Marché du papier de spécialité au Moyen-Orient et en Afrique, par type de produit (papier d’impression et étiquettes, papier décoratif, papier autocopiant, papier d’impression, papier d’emballage, papier fonctionnel, papier kraft , papier thermique, papier pour notices pharmaceutiques, autres), matière première (pâte à papier et produits chimiques fonctionnels), utilisateur final (industrie, bâtiment et construction, emballage, étiquette, impressions, automobile, services alimentaires, électricité, applications médicales, autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Le marché du papier spécial a connu une croissance considérable ces dernières années en raison de l'adoption rapide de mécanismes d'emballage et de services de livraison à domicile dans plusieurs régions. Le papier spécial est utilisé pour transporter et protéger une large gamme de marchandises. Une forte demande des utilisateurs finaux, notamment pour l'emballage et l'étiquetage, devrait stimuler la croissance du marché du papier spécial dans ce domaine tout au long de la période de prévision. En termes de volume, le marché du papier spécial représentait environ 6 % de l'industrie mondiale du papier spécialisé.

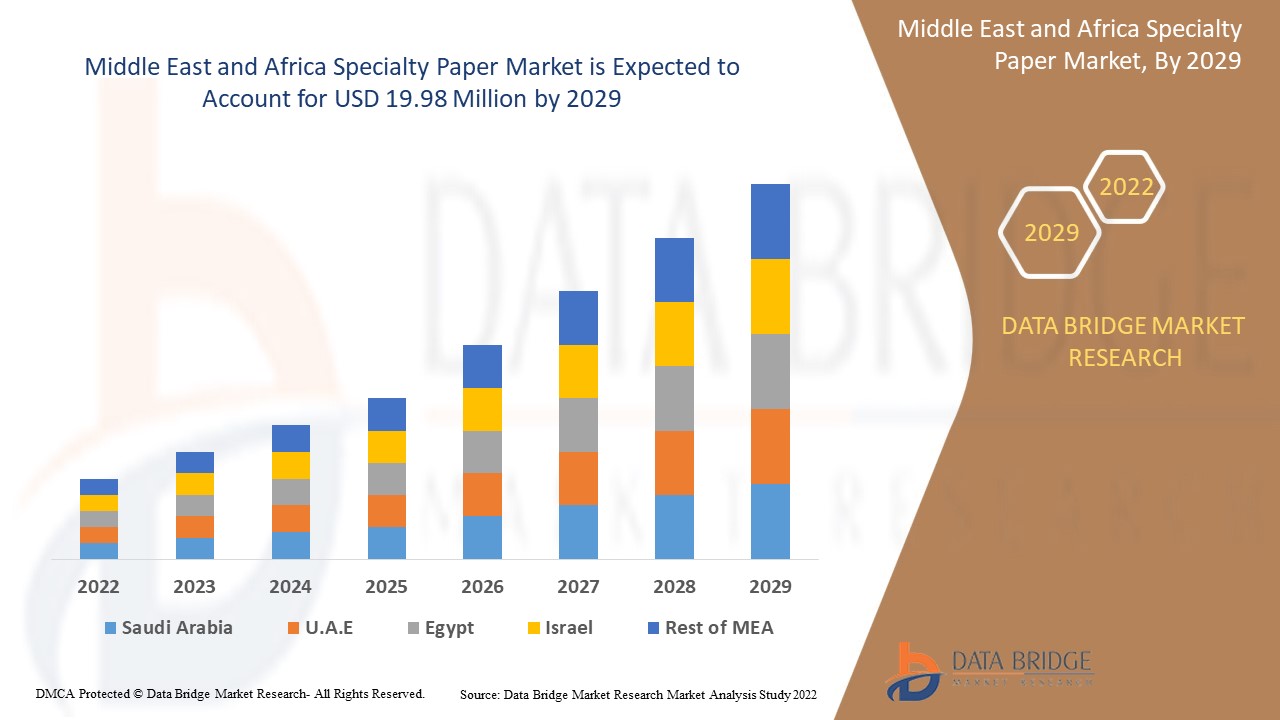

Français Data Bridge Market Research analyse que le marché du papier spécial au Moyen-Orient et en Afrique était évalué à 13,52 millions USD en 2021 et devrait atteindre 19,98 millions USD d'ici 2029, enregistrant un TCAC de 5,0 % au cours de la période de prévision de 2022 à 2029. Le rapport de marché organisé par l'équipe Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production, une analyse des brevets et des avancées technologiques.

