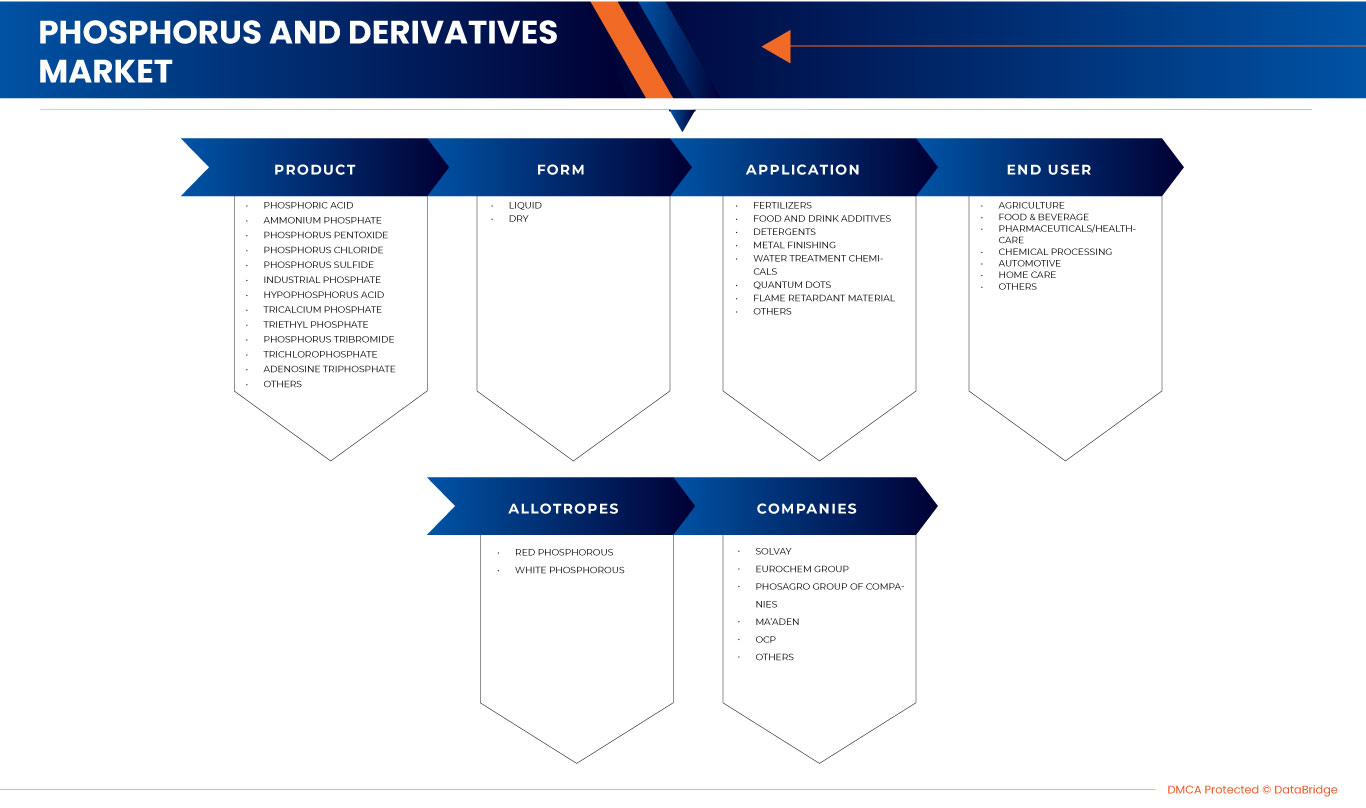

Marché du phosphore et des dérivés au Moyen-Orient et en Afrique, par produit ( acide phosphorique , phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres), forme (sec et liquide), application (engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériaux ignifuges et autres), utilisateur final (agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins à domicile et autres), allotropes (phosphore rouge et phosphore blanc) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

