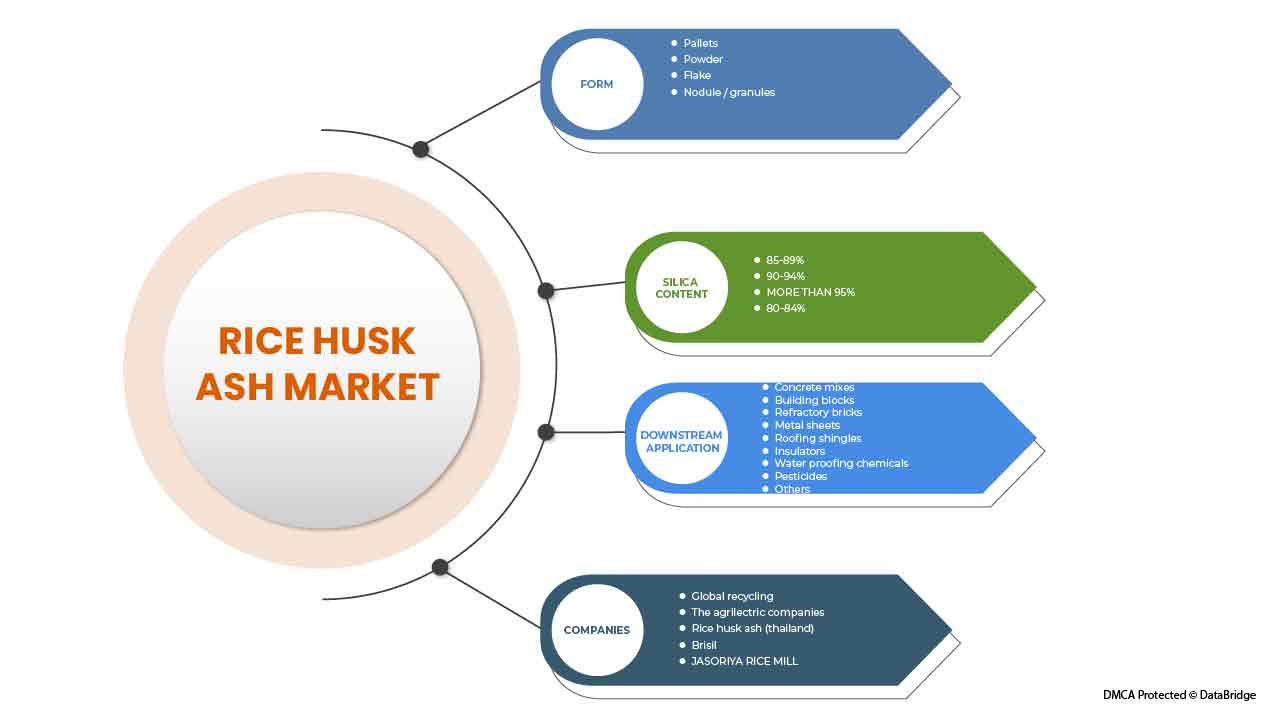

Marché des cendres de balle de riz au Moyen-Orient et en Afrique, par forme (palettes, poudre, flocons, nodules/granulés), teneur en silicium (80-84 %, 85-89 %, 90-94 %, plus de 95 %), application en aval (mélanges de béton, blocs de construction, briques réfractaires, tôles, bardeaux de toiture, isolants, produits chimiques d'imperméabilisation, pesticides , autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché

