Middle East And Africa Polybutylene Succinate Pbs Market

Taille du marché en milliards USD

TCAC :

%

USD

21.17 Million

USD

34.51 Million

2025

2033

USD

21.17 Million

USD

34.51 Million

2025

2033

| 2026 –2033 | |

| USD 21.17 Million | |

| USD 34.51 Million | |

|

|

|

|

Marché du polybutylène succinate (PBS) au Moyen-Orient et en Afrique : segmentation par produit (PBS conventionnel et PBS biosourcé), procédé (transestérification et estérification directe), application (sacs, films de paillage, films d’emballage, produits d’hygiène jetables, filets de pêche, capsules de café, composites bois-plastique et autres), usage (à usage unique et réutilisable), couche d’emballage (emballage primaire, secondaire et tertiaire), utilisation finale (emballage, agriculture, textile, biens de consommation, électronique et électrique, automobile et autres) – Tendances et prévisions du secteur jusqu’en 2033

Quelle est la taille et le taux de croissance du marché du polybutylène succinate (PBS) au Moyen-Orient et en Afrique ?

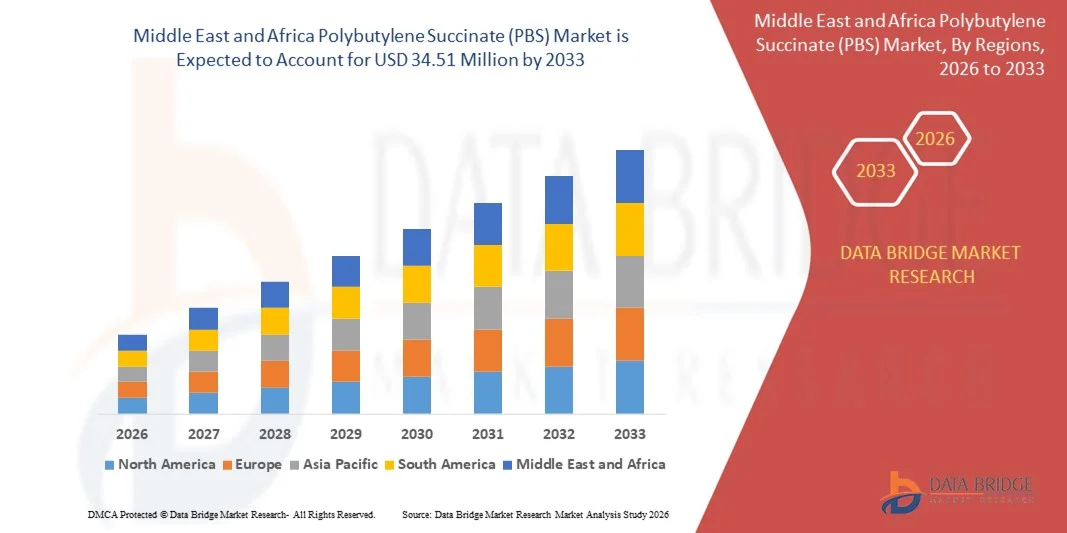

- Le marché du polybutylène succinate (PBS) au Moyen-Orient et en Afrique était évalué à 21,17 millions de dollars en 2025 et devrait atteindre 34,51 millions de dollars d'ici 2033 , avec un TCAC de 6,3 % au cours de la période de prévision.

- Le polybutylène succinate est fréquemment associé à des fibres naturelles telles que le panic érigé (SG). Ces matériaux composites innovants sont largement utilisés dans le secteur automobile car ils sont présentés comme des alternatives biosourcées viables aux polymères conventionnels dérivés du pétrole.

- Selon l'OICA, la production de véhicules utilitaires légers en France a augmenté de 6,5 %, passant de 495 123 unités en 2018 à 527 262 en 2019, tandis qu'en Espagne, elle a progressé de 5,6 %, passant de 496 671 unités en 2018 à 524 504 en 2019. Cette hausse de la production automobile entraînera une augmentation progressive de la demande de polybutylène succinate, stimulant ainsi le marché.

Quels sont les principaux enseignements du marché du polybutylène succinate (PBS) ?

- Le polybutylène succinate est de plus en plus utilisé dans les applications agricoles, notamment pour la fabrication de films de paillis. Ces films sont couramment utilisés pour modifier la température du sol, contrôler la prolifération des adventices, réduire l'évaporation et améliorer le rendement et la précocité des cultures.

- Les gouvernements investissent également massivement dans des projets et des investissements agricoles, car il s'agit de l'un des moyens les plus efficaces d'améliorer la durabilité environnementale.

- L'Arabie saoudite a dominé le marché du polybutylène succinate (PBS) au Moyen-Orient et en Afrique en 2024, avec une part de revenus de 34,7 %, portée par la demande croissante d'emballages biodégradables, de films agricoles durables et de produits de consommation écologiques.

