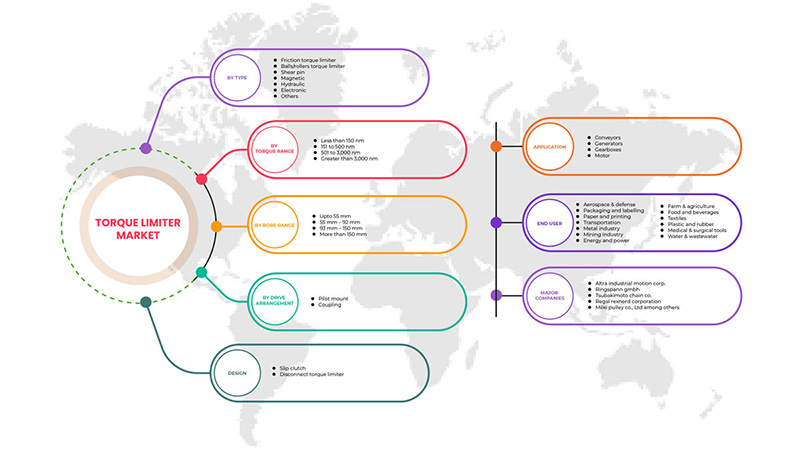

Middle East and Africa Torque Limiter Market, By Type (Friction Torque Limiter, Balls/Rollers Torque Limiter, Shear Pin, Hydraulic, Magnetic, Electronic, and Others), Torque Range (501 to 3,000 Nm, 151 to 500 Nm, Greater Than 3,000 Nm, Less Than 150 Nm), Bore Range (55 Mm – 92 Mm, Upto 55 Mm, 93 Mm – 150 Mm, More Than 150 Mm), Drive Arrangement (Coupling, Pilot Mount), Design (Slip Clutch, Disconnect Torque Limiter), Application (Conveyors, Gearboxes, Generators, Motor), End User (Aerospace & Defense, Packaging & Labeling, Paper & Printing, Transportation, Metal Industry, Mining Industry, Energy & Power, Farm & Agriculture, Food and Beverages, Textiles, Plastic & Rubber, Medical & Surgical Tools, Water & Wastewater) – Industry Trends and Forecast to 2030.

Middle East and Africa Torque Limiter Market Analysis and Size

Any apparatus with spinning parts can be protected by using torque limiters. A torque limiter can ensure that torque never exceeds dangerous levels if there is any chance that a drive shaft will transmit too much torque to the driven shaft or tangential components. The components introduce a disconnect technique while coupling the two rotating bodies. The high adoption of torque limiters in the aerospace industry is expected to boost market growth, while the high carbon footprint of the automotive sector may restrain the market growth. Grow in awareness about enhanced safety systems is expected to act as an opportunity, and a lack of technological awareness about the functioning of products may challenge the market growth.