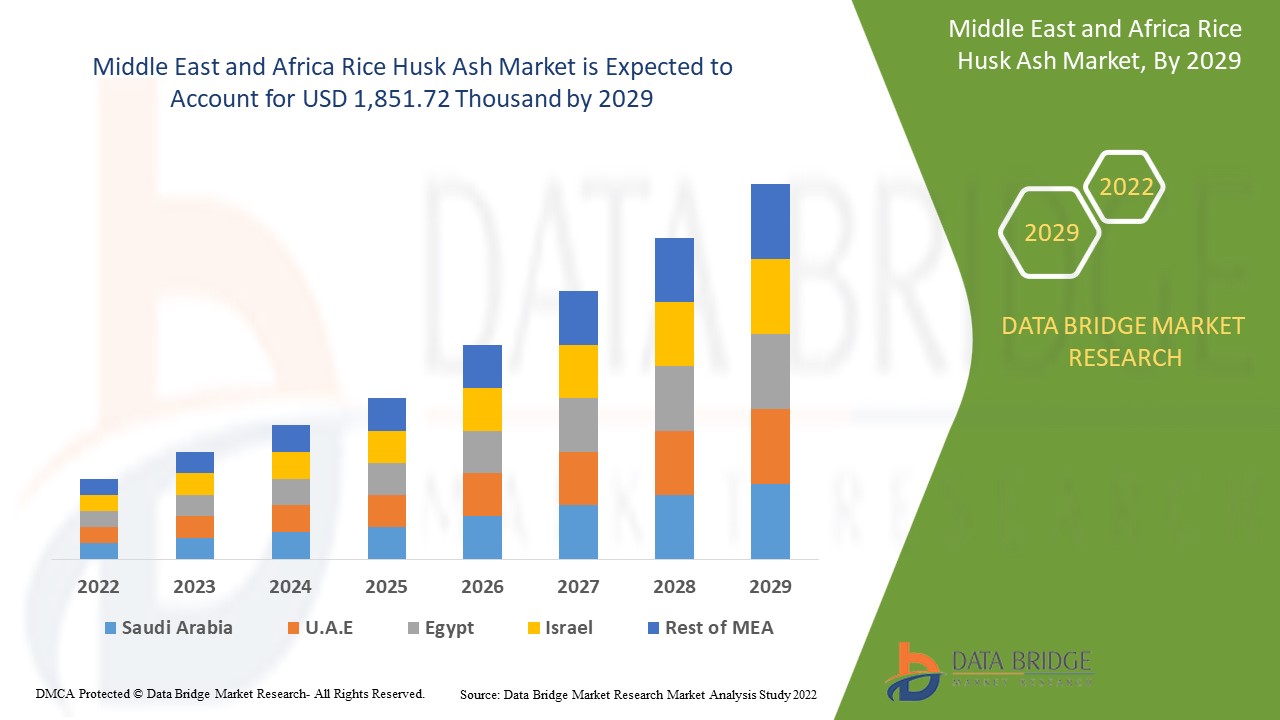

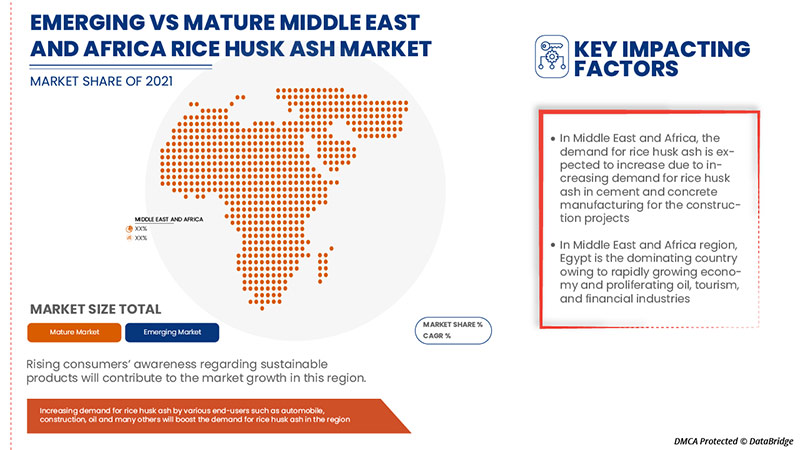

Le marché des cendres de balle de riz au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,0 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 1 851,72 milliers de dollars d'ici 2029.

Le principal facteur à l’origine de la croissance du marché des cendres de balle de riz au Moyen-Orient et en Afrique est la vaste gamme de produits dans l’industrie de la construction en raison de sa teneur élevée en silice.

La large gamme de produits dans le secteur de la construction en raison de la teneur élevée en silice devrait stimuler le marché des cendres de balle de riz au Moyen-Orient et en Afrique. La sensibilisation croissante aux avantages techniques de l'utilisation de la cendre de balle de riz devrait propulser la croissance du marché des cendres de balle de riz au Moyen-Orient et en Afrique.

Les principales contraintes susceptibles d’avoir un impact négatif sur le marché des cendres de balle de riz au Moyen-Orient et en Afrique sont les problèmes liés au rapport eau/ciment lié à l’utilisation de cendres de balle de riz et à la forte portée du marché des substituts.

