Marché des outils électriques au Moyen-Orient et en Afrique , par type (outils de sciage et de coupe, outils de perçage et de fixation, outils de démolition, outils de fraisage, grignoteuses portatives, outils pneumatiques, outils d’enlèvement de matière, cordons et prises électriques, accessoires, autres), mode de fonctionnement (électrique, outil à combustible liquide, hydraulique, pneumatique, outils à poudre), application (béton et construction, travail du bois, travail des métaux, soudage, autres), matériau (béton, bois/métal, brique/bloc, verre, autres), utilisateur final (industriel/professionnel, résidentiel), canal de vente (ventes indirectes, ventes directes) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

Différents types d'outils électriques disponibles sur des plateformes avec ou sans fil possédant des capacités de puissance sont largement déployés. La fonctionnalité et la pénétration de l'utilisation pour les travaux à grande échelle ont été améliorées grâce aux mécanismes et aux batteries améliorés .

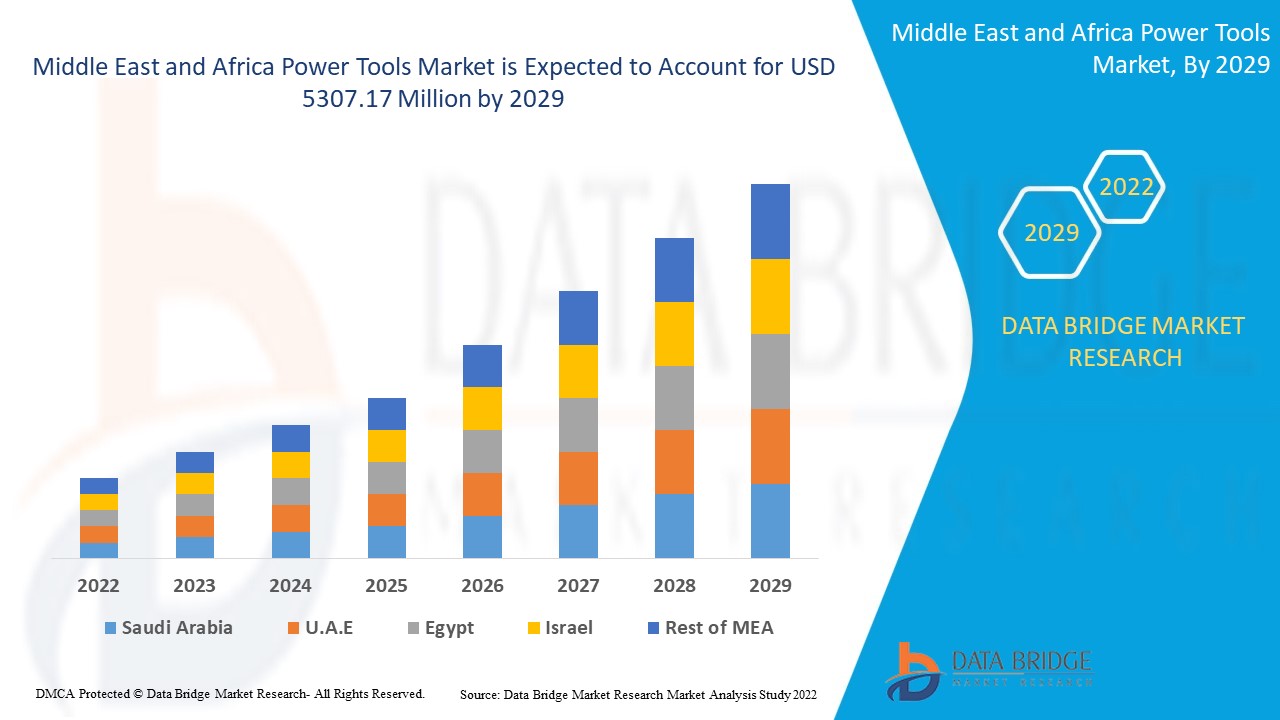

Le marché des outils électriques au Moyen-Orient et en Afrique était évalué à 3 721,31 millions USD en 2021 et devrait atteindre 5 307,17 millions USD d'ici 2029, enregistrant un TCAC de 6,10 % au cours de la période de prévision 2022-2029. Les outils de perçage et de fixation représentent le segment de type le plus important dans l'industrie d'utilisation finale en raison de leur facilité d'utilisation et de leur prix inférieur par rapport aux autres outils électriques . Le rapport de marché élaboré par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse des pilons.

