Marché des peptisants en caoutchouc au Moyen-Orient et en Afrique, par produit (dibenzamido diphényl disulfure (DBD), pentachlorothiophénol, pentachlorothiophénate de zinc, aryl mercaptans, mercaptobenzothiazole et autres), application ( caoutchouc naturel et caoutchouc synthétique), utilisation finale (pneu et non-pneu) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des peptides de caoutchouc au Moyen-Orient et en Afrique

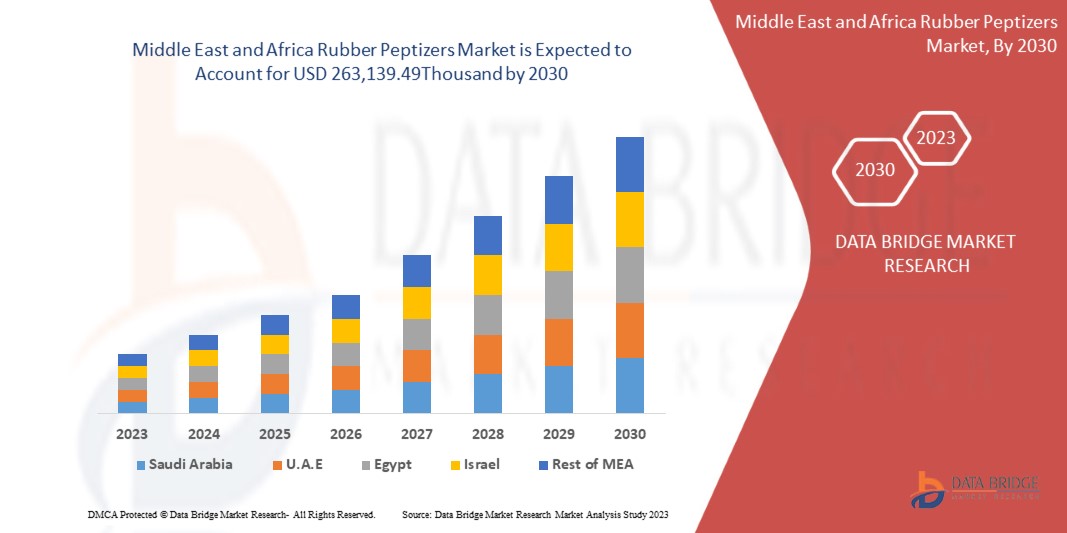

Le marché des peptisants en caoutchouc au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,2 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 263 139,49 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché des peptisants en caoutchouc au Moyen-Orient et en Afrique est la demande accrue d'utilisation dans le secteur de la construction.

Le rapport sur le marché des peptisants en caoutchouc au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Sous-produit (disulfure de dibenzamidodiphényle (DBD), pentachlorothiophénol, pentachlorothiophénate de zinc, arylmercaptans, mercaptobenzothiazole et autres), application (caoutchouc naturel et caoutchouc synthétique), utilisation finale (pneu et autre) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Struktol Company of America, LLC, LANXESS, Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., Ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, HENAN CONNECT RUBBER CHEMICAL LIMITED et Kettlitz-Chemie GmbH & Co. KG |

Définition du marché

Les peptisants servent soit de catalyseurs d'oxydation, soit d'accepteurs de radicaux, qui éliminent essentiellement les radicaux libres formés lors du mélange initial de l'élastomère. Cela empêche la recombinaison du polymère, ce qui permet une baisse conséquente du poids moléculaire du polymère et, par conséquent, une réduction de la viscosité du composé. Ce ramollissement du polymère permet ensuite l'incorporation de la gamme de matériaux de composition inclus dans la formulation. Des exemples de peptisants sont le pentachlorothiophénol, la phénylhydrazine, certains diphénylsulfures et le xylyl mercaptan. Chaque peptisant a une charge optimale dans un composé pour une efficacité maximale. Les peptisants sont utilisés dans la mastication du caoutchouc naturel pour optimiser son traitement. Ils réduisent le poids moléculaire des polymères en décomposant les chaînes moléculaires. L'utilisation accrue de peptisants pour caoutchouc dans diverses applications, telles que le caoutchouc naturel et le caoutchouc synthétique, pour l'industrie du pneu et d'autres industries du caoutchouc, devrait augmenter la demande dans le monde entier.

