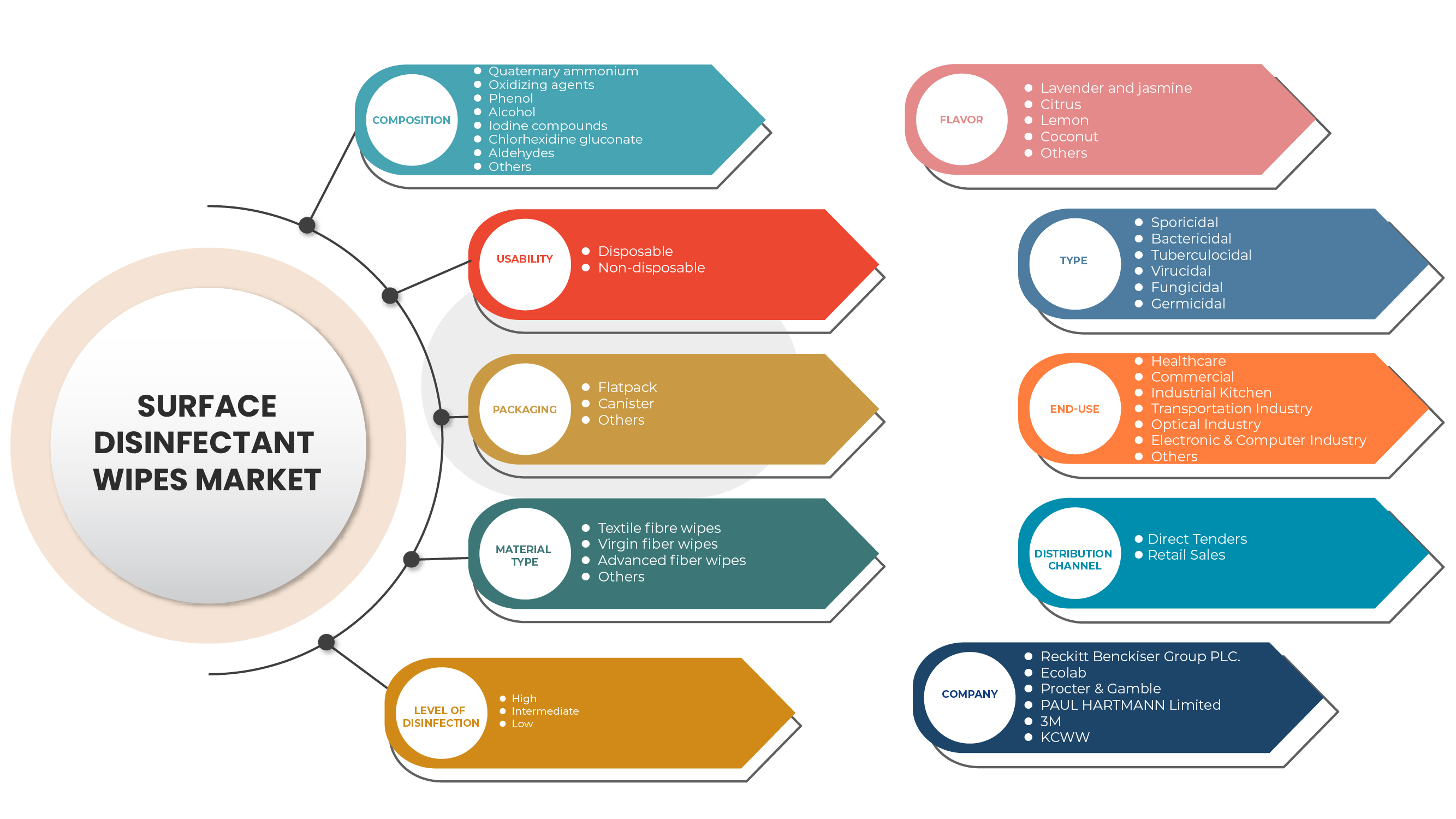

Middle East & Africa Surface Disinfectant Wipes Market, By Composition (Quaternary Ammonium, Oxidizing Agents, Phenol, Alcohol, Chlorine Compounds, Iodine Compounds, Chlorhexidine Gluconate, Aldehydes, And Others), Usability (Disposable And Non-Disposable), Packaging (Flatpack, Canister And Others), Material Type (Textile Fiber Wipes, Virgin Fiber Wipes, Advanced Fiber Wipes And Others), Levels Of Disinfection (High, Intermediate And Low), Flavor (Lavender And Jasmine, Citrus, Lemon, Coconut And Others), Type (Sporicidal, Bactericidal, Tuberculocidal, Virucidal, Fungicidal And Germicidal), End-Use (Healthcare, Commercial, Industrial Kitchen, Transportation Industry, Optical Industry, Electronic And Computer Industry And Others), Distribution Channel (Direct Tenders And Retail Sales), Industry Trends and Forecast to 2029