Le phosphore et l'acide phosphorique désignent des acides cristallins généralement faibles, incolores et inodores. Ces matières inorganiques sont corrosives pour les métaux ferreux et leurs alliages et possèdent une bonne solubilité dans l'eau. Elles ont tendance à se décomposer à haute température. Elles peuvent former des fumées toxiques lorsqu'elles sont combinées à de l'alcool. Elles confèrent aux boissons gazeuses une saveur acidulée et empêchent la croissance de moisissures et de bactéries, qui peuvent se multiplier facilement dans une solution sucrée. La majeure partie de l'acidité du soda provient également de l'acide phosphorique.

Les facteurs déterminants susceptibles d'être responsables de la croissance du marché nord-américain du phosphore et de ses dérivés sont la croissance rapide des secteurs de l'agriculture et de l'alimentation et des boissons. Cependant, les facteurs susceptibles de freiner le marché sont les réglementations gouvernementales strictes sur l'utilisation du phosphore et de ses dérivés.

D'autre part, les initiatives stratégiques des acteurs du marché et l'essor du secteur agricole et des industries agroalimentaires peuvent constituer une opportunité pour la croissance du marché nord-américain du phosphore et de ses dérivés. Les risques associés à la surutilisation de produits à base de phosphate peuvent créer des défis pour le marché nord-américain du phosphore et de ses dérivés. Certains développements récents concernent le marché nord-américain du phosphore et de ses dérivés.

Toutefois, les effets nocifs du phosphore et de ses dérivés sur l’environnement devraient entraver la croissance du marché nord-américain du phosphore et de ses dérivés au cours de la période de prévision.

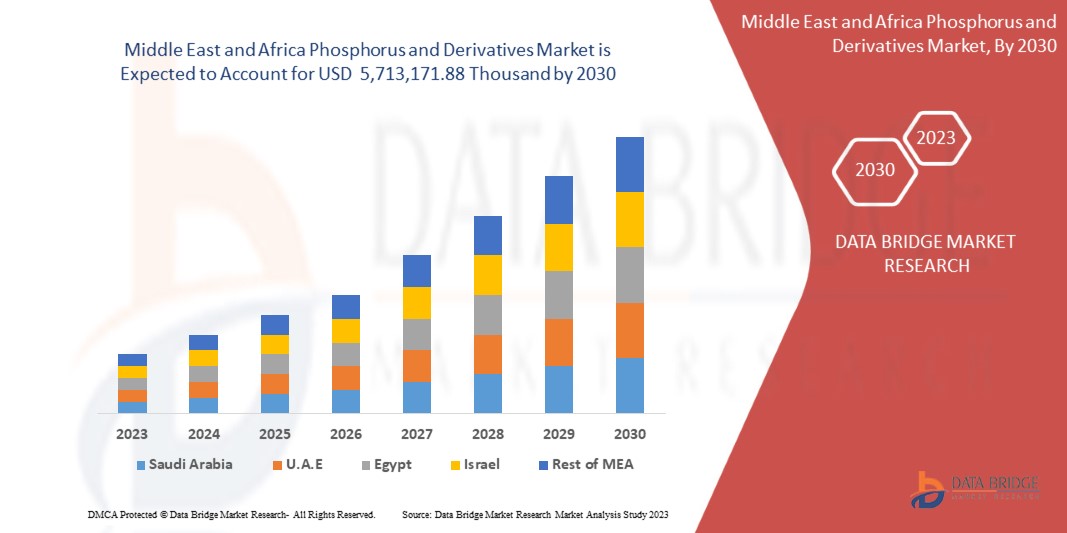

Data Bridge Market Research estime que le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique devrait atteindre la valeur de 5 713 171,88 milliers de dollars d'ici 2030, à un TCAC de 3,41 % au cours de la période de prévision. L'acide phosphorique est le segment de produit le plus important du marché en raison de l'utilisation croissante du phosphore sur le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (2016-2021) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Produit (acide phosphorique, phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres), forme (sec et liquide), application (engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériau ignifuge et autres), utilisateur final (agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins à domicile et autres), allotropes (phosphore rouge et phosphore blanc) |

|

Pays couverts |

Maroc Afrique du Sud, Arabie saoudite, Émirats arabes unis, Qatar, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd. et Sekisui Diagnostics, entre autres |