Dynamique du marché des peptides de caoutchouc au Moyen-Orient et en Afrique

Conducteurs

- ACCROISSEMENT DE L'UTILISATION DES PEPTISANTS DE CAOUTCHOUC DANS LA FABRICATION DE PRODUITS EN CAOUTCHOUC

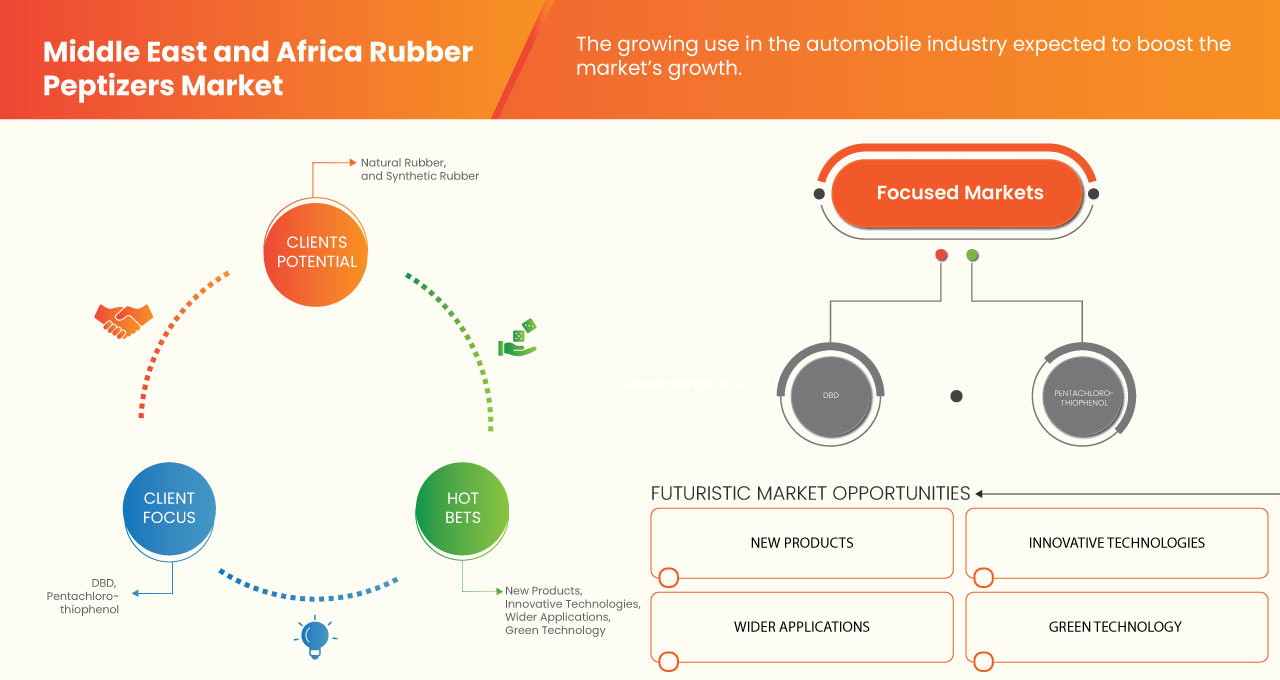

L'utilisation croissante du caoutchouc naturel par les industries automobile, chimique , médicale et autres devrait favoriser la portée des peptisants au niveau du Moyen-Orient et de l'Afrique. Par rapport au caoutchouc naturel, le caoutchouc synthétique offre une meilleure résistance à l'abrasion. En raison de cet avantage, le caoutchouc synthétique est de plus en plus utilisé dans les joints et les joints en caoutchouc. Les peptisants de caoutchouc sont utilisés dans la mastication du caoutchouc naturel pour optimiser son traitement. Cet additif de caoutchouc assure la qualité dans la fabrication de produits en caoutchouc où il y a peu ou pas de rejet. Il nécessite des produits chimiques spéciaux pour obtenir une bonne dispersion des charges et une plasticité parfaite. Le caoutchouc naturel sans traitement est extrêmement résistant. Dans ce cas, les peptisants sont utilisés dans la mastication du caoutchouc naturel pour optimiser le traitement. L'utilisation de peptisants, qui est un additif de caoutchouc, accélère la mastication sur une large plage de températures.