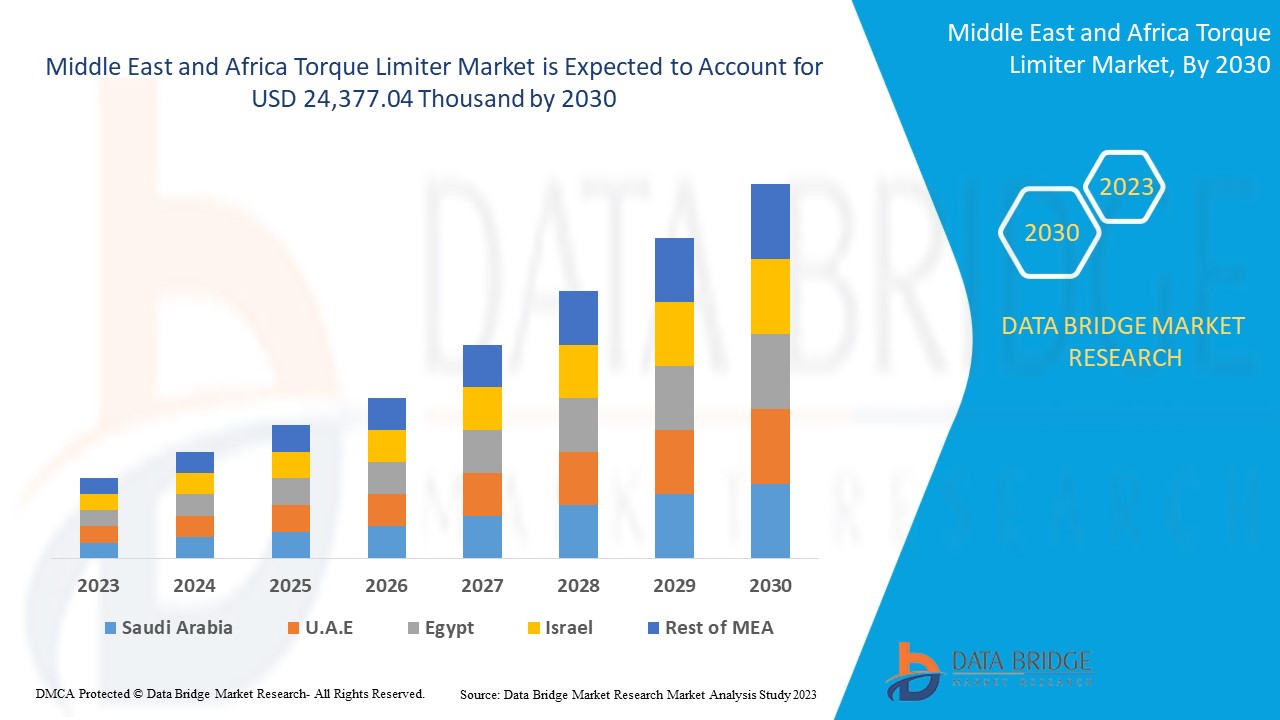

Data Bridge Market Research analyses that the Middle East and Africa torque limiter market is expected to reach the value of USD 24,377.04 Thousand by 2030, at a CAGR of 4.1% during the forecast period. The torque limiter market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2016) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Type (Friction Torque Limiter, Balls/Rollers Torque Limiter, Shear Pin, Hydraulic, Magnetic, Electronic, and Others), Torque Range (501 to 3,000 Nm, 151 to 500 Nm, Greater Than 3,000 Nm, Less Than 150 Nm), Bore Range (55 Mm – 92 Mm, Upto 55 Mm, 93 Mm – 150 Mm, More Than 150 Mm), Drive Arrangement (Coupling, Pilot Mount), Design (Slip Clutch, Disconnect Torque Limiter), Application (Conveyors, Gearboxes, Generators, Motor), End User (Aerospace & Defense, Packaging & Labeling, Paper & Printing, Transportation, Metal Industry, Mining Industry, Energy & Power, Farm & Agriculture, Food and Beverages, Textiles, Plastic & Rubber, Medical & Surgical Tools, Water & Wastewater). |

|

Countries Covered |

Arabie saoudite, Émirats arabes unis, Israël, Afrique du Sud, Égypte, Koweït, Qatar, reste du Moyen-Orient et de l’Afrique (MEA). |

|

Acteurs du marché couverts |

Français Altra Industrial Motion Corp., Chr. Mayr GmbH + Co. KG, KTR Systems GmbH, R+W Antriebselemente GmbH, Nexen Group, Inc., Howdon Power Transmission Limited, TSUBAKIMOTO CHAIN CO., RINGSPANN GmbH, Cross+Morse, TOK, inc., Miki Pulley Co., Ltd, Regal Rexnord Corporation, Hersey Clutch Company, ComInTec Srl, Compomac Spa, Great Tong Ling Enterprise Co., Ltd. (GTL), Geartronics Incorporated, ZETASASSI SRL, Andantex USA Inc., SIT SpA, Maschinenfabrik Mönninghoff GmbH & Co. KG, The Carlyle Johnson Machine Company, LLC., Fenner Drives, Inc., Dalton Gear Company, MACH III CLUTCH, INC. et Nu-Teck Couplings Pvt. Ltd. |

Définition du marché

Un seul événement ou une seule action peut provoquer la défaillance ou la fracture de composants d'entraînement critiques. Une surcharge mécanique se produit lorsqu'un composant en rotation est soumis à des couples supérieurs à ceux que le système est censé tolérer. Toute opération de rotation peut générer un couple important. En cas de dysfonctionnement, toute cette force peut endommager les accouplements, les arbres d'entraînement ou de moteur et les engrenages, entre autres composants concernés.

