Marché des capteurs tactiles au Moyen-Orient et en Afrique , par type (résistif, capacitif, onde acoustique de surface (SAW), infrarouge, optique), flexibilité (conventionnel, flexible, autres), canal (multicanal, canal unique), application (électronique grand public, appareils électroménagers, appareils médicaux, systèmes biométriques, automobile, guichets automatiques bancaires (GAB), systèmes biométriques, automobile et autres) Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

L'intégration croissante des capteurs due au nombre croissant d' écrans et d'appareils tactiles pourrait accroître la croissance du marché des capteurs tactiles au Moyen-Orient et en Afrique. La demande croissante d'électronique grand public comme les téléviseurs intelligents, les haut-parleurs et les systèmes domotiques complète la croissance du marché.

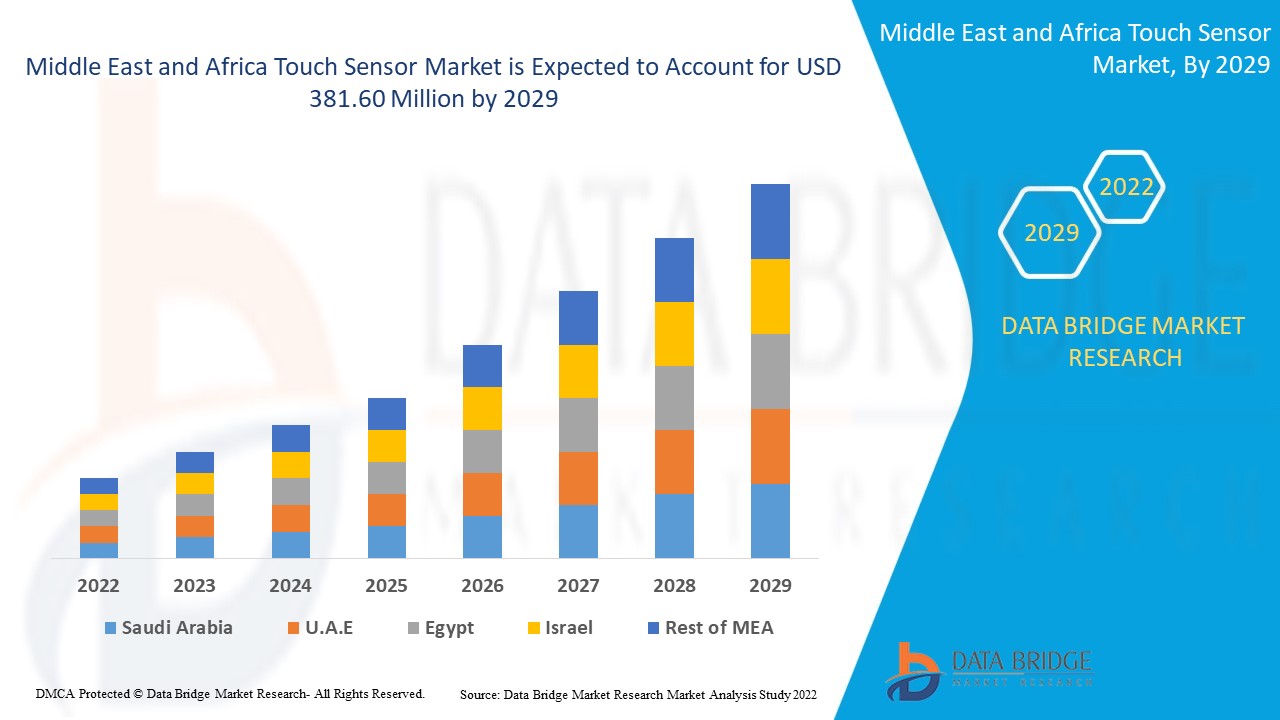

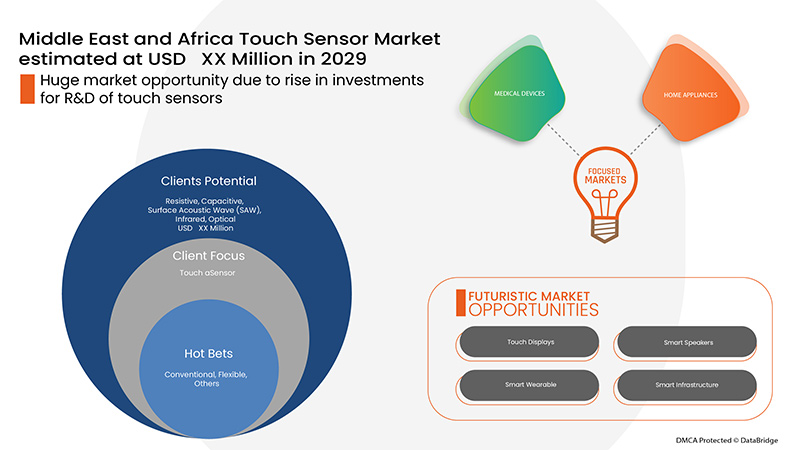

La demande croissante d' affichage numérique interactif dans les magasins de détail et les centres commerciaux stimule la demande de ces capteurs tactiles. Data Bridge Market Research analyse que le marché des capteurs tactiles au Moyen-Orient et en Afrique devrait atteindre la valeur de 381,60 millions USD d'ici 2029, à un TCAC de 11,5 % au cours de la période de prévision. En outre, la demande croissante d'affichage numérique interactif dans les magasins de détail et les centres commerciaux, qui réduit le travail manuel et agit comme une auto-assistance pour les consommateurs, accélère encore la croissance du marché. La progression rapide de la technologie des capteurs tactiles et l'utilisation croissante des écrans tactiles dans le secteur de l'éducation et des entreprises pour accroître l'interactivité stimulent la croissance du marché. Le segment automobile a un potentiel énorme pour mener la demande de capteurs tactiles en raison de l'intégration rapide des panneaux tactiles dans les véhicules.

Les acteurs du marché des capteurs tactiles au Moyen-Orient et en Afrique se concentrent davantage sur le développement de nouveaux produits, le partenariat et d’autres stratégies pour augmenter la part de marché des capteurs tactiles au Moyen-Orient et en Afrique.

