Middle East And Africa Padded Mailers Market

Taille du marché en milliards USD

TCAC :

%

USD

1.42 Billion

USD

1.89 Billion

2025

2033

USD

1.42 Billion

USD

1.89 Billion

2025

2033

| 2026 –2033 | |

| USD 1.42 Billion | |

| USD 1.89 Billion | |

|

|

|

|

Segmentation du marché des enveloppes matelassées au Moyen-Orient et en Afrique, par type (auto-adhésives et à fermeture pelable), capacité (moins de 300 g, 300 à 500 g, 500 à 1 000 g, 1 000 à 2 000 g et plus de 2 000 g), dimensions (25,4 cm x 33 cm, 22,9 cm x 30,5 cm et 15,2 cm x 22,9 cm), canal de distribution (supermarchés/hypermarchés, commerce électronique, magasins spécialisés et autres), application (produits pharmaceutiques, électriques et électroniques, automobiles et industries connexes, agroalimentaire, cosmétiques et soins personnels, livres et CD audio, bijoux, cadeaux, cadres, montres et articles de fantaisie, cassettes vidéo et autres) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des enveloppes matelassées au Moyen-Orient et en Afrique

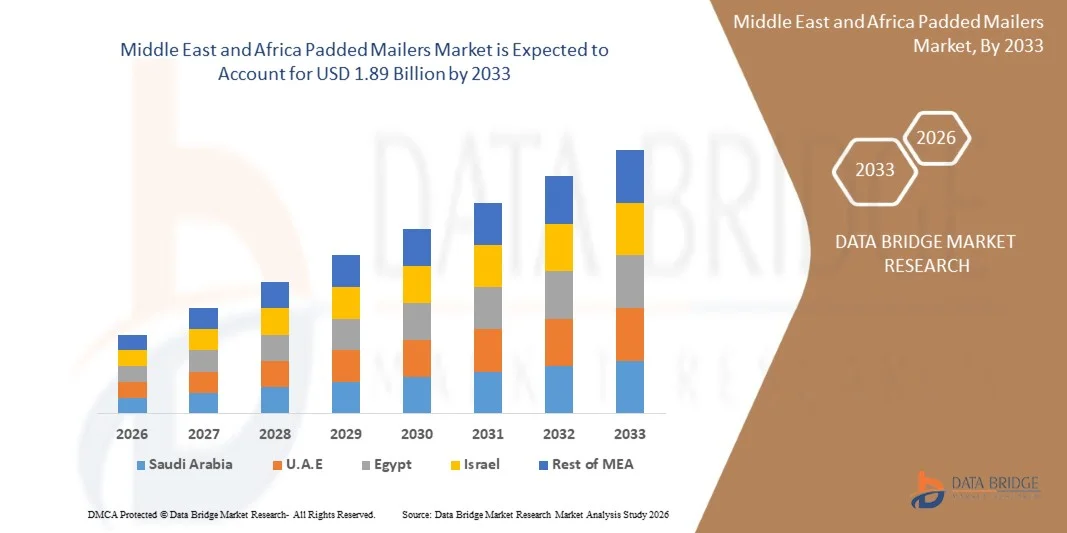

- Le marché des enveloppes matelassées au Moyen-Orient et en Afrique était évalué à 1,42 milliard de dollars en 2025 et devrait atteindre 1,89 milliard de dollars d'ici 2033 , soit un TCAC de 3,6 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion rapide du commerce électronique et la demande croissante de solutions d'emballage légères, économiques et protectrices dans divers secteurs, notamment la distribution, l'électronique et la santé.

- De plus, la sensibilisation croissante à l'environnement et la pression réglementaire favorisent l'adoption d'emballages durables, incitant les fabricants à développer des enveloppes matelassées recyclables et à base de fibres, conformes aux objectifs de l'économie circulaire, et accélérant ainsi leur pénétration du marché.