Définition du marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

Le phosphore est un élément non métallique combustible généralement présent sous deux formes allotropiques : le phosphore blanc et le phosphore rouge. L'acide phosphorique, l'acide phosphoreux, l'oxychlorure de phosphore, le pentachlorure de phosphore, le tribromure de phosphore, l'hypophosphite de sodium, le phosphate de tributyle et le phosphate de triéthyle sont de tels dérivés du phosphore. L'acide phosphorique, un dérivé du phosphore, est un acide cristallin généralement faible, incolore et inodore. Ces matières inorganiques sont corrosives pour le métal ferreux et ses alliages et possèdent une bonne solubilité dans l'eau. Elles ont tendance à se décomposer à haute température. Elles peuvent former des fumées toxiques lorsqu'elles sont combinées à l'alcool. Il donne aux boissons gazeuses une saveur acidulée et empêche la croissance de moisissures et de bactéries, qui peuvent se multiplier facilement dans une solution sucrée. La majeure partie de l'acidité du soda provient également de l'acide phosphorique.

Le phosphore est d'abord transformé en pentoxyde de phosphore par un procédé de fabrication chimique. Il est ensuite traité à nouveau pour devenir de l'acide phosphorique.

Dynamique du marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante d'engrais dans l'industrie agricole

L'acide phosphorique produit plusieurs engrais, notamment le DAP, le MAP, les NPK et le SSP.

Le phosphate diammonique (DAP) est l'engrais phosphaté le plus populaire en raison de ses propriétés physiques. La composition du DAP est de N-18% et de P2O5 -46%. Les engrais DAP sont parfaits pour toutes les cultures agricoles pour fournir une nutrition complète en phosphore tout au long de la croissance et du développement des cultures et une dose de démarrage d'azote et de faible teneur en soufre. Il peut être appliqué en automne pour le labourage et au printemps pendant le semis et la culture avant le semis. La dissolution dans le sol permet une alcalinisation temporaire du pH de la solution du sol autour du granulé d'engrais, stimulant ainsi une meilleure absorption du phosphore des engrais sur les sols acides. Le soufre des engrais contribue également à une meilleure absorption de l'azote et du phosphore par les plantes.

Ainsi, les multiples utilisations de l’acide phosphorique pour produire des engrais phosphatés devraient stimuler la croissance du marché de l’acide phosphorique au Moyen-Orient et en Afrique.

- Demande croissante dans le secteur pharmaceutique

L'acide phosphorique est principalement utilisé dans de nombreuses applications médicales, telles que le ciment dentaire, pour préparer des dérivés d'albumine, acidifier l'urine, éliminer les débris nécrotiques (cellules ou tissus morts), les médicaments anti-nausées, les blanchisseurs de dents et les liquides de bain de bouche.

L'acide phosphorique utilisé dans le blanchiment des dents peut altérer la surface des dents. L'utilisation d'acide phosphorique à 37 % après le blanchiment peut augmenter considérablement l'effet décalcifiant de l'acide sur la surface de l'émail, créant une surface gravée irrégulière. De plus, il peut créer une sensibilité au niveau des dents.

Ainsi, l’utilisation croissante de l’acide phosphorique dans les applications médicales devrait stimuler la croissance du marché de l’acide phosphorique au Moyen-Orient et en Afrique.

Retenue

- Réglementation gouvernementale stricte sur l'utilisation du phosphore et de ses dérivés

Il existe de nombreuses réglementations émanant de différents organismes de réglementation gouvernementaux concernant l’utilisation et la production d’acide phosphorique.

