques, leur permettant de proposer une offre de soins complète dans un environnement clinique rationalisé.

- Ces tendances transforment le paysage des dispositifs esthétiques en mettant l'accent sur la sécurité, l'efficacité et la personnalisation des soins. Des entreprises comme Allergan et Lumenis sont à l'avant-garde et innovent continuellement dans leurs gammes de produits pour répondre à l'évolution des demandes des consommateurs et des exigences cliniques.

- La demande en dispositifs esthétiques avancés et peu invasifs augmente rapidement sur les marchés développés et émergents, stimulée par une sensibilisation croissante, l'expansion des cliniques esthétiques et une attention croissante portée au bien-être et aux soins personnels.

Dynamique du marché nord-américain des dispositifs esthétiques

Conducteur

Une demande croissante stimulée par une sensibilisation croissante et l'expansion des procédures cosmétiques

- La sensibilisation croissante aux traitements esthétiques parmi une population plus large, y compris les milléniaux et les populations vieillissantes, associée à la demande croissante de procédures cosmétiques mini-invasives et non invasives, est un moteur majeur de la forte demande d'appareils esthétiques avancés.

- Par exemple, en avril 2024, Lumenis Ltd. a annoncé le lancement de sa plateforme laser de pointe, conçue pour répondre à un large éventail d'applications telles que le resurfaçage cutané, la réduction des rides et le traitement des lésions vasculaires, offrant une précision accrue et un confort accru pour les patients. Ces innovations continues, menées par des entreprises leaders, devraient accélérer la croissance du marché des dispositifs esthétiques tout au long de la période de prévision.

- Alors que les consommateurs recherchent de plus en plus des solutions efficaces mais à faible risque pour le rajeunissement de la peau, le remodelage du corps et l'épilation, les appareils esthétiques qui offrent des temps de récupération plus rapides et moins d'effets secondaires gagnent en popularité dans les cliniques de dermatologie, les centres de chirurgie plastique et les spas médicaux en Amérique du Nord.

- Par ailleurs, la préférence croissante pour les plans de traitement personnalisés et les appareils multifonctionnels capables de répondre à divers problèmes esthétiques en une seule séance stimule la croissance du marché. Les appareils utilisant des technologies telles que la radiofréquence, les ultrasons, la cryolipolyse et les lasers fractionnés sont particulièrement prisés pour leur sécurité et leur efficacité.

- Le nombre croissant de praticiens cosmétiques formés et l'essor du tourisme médical dans les économies émergentes contribuent également à l'adoption croissante de ces dispositifs, permettant l'accès à des traitements esthétiques avancés dans diverses régions géographiques.

Retenue/Défi

Préoccupations concernant les coûts initiaux élevés et la conformité réglementaire

- L'investissement initial élevé requis pour acquérir des dispositifs esthétiques de pointe demeure un obstacle majeur, notamment pour les petites cliniques et les acteurs des marchés émergents, confrontés à des contraintes budgétaires. Ce défi est aggravé par le besoin constant de mises à niveau et de maintenance des dispositifs, qui alourdit les dépenses globales.

- Par exemple, les appareils esthétiques haut de gamme équipés de fonctionnalités avancées telles que la technologie laser fractionnée ou les ultrasons focalisés de haute intensité (HIFU) sont généralement assortis d'un surcoût considérable, ce qui limite leur accessibilité sur les marchés sensibles aux prix.

- En outre, les exigences réglementaires strictes et variables selon les pays exigent des essais cliniques, des certifications et des approbations rigoureux, ce qui peut retarder le lancement des produits et augmenter les dépenses liées à la conformité, impactant ainsi la croissance du marché.

- Bien que les fabricants introduisent progressivement des modèles plus rentables et des solutions de financement flexibles pour alléger la charge financière des utilisateurs finaux, le coût perçu comme élevé et le paysage réglementaire complexe continuent de restreindre une pénétration plus large du marché.

- Pour assurer une croissance soutenue, l'industrie doit se concentrer sur le développement de solutions abordables et innovantes, la rationalisation des voies réglementaires et la fourniture d'une formation complète aux praticiens afin d'améliorer la convivialité des appareils et les résultats pour les patients.