Analyse du marché des enveloppes matelassées au Moyen-Orient et en Afrique

- Les enveloppes matelassées sont des emballages rembourrés conçus pour protéger les produits pendant le transport tout en réduisant les coûts d'expédition grâce à leur légèreté. Elles sont largement utilisées pour l'expédition d'articles de petite et moyenne taille tels que des livres, des appareils électroniques, des bijoux et des produits pharmaceutiques, aussi bien auprès des consommateurs (B2C) que des entreprises (B2B).

- La demande croissante d'enveloppes matelassées aux États-Unis est principalement due à l'essor du commerce en ligne, à une attention accrue portée à la sécurité des produits pendant le transport et à une préférence grandissante pour les enveloppes écologiques en papier par rapport aux alternatives traditionnelles en plastique.

- L'Arabie saoudite a dominé le marché des enveloppes matelassées au Moyen-Orient et en Afrique en 2025, grâce à l'expansion de son secteur du commerce électronique, au développement de ses infrastructures logistiques et à une préférence croissante pour les emballages durables.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique au cours de la période de prévision, grâce à leurs infrastructures logistiques avancées, à leur forte pénétration du commerce électronique et à la transformation numérique rapide du commerce de détail.

- Le segment des enveloppes auto-adhésives a dominé le marché avec une part de 63,9 % en 2025, grâce à sa praticité, son efficacité et sa forte adhérence qui garantit un emballage sécurisé. Les entreprises des secteurs du e-commerce et du commerce de détail privilégient les enveloppes matelassées auto-adhésives car elles réduisent les efforts manuels et le temps d'emballage tout en assurant une protection inviolable pendant le transport. Leur rentabilité et leur compatibilité avec les systèmes d'emballage automatisés contribuent également à leur large adoption dans les services logistiques et postaux.

Portée du rapport et segmentation du marché des enveloppes matelassées au Moyen-Orient et en Afrique

|

Attributs |

Moyen-Orient et Afrique - Enveloppes matelassées : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des enveloppes matelassées au Moyen-Orient et en Afrique

« Expansion croissante du commerce électronique et innovation en matière d’emballage durable »

- L'essor du commerce électronique, conjugué à l'innovation croissante en matière de solutions d'emballage durables, est une tendance majeure qui influence le marché des enveloppes matelassées au Moyen-Orient et en Afrique. La montée en puissance du commerce en ligne génère une forte demande pour des emballages légers, protecteurs et économiques, adaptés à l'expédition sécurisée d'articles petits et fragiles.

- Par exemple, Sealed Air Corporation a lancé des enveloppes à bulles éco-conçues intégrant des plastiques recyclés et des couches de rembourrage à base de papier. Ces produits permettent de réduire la consommation de matériaux tout en garantissant la durabilité et la protection des produits, conformément aux exigences mondiales en matière de développement durable et d'expédition du commerce électronique.

- L'attention croissante portée au respect de l'environnement et aux objectifs de développement durable des entreprises favorise l'adoption d'enveloppes matelassées compostables et recyclables. Les fabricants développent des alternatives à base de papier et des polymères biosourcés afin de minimiser l'impact environnemental tout en offrant une résistance à la déchirure et des performances d'amortissement comparables.

- Les tendances en matière de personnalisation et de stratégie de marque redessinent également le marché, les entreprises de commerce électronique cherchant à renforcer l'attrait de leurs marques. Les enveloppes matelassées imprimées, ornées du logo de l'entreprise et de certifications écologiques, sont de plus en plus utilisées pour consolider la confiance des consommateurs et aligner les emballages sur les valeurs de développement durable des marques.

- Les progrès réalisés dans le domaine des matériaux et des technologies d'impression numérique permettent de produire des enveloppes matelassées de haute qualité, plus facilement recyclables, plus résistantes à l'humidité et fabriquées avec une énergie plus efficace. Cette innovation permet aux producteurs de répondre aux différents besoins de protection des produits tout en maîtrisant les coûts et en préservant l'environnement.

- La dynamique conjuguée de la croissance du commerce électronique et de l'innovation durable annonce une phase de transformation pour le secteur des enveloppes matelassées. À mesure que la logistique, l'image de marque et les considérations environnementales convergent, les fabricants sont bien placés pour tirer profit de la demande croissante des consommateurs et des entreprises en matière d'enveloppes de protection éco-efficientes.

