Marché des unités de réfrigération pour camions au Moyen-Orient et en AfriquePar type (système divisé et système de montage sur toit), longueur ( 12 mètres), application (réfrigéré et congelé), source d'alimentation (alimentée par moteur et indépendante), capacité de puissance (moins de 5 kW, 5 kW - 19 kW et plus de 19 kW), type de véhicule (véhicules utilitaires légers (LCV), véhicules utilitaires moyens et lourds, remorque (conteneur), bus et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique

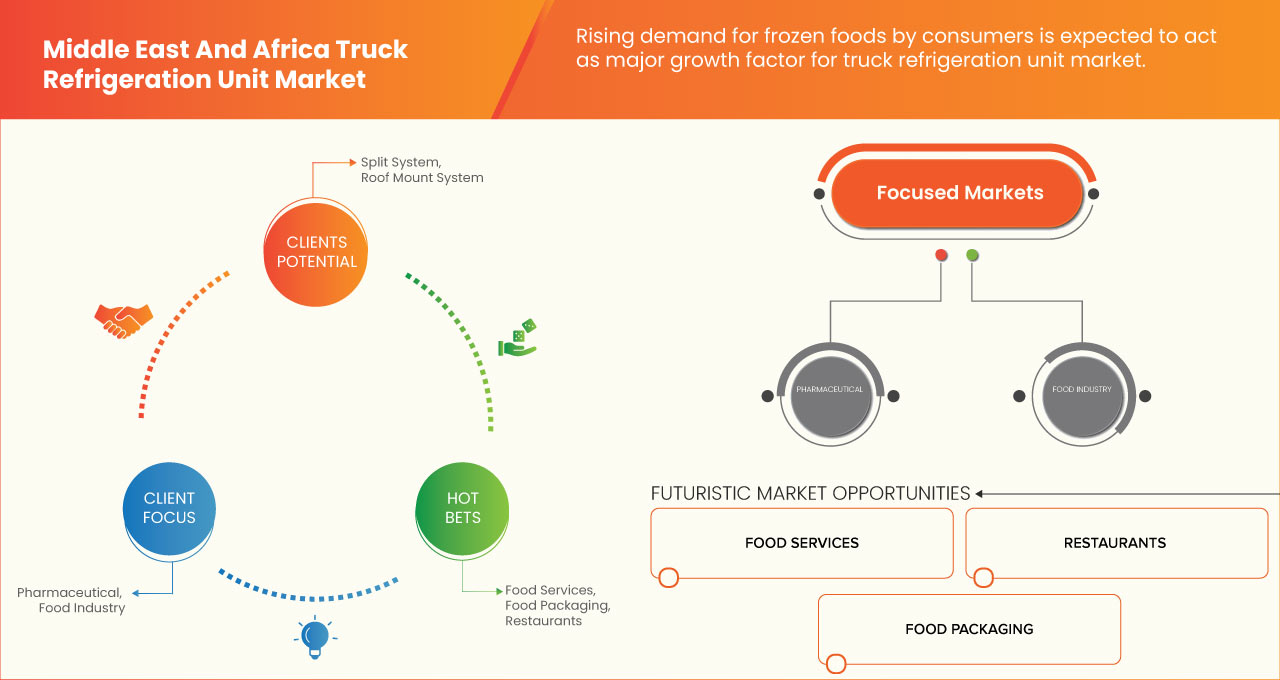

L'évolution des préférences des consommateurs pour les produits alimentaires surgelés a entraîné une demande croissante d'unités de réfrigération pour camions dans de nombreux secteurs. En outre, les fruits et légumes réfrigérés sont de plus en plus utilisés par les consommateurs et le transport de médicaments, de vaccins , de médicaments généraux et de compléments alimentaires s'est accru dans le monde entier.