Définition du marché

Le nom même des outils électriques indique clairement qu'ils sont utilisés dans de nombreuses applications industrielles lorsqu'ils sont actionnés par une source d'énergie supplémentaire. Les scies circulaires, les scies sauteuses, les perceuses, les marteaux perforateurs, les ponceuses, les meuleuses, les défonceuses et bien d'autres sont des exemples d'outils électriques. Cependant, s'ils ne sont pas utilisés avec précaution et précaution, les outils électriques peuvent entraîner de nombreux dangers.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type (outils de sciage et de coupe, outils de perçage et de fixation, outils de démolition, outils de fraisage, grignoteuses portatives, outils pneumatiques, outils d'enlèvement de matière, cordons et prises électriques, accessoires, autres), mode de fonctionnement (électrique, outil à combustible liquide, hydraulique, pneumatique, outils à poudre), application (béton et construction, travail du bois, travail des métaux, soudage, autres), matériau (béton, bois/métal, brique/bloc, verre, autres), utilisateur final (industriel/professionnel, résidentiel), canal de vente (ventes indirectes, ventes directes) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l’Afrique (MEA). |

|

Acteurs du marché couverts |

Stanley Black & Decker, Inc. (États-Unis), Robert Bosch GmbH (Allemagne), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japon), Hilti Corporation (Liechtenstein), Atlas Copco AB (Suède), Ingersoll Rand (États-Unis), Snap-on Incorporated (États-Unis), Apex Tool Group (États-Unis), Koki Holding Co., Ltd. (Japon), Honeywell International Inc. (États-Unis), 3M (États-Unis), Emerson Electric Co. (États-Unis), Festool GmbH (Allemagne), KYOCERA Corporation (Japon), Makita Corporation (Japon), Hilti AG (Liechtenstein) et Husqvarna AB (Suède) |

|

Opportunités de marché |

|

Dynamique du marché des outils électriques au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs :

- La croissance des investissements en recherche et développement ouvre la voie aux innovations

Le nombre croissant de collaborations stratégiques sur le marché a entraîné une augmentation des fonds destinés à la croissance et au développement de technologies et de machines avancées et automatisées. En outre, la croissance du niveau d'investissement dans les compétences en recherche et développement ouvrirait la voie à des innovations dans le domaine des technologies de fabrication.

- La prolifération croissante de l’électronique à l’échelle mondiale va induire une demande et une offre accrues dans les pays émergents

La prolifération et la pénétration croissantes des outils et équipements électroniques sont l'un des principaux facteurs favorisant la croissance du marché. En d'autres termes, la demande et la disponibilité accrues de clés à écrous électriques, de scies à chantourner électriques, de tournevis électriques, de marteaux électriques et de compacteurs électriques influencent directement le taux de croissance du marché. De plus, l'acceptation et l'application croissantes par l'industrie aérospatiale ouvriront davantage la voie à la croissance du marché.

- La croissance et l'expansion des marchés verticaux des utilisateurs finaux offrent de nombreuses opportunités aux petites entreprises

En raison de la croissance économique mondiale, le secteur des semi-conducteurs et de l'électronique dispose d'un potentiel de croissance considérable. Les principaux fabricants se concentrent de plus en plus sur l'application de technologies avancées, ce qui élargira le champ de croissance.

