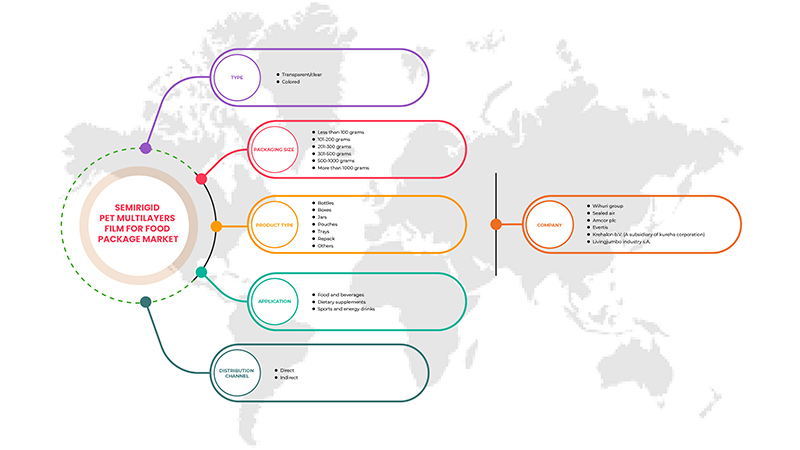

Film multicouches semi-rigide PET pour le marché des emballages alimentaires au Moyen-Orient et en Afrique, par type (transparent/clair et coloré), type de produit (bouteilles, boîtes, pots, sachets , plateaux, reconditionnement et autres), taille de l'emballage (moins de 100 grammes, 101-200 grammes, 201-300 grammes, 301-500 grammes, 500-1000 grammes et plus de 1000 grammes), application (aliments et boissons, compléments alimentaires, boissons sportives et énergisantes), canal de distribution (direct et indirect) Tendances de l'industrie et prévisions jusqu'en 2029

Analyse et perspectives du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique

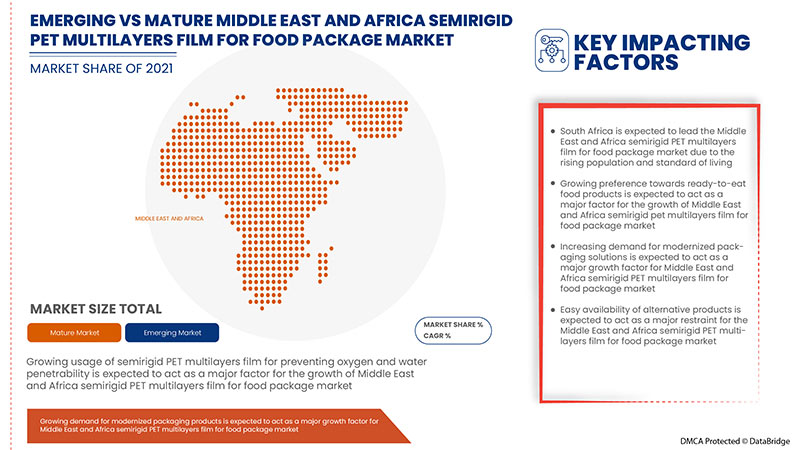

La croissance de l'utilisation des films d'emballage multicouches semi-rigides en PET pour empêcher la pénétration de l'oxygène et de l'eau et l'augmentation de la demande et de la sensibilisation aux films multicouches semi-rigides pour la durée de conservation devraient stimuler la demande de films multicouches semi-rigides en PET pour le marché des emballages alimentaires au Moyen-Orient et en Afrique. Cependant, la volatilité des prix des matières premières et la disponibilité de produits alternatifs pourraient encore limiter la croissance du marché.