Définition du marché

Le papier spécial est un type de papier particulier qui possède des propriétés et des caractéristiques spécifiques. Il est conçu pour des utilisations spécifiques telles que la filtration de l'eau, etc. Par exemple, le papier thermique , l'impression de billets de banque, l'emballage de boissons et le papier spécial. Ce papier est doté d'un revêtement qui fournit une image claire et haute définition lorsqu'il est exposé à la chaleur. En raison de ses propriétés, le papier spécial a des applications dans diverses industries, notamment l'emballage et l'étiquetage, la vente au détail, les soins de santé, la construction et l'entretien du linge.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type de produit (papier d'impression et étiquettes, papier décoratif, papier autocopiant, papier d'impression, papier d'emballage, papier fonctionnel, papier kraft, papier thermique, papier pour notices pharmaceutiques, autres), matière première (pâte à papier et produits chimiques fonctionnels), utilisateur final (industrie, bâtiment et construction, emballage, étiquette, impressions, automobile, services alimentaires, électricité, applications médicales, autres) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Égypte, Israël, Afrique du Sud, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Stora Enso (Finlande) Sappi (Afrique du Sud), Smurfit Kappa (Irlande) Fedrigoni SPA (Italie), Domtar Corporation (États-Unis), Nippon Paper industries Co. Ltd. (Japon), Mondi (Royaume-Uni), International Paper (États-Unis), Oji Holdings Corporation (Japon), Asia Pulp & Paper (APP) Sinar Mas. (Indonésie) |

|

Opportunités de marché |

|

Dynamique du marché des papiers spéciaux au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Croissance de la population urbaine

Avec l'augmentation du revenu disponible et le rythme de vie effréné de la population urbaine, la demande de produits alimentaires emballés augmente considérablement. Le papier spécial étant largement utilisé dans le secteur de la restauration pour emballer les produits à emporter, la consommation croissante de produits alimentaires emballés stimule la demande de papier spécial, augmentant ainsi la croissance du marché.

- Accélération des préférences des consommateurs en matière de laminage décoratif

L'utilisation croissante des derniers modèles, couleurs et matériaux dans la décoration intérieure est à l'origine de nouveaux papiers décoratifs avancés . En raison de sa pertinence, de sa résistance et de son impact moindre sur l'environnement, le papier kraft connaît une demande croissante de pochettes d'emballage et de sacs pour la manutention des marchandises.

- Applications croissantes dans le commerce électronique

Le marché gagne du terrain en raison de ses applications croissantes dans les activités de commerce électronique, par exemple l'emballage, le stockage et le transport. Le secteur croissant des achats en ligne dans les économies émergentes et développées est l'un des principaux moteurs du marché du papier spécial au Moyen-Orient et en Afrique.

- Augmentation de la demande en raison des matériaux d'emballage respectueux de l'environnement

Les fabricants de biens de consommation de cette région choisissent des matériaux d'emballage écologiques pour soutenir la durabilité. Les boîtes en carton ondulé fabriquées à partir de carton ondulé conservent leur forme d'emballage durable et constituent un produit respectueux de l'environnement.

Opportunités

- Une grande opportunité dans la nanotechnologie

La structure moléculaire du papier spécial est pratique et permet de développer des variantes de produits innovantes adaptées aux besoins des utilisateurs finaux. De plus, les nanomatériaux contenus dans les papiers spéciaux le rendent approprié pour divers sous-produits du papier lui-même. Les marchés inexploités plus vastes offrent des opportunités avantageuses à tous les acteurs du marché.

- Progrès technologique

Le nombre croissant de développements de produits ouvrira de nouvelles opportunités de marché et accélérera l'expansion de l'industrie. Les progrès technologiques du papier spécialisé constituent un substitut au potentiel d'expansion de la demande du marché du papier spécialisé. Cet élément contribue à la croissance du marché. Les fabricants développent des produits plus efficaces, plus fiables et plus pratiques.

