North America 3d Printing Gases Market

Taille du marché en milliards USD

TCAC :

%

USD

29.90 Billion

USD

291.00 Billion

2024

2032

USD

29.90 Billion

USD

291.00 Billion

2024

2032

| 2025 –2032 | |

| USD 29.90 Billion | |

| USD 291.00 Billion | |

|

|

|

|

Segmentation du marché des gaz d'impression 3D en Amérique du Nord, par type (argon, azote, hydrogène, hélium, etc.), technologie (stéréolithographie (SLA), frittage sélectif par laser (SLS), dépôt de fil fondu (FDM), procédé de lumière numérique (DLP), fusion multijet (MJF), Polyjet, frittage laser direct de métal (DMLS), fusion par faisceau d'électrons (EBM), Poly-Jet, etc.), matériau (plastique, métal, alumure, bois, etc.), stockage et distribution (bouteilles, liquides marchands et tonnage), fonction (isolation, éclairage, refroidissement, etc.), utilisateur final (industrie, automobile, aérospatiale, biens de consommation, médical, bâtiment et construction, bijouterie, alimentation, jouets, arts visuels, robotique, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des gaz d'impression 3D

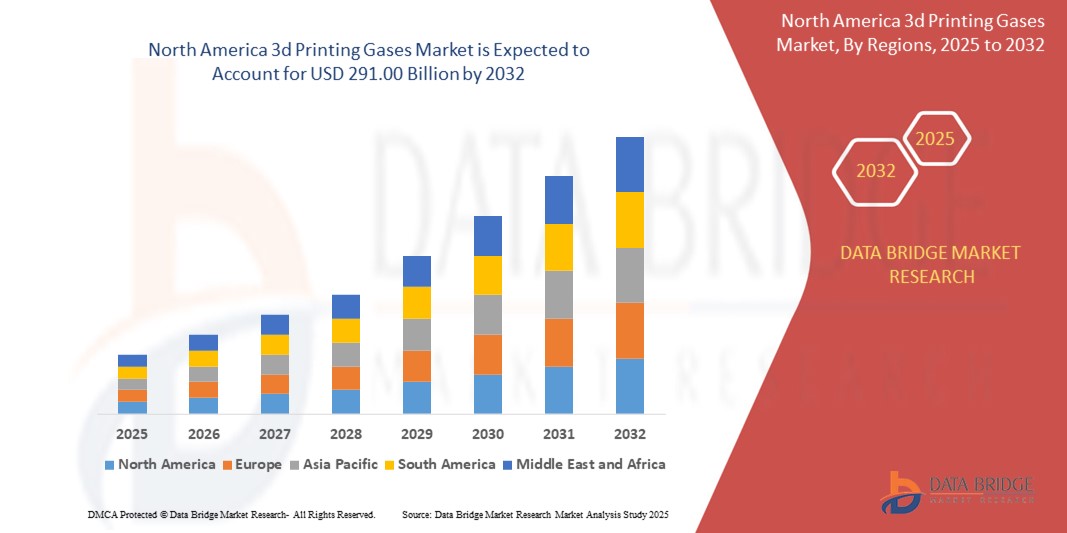

- La taille du marché des gaz d'impression 3D en Amérique du Nord était évaluée à 29,90 milliards USD en 2024 et devrait atteindre 291,00 milliards USD d'ici 2032 , à un TCAC de 32,9 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption rapide des technologies de fabrication additive dans les secteurs de l'aérospatiale, de l'automobile et de la médecine en Amérique du Nord, qui nécessitent des gaz de haute pureté tels que l'argon et l'azote pour maintenir des environnements d'impression contrôlés pendant l'impression 3D à base de métal.

- De plus, l'augmentation des investissements publics et privés dans la fabrication de pointe, ainsi que la présence d'une base industrielle et d'infrastructures de R&D solides, favorisent l'intégration de l'impression 3D dans la production de masse. Ces facteurs convergents accélèrent considérablement la demande de systèmes de distribution de gaz fiables et de solutions d'optimisation des procédés, dynamisant ainsi le marché des gaz d'impression 3D dans la région.

Analyse du marché des gaz d'impression 3D

- Les gaz d'impression 3D tels que l'argon, l'azote et l'hydrogène jouent un rôle essentiel dans le maintien de conditions inertes et stables lors de la fabrication additive, notamment pour les technologies d'impression métal comme le DMLS et l'EBM. Ces gaz préviennent l'oxydation, garantissent l'intégrité des matériaux et garantissent une qualité constante des pièces dans les industries de haute performance.