Le point de consigne n'est jamais dépassé grâce aux limiteurs de couple. Ces pièces empêchent les surcharges et les pannes mécaniques en limitant les forces de couple à un niveau que les composants rotatifs peuvent supporter en toute sécurité. Ils peuvent fonctionner seuls ou en tandem avec des capteurs électriques. Les limiteurs de couple mécaniques sont parfois appelés embrayages de surcharge.

Dynamique du marché des limiteurs de couple au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Adoption élevée du limiteur de couple dans l'industrie aérospatiale

Le succès de tout avion électrique et de tout avion électrique futur dépend de la sécurité et de la fiabilité des actionneurs électriques (EA). En limitant le couple auquel sont soumis les composants de la chaîne cinématique de l'actionneur, les limiteurs de couple augmentent la fiabilité des actionneurs électromécaniques (EMA). Si le couple transmis par l'arbre dépasse un certain seuil, l'arbre cède progressivement. Cela protège contre une éventuelle défaillance et un blocage de l'actionneur.

Dans la plupart des applications aéronautiques, un limiteur de couple avec verrou à bille intègre un ressort de friction. Il est situé dans la transmission de l'élévateur mobile, qui aide les panneaux d'aile à protéger la boîte de vitesses et le moteur contre les dommages en cas d'obstruction majeure du volet. Le couple est transféré d'un côté du limiteur à l'autre par la force de rétraction du ressort de friction spécialement conçu, qui retient la bille dans le limiteur dans des poches appropriées. Si le couple est trop important, les billes sortiront de leurs poches et comprimeront le ressort, ce qui pourrait entraîner une défaillance du limiteur de couple. Cela établit une protection sûre et fiable contre les surcharges.

- Apparition des véhicules électriques et de leur système de limitation de couple

L'industrie automobile a connu une croissance considérable en raison de la demande croissante de véhicules électriques de luxe. La plupart des véhicules électriques (VE) sont des véhicules à batterie, qui utilisent une batterie pour stocker l'énergie électrique qui alimente les véhicules. Certains des facteurs qui stimulent les ventes de véhicules électriques comprennent les réglementations gouvernementales strictes concernant les émissions des véhicules et la demande croissante de véhicules à faible consommation de carburant, à hautes performances et à faibles émissions. Cela contribue à l'adoption des véhicules électriques, car les véhicules entièrement électriques sont à zéro émission, minimisant ainsi efficacement les émissions de carbone.

Opportunités

- Tendances à la hausse pour l'industrie de l'emballage à travers le monde

Le pouvoir de l'emballage prend de plus en plus d'importance dans différents secteurs tels que l'alimentation, la pharmacie, les cosmétiques et bien d'autres. L'emballage représente la reconnaissance de la marque et influence fortement le comportement d'achat du consommateur.

De plus, l'industrie de l'emballage s'automatise au fil des ans. L'automatisation implique l'utilisation de robots pour la manipulation des produits dans le processus d'emballage. Ces robots déplacent les produits à différentes étapes et sont maintenus pendant le temps requis. Cependant, les équipements d'automatisation utilisent des robots, qui à leur tour utilisent des moteurs et des engrenages pour contrôler le mouvement des convoyeurs et des produits. Ainsi, l'automatisation a aidé l'industrie de l'emballage à gagner en importance.