Portée du marché nord-américain des dispositifs esthétiques

Le marché est segmenté en fonction des produits, des matières premières, de l’utilisateur final et du canal de distribution.

- Par produits

En termes de produits, le marché des dispositifs esthétiques se segmente en produits d'esthétique faciale, appareils de remodelage corporel, implants cosmétiques, dispositifs d'esthétique cutanée, appareils d'épilation, etc. En 2024, le segment des produits d'esthétique faciale détenait la plus grande part de chiffre d'affaires, soit 38,7 %, grâce à l'importance croissante accordée en Amérique du Nord à la beauté, au bien-être et au vieillissement en beauté. La popularité croissante des traitements non invasifs et mini-invasifs, tels que les peelings chimiques, la microdermabrasion, le resurfaçage au laser et les produits injectables comme la toxine botulique et les produits de comblement, stimule considérablement la demande. Les innovations technologiques ont amélioré la sécurité, réduit les temps d'arrêt et amélioré l'efficacité des traitements, attirant ainsi un public plus large, notamment les jeunes consommateurs en quête de soins préventifs.

Le segment des appareils de remodelage corporel devrait enregistrer le TCAC le plus rapide, soit 15,8 % entre 2025 et 2032. Cette croissance est alimentée par la prévalence croissante de l'obésité et de la sédentarité, combinée à une préférence croissante des consommateurs pour les techniques non chirurgicales de réduction des graisses comme la cryolipolyse, les ultrasons et la radiofréquence. De plus, la sensibilisation croissante à l'esthétique corporelle et à l'image de soi encourage leur adoption, tant sur les marchés développés qu'émergents.

- Par matières premières

En fonction des matières premières, le marché des dispositifs esthétiques est segmenté en polymères, biomatériaux et métaux. Le segment des polymères détenait la plus grande part de marché, avec 47,6 % en 2024, grâce à la large application des matériaux à base de polymères dans divers dispositifs esthétiques, grâce à leur flexibilité, leur légèreté et leur biocompatibilité. Ces matériaux sont largement utilisés dans les implants cosmétiques, les produits de comblement dermique et divers dispositifs de traitement cutané.

Les biomatériaux devraient connaître la croissance la plus rapide au cours de la période de prévision, avec un TCAC de 14,2 %, grâce aux progrès de la médecine régénérative et de l'ingénierie tissulaire, qui utilisent des matériaux d'origine naturelle pour favoriser la guérison et l'intégration au sein du corps humain. Ce segment bénéficie d'une intensification des activités de recherche et développement axées sur la médecine personnalisée et les dispositifs implantables imitant les tissus biologiques. Les métaux tels que le titane, l'acier inoxydable et les alliages cobalt-chrome continuent de jouer un rôle essentiel, notamment pour assurer l'intégrité structurelle et la durabilité des implants cosmétiques, des instruments chirurgicaux et d'autres applications à haute résistance, détenant une part de marché de 28,3 % en 2024, notamment lorsque la stabilité à long terme et la biocompatibilité sont essentielles.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des dispositifs esthétiques est segmenté en hôpitaux, cliniques dermatologiques, cliniques, instituts de recherche universitaires et privés, entre autres. En 2024, les hôpitaux dominaient le marché, représentant 42,5 % du chiffre d'affaires, grâce à leurs infrastructures solides, leur accès à des spécialistes pluridisciplinaires et leur capacité à réaliser des interventions esthétiques chirurgicales et non chirurgicales avancées. La présence de services spécialisés et les collaborations avec les fabricants de dispositifs médicaux permettent aux hôpitaux de proposer des traitements de pointe, favorisant ainsi l'afflux de patients.

Les cliniques dermatologiques devraient connaître le TCAC le plus rapide, soit 14,9 %, entre 2025 et 2032, car elles se concentrent de plus en plus sur la dermatologie esthétique et les interventions esthétiques ambulatoires. La sensibilisation croissante aux questions esthétiques et la préférence pour des traitements moins invasifs ont incité davantage de patients à se tourner vers les cliniques dermatologiques, qui offrent souvent des soins personnalisés, des délais d'attente plus courts et des technologies innovantes adaptées aux problèmes de peau. De plus, les instituts de recherche universitaires et privés contribuent en innovant sur les nouvelles technologies et en menant des essais cliniques, favorisant ainsi l'innovation continue dans le secteur.

