North America Acrylic Monomers Market

Taille du marché en milliards USD

TCAC :

%

USD

1,107,202.15 Thousand

USD

1,608,199.90 Thousand

2022

2030

USD

1,107,202.15 Thousand

USD

1,608,199.90 Thousand

2022

2030

| 2023 –2030 | |

| USD 1,107,202.15 Thousand | |

| USD 1,608,199.90 Thousand | |

|

|

|

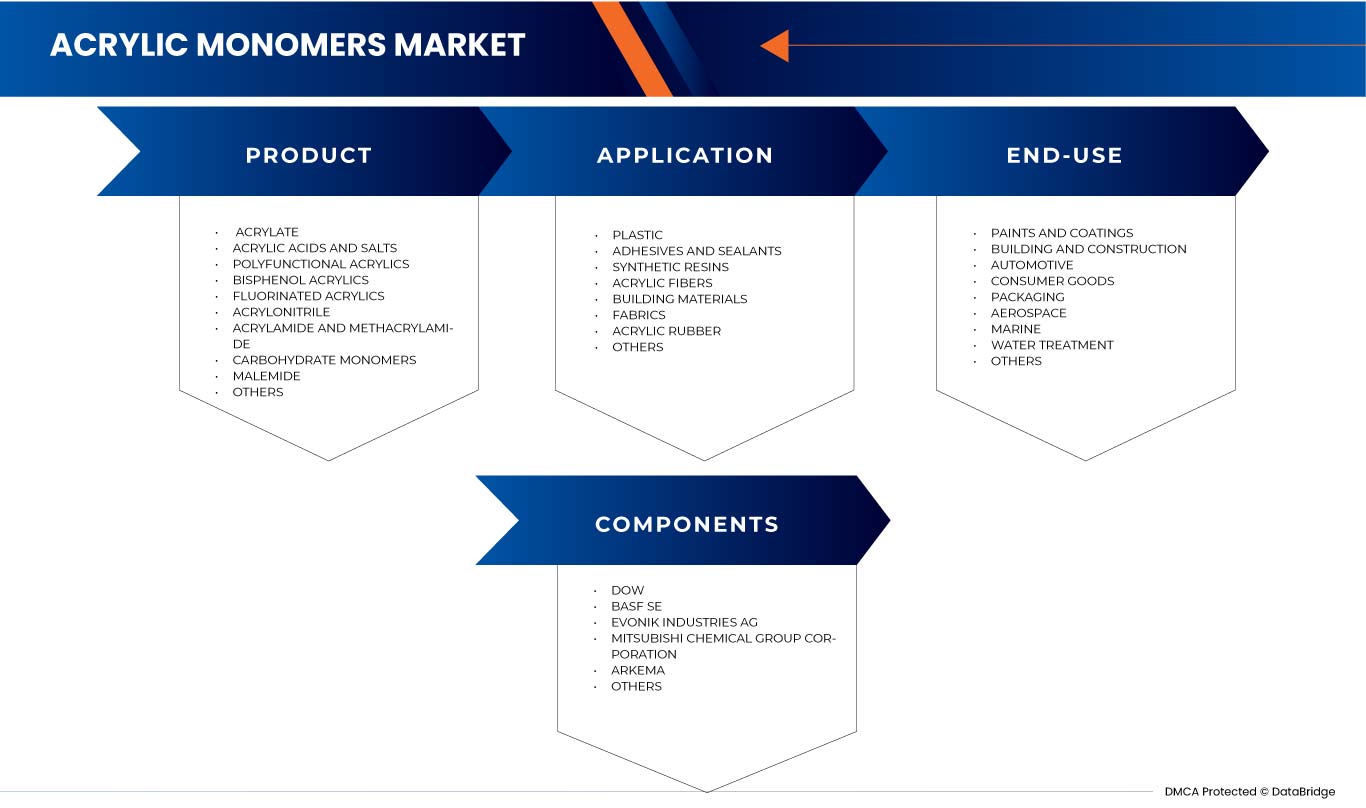

Marché des monomères acryliques en Amérique du Nord, par produit (acrylate, acides et sels acryliques, acryliques polyfonctionnels, acryliques bisphénoliques, acryliques fluorés, acrylonitrile, acrylamide et méthacrylamide, monomères glucidiques, malémide et autres), application (plastique, adhésifs et produits d'étanchéité, résines synthétiques, fibres acryliques, matériaux de construction, tissus, caoutchouc acrylique et autres), utilisation finale (peintures et revêtements, bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau, marine, aérospatiale et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des monomères acryliques en Amérique du Nord