La FDA protège la santé publique en garantissant la sécurité, l'efficacité et la sûreté des médicaments à usage humain et vétérinaire, des produits biologiques, des produits chimiques et autres. L'USFDA a édicté certaines réglementations concernant l'utilisation de l'acide phosphorique dans les aliments et des réglementations concernant la manipulation de l'acide phosphorique. Vous trouverez ci-dessous certains des paramètres définis par la FDA à des fins de protection

Ainsi, en raison des réglementations gouvernementales strictes sur l’acide phosphorique, il existe des limitations sur l’utilisation de l’acide phosphorique, ce qui peut entraver la croissance du marché au cours de la période de prévision.

Opportunité

Accroître l'innovation et le lancement de nouveaux produits

Les principaux acteurs du marché ont lancé de nouveaux produits présentant des capacités améliorées. Les fabricants ont pris les mesures nécessaires pour améliorer la précision des nouveaux produits et la fonctionnalité globale.

Les acteurs du marché se concentrent davantage sur la production d’acide phosphorique au niveau national et opèrent en exportant vers d’autres régions pour développer leurs activités.

Ainsi, les innovations croissantes et les lancements de nouveaux produits devraient offrir une opportunité pour le marché de l’acide phosphorique au Moyen-Orient et en Afrique.

Défi

Risques associés à la surconsommation de produits à base de phosphate

Aux niveaux étatique, provisoire et national, l’approvisionnement en acide phosphorique est réglementé par diverses règles gouvernementales, car plusieurs risques peuvent avoir un impact sur l’utilisation des engrais, et il existe plusieurs impacts environnementaux lors de la production d’acide phosphorique.

La production d’engrais phosphatés utilise généralement comme matière première de la roche phosphatée sédimentaire, qui contient des concentrations accrues de radionucléides de la série U environ 10 à 100 fois supérieures à celles des sols non perturbés.

Ainsi, en raison des effets nocifs de l’acide phosphorique sur l’air, l’eau, le sol et la santé humaine, de nombreux organismes gouvernementaux ont mené la mise en œuvre de plusieurs réglementations, de systèmes de certification de haut niveau et d’enregistrements d’entreprises pour l’utilisation de l’acide phosphorique, ce qui peut constituer un défi pour le marché de l’acide phosphorique au Moyen-Orient et en Afrique.

Développements récents

- En mars 2023, Solvay a annoncé avoir été reconnu comme l'un des 60 meilleurs fournisseurs de 2022 par le réseau de plus de 10 000 fournisseurs de Northrop Grumman Corporation au Moyen-Orient et en Afrique. Cela renforcera notamment l'image de marque de l'entreprise.

- En mars 2023, le groupe Airedale a annoncé que l'entreprise poursuivrait sa croissance en acquérant McCann Chemicals. Cela contribuera à accroître la croissance et la diversification du portefeuille de produits de l'entreprise.