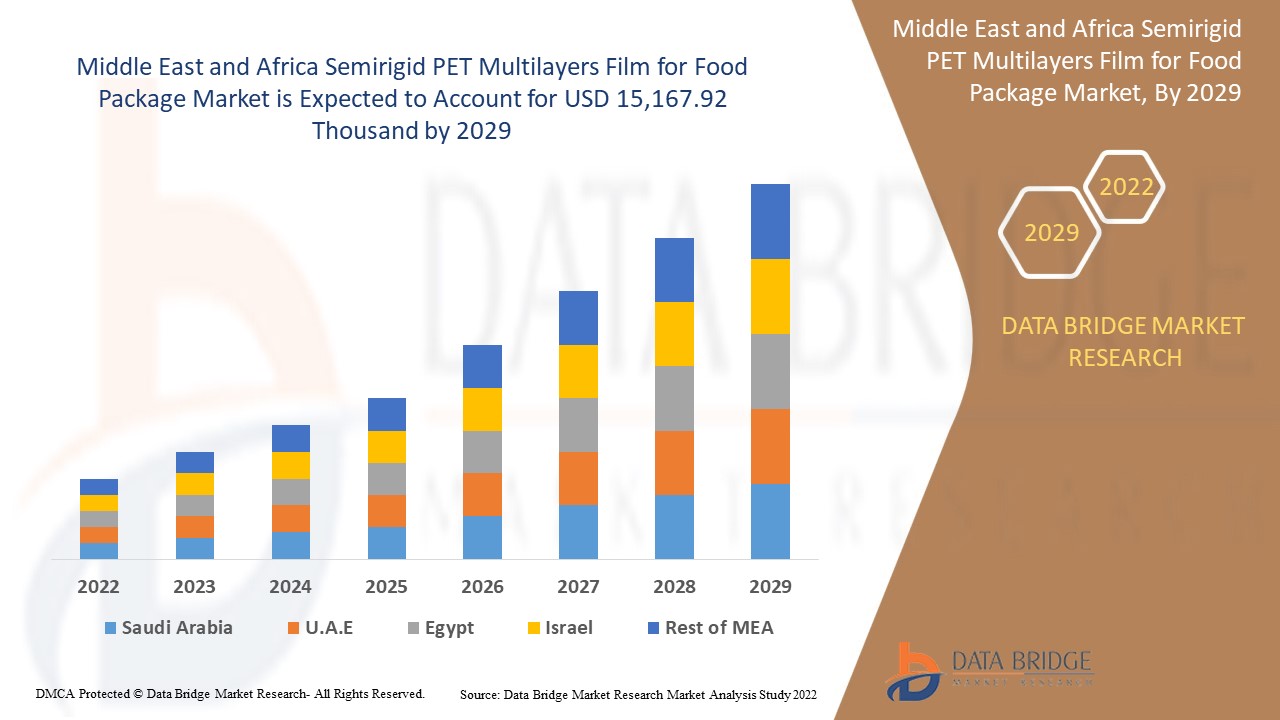

Data Bridge Market Research analyse que le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique devrait atteindre la valeur de 15 167,92 milliers USD d'ici 2029, à un TCAC de 3,1 % au cours de la période de prévision. Transparent/clair représente le segment de type le plus important sur le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique. Le rapport sur le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Type (transparent/clair et coloré), type de produit (bouteilles, boîtes, pots, sachets, plateaux, reconditionnement et autres), taille de l'emballage (moins de 100 grammes, 101-200 grammes, 201-300 grammes, 301-500 grammes, 500-1000 grammes et plus de 1000 grammes), application (aliments et boissons, compléments alimentaires, boissons sportives et énergisantes), canal de distribution (direct et indirect) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Sealed Air, Amcor plc et Krehalon BV (une filiale de KUREHA CORPORATION), entre autres |

Définition du marché

Le polyéthylène téréphtalate est un plastique transparent, solide et léger appartenant à la famille des polyesters. Il est largement utilisé comme matériau d'emballage alimentaire car il est hygiénique, solide, léger, incassable et conserve la fraîcheur. Le film multicouches PET semi-rigide est composé de plusieurs couches. Cela augmente considérablement la durée de conservation en contrôlant le taux de transmission de l'oxygène, du dioxyde de carbone et de l'humidité.

Les fabricants et les concepteurs d'emballages préfèrent les films multicouches PET semi-rigides car ils sont sûrs, solides, transparents et polyvalents. Leurs propriétés permettent une innovation supérieure en termes de conception et de performance des emballages. Ils aident à protéger l'intégrité, la fraîcheur et le goût des aliments. Les consommateurs les reconnaissent en raison de leur légèreté, de leur refermabilité, de leur résistance aux éclats et de leur style innovant. Ils ont de bonnes propriétés de barrière qui protègent et préservent le contenu de l'emballage. Ils peuvent être recyclés facilement et le matériau PET peut être réutilisé pour une large gamme d'applications.

Dynamique du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Utilisation croissante de films d'emballage multicouches semi-rigides en PET pour empêcher la pénétration de l'oxygène et de l'eau

Dans le contexte actuel, la demande de films d'emballage multicouches est énorme en raison de l'évolution des préférences des consommateurs en faveur des aliments emballés. Ces films sont coextrudés car ils sont créés par un processus de coextrusion multicouche. Le film d'emballage multicouche PET semi-rigide est composé de plusieurs couches de PET ainsi que d'autres matériaux qui améliorent les propriétés mécaniques et physiques du film, telles que la résistance à la perforation, à la déchirure et à la chaleur, tout en aidant à prévenir l'interaction avec l'oxygène, l'humidité et d'autres gaz tels que le dioxyde de carbone, ainsi qu'en limitant l'effet de l'huile minérale et de la lumière UV. Par conséquent, l'utilisation croissante de films multicouches PET semi-rigides pour l'emballage alimentaire afin de protéger les produits emballés des gaz et de l'humidité devrait stimuler la demande pour ces films multicouches, ce qui entraînera la croissance du marché des films multicouches PET semi-rigides pour l'emballage alimentaire au Moyen-Orient et en Afrique.

-

Demande et sensibilisation croissantes pour les films multicouches semi-rigides pour la durée de conservation

Le mode de vie moderne et actif des consommateurs et la demande qui en résulte pour des emballages alimentaires pratiques stimulent constamment la demande de films multicouches PET semi-rigides. En effet, les films multicouches PET semi-rigides contribuent à prolonger la durée de vie du produit. Le mélange de plusieurs couches de polymère augmente considérablement la durée de conservation en contrôlant le taux de transmission d'oxygène, de dioxyde de carbone et d'humidité, ainsi que la concentration d'oxygène à l'intérieur de l'emballage, préservant ainsi la fraîcheur des produits frais pendant une période prolongée. Les gens sont de plus en plus conscients de l'importance des emballages alimentaires en film multicouche PET semi-rigide pour une durée de conservation plus longue à mesure que leurs préoccupations environnementales augmentent. De plus, la propagation du COVID-19 dans la plupart des pays du monde a fait que la demande d'aliments emballés a triplé par rapport à la normale, les consommateurs recherchant des produits alimentaires à longue durée de conservation.

