Middle East And Africa Ultrasound Imaging Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

1.17 Billion

USD

2.17 Billion

2021

2029

USD

1.17 Billion

USD

2.17 Billion

2021

2029

| 2022 –2029 | |

| USD 1.17 Billion | |

| USD 2.17 Billion | |

|

|

|

Marché des appareils d'imagerie à ultrasons au Moyen-Orient et en Afrique, par format de matrice (matrice phasée, matrice linéaire, matrice linéaire incurvée, autres), affichage de l'appareil (appareils à ultrasons couleur, appareils à ultrasons noir et blanc (N/B)), portabilité de l'appareil (appareils à ultrasons sur chariot/chariot, appareils à ultrasons compacts/portables, appareils à ultrasons fixes, appareils à ultrasons au point de service ), technologie (échographie diagnostique, échographie thérapeutique), application (radiologie/imagerie générale, obstétrique et gynécologie, cardiovasculaire, gastroentérologie, vasculaire, urologique, orthopédique et musculo-squelettique , gestion de la douleur, service d'urgence, soins intensifs, autres), utilisateur final (hôpitaux, centres chirurgicaux, recherche et universités, centres de maternité, centres de soins ambulatoires, centres de diagnostic, autres), canal de distribution (appel d'offres direct, distributeurs tiers, Ventes au détail – Tendances et prévisions du secteur jusqu’en 2029

Analyse et taille du marché

Les procédures de traitement urologique sont de plus en plus populaires dans le monde entier. Le nombre croissant d'opérations médicales impliquant les reins, les uretères, la vessie, l'urètre, la prostate et la santé reproductive a élargi le champ d'expansion des instruments d'imagerie par ultrasons. L'augmentation de la mise en œuvre de nouvelles technologies dans ces systèmes médicaux renforcerait encore davantage leur efficacité dans les processus de soins de santé.