Les principaux facteurs qui devraient stimuler la croissance du marché des capteurs tactiles au Moyen-Orient et en Afrique sont l'adoption croissante des écrans tactiles, la demande croissante d'électronique grand public, l'utilisation croissante des écrans tactiles dans l'industrie automobile et les initiatives gouvernementales en faveur de la numérisation. Cependant, la baisse de la demande de PC tout-en-un pourrait freiner la croissance du marché.

Le rapport de marché élaboré par l’équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie par des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (résistif, capacitif, à ondes acoustiques de surface (SAW), infrarouge, optique), flexibilité (conventionnel, flexible, autres), canal (multicanal, canal unique), application (électronique grand public, appareils électroménagers, appareils médicaux, systèmes biométriques, automobile, guichets automatiques bancaires (GAB), systèmes biométriques, automobile et autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël, Égypte et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Renesas Electronics Corporation, Silicon Laboratories, Zytronic PLC, Synaptics Incorporated, Infineon Technologies AG, Nissha Co., Ltd., Azoteq (PTY) Ltd, Microchip Technology Inc., entre autres |

Définition du marché

Un capteur tactile est défini comme un capteur électronique utilisé pour détecter et enregistrer le contact physique. Ils sont considérés comme des alternatives économiques de taille miniature aux commutateurs mécaniques traditionnels . Le capteur fonctionne généralement lorsqu'un contact ou une pression est appliqué sur la surface, ce qui permet au courant de circuler dans le circuit . Ils sont de différents types, notamment capacitifs, résistifs, infrarouges et à ondes acoustiques de surface (SAW).

Ils sont utilisés dans diverses applications, notamment dans l'électronique grand public , les appareils médicaux et l'automobile, en raison de leurs nombreux avantages. Les appareils électroniques grand public vont des systèmes de divertissement tels que les haut-parleurs aux appareils de communication tels que les téléphones portables, en passant par les maisons intelligentes et la domotique.