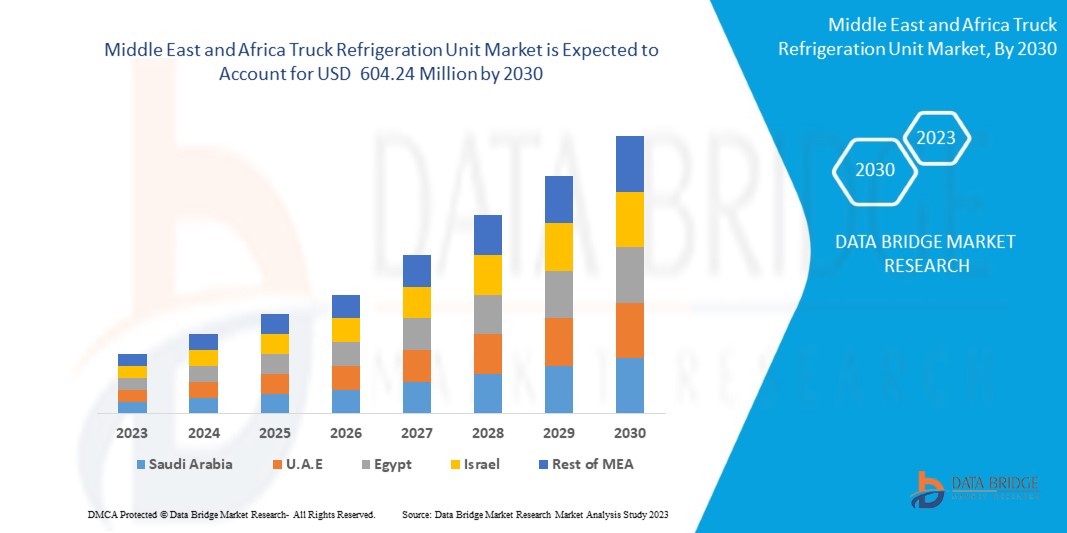

Data Bridge Market Research analyse que le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique devrait atteindre une valeur de 604,24 millions USD d'ici 2030, à un TCAC de 3,4 %, au cours de la période de prévision de 2023 à 2030. Le marché des unités de réfrigération pour camions couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en milliers d'unités, prix en USD |

|

Segments couverts |

Par type (système divisé et système de montage sur toit), longueur (< 8 mètres, 8-12 mètres et > 12 mètres), application (réfrigéré et congelé), source d'alimentation (alimentée par moteur et indépendante), capacité de puissance (moins de 5 kW, 5 kW - 19 kW et plus de 19 kW), type de véhicule (véhicules utilitaires légers (LCV), véhicules utilitaires moyens et lourds, remorque (conteneur), bus et autres) |

|

Pays couverts |

Afrique du Sud, Égypte, Bahreïn, Qatar, Koweït, Oman, Arabie saoudite, Émirats arabes unis, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, SANDEN CORPORATION, Mobile Climate Control., TRANE TECHNOLOGIES PLC, Klinge Corporation, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD, et Schmitz Cargobull entre autres |

Définition du marché

Les systèmes de réfrigération des camions sont utilisés comme camions réfrigérés/réfrigérés avec des systèmes de réfrigération mécanique pour transporter des marchandises périssables (comme les aliments surgelés, les légumes, les fruits, la crème glacée et le vin) afin de conserver les produits réfrigérés ou congelés à des températures appropriées jusqu'au point de vente. Un réfrigérateur est un camion, une remorque ou un conteneur de fret doté d'une unité de réfrigération pour le transport de produits sensibles à la température. Des alternatives générales pour prendre en charge le fret dans une plage de températures « fraîches » ou « fraîches » ou dans une plage de températures congelées sont disponibles pour l'expédition LTL (Less-Than-Truckload). Pour les chargements tels que les aliments frais ou d'autres produits périssables, une plage « froide » est généralement utilisée. Les réfrigérateurs déplacent parfois leurs remorques avec du fret sec qui ne nécessite pas de réfrigération. Il est essentiel de noter quelques détails lors du transport de marchandises. Le transport longue distance de marchandises périssables et sensibles à la température nécessite l'utilisation de camions frigorifiques. Les exemples les plus courants sont les viandes congelées et les produits frais.