Dynamique du marché des enveloppes matelassées au Moyen-Orient et en Afrique

Conducteur

« Augmentation des expéditions de produits individuels »

- L'augmentation du volume des envois de produits individuels, principalement due à la vente en ligne et aux modèles de vente directe au consommateur, est un moteur important du marché des enveloppes matelassées au Moyen-Orient et en Afrique. Le besoin de solutions d'emballage compactes, légères et sécurisées, adaptées aux livraisons individuelles, a renforcé la demande d'enveloppes de protection dans de nombreux secteurs.

- Par exemple, les vendeurs d'Amazon et de Shopify utilisent de plus en plus les enveloppes à bulles et en papier pour expédier directement aux consommateurs des vêtements, des cosmétiques et des appareils électroniques. Ces produits offrent un amorti fiable, un poids d'expédition réduit et un meilleur rapport coût-efficacité par rapport aux emballages en carton ondulé traditionnels.

- L'essor de la logistique des petits colis et la tendance à la réduction des déchets d'emballage incitent les entreprises à adopter les enveloppes matelassées comme alternative d'emballage écologique et économique. Cette évolution s'inscrit dans les objectifs mondiaux de réduction des émissions de carbone tout en améliorant l'efficacité de la livraison du dernier kilomètre.

- L'exigence croissante des consommateurs en matière de livraison de produits sûrs et intacts favorise l'adoption d'enveloppes matelassées dotées de couches de protection renforcées et de fermetures inviolables. Les marques de commerce électronique privilégient également des enveloppes pratiques et faciles à recycler afin d'améliorer l'expérience client.

- L'essor des places de marché en ligne, conjugué à la hausse des expéditions transfrontalières et au recours accru aux emballages souples, devrait soutenir une forte croissance du marché des enveloppes matelassées. Cette forte demande souligne leur rôle essentiel dans les circuits de distribution modernes axés sur la livraison fréquente de petits colis.

Retenue/Défi

« La volatilité des prix des matières premières et des infrastructures de recyclage »

- Les fluctuations des prix des matières premières et le manque d'infrastructures de recyclage performantes constituent des défis majeurs pour le marché des enveloppes matelassées au Moyen-Orient et en Afrique. La variabilité du coût des résines plastiques, des fibres de papier et des adhésifs influe directement sur les coûts de production et les stratégies de prix des fabricants d'emballages.

- Par exemple, de grands fabricants d'emballages comme Storopack et Pregis ont subi d'importantes fluctuations du coût des matières premières en raison des variations des marchés mondiaux du pétrole brut et des pénuries d'approvisionnement en pâte à papier. Ces variations ont influencé les prix des produits et affecté les marges bénéficiaires des fournisseurs et des distributeurs.

- La composition complexe des enveloppes multi-matériaux, souvent composées de papier et de films plastiques, constitue un obstacle à leur recyclage efficace. Les capacités de traitement limitées des installations de recyclage entravent la séparation et le retraitement adéquats de ces matériaux, ce qui engendre des inefficacités dans la gestion des déchets.

- L'accès inégal aux infrastructures de recyclage selon les régions, notamment dans les pays en développement, freine la transition vers une économie circulaire. Cette limitation réduit l'efficacité environnementale globale des initiatives d'envoi durable et accroît les coûts liés à la responsabilité des producteurs.

- Pour atténuer ces difficultés, les entreprises investissent dans des solutions monomatériaux, l'approvisionnement local en matériaux et des programmes de responsabilité élargie des producteurs. Le renforcement des systèmes de recyclage, la normalisation de la composition des matériaux et la stabilisation des chaînes d'approvisionnement en matières premières seront essentiels pour assurer une croissance durable et une résilience environnementale sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique.

Le marché des enveloppes matelassées au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, de la capacité, de la taille, du canal de distribution et de l'application.