- Le marché japonais du polybutylène succinate (PBS) connaît une croissance soutenue, avec un TCAC de 7,9 %, soutenue par la demande croissante de matériaux biodégradables de haute qualité pour l'emballage, le textile et les biens de consommation.

- Le segment du PBS conventionnel a dominé le marché avec une part de revenus de 58,6 % en 2024, grâce à sa base de production établie, sa compétitivité en termes de coûts et son utilisation répandue dans les films d'emballage, les produits agricoles et les biens de consommation.

Portée du rapport et segmentation du marché du polybutylène succinate (PBS)

|

Attributs |

Aperçu clé du marché du polybutylène succinate (PBS) |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché du polybutylène succinate (PBS) ?

Adoption croissante de matériaux biosourcés et compostables pour des emballages durables et des applications grand public

- Une tendance majeure et croissante sur le marché du polybutylène succinate (PBS) est le recours accru aux polymères biosourcés, biodégradables et compostables comme alternatives aux plastiques conventionnels issus du pétrole. Cette transition est motivée par des préoccupations environnementales grandissantes, la pression réglementaire sur les plastiques à usage unique et la demande croissante des consommateurs pour des matériaux durables dans les secteurs de l'emballage, de l'agriculture et des biens de consommation.

- Par exemple, des producteurs de matériaux de premier plan tels que BASF SE, Indorama Ventures, Mitsubishi Chemical et Far Eastern New Century développent la production de PBS biosourcé et mettent au point des qualités hautes performances adaptées aux films, aux produits moulés et aux mélanges avec le PLA et le PBAT.

- L'utilisation croissante du PBS dans les films d'emballage, les sacs compostables, les couverts jetables et les matériaux en contact avec les aliments permet aux fabricants d'atteindre leurs objectifs de développement durable tout en conservant une flexibilité, une résistance à la chaleur et une facilité de transformation comparables à celles des plastiques conventionnels.

- Les progrès réalisés dans la production d'acide biosuccinique, les technologies de mélange de polymères et l'optimisation des coûts améliorent encore la viabilité commerciale du PBS dans les applications à grande échelle.

- L'adoption croissante des principes de l'économie circulaire, des normes relatives aux emballages compostables et des programmes de certification de biodégradabilité renforce l'importance du PBS comme matériau de base dans les alternatives durables au plastique.

- Face à la hausse constante des exigences en matière de développement durable à l'échelle mondiale, le polybutylène succinate s'impose comme un matériau essentiel pour la conception de produits respectueux de l'environnement, sans compromettre leurs performances fonctionnelles.

Quels sont les principaux moteurs du marché du polybutylène succinate (PBS) ?

- Un facteur clé de croissance du marché du polybutylène succinate (PBS) est la mise en œuvre croissante de politiques de réduction des plastiques et d'interdictions des plastiques à usage unique dans les secteurs de l'emballage, de la restauration et de l'agriculture.

- Par exemple, entre 2024 et 2025, les gouvernements d'Europe, du Moyen-Orient et d'Afrique ont renforcé les réglementations favorisant les matériaux compostables, ce qui a entraîné une plus grande adoption du PBS dans les films d'emballage, les produits jetables et les applications de paillis agricole.

- La demande croissante d'emballages alimentaires durables, de biens de consommation compostables et d'intrants agricoles biodégradables accélère la consommation de PBS dans l'ensemble des industries utilisatrices finales.

- Les progrès technologiques réalisés dans le domaine des matières premières biosourcées, des procédés de fermentation et de la modification des polymères améliorent la résistance mécanique, la stabilité thermique et la compétitivité du PBS.

- L’engagement croissant des marques en faveur de la neutralité carbone, de l’éco-étiquetage et de la transition vers des emballages durables encourage les fabricants à intégrer le PBS dans leurs gammes de produits.

- Soutenu par les réglementations environnementales, les objectifs de développement durable des entreprises et la sensibilisation croissante des consommateurs, le marché du polybutylène succinate (PBS) devrait connaître une forte croissance à long terme sur les marchés mondiaux.

Quel facteur freine la croissance du marché du polybutylène succinate (PBS) ?

- Les matières premières de base du polybutylène succinate, notamment l'acide succinique et les 1,4-butanediols, sont dérivées de matières premières pétrolières.

- Par conséquent, les fluctuations du prix du pétrole brut influent sur le prix des matières premières du polybutylène succinate. Le prix du polybutylène succinate augmente également en raison de l'incertitude liée aux prix du pétrole brut.

- Par conséquent, les fabricants de polybutylène succinate sont susceptibles de faire face à de fortes fluctuations des prix du pétrole brut. Ce facteur devrait freiner la croissance du marché mondial du polybutylène succinate (PBS).