Dynamique du marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Augmentation du transport de denrées périssables telles que les produits alimentaires et pharmaceutiques

Les produits alimentaires congelés nécessitent des modes de transport réfrigérés pour maintenir la qualité des produits sur de longues distances. Les produits alimentaires transportés doivent être réfrigérés afin qu'ils ne se détériorent pas et ne perdent pas leur valeur d'origine. De la ferme à l'usine jusqu'à l'assiette, les produits alimentaires peuvent être confrontés à de nombreux risques pour la santé au cours de leur parcours dans la chaîne d'approvisionnement. Des pratiques et procédures de manipulation sûres des aliments sont donc mises en œuvre à chaque étape du cycle de vie de la production alimentaire afin de limiter ces risques et de prévenir les dommages aux consommateurs.

-

Demande croissante des consommateurs en aliments surgelés

Les caractéristiques pratiques sont au cœur des emballages qui améliorent la facilité d'utilisation, à la maison comme en déplacement. Les caractéristiques pratiques, telles que l'ouverture facile, la portabilité et l'utilisation à une seule main, continuent de stimuler l'innovation en matière d'emballage d'aliments surgelés pour une large gamme d'aliments transformés, y compris les entrées, les collations et même les produits de restauration. Comme les aliments transformés nécessitent un matériau d'emballage simple et flexible, ils sont pratiques et faciles à utiliser. Ainsi, la demande croissante d'aliments surgelés par les consommateurs devrait stimuler la demande du marché.

-

Croissance croissante des supermarchés et des restaurants tels que KFC et Subway

La croissance croissante des restaurants et des supermarchés favorise davantage les produits alimentaires surgelés. Après la pandémie de COVID-19, l’utilisation des aliments surgelés a considérablement augmenté en raison du mode de vie et du manque de temps. Les services de livraison de repas sont devenus extrêmement importants, mais ont entraîné des défis uniques. La confiance dans le processus de manipulation des aliments, les méthodes de livraison et la demande de transactions sans contact sont devenues primordiales pour ceux qui utilisent les restaurants pour la livraison à domicile. Si l’on se souvient que plus de 900 000 personnes sont mortes aux États-Unis, la situation actuelle est une considération à long terme pour les travailleurs de la restauration, les travailleurs sur le terrain et les autres employés liés au secteur.

Opportunités

-

Des investissements croissants dans le secteur de la restauration par des pays comme l'Inde et la Chine

L'importance du secteur agro-industriel pour les pays en développement est évaluée à la lumière de deux tendances différentes. Premièrement, les produits transformés surgelés dominent désormais le commerce alimentaire du Moyen-Orient et de l'Afrique, ce qui est le cas à la fois pour les exportations et les importations en provenance des pays en développement. Deuxièmement, on observe un changement significatif dans la composition des exportations alimentaires des pays en développement, les « exportations non traditionnelles » occupant la première place. Ces exportations offrent de nouvelles opportunités pour les stratégies de développement, même si les pays les moins avancés sont passés du statut d'exportateurs nets de produits alimentaires à celui d'importateurs nets de produits transformés.

-

Forte demande de produits alimentaires et d'emballages alimentaires hygiéniques

La sécurité alimentaire est d'une importance capitale pour les consommateurs comme pour les transformateurs de produits alimentaires, car elle contribue à protéger la santé des consommateurs contre les maladies d'origine alimentaire et les intoxications alimentaires. La production hygiénique de produits alimentaires implique la manipulation, la préparation et le stockage des aliments ou des boissons de manière à minimiser le risque de maladie d'origine alimentaire pour les consommateurs. Les directives de sécurité alimentaire visent à empêcher la contamination des aliments et la survenue d'intoxications alimentaires.