Market Analysis and Insights

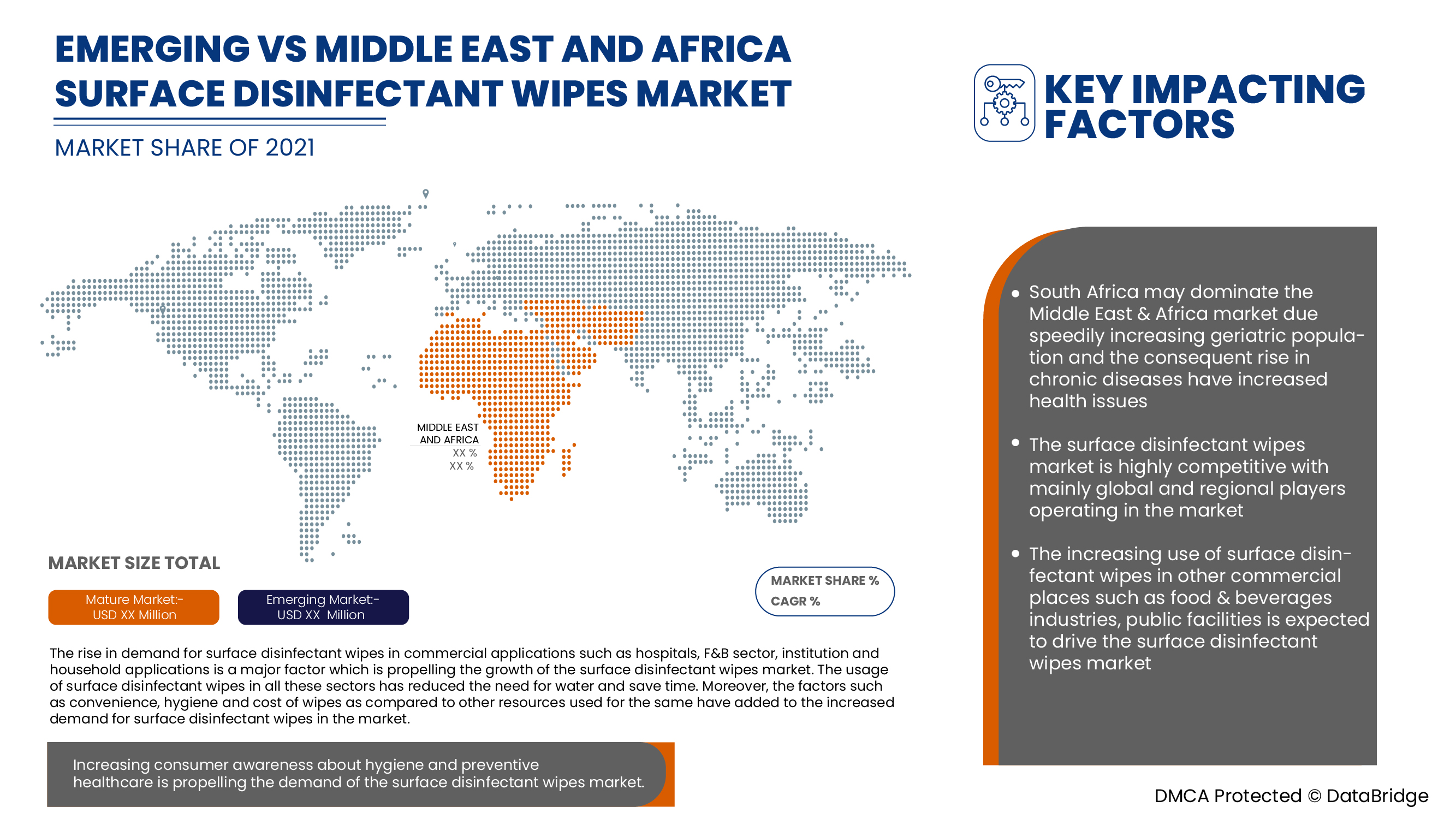

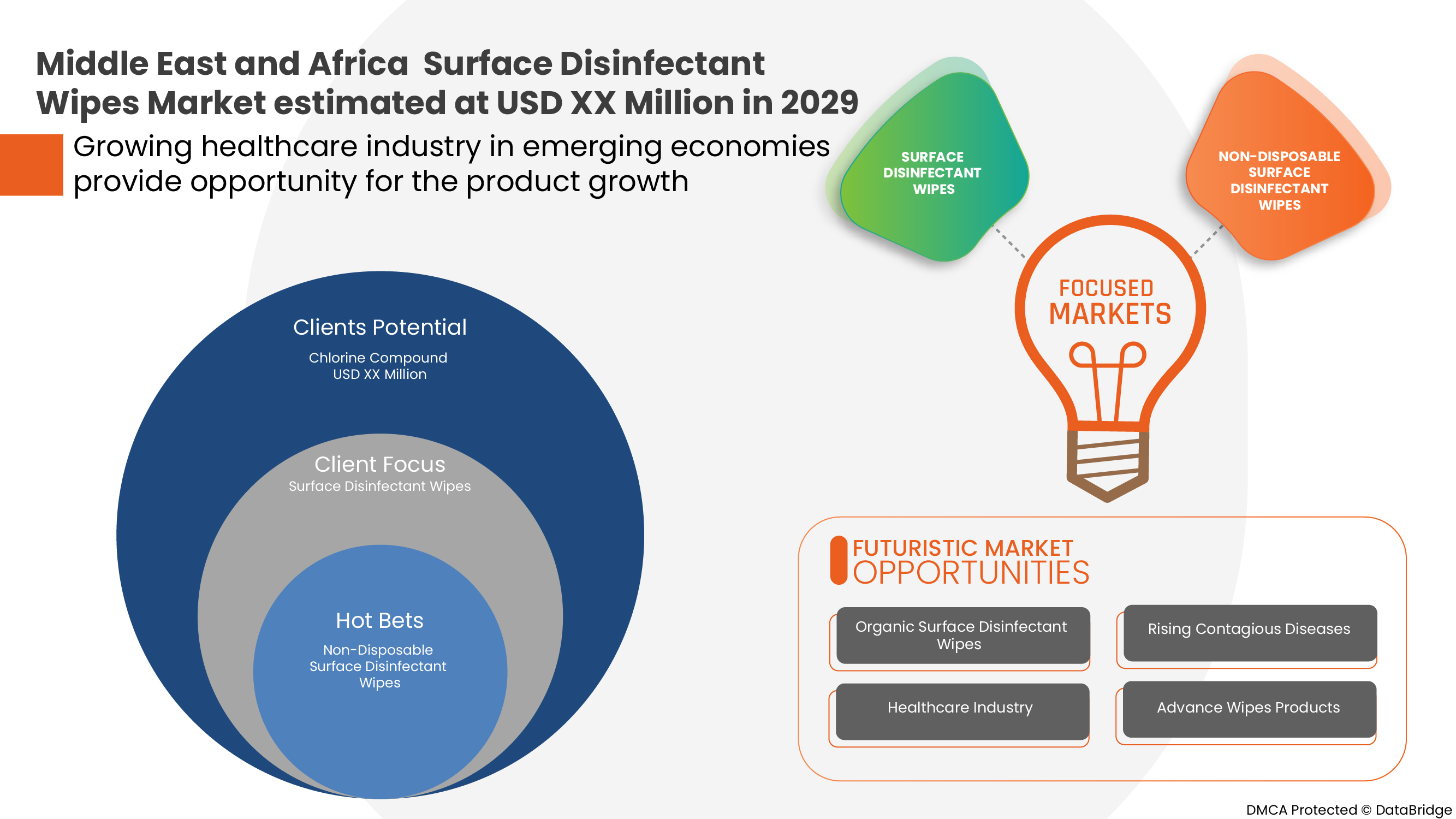

The Middle East & Africa surface disinfectant wipes market is gaining significant growth due to the growing healthcare industry and the demand for flavored surface disinfectant wipes. The increase in demand for different types of surface disinfectant wipes owing to increasing infectious diseases is also boosting the growth of the Middle East & Africa surface disinfectant wipes market.

However, stringent government regulations associated with fluctuating raw materials prices are expected to restrain the market growth of surface disinfectant wipes during the forecast period.

