Marché des rameurs au Moyen-Orient et en Afrique, par type (air, eau, magnétique et hydraulique), type de corps (métal et bois massif), capacité de poids (300 à 499 livres, 200 à 249 livres, 100 à 199 livres et moins de 100 livres), canal de distribution (en ligne et hors ligne), niveau de résistance (moins de 24 et plus de 24), couleur (noir, gris clair et autres), utilisateur final (commercial et résidentiel) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des rameurs au Moyen-Orient et en Afrique

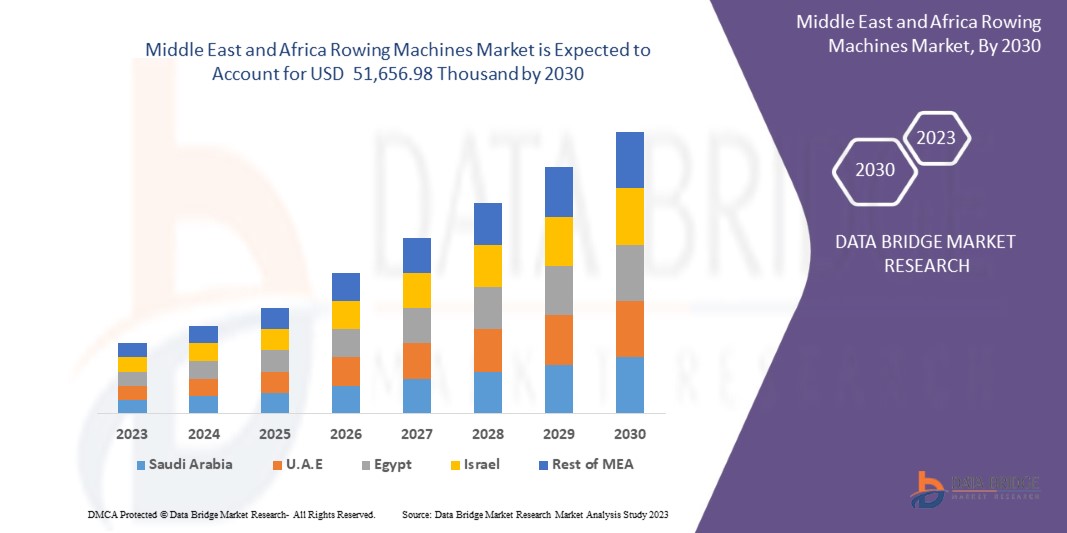

Le marché des rameurs au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,8% au cours de la période de prévision de 2023 à 2030 et devrait atteindre 51 656,98 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché est la popularité croissante des produits de rameurs parmi les milléniaux et la sensibilisation croissante aux propriétés des produits de rameurs.

Un rameur, parfois appelé rameur, simule les mouvements de l'aviron et est excellent pour un entraînement complet du corps. La forme aérobique augmentera avec un entraînement cardiovasculaire à faible impact sur un rameur. De plus, il tonifie et renforce tous les muscles du corps. De nombreuses salles de sport disposent de rameurs faciles à utiliser. Un rameur est une option d'exercice flexible car il est plus facile à transporter qu'un tapis roulant ou un vélo elliptique.

Le rapport sur le marché des rameurs au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par type (air, eau, magnétique et hydraulique), type de corps (métal et bois massif), capacité de poids (300 à 499 livres, 200 à 249 livres, 100 à 199 livres et moins de 100 livres), canal de distribution (en ligne et hors ligne), niveau de résistance (moins de 24 et plus de 24), couleur (noir, gris clair et autres), utilisateur final (commercial et résidentiel) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français BODYCRAFT, Johnson Health Tech, Nautilus, Inc., Mr Captain Brand, Stamina Products, Inc., Sunny Health and Fitness, iFIT Inc., York Fitness UK, Infiniti, Concept2 inc., WaterRower, RP3 Rowing, Peloton Interactive, Inc., ERGATTA, AVIRON INTERACTIVE INC., TECHNOGYM SpA, Hydrow, Oartec, Decathlon, Intense Enterprises, HAMMER Sport AG, Tunturi New Fitness, adidas AG., Cosco (India) Limited, Life Fitness, Pure Design Fitness, TOPIOM, Modcon Industries Private Limited, Shandong DHZ Fitness Equipment Co., Ltd, KAYA, SHUA et SHANDONG BAODELONG FITNESS CO., LTD, entre autres. |

Définition du marché

Les rameurs, également appelés ergomètres ou ergomètres, sollicitent le haut et le bas du corps à chaque mouvement. Un rameur d'intérieur ou un rameur est une machine utilisée pour stimuler l'action de l'aviron dans le but de faire de l'exercice ou de s'entraîner à l'aviron. Cela permet de renforcer, de tonifier les muscles et d'améliorer l'endurance. L'aviron est considéré comme un entraînement complet du corps.