Restrictions

-

Coût élevé associé au système de climatisation économe en énergie

Les coûts du système de climatisation des véhicules de transport de produits alimentaires comprennent à la fois les dépenses en matières premières et les coûts nécessaires au transport des produits finis. Les entreprises de fabrication opèrent dans des secteurs hautement compétitifs. Afin de faire face à la concurrence, ces entreprises cherchent des moyens de réduire les coûts, ce qui leur permet d'offrir des prix plus bas aux clients. Dans le processus de production, l'offre et la demande de matières premières jouent un rôle très important dans la détermination des coûts de l'entreprise.

-

Croissance des préoccupations sanitaires liées à la consommation de fruits et légumes surgelés

Les aliments hautement transformés contiennent souvent des quantités malsaines de sucre ajouté, de sodium et de gras. Ces ingrédients améliorent le goût des aliments, mais une consommation excessive peut entraîner de graves problèmes de santé tels que l'obésité, les maladies cardiaques, l'hypertension artérielle et le diabète.

Défis

- Manque de sensibilisation aux effets dangereux des aliments surgelés

L'hygiène alimentaire est l'ensemble des conditions et des mesures nécessaires pour assurer la sécurité des aliments depuis leur production jusqu'à leur consommation. Le manque d'hygiène alimentaire peut entraîner des maladies d'origine alimentaire, voire la mort du consommateur. Chaque année, des millions de personnes dans le monde souffrent de la transmission de maladies par la consommation d'aliments non hygiéniques.

- Manque d'infrastructures

De nombreux laboratoires de contrôle de la sécurité des aliments surgelés manquent d'infrastructures. Il est très difficile de contrôler la présence de résidus de pesticides hautement toxiques, d'antibiotiques ou de métaux lourds et de micro-organismes dangereux dans les matières premières alimentaires. Au cours de la transformation, la mise en œuvre de contrôles microbiologiques, tels que les programmes HACCP ou GMP, est pratiquement impossible en raison des conditions et des infrastructures inadéquates des usines, de la formation du personnel, de la qualité de l'eau, des technologies modernes pour les opérations de conditionnement, de l'assurance qualité et des procédures de désinfection standard. Cela devrait freiner la croissance du marché.

Développement récent

- En septembre 2019, MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD a remporté le contrat de fourniture d'équipements de traction de haute technologie pour la société Construcciones y Auxiliar de Ferrocarriles, SA (CAF). L'entreprise a livré des équipements de traction pour les 88 trains utilisés sur le réseau ferroviaire néerlandais. Cette entreprise a renforcé la valeur de sa marque sur le marché et sa clientèle

Portée du marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique

Le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique est segmenté en fonction du type, de la longueur, de l'application, de la source d'alimentation, de la capacité électrique et du type de véhicule. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Système divisé

- Système de montage sur toit

Sur la base du type, le marché des unités de réfrigération pour camions du Moyen-Orient et de l'Afrique est segmenté en système divisé et système de montage sur toit.

Longueur

- < 8 mètres

- 8-12 mètres

- >12 mètres

Sur la base de la longueur, le marché des unités de réfrigération pour camions du Moyen-Orient et de l'Afrique est segmenté en < 8 mètres, 8-12 mètres et > 12 mètres.

Application

- Glacé

- Congelé

Sur la base des applications, le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique est segmenté en réfrigéré et surgelé.

Source d'énergie

- Alimenté par moteur

- Indépendant

Sur la base de la source d'énergie, le marché des unités de réfrigération pour camions du Moyen-Orient et de l'Afrique est segmenté en moteurs et indépendants.

Capacité de puissance

- Moins de 5 kW

- 5 kW - 19 kW

- Plus de 19 kW

Sur la base de la capacité de puissance, le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique est segmenté en moins de 5 kW, 5 kW - 19 kW et plus de 19 kW.