- ADOPTÉ PAR LES DIFFÉRENTES INDUSTRIES EN RAISON DE SA VISCOSITÉ IMPORTANTE

Les peptisants servent soit de catalyseurs d'oxydation, soit d'accepteurs de radicaux, qui éliminent essentiellement les radicaux libres formés lors du mélange initial de l'élastomère. Cela empêche la recombinaison du polymère, ce qui permet une baisse conséquente du poids moléculaire du polymère et, par conséquent, une réduction de la viscosité du composé. Les peptisants sont utilisés dans la mastication du caoutchouc naturel pour optimiser son traitement. Ils réduisent le poids moléculaire des polymères en décomposant les chaînes moléculaires. Contrairement à la mastication mécanique du caoutchouc, les peptisants chimiques raccourcissent le temps de mastication et diminuent la consommation d'énergie, ce qui améliore la productivité du mélange.

- APPLICATIONS AUGMENTÉES DANS L'INDUSTRIE AUTOMOBILE

La croissance rapide du secteur automobile a entraîné une augmentation de la demande d'additifs pour caoutchouc dans la production de pneus, car différents produits en caoutchouc améliorent la résistance des pneus aux rayons du soleil, à l'ozone, à la chaleur et aux contraintes mécaniques. Les additifs pour caoutchouc sont utilisés pour améliorer la résistance et les performances du caoutchouc. La demande d'additifs pour caoutchouc pour les applications autres que les pneus stimule la croissance du marché.

Opportunités

- ADOPTION DE LA TECHNOLOGIE VERTE DANS LA FABRICATION DU CAOUTCHOUC

L'adoption de la technologie verte dans la fabrication du caoutchouc a ouvert de nombreuses voies pour les peptisants du caoutchouc, également en ce qui concerne le traitement du caoutchouc naturel, les peptisants étant l'un des principaux composés. La réduction du poids moléculaire et des propriétés du caoutchouc naturel, telles que la viscosité, la résistance à la traction et la résistance à la compression, a également diminué. La mastication est effectuée uniquement pour le caoutchouc naturel. La mastication peut être effectuée chimiquement (en utilisant des peptisants). La mastication chimique du caoutchouc naturel entraîne une session de chaîne, un poids moléculaire plus faible, une distribution de poids moléculaire limite et un nombre accru d'extrémités de chaîne libres. Les peptisants sont des produits chimiques utilisés pour la mastication chimique. Il existe deux types de peptisants. Ce sont les peptisants physiques et chimiques. Les peptisants physiques sont des lubrifiants qui réduisent la viscosité interne et ne réduisent pas le poids moléculaire. Les peptisants chimiques sont des catalyseurs d'oxydation ou des accepteurs de radicaux.

- UTILISATION CROISSANTE DES PEPTISANTS DE CAOUTCHOUC DANS LE SECTEUR DE LA CONSTRUCTION

Le secteur de la construction est l'un des marchés les plus importants pour les additifs chimiques pour le caoutchouc. Une grande variété d'additifs chimiques pour le caoutchouc est utilisée dans la production de multiples composants et ingrédients pour le secteur de la construction, tels que les dalles en caoutchouc, les joints, les joints et les tuyaux, entre autres. Le secteur de la construction affiche une croissance exceptionnelle à l'échelle mondiale avec des investissements et des activités de construction en augmentation. Le compoundage est la science des matériaux qui consiste à modifier un caoutchouc ou un élastomère, ou un mélange de polymères et d'autres matériaux pour optimiser les propriétés afin de répondre à une application de service donnée ou à un ensemble de paramètres de performance. Le compoundage est une science multidisciplinaire complexe nécessitant une connaissance de la physique des matériaux, de la chimie organique et des polymères, de la chimie inorganique et de la cinétique des réactions chimiques.

