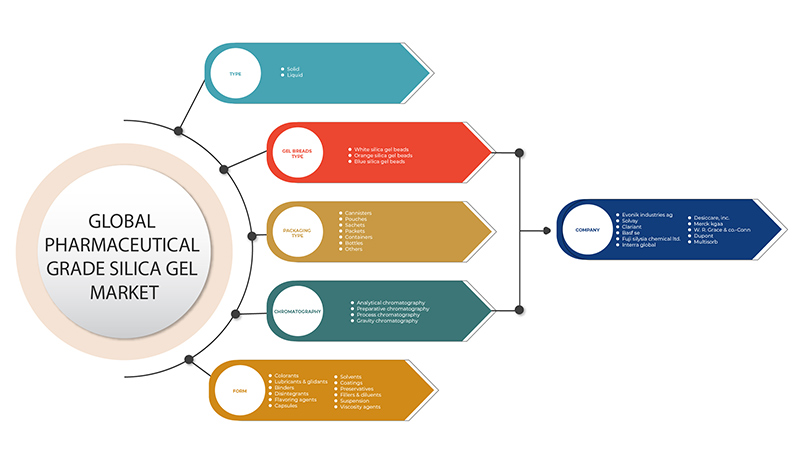

Middle East and Africa Pharmaceutical Grade Silica Gel Market, By Type (Liquid, and Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents, and Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) Industry Trends and Forecast to 2029.

Market Analysis and Insights

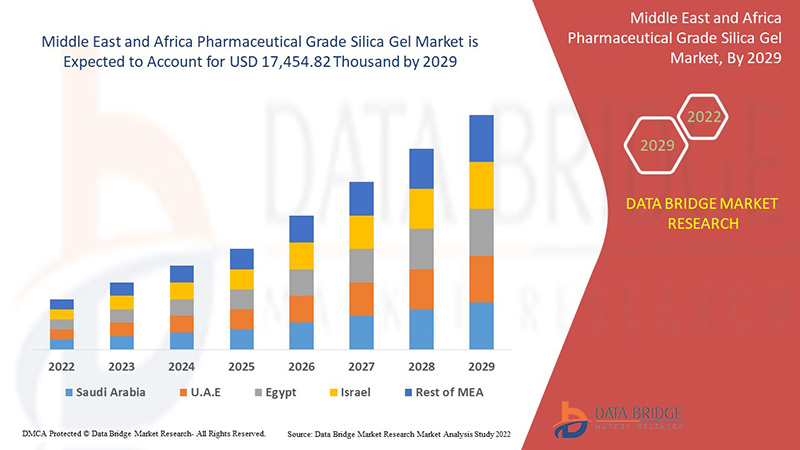

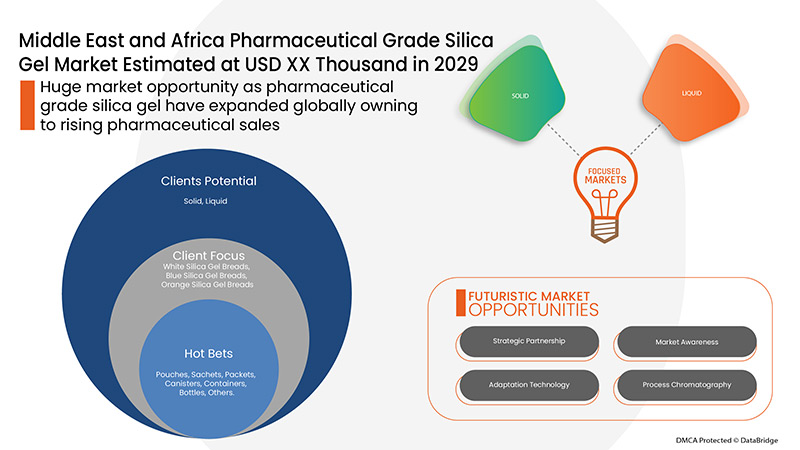

Middle East and Africa pharmaceutical grade silica gel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 2.6% in the forecast period of 2022 to 2029 and is expected to reach USD 17,454.82 thousand by 2029.

The major factor driving the growth of the pharmaceutical grade silica gel market are growing demand for medicinal drugs, extensive deployment or R&D in the pharma sector, and rising spending on biotechnology using chromatography for detecting molecular components.

Silica gel as a stationary phase is largely accepted as one of the top adsorbents used in column chromatography as well as other separation techniques. One of the major advantages is its tremendous affinity for adsorption. Additionally, it is commercially very readily available in several different sizes and types. The major significant reason for silica gel used as a stationary phase in column chromatography is that it has feasible to obtain the extract essential size of the particle size for a particular method.

