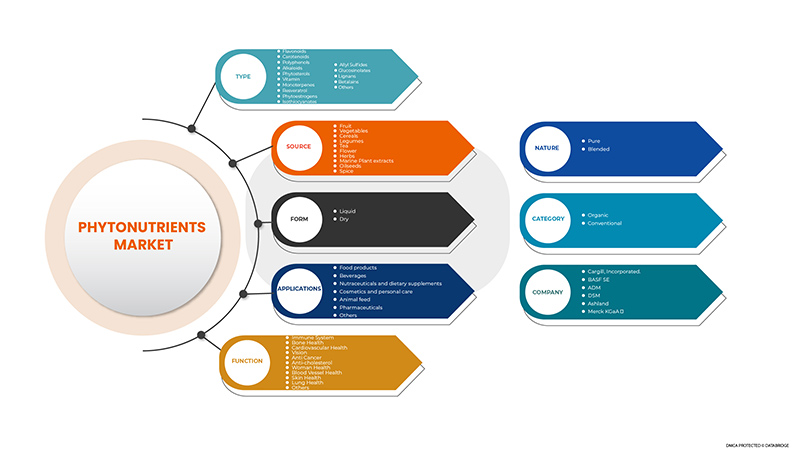

Middle East and Africa Phytonutrients Market, By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Function (Immune System, Vision, Skin Health, Bone Health, Cardiovascular Health, Anti-Cancer, Lung Health, Blood Vessel Health, Woman Health, Anti-Cholesterol, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, Marine Plant Extracts), Form (Liquid, Dry), Category (Organic, Conventional), Nature (Blended, Pure), Application (Food Products, Beverages, Nutraceuticals, and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, Others) Industry Trends and Forecast to 2029.