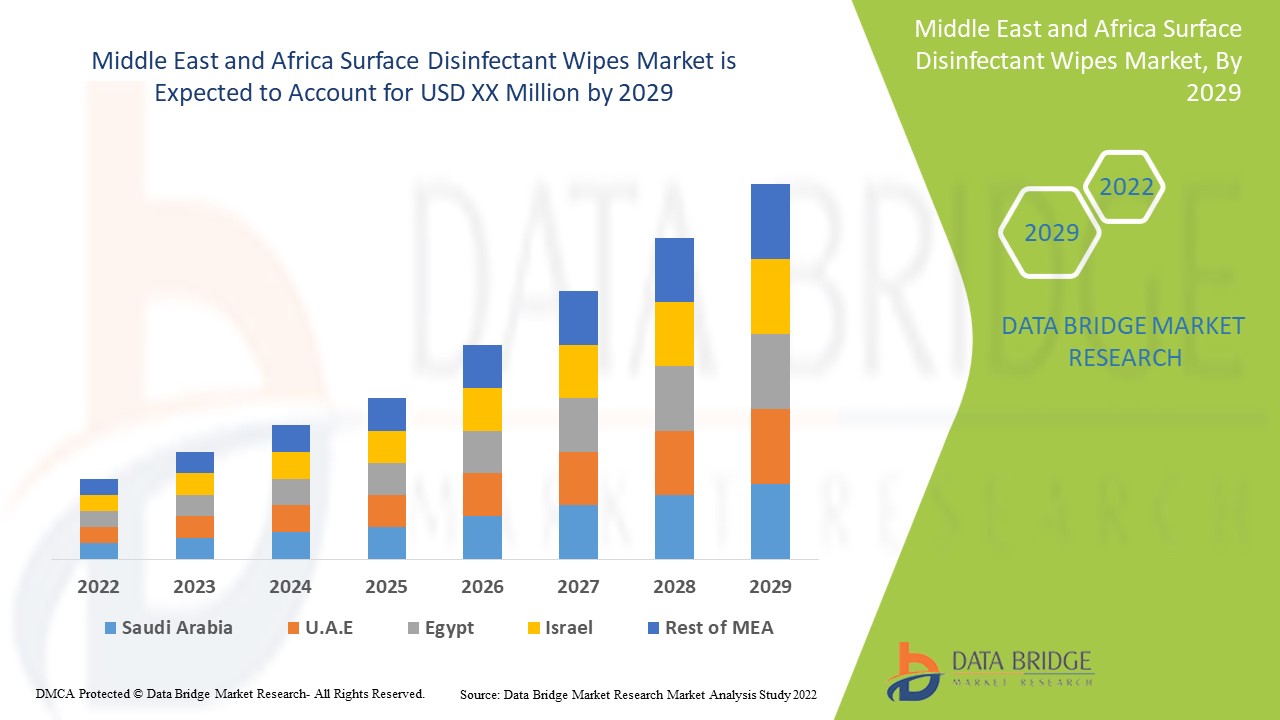

Data Bridge Market Research analyses that the Middle East & Africa surface disinfectant wipes market will grow at a CAGR of 5.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Composition (Quaternary Ammonium, Oxidizing Agents, Phenol, Alcohol, Chlorine Compounds, Iodine Compounds, Chlorhexidine Gluconate, Aldehydes, And Others), Usability (Disposable And Non-Disposable), Packaging (Flatpack, Canister And Others), Material Type (Textile Fiber Wipes, Virgin Fiber Wipes, Advanced Fiber Wipes And Others), Levels Of Disinfection (High, Intermediate And Low), Flavor (Lavender And Jasmine, Citrus, Lemon, Coconut And Others), Type (Sporicidal, Bactericidal, Tuberculocidal, Virucidal, Fungicidal And Germicidal), End-Use (Healthcare, Commercial, Industrial Kitchen, Transportation Industry, Optical Industry, Electronic And Computer Industry And Others), Distribution Channel (Direct Tenders And Retail Sales), Industry Trends and Forecast to 2029 |

|

Countries Covered |

South Africa, Saudi Arabia, UAE, Egypt, Isreal and the Rest of the Middle East & Africa |

|

Market Players Covered |

PDI, Inc., Metrex Research, LLC, Ecolab, 3M, Contec, Inc., KCWW, Pal International, Reckitt Benckiser Group plc, Diversey Holdings LTD, Spartan Chemical Company, Inc., Procter & Gamble, STERIS, Johnson & Son Inc., Colgate-Palmolive Company et PAUL HARTMANN Limited |

Définition du marché

De petites serviettes ou lingettes humides sont utilisées pour nettoyer les surfaces afin d'éliminer la saleté et les microbes, comme les staphylocoques et les salmonelles, qui peuvent avoir été déposés sur la surface affectée par des aliments, des personnes ou des animaux. Souvent parfumées avec une odeur agréable, comme les agrumes ou le pin, on les appelle lingettes.

