Middle East And Africa Sleep Apnea Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

253.37 Million

USD

382.98 Million

2025

2033

USD

253.37 Million

USD

382.98 Million

2025

2033

| 2026 –2033 | |

| USD 253.37 Million | |

| USD 382.98 Million | |

|

|

|

|

Segmentation du marché des dispositifs pour l'apnée du sommeil au Moyen-Orient et en Afrique, par type de maladie (syndrome d'apnée obstructive du sommeil, syndrome d'apnée centrale du sommeil et syndrome d'apnée complexe du sommeil), type (dispositif et thérapie), données démographiques des patients (pédiatriques, adultes et gériatriques), utilisateur final (hôpitaux/cliniques, centres de diagnostic, centres de soins ambulatoires, centres de soins spécialisés et soins à domicile), canal de distribution (appels d'offres directs et vente au détail) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique

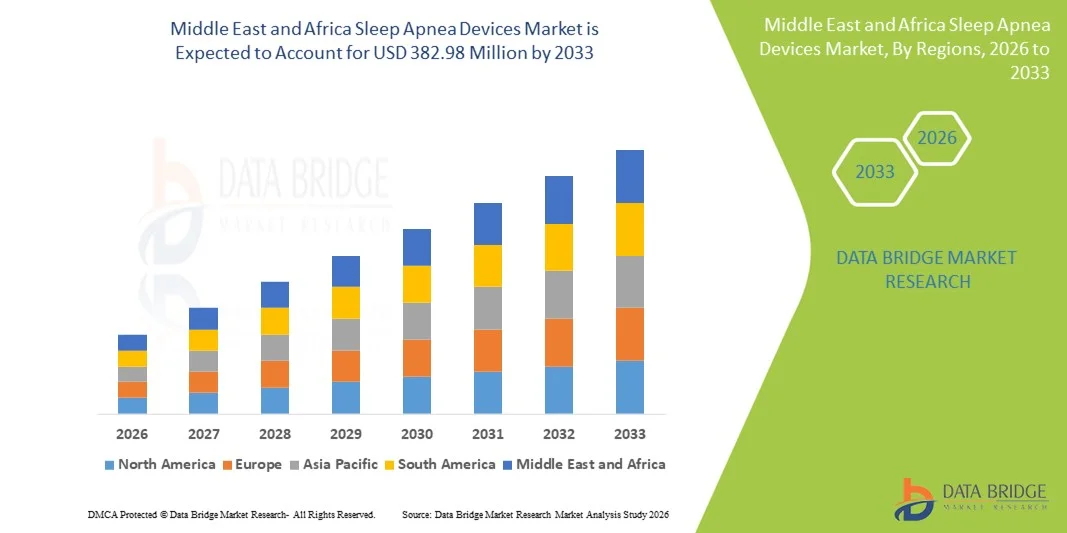

- Le marché mondial des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique était évalué à 253,37 millions de dollars américains en 2025 et devrait atteindre 382,98 millions de dollars américains d'ici 2033 , soit un TCAC de 5,3 % au cours de la période de prévision.

- L'expansion du marché au Moyen-Orient et en Afrique est stimulée par la prévalence croissante de l'apnée du sommeil, la hausse de l'obésité et du vieillissement de la population, l'amélioration progressive des infrastructures de santé et la sensibilisation accrue aux troubles du sommeil et aux technologies de diagnostic et de traitement disponibles.

- La croissance de la région témoigne de la modernisation continue des soins de santé et de l'adoption des dispositifs de diagnostic du sommeil, tant en milieu clinique qu'à domicile. Toutefois, leur utilisation demeure inférieure à celle des régions développées en raison du sous-diagnostic et de l'accès limité aux soins spécialisés.

Analyse du marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique

- Les dispositifs et les thérapies contre l'apnée du sommeil, notamment la PPC (pression positive continue), la BiPAP (pression positive à deux niveaux) et d'autres solutions de traitement, deviennent de plus en plus essentiels en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud, en raison d'une sensibilisation accrue aux troubles du sommeil, de la prévalence croissante de l'obésité et du développement des infrastructures de santé.