Dynamique du marché des rameurs au Moyen-Orient et en Afrique

CONDUCTEURS

Sensibilisation croissante à la gestion du poids chez les Millennials

- Ces derniers temps, la génération Y est de plus en plus encline à l’obésité. Selon une estimation de Cancer Research UK, sept millennials sur dix nés entre 1981 et 1996 sont sur le point de devenir obèses ou en surpoids jusqu’à ce qu’ils atteignent l’âge mûr. Plusieurs facteurs, tels que la consommation d’aliments hautement transformés, un mode de vie rapide, une alimentation sous l’effet du stress et un mode de vie sédentaire, sont attribués à l’obésité chez les millennials. Cependant, en raison de différents facteurs, on constate une prise de conscience accrue de la gestion du poids chez les individus. À l’ère du numérique, les millennials sont connectés à un large éventail d’informations disponibles sur les médias sociaux et sur Internet. La population est exposée à diverses études par le biais d’articles de presse et d’autres sources liées à la gestion du poids et à son importance pour le bien-être mental et physique. En outre, les entreprises impliquées dans l’industrie du fitness, les entreprises, les professionnels de la santé et le gouvernement s’efforcent de sensibiliser la population jeune aux avantages de la forme physique pour éviter des maladies telles que le diabète, le cancer et les maladies cardiaques.

Augmentation des dépenses consacrées au sport professionnel au Moyen-Orient et en Afrique

- La plupart des pays du monde ont tendance à dépenser de l’argent pour le sport de leurs citoyens. L’aspect le plus important de l’investissement dans le sport professionnel est d’améliorer la santé publique afin de réduire le risque de maladies chroniques telles que les maladies cardiaques et l’obésité, ainsi que d’améliorer la santé mentale. De plus, le développement du sport a le potentiel de contribuer au développement économique de la nation en créant des emplois et en générant des revenus grâce aux événements et au tourisme. En outre, le sport peut améliorer la communication et la compréhension interculturelles. Les pays peuvent promouvoir leur culture et créer des liens avec d’autres nations en organisant des événements sportifs internationaux. Par conséquent, pour promouvoir la culture sportive, le gouvernement et diverses autres organisations dépensent de l’argent dans le sport professionnel.

L'acceptation croissante des équipements de fitness dans le secteur florissant de l'hôtellerie

- Au cours des dernières décennies, le secteur de l’hôtellerie a connu un essor mondial en raison de facteurs tels que l’augmentation du revenu disponible, les progrès technologiques, la facilité d’accès à l’information et la mondialisation. Dans le secteur de l’hôtellerie, les exigences des clients des hôtels et celles des clients des salles de sport coïncident de plus en plus. Les amateurs de fitness qui résident dans des hôtels pour diverses raisons, comme des vacances ou des voyages d’affaires, préfèrent réserver une chambre dans un hôtel qui a accès à des centres de fitness ou à des salles de sport. Les millennials sont de plus en plus conscients de leur condition physique. Ainsi, ils recherchent différentes façons de rester en forme même lorsqu’ils voyagent et séjournent dans des hôtels.