-

Les préférences des consommateurs évoluent vers une consommation d'aliments emballés

L'immense popularité mondiale des produits alimentaires prêts à consommer augmente, ce qui influence l'évolution des consommateurs vers les produits emballés. Les professionnels qui travaillent avec un équilibre travail-vie personnelle trépidant et une charge de travail croissante stimulent la demande d'aliments emballés. Ainsi, la demande croissante d'aliments emballés devrait contribuer au développement du marché des films multicouches PET semi-rigides pour l'emballage alimentaire au Moyen-Orient et en Afrique. La détérioration des aliments pendant la manipulation et le stockage devrait également stimuler l'adoption des films multicouches PET d'emballage dans les années à venir, car leur nature imperméable les rend idéaux pour le stockage des aliments emballés. En raison des modes de vie plus occupés des consommateurs et de la demande qui en résulte pour les produits alimentaires prêts à l'emploi par le biais de l'emballage, la croissance du marché des films multicouches PET semi-rigides pour l'emballage alimentaire au Moyen-Orient et en Afrique pourrait s'accélérer.

-

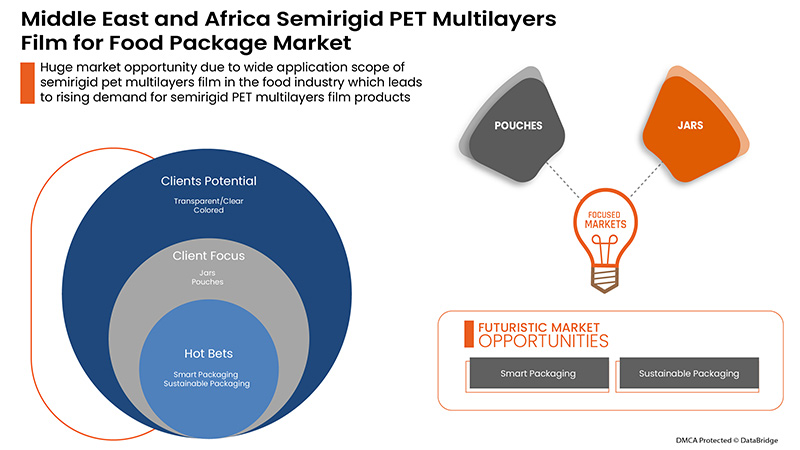

Large champ d'application du film multicouche PET semi-rigide dans l'industrie alimentaire

Le film PET est utilisé dans de nombreuses applications en raison de ses propriétés optiques, physiques, mécaniques, thermiques et chimiques uniques. Il est principalement utilisé dans une large gamme d'applications d'emballage de film multicouche PET semi-rigide, des aliments et médicaments aux biens industriels et de consommation. Pour la barrière, l'adhérence du métal est l'adhérence de laminage, l'adhérence de revêtement par extrusion, l'impression ou le scellage, en tant que simple ou métallisé, formable, thermorétractable et enduit. Le film multicouche PET a des propriétés exceptionnelles pour le marché de l'emballage. Un film multicouche PET semi-rigide a une large gamme d'applications dans l'industrie alimentaire, notamment la viande, la volaille, le poisson, les produits laitiers, les snacks, les boissons, les aliments déshydratés et les céréales, les produits de boulangerie, la confiserie, les aliments pour animaux de compagnie et bien d'autres. Un film multicouche PET semi-rigide a une large gamme d'applications dans l'emballage alimentaire, notamment les sacs à pain, les sacs à pâtes, les barres de collation et de nutrition, les emballages à haute température/micro-ondes/sacs à bouillir, les emballages d'aliments pour animaux de compagnie et les sachets/sachets à fond plat/sachets ou plateaux refermables, et bien d'autres.

Opportunités

-

Développer des solutions d'emballage créatives avec de nouvelles idées de conception

L'emballage évolue constamment avec de nouveaux matériaux, technologies et processus. Ces changements sont dus à la nécessité d'améliorer la qualité des produits, la productivité, la logistique, les performances environnementales et les préférences des consommateurs en constante évolution. Dans l'industrie alimentaire, la plupart des opérations d'emballage sont automatiques ou semi-automatiques. L'adoption de technologies d'impression nouvelles et avancées est en hausse pour offrir aux consommateurs des solutions d'emballage personnalisées. Cela a aidé les entreprises à accroître la valeur de leur marque sur le marché et à renforcer l'engagement des clients avec l'emballage du produit. Par conséquent, la croissance des solutions d'emballage avec de nouvelles conceptions et innovations pour créer et maintenir un avantage concurrentiel, répondre aux changements de comportement des consommateurs et la disponibilité de nouveaux matériaux et technologies peuvent offrir diverses opportunités de croissance pour le marché des films multicouches PET semi-rigides pour l'emballage alimentaire au Moyen-Orient et en Afrique.

-

Augmentation de la demande d'emballages conviviaux

L'un des principaux facteurs déterminants pour l'innovation dans le domaine de l'emballage alimentaire est la demande croissante des consommateurs en matière de commodité. Les solutions d'emballage modernes offrent de nombreux attributs de commodité. Il s'agit notamment de la facilité d'accès et d'ouverture, d'élimination et de manipulation, de la visibilité du produit, de la capacité de refermeture, de la capacité de cuisson au micro-ondes et de la durée de conservation prolongée. On observe également une tendance à la consommation d'aliments prêts à consommer. Les changements rapides du mode de vie ont augmenté la demande d'aliments prêts à consommer. Cela accroît le besoin de films multicouches PET semi-rigides pour l'emballage, la livraison et la conservation des aliments. Ainsi, les préférences des consommateurs en constante évolution, les tendances du secteur du commerce électronique et la demande de produits d'emballage conviviaux ont ouvert de nombreuses opportunités aux fournisseurs de solutions d'emballage en film multicouche PET semi-rigide pour adopter des technologies et des conceptions innovantes afin d'accroître leur part de marché.