- La demande croissante de solutions contre l'apnée du sommeil est principalement alimentée par la forte incidence du syndrome d'apnée obstructive du sommeil, l'adoption croissante des thérapies par dispositifs et la disponibilité accrue d'options de traitement cliniques et à domicile pour les adultes et les patients gériatriques.

- L'Arabie saoudite a dominé le marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique (MEA) avec la plus grande part de revenus (42,5 %) en 2025, grâce à une infrastructure hospitalière avancée, des centres de soins spécialisés et des dépenses de santé élevées.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide au cours de la période de prévision, grâce à l'adoption croissante des solutions de soins de santé à domicile et à l'expansion rapide des infrastructures de diagnostic et de traitement.

- Le segment des dispositifs a dominé le marché avec une part de 58 % en 2025, grâce à l'efficacité des systèmes CPAP et BiPAP dans le traitement des syndromes d'apnée obstructive et complexe du sommeil, à leur facilité d'utilisation et à l'observance croissante des patients aux traitements à domicile.

Portée du rapport et segmentation du marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique

|

Attributs |

Principaux enseignements du marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des dispositifs pour l'apnée du sommeil au Moyen-Orient et en Afrique

Adoption croissante des soins de santé à domicile et de la surveillance à distance

- Une tendance significative et croissante sur le marché des dispositifs contre l'apnée du sommeil (MEA) est l'adoption accrue des solutions de soins à domicile et des technologies de télésurveillance , permettant aux patients de recevoir un traitement sans visites fréquentes à l'hôpital.

- Par exemple, les appareils Philips DreamStation et ResMed AirSense permettent aux patients d'Arabie saoudite et des Émirats arabes unis de surveiller à distance leur observance du traitement par PPC, réduisant ainsi leur dépendance aux consultations médicales.

- L'intégration avec les applications mobiles et les plateformes cloud permet aux professionnels de santé de suivre l'observance thérapeutique des patients, de générer des rapports et d'intervenir en cas de problème, améliorant ainsi les résultats des traitements.

- L'intégration transparente des dispositifs de traitement de l'apnée du sommeil aux plateformes de télésanté et de soins à domicile améliore le confort et l'observance du traitement par les patients, en fournissant aux cliniciens des données en temps réel pour une gestion proactive.

- Cette tendance vers des solutions thérapeutiques plus connectées, centrées sur le patient et accessibles redéfinit les attentes en matière de prise en charge de l'apnée du sommeil au Moyen-Orient et en Afrique, incitant les fabricants d'appareils à innover dans le domaine des fonctionnalités de télésurveillance.

- La demande d'appareils pour l'apnée du sommeil intégrant des fonctionnalités de soins à domicile et de télésurveillance connaît une croissance rapide en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud, les patients et les professionnels de santé privilégiant la commodité, l'observance du traitement et la continuité des soins.

- La collaboration entre les fabricants de dispositifs et les fournisseurs de télésanté crée des solutions de soins intégrées, améliorant la surveillance en temps réel et l'engagement des patients au Moyen-Orient et en Afrique.

Dynamique du marché des dispositifs pour l'apnée du sommeil au Moyen-Orient et en Afrique

Conducteur

Prévalence croissante de l'apnée du sommeil et initiatives de sensibilisation

- La prévalence croissante de l'apnée obstructive du sommeil et d'autres troubles connexes, associée à la multiplication des campagnes de sensibilisation, est un facteur important de la demande croissante d'appareils pour le traitement de l'apnée du sommeil au Moyen-Orient et en Afrique.

- Par exemple, aux Émirats arabes unis et en Arabie saoudite, des initiatives gouvernementales et privées en matière de santé promeuvent des programmes de diagnostic précoce dans les hôpitaux et les cliniques afin de détecter l'apnée du sommeil chez les adultes et les personnes âgées.

- À mesure que les patients prennent conscience des risques pour la santé liés à l'apnée du sommeil non traitée, la demande pour des traitements efficaces tels que les appareils CPAP et BiPAP est en hausse.

- De plus, l'adoption croissante des thérapies par dispositifs dans les hôpitaux, les centres de diagnostic et les services de soins à domicile positionne les dispositifs contre l'apnée du sommeil comme une solution de soins de santé essentielle.