En raison du respect des normes réglementaires environnementales et des coûts inférieurs des matières premières et des coûts de fabrication, la demande croissante devrait offrir des opportunités sur le marché des cendres de balle de riz au Moyen-Orient et en Afrique.

Cependant, les problèmes d’élimination liés aux cendres de balle de riz et la forte dépendance à l’égard de la production de rizières devraient remettre en cause la croissance du marché des cendres de balle de riz au Moyen-Orient et en Afrique.

Le rapport sur le marché des cendres de balle de riz au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en kilotonnes, prix en dollars américains |

|

Segments couverts |

Par forme (palettes, poudre, flocons, nodules/granulés), teneur en silicium (80-84 %, 85-89 %, 90-94 %, plus de 95 %), application en aval ( mélanges de béton , blocs de construction, briques réfractaires, tôles, bardeaux de toiture, isolants, produits chimiques d'imperméabilisation , pesticides, autres) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

PIONEER Carbon, entre autres |

Définition du marché

La cendre de balle de riz est un sous-produit naturel récupéré des rizières après décorticage du riz. L'enveloppe de la balle de riz est généralement composée de 30 % de lignine, de 20 % de silice et de 50 % de cellulose. Si elle est incinérée par décomposition thermique contrôlée, elle transforme le résidu en cendres.

La cendre de balle de riz est produite après une combustion contrôlée de la balle de riz et possède une propriété pouzzolanique et une réactivité élevées. Elle est considérée comme un matériau de cimentation approprié dans l'industrie de la construction, soit comme substitut du ciment, soit comme adjuvant. En tant qu'adjuvant, la cendre de balle de riz produit du béton à haute résistance, tandis que le remplacement du ciment par de la cendre de balle de riz produit des blocs de construction à faible coût. La cendre de balle de riz est utilisée pour produire des matériaux de construction légers car l'ajout de RHA rend le béton plus léger.

Dynamique du marché des cendres de balles de riz au Moyen-Orient et en Afrique

Conducteurs

- Large gamme de produits dans le secteur de la construction en raison de la teneur élevée en silice

L'utilisation de la cendre de balle de riz est de plus en plus répandue dans le secteur du bâtiment et de la construction, car elle est largement utilisée comme pouzzolane, charge, additif, agent abrasif, adsorbant d'huile, composant de balayage et agent de suspension pour les émaux de porcelaine. Dans l'industrie du ciment, la cendre de balle de riz est utilisée pour sa silice amorphe dans la fabrication du béton. Elle est utilisée pour remplacer le ciment Portland ordinaire (OPC), un composant de béton très coûteux et majeur. L'utilisation de la cendre de balle de riz permet de produire des blocs de construction à faible coût. Les blocs de construction à faible coût sont très appréciés dans de nombreux pays sous-développés et en développement tels que le Kenya, le Nigéria et l'Indonésie, entre autres.

Ainsi, l’utilisation croissante de cendres de balles de riz dans l’industrie de la construction pour fabriquer du béton et des produits en béton et d’autres produits utilisés, tels que les sols de salle de bain, devrait stimuler le marché des cendres de balles de riz au Moyen-Orient et en Afrique.

- Sensibilisation accrue aux avantages techniques de la cendre de balle de riz

L'utilisation principale des cendres de balle de riz se situe dans l'industrie du bâtiment et de la construction en tant que matériau cimentaire supplémentaire (SCM) dans le ciment mélangé, car les cendres de balle de riz sont ajoutées au ciment Portland pour améliorer certains aspects des performances du mélange obtenu.

En outre, le mélange de béton à base de cendre de balle de riz offre une résistance supérieure à la pénétration des ions chlorure dans le milieu marin. Par conséquent, l'application de ces mélanges de béton se développe pour les activités de construction en milieu marin. Outre ces applications, la cendre de balle de riz est utilisée dans d'autres secteurs tels que les bardeaux de toiture, les produits chimiques d'imperméabilisation, les absorbants de déversements d'hydrocarbures , les peintures spéciales, les retardateurs de flamme, les insecticides et les biofertilisants, entre autres, ce qui pourrait à son tour alimenter la croissance du marché de la cendre de balle de riz au Moyen-Orient et en Afrique.