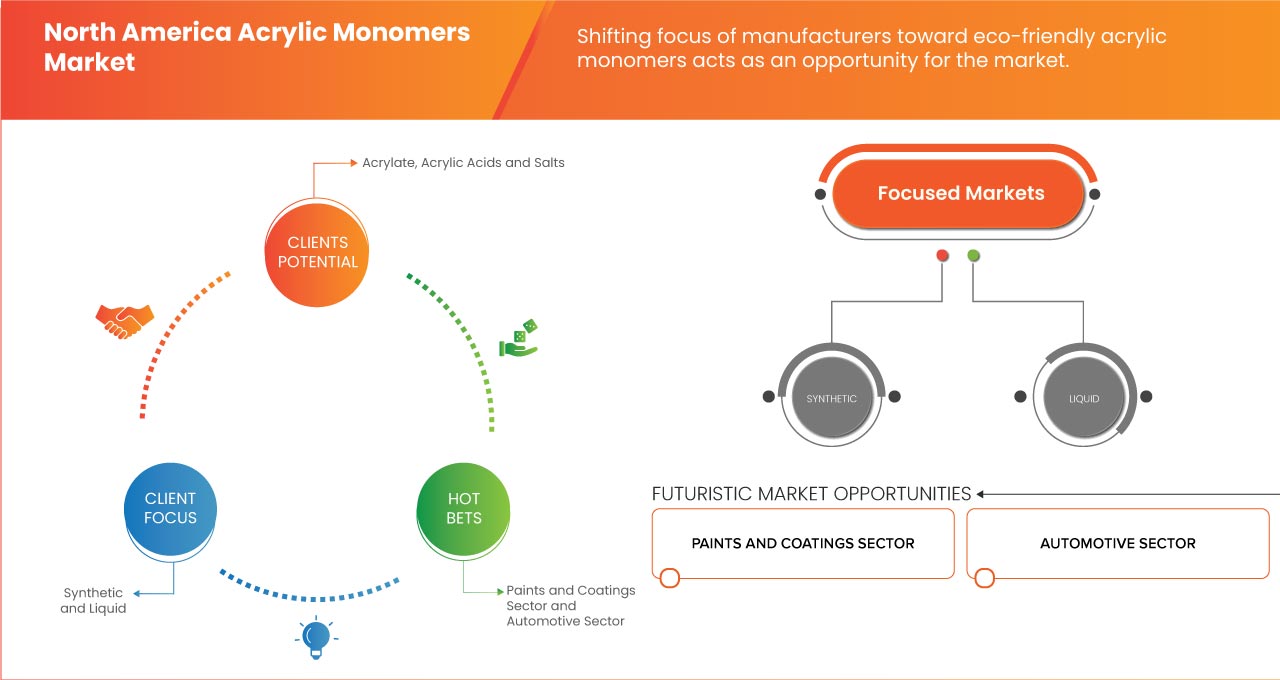

Le marché nord-américain des monomères acryliques est stimulé par l'augmentation des dépenses dans le secteur de la construction. En outre, les perspectives positives concernant l'industrie des peintures et des revêtements constituent un moteur important pour le marché. De plus, l'orientation des fabricants vers les monomères acryliques respectueux de l'environnement devrait stimuler la croissance du marché. Cependant, le respect de normes réglementaires complexes et en constante évolution devrait freiner la croissance du marché.