-

L'expansion de l'industrie alimentaire influence les films d'emballage

L'évolution des emballages de restauration est une cause majeure de l'expansion de l'industrie alimentaire. La restauration est devenue une part importante des dépenses de consommation. L'industrie de la restauration comprend les restaurants, les hôtels, les cafés et les services de restauration. À mesure que cette tendance s'accentue, son influence sur les emballages alimentaires augmente également. L'emballage joue un rôle clé pour garantir la sécurité alimentaire et offrir un confort aux consommateurs. En outre, des facteurs tels que la mondialisation, l'évolution du niveau de vie, la santé et le bien-être et l'augmentation des revenus disponibles créent une demande dans l'industrie alimentaire. L'industrie alimentaire a connu des développements drastiques ces derniers temps. Par conséquent, la croissance et le développement de l'industrie peuvent offrir de nouvelles opportunités pour la croissance du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique.

Contraintes/Défis

- Volatilité des prix des matières premières

Le PET est une fibre synthétique qui a été fabriquée. Cependant, ses matières premières proviennent toujours de la nature, une ressource naturelle non renouvelable. C'est un type de plastique qui est généralement dérivé du pétrole. Il existe des alternatives au PET dérivé du pétrole, telles que celles fabriquées à partir de plastique recyclé, de cultures ou même de déchets. La hausse des prix du pétrole brut suscite des inquiétudes dans les industries qui dépendent des dérivés du pétrole naturel, tels que les films multicouches PET semi-rigides. Les prix de vente des films multicouches PET semi-rigides fluctuent en raison des variations des prix de l'acide téréphtalique purifié (PTA) et du monoéthylène glycol (MEG), les matières premières de base utilisées pour fabriquer du PET à partir du pétrole brut. Les prix du PTA et du MEG sont fortement influencés par les prix du pétrole brut et les taux de change. Certains consommateurs de films multicouches PET semi-rigides semblent accepter la tendance fluctuante des prix, tandis que la plupart des consommateurs ne l'acceptent pas. En conséquence, la croissance du marché des films multicouches PET semi-rigides pour l'emballage alimentaire au Moyen-Orient et en Afrique est gravement entravée.

- Disponibilité de produits alternatifs

Ces dernières années, nous assistons à une campagne mondiale sans précédent contre la production et l’utilisation du plastique. Les déchets plastiques ont influencé l’opinion publique et, en raison de cette nouvelle sensibilité des consommateurs, les législateurs internationaux adoptent des lois restrictives sur l’utilisation des plastiques jetables, créant de nouveaux procédés et polymères capables de remplacer la production actuelle de films PET à base de pétrole. Ainsi, les alternatives au PET déjà sur le marché et celles en cours de développement sont le BIO-PET, d’autres polymères non biodégradables et des polymères naturels et biodégradables. Le polyéthylène furoate (PEF) et le polytriméthylène furan dicarboxylate sont deux polymères alternatifs actuellement disponibles (PTF). Ce sont des polymères furaniques qui pourraient être obtenus à partir de sources 100 % renouvelables. Il existe une énorme activité dans le monde liée au développement de polymères biodégradables pour tous les types d’applications traditionnellement associées au plastique.

- Inquiétudes concernant le recyclage des films multicouches

Les fabricants peuvent choisir différents matériaux et combinaisons de couches lors du développement de solutions d'emballage multicouches. Cela a conduit à une prévention dans une séparation claire des groupes de matériaux individuels. Le principal défi du recyclage des déchets plastiques post-consommation est le tri des emballages multicouches. Les emballages multicouches sont difficiles à identifier et à recycler. Des technologies d'identification doivent être déployées pour identifier les différentes propriétés de surface. Les emballages multicouches sont un mélange complexe d'autres matériaux qui sont également contaminés après utilisation. Par conséquent, l'absence de processus de tri et de recyclage industriels à grande échelle pour les solutions d'emballage multicouches peut remettre en cause la croissance du marché des films multicouches PET semi-rigides pour les emballages alimentaires au Moyen-Orient et en Afrique.

- Préoccupations environnementales et réglementation gouvernementale stricte

Le PET est l'un des plastiques les plus couramment utilisés. Les préoccupations concernant les graves problèmes de pollution plastique et son impact négatif sur l'environnement sont de plus en plus nombreuses. Il perturbe l'environnement de nombreuses façons en affectant la qualité de l'air, du sol et de l'eau. La combustion du PET libère des gaz nocifs tels que l'oxyde nitrique, le dioxyde de soufre et le chlorofluorocarbone. Le processus de production du PET est un processus à forte intensité énergétique. Les émissions du processus contaminent gravement les sources d'eau avec de nombreux polluants. De plus, une mauvaise gestion et des réglementations gouvernementales strictes réduisent encore davantage la demande pour ces produits dans les pays en développement. Cela, à son tour, pourrait remettre en cause la croissance du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique.