Opportunités:

- Le secteur du bâtiment et de la construction présente de nombreuses opportunités

L'urbanisation croissante, la modernisation et la mondialisation stimulent la croissance de la valeur marchande. En d'autres termes, le nombre croissant de bâtiments et d'activités de construction, en particulier dans les économies en développement, pour développer les infrastructures, offrira de très nombreuses opportunités de croissance pour le marché.

Le développement des infrastructures industrielles et le remodelage des structures en béton, les progrès technologiques croissants pour améliorer le fonctionnement des outils à semi-conducteurs et la sensibilisation accrue de l'industrie automobile à la sécurité des véhicules et aux avancées technologiques sont d'autres facteurs déterminants de la croissance du marché. En outre, les progrès de la technologie de fabrication offrent des opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. En outre, l'adoption croissante des outils électriques alimentés par batterie à l'échelle mondiale et la demande croissante d'outils de fixation électriques dans l'environnement industriel augmenteront encore la croissance future du marché.

Restrictions/défis du marché des outils électriques au Moyen-Orient et en Afrique

- Augmentation du nombre de réglementations visant à limiter la portée de la croissance à long terme

L'application de plus en plus stricte des réglementations environnementales imposées aux industries créera des obstacles à la croissance du marché. De plus, les réglementations strictes sur l'homologation des produits réduiront la portée de la croissance du marché. En outre, la suspension de l'activité commerciale en raison de la pandémie de coronavirus créera à nouveau des obstacles.

- Les perturbations de la chaîne d’approvisionnement constitueront une menace pour la demande croissante sans précédent du marché

Avec le nombre croissant de restrictions dans le monde en raison de la pandémie, la demande et l'offre de matériaux d'affichage ont été touchées. De plus, les fluctuations des prix des matières premières s'avéreront un inconvénient pour le marché. Par conséquent, cela mettra à mal le taux de croissance du marché.

En outre, le manque de sensibilisation dans les régions sous-développées et les coûts élevés associés aux activités de fabrication constitueront des freins à la croissance du marché. Le manque d’infrastructures solides dans les économies en retard, la baisse des ventes de véhicules commerciaux en raison de la COVID-19 et les accidents et problèmes de santé liés aux outils électriques constitueront également un défi pour le taux de croissance du marché.

Ce rapport sur le marché des outils électriques fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des outils électriques, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du Covid-19 sur le marché des outils électriques au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur le marché des outils électriques. Les coûts d'investissement limités et le manque d'employés ont entravé les ventes et la production de la technologie des outils électriques. Cependant, le gouvernement et les principaux acteurs du marché ont adopté de nouvelles mesures de sécurité pour développer les pratiques. Les progrès de la technologie ont fait grimper le taux de vente des capteurs de température à thermocouple, car ils ciblaient le bon public. L'augmentation de l'industrialisation à travers le monde devrait stimuler davantage la croissance du marché dans le scénario post-pandémique.

Développements récents

- En mars 2020, Robert Bosch GmbH a annoncé le lancement du perçage pratiquement sans poussière. L'aspirateur à poussière sans fil est intégré aux marteaux Bosch pour les protéger de la poussière lors du perçage et de la construction d'échafaudages. Ce nouveau produit vient élargir la gamme de produits de l'entreprise.

- En mars 2019, Festool GmbH a annoncé le lancement de l'outil oscillant sans fil Vecturo OSC 18. Le nouvel outil sans fil est composé d'une batterie lithium-ion de 18 volts et d'un moteur EC-TEC sans balais. Le produit offre une coupe, un grattage et un sciage précis. Le nouveau produit a élargi la gamme de produits de l'entreprise.