- Par type

Le marché des enveloppes matelassées au Moyen-Orient et en Afrique est segmenté, selon le type, en enveloppes auto-adhésives et enveloppes autocollantes. Le segment des enveloppes auto-adhésives a dominé le marché en 2025, représentant 63,9 % des revenus, grâce notamment à leur praticité, leur efficacité et leur forte adhérence, garantissant un emballage sécurisé. Les entreprises des secteurs du e-commerce et du commerce de détail privilégient les enveloppes matelassées auto-adhésives, car elles réduisent les efforts manuels et le temps d'emballage tout en assurant une protection inviolable pendant le transport. Leur rentabilité et leur compatibilité avec les systèmes d'emballage automatisés contribuent également à leur large adoption dans les services logistiques et postaux.

Le segment des emballages pelables et refermables devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à leur grande facilité d'utilisation et à leur étanchéité renforcée. Les enveloppes matelassées pelables et refermables offrent un système de fermeture rapide et propre, séduisant aussi bien les consommateurs que les professionnels de l'emballage dans des secteurs comme les cosmétiques et l'électronique. La croissance de ce segment est également alimentée par l'utilisation croissante de matériaux pelables et refermables durables et recyclables, répondant ainsi à la demande grandissante d'alternatives d'emballage écologiques.

- Par capacité

En fonction de la capacité, le marché est segmenté en cinq catégories : moins de 300 g, de 300 à 500 g, de 500 à 1 000 g, de 1 000 à 2 000 g et plus de 2 000 g. Le segment des emballages de 300 à 500 g dominait le marché en 2025, car cette gamme est la plus couramment utilisée pour l’envoi d’articles de taille moyenne tels que les livres, les vêtements et les accessoires électroniques. Cette capacité offre un équilibre idéal entre protection et rentabilité, ce qui en fait un choix privilégié pour les détaillants en ligne et les entreprises de messagerie gérant des envois de tailles variées.

Le segment des emballages de 500 à 1 000 g devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par l’essor du commerce en ligne de biens de consommation lourds. Cette catégorie offre une durabilité et un amortissement accrus, protégeant ainsi les articles fragiles et précieux tels que les appareils électroniques et les pièces automobiles. Face à la demande croissante d’emballages de protection haut de gamme pour le transport international, les enveloppes matelassées à capacité de charge élevée deviennent une solution essentielle pour une logistique sûre et efficace.

- Par taille

Le marché des enveloppes matelassées au Moyen-Orient et en Afrique est segmenté en fonction de la taille : 25,4 cm x 33 cm, 22,9 cm x 30,5 cm et 15,2 cm x 22,9 cm. Le segment 25,4 cm x 33 cm dominait le marché en 2025, principalement grâce à sa polyvalence permettant d’expédier des documents volumineux, des vêtements et des produits de détail de taille moyenne. Les entreprises privilégient ce format pour son équilibre entre flexibilité et protection, garantissant ainsi une protection optimale des produits lors des transports longue distance.

Le segment des enveloppes matelassées de 23 x 30 cm (9 x 12 pouces) devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à leur utilisation croissante pour l'envoi de produits compacts mais de valeur, tels que les petits appareils électroniques et les livres. Ce format est largement utilisé par les plateformes de commerce électronique et les éditeurs pour des emballages à la fois légers et protecteurs. La tendance croissante des solutions d'emballage personnalisées stimule encore la demande d'enveloppes matelassées de 23 x 30 cm (9 x 12 pouces) qui allient optimisation du format et matériaux écologiques.

- Par canal de distribution

Le marché des enveloppes matelassées au Moyen-Orient et en Afrique est segmenté, selon le canal de distribution, en supermarchés/hypermarchés, e-commerce, magasins spécialisés et autres. Le segment e-commerce a dominé le marché en 2025, porté par la croissance exponentielle du commerce en ligne et des marques de vente directe au consommateur. Les plateformes e-commerce privilégient les enveloppes matelassées pour leur légèreté, qui réduit les coûts d'expédition, et leur capacité à assurer une protection optimale lors des livraisons en plusieurs étapes. L'expansion des réseaux logistiques mondiaux a encore renforcé l'importance de ce segment.

