Middle East Dredging Market

Taille du marché en milliards USD

TCAC :

%

USD

1.80 Million

USD

2.20 Million

2024

2032

USD

1.80 Million

USD

2.20 Million

2024

2032

| 2025 –2032 | |

| USD 1.80 Million | |

| USD 2.20 Million | |

|

|

|

|

Segmentation du marché du dragage au Moyen-Orient, par offre (dragues mécaniques, dragues hydrauliques, dragues mécaniques/hydrauliques, dragues hydrodynamiques et équipements auxiliaires), type de service (dragage d'entretien, dragage de capital et dragage de réparation), matériau (sable et gravier, argile et slit, roche et autres), profondeur de dragage (dragage en eaux peu profondes et en eaux profondes), zone d'exploitation (mer, port, rivière, lacs et canaux, et autres), mode de transport (pipeline et barges), déploiement (en mer et à terre), application (aménagement urbain, activité commerciale, entretien commercial, protection du littoral, infrastructures énergétiques, assainissement des terres et loisirs), utilisateur final (pétrole et gaz, métaux et mines, énergies renouvelables, gouvernement, alimentation et agriculture, et autres) - Tendances et prévisions du secteur jusqu'en 2032

Quelle est la taille et le taux de croissance du marché du dragage au Moyen-Orient ?

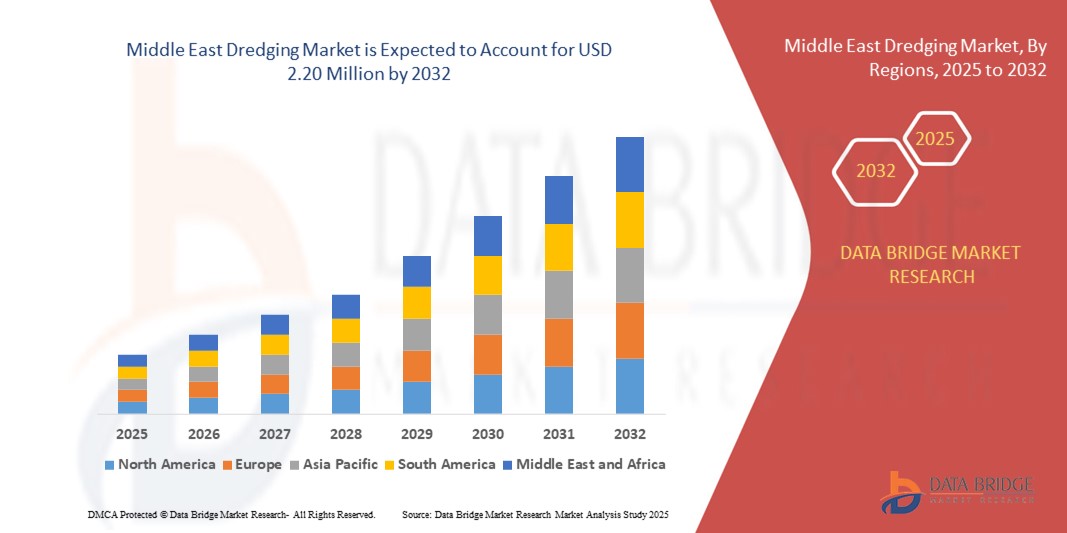

- La taille du marché du dragage au Moyen-Orient était évaluée à 1,80 million USD en 2024 et devrait atteindre 2,20 millions USD d'ici 2032 , à un TCAC de 2,50 % au cours de la période de prévision.

- La croissance rapide des activités minières dans la région, conjuguée à une demande croissante de solutions efficaces et rentables, est le principal moteur de la croissance du marché. Le financement public, qui stimule la croissance des initiatives de dragage, aggravera encore la croissance du marché.

- Par ailleurs, le dragage d'infrastructures est en plein essor grâce à la croissance des secteurs de l'énergie, du pétrole et du gaz, ce qui renforce encore la croissance du marché. Cependant, les réglementations gouvernementales strictes en matière de sécurité environnementale freinent la croissance du marché.

Quels sont les principaux points à retenir du marché du dragage au Moyen-Orient ?

- Le marché du dragage au Moyen-Orient connaît actuellement une croissance notable des activités minières, signe d'une expansion rapide et substantielle du marché dans la région. Cette forte croissance peut être attribuée à la demande croissante de services de dragage et d'activités associées. La région du Moyen-Orient connaît une augmentation significative des opérations de dragage, signe d'une industrie florissante qui s'étend au-delà des frontières locales.