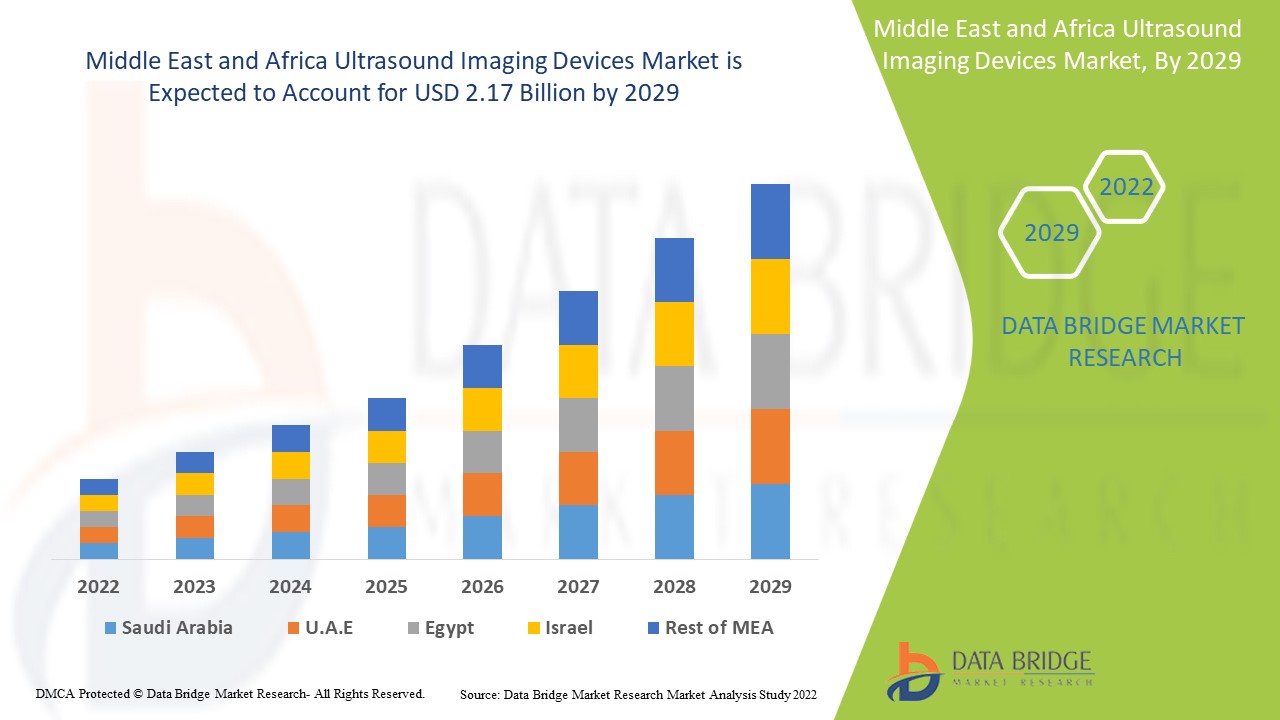

Français Data Bridge Market Research analyse que le marché des appareils d’imagerie à ultrasons, qui était de 1,17 milliard USD en 2021, monterait en flèche pour atteindre 2,17 milliards USD d’ici 2029 et devrait connaître un TCAC de 8,00 % au cours de la période de prévision 2022 à 2029. En plus des informations sur le marché telles que la valeur du marché, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l’équipe de recherche sur le marché de Data Bridge comprend également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

Définition du marché

Les appareils d'imagerie à ultrasons sont des appareils qui utilisent des ondes sonores à haute fréquence pour produire des images de l'intérieur du corps. Le système à ultrasons utilise la technologie d'imagerie par ultrasons. L'équipement à ultrasons peut générer des images en temps réel des composants biologiques qui montrent comment le corps bouge. Un transducteur et un détecteur à ultrasons, ou sonde, constituent un système à ultrasons. Cette technologie de diagnostic peu invasive n'utilise pas de rayonnement ionisant pour diagnostiquer ou traiter les maladies du corps.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, volumes en unités, prix en USD |

|

Segments couverts |

Format de matrice (réseau phasé, réseau linéaire, réseau linéaire incurvé, autres), affichage de l'appareil (appareils à ultrasons couleur, appareils à ultrasons noir et blanc (N/B)), portabilité de l'appareil (appareils à ultrasons sur chariot, appareils à ultrasons compacts/portables, appareils à ultrasons fixes, appareils à ultrasons au point d'intervention), technologie (échographie diagnostique, échographie thérapeutique), application (radiologie/imagerie générale, obstétrique et gynécologie, cardiovasculaire, gastroentérologie, vasculaire, urologique, orthopédique et musculo-squelettique, gestion de la douleur, service d'urgence, soins intensifs, autres), utilisateur final (hôpitaux, centres chirurgicaux, recherche et universités, maternités, centres de soins ambulatoires, centres de diagnostic, autres), canal de distribution (appel d'offres direct, distributeurs tiers, vente au détail) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA) |

|

Acteurs du marché couverts |

Koninklijke Philips NV (Pays-Bas), CANON MEDICAL SYSTEMS CORPORATION (Japon), Hitachi, Ltd. (Japon), Siemens (Allemagne), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Chine), ALPINION MEDICAL SYSTEMS Co., Ltd (États-Unis), CHISON Medical Technologies Co., Ltd. (États-Unis), EDAN Instruments, Inc. (Chine), ESAOTE SPA (Italie), FUJIFILM Corporation (Japon), FUKUDA DENSHI (Japon), Hologic, Inc. (États-Unis), SAMSUNG HEALTHCARE (États-Unis), Analogic Corporation (États-Unis), General Electric (États-Unis), TOSHIBA CORPORATION (Japon), Trivitron Healthcare (Inde) |

|

Opportunités de marché |

|

Dynamique du marché des appareils d'imagerie à ultrasons

Conducteurs

- Augmentation de la prévalence des maladies

La fréquence croissante des maladies et troubles aigus et chroniques dans le monde entier, pour diverses raisons, est l'un des principaux facteurs à l'origine de la croissance du marché. Par exemple, la prévalence croissante des tumeurs cancéreuses, des calculs biliaires, de la stéatose hépatique et d'autres troubles a un impact direct et positif sur la croissance du marché. En 2015, 415 millions de personnes dans le monde étaient diabétiques ; d'ici 2040, ce nombre atteindra 642 millions.