Portée du marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

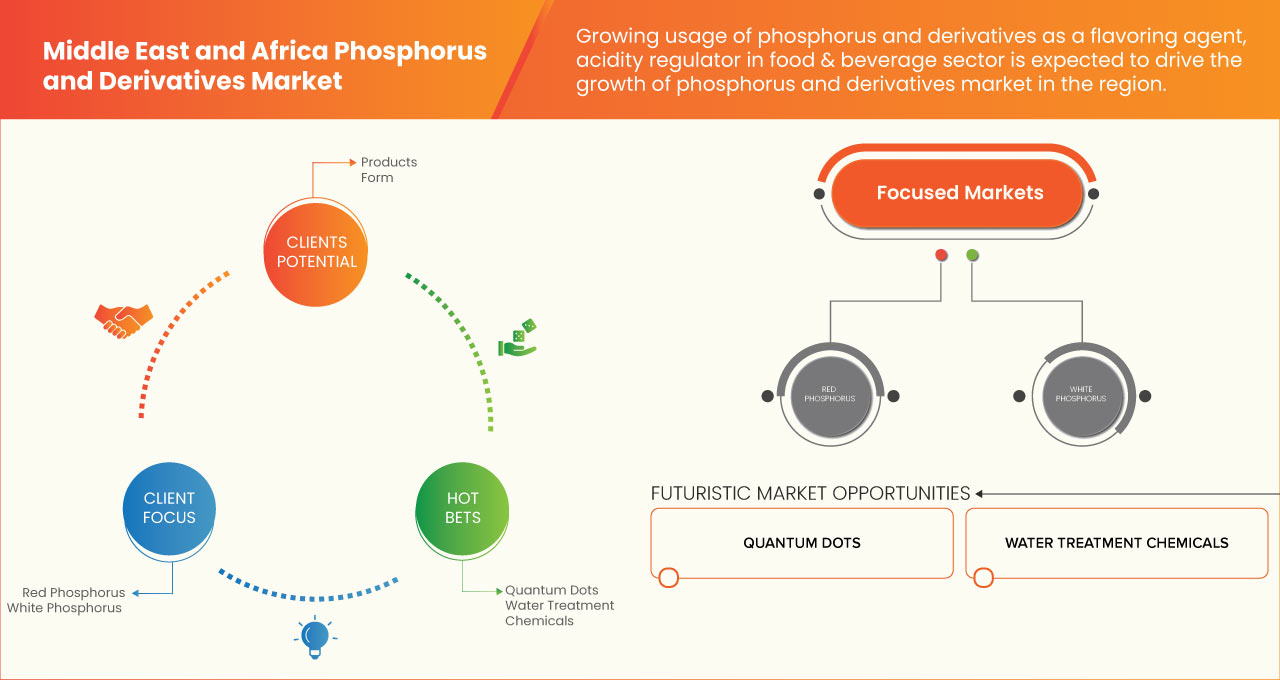

Le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique est segmenté en cinq segments notables tels que le produit, la forme, l'application, l'utilisateur final et les allotropes. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Acide phosphorique

- Phosphate d'ammonium

- Pentoxyde de phosphore

- Chlorure de phosphore

- Sulfure de phosphore

- Phosphate industriel

- Acide hypophosphoreux

- Phosphate tricalcique

- Phosphate de triéthyle

- Tribromure de phosphore

- Trichlorophosphate

- Adénosine triphosphate

- Autres

Sur la base du produit, le marché du phosphore et des dérivés du Moyen-Orient et de l'Afrique est segmenté en acide phosphorique, phosphate d'ammonium, pentoxyde de phosphore, chlorure de phosphore, sulfure de phosphore, phosphate industriel, acide hypophosphoreux, phosphate tricalcique, phosphate de triéthyle, tribromure de phosphore, trichlorophosphate, adénosine triphosphate et autres.

Formulaire

- Sec

- Liquide

Sur la base de la forme, le marché du phosphore et des dérivés du Moyen-Orient et de l’Afrique est segmenté en sec et liquide.

Application

- Engrais

- Additifs alimentaires et boissons

- Détergents

- Finition des métaux

- Produits chimiques pour le traitement de l'eau

- Points quantiques

- Matériau ignifuge

- Autres

Sur la base de l'application, le marché du phosphore et des dérivés du Moyen-Orient et de l'Afrique est segmenté en engrais, additifs alimentaires et boissons, détergents, finition des métaux, produits chimiques de traitement de l'eau, points quantiques, matériaux ignifuges et autres.

Utilisateur final

- Agriculture

- Alimentation et boissons

- Produits pharmaceutiques/Soins de santé

- Traitement chimique

- Automobile

- Soins à domicile

- Autres

Sur la base de l'utilisateur final, le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique est segmenté en agriculture, alimentation et boissons, produits pharmaceutiques/soins de santé, traitement chimique, automobile, soins ménagers et autres.