Portée du marché des outils électriques au Moyen-Orient et en Afrique

Le marché des outils électriques est segmenté en fonction du type, du mode de fonctionnement, de l'application, du matériau, de l'utilisateur final et du canal de vente. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Outils de sciage et de coupe

- Outils de perçage et de fixation

- Outils de démolition

- Outils de routage

- Grignoteuses portatives

- Outils pneumatiques

- Outils d'enlèvement de matière

- Cordons et prises électriques

- Accessoires

- Autres

Mode de fonctionnement

- Électrique

- Outil pour carburant liquide

- Hydraulique

- Pneumatique

- Outils à poudre

Application

- Béton et construction

- Travail du bois

- Travail des métaux

- Soudage

- Autres

Matériel

- Béton

- Bois/Métal

- Brique/Bloc

- Verre

- Autres

Utilisateur final

- Industriel/Professionnel

- Résidentiel

Analyse/perspectives régionales du marché des outils électriques au Moyen-Orient et en Afrique

Le marché des outils électriques est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, mode de fonctionnement, application, matériau, utilisateur final et canal de vente comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des outils électriques sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël, le reste du Moyen-Orient et de l’Afrique (MEA).

Israël domine la région du Moyen-Orient et de l'Afrique en raison des initiatives gouvernementales accrues prises pour stimuler les projets de construction qui nécessitent des outils électriques pour une meilleure productivité et efficacité au travail.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Power Tools Market

The power tools market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to power tools market.

Some of the major players operating in the power tools market are

- Stanley Black & Decker, Inc. (US)

- Robert Bosch GmbH (Germany)

- Techtronic Industries Co. Ltd. (Hong Kong)

- Makita Corporation (Japan)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Ingersoll Rand (US)

- Snap-on Incorporated (US)

- Apex Tool Group (US)

- Koki Holding Co., Ltd. (Japan)

- Honeywell International Inc. (US)

- 3M (US)

- Emerson Electric Co. (US)

- Festool GmbH (Germany)

- KYOCERA Corporation (Japan)

- Makita Corporation (Japan),

- Hilti AG (Liechtenstein)

- Husqvarna AB (Sweden)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE GROWTH OF CORDLESS POWER TOOLS

5.1.2 INTEGRATION OF BRUSHLESS MOTORS IN POWER TOOLS

5.1.3 INCREASING GROWTH IN INFRASTRUCTURE PROJECTS MIDDLE EAST AND AFRICALY

5.1.4 BETTER OFFERING THAN HAND TOOLS

5.1.5 EXPANSION OF THE MOTOR VEHICLE MAINTENANCE MARKET AS VEHICLE OWNERSHIP RATE INCREASES

5.2 RESTRAINTS

5.2.1 HIGH MAINTENANCE OF POWER TOOLS

5.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIALS

5.2.3 LIMITATIONS INVOLVED IN LI-ION BATTERY USAGE FOR CORDLESS POWER TOOLS

5.3 OPPORTUNITIES

5.3.1 GROWTH IN WIND ENERGY INDUSTRY AIDING THE POWER TOOLS MARKET

5.3.2 SMART CONNECTIVITY IN POWER TOOLS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.3.4 POWER TOOLS BEING MADE AVAILABLE ON E-COMMERCE PLATFORM

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT POWER TOOLS

5.4.2 REGULATORY COMPLIANCE AND POWER TOOL SAFETY

6 ANALYSIS OF IMPACT OF COVID-19 PANDEMIC ON THE MIDDLE EAST AND AFRICA POWER TOOLS MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SAWING AND CUTTING TOOLS