Le segment des boutiques spécialisées devrait connaître la croissance la plus rapide entre 2026 et 2033, en raison de la demande croissante de solutions d'emballage personnalisées et haut de gamme. Ces boutiques proposent souvent des enveloppes matelassées de marque ou décoratives, adaptées à des catégories de produits spécifiques comme les cadeaux ou les bijoux. L'intérêt croissant des consommateurs pour les emballages esthétiques et l'utilisation de matériaux durables favorise l'adoption des enveloppes matelassées dans ce segment.

- Sur demande

En fonction de l'application, le marché est segmenté en produits pharmaceutiques, électronique et électrique, automobile et industries connexes, agroalimentaire, cosmétiques et soins personnels, livres et CD audio, bijoux, cadeaux, cadres, montres et articles de fantaisie, cassettes vidéo et autres. Le segment de l'électronique et de l'électrique, porté par le commerce électronique, a dominé le marché en 2025 en raison de l'augmentation des expéditions de produits électroniques compacts nécessitant une protection rembourrée. Ces enveloppes offrent un rembourrage qui protège les appareils sensibles des chocs, de l'humidité et des vibrations, ce qui en fait une solution d'emballage privilégiée par les détaillants en ligne.

Le secteur des cosmétiques et des soins personnels devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'essor des expéditions mondiales de produits de beauté. Les enveloppes matelassées offrent une solution d'emballage sécurisée, légère et esthétique pour les flacons de cosmétiques fragiles et les petits coffrets de soins. Face à la sensibilisation croissante des consommateurs aux emballages durables et de marque, les entreprises cosmétiques adoptent de plus en plus les enveloppes matelassées recyclables afin d'améliorer la sécurité de leurs produits et leur responsabilité environnementale.

Analyse régionale du marché des enveloppes matelassées au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des enveloppes matelassées au Moyen-Orient et en Afrique en 2025, avec la plus grande part de revenus, grâce à l'expansion de son secteur du commerce électronique, au développement de ses infrastructures logistiques et à une préférence croissante pour les emballages durables.

- L'accent mis par le pays sur la diversification de son économie dans le cadre de la Vision 2030, conjugué à l'essor du commerce en ligne, a engendré une forte demande d'emballages d'expédition protecteurs, légers et recyclables. L'adoption de solutions d'emballage écologiques est par ailleurs encouragée par les initiatives gouvernementales en matière de développement durable et par la sensibilisation croissante des consommateurs.

- La présence de grandes marques internationales d'emballage, les investissements continus dans les réseaux de distribution et l'expansion des capacités de production nationales continuent de renforcer le leadership de l'Arabie saoudite sur le marché régional.

Analyse du marché des enveloppes matelassées aux Émirats arabes unis, au Moyen-Orient et en Afrique

Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché des enveloppes matelassées au Moyen-Orient et en Afrique entre 2026 et 2033, grâce à leurs infrastructures logistiques de pointe, à un fort taux de pénétration du commerce électronique et à une transformation numérique rapide du commerce de détail. L'industrie de l'emballage du pays connaît une forte croissance, portée par la demande accrue d'enveloppes recyclables et haut de gamme destinées aux segments du luxe et de l'électronique. L'accent mis par le gouvernement sur le développement durable et les initiatives zéro déchet favorise l'adoption des enveloppes matelassées en papier. Les partenariats entre les producteurs d'emballages locaux et les plateformes de commerce électronique internationales, conjugués à la préférence croissante des consommateurs pour les emballages écologiques, positionnent les Émirats arabes unis comme le marché à la croissance la plus rapide de la région.

Analyse du marché des enveloppes matelassées en Afrique du Sud, au Moyen-Orient et en Afrique

L'Afrique du Sud devrait connaître une croissance soutenue entre 2026 et 2033, portée par le développement de ses secteurs du commerce de détail et de la messagerie, ainsi que par une sensibilisation accrue aux solutions d'emballage durables. L'essor des plateformes d'achat en ligne et des petites entreprises contribue à une demande constante d'enveloppes matelassées résistantes et économiques. Les efforts gouvernementaux en faveur du recyclage et de la réduction des déchets, conjugués à l'arrivée de fabricants internationaux d'emballages, facilitent l'accès à des enveloppes écologiques. L'intérêt croissant des consommateurs pour les emballages recyclables et le développement de chaînes d'approvisionnement régionales stimulent une croissance progressive mais stable du marché sud-africain.