- Par canal de distribution

En fonction du canal de distribution, le marché des dispositifs esthétiques est segmenté en ventes directes et ventes au détail. Le segment des ventes directes a dominé le marché en 2024, avec une part de chiffre d'affaires de 54,3 %, principalement grâce aux contrats d'approvisionnement en gros conclus avec les hôpitaux, les organismes publics de santé et les grands prestataires de soins de santé, qui garantissent un approvisionnement régulier, négocient de meilleurs prix et gèrent les stocks des dispositifs à forte demande. Ce segment bénéficie d'accords à long terme et du pouvoir d'achat des institutions.

À l'inverse, le segment des ventes au détail devrait enregistrer le TCAC le plus rapide, soit 13,6 %, sur la période de prévision, grâce à la prolifération des plateformes de commerce électronique et des places de marché en ligne, qui ont élargi l'accès aux produits aux petites cliniques, aux praticiens individuels et aux consommateurs finaux. La croissance des ventes au détail est également soutenue par la confiance croissante des consommateurs dans l'achat d'appareils esthétiques en ligne, la disponibilité d'appareils conviviaux à usage domestique et l'intensification des efforts marketing ciblant les canaux de vente directe aux consommateurs, élargissant ainsi la portée du marché et encourageant l'essai des produits.

Analyse régionale du marché nord-américain des dispositifs esthétiques

- Le marché nord-américain des dispositifs esthétiques représentait 39,8 % du chiffre d'affaires mondial en 2024, porté par la demande croissante de procédures esthétiques mini-invasives et non invasives, la sensibilisation croissante à l'esthétique personnelle et l'augmentation des revenus disponibles. La région bénéficie d'une infrastructure de santé mature, d'une forte présence de cliniques spécialisées et d'une large acceptation des traitements esthétiques avancés par les consommateurs. L'innovation continue des principaux fabricants, allant des plateformes laser multifonctionnelles aux systèmes avancés d'ultrasons et de radiofréquence, a fait de l'Amérique du Nord un pôle mondial d'adoption des technologies esthétiques.

- L'influence croissante des réseaux sociaux, l'attention accrue portée aux traitements anti-âge et les progrès en matière de précision et de sécurité des appareils accélèrent la demande de soins esthétiques. Les cliniques dermatologiques, les spas médicaux et les hôpitaux d'Amérique du Nord investissent de plus en plus dans des plateformes multifonctionnelles pour proposer des solutions complètes de rajeunissement cutané, de remodelage corporel et d'épilation. Le segment des cliniques dermatologiques a contribué à environ 46,2 % du chiffre d'affaires total du marché nord-américain en 2024, soulignant le rôle essentiel des traitements ciblés et dispensés par des spécialistes pour accroître la satisfaction des patients et favoriser la répétition des interventions.

- Les avancées technologiques, telles que les outils d'analyse cutanée basés sur l'IA, les appareils de traitement portables à domicile et les systèmes hybrides combinant plusieurs modalités, améliorent encore les résultats des traitements, raccourcissent les périodes de convalescence et élargissent le champ des affections traitables. Le leadership nord-américain sur le marché s'appuie également sur de solides programmes de formation des praticiens, des normes réglementaires strictes garantissant sécurité et efficacité, et un solide écosystème de partenariats marketing et de marques qui renforcent l'engagement des consommateurs.