Contraintes/Défis

- La faible durée de vie du limiteur de couple

Un limiteur de couple, souvent un embrayage de surcharge, est une machine simple qui protège les équipements mécaniques contre les dommages. C'est l'un des dispositifs les plus utiles pour les véhicules, les avions, les bandes transporteuses et de nombreux autres mécanismes motorisés. D'un autre côté, il a aussi un côté négatif.

Par exemple, dans le cas d'un limiteur de couple à goupille de cisaillement suite à une surcharge de couple, les goupilles de cisaillement doivent être remplacées à chaque fois. De plus, il peut être difficile de contrôler avec précision le niveau de couple auquel la goupille de cisaillement se brisera. La ou les goupilles ne parviendront pas à transmettre le couple excessif à un niveau de couple proche du maximum calculé, ce qui entraînera une séparation complète des arbres menant et mené. Cela entraîne des coûts de maintenance supplémentaires car le limiteur de couple a une durée de vie très limitée.

De même, la surcharge protège la machine contre les dommages en provoquant le glissement du composant d'entraînement par rapport aux intervalles de friction. L'entraînement reprend la transmission du couple une fois la surcharge supprimée. La pression du ressort d'un limiteur de couple à friction est modifiée pour modifier précisément la quantité de couple qui provoquera le glissement de l'appareil. Dans les entraînements par pignons sur les convoyeurs et autres applications connexes, les limiteurs de couple à friction sont fréquemment utilisés car ils offrent une protection simple et abordable contre les surcharges. Les limiteurs de couple à friction présentent l'inconvénient de subir une usure importante lorsqu'ils sont utilisés dans une situation de surcharge à des vitesses élevées.

- Manque de sensibilisation technologique sur le fonctionnement des produits

Le besoin de limiteurs de couple dans tous les secteurs industriels prend de l'importance, mais il est essentiel de connaître les aspects technologiques et financiers des systèmes de gestion du couple. L'objectif ultime est d'optimiser l'utilisation du couple et de maximiser l'automatisation ou l'efficacité du véhicule.

Cependant, la plupart des industries adoptent des limiteurs de couple dans leur processus de travail. Pourtant, la plupart des professionnels ne sont pas conscients des aspects techniques, ce qui conduit à des idées fausses, à des perceptions et à une mise en œuvre de méthodes erronées entraînant des résultats négatifs. Les informations nécessaires pour sélectionner le limiteur de couple doivent être disponibles localement et fournir des méthodes pour sélectionner la technologie la plus efficace. De plus, le manque de recherche et développement créera une confusion dans le choix de la bonne technologie en fonction des conditions du site et du type d'industrie.

Impact post-COVID-19 sur le marché des limiteurs de couple au Moyen-Orient et en Afrique

La COVID-19 a eu un impact négatif sur le marché des limiteurs de couple en raison de la fermeture rapide des installations de fabrication dans toutes les régions.

La pandémie de COVID-19 a eu un impact négatif sur le marché des limiteurs de couple. L'adoption croissante de la sécurité et la sensibilisation aux systèmes de sécurité améliorés dans tous les secteurs ont aidé le marché à croître après la pandémie. En outre, on s'attend à une croissance sectorielle considérable dans un avenir proche.

Les fabricants prennent diverses décisions stratégiques pour améliorer leurs offres dans le scénario post-COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le limiteur de couple. Grâce à cela, les entreprises apporteront des technologies de pointe sur le marché.

Développement récent

- En novembre 2023, Altra Industrial Motion Corp. a annoncé le lancement d'un tout nouveau système de freinage SIL3/Ple. Il s'agit d'une technologie de système de freinage avancée qui offre des performances de sécurité améliorées requises pour répondre aux réglementations de sécurité exigeantes sur les applications, notamment les équipements de déplacement de personnes et de levage. L'entreprise attirera davantage de clients et élargira son portefeuille de produits grâce à ce lancement de produit.