- L'amélioration de l'accès aux infrastructures de soins de santé, associée à l'augmentation des investissements dans les centres de soins spécialisés et la surveillance à domicile, accélère encore l'adoption dans les principaux pays du Moyen-Orient et d'Afrique.

- La commodité des thérapies à domicile, associée aux fonctionnalités de surveillance à distance et de suivi de l'observance, favorise une adoption accrue par les patients et les cliniciens en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud.

- L'augmentation de la couverture d'assurance pour les traitements de l'apnée du sommeil dans des pays comme les Émirats arabes unis encourage davantage de patients à adopter des thérapies utilisant des dispositifs médicaux.

- Les innovations constantes dans les technologies CPAP et BiPAP, telles qu'un fonctionnement plus silencieux et une meilleure humidification, améliorent le confort des patients et favorisent l'observance du traitement.

Retenue/Défi

Coût élevé des appareils et sensibilisation limitée dans certaines régions

- Le coût relativement élevé des appareils de pointe pour le traitement de l'apnée du sommeil, tels que les systèmes CPAP et BiPAP, constitue un frein important à la croissance du marché dans les régions du Moyen-Orient et d'Afrique où les prix sont un facteur déterminant.

- Par exemple, certains patients en Afrique du Sud et dans d'autres pays africains peuvent retarder ou éviter un traitement en raison de problèmes d'accessibilité financière, malgré la disponibilité des dispositifs dans les hôpitaux et les cliniques.

- Dans certains pays, la méconnaissance des symptômes de l'apnée du sommeil et des options de traitement entraîne un sous-diagnostic et un retard dans l'adoption de ces traitements, limitant ainsi la pénétration globale du marché.

- Bien que les initiatives mises en place dans les centres urbains contribuent à sensibiliser la population, les régions rurales et semi-urbaines continuent de se heurter à des obstacles liés à un accès insuffisant à l'éducation et aux soins de santé.

- Surmonter ces défis grâce à des campagnes de sensibilisation, à l'élargissement de la couverture d'assurance et à des options d'appareils rentables est essentiel pour libérer tout le potentiel du marché MENA.

- Les prestataires de soins de santé et les fabricants de dispositifs médicaux se concentrent sur l'éducation des patients, le rayonnement régional et les modèles de dispositifs abordables afin de lever les obstacles à l'adoption en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud.

- Le manque de spécialistes du sommeil qualifiés dans certains pays du Moyen-Orient et d'Afrique (MEA) compromet le diagnostic précoce et l'initiation du traitement.

- L'hétérogénéité des approbations réglementaires et les restrictions à l'importation dans certains pays africains retardent l'introduction des dispositifs avancés pour le traitement de l'apnée du sommeil.

Étendue du marché des dispositifs pour l'apnée du sommeil au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de maladie, du type de dispositif, des caractéristiques démographiques des patients, de l'utilisateur final et du canal de distribution.

- Par type de maladie

Selon le type de maladie, le marché des dispositifs pour l'apnée du sommeil en Arabie saoudite, en Afrique de l'Est (MEA) est segmenté en syndrome d'apnée obstructive du sommeil (SAOS), syndrome d'apnée centrale du sommeil et syndrome d'apnée complexe du sommeil. Le segment du SAOS dominait le marché en 2025, représentant 61 % des revenus, grâce à sa forte prévalence chez les adultes et les personnes âgées en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud. L'apnée obstructive du sommeil est largement reconnue par les cliniciens, ce qui entraîne une augmentation des taux de diagnostic et une plus grande adoption des traitements par dispositifs tels que la PPC (pression positive continue) et la VNI (pression positive à deux niveaux). Par ailleurs, les campagnes de sensibilisation des patients et les initiatives gouvernementales visant à améliorer le diagnostic précoce ont renforcé la présence de ce segment sur le marché. Les hôpitaux et les prestataires de soins à domicile recommandent activement les traitements par dispositifs, ce qui confirme la position dominante du SAOS. L'efficacité des dispositifs dans la gestion des symptômes et la prévention des comorbidités, telles que les maladies cardiovasculaires, contribue également à une forte pénétration du marché.