- Compétences en recherche et développement

L'augmentation des dépenses de recherche et développement, notamment dans les pays développés et en développement, dans le domaine des équipements et dispositifs médicaux, offrira des perspectives de croissance du marché encore plus rentables. Le taux de croissance du marché est encore renforcé par les capacités de recherche et développement liées aux développements des technologies d'imagerie médicale.

- Des investissements en hausse pour les établissements de santé

Un autre facteur important qui stimule l'expansion du marché est l'accent renouvelé mis sur l'amélioration de l'état des établissements de santé et de l'infrastructure globale des soins de santé. Le nombre croissant de partenariats public-privé et de coopérations stratégiques en matière de financement et de déploiement de technologies nouvelles et améliorées offre des perspectives de marché encore plus rentables. En outre, les mesures gouvernementales accrues visant à sensibiliser à la nécessité d'un diagnostic précoce stimulent à nouveau le taux de croissance du marché.

- Demande d'appareils d'imagerie à ultrasons

Avec la demande croissante d'appareils d'imagerie à ultrasons à usage diagnostique et thérapeutique peu invasif et le lancement d'équipements à ultrasons plus avancés sur le plan technologique, la demande d'appareils d'imagerie à ultrasons a augmenté par rapport à l'année précédente. En outre, les mesures gouvernementales visant à sensibiliser à la nécessité d'un diagnostic précoce ont accru la demande d'instruments d'imagerie à ultrasons.

Opportunités

L'incidence des maladies chroniques devrait augmenter, ce qui entraînera une augmentation du nombre de patients nécessitant des options diagnostiques et thérapeutiques améliorées. Les marchés émergents seraient les plus touchés, car la croissance démographique dans les pays en développement, en particulier en Inde et en Chine, devrait être importante, ce qui entraînerait une augmentation des dépenses de santé dans ces pays. Les progrès dans l'identification et le diagnostic des maladies contribueront également à maîtriser les dépenses de traitement des maladies chroniques. Selon l'Organisation mondiale de la santé, la prévalence des maladies chroniques devrait augmenter de 57 % d'ici 2020, avec des taux d'obésité et des incidences de maladies comme le diabète en hausse, ce qui accroîtra le besoin d'appareils à ultrasons pour identifier les patients. L'utilisation des technologies à ultrasons pour diagnostiquer les patients plus tôt contribue à réduire les coûts totaux des soins de santé. L'utilisation d'appareils à ultrasons devrait augmenter à mesure que le nombre de patients atteints de maladies chroniques augmente, ce qui alimentera l'expansion du marché.

Contraintes/Défis

D’un autre côté, l’expansion du marché risque d’être entravée par les coûts élevés associés aux capacités de recherche et développement, les infrastructures inadéquates, la répartition inégale des services médicaux et le manque de sensibilisation dans les pays en retard. En outre, au cours de la période de prévision 2022-2029, le marché devrait être confronté à un manque de scénario de remboursement favorable et de pénétration technologique dans les économies en développement, à une baisse des dépenses de santé dans les pays avancés, à l’augmentation de l’expiration des brevets, à la pression gouvernementale sur les prix, au coût élevé des appareils à ultrasons et au manque d’infrastructures adaptées dans les pays à revenu faible et intermédiaire.

L'expansion du marché des appareils d'imagerie à ultrasons est entravée par des autorisations et des réglementations strictes émanant d'entités gouvernementales telles que la Food and Drug Administration (FDA) des États-Unis. Outre le processus d'enregistrement standard, les fabricants doivent se conformer à un certain nombre de règles, notamment le contrôle de la qualité des appareils, l'étiquetage, l'approbation préalable à la mise sur le marché, l'enquête sur les appareils et les rapports.