Part de marché des enveloppes matelassées au Moyen-Orient et en Afrique

Le secteur des enveloppes matelassées est principalement dominé par des entreprises bien établies, notamment :

- Vereinigte Papierwarenfabriken GmbH (Allemagne)

- Sealed Air (États-Unis)

- Pregis LLC (États-Unis)

- ProAmpac (États-Unis)

- Groupe Intertape Polymer (Canada)

- Polycell Packaging Corp (Taïwan)

- PAC Worldwide Corporation. (États-Unis)

- STOROPACK HANS REICHENECKER GMBH (Allemagne)

- abrisojiffy.com (Belgique)

- Bravo Pack Inc (États-Unis)

- 3M (États-Unis)

- LPS Industries. (États-Unis)

- AP Packaging Corp. (États-Unis)

- Sonoco ThermoSafe (États-Unis)

- Smurfit Kappa (Irlande)

- DS Smith (Royaume-Uni)

Dernières évolutions du marché des enveloppes matelassées au Moyen-Orient et en Afrique

- En septembre 2024, Mondi, leader mondial des emballages et papiers durables, a lancé, en collaboration avec Amazon, ses enveloppes de protection entièrement recyclables en papier. Cette innovation a marqué une avancée majeure sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique, en accélérant la transition vers des emballages écologiques et sans plastique. En éliminant le recours au papier bulle traditionnel, les enveloppes en papier de Mondi répondent à l'exigence croissante de durabilité des autorités réglementaires et des consommateurs, renforçant ainsi la transition du secteur vers une économie circulaire et des solutions de commerce électronique respectueuses de l'environnement.

- En 2023, CompanyBox a fait progresser le paysage du développement durable sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique avec le lancement d'enveloppes en papier 100 % recyclables et compostables, imprimées avec des encres à base d'eau écologiques. Cette innovation a renforcé la position de l'entreprise auprès des consommateurs et des détaillants soucieux de l'environnement, répondant ainsi à la préférence croissante pour les emballages écologiques. Cette initiative a contribué à la dynamique du marché en faveur de solutions biodégradables alliant durabilité et impact environnemental minimal.

- En 2021, Georgia-Pacific a étendu ses capacités de production pour fabriquer des enveloppes matelassées en papier recyclables pour la collecte en bordure de trottoir, une initiative qui a considérablement accru la disponibilité d'options d'emballage écologiques. Cette expansion répondait à la demande mondiale croissante de matériaux d'expédition durables et a renforcé le rôle de Georgia-Pacific dans la réalisation des objectifs de développement durable de l'industrie de l'emballage. Cette initiative a également aidé les détaillants à adopter des solutions recyclables pour réduire les déchets plastiques et se conformer aux normes environnementales en constante évolution.

- En 2020, PREGIS LLC a révolutionné la productivité sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique en lançant le système d'ensachage en polyéthylène MAX-PRO 24. L'automatisation du système a amélioré l'efficacité de l'emballage et réduit les coûts de main-d'œuvre, permettant ainsi un traitement plus rapide des commandes pour les entreprises de commerce électronique et de logistique. Cette innovation a établi une nouvelle référence en matière de performance opérationnelle, positionnant PREGIS comme un acteur clé de l'innovation dans l'amélioration de la vitesse de production et de la rentabilité du secteur des enveloppes matelassées.

- En 2020, Intertape Polymer Group a répondu à l'évolution des besoins du marché en lançant une nouvelle gamme de ruban adhésif de distanciation sociale, conçue pour garantir sécurité et fiabilité pendant la pandémie. Ce lancement a illustré la capacité d'adaptation de l'entreprise face aux défis posés par la pandémie et au maintien de la continuité de sa chaîne d'approvisionnement. En élargissant son portefeuille de produits pour favoriser des environnements d'expédition sûrs et organisés, Intertape a renforcé sa présence et sa résilience sur le marché des enveloppes matelassées au Moyen-Orient et en Afrique, dans un contexte de perturbations mondiales.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.