Les lingettes désinfectantes pour surfaces constituent une méthode simple pour garder pratiquement tout type de surface dure et non perméable propre pour l'utilisation, la stérilisation et l'essuyage de l'objet ou de la surface, permettant à la zone nettoyée de rester humide pendant environ 30 secondes avant de sécher. Les rebords, les appareils, les éviers, les installations (éclairage et eau), les poignées de porte, les poignées de porte, les balustrades, les carreaux, la pierre, la production de faïence, les téléphones, les jouets et les consoles sont les objets ou zones typiques où les lingettes désinfectantes pour surfaces peuvent être utilisées pour le nettoyage et la stérilisation.

Les lingettes désinfectantes pour surfaces sont disponibles en différentes tailles et épaisseurs. Les lingettes plus fines peuvent nécessiter une force plus importante lorsqu'elles sont utilisées pour nettoyer sur des surfaces ou sur des surfaces dures. En général, la lingette est assez solide et offre la force nécessaire pour nettoyer complètement la surface ou l'objet.

Ainsi, les lingettes désinfectantes de surface sont largement utilisées dans des applications telles que les soins de santé, la médecine, l’alimentation et de nombreuses autres industries pour maintenir l’hygiène et éviter les infections.

Dynamique du marché des lingettes désinfectantes pour surfaces au Moyen-Orient et en Afrique

Conducteurs

-

Utilisation croissante des lingettes désinfectantes de surface pour les applications commerciales

Les désinfectants de surface sont des composés chimiques utilisés pour détruire les agents pathogènes et autres micro-organismes par désinfection. Les lingettes désinfectantes de surface aident à inhiber la croissance d'agents pathogènes tels que les bactéries, les virus et les champignons, entre autres, ce qui conduit à diverses formes de contamination et d'infections. Ces désinfectants de surface comprennent divers composés chimiques tels que l'ammonium quaternaire ou quarts, les composés chlorés, les composés phénoliques, les agents oxydants, l'alcool, les composés amphotères et même leurs combinaisons. L'essor des lingettes désinfectantes de surface est observé dans diverses applications commerciales, à savoir la maison, la cuisine, l'alimentation et l'agriculture, et l'hôtellerie, pour prévenir la contamination.