Le syndrome d'apnée centrale du sommeil devrait connaître la croissance la plus rapide, avec un TCAC projeté de 5,1 % entre 2026 et 2033, en raison d'une meilleure reconnaissance de cette affection chez les patients âgés atteints de troubles cardiovasculaires ou neurologiques chroniques. Les progrès réalisés dans les thérapies de servo-ventilation adaptative et les interventions cliniques ciblées favorisent leur adoption dans les centres de soins spécialisés et les cliniques de diagnostic. Les campagnes de sensibilisation axées sur le dépistage et le traitement précoces de l'apnée centrale du sommeil, notamment dans les centres urbains, contribuent également à cette croissance. L'intensification des recherches et des essais cliniques dans les pays du Moyen-Orient et d'Afrique encourage les professionnels de santé à adopter des solutions spécifiques basées sur des dispositifs, renforçant ainsi le potentiel de croissance de ce segment.

- Par type

Le marché des dispositifs pour l'apnée du sommeil selon la MEA est segmenté en deux catégories : les dispositifs et les thérapies. Le segment des dispositifs dominait le marché en 2025 avec une part de 58 %, grâce notamment aux appareils CPAP et BiPAP, largement prescrits pour le traitement de l'apnée obstructive du sommeil. Ces dispositifs sont privilégiés en raison de leur efficacité prouvée, de leur facilité d'utilisation et de leur intégration aux systèmes de télésanté et de suivi à domicile, en particulier en Arabie saoudite et aux Émirats arabes unis. Les professionnels de santé encouragent activement leur utilisation en première intention, tandis que l'observance du traitement par les patients est assurée par un suivi à distance. Le marché bénéficie également d'innovations constantes, telles que des dispositifs portables, silencieux et économes en énergie, qui favorisent leur adoption par les patients, tant en milieu clinique qu'à domicile. La forte sensibilisation des populations adultes et gériatriques contribue également à la position dominante des dispositifs sur le marché.

Le segment des thérapies devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la demande croissante d'appareils buccaux, de programmes de modification des habitudes de vie et d'interventions complémentaires, tant chez les enfants que chez les adultes. Le développement des soins à domicile, associé à l'intégration de la télémédecine, facilite l'accès des patients aux solutions thérapeutiques. La recommandation croissante par les médecins de thérapies sans dispositif dans les cas légers à modérés et la sensibilisation accrue aux bienfaits des thérapies pour les patients gériatriques favorisent une adoption accélérée. Aux Émirats arabes unis et en Afrique du Sud, les cliniques spécialisées proposent de plus en plus de forfaits thérapeutiques intégrés, contribuant ainsi à une croissance plus rapide de ce segment.

- Selon les caractéristiques démographiques des patients

Sur la base des caractéristiques démographiques des patients, le marché est segmenté en trois catégories : pédiatrique, adulte et gériatrique. Le segment adulte dominait le marché avec une part de 65 % en 2025, reflétant la prévalence plus élevée de l’apnée du sommeil chez les 30-60 ans. Les adultes représentent la plus grande population de patients recherchant un diagnostic et un traitement par dispositif en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud. Les campagnes de sensibilisation ciblant les populations en âge de travailler, associées à un accès accru aux centres de diagnostic et aux solutions de soins à domicile, expliquent la domination du segment adulte. Cette population présente également une meilleure observance des traitements par dispositif, grâce aux applications de surveillance mobile et aux suivis cliniques. Les dispositifs et les thérapies adaptés au mode de vie des patients adultes contribuent également à renforcer leur part de marché.

Le segment gériatrique devrait connaître la croissance la plus rapide parmi les groupes démographiques de patients, avec un TCAC projeté de 5,4 % entre 2026 et 2033. Cette croissance est alimentée par le vieillissement de la population dans les pays du Moyen-Orient et d'Afrique et par la reconnaissance croissante de l'apnée du sommeil comme facteur de risque de comorbidités telles que l'hypertension et les maladies cardiaques. L'adoption des appareils CPAP et BiPAP adaptatifs, ainsi que les programmes de surveillance spécialisés en milieu hospitalier et à domicile, stimulent la croissance de ce segment. Les initiatives de sensibilisation auprès des patients gériatriques, associées au suivi de l'observance thérapeutique par télémédecine, accélèrent encore davantage l'adoption de ces appareils.