La dynamique du marché des capteurs tactiles au Moyen-Orient et en Afrique comprend :

- Adoption croissante des écrans tactiles

Le monde est passé progressivement des appareils mécaniques traditionnels aux appareils tactiles modernes. Les particuliers, les entreprises et les fabricants adoptent des écrans et des interfaces tactiles pour une meilleure visualisation et une meilleure expérience. L'une des principales raisons de leur adoption est qu'ils sont interactifs, attrayants et très simples à utiliser. La souris et le clavier ont été remplacés par une interface utilisateur simple, très réactive et facile à utiliser pour la navigation. Ils sont également très durables et résilients, ce qui leur confère une durée de vie plus longue. Ainsi, l'intégration rapide des appareils tactiles et à écran tactile dans des secteurs allant de la restauration aux entreprises de fabrication en passant par les services financiers est un facteur susceptible de stimuler la croissance du marché.

- Demande croissante en électronique grand public

La tendance à la hausse de la demande en électronique grand public, alimentée par la forte demande d’appareils dotés de meilleures fonctionnalités, est un facteur majeur qui devrait stimuler la croissance du marché des capteurs tactiles au Moyen-Orient et en Afrique.

- Utilisation croissante des capteurs tactiles dans l'industrie automobile

Le contrôle tactile est utilisé depuis de nombreuses années, mais son application était limitée. Cependant, à mesure que les différents secteurs industriels passent des systèmes mécaniques aux systèmes tactiles, les appareils tactiles ont connu une explosion. L'industrie automobile est devenue l'un des principaux utilisateurs d'écrans tactiles et devrait stimuler la croissance du marché des capteurs tactiles au Moyen-Orient et en Afrique.

- Initiatives gouvernementales pour la numérisation

La numérisation a radicalement transformé nos vies, et l'avènement de cette pandémie a bouleversé cette situation. Elle a obligé les économies du monde entier à repenser leurs stratégies et à maintenir le pays en activité. Elle a mis en lumière leurs lacunes en termes de transformation. L'impulsion donnée par le gouvernement en faveur de la numérisation par le biais d'initiatives et d'investissements étrangers est un facteur majeur qui devrait stimuler la croissance du marché.

- Demande croissante en matière d'affichage numérique interactif

Les écrans sur site ont été introduits pour la première fois dans les années 1970, lorsque de grands téléviseurs cathodiques étaient utilisés comme écrans pour la gestion de contenu. En 1980, ils étaient largement utilisés dans les espaces de vente au détail. Cependant, en 2000, la signalisation pilotée par logiciel a explosé et est devenue très populaire. Une décennie plus tard, les écrans flexibles et incurvés sont apparus, ouvrant la voie à l'interaction machine-machine et homme-machine donnant naissance à la signalisation numérique interactive. Les progrès technologiques et la connectivité à haut débit ont ouvert de nouvelles portes de possibilités.

Contraintes/défis rencontrés par le marché des capteurs tactiles au Moyen-Orient et en Afrique

- Baisse de la demande pour les PC tout-en-un

Aujourd'hui, les PC sont largement utilisés dans toutes les entreprises pour leur travail. Un ordinateur normal est livré avec un processeur, un écran et d'autres composants séparés, alors que dans un PC tout-en-un (AIO), tous les composants sont intégrés dans l'écran. L'Apple iMac est considéré comme l'un des AIO les plus réussis en général. En général, l'AIO est très attrayant et dispose d'un écran tactile. Comme de plus en plus d'entreprises fournissent des ordinateurs portables à leurs employés pour travailler à domicile au lieu de tout sur un seul PC, cela devrait freiner la croissance du marché.

- Pénurie d'approvisionnement en puces électroniques

Les dirigeants et cadres des multinationales du Moyen-Orient et d’Afrique s’inquiètent de la pénurie de semi-conducteurs, qui a affecté la production et les ventes dans de nombreux pays. Aucune solution n’est en vue à court terme. Cela représente un défi de taille pour la croissance du marché.