Silica gel is a polar adsorbent that is slightly acidic and has a strong capacity to adsorb the basic substance. The silica gel is most widely used in reversed-phase partition chromatography and it has broad applications that consist of the separation of steroids, amino acids, lipids, alkaloids, and several pharmaceutical processes.

Middle East and Africa pharmaceutical grade silica gel market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en kilotonnes, prix en dollars américains |

|

Segments couverts |

Par type (liquide et solide), type de pains de gel (pains de gel de silice blancs, pains de gel de silice orange et pains de gel de silice bleus), forme (colorants, lubrifiants et agents de glissement, liants, désintégrants, agents aromatisants, capsules, solvants, revêtements, conservateurs, charges et diluants, suspension, agents de viscosité et autres), type d'emballage (bidons, sachets, sachets, paquets, conteneurs, bouteilles et autres), chromatographie (chromatographie analytique, chromatographie préparative, chromatographie de procédé et chromatographie par gravité) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

Dynamique du marché du gel de silice de qualité pharmaceutique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de médicaments

L'industrie pharmaceutique en pleine croissance a stimulé la croissance de la production de médicaments, ce qui a augmenté la consommation de gel de silice au fil des ans. La demande de gel de silice devrait encore augmenter car la chromatographie peut être réalisée à l'aide de gel de silice. La chromatographie sur colonne de gel de silice est largement utilisée dans l'industrie pharmaceutique pour collecter ou séparer différents composants de médicaments.

- Déploiement massif de la R&D dans le secteur pharmaceutique

Le besoin croissant d'intégrité des données et d'automatisation a conduit à l'intégration de logiciels sophistiqués aux systèmes de chromatographie contemporains. Ces avancées technologiques pour le développement de systèmes améliorés, de colonnes innovantes et jetables, de résines plus performantes et d'autres accessoires peuvent aider le marché à croître de manière significative.

- Augmentation des dépenses consacrées à la biotechnologie utilisant la chromatographie pour détecter les composants moléculaires

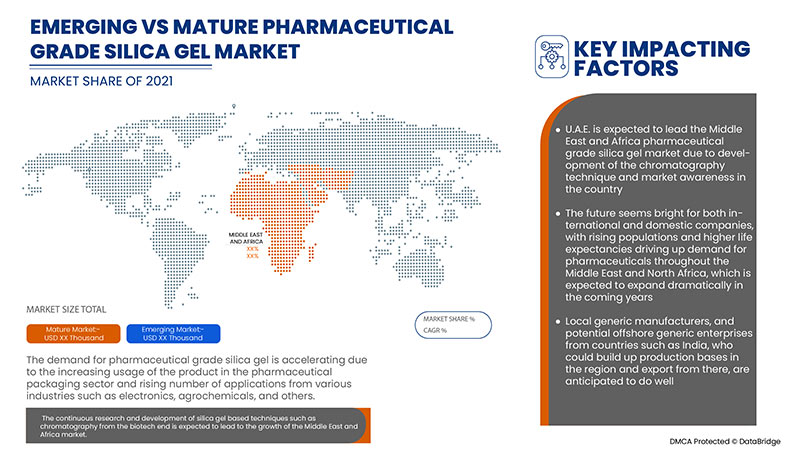

La bioencapsulation consiste à envelopper des tissus ou des substances biologiquement actives dans une membrane semi-perméable pour protéger les structures biologiques enfermées telles que les cellules, les enzymes , les médicaments et les matériaux magnétiques, entre autres. La recherche et le développement continus de techniques à base de gel de silice, comme la chromatographie du côté biotechnologique, conduiront à la croissance du marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique.

Opportunités

- Perspectives lucratives pour la R&D interne

La chromatographie est une technique en constante évolution et l’augmentation de la demande d’instruments et de réactifs de chromatographie pour la recherche et le développement est un facteur majeur de la croissance et de la demande pour le marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique.

- Disponibilité facile des matières premières grâce à des partenaires stratégiques bien établis

La forme amorphe du dioxyde de silicium est utilisée pour fabriquer du gel de silice à base pharmaceutique. L'énorme disponibilité de différentes matières premières à la surface de la terre ainsi que la capacité de produire synthétiquement ces matières premières ainsi que les partenariats bien établis des entreprises produisant du gel de silice de qualité pharmaceutique avec divers fournisseurs et partenaires, qui fournissent en permanence des matières premières de haute qualité à ces acteurs pour la production de gel de silice.