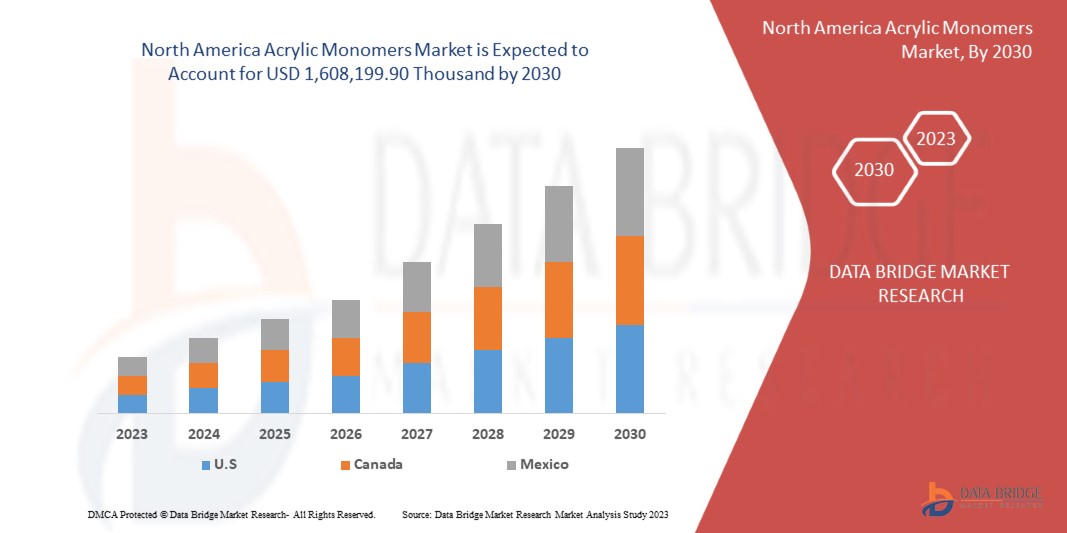

Data Bridge Market Research analyse que le marché nord-américain des monomères acryliques devrait atteindre 1 608 199,90 milliers USD d'ici 2030, contre 1 107 202,15 milliers USD en 2022, avec un TCAC de 4,9 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en milliers de litres |

|

Segments couverts |

Produit (acrylate, acides et sels acryliques, acryliques polyfonctionnels, acryliques bisphénoliques, acryliques fluorés, acrylonitrile, acrylamide et méthacrylamide, monomères glucidiques, malémide et autres), application (plastique, adhésifs et produits d'étanchéité, résines synthétiques, fibres acryliques, matériaux de construction, tissus, caoutchouc acrylique et autres), utilisation finale (peintures et revêtements, bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau , marine, aérospatiale et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

BASF SE, Arkema, Mitsubishi Chemical Group Corporation, Dow, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD., LobaChemie Pvt Ltd., Solventis et Tokyo Chemical Industries CO., Ltd. |

Définition du marché

Les monomères acryliques sont constitués de composés qui englobent l'acide acrylique et ses acrylates associés. Ces composés constituent principalement des acrylates, de l'acide acrylique ou des polymères. Les monomères acryliques sont connus pour leur grande réactivité. Ils sont généralement combinés à de la poudre polymère pour créer des ongles en acrylique durables. Le méthacrylate d'éthyle (EMA) est un composant typique des monomères acryliques en raison de sa résistance exceptionnelle, de son durcissement rapide et de ses excellentes propriétés d'adhérence.

Dynamique du marché des monomères acryliques en Amérique du Nord

Cette section traite de la compréhension des moteurs, des contraintes, des opportunités et des défis du marché. Tous ces éléments sont abordés en détail ci-dessous :

Conducteurs

- Perspectives positives pour l'industrie des peintures et des revêtements

L'industrie des peintures et des revêtements a des perspectives positives en ce qui concerne le marché des monomères acryliques, stimulées par divers facteurs et applications qui contribuent à sa croissance. L'un des principaux moteurs des perspectives positives de l'industrie des peintures et des revêtements est l'utilisation intensive de monomères acryliques, en particulier l'acrylate de N-butyle. Ces monomères servent de blocs de construction essentiels pour les copolymères utilisés dans la formulation de peintures et de revêtements. Ces propriétés incluent la capacité de former des polymères hydrophobes, qui sont essentiels pour créer des revêtements offrant protection et durabilité. Cette propriété les rend particulièrement précieux dans la formulation de revêtements, où la résistance à l'eau et la durabilité sont essentielles. Le méthacrylate, un autre monomère acrylique essentiel dérivé de l'acide méthacrylique, est largement utilisé dans diverses applications, notamment les écrans d'ordinateur et les peintures.