Impact post-COVID-19 sur le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique a connu une baisse significative des ventes en raison de la fermeture des restaurants et des points de restauration au cours des dernières années.

Cependant, la croissance du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique après la pandémie est attribuée à l'ouverture des points de restauration, aux achats en épicerie et aux dépenses de consommation. Les principaux acteurs du marché prennent diverses décisions stratégiques pour rebondir après le COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer leurs offres grâce à des solutions d'emballage alimentaire hygiéniques et durables.

Développement récent

- En mai 2022, Sealed Air a lancé un nouveau portefeuille de solutions d'impression numérique, de conception et d'emballage intelligent. Ces produits ont été retrouvés sous une nouvelle marque - prismiq. La marque vise à créer de la valeur pour les clients grâce à des solutions d'emballage numérique. Ce nouveau lancement de produit aidera l'entreprise à exploiter les futurs emballages et graphiques numériques, améliorant ainsi son offre de produits sur le marché

Portée du marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique

Le marché des films multicouches semi-rigides PET pour emballage alimentaire au Moyen-Orient et en Afrique est segmenté en fonction du type, du type de produit, de la taille de l'emballage, de l'application et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Transparent/Clair

- Coloré

Sur la base du type, le marché des films multicouches PET semi-rigides pour emballages alimentaires du Moyen-Orient et de l'Afrique est segmenté en transparent/clair et coloré.

Type de produit

- Bouteilles

- Boîtes

- Pots

- Pochettes

- Plateaux

- Reconditionner

- Autres

Sur la base du type de produit, le marché des films multicouches PET semi-rigides pour emballages alimentaires du Moyen-Orient et de l'Afrique est segmenté en bouteilles, boîtes, pots, sachets, plateaux, reconditionnements et autres.

Taille de l'emballage

- Moins de 100 grammes

- 101-200 grammes

- 201-300 grammes

- 301-500 grammes

- 500-1000 grammes

- Plus de 1000 grammes

Sur la base de la taille de l'emballage, le marché des films multicouches PET semi-rigides pour emballages alimentaires du Moyen-Orient et de l'Afrique est segmenté en moins de 100 grammes, 101-200 grammes, 201-300 grammes, 301-500 grammes, 500-1000 grammes et plus de 1000 grammes.

Application

- Alimentation et boissons

- Compléments alimentaires

- Boissons sportives et énergisantes

Sur la base de l'application, le marché des films multicouches PET semi-rigides pour emballages alimentaires du Moyen-Orient et de l'Afrique est segmenté en aliments et boissons, compléments alimentaires, boissons sportives et énergisantes.

Canal de distribution

- Direct

- Indirect

Sur la base du canal de distribution, le marché des films multicouches PET semi-rigides pour emballages alimentaires du Moyen-Orient et de l'Afrique est segmenté en direct et indirect.

Film multicouches semi-rigide PET pour le marché des emballages alimentaires au Moyen-Orient et en Afrique

Le marché des films multicouches PET semi-rigides pour emballages alimentaires au Moyen-Orient et en Afrique est analysé, et des informations et tendances sur la taille du marché sont fournies par pays, type, type de produit, taille de l'emballage, application et canal de distribution comme référencé ci-dessus.

Le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique couvre des pays tels que l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique. L'Afrique du Sud devrait dominer le marché des films multicouches semi-rigides PET pour emballages alimentaires au Moyen-Orient et en Afrique, car l'augmentation de la population et l'allongement de l'espérance de vie stimulent la demande d'emballages. L'Égypte et l'Arabie saoudite sont deux autres pays où la demande augmente.

La section pays du rapport sur le marché des films multicouches PET semi-rigides pour emballages alimentaires au Moyen-Orient et en Afrique fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la part de marché des films multicouches semi-rigides PET pour emballages alimentaires et paysage concurrentiel au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des films multicouches PET semi-rigides pour emballages alimentaires au Moyen-Orient et en Afrique fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises se concentrant sur le marché des films multicouches PET semi-rigides pour emballages alimentaires au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des films multicouches PET semi-rigides pour emballages alimentaires au Moyen-Orient et en Afrique sont Sealed Air, Amcor plc et Krehalon BV (une filiale de KUREHA CORPORATION), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THE THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.3 BRAND OUTLOOK

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 RAW MATERIAL PRODUCTION COVERAGE

4.11 REGULATORY FRAMEWORK AND GUIDELINES

5 REGIONAL SUMMARY

5.1 MIDDLE EAST & AFRICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN USAGE OF SEMIRIGID PET MULTILAYER PACKAGING FILM FOR PREVENTING OXYGEN AND WATER PENETRABILITY

6.1.2 INCREASE IN DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE

6.1.3 SHIFT IN CONSUMER PREFERENCES TOWARDS THE CONSUMPTION OF PACKAGED FOODS

6.1.4 WIDE APPLICATION SCOPE OF SEMIRIGID PET MULTILAYERS FILM IN THE FOOD INDUSTRY

6.2 RESTRAINTS

6.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF CREATIVE PACKAGING SOLUTIONS WITH NEW DESIGN IDEAS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.3.3 EXPANSION OF THE FOOD INDUSTRY INFLUENCES PACKAGING FILMS