-

Sensibiliser les consommateurs à l’hygiène et aux soins préventifs

De nombreux problèmes de santé peuvent affecter une personne, mais les connaissances préalables et les mesures préventives permettent de réduire la gravité de la maladie ou de la prévenir complètement. L'hygiène est de la plus haute importance pour les personnes de tous âges. Diverses pratiques non hygiéniques entraînent des infections transmissibles ou nosocomiales chez les personnes, et avec l'émergence de la pandémie de COVID-19, l'importance de l'hygiène est assimilée à la survie. L'éducation joue un rôle essentiel dans la sensibilisation du grand public de tous les groupes d'âge à la santé, à l'hygiène et aux soins préventifs. Une telle compréhension joue un rôle vital dans la prévention de divers risques sanitaires. Le gouvernement et les organisations non gouvernementales ont lancé diverses campagnes pour combler le manque de connaissances à ce sujet.

Cette prise de conscience de la santé et de l'hygiène a accru la demande de lingettes désinfectantes de surface dans diverses applications alimentaires et de boissons, de soins de santé, pharmaceutiques et autres. En outre, de nombreuses entreprises et gouvernements lancent également diverses campagnes et divers programmes de sensibilisation qui contribuent à la croissance du marché dans les années à venir.

Opportunités

-

Stratégies des principaux acteurs du marché

La demande de lingettes désinfectantes pour surfaces a considérablement augmenté dans le monde entier en raison de la sensibilisation croissante des consommateurs à l'hygiène et aux soins de santé préventifs. Récemment, la demande mondiale de lingettes désinfectantes pour surfaces a augmenté en raison de l'épidémie de COVID-19. De plus, de nombreux hôpitaux du monde entier augmentent considérablement le besoin de lingettes désinfectantes pour surfaces. Ces facteurs positifs augmentent la demande de lingettes désinfectantes pour surfaces et répondent à la demande du marché. Les petits comme les grands acteurs du marché utilisent diverses stratégies.

Les initiatives stratégiques telles que les acquisitions, les partenariats, les accords contractuels et la participation à des conférences offrent l'occasion d'élargir géographiquement leur base de clientèle. De plus, grâce à de telles stratégies d'initiative, les deux entreprises peuvent étendre leur portée grâce à de nouveaux marchés géographiques ou sectoriels, à l'accès à de nouveaux produits ou services ou à de nouveaux types de clients. Les deux acteurs du marché ouvrent la porte à des ressources supplémentaires ou nouvelles telles que la technologie et le talent.

Contraintes/Défis

- L'escalade des déchets médicaux

Les déchets médicaux (DM) sont les déchets générés par les activités de soins de santé, notamment les déchets infectieux et non infectieux tels que les objets tranchants, non tranchants, le sang, les parties du corps, les produits chimiques, les lingettes désinfectantes de surface jetables et non jetables, les produits pharmaceutiques, les dispositifs médicaux et les matières radioactives. 10 à 25 % des déchets médicaux sont infectieux et nécessitent un traitement spécial et sont qualifiés de déchets médicaux à risque. L'épidémie de COVID-19 a intensifié l'utilisation de lingettes désinfectantes de surface jetables, générant d'énormes déchets médicaux.

Les principales sources de déchets médicaux sont les hôpitaux et autres établissements de santé, les laboratoires et centres de recherche, les laboratoires de recherche et d’expérimentation animale, les banques de sang et les services de collecte, ainsi que les maisons de retraite pour personnes âgées, où divers types de lingettes désinfectantes sont énormément utilisés. Les pays à revenu élevé produisent beaucoup de déchets par lit d’hôpital et par jour par rapport aux pays à faible revenu.