- Croissance de la production de silice de haute qualité

L'utilisation croissante de la silice de haute qualité obtenue à partir de cendres de balle de riz dans les industries du bâtiment et de la construction, de l'acier, de la céramique et des réfractaires, entre autres, donne des perspectives positives sur la croissance du marché. L'augmentation de la préférence pour la cendre de balle de riz au lieu de la fumée de silice et des cendres volantes dans l'industrie du ciment et de la construction influencera le marché. En plus des avantages environnementaux et économiques, les méthodes à faible consommation d'énergie et plus simples pour obtenir de la silice pure devraient stimuler le marché tout en créant de nouvelles opportunités pour développer de nouvelles applications industrielles de la cendre de balle de riz.

Opportunités

- Demande croissante en raison du respect des normes réglementaires environnementales

La balle de riz est un déchet organique produit en grande quantité. C'est un sous-produit majeur de l'industrie de la rizerie et de la biomasse agricole. Par conséquent, l'utilisation de cendres de balle de riz par d'autres industries contribue à réduire les déchets, et la cendre de balle de riz est utilisée comme additif dans de nombreux matériaux et applications, tels que les briques réfractaires, la fabrication d'isolants et les matériaux pour les retardateurs de flamme. En outre, la cendre de balle de riz gagne en popularité et obtient l'approbation des organismes de réglementation en raison de ses effets favorables sur le sol en termes de correction de l'acidité. Par conséquent, l'adhésion à la cendre de balle de riz à diverses autres fins devrait offrir des opportunités lucratives de croissance sur le marché de la cendre de balle de riz au Moyen-Orient et en Afrique.

- Utilisation croissante des cendres de balle de riz pour produire des pneus en caoutchouc

L'utilisation de la silice extraite des cendres de balle de riz présente également d'autres avantages. L'énergie consommée pour extraire la silice de la source traditionnelle, comme le sable, est beaucoup plus élevée. Il faut la chauffer à 1 400 degrés Celsius pour extraire la silice du sable. En comparaison, la température requise pour extraire la silice des cendres de balle de riz n'est que de 100 degrés Celsius. De plus, la silice extraite des cendres de balle de riz confère à la bande de roulement une résistance et une rigidité bien meilleures et offre une résistance au roulement plus faible. Cela devrait offrir une opportunité de croissance au marché des cendres de balle de riz au Moyen-Orient et en Afrique.

Contraintes/Défis

- Problèmes liés au rapport eau/ciment en utilisant des cendres de balles de riz

La cendre de balle de riz améliore les propriétés du béton lorsqu'elle est utilisée en quantité spécifique, mais à mesure que la quantité de cendre de balle de riz augmente, la résistance du ciment et du béton a tendance à diminuer car la cendre de balle de riz est plus fine que le ciment et nécessite une plus grande quantité d'eau pour se déposer. Cela a un impact considérable sur la résistance, ce qui devrait limiter l'utilisation de la cendre de balle de riz sur le marché de la cendre de balle de riz au Moyen-Orient et en Afrique

- Forte présence sur le marché des substituts

La production de silice à partir de la cendre de balle de riz ne suffit pas à répondre aux besoins en silice. Les méthodes conventionnelles de production de silice sont toujours privilégiées et utilisées pour répondre aux besoins croissants en matières premières dans diverses industries. De plus, la combustion de la balle de riz pour produire de la cendre de balle de riz produit beaucoup de pollution, ce qui affecte sa croissance et limite son utilisation au cours de la période de prévision. Cela s'intensifiera et renforcera le marché des substituts.

- Problèmes d'élimination associés aux cendres de balles de riz

L'adoption de technologies de pointe pour traiter les déchets tels que les cendres de balle de riz et l'eau, tandis que certains rizeries utilisent également les cendres de balle pour une bonne utilisation écologique comme le rajeunissement des sols et l'augmentation de la fertilité. En outre, pour résoudre ce problème, les cendres de balle de riz sont utilisées dans différentes applications pour une élimination sûre. Plusieurs moyens sont envisagés pour éliminer les cendres de balle de riz en rendant leur utilisation commerciale plus faisable et plus efficace. Cependant, l'élimination inappropriée des cendres de balle de riz et le manque d'installations dans diverses rizeries constituent un sérieux défi qui pourrait entraver la croissance du marché au cours de la période de prévision .

