Marché de la conversion de la chaleur résiduelle en électricité à partir du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique, par taille (petite, moyenne, grande), capacité (moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW, plus de 7 000 kW), modèle (régime stable, dynamique), application (ICE ou turbine à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole , industrie chimique, ICE en décharge, autres) – Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique

Le cycle organique de Rankine (ORC) convertit la chaleur résiduelle en électricité en convertissant la chaleur thermique des liquides ou des gaz pour produire efficacement une énergie neutre en carbone. La chaleur est générée à partir de sources géothermiques ou de chaleur résiduelle industrielle ou commerciale. Le cycle organique de Rankine (ORC) permet aux entreprises de produire plus d'électricité pour répondre à la demande croissante. Le marché du cycle organique de Rankine (ORC) pour la production d'électricité connaît une croissance rapide au Moyen-Orient et en Afrique en raison des industries qui ont commencé à se concentrer sur l'amélioration de l'efficacité des centrales électriques pour réduire les temps d'arrêt.

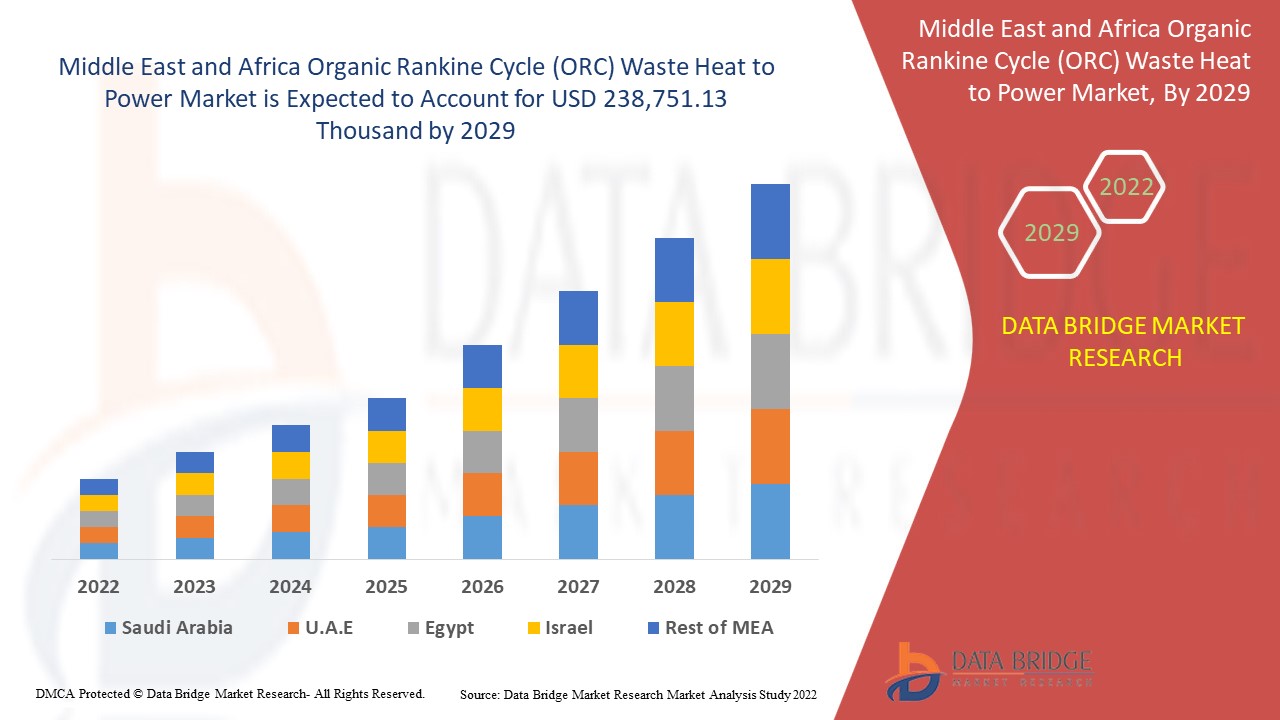

Data Bridge Market Research analyse que le marché de la conversion de la chaleur résiduelle en électricité à partir du cycle organique de Rankine (ORC) devrait atteindre la valeur de 238 751,13 milliers de dollars d'ici 2029, à un TCAC de 7,3 % au cours de la période de prévision de 2022 à 2029. « Moyen » représente le segment de taille de module le plus important.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par taille (petite, moyenne, grande), capacité (moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW, plus de 7 000 kW), modèle (régime stable, dynamique), application (ICE ou turbine à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole, industrie chimique, ICE en décharge, autres). |

|

Pays couverts |

L’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte, Bahreïn, Oman, le Koweït et le reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Français MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Steam Turbines, BorgWarner Inc., entre autres. |