Contraintes/Défis

Les émissions de carbone au cours du processus de fabrication du papier devraient constituer un inconvénient majeur pour les papiers spéciaux, entravant la croissance du marché. En outre, le début de l'ère de la numérisation devrait être un autre facteur limitant majeur pour le développement du marché des papiers spéciaux dans les années à venir. En outre, le marché des papiers spéciaux est extrêmement fragmenté, ce qui constitue un autre facteur limitant la croissance du marché des papiers spéciaux au cours de la période de prévision.

Ce rapport sur le marché des papiers spéciaux au Moyen-Orient et en Afrique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des papiers spéciaux au Moyen-Orient et en Afrique, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché du papier spécial au Moyen-Orient et en Afrique

Le marché global du papier spécial a été discrètement affecté par l'épidémie de SARS-CoV-2 qui s'est propagée au cours de la période de prévision. Au cours de la première moitié de la période COVID-19 , le marché a été affecté négativement par le confinement strict, la réduction des effectifs, les normes et les restrictions de mouvement. Mais l'augmentation de la consommation d'aliments emballés et l'essor du commerce électronique pendant l'épidémie d'infection ou de virus augmentent la demande et les ventes de papier dans cette région.

Développement récent

- En avril 2020, Domtar Corporation a déclaré avoir acquis l'activité de papier pour point de vente (POS) basée aux États-Unis d'Appvion Operations, Inc., ce qui permettra à la société de devenir un fabricant intégré de POS qui produira du papier à grande échelle.

- En décembre 2019, United Carton Company, basée en Arabie saoudite, a déclaré sa réussite pour ses opérations d'emballage en carton ondulé, avec l'installation de Nozomi C1800, une imprimante à jet d'encre LED à six couleurs à passage unique développée par Electronics for Imaging Inc.

- En octobre 2019, Hotpack Packaging Industries LLC, basée aux Émirats arabes unis, a déclaré avoir obtenu les certifications ISO 22000 (sécurité alimentaire) et HACCP (analyse des risques et contrôle des points critiques) du United Registrar of Systems. Cette entreprise a pour objectif de produire des produits sûrs et de qualité et s'appuie sur ces certifications pour démontrer son engagement,

Portée du marché du papier spécial au Moyen-Orient et en Afrique

Le marché du papier spécial au Moyen-Orient et en Afrique est segmenté en fonction des produits, des matières premières et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Sortie et labels

- Papier Décoratif

- Papier autocopiant

- Papier d'impression

- Papier d'emballage

- Document fonctionnel

- Papier Kraft

- Papier thermique

- Brochure sur les produits pharmaceutiques

- Autres

Matière première

- Pulpe

- Chimie fonctionnelle

Utilisateur final

- Industriel

- Bâtiment et construction

- Emballage, étiquette

- Impressions

- Automobile

- Services de restauration

- Électricité

- Demande médicale

- Autres

Analyse/perspectives régionales du marché du papier spécial au Moyen-Orient et en Afrique

Le marché du papier spécial au Moyen-Orient et en Afrique est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, produits, matières premières et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché du papier spécialisé au Moyen-Orient et en Afrique sont les Émirats arabes unis, l’Arabie saoudite, l’Égypte, Israël, l’Afrique du Sud, le reste du Moyen-Orient et de l’Afrique.

Les Émirats arabes unis et l'Arabie saoudite dominent le marché du papier de spécialité au Moyen-Orient et en Afrique en termes de parts de marché et de revenus au cours de la période de prévision. Cela est dû à la demande croissante de papier de spécialité au Moyen-Orient et en Afrique dans cette région. Le marché du papier de spécialité aux Émirats arabes unis et en Afrique, avec l'Arabie saoudite en tête en termes de demande croissante d'options de sécurité telles que l'impression de billets de banque, augmente la demande de papier de spécialité sur le marché.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du papier spécial au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des papiers spéciaux au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des papiers spéciaux au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché du papier spécial au Moyen-Orient et en Afrique sont :