- Le déploiement croissant d’installations d’impression 3D industrielles à grande échelle, l’accent croissant mis sur la fabrication de composants légers et complexes et les progrès dans les technologies de traitement et de purification des gaz sont des facteurs clés qui favorisent l’expansion du marché en Amérique du Nord.

- Les États-Unis ont dominé le marché des gaz d'impression 3D avec une part de marché de 55,7 % en 2024, grâce à leur leadership dans l'adoption de la fabrication additive dans les secteurs de l'aérospatiale, de la défense et de la santé. La présence de pôles de fabrication de pointe, d'importants investissements en R&D et la forte demande d'impression 3D métal pour des applications critiques telles que les pièces de turbines, les implants et les composants automobiles légers favorisent l'essor des gaz inertes de haute pureté comme l'argon et l'azote.

- Le Canada devrait être la région connaissant la croissance la plus rapide sur le marché des gaz d'impression 3D au cours de la période de prévision en raison des initiatives croissantes soutenues par le gouvernement visant à intégrer la fabrication additive dans les secteurs de l'aérospatiale, de l'énergie et de la médecine.

- Le segment de l'argon dominait le marché avec une part de marché de 42,1 % en 2024, en raison de sa nature inerte et de son utilisation répandue dans les procédés de fabrication additive métallique tels que le frittage laser direct de métaux (DMLS) et la fusion par faisceau d'électrons (EBM). L'argon garantit un environnement stable et exempt de contamination, essentiel pour prévenir l'oxydation lors de la fusion du métal, ce qui en fait un choix privilégié pour les applications industrielles et aérospatiales.

Portée du rapport et segmentation du marché des gaz d'impression 3D

|

Attributs |

Informations clés sur le marché des gaz d'impression 3D |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des gaz d'impression 3D

« Demande croissante de gaz spécialisés »

- Le marché nord-américain des gaz d'impression 3D est en pleine expansion, car les fabricants et les laboratoires de recherche ont de plus en plus besoin de gaz spécialisés de haute pureté tels que l'argon, l'azote et des mélanges de gaz personnalisés pour les processus de fabrication additive, essentiels pour garantir la qualité des produits et minimiser l'oxydation et la contamination dans les applications de haute précision.

- Par exemple, aux États-Unis, des secteurs tels que l'aérospatiale, la défense et la santé, y compris les entreprises impliquées dans les implants médicaux personnalisés et les composants haute performance, ont réalisé des investissements importants dans des solutions de gaz avancées pour maintenir des normes strictes de précision et d'intégrité des pièces lors de la production d'impression 3D.

- Le segment des mélanges de gaz est devenu le sous-marché le plus important et celui qui connaît la croissance la plus rapide, reflétant la complexité croissante des matériaux et des applications imprimés en 3D, exigeant un contrôle atmosphérique sur mesure pour des résultats d'impression optimaux.

- Le passage du prototypage à la production de masse dans des domaines tels que l'aérospatiale et l'automobile augmente la nécessité d'environnements gazeux contrôlés, car même une contamination ou une porosité mineure a un impact direct sur les performances et la sécurité des pièces critiques.

- Les principaux fournisseurs de gaz industriels en Amérique du Nord lancent des produits de gaz innovants et augmentent leurs capacités de production pour répondre aux exigences en constante évolution, tout en collaborant avec les fabricants d'imprimantes 3D et les utilisateurs finaux pour des solutions spécifiques aux applications.

- La position de l'Amérique du Nord en tant que pionnier de l'impression 3D, combinée à une solide chaîne d'approvisionnement locale pour le matériel et les gaz spéciaux, continue de renforcer la croissance du marché, en particulier à mesure que de plus en plus d'industries intègrent les technologies d'impression métallique et de bio-impression.

Dynamique du marché des gaz d'impression 3D

Conducteur

« Croissance de l'industrie de l'impression 3D »

- L'avancement rapide de l'industrie de l'impression 3D en Amérique du Nord, avec une mise en œuvre croissante dans les secteurs de l'aérospatiale, de la santé, de l'automobile et des biens de consommation, est le principal catalyseur de la demande accrue de gaz d'impression 3D de haute qualité.