Définition du marché

Les systèmes à cycle organique de Rankine (ORC) sont utilisés pour la production d'électricité à partir de sources de chaleur à basse et moyenne température, entre 80 et 350 °C, et pour des applications de petite et moyenne envergure à n'importe quelle température . Cette technologie permet d'exploiter la chaleur de faible qualité qui serait autrement gaspillée. Le principe de fonctionnement d'une centrale électrique à cycle organique de Rankine est similaire au procédé le plus largement utilisé pour la production d'électricité, le cycle Clausius-Rakine.

Dynamique du marché de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

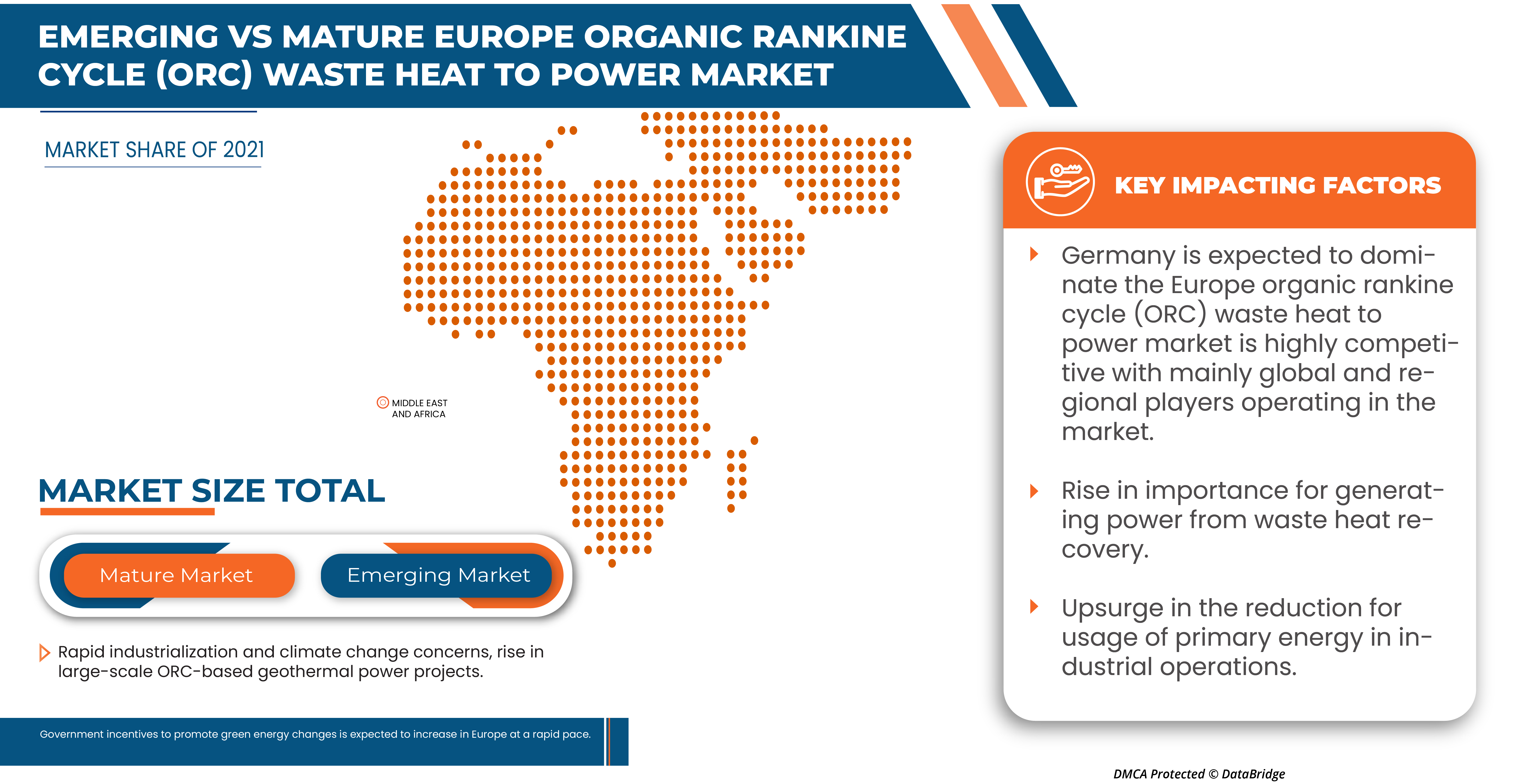

- Augmentation de l'importance de la production d'électricité à partir de la récupération de chaleur résiduelle

Dans de nombreuses installations industrielles, une quantité considérable de chaleur est gaspillée et n'est pas utilisée à des fins économiques. La chaleur ne peut donc pas être stockée ou transportée vers d'autres processus ou utilisateurs. Dans la plupart des cas, cette chaleur résiduelle nécessite des systèmes de refroidissement et des traitements pour éviter toute pollution de l'environnement, ce qui pourrait augmenter les dépenses.