La demande de revêtements hautes performances offrant une durabilité, une résistance aux intempéries et une transparence exceptionnelles est en hausse. Les monomères acryliques, avec leur nature hydrophobe et leur capacité à former des polymères résistants, répondent efficacement à ces exigences. Les fabricants du secteur des peintures et des revêtements se tournent de plus en plus vers les copolymères acryliques pour améliorer la qualité et la longévité de leurs produits. L'expansion des projets de construction et d'infrastructures dans le monde entier a généré une demande importante de peintures et de revêtements, ce qui stimule la croissance du marché.

- Augmentation des dépenses dans le secteur de la construction

Le secteur de la construction est un pilier essentiel du développement économique de l’Amérique du Nord, façonnant le paysage urbain et jetant les bases de la croissance des infrastructures. La forte hausse des dépenses de construction est principalement attribuée à l’urbanisation croissante et à l’expansion démographique. Avec l’augmentation du nombre de personnes qui s’installent dans les villes, la demande de développement résidentiel, commercial et d’infrastructures augmente. Les gouvernements et les investisseurs privés investissent des fonds substantiels dans des projets de construction pour répondre à ces demandes. Cette poussée de l’activité de construction sert de catalyseur pour le marché des monomères acryliques.

Les monomères acryliques, qui renforcent le béton, sont la solution idéale. Ils renforcent la matrice du béton, réduisant ainsi le risque de fissures et de fractures. Cette durabilité accrue garantit que les structures peuvent résister à l'épreuve du temps, en s'alignant parfaitement sur les objectifs à long terme des projets de construction. Les monomères acryliques jouent un rôle essentiel dans cette entreprise en améliorant la maniabilité et la fluidité du béton. Grâce à des rapports eau-ciment optimisés et à une fluidité améliorée, les équipes de construction peuvent couler et consolider efficacement le béton, permettant la réalisation de conceptions complexes et audacieuses. Cela permet non seulement de gagner du temps, mais aussi de réduire les coûts de main-d'œuvre, ce qui en fait un choix économiquement intéressant pour les projets de construction. Les monomères acryliques offrent l'adhérence, la résistance à l'eau et la durabilité requises, ce qui en fait un composant indispensable dans la construction de ces structures monumentales, ce qui propulse la croissance du marché.

Opportunités

- Changement d'orientation des fabricants vers des monomères acryliques respectueux de l'environnement

Le marché des monomères acryliques connaît actuellement un changement d'orientation important, les fabricants se tournant de plus en plus vers des monomères acryliques respectueux de l'environnement. L'un des principaux facteurs à l'origine de ce changement est la préoccupation croissante pour l'environnement. Ces dernières années, on a assisté à une prise de conscience croissante de l'impact environnemental des monomères acryliques traditionnels, qui sont souvent dérivés de combustibles fossiles et peuvent libérer des émissions nocives lors de leur production. Cela a conduit à une demande accrue d'alternatives plus respectueuses de l'environnement. Les fabricants investissent désormais dans la recherche et le développement pour créer des monomères acryliques dérivés de ressources renouvelables et ayant un impact environnemental réduit.

En outre, les réglementations et politiques gouvernementales strictes visant à réduire les émissions de gaz à effet de serre poussent les fabricants à adopter des pratiques plus durables. Cette pression réglementaire favorise le développement et l'adoption de monomères acryliques respectueux de l'environnement comme moyen de se conformer aux normes environnementales. En conséquence, les fabricants qui adoptent ce changement d'orientation sont susceptibles d'acquérir un avantage concurrentiel sur le marché. L'évolution vers des monomères acryliques respectueux de l'environnement s'aligne également sur l'évolution des préférences des consommateurs. Les consommateurs d'aujourd'hui sont plus soucieux de l'environnement et recherchent de plus en plus des produits fabriqués à l'aide de processus durables et respectueux de l'environnement, offrant ainsi une opportunité de croissance du marché.