OPPORTUNITÉS

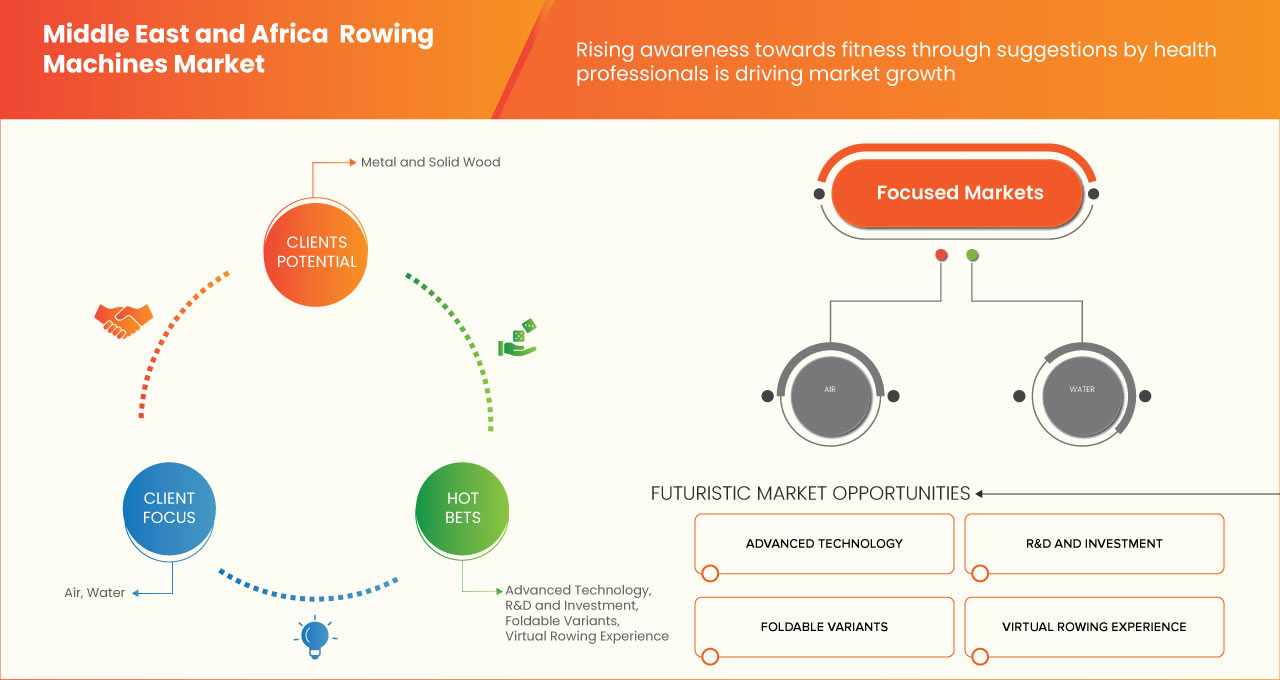

Augmentation des dépenses pour les variantes pliables

- Le marché des rameurs au Moyen-Orient et en Afrique a connu une croissance ces dernières années en raison de divers facteurs tels qu'une sensibilisation accrue à l'activité physique et une augmentation du nombre de salles de sport dédiées. De plus, les fabricants de rameurs ont observé cette tendance et se concentrent sur le développement de nouvelles variantes de rameurs, qui sont de nature pliable. Comme les rameurs classiques gagnaient plus d'espace, il était difficile d'installer la machine avec d'autres instruments dans la salle de sport. Cependant, grâce aux variantes pliables, le problème de l'espace dans la salle de sport est résolu. Lorsqu'elles ne sont pas utilisées, les machines peuvent être pliées et rangées, ce qui permet de gagner de la place pour d'autres activités. De plus, les rameurs verticaux sur pied sont présents sur le marché et attirent les clients.

Intégration croissante d'autres fonctionnalités, à savoir le divertissement et l'expérience d'aviron virtuelle

- L'industrie du fitness innove constamment, alimentée par les développements numériques et l'engagement sur les réseaux sociaux. Les technologies, notamment la réalité virtuelle et augmentée, la blockchain, l'intelligence artificielle , l'Internet des objets, la robotique, le cloud, l'analyse de données, la technologie portable et bien d'autres, prennent une importance croissante. Les fabricants de rameurs intègrent un large éventail d'avancées technologiques dans les rameurs pour offrir une expérience conviviale aux clients.

RESTRICTIONS/DÉFIS

Prix élevés associés aux rameurs

- Les rameurs sont des équipements de fitness bien connus qui sont utilisés pour les entraînements complets du corps. En effectuant des exercices sur des rameurs, on peut entraîner une majorité de muscles, garder le cœur fort et aider à perdre du poids. Cependant, le prix élevé est l'un des principaux inconvénients liés aux rameurs. La majorité du prix est liée au coût de production de l'équipement. Diverses matières premières telles que l'acier, le fer, le caoutchouc et le cuir sont nécessaires à la fabrication d'équipements de fitness tels que les rameurs. Les prix de l'acier sont de nature volatile et sont affectés par l'offre et la demande ou les situations géopolitiques qui se produisent dans le monde. De plus, les prix du charbon à coke, qui est une matière première essentielle pour la fabrication de l'acier, sont de nature volatile. Le manque de matières premières dû à une demande accrue a entraîné une augmentation du coût des rameurs. Les rameurs ne sont pas populaires par rapport à d'autres équipements de fitness, tels que les vélos et les tapis de course, ce qui fait grimper le coût des rameurs. De plus, le coût des rameurs augmente en raison des coûts logistiques élevés. Les coûts de fret sont élevés en raison de la volatilité du prix du pétrole brut et de la pénurie de conteneurs, ce qui contribue au coût élevé de la logistique.