Middle East and Africa Phytonutrients Market Analysis and Insights

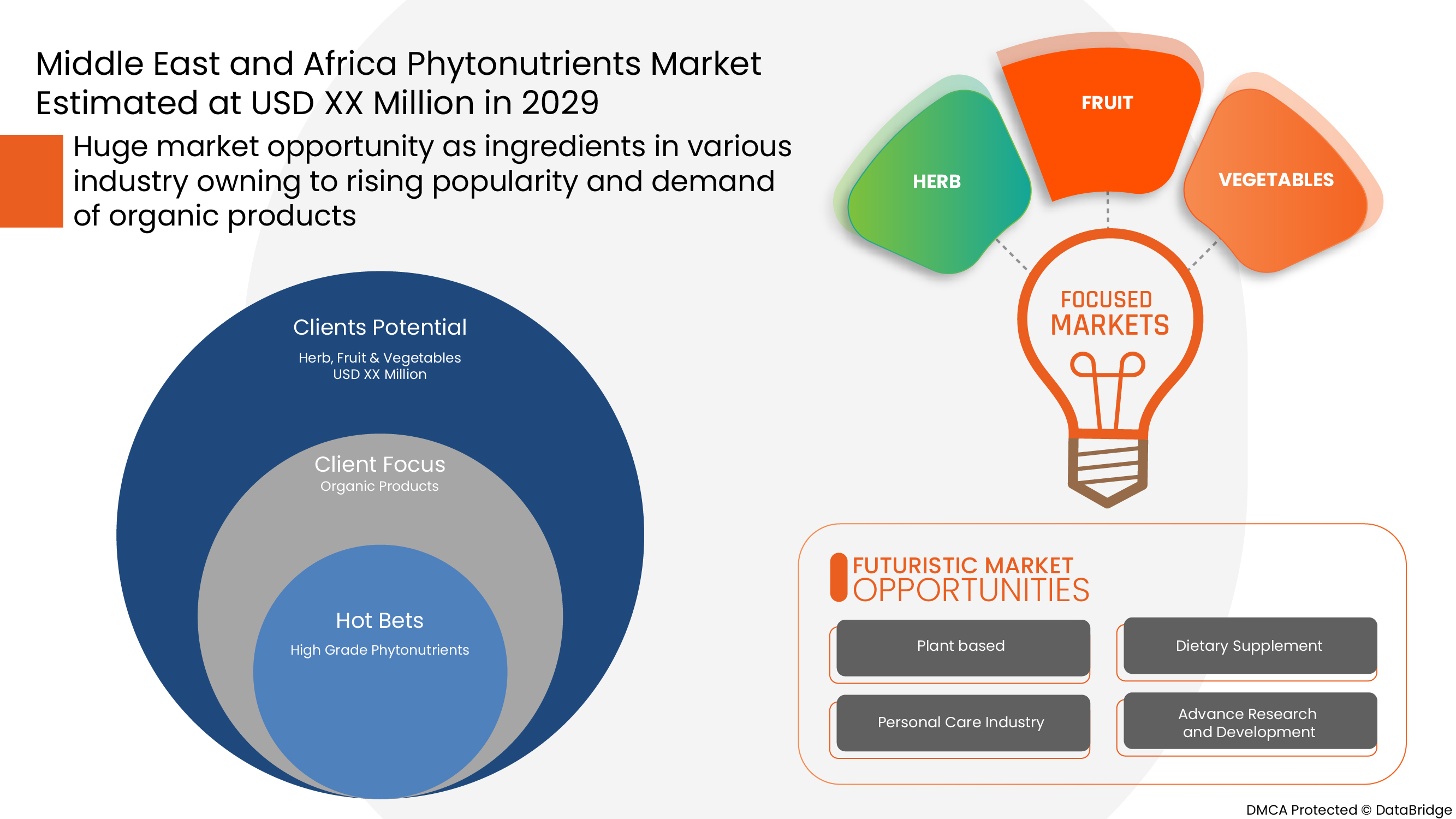

Increasing demand for phytonutrients in the food and beverage industries will accelerate the market demand. The rising focus on pharmaceutical industries to reduce cancer, diabetes, and heart disease will also enhance the global phytonutrients market's growth. Additionally, the need for phytonutrients in the feed and cosmetics industries is also expected to drive the market. The increase in demand for ayurvedic products is expected to act as an opportunity for the market.

The standard quality determination technique of phytonutrients and their products is inadequate, which is expected to restrain the growth of the Middle East and Africa phytonutrients market. Additionally, the phytonutrient supplements are insufficient in regulating products that involve marketing and promotion, which are the other factors anticipated to inhibit the development of the global phytonutrients market through the forecast term. The manufacturers of the phytonutrients focus on the R&D work on the extraction process of phytonutrients that may challenge competitors in the market.