- Un potentiel immense dans le secteur du traitement de l'eau

L'industrie du traitement de l'eau connaît actuellement un potentiel immense, créant une opportunité prometteuse pour le marché des monomères acryliques. Ces dernières années, les préoccupations concernant la pollution et la pénurie d'eau ont considérablement augmenté, ce qui a entraîné le besoin de solutions efficaces de traitement de l'eau. Les monomères acryliques, en particulier l'acide acrylique glacial, jouent un rôle crucial dans cette industrie car ils sont utilisés comme polymères floculants. Ces polymères aident à éliminer les impuretés et les contaminants de l'eau, la rendant plus sûre et plus adaptée à diverses applications.

L'une des principales applications des monomères acryliques, tels que l'acide acrylique glacial, est leur rôle en tant que polymères floculants. Dans les processus de traitement de l'eau, les floculants sont des substances qui aident à l'agglomération et à la précipitation des particules en suspension. L'acide acrylique glacial peut servir de monomère pour la production de ces polymères floculants. Lorsqu'ils sont ajoutés à l'eau, ces polymères se lient aux impuretés et aux contaminants, ce qui les amène à former des flocons agglomérés. Ce processus est essentiel pour éliminer les polluants, notamment les matières organiques, les produits chimiques et les métaux lourds, des sources d'eau. Les flocons agglomérés formés à l'aide de monomères acryliques peuvent être facilement filtrés, ce qui permet d'obtenir une eau plus propre. Cela est particulièrement précieux dans les industries où la qualité de l'eau est de la plus haute importance, comme les usines de traitement des eaux municipales, les processus industriels et même dans la production d'eau potable. La capacité des monomères acryliques à améliorer l'efficacité des processus de traitement de l'eau en facilitant l'élimination des impuretés est un facteur important contribuant à leur pertinence dans l'industrie du traitement de l'eau.

Contraintes/Défis

- Fluctuations des prix des matières premières

Les monomères acryliques sont fabriqués à partir d'ingrédients tels que le propylène et l'isobutylène. Lorsque les prix de ces matières premières augmentent soudainement, la production de monomères acryliques devient plus coûteuse. Les fabricants risquent alors de devoir facturer leurs produits plus cher ou de voir leurs bénéfices diminuer.

Les entreprises qui utilisent des monomères acryliques pour fabriquer des peintures, des adhésifs ou des revêtements comptent sur un approvisionnement et un coût stables de ces monomères pour planifier leurs budgets et leurs prix. Lorsque les prix des matières premières augmentent, ces plans sont perturbés, ce qui entraîne une incertitude sur le marché.

En outre, ces fluctuations de prix peuvent affecter davantage les petites entreprises et les start-ups, car elles ne disposent pas toujours des ressources nécessaires pour faire face à des augmentations soudaines des coûts. Elles peuvent donc avoir plus de mal à être compétitives sur le marché.

Les industries qui utilisent des monomères acryliques, comme la construction, l'automobile et les peintures et revêtements , en ressentent également les effets. Des coûts imprévisibles peuvent affecter leurs projets et leurs budgets, ce qui peut entraîner des retards ou une augmentation des dépenses.

- Répondre à des normes réglementaires complexes et évolutives

Dans l'industrie des monomères acryliques, des règles sont établies par les gouvernements et les agences environnementales du monde entier. Ces règles visent à garantir la sécurité des travailleurs, des consommateurs et de l'environnement. Elles peuvent inclure des limites sur l'utilisation de certains produits chimiques ou des directives sur la gestion des déchets.

Le respect de ces réglementations nécessite souvent des investissements importants en recherche et développement. Les entreprises peuvent avoir besoin de reformuler leurs produits, de modifier leurs processus de production ou d'investir dans de nouveaux équipements pour répondre à ces normes. Les formalités administratives et la documentation requises pour la conformité peuvent également être écrasantes. Cela peut ralentir le développement des produits et augmenter les coûts.