7.2.1 CIRCULAR SAWS

7.2.2 JIGSAWS

7.2.3 MULTI-CUTTER SAWS

7.2.4 CHOP SAWS

7.2.5 BAND SAWS

7.2.6 RECIPROCATING SAWS

7.2.7 SHEARS AND NIBBLERS

7.3 DRILLING AND FASTENING TOOLS

7.3.1 DRILLS

7.3.2 SCREWDRIVERS AND NUTRUNNERS

7.3.3 IMPACT WRENCHES

7.3.4 IMPACT DRIVERS

7.4 DEMOLITION TOOLS

7.4.1 DEMOLITION HAMMER

7.4.2 HAMMER DRILL

7.4.3 BREAKER

7.4.4 ROTARY HAMMER

7.4.5 OTHERS

7.5 ROUTING TOOLS

7.5.1 ROUTERS/PLANER

7.5.2 JOINERS

7.6 PORTABLE NIBBLERS

7.7 AIR-POWERED TOOLS

7.7.1 AIR HOSES

7.7.2 AIR HAMMERS

7.7.3 AIR SCALERS

7.7.4 OTHERS

7.8 MATERIAL REMOVAL TOOLS

7.8.1 GRINDERS

7.8.1.1 DIE AND STRAIGHT GRINDER

7.8.1.2 ANGLE GRINDER

7.8.1.3 ROTARY FILES

7.8.1.4 BENCH GRINDER

7.8.1.5 PENCIL GRINDERS

7.8.2 SANDERS

7.8.3 POLISHERS/BUFFERS

7.9 ELECTRIC CORDS AND PLUGS

7.1 ACCESSORIES

7.11 OTHERS

8 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION

8.1 OVERVIEW

8.2 ELECTRIC

8.2.1 CORDED TOOL

8.2.2 CORDLESS TOOL

8.3 LIQUID FUEL TOOL

8.4 HYDRAULIC

8.5 PNEUMATIC

8.6 POWDER-ACTUATED TOOLS

9 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONCRETE AND CONSTRUCTION

9.3 WOODWORKING

9.4 METALWORKING

9.5 WELDING

9.6 OTHERS

10 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 CONCRETE

10.3 WOOD/METAL

10.4 BRICK/BLOCK

10.5 GLASS

10.6 OTHERS

11 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER

11.1 OVERVIEW

11.2 INDUSTRIAL/PROFESSIONAL

11.2.1 BY TYPE

11.2.1.1 Sawing and Cutting Tools

11.2.1.2 Drilling and Fastening Tools

11.2.1.3 Demolition Tools

11.2.1.4 Routing Tools

11.2.1.5 Portable Nibblers

11.2.1.6 Air-Powered Tools

11.2.1.7 Material Removal Tools

11.2.1.8 Electric Cords and Plugs

11.2.1.9 Others

11.2.2 BY MODE OF OPERATION

11.2.2.1 Electric

11.2.2.2 Liquid Fuel Tool

11.2.2.3 Hydraulic

11.2.2.4 Pneumatic

11.2.2.5 Powder-Actuated Tools

11.3 RESIDENTIAL

11.3.1 ELECTRIC

11.3.2 LIQUID FUEL TOOL

11.3.3 HYDRAULIC

11.3.4 PNEUMATIC

11.3.5 POWDER-ACTUATED TOOLS

12 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 INDIRECT SALES

12.3 DIRECT SALES

13 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY GEOGRAPHY

13.1 MIDDLE EAST AND AFRICA

13.1.1 ISRAEL

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 U.A.E.

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT

16 COMPANY PROFILES

16.1 TECHTRONIC INDUSTRIES CO. LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 STANLEY BLACK & DECKER, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 MAKITA CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 ROBERT BOSCH GMBH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HILTI AG

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 3M

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 APEX TOOL GROUP, LLC

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ATLAS COPCO AB

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 C. & E. FEIN GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DELTA POWER EQUIPMENT CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EMERSON ELECTRIC CO.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FERM INTERNATIONAL B.V.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FESTOOL GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 HUSQVARNA AB

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 INGERSOLL RAND

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 INTERSKOL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 KOKI HOLDINGS CO., LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 KYOCERA CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 PANASONIC CORPORATION OF NORTH AMERICA (A SUBSIDIARY OF PANASONIC CORPORATION)