- Forte dépendance à la production de riz paddy

Le pourcentage de production de cendres de balle de riz dépend également du taux de mouture du riz et du type de riz disponible. De plus, le riz est une culture kharif ou d'hiver et ne pousse qu'à une période précise de l'année, pendant les hivers. Par conséquent, il peut ne pas être disponible en grandes quantités tout au long de l'année, ce qui peut affecter la disponibilité des cendres de balle de riz pour d'autres applications dans d'autres industries telles que l'industrie du ciment, l'industrie de la production de silice, l'industrie du pneu, et bien d'autres. À cela s'ajoute un autre problème : la part de l'Asie dans la production mondiale de paddy est supérieure à 90 %. Le riz paddy est une céréale vivrière primaire dans de nombreux pays asiatiques tels que l'Inde et la Chine. En 2018, l'Inde ne représentait qu'environ 21 % de la production mondiale de riz. Par conséquent, il devient difficile pour les autres parties d'avoir un bon accès aux ressources, y compris la matière première et les produits finis. Par conséquent, la présence géographique limitée et la dépendance totale à l'égard des balles de riz dans le riz paddy constituent un défi sérieux que le marché des cendres de balles de riz du Moyen-Orient et de l'Afrique doit surmonter pour enregistrer une croissance significative au cours de la période de prévision.

Le COVID-19 a eu un impact minime sur le marché des cendres de balles de riz au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur les cendres de balle de riz dans les opérations mondiales et la chaîne d'approvisionnement, plusieurs installations de fabrication étant toujours en activité. Les prestataires de services ont continué à proposer des cendres de balle de riz en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

Développement récent

- Les installations de production de PIONEER Carbon ont été entièrement certifiées ISO 14001 et BS OHSAS 1800. Ces certifications garantissent les protocoles de contrôle de qualité rigoureux de l'entreprise pour ses produits et son adhésion aux systèmes de gestion environnementale

Portée du marché des cendres de balles de riz au Moyen-Orient et en Afrique

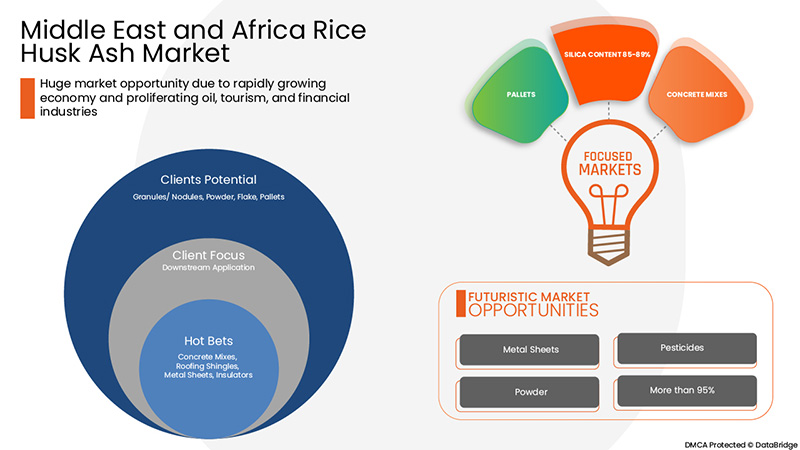

Le marché des cendres de balle de riz au Moyen-Orient et en Afrique est classé en fonction de la forme, de la teneur en silicium et de l'application en aval. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Formulaire

- Granules/Nodules

- Palettes

- Flocon

- Poudre

Sur la base de la forme, le marché des cendres de balle de riz du Moyen-Orient et de l'Afrique est classé en granulés/nodules, palettes, flocons et poudre.

Teneur en silicium

- 80-84%

- 85-89%

- 90-94%,

- Plus de 95%

Sur la base de la teneur en silice, le marché des cendres de balle de riz du Moyen-Orient et de l'Afrique est classé en 80-84 %, 85-89 %, 90-94 % et plus de 95 %.

Application en aval

- Mélanges de béton

- Bardeaux de toiture

- Blocs de construction

- Briques réfractaires

- Feuilles de métal

- Isolateurs

- Produits chimiques d'imperméabilisation

- Pesticides

- Autres

Sur la base des applications en aval, le marché des cendres de balle de riz du Moyen-Orient et de l'Afrique est classé en mélanges de béton, bardeaux de toiture, blocs de construction, briques réfractaires, tôles, isolants, produits chimiques d'imperméabilisation, pesticides et autres.