Comment le marché du polybutylène succinate (PBS) est-il segmenté ?

Le marché est segmenté en fonction du produit, du procédé, de l'application, de l'utilisation, de la couche d'emballage et de l'utilisation finale .

- Sous-produit

Le marché du polybutylène succinate (PBS) est segmenté, selon le type de produit, en polybutylène succinate (PBS) conventionnel et polybutylène succinate (PBS) biosourcé. Le segment du PBS conventionnel a dominé le marché en 2024, représentant 58,6 % des revenus, grâce à son infrastructure de production bien établie, sa compétitivité en termes de coûts et son utilisation répandue dans les films d'emballage, les produits agricoles et les biens de consommation. Le PBS conventionnel offre une résistance mécanique, une flexibilité et une stabilité thermique fiables, ce qui le rend adapté aux applications commerciales à grande échelle.

Le segment des PBS biosourcés devrait connaître le taux de croissance annuel composé le plus rapide entre 2025 et 2032, soutenu par le renforcement des réglementations environnementales, la demande croissante de plastiques compostables et la disponibilité accrue d'acide succinique biosourcé. Les engagements des marques en matière de développement durable et les progrès réalisés dans la transformation des matières premières biosourcées accélèrent encore davantage l'adoption de ces solutions.

- Par processus

Selon le procédé utilisé, le marché est segmenté en transestérification et estérification directe. En 2024, le segment de l'estérification directe détenait la plus grande part de marché (54,2 %), grâce à un processus simplifié, des coûts de production réduits et son adéquation à la production à grande échelle de PBS. Cette méthode est largement adoptée par les principaux producteurs afin d'améliorer le rendement et de simplifier les opérations.

Le segment de la transestérification devrait connaître la croissance annuelle composée la plus rapide entre 2025 et 2032, grâce à sa capacité à produire des polymères de masse moléculaire plus élevée et à améliorer l'homogénéité des matériaux. L'augmentation des investissements dans les technologies de polymérisation avancées favorise son adoption pour les PBS haute performance et de spécialité.

- Sur demande

Selon l'application, le marché du polybutylène succinate (PBS) se segmente en sacs, films de paillis, films d'emballage, produits d'hygiène jetables, filets de pêche, capsules de café, composites bois-plastique et autres. Le segment des films d'emballage dominait le marché en 2024 avec une part de 31,4 %, porté par la demande croissante d'emballages alimentaires biodégradables, de films compostables et d'alternatives durables aux plastiques conventionnels.

Le segment des films de paillis devrait enregistrer le TCAC le plus rapide entre 2025 et 2032, soutenu par l'adoption croissante d'intrants agricoles biodégradables et par les initiatives gouvernementales promouvant des pratiques agricoles durables.

- Par usage

Selon l'usage, le marché est segmenté en applications à usage unique et réutilisables. Le segment à usage unique représentait la plus grande part de revenus (62,7 %) en 2024, grâce à son utilisation généralisée dans les emballages jetables, les produits d'hygiène et les films agricoles. Le PBS remplace de plus en plus les plastiques conventionnels dans les applications à courte durée de vie en raison de sa compostabilité et de sa conformité réglementaire.

Le segment des produits réutilisables devrait connaître le taux de croissance annuel composé le plus rapide au cours de la période de prévision, grâce aux améliorations apportées aux matériaux qui améliorent la durabilité, la résistance mécanique et la résistance à une utilisation répétée, notamment dans les biens de consommation et les applications d'emballage.

Par couche d'emballage

En fonction du type d'emballage, le marché se divise en emballage primaire, secondaire et tertiaire. Le segment de l'emballage primaire a dominé le marché en 2024, représentant 46,9 % des revenus, grâce aux applications en contact direct avec les aliments, telles que les films, les sacs et les contenants d'emballage.

Le segment des emballages secondaires devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, soutenu par l'utilisation croissante de matériaux biodégradables pour l'emballage, le regroupement et la protection des produits dans les chaînes logistiques et de distribution.

- Par utilisation finale

Le marché du polybutylène succinate (PBS) est segmenté, selon l'utilisation finale, en emballage, agriculture, textile, biens de consommation, électronique et électrique, automobile et autres. Le segment de l'emballage détenait la plus grande part de marché (38,5 %) en 2024, porté par la demande croissante d'emballages alimentaires durables et de produits de consommation compostables.

Le secteur agricole devrait connaître la croissance annuelle composée la plus rapide entre 2025 et 2032, grâce à l'utilisation croissante de films de paillis biodégradables et au soutien gouvernemental aux solutions agricoles écologiques.

Quelle région détient la plus grande part du marché du polybutylène succinate (PBS) ?