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 SNAP-ON INCORPORATED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SERVICES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA PORTABLE NIBBLERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA ELECTRIC CORDS AND PLUGS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA ACCESSORIES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA ELECTRIC IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA ELECTRIC TOOLS IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA HYDRAULIC IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA LIQUID FUEL TOOL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA CONCRETE AND CONSTRUCTION IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA WOODWORKING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA METALWORKING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA WELDING IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CONCRETE IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WOOD/METAL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA BRICK/BLOCK IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA GLASS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE LOAN IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE,2018-2027, (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION,2018-2027, (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION,2018-2027, (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, MARKET FORECAST 2020-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA INDIRECT SALES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA DIRECT SALES IN POWER TOOLS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 65 ISRAEL POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 66 ISRAEL SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 67 ISRAEL DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 68 ISRAEL DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 69 ISRAEL ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 70 ISRAEL AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 71 ISRAEL MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 ISRAEL GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 ISRAEL POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 74 ISRAEL ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 75 ISRAEL POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 76 ISRAEL POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 77 ISRAEL POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 78 ISRAEL INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 79 ISRAEL INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 80 ISRAEL RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 81 ISRAEL POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 83 SAUDI ARABIA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 95 SAUDI ARABIA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 98 SAUDI ARABIA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 99 SOUTH AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 100 SOUTH AFRICA SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 SOUTH AFRICA DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 102 SOUTH AFRICA DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 103 SOUTH AFRICA ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 104 SOUTH AFRICA AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 SOUTH AFRICA MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 106 SOUTH AFRICA GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 107 SOUTH AFRICA POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 108 SOUTH AFRICA ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 109 SOUTH AFRICA POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 110 SOUTH AFRICA POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 111 SOUTH AFRICA POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 112 SOUTH AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 113 SOUTH AFRICA INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 114 SOUTH AFRICA RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 115 SOUTH AFRICA POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 116 U.A.E. POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 117 U.A.E. SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 118 U.A.E. DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 119 U.A.E. DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 120 U.A.E. ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 121 U.A.E. AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 U.A.E. MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 123 U.A.E. GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 124 U.A.E. POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 125 U.A.E. ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 126 U.A.E. POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 127 U.A.E. POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 128 U.A.E. POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 129 U.A.E. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 130 U.A.E. INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 131 U.A.E. RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 132 U.A.E. POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 133 EGYPT POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 EGYPT SAWING AND CUTTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 135 EGYPT DRILLING AND FASTENING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 136 EGYPT DEMOLITION TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 137 EGYPT ROUTING TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 138 EGYPT AIR-POWERED TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 139 EGYPT MATERIAL REMOVAL TOOLS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 140 EGYPT GRINDERS IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 141 EGYPT POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 142 EGYPT ELECTRIC IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 143 EGYPT POWER TOOLS MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 144 EGYPT POWER TOOLS MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 145 EGYPT POWER TOOLS MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 146 EGYPT INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 147 EGYPT INDUSTRIAL/PROFESSIONAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 148 EGYPT RESIDENTIAL IN POWER TOOLS MARKET, BY MODE OF OPERATION, 2018-2027 (USD MILLION)

TABLE 149 EGYPT POWER TOOLS MARKET, BY SALES CHANNEL, 2018-2027 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET, BY TYPE, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN THE GROWTH OF CORDLESS POWER TOOLS IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA POWER TOOLS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 SAWING AND CUTTING TOOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA POWER TOOLS MARKET

FIGURE 14 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY TYPE, 2019

FIGURE 15 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY MODE OF OPERATION, 2019

FIGURE 16 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY APPLICATION, 2019

FIGURE 17 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY MATERIAL, 2019

FIGURE 18 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY END USER, 2019

FIGURE 19 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY SALES CHANNEL, 2019

FIGURE 20 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2019)

FIGURE 22 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: BY TYPE (2020-2027)

FIGURE 25 MIDDLE EAST AND AFRICA POWER TOOLS MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.