- Par l'utilisateur final

Selon l'utilisateur final, le marché des dispositifs pour l'apnée du sommeil au Moyen-Orient et en Afrique (MEA) est segmenté en hôpitaux/cliniques, centres de diagnostic, centres de soins ambulatoires, centres de soins spécialisés et soins à domicile. Le segment des hôpitaux/cliniques dominait le marché avec une part de 52 % en 2025, grâce à la forte dépendance au diagnostic clinique et à la thérapie supervisée par dispositifs pour les patients adultes et gériatriques. Les hôpitaux d'Arabie saoudite, des Émirats arabes unis et d'Afrique du Sud sont équipés de laboratoires du sommeil de pointe, offrant des services de titration et de surveillance des appareils CPAP/BiPAP. Les cliniciens privilégient les traitements en milieu hospitalier pour le diagnostic initial et l'initiation du traitement, garantissant ainsi l'observance du traitement et de meilleurs résultats. Cette position dominante est également favorisée par la couverture d'assurance et les programmes de santé gouvernementaux qui facilitent l'accès aux dispositifs via les hôpitaux. De plus, les hôpitaux offrent des services de suivi intégrés et un soutien à la télésurveillance, améliorant ainsi l'observance du traitement et la croissance globale du segment.

Le segment des soins à domicile devrait connaître la croissance la plus rapide, avec un TCAC projeté de 6,1 % entre 2026 et 2033, portée par l'adoption croissante des thérapies CPAP et BiPAP assistées par télémédecine dans les populations urbaines et périurbaines. La commodité, la confidentialité et la surveillance continue incitent les patients à privilégier les traitements à domicile, notamment aux Émirats arabes unis et en Arabie saoudite. Cette croissance est également alimentée par les appareils portables fonctionnant sur batterie et les systèmes de suivi de l'observance thérapeutique basés sur le cloud. Le développement des programmes d'éducation des patients et des infrastructures de télésurveillance encourage l'adoption de ces traitements, en particulier chez les patients adultes et gériatriques souhaitant se soigner à domicile.

- Par canal de distribution

Selon le canal de distribution, le marché des dispositifs de traitement de l'apnée du sommeil au Moyen-Orient et en Afrique (MEA) se divise en deux segments : les appels d'offres directs et la vente au détail. En 2025, le segment des appels d'offres directs dominait le marché avec une part de 60 %, grâce aux achats effectués par les hôpitaux, les centres de soins spécialisés et les programmes de santé gouvernementaux en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud. Les grands hôpitaux et les centres de diagnostic privilégient souvent les accords d'appel d'offres directs avec les fabricants afin de garantir la qualité, la rentabilité et un approvisionnement constant en appareils CPAP, BiPAP et autres solutions. Les appels d'offres directs permettent également de proposer des offres groupées incluant l'installation, la formation et la maintenance, favorisant ainsi l'adoption à long terme. Par ailleurs, les initiatives gouvernementales et les partenariats avec les hôpitaux encouragent ce canal pour le déploiement à grande échelle des dispositifs, notamment dans les centres urbains.

Le segment des ventes au détail devrait connaître la croissance la plus rapide, avec un TCAC projeté de 6,5 % entre 2026 et 2033. Cette croissance sera alimentée par une sensibilisation accrue des consommateurs et par la disponibilité croissante des appareils CPAP et BiPAP via les plateformes en ligne, les pharmacies et les magasins de matériel médical. Les ventes au détail permettent aux patients d'accéder directement à ces appareils pour leur traitement à domicile, sans avoir besoin d'une prescription hospitalière, ce qui favorise leur confort et l'observance de leur traitement. Le développement des canaux de commerce électronique aux Émirats arabes unis et en Arabie saoudite, conjugué aux initiatives de marketing et d'information des patients, accélère l'adoption de ces appareils par les consommateurs. La croissance est particulièrement forte chez les patients adultes et gériatriques qui privilégient les options de traitement privées à domicile.

Analyse régionale du marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique (MEA) avec la plus grande part de revenus (42,5 %) en 2025, grâce à une infrastructure hospitalière avancée, des centres de soins spécialisés et des dépenses de santé élevées.

- Dans la région, les patients et les professionnels de santé adoptent de plus en plus les thérapies par dispositifs tels que la PPC et la BiPAP en raison de leur efficacité prouvée, de leur intégration aux plateformes de télémédecine et de leur capacité à améliorer l'observance du traitement à long terme.