- Stora Enso (Finlande)

- Sappi (Afrique du Sud)

- Smurfit Kappa (Ireland)

- Fedrigoni S.P.A (Italy)

- Domtar Corporation (US)

- Nippon Paper industries Co. Ltd. (Japan)

- Mondi (UK)

- International Paper (US)

- Oji Holdings Corporation (Japan)

- Asia Pulp and Paper (APP) Sinar Mas. (Indonesia)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET CHALLANGE MATRIX

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19

5.1 SUPPLY CHAIN IMPACT ANALYSIS

5.2 DEMAND IMPACT ANALYSIS

5.3 PRICE IMPACT

1 MARKET OVERVIEW

5.4 DRIVERS

5.4.1 INCREASING ADOPTION OF SPECIALTY PAPER IN SMOKING AND VARIOUS INDUSTRIES

5.4.2 GROWING DEMAND OF HIGH-QUALITY PACKAGING MATERIAL

5.4.3 INCREASING USE OF SPECIALTY PAPER IN PRINTING INDUSTRY

5.4.4 ACCELERATING CONSUMER PREFERENCES TOWARDS DECORATIVE LAMINATION

5.5 RESTRAINTS

5.5.1 AVAILABILITY OF SUBSTITUTES

5.5.2 SHORTAGE OF RAW MATERIAL

5.6 OPPORTUNITIES

5.6.1 TECHNOLOGICAL EVOLUTION OF SPECIALTY PAPER

5.6.2 INCREASING OPPORTUNITY IN NANO TECHNOLOGY

5.7 CHALLENGE

5.7.1 STRINGENT REGULATORY POLICIES FOR SPECIALTY PAPER

6 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 PACKAGING PAPER

6.3 RELEASE AND LABELS

6.4 PRINTING PAPER

6.5 FUNCTIONAL PAPER

6.6 DÉCOR PAPER

6.7 KRAFT PAPER

6.8 CARBONLESS PAPER

6.9 FILTER PAPER

6.1 THERMAL PAPER

6.11 PHARMACEUTICAL LEAFLET PAPER

6.12 OTHERS

7 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 PULP

7.3 FUNCTIONAL CHEMICAL

7.3.1 ADDITIVES

7.3.2 COATINGS

7.3.3 FILLERS

7.3.4 BINDERS

7.3.5 OTHERS

8 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LABEL

8.2.1 RELEASE AND LABELS

8.2.2 PACKAGING PAPER

8.2.3 PRINTING PAPER

8.2.4 FUNCTIONAL PAPER

8.2.5 DÉCOR PAPER

8.2.6 KRAFT PAPER

8.2.7 CARBONLESS PAPER

8.2.8 THERMAL PAPER

8.2.9 OTHERS

8.3 PACKAGING

8.3.1 PACKAGING PAPER

8.3.2 RELEASE AND LABELS

8.3.3 DÉCOR PAPER

8.3.4 KRAFT PAPER

8.3.5 CARBONLESS PAPER

8.3.6 OTHERS

8.4 FOOD SERVICES

8.4.1 PACKAGING PAPER

8.4.2 RELEASE AND LABELS

8.4.3 FUNCTIONAL PAPER

8.4.4 DÉCOR PAPER

8.4.5 KRAFT PAPER

8.4.6 CARBONLESS PAPER

8.4.7 FILTER PAPER

8.4.8 THERMAL PAPER

8.4.9 OTHERS

8.5 BUILDING AND CONSTRUCTION

8.5.1 PACKAGING PAPER

8.5.2 DÉCOR PAPER

8.5.3 KRAFT PAPER

8.5.4 OTHERS

8.6 INDUSTRIAL

8.6.1 PACKAGING PAPER

8.6.2 RELEASE AND LABELS

8.6.3 PRINTING PAPER

8.6.4 FUNCTIONAL PAPER

8.6.5 DÉCOR PAPER

8.6.6 KRAFT PAPER

8.6.7 CARBONLESS PAPER

8.6.8 FILTER PAPER

8.6.9 THERMAL PAPER

8.6.10 PHARMACEUTICAL LEAFLET PAPER

8.6.11 OTHERS

8.7 PRINTINGS

8.7.1 PACKAGING PAPER

8.7.2 RELEASE AND LABELS

8.7.3 PRINTING PAPER

8.7.4 FUNCTIONAL PAPER

8.7.5 DÉCOR PAPER

8.7.6 KRAFT PAPER

8.7.7 CARBONLESS PAPER

8.7.8 THERMAL PAPER

8.7.9 OTHERS