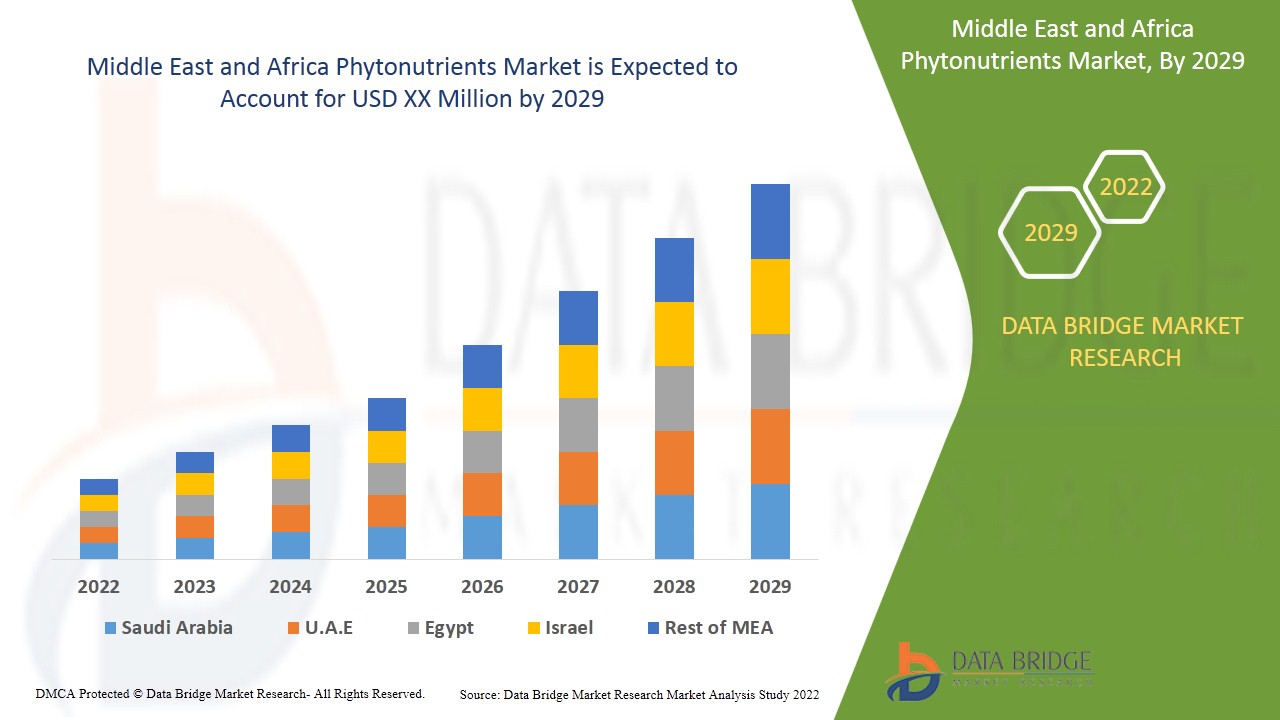

Data Bridge Market Research analyses that the Middle East and Africa phytonutrients market will grow at a CAGR of 7.2% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million, Volume in Units, Pricing in USD |

|

Segments Covered |

Par type ( flavonoïdes , caroténoïdes, polyphénols, alcaloïdes, phytostérols, vitamines , monoterpènes, resvératrol, phytoestrogènes, isothiocyanates, sulfures d'allyle, glucosinolates, lignanes, bétalaïnes et autres), fonction (système immunitaire, vision, santé de la peau, santé des os, santé cardiovasculaire, anticancéreux, santé pulmonaire, santé des vaisseaux sanguins, santé de la femme, anticholestérol et autres), source (épice, herbe, fleur, thé, fruit, légumes, céréales , légumineuses, graines oléagineuses, extraits de plantes marines), forme (liquide, sec), catégorie (biologique, conventionnel), nature (mélangé, pur), application (produits alimentaires, boissons , nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, alimentation animale, produits pharmaceutiques, autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Koweït, Oman, Qatar et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

ConnOils LLC, Ashland, Vitae Caps SA, IFF Nutrition & Biosciences, Kothari Phytochemicals International, Sabinsa, Merck KGaA, BTSA, ExcelVite, NutriScience Innovations, LLC, Cyanotech Corporation, Bio-India Biologicals (BIB) Corporation, Brlb International, Hindustan Herbals, Lycored, DSM, ADM, BASF SE, Cargill, Incorporated., MANUS AKTTEVA BIOPHARMA LLP, Döhler GMBH, entre autres |

Dynamique du marché des phytonutriments au Moyen-Orient et en Afrique

Conducteurs

- Demande croissante de produits alimentaires et de boissons

La demande croissante d'aliments et de boissons en raison de l'augmentation de la population mondiale devrait stimuler la demande de phytonutriments dans l'industrie. En outre, la demande croissante de produits alimentaires et de boissons à base d'ingrédients naturels en raison de l'inquiétude croissante concernant la qualité et la valeur nutritionnelle des produits alimentaires et des boissons devrait stimuler la demande de phytonutriments dans l'industrie alimentaire et des boissons.

- Demande croissante d'aliments pour animaux

Dans l'industrie de l'alimentation animale, les phytonutriments sont utilisés comme antioxydants dans les aliments pour animaux afin d'améliorer la croissance des animaux et de les protéger des dommages oxydatifs causés par les radicaux libres. Les phytonutriments contribuent à renforcer l'immunité innée des animaux, en particulier de la volaille. La croissance des phytonutriments dans l'alimentation animale est attribuée à certains facteurs tels que la demande croissante de viande dans le monde, la consommation croissante de viande de volaille, et d'autres facteurs qui devraient stimuler la demande d'aliments pour animaux, ce qui, à son tour, devrait augmenter la demande de phytonutriments dans l'industrie de l'alimentation animale au cours de la période de prévision.

Opportunités

- Demande croissante de produits de soins de la peau et de cosmétiques naturels

La sensibilisation croissante des consommateurs aux avantages des produits naturels ou biologiques devrait accroître la demande de produits de soins de la peau et de cosmétiques naturels. De plus, les préoccupations environnementales croissantes devraient augmenter la demande de produits dans les années à venir. En outre, la demande de composés phytochimiques dans les produits de soins de la peau et les cosmétiques, tels que la curcumine, le resvératrol, l'épicatéchine, l'acide ellagique et l'apigénine utilisés dans les formulations cosmétiques pour lutter contre le vieillissement cutané, augmente. Ainsi, l'augmentation de la demande de produits de soins de la peau et de cosmétiques naturels devrait constituer une opportunité pour le marché des phytonutriments au Moyen-Orient et en Afrique.