Disponibilité d'autres équipements de fitness et d'exercices divers

- Bien que les rameurs présentent divers avantages, ils présentent également quelques inconvénients. Ils nécessitent une grande surface en raison du volant d'inertie ou du réservoir, des rails et de la nécessité d'un espace suffisant pour une extension complète des bras et des jambes. Il peut être difficile d'intégrer la machine dans une maison ou un appartement plus compact. De plus, si la forme appropriée n'est pas maintenue, le rameur peut provoquer des blessures ou des maux de dos. Le bruit généré par les rameurs peut être insupportable pour certaines personnes, ce qui s'avère être l'un des inconvénients des rameurs.

Développement récent

- En septembre 2021, Nautilus, Inc. a annoncé la signature d'un accord formel pour acquérir VAY, un leader de la technologie du mouvement au Moyen-Orient et en Afrique. Cet achat permettra à Nautilus de développer sa plateforme numérique JRNY en proposant des technologies de base qui alimenteront la vision de l'entreprise et ses capacités de suivi des mouvements, ce qui permettra une analyse des données en temps réel pendant les séances d'entraînement. Ces fonctionnalités seront intégrées à la plateforme JRNY de Nautilus pour développer et accélérer des séances d'exercices individuels hautement personnalisées

Portée du marché des rameurs au Moyen-Orient et en Afrique

Le marché des rameurs du Moyen-Orient et de l'Afrique est segmenté en sept segments notables en fonction du type, du type de corps, de la capacité de poids, du canal de distribution, du niveau de résistance, de la couleur et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Air

- Eau

- Magnétique

- Hydraulique

Sur la base du type, le marché est segmenté en air, eau, magnétique et hydraulique.

Type de corps

- Métal

- Bois massif

En fonction du type de carrosserie, le marché est segmenté en métal et en bois massif.

Capacité de poids

- 300 à 499 livres

- 200 à 249 livres

- 100 à 199 livres

- Moins de 100 livres

Sur la base de la capacité de poids, le marché est segmenté en 300 à 499 livres, 200 à 249 livres, 100 à 199 livres et moins de 100 livres.

Canal de distribution

- En ligne

- Hors ligne

Sur la base du canal de distribution, le marché est segmenté en en ligne et hors ligne.

Niveau de résistance

- Moins de 24

- Plus de 24

Sur la base du niveau de résistance, le marché est segmenté en moins de 24 et plus de 24.

Couleur

- Noir

- Gris clair

- Autres

Sur la base de la couleur, le marché est segmenté en noir, gris clair et autres.

Utilisateur final

- Commercial

- Résidentiel

Sur la base de l’utilisateur final, le marché est segmenté en commercial et résidentiel.

Analyse/perspectives régionales du marché des rameurs au Moyen-Orient et en Afrique

Le marché des rameurs du Moyen-Orient et de l’Afrique est segmenté en sept segments notables en fonction du type, du type de corps, de la capacité de poids, du canal de distribution, du niveau de résistance, de la couleur et de l’utilisateur final.

Les pays du marché des rameurs du Moyen-Orient et de l’Afrique sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud domine le marché des rameurs au Moyen-Orient et en Afrique en termes de part de marché et de revenus du marché en raison de la popularité croissante des rameurs parmi les milléniaux de la région.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des rameurs au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des rameurs au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Français Certains des principaux participants opérant sur le marché des rameurs au Moyen-Orient et en Afrique sont BODYCRAFT, Johnson Health Tech, Nautilus, Inc., Mr Captain Brand, Stamina Products, Inc., Sunny Health and Fitness, iFIT Inc., York Fitness UK, Infiniti, Concept2 inc., WaterRower, RP3 Rowing, Peloton Interactive, Inc., ERGATTA, AVIRON INTERACTIVE INC., TECHNOGYM SpA, Hydrow, Oartec, Decathlon, Intense Enterprises, HAMMER Sport AG, Tunturi New Fitness, adidas AG., Cosco (India) Limited, Life Fitness, Pure Design Fitness, TOPIOM, Modcon Industries Private Limited, Shandong DHZ Fitness Equipment Co., Ltd, KAYA, SHUA et SHANDONG BAODELONG FITNESS CO., LTD entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS TOWARDS WEIGHT MANAGEMENT AMONG MILLENNIALS