Analyse et perspectives régionales des cendres de balles de riz au Moyen-Orient et en Afrique

Le marché des cendres de balle de riz au Moyen-Orient et en Afrique est classé en fonction du pays, de la forme, de la teneur en silicium et de l’application en aval.

Le marché des cendres de balle de riz du Moyen-Orient et de l'Afrique est segmenté en Afrique du Sud, en Égypte, en Arabie saoudite, aux Émirats arabes unis, en Israël et dans le reste du Moyen-Orient et de l'Afrique. L'Égypte devrait dominer le marché des cendres de balle de riz du Moyen-Orient et de l'Afrique en raison de sa vaste gamme de produits dans le secteur de la construction en raison de sa teneur élevée en silice.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cendres de balles de riz au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des cendres de balle de riz au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des cendres de balle de riz au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des cendres de balles de riz au Moyen-Orient et en Afrique sont PIONEER Carbon, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse mondiale contre régionale et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA RICE HUSK ASH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 FORM LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET DOWNSTREAM APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT’S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 MIDDLE EAST & AFRICA IMPORT EXPORT SCENARIO

4.3 LIST OF KEY BUYERS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.6 PRODUCTION CONSUMPTION ANALYSIS- MIDDLE EAST & AFRICA RICE HUSK ASH MARKET

4.6.1 RICE HUSK ASH PRODUCTION BY INCINERATION OF RICE HUSK

4.7 RAW MATERIAL PRODUCTION COVERAGE – MIDDLE EAST & AFRICA RICE HUSK ASH MARKET

RICE PADDY/RICE HUSK 59

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKAGING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATORY COVERAGE

4.11.1 INDIA’S CENTRAL POLLUTION CONTROL BOARD

4.11.2 EUROPEAN COMMISSION (EC)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EXTENSIVE PRODUCT SCOPE IN THE CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT

5.1.2 RISING AWARENESS ABOUT THE TECHNICAL BENEFITS OF RICE HUSK ASH

5.1.3 GROWTH IN PRODUCTION OF HIGH-QUALITY SILICA

5.2 RESTRAINTS

5.2.1 PROBLEMS ASSOCIATED WITH WATER/CEMENT RATIO BY USING RICE HUSK ASH

5.2.2 STRONG MARKET REACH OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND OWING TO ADHERENCE TO ENVIRONMENTAL REGULATORY NORMS

5.3.2 INCREASING USE OF RICE HUSK ASH TO PRODUCE RUBBER TIRES

5.3.3 ABUNDANT AVAILABILITY OF RICE HUSK ASH

5.4 CHALLENGES

5.4.1 DISPOSAL ISSUES ASSOCIATED WITH RICE HUSK ASH

5.4.2 HIGH DEPENDENCY ON THE PRODUCTION OF RICE PADDY

6 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY FORM

6.1 OVERVIEW

6.2 PALLETS

6.3 POWDER

6.4 FLAKE

6.5 NODULE / GRANULES

7 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT

7.1 OVERVIEW

7.2 85-89%

7.3 90-94%

7.4 MORE THAN 95%

7.5 80-84%

8 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION

8.1 OVERVIEW

8.2 CONCRETE MIXES

8.2.1 CONCRETE MIXES, BY TYPE

8.2.1.1 GREEN CONCRETE

8.2.1.2 HIGH PERFORMANCE CONCRETE

8.2.1.3 OTHERS

8.3 BUILDING BLOCKS

8.4 REFRACTORY BRICKS

8.5 METAL SHEETS

8.6 ROOFING SHINGLES

8.7 INSULATORS

8.8 WATER PROOFING CHEMICALS

8.9 PESTICIDES

8.1 OTHERS

9 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY GEOGRAPHY

9.1 MIDDLE EAST AND AFRICA

9.1.1 EGYPT

9.1.2 SAUDI ARABIA

9.1.3 ISRAEL

9.1.4 SOUTH AFRICA

9.1.5 UNITED ARAB EMIRATES

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 MIDDLE EAST & AFRICA RECYCLING

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATE

12.2 THE AGRILECTIC COMPANIES

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 RICE HUSK ASH (THAILAND)