Ce rapport sur le marché des appareils d'imagerie à ultrasons fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des appareils d'imagerie à ultrasons, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des appareils d'imagerie à ultrasons

La réponse du marché au COVID-19 a été minime. La diminution du taux de fabrication de dispositifs médicaux a eu un impact négatif sur les revenus. La demande d'équipements à ultrasons a chuté en raison de la baisse de l'utilisation des systèmes d'imagerie en raison d'une diminution des besoins en traitements d'urgence. D'autre part, la période post-pandémique devrait remettre le marché sur les rails. Le COVID-19 est une maladie fluide qui peut endommager une variété de tissus et d'organes au fur et à mesure de son développement. Par conséquent, l'impact de la maladie à tous les stades et sur tous les organes nécessite une technologie d'imagerie fonctionnelle et polyvalente capable de détecter de manière dynamique des particularités ou des anomalies. L'échographie répond à tous ces critères et présente divers avantages par rapport aux autres modalités d'imagerie, tels que la portabilité, l'abordabilité et la biosécurité. Tout au long de l'épidémie de COVID-19, l'échographie a joué un rôle essentiel dans le triage, la surveillance, la détection des lésions organiques et a permis aux patients de prendre des décisions thérapeutiques personnalisées. Cette revue se concentre sur les principaux résultats pathogéniques associés aux altérations échographiques induites par le COVID-19 dans les poumons, le cœur et le foie.

Développement récent

- Hitachi, Ltd. a commencé les ventes internationales de l'ARIETTA 750, un nouveau modèle de la série de plates-formes d'échographie diagnostique ARIETTA, en mars 2020. Hitachi, Ltd. a amélioré son portefeuille de produits et la demande du marché avec ce nouveau lancement, ce qui s'est traduit par une augmentation des revenus à l'avenir.

- En février 2022, Butterfly Network, Inc. et Ambra Health ont annoncé une collaboration visant à accélérer et à simplifier l'échange de données d'imagerie au chevet du patient. Ce partenariat améliorera l'accès et le partage des précieuses informations échographiques entre les hôpitaux et les systèmes de santé, améliorant ainsi l'évolutivité de Butterfly Blueprint, la plateforme d'entreprise de Butterfly.

Portée du marché des appareils d'imagerie à ultrasons au Moyen-Orient et en Afrique

Le marché des appareils d'imagerie à ultrasons est segmenté en fonction du produit, de l'affichage de l'appareil, de la portabilité de l'appareil, de l'application, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Format de tableau

- Réseau à commande de phase

- Réseau linéaire

- Réseau linéaire incurvé

- Autres

Technologie

- Systèmes d'échographie diagnostique

- Systèmes d'imagerie 2D

- Systèmes d'imagerie 3D et 4D

- Imagerie Doppler

- Systèmes d'ultrasons thérapeutiques

- Ultrasons focalisés de haute intensité (HIFU)

- Lithotripsie extracorporelle par ondes de choc (LEC)

Affichage de l'appareil

- Appareils à ultrasons couleur

- Appareils à ultrasons en noir et blanc (N/B)

Portabilité des appareils

- Appareils à ultrasons sur chariot

- Appareils à ultrasons compacts/portables

Application

- Radiologie/Imagerie générale

- Cardiologie

- Obstétrique/Gynécologie

- Vasculaire

- Urologie

- Autres

Utilisateur final

- Hôpitaux

- Centres chirurgicaux

- Recherche et université

- Centres de maternité

- Centres de soins ambulatoires

- Centres de diagnostic

- Autres

Canal de distribution

- Appel d'offres direct

- Distributeurs tiers

- Ventes au détail

Analyse/perspectives régionales du marché des appareils d'imagerie à ultrasons

Le marché des appareils d’imagerie à ultrasons est analysé et des informations et tendances sur la taille du marché sont fournies par pays, produit, affichage de l’appareil, portabilité de l’appareil, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des appareils d'imagerie à ultrasons sont l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA).

L'Afrique du Sud domine le marché du Moyen-Orient et de l'Afrique grâce à la transition rapide des infrastructures de santé qui entraîne une forte demande d'équipements médicaux, notamment d'appareils d'imagerie à ultrasons. L'échographie étant moins coûteuse que d'autres modalités d'imagerie, il existe une demande importante pour ces équipements dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Croissance des infrastructures de santé Base installée et pénétration des nouvelles technologies

The ultrasound imaging devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for ultrasound imaging devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the ultrasound imaging devices market. The data is available for historic period 2010-2020.