6.4 CHALLENGES

6.4.1 CONCERNS ABOUT THE RECYCLING OF MULTILAYER FILMS

6.4.2 ENVIRONMENTAL CONCERNS AND STRICT GOVERNMENT REGULATION

7 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TRANSPARENT/CLEAR

7.3 COLORED

8 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BOTTLES

8.3 BOXES

8.4 JARS

8.5 POUCHES

8.6 TRAYS

8.7 REPACK

8.8 OTHERS

9 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE

9.1 OVERVIEW

9.2 LESS THAN 100 GRAMS

9.3 101-200 GRAMS

9.4 201-300 GRAMS

9.5 301-500 GRAMS

9.6 500-1000 GRAMS

9.7 MORE THAN 1000 GRAMS

10 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD AND BEVERAGES

10.2.1 FOOD

10.2.1.1 DAIRY

10.2.1.1.1 CHEESE

10.2.1.1.2 ICE CREAM

10.2.1.1.3 MILK POWDER

10.2.1.1.4 DAIRY SPREAD

10.2.1.1.5 YOGURT

10.2.1.1.6 OTHERS

10.2.1.1.7 DAIRY, BY TYPE

10.2.1.1.7.1 TRANSPARENT/CLEAR

10.2.1.1.7.2 COLORED

10.2.1.1.8 DAIRY, BY PRODUCT TYPE

10.2.1.1.8.1 BOTTLES

10.2.1.1.8.2 BOXES

10.2.1.1.8.3 JARS

10.2.1.1.8.4 POUCHES

10.2.1.1.8.5 TRAYS

10.2.1.1.8.6 REPACK

10.2.1.1.8.7 OTHERS

10.2.1.2 BAKERY

10.2.1.2.1 BREADS & ROLLS

10.2.1.2.2 CAKES & PASTRIES

10.2.1.2.3 BISCUITS

10.2.1.2.4 MUFFINS

10.2.1.2.5 COOKIES

10.2.1.2.6 DOUGHNUTS

10.2.1.2.7 OTHERS

10.2.1.2.8 BAKERY, BY TYPE

10.2.1.2.8.1 TRANSPARENT/CLEAR

10.2.1.2.8.2 COLORED

10.2.1.2.9 BAKERY, BY PRODUCT TYPE

10.2.1.2.9.1 BOTTLES

10.2.1.2.9.2 BOXES

10.2.1.2.9.3 JARS

10.2.1.2.9.4 POUCHES

10.2.1.2.9.5 TRAYS

10.2.1.2.9.6 REPACK

10.2.1.2.9.7 OTHERS

10.2.1.3 PROCESSED FOOD

10.2.1.3.1 READY MEALS

10.2.1.3.2 SAUCES, DRESSINGS AND CONDIMENTS

10.2.1.3.3 SOUPS

10.2.1.3.4 JAMS, PRESERVES AND MARMALADES

10.2.1.3.5 OTHERS

10.2.1.3.6 PROCESSED FOOD, BY TYPE

10.2.1.3.6.1.1 TRANSPARENT/CLEAR

10.2.1.3.6.1.2 COLORED

10.2.1.3.7 PROCESSED FOOD, BY PRODUCT TYPE

10.2.1.3.7.1.1 BOTTLES

10.2.1.3.7.1.2 BOXES

10.2.1.3.7.1.3 JARS

10.2.1.3.7.1.4 POUCHES

10.2.1.3.7.1.5 TRAYS

10.2.1.3.7.1.6 REPACK

10.2.1.3.7.1.7 OTHERS

10.2.1.4 CONFECTIONARY

10.2.1.4.1 HARD-BOILED SWEETS

10.2.1.4.2 MINTS

10.2.1.4.3 GUMS & JELLIES

10.2.1.4.4 CHOCOLATE

10.2.1.4.5 CHOCOLATE SYRUPS

10.2.1.4.6 CARAMELS & TOFFEES

10.2.1.4.7 OTHERS

10.2.1.5 CONFECTIONARY, BY TYPE

10.2.1.5.1 TRANSPARENT/CLEAR

10.2.1.5.2 COLORED

10.2.1.6 CONFECTIONARY, BY PRODUCT TYPE

10.2.1.6.1 BOTTLES

10.2.1.6.2 BOXES

10.2.1.6.3 JARS

10.2.1.6.4 POUCHES

10.2.1.6.5 TRAYS

10.2.1.6.6 REPACK

10.2.1.6.7 OTHERS

10.2.1.7 FROZEN DESSERTS

10.2.1.7.1 GELATO

10.2.1.7.2 CUSTARD

10.2.1.7.3 SORBET

10.2.1.7.4 OTHERS

10.2.1.8 FROZEN DESSERTS,BY TYPE

10.2.1.8.1 TRANSPARENT/CLEAR

10.2.1.8.2 COLORED

10.2.1.9 FROZEN DESSERTS, BY PRODUCT TYPE

10.2.1.9.1 BOTTLES

10.2.1.9.2 BOXES

10.2.1.9.3 JARS

10.2.1.9.4 POUCHES

10.2.1.9.5 TRAYS

10.2.1.9.6 REPACK

10.2.1.9.7 OTHERS

10.2.1.10 FUNCTIONAL FOODS

10.2.1.10.1 TRANSPARENT/CLEAR

10.2.1.10.2 COLORED

10.2.1.10.3 BOTTLES