- L'Arabie saoudite a dominé le marché du polybutylène succinate (PBS) au Moyen-Orient et en Afrique en 2024, avec une part de marché de 34,7 %, portée par la demande croissante d'emballages biodégradables, de films agricoles durables et de produits de consommation écologiques. Les importants investissements nationaux dans la production verte et la disponibilité de matières premières renouvelables accélèrent l'adoption du PBS dans de nombreux secteurs.

- Les initiatives du pays visant à réduire les déchets plastiques, à promouvoir les emballages compostables et à encourager les pratiques d'économie circulaire soutiennent la production et l'intégration à grande échelle de polymères biosourcés. Les incitations gouvernementales et les collaborations avec les fabricants mondiaux de polymères biosourcés renforcent la position de l'Arabie saoudite en tant que principal pôle d'attraction pour les polymères biosourcés dans la région, ce qui, selon le gouvernement, favorise la croissance du marché à long terme et l'adoption de pratiques durables.

Analyse du marché du polybutylène succinate (PBS) aux Émirats arabes unis

Le marché du polybutylène succinate (PBS) aux Émirats arabes unis connaît une croissance soutenue, avec un TCAC de 8,1 %, portée par l'utilisation croissante d'emballages durables, de produits de consommation biodégradables et d'applications industrielles. Les fabricants privilégient les formulations de PBS haute performance, une meilleure stabilité thermique et des solutions compostables afin de se conformer aux réglementations environnementales. Les investissements dans les installations de production de polymères biosourcés, les technologies de transformation avancées et les collaborations stratégiques avec des fournisseurs régionaux et internationaux renforcent le rôle des Émirats arabes unis en tant que pôle de croissance et d'innovation majeur sur le marché du PBS au Moyen-Orient et en Afrique, confirmant ainsi l'importance du pays comme moteur des tendances régionales en matière de développement durable.

Analyse du marché du polybutylène succinate (PBS) en Afrique du Sud

Le marché sud-africain du polybutylène succinate (PBS) est en pleine expansion, porté par l'adoption croissante d'emballages écologiques, de films agricoles et de biens de consommation biodégradables. La sensibilisation accrue au développement durable, les politiques gouvernementales encourageant les matériaux compostables et l'augmentation des importations de polymères biosourcés stimulent la croissance du marché. L'innovation continue dans le mélange de polymères, l'amélioration des performances et les procédés de fabrication à grande échelle positionne l'Afrique du Sud comme un acteur majeur du marché du PBS au Moyen-Orient et en Afrique, contribuant ainsi à accélérer l'adoption régionale de solutions polymères durables.

Quelles sont les principales entreprises du marché du polybutylène succinate (PBS) ?

L'industrie du polybutylène succinate (PBS) est principalement dominée par des entreprises bien établies, notamment :

- Indorama Ventures Public Company Limited (Thaïlande)

- Alpek SAB de CV (Mexique)

- Jiangsu Sanfangxiang Group Co., Ltd. (Chine)

- Far Eastern New Century Corporation (Taïwan)

- DAK Amériques (États-Unis)

- BASF SE (Allemagne)

- Zhejiang Biodegradable Advanced Material Co. Ltd (Chine)

- Xinhaibio (Chine)

- Lubrilog (France)

- ECCO Gleittechnik GmbH (Allemagne)

- HUSK-ITT Corporation (États-Unis)

- Setral Chemie GmbH (Allemagne)

- IKV Tribologie Ltd (Allemagne)

- Hangzhou Ruijiang Chemical Co. (Chine)

- WILLEAP (Corée du Sud)

Quels sont les développements récents sur le marché mondial du polybutylène succinate (PBS) ?

- En septembre 2022, Technip Energies, société française d'ingénierie et de technologie, a renforcé son portefeuille de produits chimiques durables en acquérant la technologie biosuccinium de DSM. Cette acquisition lui a permis d'obtenir les droits de licence exclusifs pour la production d'acide succinique biosourcé, matière première essentielle au polybutylène succinate (PBS). L'acquisition comprend plusieurs familles de brevets et des souches de levures propriétaires validées à l'échelle industrielle. Technip Energies consolide ainsi sa position de leader et son positionnement à long terme dans les chaînes de valeur des polymères biosourcés.

- En avril 2021, Mitsubishi Chemical Corporation a mis au point une version de BioPBS biodégradable en milieu marin, s'inscrivant dans sa stratégie de développement des produits à base de polybutylène succinate (PBS) d'origine végétale et d'élargissement de leurs applications potentielles. Ce développement contribue à la diversification du portefeuille et à la croissance du chiffre d'affaires, tout en répondant aux exigences de développement durable. L'entreprise conclut que cette innovation renforce son avantage concurrentiel sur les marchés des polymères biodégradables et écologiques.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.