- En septembre 2019, Chr. Mayr GmbH + Co. KG. a lancé sur le marché la sécurité intelligente pour les petits freins. Elle est dotée d'une transmission de puissance et est non seulement capable de surveiller et d'alimenter les freins de sécurité sans utiliser de capteurs. Elle fournit également des données et assure ainsi une sécurité intelligente. Grâce à ce produit, l'entreprise a attiré davantage de clients et élargi son portefeuille de produits.

Portée du marché des limiteurs de couple au Moyen-Orient et en Afrique

Au Moyen-Orient et en Afrique, le marché des limiteurs de couple est segmenté en six segments notables, qui sont basés sur le type, la plage de couple, la plage d'alésage, la disposition de l'entraînement, la conception, l'application et l'utilisateur final.

La croissance parmi ces segments vous aidera à analyser les faibles segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Limiteur de couple à friction

- Limiteur de couple à billes/rouleaux

- Goupille de cisaillement

- Magnétique

- Hydraulique

- Électronique

- Autres

Sur la base du type, le marché des limiteurs de couple au Moyen-Orient et en Afrique est segmenté en limiteur de couple à friction, limiteur de couple à billes/rouleaux, goupille de cisaillement, magnétique, hydraulique, électronique et autres.

Plage de couple

- 501 à 3 000 Nm

- 151 à 500 Nm

- Supérieur à 3 000 Nm

- Moins de 150 Nm

Sur la base de la plage de couple, le marché des limiteurs de couple du Moyen-Orient et de l'Afrique a été segmenté en 501 à 3 000 nm, 151 à 500 nm, supérieur à 3 000 nm et inférieur à 150 nm.

Plage d'alésage

- 55 mm – 92 mm

- Jusqu'à 55 mm

- 93 mm – 150 mm

- Plus de 150 mm

Sur la base de la plage d'alésage, le marché des limiteurs de couple du Moyen-Orient et de l'Afrique a été segmenté en 55 mm - 92 mm, jusqu'à 55 mm, 93 mm - 150 mm et plus de 150 mm.

Disposition de l'entraînement

- Couplage

- Support pilote

Sur la base de la disposition de l'entraînement, le marché du limiteur de couple du Moyen-Orient et de l'Afrique est segmenté en accouplement et support pilote.

Conception

- Embrayage à glissement

- Déconnecter le limiteur de couple

Sur la base de la conception, le marché des limiteurs de couple du Moyen-Orient et de l'Afrique est segmenté en limiteurs de couple à embrayage à glissement et à déconnexion.

Application

- Convoyeurs

- Boîtes de vitesses

- Générateurs

- Moteur

Sur la base de l'application, le marché des limiteurs de couple au Moyen-Orient et en Afrique est segmenté en convoyeurs, boîtes de vitesses, générateurs et moteurs.

Utilisateur final

- Aérospatiale et Défense

- Emballage et étiquetage

- Papier et impression

- Transport

- Industrie métallurgique

- Industrie minière

- Énergie et puissance

- Ferme et agriculture

- Alimentation et boissons

- Textiles

- Plastique et caoutchouc

- Outils médicaux et chirurgicaux

- Eau et eaux usées

Sur la base de l'application, le marché des limiteurs de couple au Moyen-Orient et en Afrique est segmenté en aérospatiale et défense, emballage et étiquetage, papier et impression, transport, industrie métallurgique, industrie minière, énergie et électricité, agriculture et agriculture, alimentation et boissons, textiles, plastique et caoutchouc, outils médicaux et chirurgicaux, et eau et eaux usées.

Analyse/perspectives régionales du marché des limiteurs de couple au Moyen-Orient et en Afrique

Le marché des limiteurs de couple au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, plage de couple, plage d’alésage, disposition d’entraînement, conception, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des limiteurs de couple sont l’Arabie saoudite, les Émirats arabes unis, Israël, l’Afrique du Sud, l’Égypte, le Koweït, le Qatar et le reste du Moyen-Orient et de l’Afrique (MEA). L’Arabie saoudite domine le Moyen-Orient et l’Afrique en raison des politiques gouvernementales et des investissements dans une industrialisation rapide.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Torque Limiter Market Share Analysis

Middle East and Africa torque limiter market competitive landscape provide details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the torque limiter market.