- Par exemple, les États-Unis sont devenus le premier marché en raison de leur infrastructure de fabrication très avancée, de l'adoption précoce de la fabrication additive et d'applications à haute valeur ajoutée, telles que la création de pièces d'aviation, de prothèses dentaires et de machines complexes, nécessitant des normes strictes d'utilisation des gaz.

- Les applications telles que la fabrication additive métallique et la bio-impression sont particulièrement gourmandes en gaz, car les environnements inertes sont essentiels pour produire des produits sans défaut et de haute performance avec des spécifications métallurgiques strictes.

- Alors que l'impression 3D s'étend du prototypage rapide à la fabrication à grande échelle et à l'intégration de la chaîne d'approvisionnement, la demande de solutions de gaz précises et fiables augmente, incitant les producteurs de gaz à suivre le rythme des avancées technologiques et des besoins en volumes plus importants.

- L'innovation continue des fournisseurs de gaz, en collaboration avec les fabricants d'équipements et les secteurs utilisateurs finaux, a rationalisé les processus de production et amélioré la qualité des matériaux, stimulant encore davantage la trajectoire de croissance des deux industries.

Retenue/Défi

« Coûts initiaux élevés »

- L'investissement initial élevé requis pour l'infrastructure des gaz spéciaux et l'équipement d'impression 3D avancé représente un obstacle important, en particulier pour les petites et moyennes entreprises qui cherchent à adopter ou à développer la fabrication additive.

- Par exemple, la mise en place et le maintien de systèmes de stockage et de distribution contrôlés et de solutions de surveillance pour des gaz tels que l'argon et l'azote, en plus de l'acquisition d'imprimantes 3D haut de gamme, peuvent augmenter considérablement les coûts initiaux du projet.

- Les procédés avancés d'impression 3D et de bio-impression en métal nécessitent également un approvisionnement continu en gaz de très haute pureté, ce qui augmente les dépenses opérationnelles courantes au-delà du simple investissement initial.

- La complexité de la formation du personnel à la manipulation du gaz et au fonctionnement de l'équipement, ainsi que la conformité aux normes réglementaires et industrielles, peuvent augmenter les besoins en temps et en ressources des nouveaux arrivants.

- Bien que le coût soit compensé au fil du temps par une efficacité et une qualité améliorées, ces exigences en capital peuvent ralentir l'adoption dans les segments sensibles aux coûts et limiter la flexibilité, en particulier pour les organisations axées sur la R&D et disposant de budgets limités.

Portée du marché des gaz d'impression 3D

Le marché est segmenté en fonction du type, de la technologie, du matériau, du stockage et de la distribution, de la fonction et de l’utilisation finale.

- Par type

Le marché des gaz d'impression 3D est segmenté en fonction de leur type : argon, azote, hydrogène, hélium, etc. En 2024, l'argon a dominé le marché avec 42,1 % de chiffre d'affaires, principalement en raison de son inertie et de son utilisation répandue dans les procédés de fabrication additive métallique tels que le frittage laser direct de métaux (DMLS) et la fusion par faisceau d'électrons (EBM). L'argon garantit un environnement stable et exempt de contamination, essentiel pour prévenir l'oxydation lors de la fusion du métal, ce qui en fait un choix privilégié pour les applications industrielles et aérospatiales.

Le segment de l'hydrogène devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à son adoption croissante dans les technologies d'impression métal de pointe qui exigent une efficacité énergétique accrue et une combustion plus propre. Le potentiel de l'hydrogène pour améliorer la qualité d'impression dans des applications spécifiques à haute température gagne du terrain dans les environnements d'impression expérimentaux et de recherche.

- Par technologie

Sur la base de la technologie, le marché est segmenté en stéréolithographie (SLA), frittage sélectif par laser (SLS), modélisation par dépôt de fil fondu (FDM), procédé de lumière numérique (DLP), fusion multi-jets (MJF), Polyjet, frittage laser direct de métal (DMLS), fusion par faisceau d'électrons (EBM), Poly-Jet, et autres. Le DMLS détenait la plus grande part de marché en 2024, attribuée à son utilisation intensive dans les secteurs de l'aérospatiale, de l'automobile et de la médecine pour la production de composants métalliques de haute précision qui nécessitent des atmosphères contrôlées, notamment l'argon et l'azote, pour garantir l'intégrité des matériaux.