Contraintes/Défis

- ÉMISSION DE GAZ ET DE POLLUANTS DANGEREUX

Les dangers causés par les industries sur notre environnement se présentent principalement sous la forme de pollution de l'air, de l'eau et du bruit. Il existe un certain nombre d'industries produisant différents produits synthétiques et non synthétiques, parmi lesquels les industries du caoutchouc jouent le rôle de colonne vertébrale géante. L'industrie de fabrication du caoutchouc ne produit pas seulement des articles en caoutchouc comme produit principal, mais produit également une quantité massive de pollution de l'air, du bruit et de l'eau comme sous-produits. Une grande quantité de matières organiques volatiles et d'autres particules sont présentes dans l'air de l'unité et de l'installation. De plus, différents produits chimiques sont utilisés au cours des processus de fabrication qui sont rejetés sous forme d'effluents dans l'environnement. L'étude a donc été menée pour évaluer la qualité de l'air et du bruit du lieu de travail et les caractéristiques des eaux usées afin que les mesures nécessaires puissent être prises pour protéger les travailleurs contre l'exposition professionnelle.

- IMPOSITION DE RÈGLEMENTS GOUVERNEMENTAUX STRICTS

Les additifs chimiques pour le caoutchouc sont associés à des effets néfastes sur la santé humaine, ce qui constitue un défi pour le marché. Cela pourrait entraver la croissance du marché au cours de la période de prévision. Divers organismes directeurs tels que l'enregistrement, l'évaluation, l'autorisation et la restriction des produits chimiques (REACH) et l'Agence de protection de l'environnement (EPA) surveillent strictement l'utilisation d'additifs chimiques dans la préparation du caoutchouc. Les réglementations strictes sur l'utilisation des produits chimiques pour le caoutchouc sont susceptibles d'entraver la demande de produits chimiques pour le caoutchouc sur le marché. Étant donné que la plupart d'entre eux sont déversés dans les plans d'eau, les produits chimiques de traitement utilisés pour le caoutchouc sont nocifs pour l'atmosphère et la vie marine.