- Cette adoption généralisée est également favorisée par une sensibilisation accrue aux troubles du sommeil, le développement des centres de soins spécialisés et l'accès croissant aux solutions de soins de santé à domicile, faisant des dispositifs contre l'apnée du sommeil une option thérapeutique privilégiée pour les adultes et les patients gériatriques en Arabie saoudite, aux Émirats arabes unis et en Afrique du Sud.

Analyse du marché des dispositifs contre l'apnée du sommeil en Arabie saoudite

Le marché saoudien des dispositifs pour l'apnée du sommeil a représenté la plus grande part de revenus (42,5 %) en 2025, grâce à des infrastructures de santé performantes, à la prévalence croissante de l'apnée obstructive du sommeil et aux initiatives gouvernementales favorisant le diagnostic et le traitement précoces. Patients et professionnels de santé privilégient de plus en plus les thérapies par dispositifs tels que la PPC (pression positive continue) et la BiPAP (pression positive continue) en raison de leur efficacité prouvée et de leur intégration aux plateformes de télémédecine. La multiplication des campagnes de sensibilisation, le développement des centres de soins spécialisés et l'amélioration de l'accès aux soins à domicile contribuent également à la croissance du marché. Les hôpitaux et les centres de diagnostic jouent un rôle essentiel dans le suivi des patients, tandis que la couverture d'assurance et les programmes de santé publics facilitent l'adoption de ces dispositifs. L'alliance du soutien clinique et de la commodité des soins à domicile positionne l'Arabie saoudite comme le marché dominant au Moyen-Orient et en Afrique.

Analyse du marché des dispositifs pour l'apnée du sommeil aux Émirats arabes unis

Le marché des dispositifs pour l'apnée du sommeil aux Émirats arabes unis devrait connaître une croissance annuelle composée (TCAC) notable au cours de la période de prévision, portée par l'adoption croissante des solutions de soins à domicile et des technologies de télésurveillance. Les patients sont de plus en plus nombreux à privilégier les traitements CPAP et BiPAP à domicile afin de réduire leurs hospitalisations tout en assurant une bonne observance thérapeutique. Les initiatives gouvernementales en matière de santé et l'intégration de la télémédecine facilitent le diagnostic précoce et le suivi continu des patients. La sensibilisation accrue de la population urbaine aux troubles du sommeil et aux facteurs de risque liés au mode de vie stimule davantage la demande. Les cliniques privées et les centres spécialisés des Émirats arabes unis proposent activement des traitements par dispositifs, tandis que les plateformes numériques améliorent le suivi de l'observance. Les initiatives visant à rendre ces dispositifs plus abordables et les campagnes d'information des patients accélèrent leur adoption en milieu résidentiel et clinique.

Analyse du marché des dispositifs contre l'apnée du sommeil en Afrique du Sud

Le marché sud-africain des dispositifs pour l'apnée du sommeil devrait connaître la croissance annuelle composée la plus rapide de la région MENA au cours de la période prévisionnelle, grâce à une meilleure reconnaissance de l'apnée du sommeil chez les adultes et les personnes âgées. Le développement des infrastructures de santé urbaines, la multiplication des campagnes de sensibilisation et la disponibilité accrue des dispositifs dans les centres de diagnostic et à domicile sont les principaux moteurs de cette croissance. Les patients privilégient nettement les thérapies par dispositifs en raison de leur efficacité et de leur facilité d'utilisation. La télésurveillance et le suivi à distance de l'observance thérapeutique favorisent l'adoption de ces dispositifs, notamment dans les zones métropolitaines. Par ailleurs, les partenariats entre les professionnels de santé et les fabricants de dispositifs contribuent à une plus large pénétration du marché. L'augmentation du nombre de centres de soins spécialisés et de programmes de soins à domicile devrait soutenir cette croissance à long terme.