Contraintes/Défis

- Effets secondaires d’une consommation excessive de phytonutriments

Les phytonutriments sont bons pour le corps humain. Cependant, une consommation excessive de certains phytonutriments peut avoir des effets secondaires. Les composés phytochimiques toxiques pour l'homme sont appelés phytotoxines. Certains composés phytochimiques ont des propriétés anti-nutritionnelles qui interfèrent avec l'absorption des nutriments. Et certains phytonutriments, tels que les polyphénols et les flavonoïdes, sont des pro-oxydants en grandes quantités ingérées.

Ainsi, les effets secondaires causés par la surconsommation de phytonutriments devraient remettre en cause la demande sur le marché des phytonutriments au Moyen-Orient et en Afrique.

Ce rapport sur le marché des phytonutriments au Moyen-Orient et en Afrique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des phytonutriments au Moyen-Orient et en Afrique, contactez Data Bridge Market Research pour un briefing d'analyste ; notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché des phytonutriments au Moyen-Orient et en Afrique

L’impact de la pandémie de COVID-19 a entraîné le confinement de la plupart des pays pour limiter la propagation du virus, ce qui a fortement affecté chaque type d’industrie. La croissance du marché mondial des phytonutriments au Moyen-Orient et en Afrique a créé une incertitude extrême en raison de l’épidémie de COVID-19. Le maintien du mouvement des aliments tout au long de la chaîne alimentaire est essentiel pour l’industrie des aliments et des boissons. La plupart des entreprises ont repris leurs activités après les directives gouvernementales, ce qui a eu un impact positif sur la croissance du marché dans les années à venir.

Développement récent

- En mars 2021, DSM a lancé ampli-D, une forme de supplément de vitamine D à action trois fois plus rapide en Australie. Ce lancement de produit a aidé l'entreprise à élargir son portefeuille de produits

Portée du marché des phytonutriments au Moyen-Orient et en Afrique

Le marché des phytonutriments du Moyen-Orient et de l'Afrique est segmenté en type, source, nature, catégorie, forme, fonction et application. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Flavonoïdes

- Caroténoïdes

- Polyphénols

- Alcaloïdes

- Phytostérols

- Vitamines

- Monoterpènes

- Resvératrol

- Phytoestrogènes

- Isothiocyanates

- Sulfures d'allyle

- Glucosinolates

- Lignanes

- Bétalaïnes

- Autres.

Sur la base du type, le marché des phytonutriments du Moyen-Orient et de l'Afrique est segmenté en flavonoïdes, caroténoïdes, polyphénols, alcaloïdes, phytostérols, vitamines, monoterpènes, resvératrol, phytoestrogènes, isothiocyanates, sulfures d'allyle, glucosinolates, lignanes, bétalaïnes et autres.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché des phytonutriments du Moyen-Orient et de l’Afrique est segmenté en sec et liquide.

Catégorie

- Organique

- Conventionnel

Sur la base de la catégorie, le marché des phytonutriments du Moyen-Orient et de l’Afrique est segmenté en biologique et conventionnel.

Nature

- Mélangé

- Pur

Sur la base de la nature, le marché des phytonutriments du Moyen-Orient et de l’Afrique est segmenté en mélangés et purs.

Fonction

- Système immunitaire

- Vision

- Santé de la peau

- Santé des os

- Santé cardiovasculaire

- Anti-cancer

- Santé pulmonaire

- Santé des vaisseaux sanguins

- Santé de la femme

- Anti-cholestérol

- Autres

Sur la base de la fonction, le marché des phytonutriments du Moyen-Orient et de l'Afrique est segmenté en système immunitaire, vision, santé de la peau, santé des os, santé cardiovasculaire, anticancéreux, santé pulmonaire, santé des vaisseaux sanguins, santé de la femme, anti-cholestérol et autres.

Source

- Pimenter

- Herbe

- Fleur

- Thé

- Fruit

- Légumes

- Céréales

- Légumineuses

- Oléagineux

- Extrait de plantes marines

Sur la base de la nature, le marché des phytonutriments du Moyen-Orient et de l'Afrique est segmenté en épices, herbes, fleurs, thé, fruits, légumes, céréales, légumineuses, oléagineux, extraits de plantes marines.