Type de véhicule

- Véhicules utilitaires légers (VUL)

- Véhicules utilitaires moyens et lourds

- Remorque (Conteneur)

- Bus

- Autres

Sur la base de la propriété, le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique est segmenté en véhicules utilitaires légers (LCV), véhicules utilitaires moyens et lourds, remorques (conteneurs), bus et autres.

Analyse/perspectives régionales du marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique

Le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par type, longueur, application, source d’alimentation, capacité d’alimentation et type de véhicule.

Les pays couverts dans le rapport sur le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Égypte, Bahreïn, le Qatar, le Koweït, Oman, l'Arabie saoudite, les Émirats arabes unis, Israël, le reste du Moyen-Orient et de l'Afrique.

Les Émirats arabes unis devraient dominer le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique en raison du nombre croissant d'entreprises de livraison de nourriture dans la région.

La section régionale du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des unités de réfrigération pour camions au Moyen-Orient et en Afrique sont MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD., DAIKIN INDUSTRIES, Ltd., Carrier, SANDEN CORPORATION, Mobile Climate Control., TRANE TECHNOLOGIES PLC, Klinge Corporation, KRONE, SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD et Schmitz Cargobull, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 MARKET APPLICATION GRID

2.11 THE MARKET CHALLENGE MATRIX BY TYPE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 NATURAL REFRIGERANTS

4.2.2 ELECTRIC VEHICLES

4.2.3 TRAILER-TOP SOLAR

4.2.4 LIQUID NITROGEN

4.2.5 SMARTER REEFERS

4.2.6 ADVANCED THERMAL MATERIALS

4.3 VALUE CHAIN ANALYSIS

4.4 NUMBER OF UNITS IN THE MARKET

4.5 NUMBER OF UNITS BY TRUCK TYPE

4.6 NUMBER OF UNITS BY PLAYERS

4.7 NUMBER OF UNITS BY REGION

4.8 PRODUCT FLOW FROM UNIT SALE TO USER

4.9 BRAND ANALYSIS

4.1 ECOSYSTEM MARKET MAP

4.11 TOP WINNING STRATEGIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TRANSPORTATION OF PERISHABLE GOODS SUCH AS FOOD ITEMS, PHARMACEUTICALS

5.1.2 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS

5.1.3 INCREASING GROWTH OF SUPERMARKETS AND RESTAURANTS SUCH AS KFC, SUBWAY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH ENERGY-EFFICIENT AC SYSTEM

5.2.2 GROWTH IN HEALTH CONCERNS ABOUT THE CONSUMPTION OF FROZEN FRUIT AND VEGETABLES

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN THE FOOD SERVICE SECTORS BY COUNTRIES LIKE INDIA AND CHINA

5.3.2 HUGE DEMAND FOR HYGIENIC FOOD PRODUCTS AND FOOD PACKAGING

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING THE HAZARDOUS EFFECTS OF FROZEN FOOD

5.4.2 LACK OF INFRASTRUCTURE

6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE

6.1 OVERVIEW

6.2 SPLIT SYSTEM

6.3 ROOF MOUNT SYSTEM

7 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH

7.1 OVERVIEW

7.2 < 8-METER

7.3 8-12-METER

7.4 >12-METER

8 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CHILLED

8.3 FROZEN

9 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE

9.1 OVERVIEW

9.2 ENGINE POWERED

9.3 INDEPENDENT

10 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY

10.1 OVERVIEW

10.2 BELOW 5 KW

10.3 5 KW - 19 KW

10.4 ABOVE 19 KW

11 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 LIGHT COMMERCIAL VEHICLES (LCV)