Désormais, l’augmentation des déchets médicaux pourrait constituer un défi majeur pour la croissance du marché mondial des lingettes désinfectantes de surface.

- Fluctuation des prix des matières premières

Les acteurs du marché des lingettes désinfectantes pour surfaces ont du mal à anticiper le risque de forte fluctuation du coût des matières premières. L'augmentation du coût des matières premières a souvent un impact significatif sur les ventes du produit, car la fabrication est directement entravée en raison du coût élevé de la matière première. Ainsi, le succès d'un produit ou d'une entreprise est fortement mis en danger par les fluctuations des coûts des matières premières et leur gestion des prix. Les entreprises compétitives adoptent diverses stratégies pour faire face à la fluctuation du prix des matières premières, notamment en remplaçant l'ingrédient par un autre ingrédient, entre autres.

Impact post-COVID-19 sur le marché des lingettes désinfectantes pour surfaces au Moyen-Orient et en Afrique

Après la COVID-19, la demande de lingettes désinfectantes pour surfaces a augmenté dans la région du Moyen-Orient et de l'Afrique en raison d'une sensibilisation accrue à la santé et à l'hygiène des consommateurs et d'une évolution progressive vers une augmentation de la demande de lingettes désinfectantes pour surfaces parmi divers utilisateurs finaux tels que l'alimentation et les boissons, l'automobile et d'autres. L'émergence de la COVID-19 a entraîné des confinements imposés par divers pays, l'annulation de vols, la perturbation de la chaîne d'approvisionnement et la concurrence pour les matières premières entre diverses industries. Cela a entraîné une fluctuation des prix. Cependant, les fabricants font désormais face à la situation et la demande de lingettes désinfectantes pour surfaces a augmenté, ce qui contribue à la croissance du marché.

Développements récents

- En mars, CleanWell, LLC. a annoncé son acquisition par Pinstripe Capital, LLC, une société de conseil en immobilier. Cette acquisition de la société conduit à l'expansion des canaux de distribution, notamment un portefeuille plus large de canaux naturels, et au développement d'une activité d'ingrédients de soutien. Ainsi, cela a augmenté la croissance de l'entreprise sur le marché.

- En mai, GOJO Industries, Inc. a annoncé le lancement de ses nouveaux produits de la marque PURELL pour la désinfection et l'assainissement des surfaces au Canada. Ces nouveaux produits lancés par l'entreprise ont augmenté ses ventes et sa demande, ce qui a entraîné une augmentation des revenus à l'avenir.

- En février 2020, GAMA Healthcare Ltd. a annoncé l'efficacité de ses lingettes universelles Clinell contre le coronavirus responsable de la COVID-19 en 30 secondes de temps de contact. La société a également annoncé la validation de l'efficacité de ses lingettes par Microbac Laboratory, un laboratoire tiers de biosécurité de niveau 3. Cette annonce faite par la société a accru sa demande et sa crédibilité sur le marché.

Portée du marché des lingettes désinfectantes pour surfaces au Moyen-Orient et en Afrique

Le marché des lingettes désinfectantes pour surfaces au Moyen-Orient et en Afrique est segmenté en neuf segments en fonction de la composition, de la facilité d'utilisation, de l'emballage, du type de matériau, du niveau de désinfection, de la saveur, du type, de l'utilisation finale et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Composition

- Composés chlorés

- Ammonium quaternaire

- Agents oxydants

- Phénol

- Alcool

- Composés d'iode

- Gluconate de chlorhexidine

- Aldéhydes

- Autres

En fonction de la composition, le marché des lingettes désinfectantes de surface du Moyen-Orient et de l'Afrique est segmenté en ammonium quaternaire, agents oxydants, phénol, alcool, composés chlorés, composés iodés, gluconate de chlorhexidine, aldéhydes et autres.

Facilité d'utilisation

- Jetable

- Non jetable

En fonction de la facilité d'utilisation, le marché des lingettes désinfectantes de surface au Moyen-Orient et en Afrique est segmenté en jetables et non jetables.