Application

- Produits alimentaires

- Boissons

- Nutraceutiques

- Compléments alimentaires

- Cosmétiques et soins personnels

- Alimentation animale

- Médicaments

- Autres

Sur la base de l'application, le marché des phytonutriments du Moyen-Orient et de l'Afrique est segmenté en produits alimentaires, boissons, nutraceutiques et compléments alimentaires, cosmétiques et soins personnels, aliments pour animaux, produits pharmaceutiques, autres

Analyse/perspectives régionales du marché des phytonutriments au Moyen-Orient et en Afrique

Le marché des phytonutriments du Moyen-Orient et de l’Afrique est analysé et des informations et tendances sur la taille du marché sont fournies en fonction du pays, du type, de la source, de la nature, de la catégorie, de la forme, de la fonction et de l’application comme référencé ci-dessus.

Certains des pays couverts dans le rapport sur le marché des phytonutriments au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, le Koweït, Oman, le Qatar et le reste du Moyen-Orient et de l’Afrique.

U.A.E. is expected to dominate the Middle East and Africa phytonutrients market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. The growth in the region is attributed to the increasing demand for cosmetics and personal care products, coupled with rising awareness regarding the health benefits of phytonutrients.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of the Middle East and African brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Phytonutrients Market Share Analysis

The Middle East and Africa phytonutrients market competitive landscape provide details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Middle East and Africa phytonutrients market.

Some of the key players in the Middle East and Africa phytonutrients market are ConnOils LLC, Ashland, Vitae Caps S.A., IFF Nutrition & Biosciences, Kothari Phytochemicals International, Sabinsa, Merck KGaA, BTSA, ExcelVite, NutriScience Innovations, LLC, Cyanotech Corporation, Bio-India Biologicals (BIB) Corporation, Brlb International, Hindustan Herbals, Lycored, DSM, ADM, BASF SE, Cargill, Incorporated., MANUS AKTTEVA BIOPHARMA LLP, Döhler GMBH, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGIES

4.1.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.1.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.1.3 A VAST NETWORK OF DISTRIBUTION