10.2.1.10.4 BOXES

10.2.1.10.5 JARS

10.2.1.10.6 POUCHES

10.2.1.10.7 TRAYS

10.2.1.10.8 REPACK

10.2.1.10.9 OTHERS

10.2.1.11 CONVENIENCE FOOD

10.2.1.11.1 INSTANT NOODLES

10.2.1.11.2 PASTA

10.2.1.11.3 SNACKS AND EXTRUDED SNACKS

10.2.1.11.4 OTHERS

10.2.1.12 CONVENIENCE FOOD, BY TYPE

10.2.1.12.1 TRANSPARENT/CLEAR

10.2.1.12.2 COLORED

10.2.1.13 CONVENIENCE FOOD, BY PRODUCT TYPE

10.2.1.13.1 BOTTLES

10.2.1.13.2 BOXES

10.2.1.13.3 JARS

10.2.1.13.4 POUCHES

10.2.1.13.5 TRAYS

10.2.1.13.6 REPACK

10.2.1.13.7 OTHERS

10.2.1.14 MEAT PRODUCTS

10.2.1.14.1 BEEF MEAT

10.2.1.14.2 PORK MEAT

10.2.1.14.3 POULTRY MEAT

10.2.1.14.4 OTHERS

10.2.1.15 MEAT PRODUCTS, BY TYPE

10.2.1.15.1 TRANSPARENT/CLEAR

10.2.1.15.2 COLORED

10.2.1.16 MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.16.1 BOTTLES

10.2.1.16.2 BOXES

10.2.1.16.3 JARS

10.2.1.16.4 POUCHES

10.2.1.16.5 TRAYS

10.2.1.16.6 REPACK

10.2.1.16.7 OTHERS

10.2.1.17 PROCESSED MEAT PRODUCTS

10.2.1.17.1 BACON

10.2.1.17.2 MEAT SNACKS

10.2.1.17.3 SAUSAGE

10.2.1.17.4 HOT DOGS

10.2.1.17.5 DELI MEAT

10.2.1.17.6 OTHERS

10.2.1.18 PROCESSED MEAT PRODUCTS, BY TYPE

10.2.1.18.1 TRANSPARENT/CLEAR

10.2.1.18.2 COLORED

10.2.1.19 PROCESSED MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.19.1 BOTTLES

10.2.1.19.2 BOXES

10.2.1.19.3 JARS

10.2.1.19.4 POUCHES

10.2.1.19.5 TRAYS

10.2.1.19.6 REPACK

10.2.1.19.7 OTHERS

10.2.2 BEVERAGES

10.2.2.1 BEVERAGES, BY APPLICATION

10.2.2.1.1 SMOOTHIES

10.2.2.1.2 JUICES

10.2.2.1.3 SPORTS DRINKS

10.2.2.1.4 ENERGY DRINKS

10.2.2.1.5 DAIRY BASED DRINKS

10.2.2.1.5.1 DAIRY BASED DRINKS, BY APPLICATION

10.2.2.1.5.1.1 REGULAR PROCESSED MILK

10.2.2.1.5.1.2 FLAVORED MILK

10.2.2.1.5.1.3 MILK SHAKES

10.2.2.1.5.1.4 FUNCTIONAL BEVERAGES

10.2.2.2 BEVERAGES, BY TYPE

10.2.2.2.1 TRANSPARENT/CLEAR

10.2.2.2.2 COLORED

10.2.2.3 BEVERAGES, BY PRODUCT TYPE

10.2.2.3.1 BOTTLES

10.2.2.3.2 BOXES

10.2.2.3.3 JARS

10.2.2.3.4 POUCHES

10.2.2.3.5 TRAYS

10.2.2.3.6 REPACK

10.2.2.3.7 OTHERS

10.3 DIETARY SUPPLEMENTS

10.3.1 DIETARY SUPPLEMENTS, BY TYPE

10.3.1.1 TRANSPARENT/CLEAR

10.3.1.2 COLORED

10.3.2 DIETARY SUPPLEMENTS, BY PRODUCT TYPE

10.3.2.1 BOTTLES

10.3.2.2 BOXES

10.3.2.3 JARS

10.3.2.4 POUCHES

10.3.2.5 TRAYS

10.3.2.6 REPACK

10.3.2.7 OTHERS

10.4 SPORTS AND ENERGY DRINKS

10.4.1 SPORTS AND ENERGY DRINKS, BY TYPE

10.4.1.1 TRANSPARENT/CLEAR

10.4.1.2 COLORED

10.4.2 SPORTS AND ENERGY DRINKS, BY PRODUCT TYPE

10.4.2.1 BOTTLES

10.4.2.2 BOXES

10.4.2.3 JARS

10.4.2.4 POUCHES

10.4.2.5 TRAYS

10.4.2.6 REPACK

10.4.2.7 OTHERS

11 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 EGYPT

12.1.3 SAUDI ARABIA

12.1.4 UNITED ARAB EMIRATES

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 COLLABORATION

13.3 CERTIFICATION

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 WIHURI GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SEALED AIR