- Les Émirats arabes unis devraient dominer le marché du dragage au Moyen-Orient avec une part de revenus de 41,87 % en 2024, grâce à de vastes projets d'expansion portuaire, à des développements d'îles artificielles et à des initiatives de protection côtière telles que les extensions des ports de Palm Jebel Ali et de Khalifa.

- L'Arabie saoudite devrait enregistrer le TCAC le plus rapide de 7,24 % entre 2025 et 2032, soutenu par des mégaprojets dans le cadre de Vision 2030 tels que NEOM, le projet de la mer Rouge et l'expansion du port islamique de Djeddah.

- Les dragues hydrauliques ont dominé le marché avec 41,6 % du chiffre d'affaires en 2024, grâce à des applications à grande échelle dans les projets d'approfondissement des ports et de remise en état des terres.

Portée du rapport et segmentation du marché du dragage au Moyen-Orient

|

Attributs |

Informations clés sur le marché du dragage au Moyen-Orient |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Quelle est la tendance clé du marché du dragage au Moyen-Orient ?

Des solutions de dragage durables et technologiquement avancées qui stimulent la transformation du marché

- Une tendance clé sur le marché mondial du dragage est l’évolution croissante vers des techniques de dragage respectueuses de l’environnement et des solutions automatisées pour minimiser l’impact environnemental tout en améliorant l’efficacité opérationnelle.

- Les fabricants adoptent des systèmes de surveillance avancés basés sur GPS , LiDAR et IoT pour garantir un dragage de précision, réduire la consommation de carburant et se conformer à des réglementations environnementales marines plus strictes.

- Par exemple, en 2024, Van Oord (Pays-Bas) a introduit une drague suceuse à élinde traînante entièrement électrique pour réduire les émissions de carbone de 20 %, établissant ainsi une référence en matière d'opérations maritimes durables.

- Les méthodes de dragage hydrodynamique et les technologies de recyclage des sédiments gagnent du terrain pour soutenir les projets de résilience côtière, la remise en état des terres et les infrastructures d'énergie renouvelable.

- Des entreprises telles que Boskalis (Pays-Bas) et DEME (Belgique) investissent massivement dans les systèmes de propulsion hybrides et les biocarburants pour s'aligner sur les objectifs mondiaux de décarbonisation.

- Cette tendance oriente l'industrie du dragage vers des pratiques maritimes vertes, permettant aux projets d'équilibrer la croissance économique avec la gestion environnementale tout en répondant aux objectifs ESG mondiaux.

Quels sont les principaux moteurs du marché du dragage au Moyen-Orient ?

- L'augmentation des activités commerciales mondiales et l'expansion des ports stimulent la demande de dragage pour maintenir les voies navigables et accueillir des navires plus gros.

- En janvier 2024, Jan De Nul (Belgique) a déployé sa drague suceuse à désagrégateur de nouvelle génération pour l'extension d'un port en eau profonde en Inde, soulignant ainsi les investissements croissants dans les infrastructures maritimes.

- Les projets de développement urbain et de remise en état des terres, notamment en Asie-Pacifique et au Moyen-Orient, stimulent la demande de services de dragage pour créer de nouvelles zones résidentielles, commerciales et industrielles.

- La croissance rapide des parcs éoliens offshore et de l'exploration pétrolière et gazière alimente le besoin de préparation des fonds marins, de creusement de tranchées pour pipelines et de stabilisation des fondations.

- Les initiatives gouvernementales favorisant la protection des côtes et l'adaptation au changement climatique augmentent les investissements dans le dragage pour le contrôle des inondations, le réapprovisionnement des plages et la restauration des zones humides.

- Ensemble, ces facteurs font du dragage un facteur essentiel du commerce mondial, de la sécurité énergétique et de la résilience climatique, garantissant une croissance régulière du marché au cours de la prochaine décennie.

Quel facteur constitue un obstacle à la croissance du marché du dragage au Moyen-Orient ?

- L'un des principaux défis du marché du dragage est la forte dépense d'investissement requise pour les dragues avancées, associée à l'augmentation des coûts de carburant et de maintenance.

- Par exemple, plusieurs petits entrepreneurs d'Asie du Sud-Est ont reporté les mises à niveau de leur flotte en 2023 en raison de la hausse des coûts des systèmes de propulsion hybrides et des moteurs conformes à la norme Tier III.

- Les préoccupations environnementales et les réglementations strictes sur l'élimination des sédiments, les émissions sonores et la protection de la biodiversité marine augmentent la complexité et les délais des projets.

- La volatilité des prix des matières premières pour les composants des dragues (acier, systèmes hydrauliques) et les perturbations dans les chaînes d'approvisionnement mondiales pèsent davantage sur les budgets opérationnels.