De plus, le non-respect peut entraîner des amendes, des problèmes juridiques et nuire à la réputation de l’entreprise, ce qui devrait mettre à mal la croissance du marché.

Développements récents

- En septembre 2023, BASF SE a élargi son portefeuille croissant de monomères biosourcés 14C avec un procédé exclusif pour la production de 2-Octyl Acrylate (2-OA). Le nouveau produit souligne l'engagement fort de BASF en faveur de l'innovation pour un avenir durable avec une teneur en 14C traçable de 73 % selon la norme ISO 16620. Outre le 2-Octyl Acrylate 14C biosourcé habituel, BASF a également lancé un nouveau produit, le 2-Octyl Acrylate BMB ISCC Plus.

- En avril 2023, Evonik a reçu la certification DIN CERTCO pour ses monomères méthacrylates biosourcés VISIOMER Terra, confirmant une teneur en bio jusqu'à 85 %. Cette certification, basée sur la méthode du radiocarbone C14 et le protocole ASTM D 6866:2021, souligne l'engagement d'Evonik en faveur du développement durable et de l'atténuation du changement climatique.

- En janvier 2023, Mitsubishi Chemical Group Corporation et Mitsui Chemicals ont lancé une recherche collaborative visant à standardiser et à optimiser la logistique chimique, qui sous-tend à la fois la société et l'industrie. Les entreprises souhaitent déployer progressivement des activités dans divers domaines clés, celles qui peuvent être immédiatement exécutées étant prévues pour débuter cet exercice. Les entreprises travailleront ensemble pour développer une logistique chimique plus solide et plus durable.

- En septembre 2019, Archer Daniels Midland et LG Chem ont formé un partenariat pour développer de l'acide acrylique biosourcé, un composant clé des polymères superabsorbants utilisés dans des produits tels que les couches. Cet effort conjoint vise à fournir des alternatives durables à l'acide acrylique d'origine pétrochimique actuellement utilisé.

Portée du marché des monomères acryliques en Amérique du Nord

Le marché nord-américain des monomères acryliques est segmenté en trois segments en fonction du produit, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Acrylate

- Acides et sels acryliques

- Acryliques Polyfonctionnels

- Acryliques bisphénoliques

- Acryliques fluorés

- Acrylonitrile

- Acrylamide et méthacrylamide

- Monomères glucidiques

- Malémide

- Autres

Sur la base du produit, le marché est segmenté en acrylamide et méthacrylamide, acrylate, acides et sels acryliques, acrylonitrile, acryliques bisphénol, monomères glucidiques, acryliques fluorés, malémide, acryliques polyfonctionnels et autres.

Application

- Plastique

- Adhésifs et produits d'étanchéité

- Résines synthétiques

- Fibres acryliques

- Matériaux de construction

- Tissus

- Caoutchouc acrylique

- Autres

Sur la base de l'application, le marché est segmenté en plastique, adhésifs et produits d'étanchéité, résines synthétiques, fibres acryliques, matériaux de construction, tissus, caoutchouc acrylique et autres.

Utilisation finale

- Peintures et revêtements

- Bâtiment et construction

- Automobile

- Biens de consommation

- Conditionnement

- Aérospatial

- Marin

- Traitement de l'eau

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en peintures et revêtements, bâtiment et construction, automobile, biens de consommation, emballage, traitement de l'eau, marine, aérospatiale et autres.

Analyse/perspectives régionales du marché des monomères acryliques en Amérique du Nord

Le marché nord-américain des monomères acryliques est analysé et des informations sur la taille du marché sont fournies en fonction du produit, de l’application et de l’utilisation finale.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des monomères acryliques en raison de la demande croissante de monomères acryliques dans le secteur de la construction du pays.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des monomères acryliques en Amérique du Nord

Le paysage concurrentiel du marché des monomères acryliques en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché.