La fusion par faisceau d'électrons (EBM) devrait connaître la croissance la plus rapide d'ici 2032, grâce à sa capacité unique à traiter des alliages réactifs et hautes performances. La dépendance de l'EBM au vide et aux environnements sous gaz inerte stimule la demande en gaz de haute pureté, notamment dans des applications spécialisées comme la fabrication de superalliages à base de titane et de nickel.

- Par matériau

En fonction des matériaux, le marché est segmenté en plastiques, métaux, alumides, bois, etc. Le segment des métaux a représenté la plus grande part de chiffre d'affaires en 2024, stimulé par la demande croissante de composants durables et fonctionnels dans des secteurs tels que l'aérospatiale, le médical et l'automobile, où les poudres métalliques sont traitées sous atmosphère protectrice.

Le segment des alumides devrait enregistrer le TCAC le plus élevé entre 2025 et 2032, grâce à son adoption croissante dans les composants structurels légers et les prototypes. Sa compatibilité avec la technologie SLS et l'exigence d'environnements gazeux contrôlés pendant le frittage renforcent encore sa pertinence sur le marché.

- Par stockage et distribution

En termes de stockage et de distribution, le marché est segmenté en bouteilles, liquides marchands et tonnage. Le segment des bouteilles a dominé le marché en 2024, grâce à son adéquation aux opérations d'impression 3D de petite et moyenne envergure et à sa facilité de transport et de manutention sur site, notamment dans les laboratoires universitaires et de prototypage.

Le segment du tonnage devrait croître au rythme le plus rapide au cours de la période de prévision, alimenté par le nombre croissant d'installations de fabrication additive industrielle à grande échelle qui nécessitent un approvisionnement continu en gaz à haut volume pour une production ininterrompue.

- Par fonction

En fonction de la fonction, le marché est segmenté en isolation, éclairage, refroidissement, etc. Le segment de l'isolation a représenté la plus grande part de chiffre d'affaires en 2024, car de nombreux procédés d'impression 3D, notamment ceux à base de métal, nécessitent une stabilité thermique et des couvertures de gaz inerte pour prévenir l'oxydation et maintenir des températures de traitement constantes.

Le segment du refroidissement devrait connaître une croissance rapide entre 2025 et 2032 en raison de la demande accrue de refroidissement de précision dans les processus à haute énergie, en particulier dans les technologies telles que DMLS et EBM, où la gestion thermique influence considérablement la qualité de fabrication.

- Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en secteurs industriel, automobile, aérospatial, biens de consommation, médical, bâtiment et construction, bijouterie, agroalimentaire, jouets, arts visuels, robotique, etc. Le secteur aérospatial a dominé le marché en 2024, grâce à sa forte dépendance à l'impression métal haute performance, qui nécessite un contrôle strict des gaz pour garantir la qualité, la fiabilité et la conformité réglementaire des pièces.

Le segment médical devrait connaître le taux de croissance le plus rapide au cours de la période de prévision, stimulé par l'utilisation croissante de l'impression 3D dans la production d'implants spécifiques aux patients, d'outils chirurgicaux et de dispositifs dentaires, où la précision et la stérilisation assistées par gaz sont essentielles.

Analyse régionale du marché des gaz d'impression 3D

- Les États-Unis ont dominé le marché des gaz d'impression 3D, avec une part de marché record de 55,7 % en 2024, grâce à leur leadership dans l'adoption de la fabrication additive dans les secteurs de l'aérospatiale, de la défense et de la santé. La présence de pôles de fabrication de pointe, d'importants investissements en R&D et la forte demande d'impression 3D métal pour des applications critiques telles que les pièces de turbines, les implants et les composants automobiles légers favorisent l'essor des gaz inertes de haute pureté comme l'argon et l'azote.

- Le pays compte plusieurs fournisseurs de gaz et équipementiers d'impression 3D de premier plan qui collaborent au développement de solutions de distribution de gaz personnalisées, garantissant un contrôle atmosphérique constant lors des travaux d'impression complexes. La croissance est également soutenue par des initiatives de financement fédérales en faveur de l'innovation industrielle nationale et des objectifs de développement durable, qui encouragent l'utilisation de technologies de gaz efficaces.

- Le marché américain continue de bénéficier de l'essor des centres d'impression industrielle à grande échelle et de l'adoption rapide de l'impression 3D métal et polymère, tant pour le prototypage que pour la production de pièces finales. Les avancées technologiques dans les systèmes de surveillance des gaz et la pénétration croissante des pratiques de l'Industrie 4.0 consolident encore sa domination sur le marché nord-américain.