De plus, ces pertes de chaleur industrielles peuvent être mieux utilisées et peuvent être envisagées à de nombreuses fins, comme le chauffage ou la production d'électricité. L'idée de base est de capter la chaleur créée dans le processus industriel et de la réutiliser dans d'autres applications, principalement pour améliorer l'efficacité énergétique, comme le traitement de la chaleur par des combustibles fossiles et la production d'un minimum d'électricité pour alimenter les moteurs utilisés dans des étapes spécifiques du processus.

- Accent accru sur l'amélioration de l'efficacité des centrales électriques

La production mondiale d'électricité dépend en grande partie des ressources en combustibles fossiles comme le charbon, le gaz naturel et le pétrole. Le nombre de centrales électriques à combustible fossile installées a augmenté à l'échelle mondiale et le développement de telles centrales électriques est en pleine croissance dans le monde entier. Cependant, la chaleur résiduelle est rejetée dans une centrale électrique et peut être rejetée dans l'environnement. La récupération de la chaleur résiduelle est la principale approche pour améliorer encore l'efficacité thermique et réduire les émissions de gaz à effet de serre des centrales électriques à combustible fossile.

- Des normes d'émission de plus en plus strictes

La consommation d'énergie augmente d'année en année dans le monde entier en raison de la hausse de la demande d'électricité. La production d'énergie à partir de combustibles fossiles est responsable de plus d'un tiers des émissions mondiales de gaz à effet de serre, qui sont à l'origine de la pollution et du changement climatique.

Retenue/Défis

- Coût élevé d'installation et de maintenance

Bien que les systèmes de récupération de chaleur résiduelle présentent des avantages significatifs, les coûts d'installation limitent la croissance du marché. La récupération de chaleur résiduelle peut être effectuée grâce à diverses techniques telles que le cycle de Rankine à vapeur (SRC), le cycle de Rankine organique (ORC) ou le cycle de Kalina. Ces technologies coûteront différemment en fonction de la production et de l'échelle du secteur industriel.

- Déficit d'approvisionnement en matières premières

Le déficit d'approvisionnement en matières premières est associé à tous les types de marchés, ce qui évaluera la dépendance économique et technique à l'égard d'un certain matériau. Le système de récupération de chaleur est construit à l'aide de diverses matières premières et de différents types d'équipements, tels qu'une pompe à fluide, un réchauffeur, un condenseur, une turbine et bien d'autres.

Impact de la COVID-19 sur le marché de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique

La période de confinement et de verrouillage pendant la crise du COVID-19 a montré l'importance d'une connectivité Internet fiable et de bonne qualité dans une grande industrie. Une connexion à haut débit dans la grande industrie a ouvert la possibilité d'un télétravail efficace, de maintenir des habitudes de divertissement et de garder des contacts étroits. Le trafic de données dans tous les réseaux a considérablement augmenté pendant la période de pandémie. Le COVID-19 a augmenté la demande d'intégration de données sur le marché. Les réseaux fixes à large bande ont gagné en popularité pour maintenir le monde connecté. Le trafic a augmenté de 30 à 40 % du jour au lendemain, principalement grâce au travail dans les grandes industries (vidéoconférence et collaboration, VPN), à l'apprentissage dans les grandes industries (vidéoconférence et collaboration, plateformes d'apprentissage en ligne) et au divertissement (jeux en ligne, streaming vidéo, médias sociaux). De plus, l'offre limitée et la pénurie de logiciels ont considérablement affecté l'intégration des données sur le marché. Le flux de nouveaux équipements, tels que les ordinateurs, les serveurs, les commutateurs et les équipements sur site client (CPE), a été soit complètement arrêté, soit retardé, avec des délais de livraison allant jusqu'à 12 mois pour différents articles.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19 . Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans l'intégration des données. Grâce à cela, les entreprises apporteront au marché une intégration avancée des données.