Certains des principaux acteurs du marché opérant sur le marché des monomères acryliques en Amérique du Nord sont BASF SE, Arkema, Mitsubishi Chemical Group Corporation, Dow, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD., LobaChemie Pv.t Ltd., Solventis et Tokyo Chemical Industries CO., Ltd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 MARKET END-USE COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR MARKET POSITION GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 VENDOR SELECTION CRITERIA

4.4 RAW MATERIAL COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 POSITIVE OUTLOOK TOWARD PAINTS AND COATINGS INDUSTRY

5.1.2 INCREASING SPENDING IN THE CONSTRUCTION SECTOR

5.1.3 HIGH ADOPTION OF ADHESIVES AND SEALANTS

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF ALTERNATIVE MATERIALS AND TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 SHIFTING FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY ACRYLIC MONOMERS

5.3.2 IMMENSE POTENTIAL IN THE WATER TREATMENT INDUSTRY

5.4 CHALLENGES

5.4.1 MEETING COMPLEX AND CHANGING REGULATORY STANDARDS

5.4.2 INTERNAL COMPETITION IN THE MARKET

6 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ACRYLATE

6.2.1 BUTYL ACRYLATE MONOMER

6.2.2 METHYL ACRYLATE MONOMER

6.2.3 METHYL METHACRYLATE MONOMER

6.2.4 ETHYL HEXYL ACRYLATE MONOMER

6.2.5 ETHYL ACRYLATE MONOMER

6.2.6 OTHERS

6.3 ACRYLIC ACIDS AND SALTS

6.4 POLYFUNCTIONAL ACRYLICS

6.5 BISPHENOL ACRYLICS

6.6 FLUORINATED ACRYLICS

6.7 ACRYLONITRILE

6.8 ACRYLAMIDE AND METHACRYLAMIDE

6.9 CARBOHYDRATE MONOMERS

6.1 MALEMIDE

6.11 OTHERS

7 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PLASTIC

7.2.1 PLASTIC MANUFACTURING

7.2.2 PLASTIC ADDITIVES

7.3 ADHESIVES AND SEALANTS

7.4 SYNTHETIC RESINS

7.5 ACRYLIC FIBERS

7.6 BUILDING MATERIALS

7.7 FABRICS

7.7.1 KNITTED

7.7.2 WOVEN

7.7.3 NONWOVEN

7.7.4 OTHERS

7.8 ACRYLIC RUBBER

7.9 OTHERS

8 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 PAINTS AND COATINGS

8.2.1 ACRYLIC ACIDS AND SALTS

8.2.2 BISPHENOL ACRYLICS

8.2.3 POLYFUNCTIONAL ACRYLICS

8.2.4 FLUORINATED ACRYLICS

8.2.5 ACRYLONITRILE

8.2.6 ACRYLAMIDE AND METHACRYLAMIDE

8.2.7 MALEMIDE

8.2.8 CARBOHYDRATE MONOMERS

8.2.9 OTHERS

8.3 BUILDING AND CONSTRUCTION

8.3.1 ACRYLATE

8.3.2 POLYFUNCTIONAL ACRYLICS

8.3.3 ACRYLIC ACIDS AND SALTS

8.3.4 BISPHENOL ACRYLICS

8.3.5 ACRYLONITRILE

8.3.6 CARBOHYDRATE MONOMERS

8.3.7 FLUORINATED ACRYLICS

8.3.8 ACRYLAMIDE AND METHACRYLAMIDE

8.3.9 MALEMIDE

8.3.10 OTHERS

8.4 AUTOMOTIVE

8.4.1 ACRYLATE

8.4.2 POLYFUNCTIONAL ACRYLICS

8.4.3 ACRYLONITRILE

8.4.4 ACRYLIC ACIDS AND SALTS

8.4.5 BISPHENOL ACRYLICS

8.4.6 FLUORINATED ACRYLICS

8.4.7 ACRYLAMIDE AND METHACRYLAMIDE

8.4.8 MALEMIDE

8.4.9 CARBOHYDRATE MONOMERS

8.4.10 OTHERS

8.5 CONSUMER GOODS

8.5.1 ACRYLATE

8.5.2 ACRYLIC ACIDS AND SALTS

8.5.3 POLYFUNCTIONAL ACRYLICS

8.5.4 BISPHENOL ACRYLICS

8.5.5 FLUORINATED ACRYLICS

8.5.6 CARBOHYDRATE MONOMERS

8.5.7 ACRYLAMIDE AND METHACRYLAMIDE

8.5.8 ACRYLONITRILE

8.5.9 MALEMIDE

8.5.10 OTHERS

8.6 PACKAGING

8.6.1 ACRYLATE

8.6.2 POLYFUNCTIONAL ACRYLICS

8.6.3 ACRYLIC ACIDS AND SALTS

8.6.4 BISPHENOL ACRYLICS

8.6.5 FLUORINATED ACRYLICS

8.6.6 CARBOHYDRATE MONOMERS

8.6.7 ACRYLAMIDE AND METHACRYLAMIDE

8.6.8 MALEMIDE

8.6.9 OTHERS

8.7 AEROSPACE

8.7.1 ACRYLATE

8.7.2 POLYFUNCTIONAL ACRYLICS

8.7.3 FLUORINATED ACRYLICS

8.7.4 BISPHENOL ACRYLICS

8.7.5 ACRYLIC ACIDS AND SALTS

8.7.6 ACRYLAMIDE AND METHACRYLAMIDE

8.7.7 CARBOHYDRATE MONOMERS

8.7.8 ACRYLONITRILE

8.7.9 MALEMIDE

8.7.10 OTHERS

8.8 MARINE

8.8.1 ACRYLATE