Allotropes

- Phosphore rouge

- Phosphore blanc

Sur la base des allotropes, le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique est segmenté en phosphore rouge et phosphore blanc.

Analyse/perspectives régionales du marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

Le marché du phosphore et de ses dérivés au Moyen-Orient et en Afrique est segmenté en cinq segments notables tels que le produit, la forme, l’application, l’utilisateur final et les allotropes.

Les pays couverts dans ce rapport de marché du marché du phosphore et des dérivés du Moyen-Orient et de l'Afrique sont le Maroc, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, le Qatar, l'Égypte, Israël et le reste du Moyen-Orient et de l'Afrique.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité du phosphore et de ses dérivés ainsi que les défis rencontrés en raison de réglementations strictes sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du phosphore et des produits dérivés au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché du phosphore et des dérivés au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails comprennent un aperçu de l'entreprise, les finances, les revenus générés, le potentiel du marché, l'expansion commerciale, les installations de service, le partenariat, le développement stratégique, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus ne concernent que l'orientation de l'entreprise vers le marché du phosphore et des dérivés au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché du phosphore et des dérivés au Moyen-Orient et en Afrique sont ANEXIB Chemicals, Nippon Chemical Industrial CO., LTD., Mosaic Company, LANXESS, Solvay, Ma'aden, ICL, Xuzhou JianPing Chemical Co., Ltd. et Sekisui Diagnostics, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 MIDDLE EAST & AFRICA PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 MOROCCO

16.1.2 EGYPT

16.1.3 ISRAEL

16.1.4 SAUDI ARABIA

16.1.5 SOUTH AFRICA

16.1.6 UNITED ARAB EMIRATES

16.1.7 QATAR

16.1.8 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC MIDDLE EAST & AFRICA

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 MIDDLE EAST AND AFRICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 MIDDLE EAST AND AFRICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 MOROCCO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 MOROCCO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 MOROCCO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 MOROCCO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 MOROCCO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 MOROCCO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 MOROCCO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 MOROCCO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 MOROCCO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 EGYPT PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 EGYPT PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 EGYPT AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 EGYPT AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 EGYPT PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 EGYPT PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 EGYPT PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 EGYPT PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 EGYPT PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 ISRAEL PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 ISRAEL PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 ISRAEL AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 ISRAEL AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 ISRAEL PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 ISRAEL PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 ISRAEL PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 ISRAEL PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 ISRAEL PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 77 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 78 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 79 SAUDI ARABIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 80 SAUDI ARABIA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 81 SAUDI ARABIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 82 SAUDI ARABIA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 83 SAUDI ARABIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 84 SAUDI ARABIA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 85 SAUDI ARABIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 86 SAUDI ARABIA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 87 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 88 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 89 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 90 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 91 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 92 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 93 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 94 SAUDI ARABIA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 95 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 96 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 97 SOUTH AFRICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 98 SOUTH AFRICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 99 SOUTH AFRICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 100 SOUTH AFRICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 101 SOUTH AFRICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 102 SOUTH AFRICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 103 SOUTH AFRICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 104 SOUTH AFRICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 105 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 106 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 107 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 108 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 109 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 110 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 111 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 112 SOUTH AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 113 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 114 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 115 UNITED ARAB EMIRATES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 117 UNITED ARAB EMIRATES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATES AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 119 UNITED ARAB EMIRATES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATES PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 121 UNITED ARAB EMIRATES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATES PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 123 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 125 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 127 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 129 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 131 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 132 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 133 QATAR PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 134 QATAR PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 135 QATAR AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 136 QATAR AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 137 QATAR PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 138 QATAR PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 139 QATAR PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 140 QATAR PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 141 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 142 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 143 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 144 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 145 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 146 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 147 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 148 QATAR PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 149 REST OF MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 150 REST OF MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2023 - 2030)

FIGURE 31 MIDDLE EAST & AFRICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.