11.2.1 BY TYPE

11.2.1.1 SPLIT SYSTEM

11.2.1.2 ROOF MOUNT SYSTEM

11.3 MEDIUM & HEAVY COMMERCIAL VEHICLES

11.3.1 BY TYPE

11.3.1.1 SPLIT SYSTEM

11.3.1.2 ROOF MOUNT SYSTEM

11.4 TRAILER (CONTAINER)

11.4.1 BY TYPE

11.4.1.1 SPLIT SYSTEM

11.4.1.2 ROOF MOUNT SYSTEM

11.5 BUS

11.5.1 BY TYPE

11.5.1.1 SPLIT SYSTEM

11.5.1.2 ROOF MOUNT SYSTEM

11.6 OTHERS

11.6.1 BY TYPE

11.6.1.1 SPLIT SYSTEM

11.6.1.2 ROOF MOUNT SYSTEM

12 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E

12.1.2 SAUDI ARABIA

12.1.3 ISRAEL

12.1.4 QATAR

12.1.5 KUWAIT

12.1.6 EGYPT

12.1.7 SOUTH AFRICA

12.1.8 BAHRAIN

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARRIER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DENSO CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DAIKIN INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SCHMITZ CARGOBULL.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADVANCED TEMPERATURE CONTROL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KRONE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 GRAYSON

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KLINGE CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KIDRON

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MOBILE CLIMATE CONTROL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SUBROS LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 TRANE TECHNOLOGIES PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 UTILITY TRAILER MANUFACTURING COMPANY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SANDEN CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SONGZ AUTOMOBILE AIR CONDITIONING CO., LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 WEBASTO SE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ZHENGZHOU GUCHEN INDUSTRY CO., LTD.,

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NUMBER OF UNITS IN THE MARKET (THOUSAND)

TABLE 2 ACCORDING TO THE MARKET ESTIMATION DONE BY DBMR, THE NUMBER OF UNITS BY TRUCK TYPE ACROSS THE GLOBE ARE AS FOLLOWS

TABLE 3 NUMBER OF UNITS BY THE PLAYER (USD MILLION)

TABLE 4 NUMBER OF UNITS BY REGION (THOUSAND UNITS)