Competitive Landscape and Ultrasound Imaging Devices Market Share Analysis

The ultrasound imaging devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultrasound imaging devices market.

Some of the major players operating in the ultrasound imaging devices market are:

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- Siemens (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.)

- CHISON Medical Technologies Co., Ltd. (U.S.)

- EDAN Instruments, Inc. (China)

- ESAOTE SPA (Italy)

- FUJIFILM Corporation (Japan)

- FUKUDA DENSHI (Japan)

- Hologic, Inc. (U.S.)

- SAMSUNG HEALTHCARE (U.S.)

- Analogic Corporation (U.S.)

- General Electric (U.S.)

- TOSHIBA CORPORATION (Japan)

- Trivitron Healthcare (India)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 ARRAY FORMAT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 TECHNOLOGICAL ADVANCEMENTS IN ULTRASOUND IMAGING SYSTEM

5.1.2 INCREASE INCIDENCE RATES OF CHRONIC DISEASES

5.1.3 INCREASE IN NUMBER OF ULTRASOUND DIAGNOSTIC IMAGING PROCEDURES IN OBSTETRICS & GYNECOLOGY FIELD

5.1.4 RISE IN AWARENESS FOR EARLY DISEASE DIAGNOSIS

5.1.5 REIMBURSEMENT FOR ULTRASOUND GUIDED PROCEDURES

5.2 RESTRAINTS

5.2.1 HIGH COST OF ULTRASOUND IMAGING DEVICES

5.2.2 DEARTH OF SKILLED AND EXPERIENCED SONOGRAPHERS WORLDWIDE.

5.2.3 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR MINIMALLY INVASIVE TECHNOLOGY

5.3.2 RISING DISPOSABLE INCOME

5.3.3 EMERGENCE OF POC ULTRASOUND DEVICES

5.4 CHALLENGES

5.4.1 LIMITATIONS OF ULTRASOUND IMAGING

5.4.2 INCREASING ADOPTION OF REFURBISHED IMAGING SYSTEM

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT

7.1 OVERVIEW

7.2 CURVED LINEAR ARRAY

7.3 LINEAR ARRAY

7.4 PHASED ARRAY

7.5 OTHERS

8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY

8.1 OVERVIEW

8.2 COLOR ULTRASOUND DEVICES

8.2.1 MID-END COLOR DOPPLER

8.2.2 LOW-END COLOR DOPPLER

8.2.3 HIGH-END COLOR DOPPLER

8.2.4 PREMIUM-END COLOR DOPPLER

8.3 BLACK AND WHITE (B/W) ULTRASOUND DEVICES

9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY

9.1 OVERVIEW

9.2 TROLLEY/CART-BASED ULTRASOUND DEVICES

9.2.1 MID-RANGE

9.2.2 LOW-END

9.2.3 HIGH-END

9.2.4 PREMIUM

9.3 STATIONARY ULTRASOUND DEVICES

9.3.1 MID-RANGE

9.3.2 LOW-END

9.3.3 HIGH-END

9.3.4 PREMIUM

9.4 POINT-OF-CARE ULTRASOUND DEVICES

9.5 COMPACT/HANDHELD ULTRASOUND DEVICES

9.5.1 MID-RANGE

9.5.2 LOW-END

9.5.3 HIGH-END

9.5.4 PREMIUM

10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 DIAGNOSTIC ULTRASOUND

10.2.1 3D AND 4D ULTRASOUND

10.2.2 2D IMAGING

10.2.3 DOPPLER IMAGING

10.3 THERAPEUTIC ULTRASOUND

10.3.1 SHOCKWAVE LITHOTRIPSY

10.3.2 OTHERS

11 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 RADIOLOGY/GENERAL IMAGING

11.3 CARDIOVASCULAR

11.4 OBSTETRICS AND GYNECOLOGY

11.5 UROLOGICAL

11.6 ORTHOPEDIC AND MUSCULOSKELETAL

11.7 GASTROENTEROLOGY

11.8 EMERGENCY DEPARTMENT

11.9 CRITICAL CARE

11.1 PAIN MANAGEMENT

11.11 VASCULAR

11.12 OTHERS

12 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 DIAGNOSTIC CENTERS

13.4 MATERNITY CENTERS

13.5 AMBULATORY CARE CENTERS

13.6 SURGICAL CENTERS

13.7 RESEARCH AND ACADEMIA

13.8 OTHERS

14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E.