- Les pénuries de personnel qualifié et les problèmes de conformité en matière de sécurité, en particulier dans les opérations en eaux profondes et en mer, entravent l'exécution efficace des projets.

- Surmonter ces défis nécessitera des cadres réglementaires collaboratifs, des investissements en R&D dans des technologies vertes rentables et un renforcement des capacités pour créer une industrie du dragage résiliente et prête pour l'avenir.

Comment le marché du dragage au Moyen-Orient est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de la technologie et de l’industrie d’utilisation finale.

- En offrant

Le marché du dragage est segmenté en dragues mécaniques, dragues hydrauliques, dragues mécaniques/hydrauliques, dragues hydrodynamiques et équipements auxiliaires. Les dragues hydrauliques ont dominé le marché avec 41,6 % du chiffre d'affaires en 2024, grâce à des applications à grande échelle dans les projets d'approfondissement des ports et de remblayage. Les dragues mécaniques sont largement utilisées dans les cours d'eau confinés grâce à leur précision dans la manutention des matériaux grossiers. Les dragues hydrodynamiques gagnent en popularité pour une gestion écologique des sédiments, réduisant la turbidité et les perturbations environnementales.

Les dragues hydrodynamiques devraient connaître la croissance la plus rapide à mesure que les organismes de réglementation encouragent des pratiques de dragage durables dans le monde entier.

- Par type de service

Le marché se divise en dragage d'entretien, dragage de capital et dragage de réhabilitation. Le dragage d'entretien a représenté 46,8 % du chiffre d'affaires en 2024, les ports et les rivières nécessitant un retrait régulier des sédiments pour assurer la navigabilité. Le dragage de capital connaît une croissance rapide en raison de l'expansion des ports, des corridors industriels et de l'aménagement des fronts de mer urbains. Le dragage de réhabilitation, bien que de moindre envergure, est essentiel à la restauration environnementale et à l'élimination des contaminants.

Le dragage de capitaux devrait connaître la croissance la plus rapide grâce à l'essor du commerce mondial et au développement de mégaprojets. Les financements publics et les partenariats public-privé augmentent les investissements dans les cycles de maintenance à long terme.

- Par matériau

Le marché est divisé en sable et gravier, argile et slit, roche et autres. Le sable et le gravier dominaient avec 38,5 % de parts de marché en 2024, portés par la demande de réensablement des plages et de remise en état des terres. Les matériaux à base d'argile et de slit sont largement utilisés pour le dragage des rivières et des lacs afin de maintenir le débit de l'eau et de réduire les risques d'inondation. Le dragage des roches gagne en popularité grâce aux projets énergétiques offshore nécessitant des interventions sur les fonds marins profonds.

Le dragage de roches devrait connaître la croissance la plus rapide avec le développement des infrastructures minières et énergétiques en eaux profondes. Des équipements de coupe de pointe réduisent les difficultés opérationnelles dans les environnements rocheux et mixtes.

- Par profondeur de dragage

Le marché est segmenté en dragage en eaux peu profondes et en eaux profondes. Le dragage en eaux peu profondes a représenté 57,2 % du chiffre d'affaires en 2024, soutenu par les projets de voies navigables intérieures, de ports et de protection côtière. Le dragage en eaux profondes est crucial pour les développements pétroliers, gaziers et d'énergies renouvelables offshore, nécessitant souvent des navires de pointe. Les avancées technologiques améliorent l'efficacité de l'excavation en eaux profondes et du transport des sédiments. Les opérations en eaux peu profondes restent rentables et accessibles aux gouvernements régionaux et aux opérateurs privés.

Le dragage en eaux profondes devrait connaître la croissance la plus rapide, la demande mondiale en ressources sous-marines s'intensifiant. Les initiatives de résilience climatique accroissent la demande de dragage peu profond pour prévenir l'érosion côtière.

- Par zone d'opération

Le marché comprend les secteurs maritime, portuaire, fluvial, lacustre et canalisé, ainsi que d'autres. Le segment maritime dominait avec 34,9 % de parts de marché en 2024, porté par les parcs éoliens offshore et la construction de pipelines sous-marins. Le dragage portuaire soutient le transport maritime mondial en permettant aux grands navires d'accoster en toute sécurité. Les fleuves et les canaux jouent un rôle essentiel dans le commerce intérieur et la prévention des inondations, alimentant une demande constante. Le dragage des lacs contribue à la restauration de la qualité de l'eau et aux aménagements récréatifs.

Le secteur portuaire devrait connaître une croissance rapide avec la modernisation des plateformes commerciales mondiales. Les navires spécialisés sont de plus en plus conçus pour opérer dans des environnements variés.