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATE

12.4 JASORIYA RICE MILL

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATE

12.5 BRISIL

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 PIONEER CARBON

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 ASTRRA CHEMICALS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 GURU CORPORATION

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 K V METACHEM

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SLAG AND ASH, INCL. SEAWEED ASH ""KELP"" (EXCLUDING SLAG, INCL. GRANULATED, FROM THE MANUFACTURE; HS CODE – 262190 (USD THOUSAND)

TABLE 3 COMPRESSION STRENGTH OF CONCRETE WITH DIFFERENT PERCENTAGES OF RICE HUSK ASH

TABLE 4 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 6 MIDDLE EAST & AFRICA PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA PALLETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 8 MIDDLE EAST & AFRICA POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA POWDER IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 10 MIDDLE EAST & AFRICA FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA FLAKE IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 12 MIDDLE EAST & AFRICA NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA NODULE / GRANULES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 14 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 16 MIDDLE EAST & AFRICA 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA 85-89% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 18 MIDDLE EAST & AFRICA 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA 90-94% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 20 MIDDLE EAST & AFRICA MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA MORE THAN 95% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 22 MIDDLE EAST & AFRICA 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA 80-84% IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 24 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 26 MIDDLE EAST & AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 28 MIDDLE EAST & AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 30 MIDDLE EAST & AFRICA BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA BUILDING BLOCKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 32 MIDDLE EAST & AFRICA REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA REFRACTORY BRICKS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 34 MIDDLE EAST & AFRICA METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA METAL SHEETS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 36 MIDDLE EAST & AFRICA ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA ROOFING SHINGLES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 38 MIDDLE EAST & AFRICA INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA INSULATORS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 40 MIDDLE EAST & AFRICA WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA WATER PROOFING CHEMICALS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 42 MIDDLE EAST & AFRICA PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA PESTICIDES IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN RICE HUSK ASH MARKET, BY REGION, 2020-2029 (KILO TONNE)

TABLE 46 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY COUNTRY, 2020-2029 (KILO TONNE)

TABLE 48 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 50 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 52 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 54 MIDDLE EAST AND AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 56 EGYPT RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 57 EGYPT RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 58 EGYPT RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 59 EGYPT RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 60 EGYPT RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 EGYPT RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 62 EGYPT CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 EGYPT CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 64 SAUDI ARABIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 66 SAUDI ARABIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 68 SAUDI ARABIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 70 SAUDI ARABIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 72 ISRAEL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 ISRAEL RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 74 ISRAEL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 75 ISRAEL RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 76 ISRAEL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 77 ISRAEL RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 78 ISRAEL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 ISRAEL CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 80 SOUTH AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 82 SOUTH AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 84 SOUTH AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 86 SOUTH AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH AFRICA CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 88 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

TABLE 90 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (USD THOUSAND)

TABLE 91 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY SILICON CONTENT, 2020-2029 (KILO TONNE)

TABLE 92 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 UNITED ARAB EMIRATES RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2020-2029 (KILO TONNE)

TABLE 94 UNITED ARAB EMIRATES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 UNITED ARAB EMIRATES CONCRETE MIXES IN RICE HUSK ASH MARKET, BY TYPE, 2020-2029 (KILO TONNE)

TABLE 96 REST OF MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 REST OF MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET, BY FORM, 2020-2029 (KILO TONNE)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: THE FORM LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA RICE RUSK ASH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: DOWNSTREAM APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 EXTENSIVE PRODUCT SCOPE IN CONSTRUCTION INDUSTRY DUE TO HIGH SILICA CONTENT IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA RICE HUSK ASH MARKET IN THE FORECAST PERIOD

FIGURE 16 PALLETS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA RICE HUSK ASH MARKET IN 2022 & 2029

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS- MIDDLE EAST & AFRICA RICE HUSK ASH MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA RICE HUSK ASH MARKET

FIGURE 20 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY FORM, 2021

FIGURE 21 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY SILICON CONTENT, 2021

FIGURE 22 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET, BY DOWNSTREAM APPLICATION, 2021

FIGURE 23 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA RICE HUSK ASH MARKET: BY FORM (2022 & 2029)

FIGURE 28 MIDDLE EAST & AFRICA RICE HUSK ASH MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.