Some of the major players operating in the Middle East and Africa torque limiter market are Altra Industrial Motion Corp., Chr. Mayr GmbH + Co. KG, KTR Systems GmbH, R+W Antriebselemente GmbH, Nexen Group, Inc., Howdon Power Transmission Limited, TSUBAKIMOTO CHAIN CO., RINGSPANN GmbH, Cross+Morse, TOK, inc., Miki Pulley Co., Ltd, Regal Rexnord Corporation, Hersey Clutch Company, ComInTec S.r.l., Compomac Spa, Great Tong Ling Enterprise Co., Ltd. (GTL), Geartronics Incorporated, ZETASASSI SRL, Andantex USA Inc., SIT S.p.A., Maschinenfabrik Mönninghoff GmbH & Co. KG, The Carlyle Johnson Machine Company, LLC., Fenner Drives, Inc., Dalton Gear Company, MACH III CLUTCH, INC., and Nu-Teck Couplings Pvt. Ltd.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TORQUE LIMITER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH ADOPTION OF TORQUE LIMITER IN THE AEROSPACE INDUSTRY

5.1.2 EMERGENCE OF EVS AND THEIR TORQUE LIMITER SYSTEM

5.1.3 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.1.4 EMERGENCE TOWARD THE UTILIZATION OF ELECTRONIC TORQUE LIMITER