Contraintes/Défis

- Réglementation stricte du gouvernement

Les normes pharmaceutiques de l'USP sont appliquées aux États-Unis par la Food and Drug Administration (FDA) et sont également utilisées dans plus de 140 pays à travers le monde. La loi indienne de 1948 sur la pharmacie contient diverses réglementations strictes concernant la composition des médicaments, qui obligent les pharmaciens/chimistes à suivre diverses procédures et contrôles pour obtenir l'approbation du gouvernement. Ces règles et réglementations strictes pourraient être l'une des plus grandes contraintes auxquelles est confronté le marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique.

- La disponibilité des substituts

Les silanols libres présents à la surface de la silice sont responsables des interactions néfastes entre ces composés et la phase stationnaire. Ces composés présentent une forme de pic incorrecte et une faible efficacité. Cela a également incité les fabricants à opter pour des substituts présents sur le marché. Pour ces raisons, plusieurs nouvelles phases stationnaires telles que les phases stationnaires sans silice, qui contiennent des silanols réduits et/ou protégés, sont introduites sur le marché.

- Les produits pharmaceutiques répondent à des normes strictes de contrôle de qualité et de performance

Partout dans le monde, chaque gouvernement consacre une part importante de son budget de santé aux médicaments et aux produits pharmaceutiques. Dans les pays en développement, des efforts administratifs et techniques considérables sont déployés pour garantir que les patients et les consommateurs reçoivent des médicaments efficaces et de bonne qualité, sans aucun compromis sur la qualité.

-

Champ d'application limité aux composés non volatils

La température du système utilisant du gel de silice pour les composés volatils doit être maintenue à des niveaux inférieurs afin que le composé ne se vaporise pas trop rapidement et qu'il y ait une perte totale de l'échantillon avant qu'il ne soit utilisé et séparé par la plaque de gel de silice. Par conséquent, le champ d'application du gel de silice est limité aux composés non volatils, ce qui peut remettre en cause la croissance du marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique.

Développement récent

- En février 2022, DuPont a lancé un nouveau portail de vente en ligne pour répondre aux besoins des acheteurs du secteur des bioprocédés. Les bioprocédés de DuPont permettent des séparations et des purifications sophistiquées pour les produits thérapeutiques, différentes marques de DuPont telles qu'AmberChrom et AmberLite étant très bien établies dans l'industrie biopharmaceutique.

Portée du marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique

Le marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique est classé en fonction du type, des pains de gel, de la forme, du type d'emballage et de la chromatographie. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Solide

- Liquide

Sur la base du type, le marché du gel de silice de qualité pharmaceutique du Moyen-Orient et de l’Afrique est segmenté en solide et liquide.

Type de pains gélifiés

- Pains blancs au gel de silice

- Pains au gel de silice à l'orange

- Pains au gel de silice bleu

Sur la base du type de pains de gel, le marché du gel de silice de qualité pharmaceutique du Moyen-Orient et de l'Afrique est segmenté en pains de gel de silice blanc, pains de gel de silice orange et pains de gel de silice bleu.

Formulaire

- Charges et diluants

- Classeurs

- Désintégrants

- Lubrifiants et agents de glissement

- Colorants

- Agents aromatisants

- Conservateurs

- Solvants

- Gélules

- Agents de viscosité

- Suspension

- Revêtements

Sur la base de la forme, le marché du gel de silice de qualité pharmaceutique du Moyen-Orient et de l'Afrique est segmenté en colorants, lubrifiants et glissants, liants, désintégrants, agents aromatisants, capsules, solvants, revêtements, conservateurs, charges et diluants, suspension, agents de viscosité, et autres hôpitaux et cliniques, centres de diagnostic, instituts universitaires et autres.

Type d'emballage

- Pochettes

- Sachets

- Paquets

- Bidons

- Conteneurs

- Bouteilles

- Autres

Sur la base du type d'emballage, le marché du gel de silice de qualité pharmaceutique du Moyen-Orient et de l'Afrique est segmenté en bidons, pochettes, sachets, paquets, conteneurs, bouteilles et autres.

Chromatographie

- Chromatographie analytique

- Chromatographie préparative

- Chromatographie de procédé

Sur la base de la chromatographie, le marché du gel de silice de qualité pharmaceutique du Moyen-Orient et de l'Afrique est segmenté en chromatographie analytique, chromatographie préparative, chromatographie de procédé et chromatographie par gravité.

Analyse/perspectives régionales du marché du gel de silice de qualité pharmaceutique

Le marché du gel de silice de qualité pharmaceutique est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, type de pains de gel, forme, type d’emballage et chromatographie comme référencé ci-dessus.