8.8 MEDICAL APPLICATION

8.8.1 PACKAGING PAPER

8.8.2 RELEASE AND LABELS

8.8.3 KRAFT PAPER

8.8.4 CARBONLESS PAPER

8.8.5 FILTER PAPER

8.8.6 THERMAL PAPER

8.8.7 PHARMACEUTICAL LEAFLET PAPER

8.8.8 OTHERS

8.9 ELECTRICALS

8.9.1 PACKAGING PAPER

8.9.2 RELEASE AND LABELS

8.9.3 PRINTING PAPER

8.9.4 KRAFT PAPER

8.9.5 CARBONLESS PAPER

8.9.6 FILTER PAPER

8.9.7 THERMAL PAPER

8.9.8 OTHERS

8.1 AUTOMOTIVE

8.10.1 PACKAGING PAPER

8.10.2 RELEASE AND LABELS

8.10.3 FUNCTIONAL PAPER

8.10.4 KRAFT PAPER

8.10.5 OTHERS

8.11 OTHERS

8.11.1 PACKAGING PAPER

8.11.2 RELEASE AND LABELS

8.11.3 PRINTING PAPER

8.11.4 FUNCTIONAL PAPER

8.11.5 DÉCOR PAPER

8.11.6 KRAFT PAPER

8.11.7 CARBONLESS PAPER

8.11.8 FILTER PAPER

8.11.9 THERMAL PAPER

8.11.10 PHARMACEUTICAL LEAFLET PAPER

8.11.11 OTHERS

9 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY GEOGRAPHY

9.1 MIDDLE EAST AND AFRICA

9.1.1 UNITED ARAB EMIRATES

9.1.2 SAUDI ARABIA

9.1.3 EGYPT

9.1.4 ISRAEL

9.1.5 SOUTH AFRICA

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 INTERNATIONAL PAPER

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 WESTROCK COMPANY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATE

12.3 DOMTAR CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATE

12.4 OJI HOLDINGS CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 STORA ENSO

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATE

12.6 AHLSTROM-MUNKSJÖ

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 ASIA PULP & PAPER (APP) SINAR MAS.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 FEDRIGONI HOLDING LIMITED.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 GEORGIA-PACIFIC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

12.1 JK PAPER

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATE

12.11 KRUGER INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 ND PAPER LLC (A SUBSIDIARY OF NINE DRAGONS WORLDWIDE (CHINA) INVESTMENT GROUP CO., LTD.)

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 NIPPON PAPER INDUSTRIES CO., LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATE

12.14 ONYX PAPERS

12.14.1 SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 PUDUMJEE PAPER PRODUCTS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT UPDATE

12.16 ROBERT WILSON PAPER

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATE

12.17 SAPPI

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT UPDATES

12.18 SMURFIT KAPPA

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT UPDATE

12.19 THE GRIFF NETWORK

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATE

12.2 WAUSAU COATED PRODUCTS, INC

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 SPECIALTY PAPER SUBSTITUTES