5.2 RESTRAINTS

5.2.1 LOW PRODUCT LIFETIME OF TORQUE LIMITER

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 RISING TRENDS FOR THE PACKAGING INDUSTRY ACROSS THE GLOBE

5.3.2 GROWTH IN AWARENESS OF ENHANCED SAFETY SYSTEMS

5.3.3 RISING IMPORTANCE OF TORQUE LIMITER IN VEHICLES

5.4 CHALLENGES

5.4.1 LACK OF TECHNOLOGICAL AWARENESS ABOUT THE FUNCTIONING OF PRODUCTS

5.4.2 CHANGING THE AUTOMOTIVE PRODUCTION CYCLE OF THE TORQUE LIMITERS

6 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TYPE

6.1 OVERVIEW

6.2 FRICTION TORQUE LIMITER

6.3 BALLS/ROLLERS TORQUE LIMITER

6.4 SHEAR PIN

6.5 HYDRAULIC

6.6 MAGNETIC

6.7 ELECTRONIC

6.8 OTHERS

7 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TORQUE RANGE

7.1 OVERVIEW

7.2 501 TO 3,000 NM

7.2.1 FRICTION TORQUE LIMITER

7.2.2 BALLS/ROLLERS TORQUE LIMITER

7.2.3 SHEAR PIN

7.2.4 HYDRAULIC

7.2.5 MAGNETIC

7.2.6 ELECTRONIC

7.2.7 OTHERS

7.3 151 TO 500 NM

7.3.1 FRICTION TORQUE LIMITER

7.3.2 BALLS/ROLLERS TORQUE LIMITER

7.3.3 SHEAR PIN

7.3.4 HYDRAULIC

7.3.5 MAGNETIC

7.3.6 ELECTRONIC

7.3.7 OTHERS

7.4 GREATER THAN 3,000 NM

7.4.1 FRICTION TORQUE LIMITER

7.4.2 BALLS/ROLLERS TORQUE LIMITER

7.4.3 SHEAR PIN

7.4.4 HYDRAULIC

7.4.5 MAGNETIC

7.4.6 ELECTRONIC

7.4.7 OTHERS

7.5 LESS THAN 150 NM

7.5.1 FRICTION TORQUE LIMITER

7.5.2 BALLS/ROLLERS TORQUE LIMITER

7.5.3 SHEAR PIN

7.5.4 HYDRAULIC

7.5.5 MAGNETIC

7.5.6 ELECTRONIC

7.5.7 OTHERS

8 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY BORE RANGE

8.1 OVERVIEW

8.2 55 MM – 92 MM

8.3 UPTO 55 MM

8.4 93 MM – 150 MM

8.5 MORE THAN 150 MM

9 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT

9.1 OVERVIEW

9.2 COUPLING

9.3 PILOT MOUNT

10 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DESIGN

10.1 OVERVIEW

10.2 SLIP CLUTCH

10.3 DISCONNECT TORQUE LIMITER

11 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CONVEYORS

11.3 GEARBOXES

11.4 GENERATORS

11.5 MOTOR

12 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY END USER

12.1 OVERVIEW

12.2 AEROSPACE & DEFENSE

12.3 PACKAGING AND LABELLING

12.4 PAPER AND PRINTING

12.5 TRANSPORTATION

12.5.1 OFF ROAD VEHICLES (CRANE & HOIST)

12.5.1.1 OVERHEAD TRAVELING BRIDGE CRANES

12.5.1.2 GANTRY CRANES

12.5.1.3 JIB CRANES

12.5.1.4 MONORAIL LIFTING SYSTEMS

12.5.1.5 TOP SLEWING CRANES

12.5.1.6 CHAIN & WIRE ROPE HOISTS

12.5.2 LIGHT DUTY RAIL TRANSMISSION

12.5.3 CLASS 8 TRUCKS

12.5.4 AUTOMOTIVE BEARINGS

12.6 METAL INDUSTRY

12.7 MINING INDUSTRY

12.8 ENERGY AND POWER

12.9 FARM & AGRICULTURE

12.9.1 COMBAINES, BAILERS & HARVESTERS

12.9.2 GRAIN HANDLING & DRYING EQUIPMENT

12.9.3 PUMPS

12.9.4 SEEDERS & SPRAYERS

12.9.5 MOWERS

12.9.6 FAN DRIVERS

12.1 FOOD AND BEVERAGES

12.11 PLASTIC AND RUBBER

12.12 MEDICAL & SURGICAL TOOLS

12.13 WATER & WASTEWATER

13 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 SOUTH AFRICA

13.1.3 U.A.E.

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 KUWAIT

13.1.7 QATAR

13.1.8 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ALTRA INDUSTRIAL MOTION CORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 RINGSPANN GMBH

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 TSUBAKIMOTO CHAIN CO.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 REGAL REXNORD CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 MIKI PULLEY CO., LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ANDANTEX USA INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 CHR. MAYR GMBH + CO. KG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 COMINTEC S.R.L.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 COMPOMAC SPA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CROSS+MORSE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 DALTON GEAR COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FENNER DRIVES, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 GEARTRONICS INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GREAT TONG LING ENTERPRISE CO., LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HERSEY CLUTCH COMPANY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 HOWDON POWER TRANSMISSION LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 KTR SYSTEMS GMBH

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MACH III CLUTCH, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MASCHINENFABRIK MÖNNINGHOFF GMBH & CO. KG

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 NEXEN GROUP, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 NU-TECK COUPLINGS PVT. LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 R+W ANTRIEBSELEMENTE GMBH

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SIT S.P.A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 THE CARLYLE JOHNSON MACHINE COMPANY, LLC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 TOK, INC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 ZETASASSI