8.8.2 POLYFUNCTIONAL ACRYLICS

8.8.3 FLUORINATED ACRYLICS

8.8.4 ACRYLIC ACIDS AND SALTS

8.8.5 BISPHENOL ACRYLICS

8.8.6 ACRYLAMIDE AND METHACRYLAMIDE

8.8.7 CARBOHYDRATE MONOMERS

8.8.8 ACRYLONITRILE

8.8.9 MALEMIDE

8.8.10 OTHERS

8.9 WATER TREATMENT

8.9.1 ACRYLAMIDE AND METHACRYLAMIDE

8.9.2 POLYFUNCTIONAL ACRYLICS

8.9.3 ACRYLIC ACIDS AND SALTS

8.9.4 ACRYLATE

8.9.5 OTHERS

8.1 OTHERS

8.10.1 ACRYLATE

8.10.2 ACRYLIC ACIDS AND SALTS

8.10.3 BISPHENOL ACRYLICS

8.10.4 POLYFUNCTIONAL ACRYLICS

8.10.5 FLUORINATED ACRYLICS

8.10.6 ACRYLONITRILE

8.10.7 ACRYLAMIDE AND METHACRYLAMIDE

8.10.8 MALEMIDE

8.10.9 CARBOHYDRATE MONOMERS

8.10.10 OTHERS

9 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 DOW

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 EVONIK INDUSTRIES AG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 MITSUBISHI CHEMICAL GROUP CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 ARKEMA

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 LG CHEM

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 LOBACHEMIE PVT. LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 NIPPON SHOKUBAI CO., LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 SOLVENTIS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 TOKYO CHEMICAL INDUSTRY CO., LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 3 NORTH AMERICA ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND LITERS)

TABLE 19 U.S. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 21 U.S. ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. PACKAGING IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. AEROSPACE IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 CANADA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 37 CANADA ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 CANADA PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 53 MEXICO ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MEXICO ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 55 MEXICO PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 MEXICO FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MEXICO ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 58 MEXICO PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACRYLIC MONOMERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACRYLIC MONOMERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACRYLIC MONOMERS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACRYLIC MONOMERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACRYLIC MONOMERS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ACRYLIC MONOMERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ACRYLIC MONOMERS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 NORTH AMERICA ACRYLIC MONOMERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA ACRYLIC MONOMERS MARKET: DBMR MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ACRYLIC MONOMERS MARKET: DBMR MARKET POSITION GRID

FIGURE 12 NORTH AMERICA ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 13 INCREASING SPENDING IN THE CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE ACRYLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET IN 2023 AND 2030

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET

FIGURE 17 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY PRODUCT, 2022

FIGURE 18 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY END-USE, 2022

FIGURE 20 NORTH AMERICA ACRYLIC MONOMERS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ACRYLIC MONOMERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.