Aperçu du marché canadien des gaz d'impression 3D

Le Canada devrait enregistrer le TCAC le plus rapide du marché nord-américain des gaz d'impression 3D entre 2025 et 2032, grâce à la multiplication des initiatives gouvernementales visant à intégrer la fabrication additive dans les secteurs de l'aérospatiale, de l'énergie et de la médecine. La présence croissante d'établissements de recherche et de pôles d'innovation universitaires stimule la demande en gaz de qualité scientifique. L'adoption croissante de l'impression 3D métal, notamment en Ontario et au Québec, favorise l'utilisation de l'argon et de l'azote dans les environnements de fabrication contrôlés.

Aperçu du marché mexicain des gaz d'impression 3D

Le marché mexicain des gaz d'impression 3D devrait connaître une croissance soutenue entre 2025 et 2032, portée par l'essor de la construction automobile et la production locale de biens de consommation et d'outillage. L'augmentation des investissements dans les parcs industriels et les installations OEM, notamment dans le nord du Mexique, stimule l'adoption des technologies d'impression 3D et, par conséquent, des gaz de haute pureté pour l'optimisation des procédés. Le marché est également soutenu par une collaboration transfrontalière croissante avec les acteurs américains de la fabrication additive et un meilleur accès aux chaînes d'approvisionnement en gaz industriels.

Part de marché des gaz d'impression 3D

L'industrie des gaz d'impression 3D est principalement dirigée par des entreprises bien établies, notamment :

- DuPont (États-Unis)

- NIPPON SANSO HOLDINGS CORPORATION (Japon)

- ExOne (États-Unis)

- 3D Systems, Inc. (États-Unis)

- Renishaw plc (Royaume-Uni)

- Universal Industrial Gases Inc. (États-Unis)

- Messer SE & Co. KGaA (Allemagne)

- Bronkhorst (Pays-Bas)

- Stratasys (Israël)

- General Electric (États-Unis)

- Höganäs AB (Suède)

- GKN Métallurgie des poudres (Allemagne)

- Equispheres (Canada)

- Sandvik AB (Suède)

- Air Products and Chemicals, Inc. (États-Unis)

- AIR LIQUIDE (France)

- Evonik Industries AG (Allemagne)

- BASF SE (Allemagne)

- Linde PLC (Irlande)

Derniers développements sur le marché nord-américain des gaz d'impression 3D

- En février 2021, 3D Systems a renforcé sa présence sur le marché des gaz d'impression 3D avec le lancement du système d'impression 3D « High Speed Fusion », conçu pour les applications aérospatiales et automobiles. Cette décision stratégique répond à la demande du secteur pour des produits hautement fiables et s'inscrit dans le cadre de l'élargissement du portefeuille de l'entreprise en réponse aux besoins du marché.

- En février 2021, AMEXCI a collaboré avec SLM Solutions, démontrant ainsi un effort concerté pour accélérer l'industrialisation de la fabrication additive. Axée sur l'accompagnement des entreprises dans la mise en œuvre de technologies de fabrication avancées, cette collaboration souligne le rôle des gaz d'impression 3D pour faciliter la production en série de pièces métalliques complexes sur un marché en pleine évolution.

- En janvier 2021, Equispheres a lancé trois poudres d'aluminium hautes performances visant à améliorer la résistance, la précision et la vitesse d'impression. Cette initiative stratégique a renforcé le chiffre d'affaires de l'entreprise et diversifié son portefeuille de produits, la positionnant ainsi pour la croissance sur le marché des matériaux d'impression 3D.

- En mai 2020, GENERAL ELECTRIC a franchi une étape technologique majeure en collaborant avec l'US Air Force pour l'impression 3D d'un couvercle de carter moteur pour le F110. Cette collaboration fructueuse témoigne des avancées de la fabrication additive métallique et a contribué à la croissance du chiffre d'affaires de GENERAL ELECTRIC grâce à une implication accrue dans les applications aérospatiales.

- En mars 2020, Stratasys a collaboré avec m2nxt Solutions, marquant ainsi une collaboration cruciale sur le marché des gaz d'impression 3D. Cette alliance visait à améliorer les solutions d'impression 3D et les applications de fabrication additive, aidant les entreprises à adopter l'Industrie 4.0 et à façonner l'évolution des technologies d'impression 3D.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.