Conditionnement

- Emballage en kit

- Boîte

- Autres

En fonction de l'emballage, le marché des lingettes désinfectantes de surface au Moyen-Orient et en Afrique est segmenté en emballages plats, bidons et autres.

Type de matériau

- Lingettes en fibres textiles

- Lingettes en fibres vierges

- Lingettes en fibres avancées

- Autres

En fonction du type de matériau, le marché des lingettes désinfectantes de surface du Moyen-Orient et de l'Afrique est segmenté en lingettes en fibres textiles, lingettes en fibres vierges, lingettes en fibres avancées et autres.

Niveau de désinfection

- Haut

- Intermédiaire

- Faible

En fonction du niveau de désinfection, le marché des lingettes désinfectantes de surface du Moyen-Orient et de l’Afrique est segmenté en élevé, intermédiaire et faible.

Saveur

- Lavande et jasmin

- Agrumes

- Citron

- Noix de coco

- Autres

En fonction de la saveur, le marché des lingettes désinfectantes pour surfaces du Moyen-Orient et de l'Afrique est segmenté en lavande et jasmin, agrumes, citron, noix de coco et autres

Taper

- Sporicide

- Bactéricide

- Tuberculicide

- Virucide

- Fongicide

- Germicide

En fonction du type, le marché des lingettes désinfectantes de surface du Moyen-Orient et de l’Afrique est segmenté en sporicides, bactéricides, tuberculocides, virucides, fongicides et germicides.

Utilisation finale

- Soins de santé

- Commercial

- Cuisine industrielle

- Secteur des transports

- Industrie optique

- Industrie électronique et informatique

- Autres

En fonction de l'utilisation finale, le marché des lingettes désinfectantes de surface du Moyen-Orient et de l'Afrique est segmenté en soins de santé, commerce, cuisine industrielle, industrie du transport, industrie optique, industrie électronique et informatique, et autres.

Canal de distribution

- Appels d'offres directs

- Ventes au détail

Based on distribution channel, the Middle East & Africa surface disinfectant wipes market is segmented into direct tenders and retail sales.

Middle East & Africa Surface Disinfectant Wipes Market Regional Analysis/Insights

Middle East & Africa surface disinfectant wipes market is analyzed, and market size insights and trends are provided by composition, usability, packaging, material type, levels of disinfection, flavor, type, end-use, and distribution channel.

The countries covered in the Middle East & Africa Surface Disinfectant Wipes Market report are South Africa, Saudi Arabia, UAE, Egypt, Israel and the Rest of the Middle East & Africa.

South Africa dominates the surface disinfectant wipes market in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the growing demand for surface disinfectant wipes from various industries.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of the Middle East & Africa brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and the Middle East & Africa Surface Disinfectant Wipes Market Share Analysis

The surface disinfectant wipes market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East & Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the Middle East & Africa surface disinfectant wipes market.

Some of the major players operating in the surface disinfectant wipes market are PDI, Inc., Metrex Research, LLC, Ecolab, 3M, Contec, Inc., KCWW, Pal International, Reckitt Benckiser Group plc, Diversey Holdings LTD, Spartan Chemical Company, Inc., Procter & Gamble, STERIS, Johnson & Son Inc., Colgate-Palmolive Company and PAUL HARTMANN Limited

Research Methodology

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances fondamentales sont les principaux facteurs de succès du rapport de marché. La méthodologie de recherche fondamentale utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, une grille de positionnement de l'entreprise, une analyse des parts de marché de l'entreprise, des normes de mesure, une analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 MIDDLE EAST & AFRICA

17.1.1 SOUTH AFRICA

17.1.2 SAUDI ARABIA

17.1.3 U.A.E.

17.1.4 EGYPT

17.1.5 ISRAEL

17.1.6 REST OF MIDDLE EAST & AFRICA

18 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 94 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 95 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 96 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 98 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 105 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 REST OF MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.