4.1.4 STRATEGIC DECISIONS BY KEY PLAYERS

4.2 PATENT ANALYSIS OF MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

4.2.1 DBMR ANALYSIS

4.2.2 COUNTRY LEVEL ANALYSIS

4.2.3 YEARWISE ANALYSIS

4.3 EXTRACTION PROCESS

4.4 CERTIFICATION

4.5 TECHNOLOGICAL CHALLENGES

4.6 LIST OF SUBSTITUTES

4.7 HEALTH CLAIMS OF PHYTONUTRIENTS

4.8 NUTRITIONAL FACTS OF PHYTONUTRIENTS

4.8.1 RECOMMENDED INTAKE OF PHYTONUTRIENTS

4.9 RAW MATERIAL PRICING ANALYSIS

4.9.1 GEOGRAPHICAL PRICING

4.9.2 DEMAND FACTOR IN PRICING

4.9.3 GEOGRAPHICAL PRICING

4.9.4 DEMAND FACTOR IN PRICING

4.1 CONSUMPTION ANALYSIS FOR PHYTONUTRIENT INTAKES IN EUROPEAN COUNTRIES

4.11 IMPORT-EXPORT ANALYSIS

4.12 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SUPPLY CHAIN ANALYSIS

4.13 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

4.14 IMPORT-EXPORT ANALYSIS

5 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: REGULATIONS

5.1 FDA REGULATIONS

5.2 EU REGULATIONS

5.3 USDA REGULATIONS

5.4 FAO REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FOOD & BEVERAGE PRODUCTS

6.1.2 INCREASING DEMAND FOR ANIMAL FEED

6.1.3 INCREASING DEMAND FOR NUTRACEUTICAL PRODUCTS

6.1.4 NUMEROUS HEALTH BENEFITS ASSOCIATED WITH PHYTONUTRIENTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES

6.2.2 QUALITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR NATURAL FOOD PRODUCTS

6.3.2 INCREASING DEMAND FOR CAROTENOIDS IN VARIOUS END-USE INDUSTRIES

6.3.3 GROWING DEMAND FOR NATURAL SKINCARE AND COSMETIC PRODUCTS

6.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF PHYTONUTRIENTS

7 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLAVONOIDS

7.3 CAROTENOIDS

7.4 POLYPHENOLS

7.5 ALKALOIDS

7.6 PHYTOSTEROLS

7.7 VITAMIN

7.8 MONOTERPENES

7.9 RESVERATROL

7.1 PHYTOESTROGENS

7.11 ISOTHIOCYANATES

7.12 ALLYL SULFIDES

7.13 GLUCOSINOLATES

7.14 LIGNANS

7.15 BETALAINS

7.16 OTHERS

8 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 FRUIT

8.3 VEGETABLES

8.4 CEREALS

8.5 LEGUMES

8.6 TEA

8.7 FLOWER

8.8 HERBS

8.9 MARINE PLANT EXTRACTS

8.1 OILSEEDS

8.11 SPICE

9 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 BLENDED

11.3 PURE

12 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 IMMUNE SYSTEM

12.3 BONE HEALTH

12.4 CARDIOVASCULAR HEALTH

12.5 VISION

12.6 ANTI-CANCER

12.7 ANTI-CHOLESTEROL

12.8 WOMEN HEALTH

12.9 BLOOD VESSEL HEALTH

12.1 SKIN HEALTH

12.11 LUNG HEALTH

12.12 OTHERS

13 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD PRODUCTS

13.3 BEVERAGES

13.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

13.5 COSMETICS AND PERSONAL CARE

13.6 PHARMACEUTICALS

13.7 ANIMAL FEED

13.8 OTHERS

14 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 KUWAIT

14.1.5 OMAN

14.1.6 QATAR

14.1.7 REST OF MIDDLE EAST AFRICA

15 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MERCK KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 BASF SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 IFF NUTRITION & BIOSCIENCES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KOTHARI PHYTOCHEMICALS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 ASHLAND

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 AAYURITZ PHYTONUTRIENTS PVT.LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 AOM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARBORIS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIO-INDIA BIOLOGICALS (BIB) CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 BRLB INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BTSA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CONNOILS LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 CYANOTECH CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUS ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 DÖHLER GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 DYNADIS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ELEMENTA

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 EXCELVITE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 GUSTAV PARMENTIER GMBH

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 HERBAL CREATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 HINDUSTAN HERBALS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 LYCORED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MATRIX LIFE SCIENCE PVT. LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 MANUS AKTTEVA BIOPHARMA LLP

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 NUTRISCIENCE INNOVATIONS, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PHYTOSOURCE, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 PRINOVA GROUP LLC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 SABINSA

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

17.31 VITAE CAPS S.A.

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 XI'AN HEALTHFUL BIOTECHNOLOGY CO., LTD

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF SUBSTITUTE

TABLE 2 POTENTIAL BENEFITS OF PHYTONUTRIENT COMPOUNDS.

TABLE 3 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED FRUITS, YEAR (2019-2021)

TABLE 4 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED VEGETABLES, YEAR (2019-2021)

TABLE 5 EUROPEAN UNION FRUITS PRICES: (2021)

TABLE 6 EUROPEAN UNION VEGETABLES PRICES: (2021)

TABLE 7 WORLD FRUITS AND VEGETABLE PRODUCTION, (MILLION TONS), 2018

TABLE 8 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 9 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 10 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 11 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 12 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 13 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 14 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 15 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 16 LIST OF SOME PHYTONUTRIENTS USED IN NUTRACEUTICAL PRODUCTS

TABLE 17 FLAVONOIDS AND SOURCES

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING USE OF PHYTONUTRIENTS IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS LEAD TO THE GROWTH OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET IN 2022 & 2029

FIGURE 14 PATENT REGISTERED FOR PHYTONUTRIENTS, BY COUNTRY

FIGURE 15 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 16 VALUE CHAIN OF PHYTONUTRIENTS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET

FIGURE 18 POULTRY MEAT CONSUMPTION KILOGRAMS PER CAPITA GROWTH FROM 2019-2021

FIGURE 19 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY SOURCE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY CATEGORY, 2021

FIGURE 23 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY NATURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY FUNCTION, 2021

FIGURE 25 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET, BY APPLICATION, 2021

FIGURE 26 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: BY TYPE (2022 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA PHYTONUTRIENTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.