- Par mode de transport

Le marché se divise en pipelines et barges. Les pipelines étaient en tête avec 61,4 % de parts de marché en 2024, privilégiés pour le transport de sédiments sur de longues distances dans le cadre de projets de grande envergure. Les barges sont essentielles pour les terrains rocheux et les applications en eaux profondes où les pipelines sont peu pratiques. Les systèmes hybrides combinant pipelines et barges se généralisent pour une plus grande flexibilité opérationnelle. Les innovations technologiques en matière de pompage de sédiments améliorent l'efficacité des pipelines et réduisent les coûts de carburant.

Le transport par pipeline devrait conserver sa prédominance grâce à ses avantages en termes de coûts et à son évolutivité. Les systèmes de barges restent essentiels pour le développement des zones reculées et insulaires aux infrastructures limitées.

- Par déploiement

Le marché est segmenté en offshore et onshore. Le dragage offshore a représenté 55,8 % du chiffre d'affaires en 2024, porté par les activités pétrolières et gazières, l'éolien offshore et l'exploitation minière sous-marine. Le dragage onshore est largement utilisé pour le développement urbain, la lutte contre les inondations et les systèmes d'irrigation agricole. Les opérations offshore nécessitent des dragues avancées et de grande capacité, ce qui augmente l'intensité capitalistique. Les projets onshore adoptent des équipements modulaires pour réduire les coûts et améliorer la mobilité. Les initiatives gouvernementales en faveur des énergies renouvelables renforcent la demande de dragage offshore.

Le dragage terrestre devrait connaître une croissance constante grâce aux programmes de villes intelligentes et de protection côtière.

- Par application

Le marché est segmenté en développement urbain, activités commerciales, entretien commercial, protection côtière, infrastructures énergétiques, assainissement des terres et loisirs. L'entretien commercial a dominé avec 29,7 % de parts de marché en 2024, garantissant la navigabilité des routes maritimes mondiales. Les projets de développement urbain exploitent le dragage pour créer des fronts de mer et des zones immobilières. La protection côtière prend de l'ampleur en raison de la montée du niveau de la mer et des ondes de tempête. Les infrastructures énergétiques, notamment les parcs éoliens offshore, stimulent les services de dragage spécialisés.

La réhabilitation des terres connaît une expansion rapide en Asie-Pacifique pour répondre à la croissance démographique. Les applications de loisirs, notamment les marinas et les zones touristiques, contribuent à la croissance de ce marché de niche.

- Par utilisateur final

Le marché est divisé en trois catégories : pétrole et gaz, métaux et mines, énergies renouvelables, secteur public, alimentation et agriculture, et autres. Les projets gouvernementaux ont dominé avec 36,4 % de parts en 2024, soutenus par des financements publics pour les ports et la gestion des inondations. Les opérations pétrolières et gazières nécessitent des dragages en eaux profondes pour les installations sous-marines. Les énergies renouvelables, notamment l'éolien offshore, apparaissent comme des contributeurs à forte croissance. Le secteur métallurgique et minier utilise le dragage pour l'extraction minière sous-marine et la gestion des résidus. Le secteur agroalimentaire s'appuie sur le dragage pour les canaux d'irrigation et le développement de l'aquaculture.

Les énergies renouvelables devraient connaître la croissance la plus rapide à mesure que les transitions vers les énergies propres s’accélèrent à l’échelle mondiale.

Quel pays détient la plus grande part du marché du dragage au Moyen-Orient ?

- Les Émirats arabes unis devraient dominer le marché du dragage au Moyen-Orient avec une part de revenus de 41,87 % en 2024, grâce à de vastes projets d'expansion portuaire, à des développements d'îles artificielles et à des initiatives de protection côtière telles que les extensions des ports de Palm Jebel Ali et de Khalifa.

- La position stratégique du pays en tant que plaque tournante mondiale du commerce et de la logistique a accéléré les investissements dans le dragage d'immobilisations et d'entretien pour soutenir un trafic maritime plus important et approfondir les chenaux portuaires.

- En outre, l'accent mis par les Émirats arabes unis sur les pratiques de dragage durables et l'adoption d'équipements de pointe ont attiré des entrepreneurs internationaux de dragage de premier plan, renforçant ainsi les capacités technologiques régionales.

Quelle région connaît la croissance la plus rapide sur le marché du dragage ?