5.1.2 INCREASING SPENDING ON PROFESSIONAL SPORTS ON A MIDDLE EAST & AFRICA LEVEL

5.1.3 RISING PREFERENCE FOR AT-HOME FITNESS

5.1.4 GROWING ACCEPTANCE OF FITNESS EQUIPMENT IN THE FLOURISHING HOSPITALITY SECTOR

5.1.5 RISING AWARENESS TOWARDS FITNESS THROUGH SUGGESTIONS BY HEALTH PROFESSIONALS

5.2 RESTRAINTS

5.2.1 HIGH PRICES ASSOCIATED WITH ROWING MACHINES

5.2.2 AVAILABILITY OF OTHER FITNESS EQUIPMENT AND VARIOUS EXERCISES

5.3 OPPORTUNITIES

5.3.1 RISING SPENDING ON FOLDABLE VARIANTS

5.3.2 INCREASING INCORPORATION OF OTHER FEATURES, NAMELY ENTERTAINMENT AND VIRTUAL ROWING EXPERIENCE

5.4 CHALLENGES

5.4.1 A LARGE AMOUNT OF SPACE REQUIREMENT

5.4.2 SAFETY CONCERNS ASSOCIATED WITH THE USE OF ROWING MACHINES

6 MIDDLE EAST & AFRICA ROWING MACHINES MARKET, BY REGION

6.1 MIDDLE EAST AND AFRICA

6.1.1 SOUTH AFRICA

6.1.2 SAUDI ARABIA

6.1.3 UNITED ARAB EMIRATES

6.1.4 EGYPT

6.1.5 ISRAEL

6.1.6 REST OF MIDDLE EAST AND AFRICA

7 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

7.2 PARTNERSHIP

7.3 ACQUISITION

7.4 PRODUCT LAUNCH

7.5 REVIEW

7.6 AWARD

7.7 EXHIBITION

7.8 EVENT

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 PELOTON INTERACTIVE, INC.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 RECENT DEVELOPMENT

9.2 JOHNSON HEALTH TECH.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENTS

9.3 LIFE FITNESS.

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 IFIT INC.