Ce rapport sur le marché des capteurs tactiles au Moyen-Orient et en Afrique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des capteurs tactiles, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En décembre 2021, Infineon Technologies AG a lancé la technologie d'interface homme-machine (IHM) tactile capacitive et inductive CAPSENSE de cinquième génération. La solution CAPSENSE de nouvelle génération intégrée aux microcontrôleurs PSoC offre des performances élevées et une faible consommation d'énergie pour les interfaces utilisateur exigeantes des produits électroménagers, grand public, industriels et IoT. Le nouveau produit a élargi l'offre de produits de l'entreprise

Portée du marché des capteurs tactiles au Moyen-Orient et en Afrique

Le marché des capteurs tactiles au Moyen-Orient et en Afrique est segmenté en fonction du type, de la flexibilité, du canal et de l'application. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Résistif

- Capacitif

- Onde acoustique de surface (SAW)

- Infrarouge

- Optique

Sur la base du type, le marché des capteurs tactiles du Moyen-Orient et de l'Afrique est segmenté en résistif, capacitif, onde acoustique de surface (SAW), infrarouge et optique.

Flexibilité

- Conventionnel

- Flexible

- Autres

Sur la base de la flexibilité, le marché des capteurs tactiles du Moyen-Orient et de l'Afrique est segmenté en conventionnel, flexible et autres.

Canal

- Canal unique

- À canaux multiples

Sur la base du canal, le marché des capteurs tactiles du Moyen-Orient et de l'Afrique est segmenté en canal unique et multicanal.

Application

- Électronique grand public

- Appareils électroménagers

- Dispositifs médicaux

- Guichets automatiques bancaires (GAB)

- Systèmes biométriques

- Automobile

- Autres

Sur la base des applications, le marché des capteurs tactiles du Moyen-Orient et de l'Afrique a été segmenté en électronique grand public, appareils électroménagers, appareils médicaux, distributeurs automatiques de billets (GAB), systèmes biométriques, automobile et autres.

Analyse/perspectives régionales du marché des capteurs tactiles au Moyen-Orient et en Afrique

Le marché des capteurs tactiles au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, flexibilité, canal et application, comme référencé ci-dessus.

Certains des pays couverts dans le rapport sur le marché des capteurs tactiles au Moyen-Orient et en Afrique sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, Israël, l’Égypte et le reste du Moyen-Orient et de l’Afrique.

Saudi Arabia is expected to dominate the Middle East and Africa touch sensor market due to increasing growth in the semiconductor industry in the region. Global digitalization trends have led many companies to increase their footprint in the region to meet the demands. This is leading the growth in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Touch Sensor Market Share Analysis

The Middle East and Africa touch sensor market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Middle East and Africa touch sensor market.

Some of the major players operating in the Middle East and Africa touch sensor market are Renesas Electronics Corporation., Silicon Laboratories, Zytronic PLC, Synaptics Incorporated, Infineon Technologies AG, Nissha Co., Ltd., Azoteq (PTY) Ltd, Microchip Technology Inc., among others.

Research Methodology: Middle East and Africa Touch Sensor Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, l'analyse des experts, l'analyse des importations/exportations, l'analyse des prix, l'analyse de la consommation de production, le scénario de la chaîne climatique, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et la part des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 TOUCH SENSOR PRICING ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF TOUCH-BASED DISPLAYS