TABLE 2 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 3 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA PACKAGING PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 5 MIDDLE EAST AND AFRICA PACKAGING PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA RELEASE AND LABELS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 7 MIDDLE EAST AND AFRICA RELEASE AND LABELS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA PRINTING PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 9 MIDDLE EAST AND AFRICA PRINTING PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA FUNCTIONAL PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 11 MIDDLE EAST AND AFRICA FUNCTIONAL PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA DÉCOR PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 13 MIDDLE EAST AND AFRICA DÉCOR PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA KRAFT PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 15 MIDDLE EAST AND AFRICA KRAFT PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA CARBONLESS PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 17 MIDDLE EAST AND AFRICA CARBONLESS PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA FILTER PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 19 MIDDLE EAST AND AFRICA FILTER PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA THERMAL PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 21 MIDDLE EAST AND AFRICA THERMAL PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA PHARMACEUTICAL LEAFLET PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 23 MIDDLE EAST AND AFRICA PHARMACEUTICAL LEAFLET PAPER IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 25 MIDDLE EAST AND AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA PULP IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA LABEL IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA PACKAGING IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA FOOD SERVICES IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA INDUSTRIAL IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA PRINTINGS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA ELECTRICALS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (KILO TONS)

TABLE 52 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 54 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 68 UNITED ARAB EMIRATES SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 69 UNITED ARAB EMIRATES SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 70 UNITED ARAB EMIRATES SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 71 UNITED ARAB EMIRATES FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 72 UNITED ARAB EMIRATES SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 73 UNITED ARAB EMIRATES LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 UNITED ARAB EMIRATES PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 75 UNITED ARAB EMIRATES FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 76 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 UNITED ARAB EMIRATES INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 UNITED ARAB EMIRATES PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 UNITED ARAB EMIRATES MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 UNITED ARAB EMIRATES ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 UNITED ARAB EMIRATES AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 UNITED ARAB EMIRATES OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 SAUDI ARABIA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 84 SAUDI ARABIA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 SAUDI ARABIA ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 EGYPT SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 99 EGYPT SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 EGYPT SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 101 EGYPT FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 102 EGYPT SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 103 EGYPT LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 EGYPT PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 EGYPT FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 EGYPT BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 EGYPT INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 108 EGYPT PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 109 EGYPT MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 110 EGYPT ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 111 EGYPT AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 112 EGYPT OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 113 ISRAEL SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 114 ISRAEL SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 115 ISRAEL SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 116 ISRAEL FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 117 ISRAEL SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 118 ISRAEL LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 ISRAEL PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 ISRAEL FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 ISRAEL BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 ISRAEL INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 ISRAEL PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 ISRAEL MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 ISRAEL ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 ISRAEL AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 ISRAEL OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 SOUTH AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 129 SOUTH AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 130 SOUTH AFRICA SPECIALTY PAPER MARKET, BY RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 131 SOUTH AFRICA FUNCTIONAL CHEMICAL IN SPECIALTY PAPER MARKET, BY FUNCTIONAL CHEMICAL RAW MATERIAL, 2018-2027 (USD MILLION)

TABLE 132 SOUTH AFRICA SPECIALTY PAPER MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 133 SOUTH AFRICA LABEL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 134 SOUTH AFRICA PACKAGING IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 135 SOUTH AFRICA FOOD SERVICES IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 136 SOUTH AFRICA BUILDING AND CONSTRUCTION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 SOUTH AFRICA INDUSTRIAL IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 138 SOUTH AFRICA PRINTINGS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 139 SOUTH AFRICA MEDICAL APPLICATION IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 SOUTH AFRICA ELECTRICALS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 SOUTH AFRICA AUTOMOTIVE IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 SOUTH AFRICA OTHERS IN SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 REST OF MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (KILO TONS)

TABLE 144 REST OF MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET : MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: THE MARKET CHALLANFGE MATRIX

FIGURE 9 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 INCREASE ADOPTION OF SPECIALTY PAPER IN SMOKING AND VARIOUS INDUSTRIES ARE EXPECTED TO THE DRIVE THE MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 14 PACKAGING PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET IN 2020 & 2027

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET

FIGURE 16 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY PRODUCT TYPE, 2019

FIGURE 17 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY RAW MATERIAL, 2019

FIGURE 18 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY APPLICATION, 2019

FIGURE 19 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: SNAPSHOT (2019)

FIGURE 20 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY COUNTRY (2019)

FIGURE 21 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY COUNTRY (2020 & 2027)

FIGURE 22 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY COUNTRY (2019 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: BY TYPE (2020-2027)

FIGURE 24 MIDDLE EAST AND AFRICA SPECIALTY PAPER MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.