Portée du marché des peptisants de caoutchouc au Moyen-Orient et en Afrique

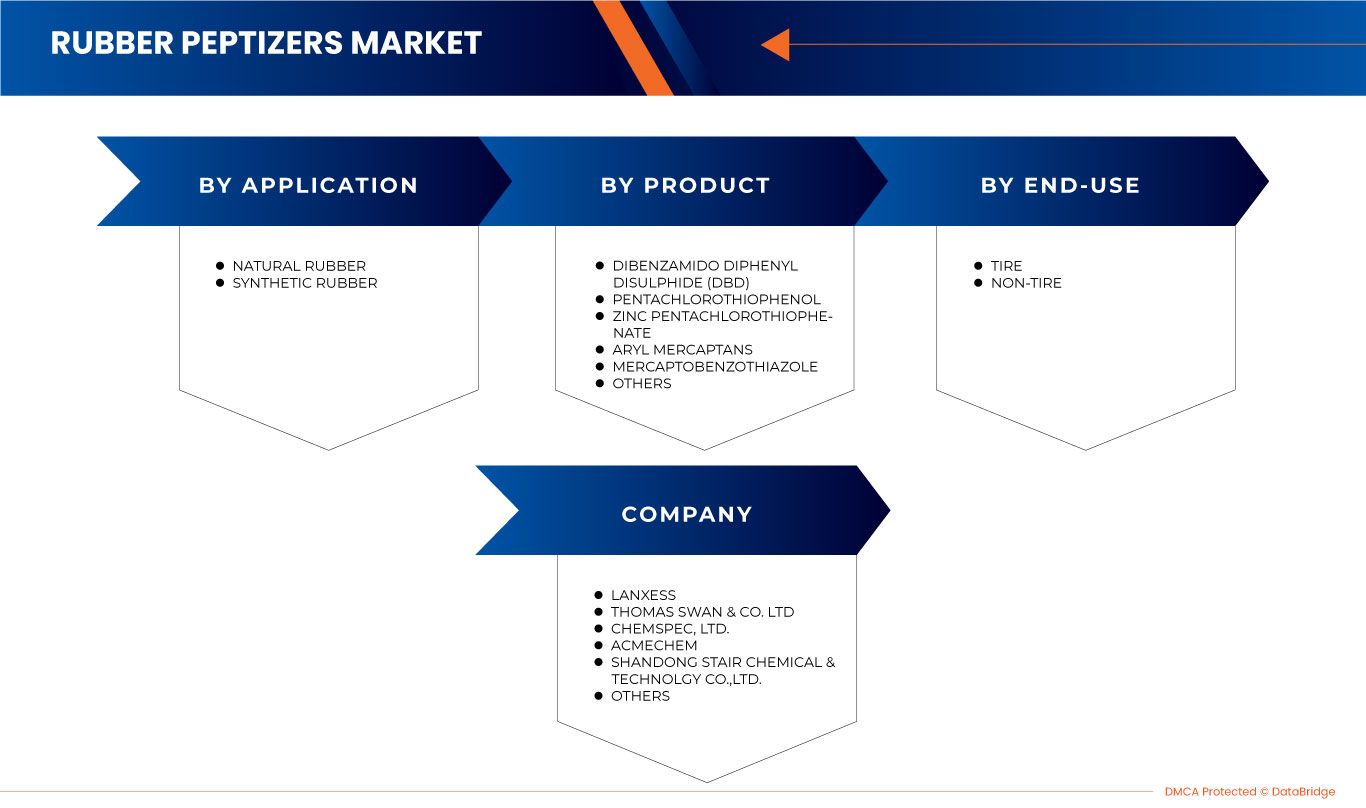

Le marché des peptisants pour caoutchouc du Moyen-Orient et de l'Afrique est classé en fonction du produit, de l'application et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Dibenzamido diphényl disulfure (DBD)

- Pentachlorothiophénol

- Pentachlorothiophénate de zinc

- Arylmercaptans

- Mercaptobenzothiazole

- Autres

En fonction du produit, le marché des peptisants du caoutchouc du Moyen-Orient et de l'Afrique est classé en dibenzamido diphényl disulfure (DBD), pentachlorothiophénol, pentachlorothiophénate de zinc, aryl mercaptans, mercaptobenzothiazole, autres.

Application

- Caoutchouc naturel

- Caoutchouc synthétique

En fonction de l'application, le marché des peptisants de caoutchouc du Moyen-Orient et de l'Afrique est classé en caoutchouc naturel et caoutchouc synthétique.

Utilisation finale

- Pneu

- Sans pneu

En fonction de l’utilisation finale, le marché des peptisants en caoutchouc du Moyen-Orient et de l’Afrique est classé en pneus et hors pneus.

Analyse/perspectives régionales du marché des peptides de caoutchouc au Moyen-Orient et en Afrique

Le marché des peptisants de caoutchouc au Moyen-Orient et en Afrique est segmenté sur la base du produit, de l’application et de l’utilisation finale.

Les pays du marché des peptisants en caoutchouc du Moyen-Orient et de l’Afrique sont l’Afrique du Sud, l’Égypte, l’Arabie saoudite, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Arabie saoudite domine le marché des peptisants de caoutchouc au Moyen-Orient et en Afrique en termes de part de marché et de revenus du marché en raison de l'adoption de la technologie verte dans la fabrication du caoutchouc.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des peptisants en caoutchouc au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des peptisants de caoutchouc au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que les entreprises se concentrant sur le marché des peptisants de caoutchouc au Moyen-Orient et en Afrique.

Français Certains des principaux acteurs opérant sur le marché des peptisants de caoutchouc au Moyen-Orient et en Afrique sont Struktol Company of America, LLC, LANXESS, Shandong Stair Chemical & Technology Co., Ltd., Zhengzhou Double Vigour Chemical Product Co., ltd., Taizhou Huangyan Donghai Chemical Co., Ltd., Acmechem, HENAN CONNECT RUBBER CHEMICAL LIMITED et Kettlitz-Chemie GmbH & Co. KG.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING AND PACKING

4.4.3 MARKETING AND DISTRIBUTION

4.4.4 END USERS

4.5 PRICE INDEX

4.6 PRODUCTION AND CONSUMPTION ANALYSIS

4.7 PRODUCTION CAPACITY OVERVIEW

4.8 RAW MATERIAL PRODUCTION COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING THE USE OF RUBBER PEPTIZERS IN THE MANUFACTURING OF RUBBER PRODUCTS