Le marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique est en outre segmenté en principaux pays, notamment les Émirats arabes unis, l'Arabie saoudite, l'Égypte, l'Afrique du Sud, Israël et le reste du Moyen-Orient et de l'Afrique.

Les Émirats arabes unis, au Moyen-Orient et en Afrique, dominent le marché du gel de silice de qualité pharmaceutique en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision. Cela est dû à la présence d'acteurs clés majeurs et à une infrastructure de soins de santé bien développée dans le pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du gel de silice de qualité pharmaceutique.

Certains des principaux acteurs opérant sur le marché du gel de silice de qualité pharmaceutique au Moyen-Orient et en Afrique sont BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGY ADVANCEMENTS

4.6 REGULATORY COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL PROCUREMENT

4.7.2.1 MANUFACTURING AND PACKING

4.7.2.2 MARKETING AND DISTRIBUTION

4.7.2.3 END USERS

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 MIDDLE EAST & AFRICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR MEDICINAL DRUGS

6.1.2 EXTENSIVE DEPLOYMENT OF R&D IN THE PHARMA SECTOR

6.1.3 RISING EXPENSES ON BIOTECHNOLOGY USING CHROMATOGRAPHY FOR DETECTING MOLECULAR COMPONENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS BY THE GOVERNMENT

6.2.2 AVAILABILITY OF SUBSTITUTES

6.2.3 RESTRICTIONS ON DERMAL AND ORAL EXPOSURE TO PHARMACEUTICAL GRADE SILICA GEL

6.2.4 HIGH PRICE OF SILICA GEL

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS IN-HOUSE R&D

6.3.2 EASY AVAILABILITY OF RAW MATERIALS THROUGH WELL-ESTABLISHED STRATEGIC PARTNERS

6.4 CHALLENGES

6.4.1 PHARMACEUTICAL ITEMS MEET STRINGENT QUALITY CONTROL AND PERFORMANCE STANDARDS

6.4.2 LIMITED APPLICATION SCOPE TO NON-VOLATILE COMPOUNDS

7 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 SOLID

7.3 LIQUID

8 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE

8.1 OVERVIEW

8.2 WHITE SILICA GEL BEADS

8.3 ORANGE SILICA GEL BEADS

8.4 BLUE SILICA GEL BEADS

9 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM

9.1 OVERVIEW

9.2 FILLERS & DILUENTS

9.3 BINDERS

9.4 DISINTEGRANTS

9.5 LUBRICANTS & GLIDANTS

9.6 COLORANTS

9.7 FLAVORING AGENTS

9.8 PRESERVATIVES

9.9 SOLVENTS

9.1 CAPSULES

9.11 VISCOSITY AGENTS

9.12 SUSPENSION

9.13 COATINGS

10 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES

10.3 SACHETS

10.4 PACKETS

10.5 CANISTERS

10.6 CONTAINERS

10.7 BOTTLES

10.8 OTHERS

11 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY

11.1 OVERVIEW

11.2 ANALYTICAL CHROMATOGRAPHY

11.3 PREPARATIVE CHROMATOGRAPHY

11.4 PROCESS CHROMATOGRAPHY

11.5 GRAVITY CHROMATOGRAPHY

12 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 EGYPT

12.1.4 SOUTH AFRICA

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.1.1 COLLABORATIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 SOLVAY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 W. R. GRACE & CO.-CONN

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 EVONIK INDUSTRIES AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CLARIANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DESICCARE, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUJI SILYSIA CHEMICAL LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 INTERRA MIDDLE EAST & AFRICA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 MULTISORB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 MIDDLE EAST & AFRICA LIQUID IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA LIQUID IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA WHITE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA ORANGE SILICA GEL BEADS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA BLUE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA FILLERS & DILUENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA BINDERS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA DISINTEGRANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA LUBRICANTS & GLIDANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA COLORANTS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA FLAVORING AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA PRESERVATIVES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA SOLVENTS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA CAPSULES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA VISCOSITY AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA SUSPENSION IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA COATINGS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA POUCHES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SACHETS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA PACKETS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA CANISTERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA CONTAINERS IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA BOTTLES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA ANALYTICAL CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA PREPARATIVE CHROMATOGRAPHY IN MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PROCESS CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA GRAVITY CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 42 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 44 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 48 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.A.E. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 54 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 60 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 62 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 EGYPT PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 68 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 72 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 74 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 ISRAEL PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 78 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 GROWING DEMAND FOR MEDICINAL DRUGS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET IN THE FORECAST PERIOD

FIGURE 15 SOLID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 19 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY GEL BEADS TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY CHROMATOGRAPHY, 2021

FIGURE 24 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.