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 EVERTIS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 KREHALON B.V. (A SUBSIDIARY OF KUREHA CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 LIVINGJUMBO INDUSTRY S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF POLYETHYLENE TEREPHTHALATE IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYETHYLENE TEREPHTHALATE, IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA TRANSPARENT/CLEAR IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA COLORED IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA BOTTLES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA BOXES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA JARS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA POUCHES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA TRAYS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA REPACK IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA LESS THAN 100 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA 101-200 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA 201-300 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA 301-500 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA 500-1000 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA MORE THAN 1000 GRAMS SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA DIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA INDIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 106 SOUTH AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 SOUTH AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH AFRICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH AFRICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH AFRICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 SOUTH AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SOUTH AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 SOUTH AFRICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 SOUTH AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 SOUTH AFRICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 SOUTH AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 SOUTH AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 SOUTH AFRICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 SOUTH AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 SOUTH AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 SOUTH AFRICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 SOUTH AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 SOUTH AFRICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 SOUTH AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 SOUTH AFRICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 SOUTH AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 SOUTH AFRICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 SOUTH AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 SOUTH AFRICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 SOUTH AFRICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 EGYPT SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 EGYPT SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 EGYPT SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 150 EGYPT SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 EGYPT FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 EGYPT FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 EGYPT DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 EGYPT DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 EGYPT DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 EGYPT BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 EGYPT BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 EGYPT BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 EGYPT PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 EGYPT PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 EGYPT PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 EGYPT CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 EGYPT CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 EGYPT CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 EGYPT FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 EGYPT FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 EGYPT FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 EGYPT FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 EGYPT FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 EGYPT CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 EGYPT CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 EGYPT CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 EGYPT MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 174 EGYPT MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 EGYPT MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 EGYPT PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 EGYPT PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 EGYPT PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 EGYPT BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 EGYPT DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 EGYPT BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 EGYPT BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 EGYPT DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 EGYPT DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 EGYPT SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 EGYPT SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 EGYPT SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 188 SAUDI ARABIA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 SAUDI ARABIA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 SAUDI ARABIA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 191 SAUDI ARABIA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 SAUDI ARABIA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 SAUDI ARABIA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 SAUDI ARABIA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 SAUDI ARABIA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 SAUDI ARABIA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 SAUDI ARABIA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 198 SAUDI ARABIA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 SAUDI ARABIA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 200 SAUDI ARABIA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 201 SAUDI ARABIA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 202 SAUDI ARABIA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 SAUDI ARABIA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 204 SAUDI ARABIA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 SAUDI ARABIA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 SAUDI ARABIA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 207 SAUDI ARABIA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SAUDI ARABIA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SAUDI ARABIA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 SAUDI ARABIA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 SAUDI ARABIA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 SAUDI ARABIA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 SAUDI ARABIA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 214 SAUDI ARABIA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SAUDI ARABIA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 SAUDI ARABIA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 218 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 220 SAUDI ARABIA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 221 SAUDI ARABIA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 222 SAUDI ARABIA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 223 SAUDI ARABIA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 224 SAUDI ARABIA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 SAUDI ARABIA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 226 SAUDI ARABIA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 SAUDI ARABIA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 228 SAUDI ARABIA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 229 UNITED ARAB EMIRATES SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 UNITED ARAB EMIRATES SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 UNITED ARAB EMIRATES SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 232 UNITED ARAB EMIRATES SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 233 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 234 UNITED ARAB EMIRATES FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 UNITED ARAB EMIRATES DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 236 UNITED ARAB EMIRATES DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 237 UNITED ARAB EMIRATES DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 238 UNITED ARAB EMIRATES BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 UNITED ARAB EMIRATES BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 240 UNITED ARAB EMIRATES BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 241 UNITED ARAB EMIRATES PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 242 UNITED ARAB EMIRATES PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 243 UNITED ARAB EMIRATES PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 244 UNITED ARAB EMIRATES CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 245 UNITED ARAB EMIRATES CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 246 UNITED ARAB EMIRATES CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 247 UNITED ARAB EMIRATES FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 248 UNITED ARAB EMIRATES FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 249 UNITED ARAB EMIRATES FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 250 UNITED ARAB EMIRATES FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 251 UNITED ARAB EMIRATES FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 252 UNITED ARAB EMIRATES CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 253 UNITED ARAB EMIRATES CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 254 UNITED ARAB EMIRATES CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 255 UNITED ARAB EMIRATES MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 256 UNITED ARAB EMIRATES MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 257 UNITED ARAB EMIRATES MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 258 UNITED ARAB EMIRATES PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 259 UNITED ARAB EMIRATES PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 260 UNITED ARAB EMIRATES PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 261 UNITED ARAB EMIRATES BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 262 UNITED ARAB EMIRATES DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 263 UNITED ARAB EMIRATES BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 264 UNITED ARAB EMIRATES BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 265 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 266 UNITED ARAB EMIRATES DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 267 UNITED ARAB EMIRATES SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 268 UNITED ARAB EMIRATES SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 269 UNITED ARAB EMIRATES SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 270 ISRAEL SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 271 ISRAEL SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 272 ISRAEL SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 273 ISRAEL SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 274 ISRAEL FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 275 ISRAEL FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 276 ISRAEL DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 277 ISRAEL DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 278 ISRAEL DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 279 ISRAEL BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 280 ISRAEL BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 281 ISRAEL BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 282 ISRAEL PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 283 ISRAEL PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 284 ISRAEL PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 285 ISRAEL CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 286 ISRAEL CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 287 ISRAEL CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 288 ISRAEL FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 289 ISRAEL FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 290 ISRAEL FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 291 ISRAEL FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 292 ISRAEL FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 293 ISRAEL CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 294 ISRAEL CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 295 ISRAEL CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 296 ISRAEL MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 297 ISRAEL MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 298 ISRAEL MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 299 ISRAEL PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 300 ISRAEL PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 301 ISRAEL PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 302 ISRAEL BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 303 ISRAEL DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 304 ISRAEL BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 305 ISRAEL BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 306 ISRAEL DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)