5.1.2 ADOPTED BY THE VARIOUS INDUSTRIES BECAUSE OF SIGNIFICANT VISCOSITY

5.1.3 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 EMISSION OF HAZARDOUS GASSES AND POLLUTANTS

5.2.2 IMPOSITION OF STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 ADOPTION OF GREEN TECHNOLOGY IN RUBBER MANUFACTURING

5.3.2 INCREASING USE OF RUBBER PEPTIZERS IN THE CONSTRUCTION SECTOR

5.4 CHALLENGES

5.4.1 DISRUPTIONS IN THE SUPPLY CHAIN

5.4.2 FLUCTUATING PRICE OF RAW MATERIALS.

6 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD)

6.3 PENTACHLOROTHIOPHENOL

6.4 MERCAPTOBENZOTHIAZOLE

6.5 ARYL MERCAPTANS

6.6 ZINC PENTACHLOROTHIOPHENATE

6.7 OTHERS

7 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 NATURAL RUBBER

7.3 SYNTHETIC RUBBER

7.3.1 SYNTHETIC RUBBER, BY CATEGORY

7.3.1.1 STYRENE-BUTADIENE RUBBER (SBR)

7.3.1.2 ACRYLONITRILE-BUTADIENE RUBBER (NBR)

7.3.1.3 POLYBUTADIENE RUBBER (BR)

7.3.1.4 BUTYL RUBBER (IIR)

7.3.1.5 OTHERS

8 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 NON-TIRE

8.3 TIRE

9 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY REGION

9.1 MIDDLE EAST & AFRICA

9.1.1 SAUDI ARABIA

9.1.2 UNITED ARAB EMIRATES

9.1.3 EGYPT

9.1.4 SOUTH AFRICA

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST & AFRICA

10 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

10.2 CERTIFICATION

10.3 ACHIEVEMENT

10.4 LAUNCH

10.5 EVENT

10.6 INVESTMENT

10.7 COMMITMENT

10.8 ACQUISITION

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LANXESS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 THOMAS SWAN & CO. LTD

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 CHEMSPEC LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ACMECHEM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 AKROCHEM CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 DONGEUN CO., LTD

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 HENAN CONNECT RUBBER CHEMICAL LIMITED

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KETTLITZ-CHEMIE GMBH & CO. KG

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KING INDUSTRIES, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 STRUKTOL COMPANY OF AMERICA, LLC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 TAIZHOU HUANGYAN DONGHAI CHEMICAL CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 ZHENGZHOU DOUBLE VIGOUR CHEMICAL PRODUCT CO., LTD.

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (PRICE/KG)

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 5 MIDDLE EAST & AFRICA DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PENTACHLOROTHIOPHENOL IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MERCAPTOBENZOTHIAZOLE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA ARYL MERCAPTANS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ZINC PENTACHLOROTHIOPHENATE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA NATURAL RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA NON-TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA TIRE IN RUBBER PEPTIZERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 20 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 22 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 27 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 32 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 35 EGYPT RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 EGYPT RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 37 EGYPT RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 38 EGYPT SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 39 EGYPT RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 40 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 42 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 SOUTH AFRICA SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 44 SOUTH AFRICA RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 45 ISRAEL RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 ISRAEL RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 47 ISRAEL RUBBER PEPTIZERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 48 ISRAEL SYNTHETIC RUBBER IN RUBBER PEPTIZERS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 49 ISRAEL RUBBER PEPTIZERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 50 REST OF MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 REST OF MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET, BY PRODUCT, 2021-2030 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 2 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: SEGMENTATION

FIGURE 14 INCREASED APPLICATIONS IN THE AUTOMOBILE INDUSTRY ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET IN THE FORECAST PERIOD

FIGURE 15 DIBENZAMIDO DIPHENYL DISULPHIDE (DBD) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN ANALYSIS – MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 17 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET

FIGURE 19 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY PRODUCT, 2022

FIGURE 20 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY END-USE, 2022

FIGURE 22 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: SNAPSHOT (2022)

FIGURE 23 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022)

FIGURE 24 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: BY PRODUCT (2023-2030)

FIGURE 27 MIDDLE EAST & AFRICA RUBBER PEPTIZERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.