TABLE 5 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST & AFRICA SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SPLIT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 9 MIDDLE EAST & AFRICA ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ROOF MOUNT SYSTEM IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 11 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST & AFRICA < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA < 8-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 15 MIDDLE EAST & AFRICA 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA 8-12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 17 MIDDLE EAST & AFRICA >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA >12-METER IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 19 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST & AFRICA CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CHILLED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 23 MIDDLE EAST & AFRICA FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FROZEN IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 25 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 27 MIDDLE EAST & AFRICA ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA ENGINE POWERED IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 29 MIDDLE EAST & AFRICA INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA INDEPENDENT IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 31 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 33 MIDDLE EAST & AFRICA BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA BELOW 5 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 35 MIDDLE EAST & AFRICA 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA 5 KW - 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 37 MIDDLE EAST & AFRICA ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ABOVE 19 KW IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 43 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 45 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 47 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 49 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 51 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 53 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 55 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 61 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 63 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 65 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 67 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 69 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 71 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 73 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 75 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 77 MIDDLE EAST AND AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 79 MIDDLE EAST AND AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 81 MIDDLE EAST AND AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 83 MIDDLE EAST AND AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 85 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 87 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 88 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 89 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 91 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 92 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 93 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 94 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 95 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 96 U.A.E. TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 97 U.A.E. LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 U.A.E. LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 99 U.A.E. MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 101 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.A.E. TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 103 U.A.E. BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 104 U.A.E. BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 105 U.A.E. OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 U.A.E. OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 107 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 109 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 110 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 111 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 112 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 113 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 114 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 115 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 116 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 117 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 118 SAUDI ARABIA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 119 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 121 SAUDI ARABIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 SAUDI ARABIA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 123 SAUDI ARABIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 SAUDI ARABIA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 125 SAUDI ARABIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SAUDI ARABIA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 127 SAUDI ARABIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SAUDI ARABIA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 129 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 131 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 132 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 133 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 134 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 135 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 136 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 137 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 138 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 139 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 140 ISRAEL TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 141 ISRAEL LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 ISRAEL LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 143 ISRAEL MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 ISRAEL MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 145 ISRAEL TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 ISRAEL TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 147 ISRAEL BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 ISRAEL BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 149 ISRAEL OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 ISRAEL OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 151 QATAR TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 QATAR TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 153 QATAR TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 154 QATAR TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 155 QATAR TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 156 QATAR TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 157 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 158 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 159 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 160 QATAR TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 161 QATAR TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 162 QATAR TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 163 QATAR LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 QATAR LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 165 QATAR MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 QATAR MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 167 QATAR TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 QATAR TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 169 QATAR BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 QATAR BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 171 QATAR OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 QATAR OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 173 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 175 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 176 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 177 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 178 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 179 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 180 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 181 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 182 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 183 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 184 KUWAIT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 185 KUWAIT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 KUWAIT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 187 KUWAIT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 KUWAIT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 189 KUWAIT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 190 KUWAIT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 191 KUWAIT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 KUWAIT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 193 KUWAIT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 194 KUWAIT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 195 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 197 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 198 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 199 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 200 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 201 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 202 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 203 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 204 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 205 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 206 EGYPT TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 207 EGYPT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 EGYPT LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 209 EGYPT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 210 EGYPT MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 211 EGYPT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 EGYPT TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 213 EGYPT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 EGYPT BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 215 EGYPT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 EGYPT OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 217 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 219 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 220 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 221 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 222 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 223 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 224 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 225 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 226 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 227 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 228 SOUTH AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 229 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 231 SOUTH AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 SOUTH AFRICA MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 233 SOUTH AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 SOUTH AFRICA TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 235 SOUTH AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 SOUTH AFRICA BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 237 SOUTH AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 SOUTH AFRICA OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 239 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 241 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 242 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 243 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 244 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 245 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 246 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 247 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 248 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 249 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 250 BAHRAIN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 251 BAHRAIN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 BAHRAIN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 253 BAHRAIN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 BAHRAIN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 255 BAHRAIN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 BAHRAIN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 257 BAHRAIN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 BAHRAIN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 259 BAHRAIN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 BAHRAIN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 261 OMAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 262 OMAN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 263 OMAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (USD MILLION)

TABLE 264 OMAN TRUCK REFRIGERATION UNIT MARKET, BY LENGTH, 2021-2030 (THOUSAND UNITS)

TABLE 265 OMAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 266 OMAN TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 267 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (USD MILLION)

TABLE 268 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2021-2030 (THOUSAND UNITS)

TABLE 269 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (USD MILLION)

TABLE 270 OMAN TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2021-2030 (THOUSAND UNITS)

TABLE 271 OMAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 272 OMAN TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 273 OMAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 OMAN LIGHT COMMERCIAL VEHICLES (LCV) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 275 OMAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 OMAN MEDIUM & HEAVY COMMERCIAL VEHICLES IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 277 OMAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 OMAN TRAILER (CONTAINER) IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 279 OMAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 OMAN BUS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 281 OMAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 282 OMAN OTHERS IN TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 283 REST OF MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 284 REST OF MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FROZEN FOODS BY CONSUMERS IS EXPECTED TO BE A KEY DRIVER FOR MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SPLIT SYSTEM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET

FIGURE 14 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: BY TYPE, 2022

FIGURE 15 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: BY LENGTH, 2022

FIGURE 16 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY APPLICATION, 2022

FIGURE 17 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER SOURCE, 2022

FIGURE 18 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY POWER CAPACITY, 2022

FIGURE 19 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET, BY VEHICLE TYPE, 2022

FIGURE 20 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA TRUCK REFRIGERATION UNIT MARKET: BY TYPE (2023-2030)

FIGURE 25 MIDDLE EAST & AFRICA TRUCK REFRIGERATION UNIT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.