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS AND SUVS

TABLE 2 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA FRICTION TORQUE LIMITER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA BALLS/ROLLERS TORQUE LIMITER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SHEAR PIN IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA HYDRAULIC IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MAGNETIC IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA ELECTRONIC IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA OTHERS IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA 501 TO 3000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA 151 TO 500 NM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA GREATER THAN 3000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA LESS THAN 150 NM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA 55 MM – 92 MM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA UPTO 55 MM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 93 MM – 150 MM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA MORE THAN 150 MM IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA COUPLING IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PILOT MOUNT IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA SLIP CLUTCH IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA DISCONNECT TORQUE LIMITER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA CONVEYORS IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA GEARBOXES IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA GENERATORS IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA MOTOR IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA PACKAGING AND LABELLING IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PAPER AND PRINTING IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA TRANSPORTATION IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA METAL INDUSTRY IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA MINING INDUSTRY IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA ENERGY AND POWER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA FOOD AND BEVERAGES IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PLASTIC AND RUBBER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA MEDICAL & SURGICAL TOOLS IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA WATER & WASTEWATER IN TORQUE LIMITER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 SAUDI ARABIA TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 SAUDI ARABIA TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 68 SAUDI ARABIA 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 SAUDI ARABIA 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SAUDI ARABIA GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 SAUDI ARABIA LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SAUDI ARABIA TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 73 SAUDI ARABIA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 74 SAUDI ARABIA TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 75 SAUDI ARABIA TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 SAUDI ARABIA TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 77 SAUDI ARABIA TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 SAUDI ARABIA OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SAUDI ARABIA FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH AFRICA OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 SOUTH AFRICA FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 U.A.E. TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 U.A.E. TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 96 U.A.E. 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 U.A.E. 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 U.A.E. GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 U.A.E. LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 U.A.E. TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 101 U.A.E. TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 102 U.A.E. TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 103 U.A.E. TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 104 U.A.E. TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 105 U.A.E. TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 U.A.E. OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 U.A.E. FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 ISRAEL TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 ISRAEL TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 110 ISRAEL 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 ISRAEL 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 ISRAEL GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 ISRAEL LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 ISRAEL TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 115 ISRAEL TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 116 ISRAEL TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 117 ISRAEL TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 118 ISRAEL TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 119 ISRAEL TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 ISRAEL OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 ISRAEL FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 EGYPT TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 EGYPT TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 124 EGYPT 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 EGYPT 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 EGYPT GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 EGYPT LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 EGYPT TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 129 EGYPT TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 130 EGYPT TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 131 EGYPT TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 132 EGYPT TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 133 EGYPT TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 EGYPT OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 EGYPT FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 KUWAIT TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 137 KUWAIT TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 138 KUWAIT 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 KUWAIT 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 KUWAIT GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 141 KUWAIT LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 KUWAIT TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 143 KUWAIT TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 144 KUWAIT TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 145 KUWAIT TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 146 KUWAIT TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 147 KUWAIT TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 KUWAIT OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 KUWAIT FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 QATAR TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 QATAR TORQUE LIMITER MARKET, BY TORQUE RANGE, 2021-2030 (USD THOUSAND)

TABLE 152 QATAR 501 TO 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 QATAR 151 TO 500 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 QATAR GREATER THAN 3,000 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 QATAR LESS THAN 150 NM IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 QATAR TORQUE LIMITER MARKET, BY BORE RANGE, 2021-2030 (USD THOUSAND)

TABLE 157 QATAR TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2021-2030 (USD THOUSAND)

TABLE 158 QATAR TORQUE LIMITER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 159 QATAR TORQUE LIMITER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 160 QATAR TORQUE LIMITER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 161 QATAR TRANSPORTATION IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 QATAR OFF ROAD VEHICLES (CRANE & HOIST) IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 QATAR FARM & AGRICULTURE IN TORQUE LIMITER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: SEGMENTATION

FIGURE 12 HIGH ADOPTION OF TORQUE LIMITERS IN THE AEROSPACE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA TORQUE LIMITER MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 13 FRICTION TORQUE LIMITER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TORQUE LIMITER MARKET IN 2023 & 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA TORQUE LIMITER MARKET

FIGURE 15 ROAD TRANSPORT EMISSIONS

FIGURE 16 PACKAGING MARKET IN DIFFERENT REGIONS

FIGURE 17 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY TORQUE RANGE, 2022

FIGURE 19 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY BORE RANGE, 2022

FIGURE 20 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DRIVE ARRANGEMENT, 2022

FIGURE 21 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY DESIGN, 2022

FIGURE 22 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY APPLICATION, 2022

FIGURE 23 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET, BY END USER, 2022

FIGURE 24 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA TORQUE LIMITER MARKET: BY TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA TORQUE LIMITER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.