6.1.2 RISING DEMAND FOR CONSUMER ELECTRONICS

6.1.3 INCREASING USE OF TOUCH SCREENS IN THE AUTOMOTIVE INDUSTRY

6.1.4 GOVERNMENT INITIATIVES FOR DIGITALIZATION

6.1.5 RISING DEMAND FOR INTERACTIVE DIGITAL SIGNAGE

6.2 RESTRAINTS

6.2.1 DECLINING DEMAND FOR ALL-IN-ONE PC

6.2.2 SHORTAGE OF SKILLED LABOUR

6.2.3 SHORT SUPPLY OF INDIUM

6.3 OPPORTUNITIES

6.3.1 SURGE IN INDUSTRIAL APPLICATIONS OF TOUCH-BASED PANELS AND EQUIPMENT

6.3.2 DEVELOPMENTS IN MULTI-TOUCH TECHNOLOGY

6.3.3 RISE IN INVESTMENTS FOR R&D OF TOUCH SENSORS

6.4 CHALLENGES

6.4.1 CHIP SUPPLY SHORTAGE

6.4.2 ACCIDENTAL TOUCHES DUE TO HIGH SENSITIVITY

7 COVID-19 IMPACT ON THE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON PRICE

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE

8.1 OVERVIEW

8.2 RESISTIVE

8.2.1 5 –WIRE

8.2.2 8 –WIRE

8.2.3 4 –WIRE

8.3 CAPACITIVE

8.3.1 BY TECHNOLOGY

8.3.1.1 PROJECTED CAPACITANCE

8.3.1.2 SURFACE CAPACITANCE

8.3.2 BY SURFACE TYPE

8.3.2.1 GLASS

8.3.2.2 NON-GLASS

8.3.2.2.1 PLASTIC/POLYMER

8.3.2.2.1.1 PET & PETG

8.3.2.2.1.2 POLYCARBONATES

8.3.2.2.1.3 PMMA

8.3.2.2.1.4 OTHERS

8.3.2.2.2 SAPPHIRE

8.4 SURFACE ACOUSTIC WAVE (SAW)

8.5 INFRARED

8.6 OPTICAL

9 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 FLEXIBLE

9.4 OTHERS

10 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL

10.1 OVERVIEW

10.2 MULTI-CHANNEL

10.3 SINGLE CHANNEL

11 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 LAPTOPS

11.2.2 MONITORS

11.2.3 WEARABLE

11.2.4 ALL-IN-ONE (AIO) PCS

11.2.5 OTHERS

11.3 HOME APPLIANCES

11.3.1 WASHING MACHINES

11.3.2 OVEN

11.3.3 REFRIGERATOR

11.3.4 OTHERS

11.4 MEDICAL DEVICES

11.5 BIOMETRIC SYSTEMS

11.6 AUTOMOTIVE

11.7 AUTOMATED TELLER MACHINES (ATM)

11.8 OTHERS

12 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROCHIP TECHNOLOGY INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 JAPAN DISPLAY INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TEXAS INSTRUMENTS INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 NISSHA CO. LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 RENESAS ELECTRONICS CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APEX MATERIAL TECHNOLOGY CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AZOTEQ (PTY) LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CAPTRON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CIRQUE CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DMC CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 ELO TOUCH SOLUTIONS INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FUTABA CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 NEONODE INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 SCHURTER

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SEMTECH CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 SILICON LABORATORIES

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 SYNAPTICS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TSITOUCH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XYMOX TECHNOLOGIES, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ZYTRONIC PLC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SURFACE ACOUSTIC WAVE (SAW) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA INFRARED IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OPTICAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CONVENTIONAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FLEXIBLE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MULTI-CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SINGLE CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL DEVICES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BIOMETRIC SYSTEMS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA AUTOMOTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA AUTOMATED TELLER MACHINES (ATM) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SAUDI ARABIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 SAUDI ARABIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SAUDI ARABIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.A.E. TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.A.E. RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.A.E. CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 U.A.E. CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.A.E. NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 EGYPT CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 EGYPT CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 92 EGYPT TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 EGYPT TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 EGYPT CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 EGYPT HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 REST OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 12 GROWING INTEGRATION OF SENSORS IN TOUCH-ENABLED DEVICES IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 13 RESISTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN MIDDLE EAST & AFRICA TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TOUCH SENSOR MARKET

FIGURE 16 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY FLEXIBILITY, 2021

FIGURE 18 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY APPLICATION, 2021

FIGURE 20 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: BY TYPE (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA TOUCH SENSOR MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.