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 HYDROW

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENT

9.6 ADIDAS AG.

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 AVIRON INTERACTIVE INC,

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENT

9.8 BODYCRAFT®

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENT

9.9 CONCEPT2 INC.

9.9.1 COMPANY SNAPSHOT

9.9.2 PRODUCT PORTFOLIO

9.9.3 RECENT DEVELOPMENT

9.1 COSCO (INDIA) LIMITED

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 DECATHLON

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 ERGATTA

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 RECENT DEVELOPMENT

9.13 HAMMER SPORT AG

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 INFINITI

9.14.1 COMPANY SNAPSHOT

9.14.2 PRODUCT PORTFOLIO

9.14.3 RECENT DEVELOPMENT

9.15 INTENSE ENTERPRISES

9.15.1 COMPANY SNAPSHOT

9.15.2 PRODUCT PORTFOLIO

9.15.3 RECENT DEVELOPMENT

9.16 KAYA

9.16.1 COMPANY SNAPSHOT

9.16.2 PRODUCT PORTFOLIO

9.16.3 RECENT DEVELOPMENT

9.17 MODCON INDUSTRIES PRIVATE LIMITED.

9.17.1 COMPANY SNAPSHOT

9.17.2 PRODUCT PORTFOLIO

9.17.3 RECENT DEVELOPMENT

9.18 MR CAPTAIN BRAND

9.18.1 COMPANY SNAPSHOT

9.18.2 PRODUCT PORTFOLIO

9.18.3 RECENT DEVELOPMENT

9.19 NAUTILUS, INC.

9.19.1 COMPANY SNAPSHOT

9.19.2 REVENUE ANALYSIS

9.19.3 PRODUCT PORTFOLIO

9.19.4 RECENT DEVELOPMENTS

9.2 OARTEC

9.20.1 COMPANY SNAPSHOT

9.20.2 PRODUCT PORTFOLIO

9.20.3 RECENT DEVELOPMENT

9.21 PURE DESIGN FITNESS

9.21.1 COMPANY SNAPSHOT

9.21.2 PRODUCT PORTFOLIO

9.21.3 RECENT DEVELOPMENT

9.22 RP3 ROWING

9.22.1 COMPANY SNAPSHOT

9.22.2 PRODUCT PORTFOLIO

9.22.3 RECENT DEVELOPMENT

9.23 STAMINA PRODUCTS, INC.

9.23.1 COMPANY SNAPSHOT

9.23.2 PRODUCT PORTFOLIO

9.23.3 RECENT DEVELOPMENT

9.24 SHANDONG BAODELONG FITNESS CO., LTD

9.24.1 COMPANY SNAPSHOT

9.24.2 PRODUCT PORTFOLIO

9.24.3 RECENT DEVELOPMENT

9.25 SHANDONG DHZ FITNESS EQUIPMENT CO., LTD

9.25.1 COMPANY SNAPSHOT

9.25.2 PRODUCT PORTFOLIO

9.25.3 RECENT DEVELOPMENTS

9.26 SHUA

9.26.1 COMPANY SNAPSHOT

9.26.2 PRODUCT PORTFOLIO

9.26.3 RECENT DEVELOPMENTS

9.27 SUNNY HEALTH AND FITNESS

9.27.1 COMPANY SNAPSHOT

9.27.2 PRODUCT PORTFOLIO

9.27.3 RECENT DEVELOPMENT

9.28 TECHNOGYM S.P.A

9.28.1 COMPANY SNAPSHOT

9.28.2 REVENUE ANALYSIS

9.28.3 PRODUCT PORTFOLIO

9.28.4 RECENT DEVELOPMENT

9.29 TOPIOM

9.29.1 COMPANY SNAPSHOT

9.29.2 PRODUCT PORTFOLIO

9.29.3 RECENT DEVELOPMENT

9.3 TUNTURI NEW FITNESS

9.30.1 COMPANY SNAPSHOT

9.30.2 PRODUCT PORTFOLIO

9.30.3 RECENT DEVELOPMENT

9.31 WATERROWER

9.31.1 COMPANY SNAPSHOT

9.31.2 PRODUCT PORTFOLIO

9.31.3 RECENT DEVELOPMENT

9.32 YORK FITNESS UK

9.32.1 COMPANY SNAPSHOT

9.32.2 PRODUCT PORTFOLIO

9.32.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY COUNTRY, 2018-2030 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 10 SOUTH AFRICA ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 11 SOUTH AFRICA ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 12 SOUTH AFRICA ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 13 SOUTH AFRICA ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 14 SOUTH AFRICA ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 15 SOUTH AFRICA ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 16 SOUTH AFRICA ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 17 SOUTH AFRICA COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 18 SAUDI ARABIA ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 26 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 27 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 28 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 34 EGYPT ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 35 EGYPT ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 36 EGYPT ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 37 EGYPT ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 38 EGYPT ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 39 EGYPT ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 40 EGYPT ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 41 EGYPT COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 42 ISRAEL ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 43 ISRAEL ROWING MACHINES MARKET, BY BODY TYPE, 2018-2030 (USD THOUSAND)

TABLE 44 ISRAEL ROWING MACHINES MARKET, BY WEIGHT CAPACITY, 2018-2030 (USD THOUSAND)

TABLE 45 ISRAEL ROWING MACHINES MARKET, BY DISTRIBUTION CHANNEL, 2018-2030 (USD THOUSAND)

TABLE 46 ISRAEL ROWING MACHINES MARKET, BY RESISTANT LEVEL, 2018-2030 (USD THOUSAND)

TABLE 47 ISRAEL ROWING MACHINES MARKET, BY COLOR, 2018-2030 (USD THOUSAND)

TABLE 48 ISRAEL ROWING MACHINES MARKET, BY END-USER, 2018-2030 (USD THOUSAND)

TABLE 49 ISRAEL COMMERCIAL IN ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

TABLE 50 REST OF MIDDLE EAST AND AFRICA ROWING MACHINES MARKET, BY TYPE, 2018-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ROWING MACHINES MARKET

FIGURE 2 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: SEGMENTATION

FIGURE 13 RISING AWARENESS TOWARDS WEIGHT MANAGEMENT AMONG MILLENNIALS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ROWING MACHINES MARKET IN THE FORECAST PERIOD

FIGURE 14 THE AIR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ROWING MACHINES MARKET IN 2023 AND 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ROWING MACHINES MARKET

FIGURE 16 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET: SNAPSHOT (2022)

FIGURE 17 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET: BY COUNTRY (2022)

FIGURE 18 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 19 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 20 MIDDLE EAST AND AFRICA ROWING MACHINES MARKET: BY TYPE (2023 - 2030)

FIGURE 21 MIDDLE EAST & AFRICA ROWING MACHINES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.