L'Arabie saoudite devrait enregistrer le TCAC le plus rapide, soit 7,24 %, entre 2025 et 2032, grâce aux mégaprojets de Vision 2030, tels que NEOM, le projet de la mer Rouge et l'agrandissement du port islamique de Djeddah. La demande croissante de terres arables pour développer des zones touristiques et industrielles, associée à la protection du littoral pour lutter contre la montée du niveau de la mer, stimule les activités de dragage. De plus, les partenariats stratégiques entre les entreprises nationales et les acteurs mondiaux du dragage accélèrent le transfert de technologie et renforcent les capacités de dragage du royaume pour répondre aux besoins futurs en infrastructures.

Quelles sont les principales entreprises du marché du dragage au Moyen-Orient ?

L'industrie du dragage est principalement dirigée par des entreprises bien établies, notamment :

- Boskalis (Pays-Bas)

- Tidewater Co. (États-Unis)

- DEME (Belgique)

- Jan De Nul (Belgique)

- Van Oord nv (Pays-Bas)

- Holland Dredging Industries BV (Pays-Bas)

- ARCHIRODON SA (Grèce)

- Société nationale de dragage maritime (EAU)

- Union Dredgers & Marine Contracting LLC (EAU)

- Gulf Cobla (LLC) (EAU)

- Xylème (États-Unis)

- LAGERSMIT (Pays-Bas)

- Al Nasser Holdings LLC (EAU)

Quels sont les développements récents sur le marché du dragage au Moyen-Orient ?

- En décembre 2023, DEME, en partenariat avec Saudi Archirodon, a remporté la deuxième phase du projet de transformation du port de NEOM, dans le nord-ouest de l'Arabie saoudite. Ce développement stratégique, crucial pour les objectifs économiques de NEOM, prévoit la construction d'un bassin portuaire durable capable d'accueillir les plus grands navires du monde, témoignant de la maîtrise technique et de l'expertise en ingénierie de DEME.

- En décembre 2023, ARCHIRODON SA, en collaboration avec DEME, a remporté le contrat pour la deuxième phase de transformation du port de NEOM, positionnant ainsi le port stratégiquement pour le commerce mondial. Lancé en décembre 2023, ce projet visait à créer un bassin facilitant l'entrée des plus grands navires du monde, contribuant ainsi aux ambitions économiques et à l'importance régionale de NEOM.

- En octobre 2023, la National Marine Dredging Company (NMDC) a dévoilé sa nouvelle marque, mettant l'accent sur son intention de renforcer les partenariats existants et d'établir des collaborations intersectorielles pour une croissance durable de l'entreprise. Le PDG du groupe NMDC, M. Yasser Zaghloul, a souligné son engagement en faveur d'un avenir énergétique durable grâce à l'innovation et aux alliances stratégiques. Basé à Abou Dhabi, ce leader du dragage souhaite explorer des collaborations avec les gouvernements et le secteur privé afin de contribuer aux objectifs de décarbonation de l'ensemble du secteur. NMDC reste déterminé à favoriser la croissance tout en s'alignant sur la renaissance culturelle d'Abou Dhabi et les initiatives durables des Émirats arabes unis.

- En octobre 2023, Boskalis a signé un contrat avec Royal IHC pour la construction d'une drague suceuse porteuse à la pointe de la technologie, qui deviendra l'une des plus grandes de sa flotte. Doté d'une capacité de trémie de 31 000 m³, le navire bénéficiera d'innovations en matière d'efficacité énergétique, notamment une installation entièrement diesel-électrique, une propulsion Azipods et la possibilité d'utiliser du méthanol (vert) comme carburant alternatif. Avec une mise en service prévue mi-2026, ce développement souligne l'engagement de Boskalis en faveur d'une flotte de dragage plus durable.

- En mars 2023, Holland Dredging Industries BV a livré et installé avec succès une tête de dragage innovante sur une drague porteuse marine. Dotée de buses, de plaques et de dents remplaçables, cette nouvelle tête de dragage intègre des plaques en acier inoxydable sur la visière pour une protection en caoutchouc. HDD constate une réduction remarquable de 30 % du temps de chargement grâce à cette amélioration, témoignant de l'engagement de l'entreprise en faveur de l'efficacité. HDD souligne également sa capacité à fournir tous les composants nécessaires à la transformation de navires existants en dragues porteuses, en collaboration avec des chantiers navals néerlandais. L'ajout de plaques en acier inoxydable sur la visière renforce la protection en caoutchouc. Cette tête de dragage innovante a démontré une réduction des temps de chargement de 30 %, témoignant de l'engagement de HDD en faveur de l'efficacité des activités de dragage. HDD propose également une gamme complète de composants pour les dragues porteuses marines, permettant la transformation de navires existants en dragues porteuses performantes grâce à des collaborations avec des chantiers navals néerlandais.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.