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GE HEALTHCARE (A SUBSIDIARY OF GENERAL ELECTRIC)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 KONINKLIJKE PHILIPS N.V.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANON MEDICAL SYSTEMS CORPORATION (A SUBSIDIARY OF CANON INC.)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HITACHI, LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SIEMENS HEALTHCARE GMBH

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ALPINION MEDICAL SYSTEMS CO., LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHISON

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 EDAN INSTRUMENTS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESAOTE SPA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FUJIFILM CORPORATION (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 FUKUDA DENSHI

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HOLOGIC, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 MOBISANTE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SAMSUNGHEALTHCARE (A SUBSIDIARY OF SAMSUNG ELECTRONICS CO., LTD.)

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 SHIMADZU MEDICAL SYSTEMS USA NORTHWEST BRANCH (A SUBSIDIARY OF SHIMADZU CORPORATION)

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 SONOSCAPE MEDICAL CORP.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 TRIVITRON HEALTHCARE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 ULTRASOUND DEVICES USED IN OBSTETRICS & GYNECOLOGY

TABLE 2 LIST OF PRIZES OF ULTRASOUND IMAGING DEVICES

TABLE 3 POC ULTRASOUND DEVICES

TABLE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CURVED LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA PHASED ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA BLACK AND WHITE (B/W) ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA POINT-OF-CARE ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RADIOLOGY/GENERAL IMAGING IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CARDIOVASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OBSTETRICS AND GYNECOLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA UROLOGICAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ORTHOPEDIC AND MUSCULOSKELETAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA GASTROENTEROLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EMERGENCY DEPARTMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA CRITICAL CARE IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PAIN MANAGEMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA VASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA DIRECT TENDER IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA RETAIL SALES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA HOSPITALS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIAGNOSTIC CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MATERNITY CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA AMBULATORY CARE CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SURGICAL CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA RESEARCH AND ACADEMIA IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 55 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 66 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 68 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 69 SOUTH AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 71 SOUTH AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 77 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 79 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 80 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 81 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 83 SAUDI ARABIA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 94 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 95 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 96 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 97 U.A.E. COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 98 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 99 U.A.E. TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 100 U.A.E. STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 101 U.A.E. COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 102 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 103 U.A.E. DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 104 U.A.E. THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 105 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 106 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 107 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 108 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 109 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 110 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 111 ISRAEL COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 112 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 113 ISRAEL TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 114 ISRAEL STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 115 ISRAEL COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 116 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 117 ISRAEL DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 118 ISRAEL THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 119 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 120 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 121 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 122 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 123 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 124 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 125 EGYPT COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 126 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 127 EGYPT TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 128 EGYPT STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 129 EGYPT COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 130 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 131 EGYPT DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 132 EGYPT THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 133 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 134 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 135 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IN ULTRASOUND IMAGING SYSTEM AND INCREASED INCIDENCE RATES OF CHRONIC DISEASES ARE DRIVING THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 12 CURVED LINEAR ARRAY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

FIGURE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019

FIGURE 15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019-2027 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, CAGR (2020-2027)

FIGURE 17 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019

FIGURE 19 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019-2027 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, CAGR (2020-2027)

FIGURE 21 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019

FIGURE 23 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019-2027 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, CAGR (2020-2027)

FIGURE 25 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019

FIGURE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019-2027 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, CAGR (2020-2027)

FIGURE 29 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019

FIGURE 31 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019-2027 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, CAGR (2020-2027)

FIGURE 33 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 35 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 37 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019

FIGURE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, CAGR (2020-2027)

FIGURE 41 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SNAPSHOT (2019)

FIGURE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019)

FIGURE 44 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 45 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 46 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT (2020-2027)

FIGURE 47 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.