Analyse du marché égyptien des dispositifs pour l'apnée du sommeil

Le marché égyptien des dispositifs pour l'apnée du sommeil est en plein essor, porté par la prévalence croissante de l'apnée obstructive du sommeil, la sensibilisation accrue des adultes et des personnes âgées, et le développement progressif des infrastructures de santé. Les hôpitaux et les centres de diagnostic jouent un rôle majeur dans la mise en place et le suivi des traitements. Les solutions de soins à domicile et les plateformes de télésurveillance sont de plus en plus accessibles, permettant aux patients de gérer leur traitement à distance. La prise en charge par l'assurance maladie et le soutien gouvernemental facilitent également l'accès aux appareils CPAP et BiPAP. Cette croissance est par ailleurs soutenue par l'expansion de la population urbaine, la hausse des taux d'obésité et les facteurs de risque liés au mode de vie. Le marché devrait connaître une adoption croissante dans les établissements de soins résidentiels, cliniques et spécialisés.

Part de marché des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique

Le secteur des dispositifs contre l'apnée du sommeil au Moyen-Orient et en Afrique est principalement dominé par des entreprises bien établies, notamment :

- ResMed Inc. (États-Unis)

- Koninklijke Philips NV (Pays-Bas)

- Fisher & Paykel Healthcare Limited (Nouvelle-Zélande)

- BMC Medical Co., Ltd. (Chine)

- Apex Medical Corp. (Taïwan)

- Löwenstein Medical GmbH & Co. KG (Allemagne)

- Conduire DeVilbiss Healthcare LLC (États-Unis)

- 3B Medical, Inc. (États-Unis)

- Breas Medical AB (Suède)

- Somnetics International, Inc. (États-Unis)

- SLS Medical Technology (Chine)

- Resvent Medical Technology Co., Ltd. (Chine)

- Teijin Pharma Limited (Japon)

- Koike Medical Co., Ltd. (Japon)

- Nidek Medical India Pvt. Ltd. (Inde)

- Medtronic (Irlande)

- Cardinal Health (États-Unis)

- Smiths Medical, Inc. (Royaume-Uni)

- Fosun Pharma (Chine)

- Elmaslar Medikal Sistemleri (Turquie)

Quels sont les développements récents sur le marché des dispositifs de traitement de l'apnée du sommeil au Moyen-Orient et en Afrique ?

- En février 2025, Nyxoah a commercialisé son traitement de stimulation du nerf hypoglosse Genio® au Moyen-Orient, devenant ainsi le premier traitement de neurostimulation pour l'apnée obstructive du sommeil disponible dans la région MENA. La première implantation réussie a été réalisée à l'hôpital saoudien-allemand de Dubaï, offrant une alternative aux patients intolérants au traitement par PPC (pression positive continue).

- En février 2025, l'hôpital saoudien-allemand de Dubaï est devenu le premier hôpital du Moyen-Orient et d'Afrique à réaliser une intervention chirurgicale d'implantation du dispositif de stimulation du nerf hypoglosse Genio® pour le traitement de l'apnée du sommeil, ce qui représente une étape clinique importante dans l'offre de traitements mini-invasifs et avancés de l'apnée obstructive du sommeil, au-delà de la thérapie PPC traditionnelle, dans la région.

- En mars 2024, Philips Respironics a lancé une initiative régionale de formation et d'assistance aux Émirats arabes unis afin de favoriser l'adoption clinique de ses systèmes CPAP avancés (notamment le DreamStation 2 Auto CPAP), fournissant ainsi aux professionnels de santé les outils et les connaissances les plus récents pour améliorer la prise en charge et les résultats thérapeutiques de l'apnée du sommeil au Moyen-Orient.

- En février 2024, BMC Medical s'est implantée au Moyen-Orient grâce à de nouveaux accords de distribution en Égypte et en Arabie saoudite, proposant des solutions CPAP abordables et portables, adaptées aux besoins locaux et intégrant des fonctionnalités telles que des humidificateurs et des applications mobiles de suivi, afin de favoriser une plus large adoption du traitement de l'apnée du sommeil à domicile.

- En mars 2021, Philips s'est associé à Middle East Healthcare Company (MEAHCO) pour lancer des services de pointe de prise en charge des troubles du sommeil en Arabie saoudite par l'intermédiaire du Saudi German Health Group. Ces services visent à fournir des solutions intégrées de diagnostic et de traitement pour des affections telles que l'apnée obstructive du sommeil (AOS), améliorant ainsi l'accès à des traitements avancés de l'AOS dans la région.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.