Aperçu du marché américain des dispositifs esthétiques

Le marché américain des dispositifs esthétiques a dominé le marché nord-américain, s'adjugeant la plus grande part de chiffre d'affaires, soit 87,6 % en 2024. Ce leadership s'explique par les dépenses élevées des consommateurs en produits cosmétiques, l'adoption précoce de technologies de pointe et la présence de marques mondialement reconnues telles qu'Allergan Aesthetics, Cynosure et Cutera. Le vaste réseau de cliniques dermatologiques, de spas médicaux et de centres de chirurgie esthétique du pays offre un large accès aux services esthétiques chirurgicaux et non chirurgicaux. L'innovation continue dans les domaines du resurfaçage au laser, du raffermissement cutané par ultrasons et du remodelage corporel mini-invasif, combinée à des stratégies marketing et des options de financement agressives, a considérablement élargi la clientèle du marché. La prévalence des tendances beauté portées par les célébrités et la vigueur du secteur du tourisme médical du pays renforcent encore sa position de leader mondial en matière d'adoption de dispositifs esthétiques.

Aperçu du marché canadien des dispositifs esthétiques

Le marché canadien des dispositifs esthétiques est en passe de connaître la croissance la plus rapide en Amérique du Nord, avec un TCAC estimé à 6,8 % entre 2025 et 2032. Cette croissance est portée par l'acceptation croissante des interventions esthétiques non chirurgicales par divers groupes d'âge, conjuguée à une accessibilité accrue aux services esthétiques en métropole et en banlieue. L'expansion des cliniques de dermatologie, des spas médicaux et des centres de soins esthétiques ambulatoires, soutenue par des cadres réglementaires favorables à l'approbation des dispositifs, améliore l'accès des patients aux technologies de pointe telles que le microneedling par radiofréquence, la cryolipolyse et les lasers fractionnés. Le vieillissement de la population canadienne alimente la demande de traitements anti-âge, tandis que la croissance du tourisme médical, notamment en provenance des États-Unis, accroît encore les sources de revenus. Les campagnes de sensibilisation du public et l'influence des médias sociaux contribuent également à un changement culturel vers des soins esthétiques axés sur la prévention et l'entretien, accélérant ainsi l'adoption de dispositifs de pointe partout au pays.

Part de marché des dispositifs esthétiques en Amérique du Nord

L'industrie des dispositifs esthétiques est principalement dirigée par des entreprises bien établies, notamment :

- AbbVie Inc. (États-Unis)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd (Chine)

- Bausch Health Companies Inc. (Canada)

- Candela Medical (États-Unis)

- Cutera (États-Unis)

- Cynosure (États-Unis)

- LUTRONIC INC (Corée du Sud)

- BTL (République tchèque)

- Medytox (Corée du Sud)

- SharpLight Technologies Inc (Israël)

- Aerolase Corp (États-Unis)

- Suneva Medical (États-Unis)

- AirXpanders, Inc. (États-Unis)

- Lumenis Be Ltd. (Israël)

- Concept Vénus (Canada)

- Sientra, Inc. (États-Unis)

- Merz North America, Inc. (États-Unis)

- Système Quanta (Italie)

- GC Aesthetics (Irlande)

Derniers développements sur le marché nord-américain des dispositifs esthétiques

- En janvier 2021, Candela, leader nord-américain des dispositifs médico-esthétiques, a annoncé la disponibilité du système Frax Pro, un dispositif de resurfaçage cutané fractionné non ablatif, approuvé par la FDA, doté des applicateurs Frax 1550 et Frax 1940. Ce dispositif a permis à l'entreprise d'élargir son portefeuille de produits esthétiques sur le marché.

- En avril 2025, LYMA Life Ltd. a reçu l'autorisation de la FDA pour son LYMA Laser PRO, un appareil portatif conçu pour la photothérapie laser de faible intensité pour le traitement des rides. Cette autorisation marque une étape importante : le LYMA Laser PRO est le premier appareil de ce type à recevoir l'autorisation de la FDA, élargissant ainsi la disponibilité des traitements esthétiques avancés à domicile sur le marché américain.

- En août 2025, les avancées en matière de traitements non chirurgicaux de raffermissement cutané ont pris de l'importance, avec des appareils comme Ultherapy, Sofwave et la luminothérapie rouge offrant des alternatives moins douloureuses et plus sophistiquées aux liftings traditionnels. Ces appareils à énergie positive sont conçus pour stimuler la production de collagène et rajeunir la peau, répondant ainsi à la demande croissante pour une peau jeune.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.