Développement récent

- En mars 2021, la revue International Journal of Low-Carbon Technologies a publié un rapport sur l'analyse économique de la centrale électrique ORC avec récupération de chaleur résiduelle à basse température. Cette analyse a conclu que l'association du système ORC avec les centrales thermiques contribue à améliorer l'efficacité du travail en réduisant l'utilisation des combustibles fossiles.

- ABB propose un système de centrale électrique ORC spécialement conçu pour les centrales électriques utilisées pour augmenter l'efficacité énergétique, comprenant l'extraction de chaleur, la conversion, l'alimentation et le contrôle électriques. Ce système est facilement adopté dans les centrales électriques et peut être intégré aux processus industriels.

Portée du marché de la production d'électricité à partir de la chaleur résiduelle issue du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique

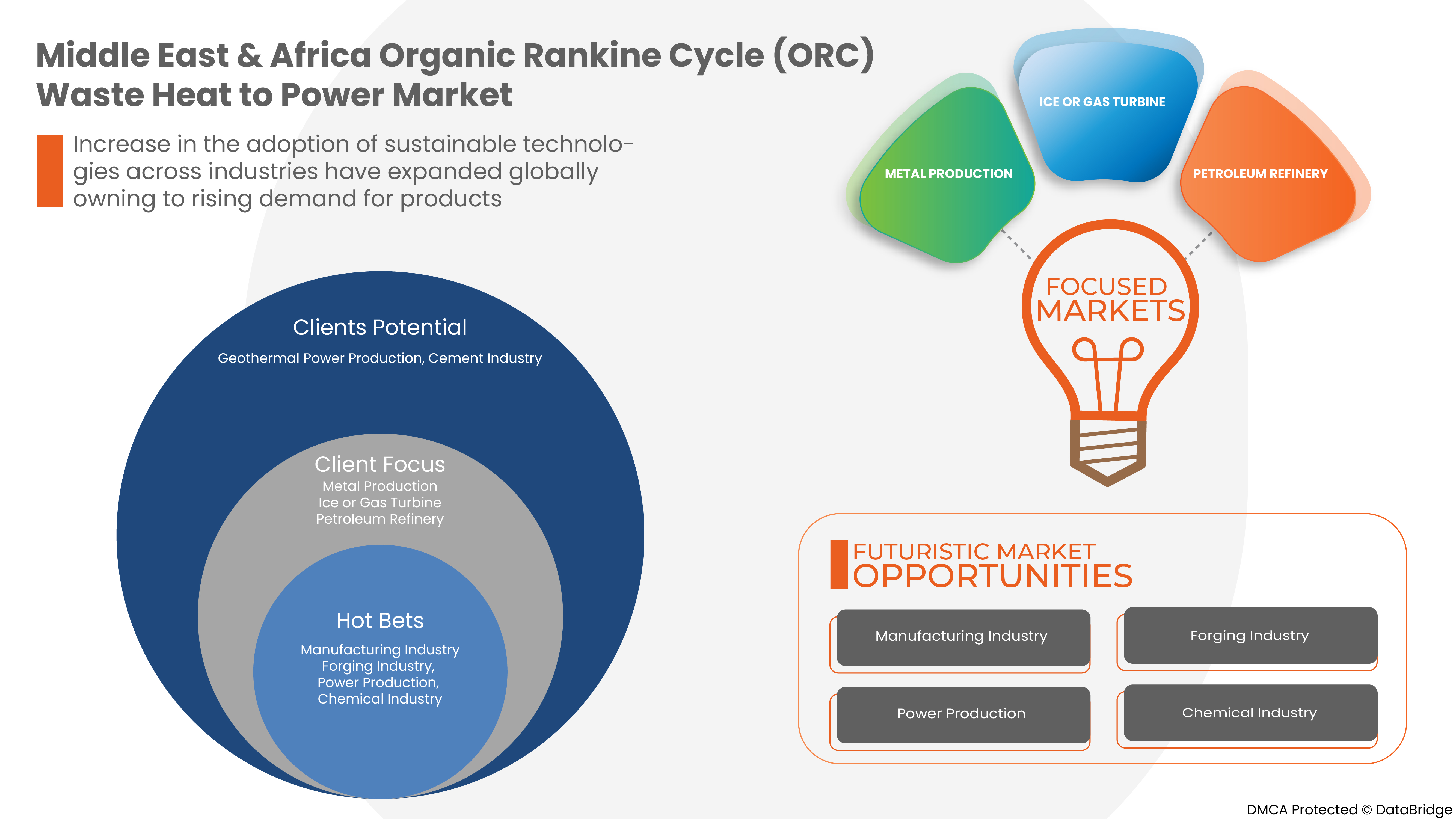

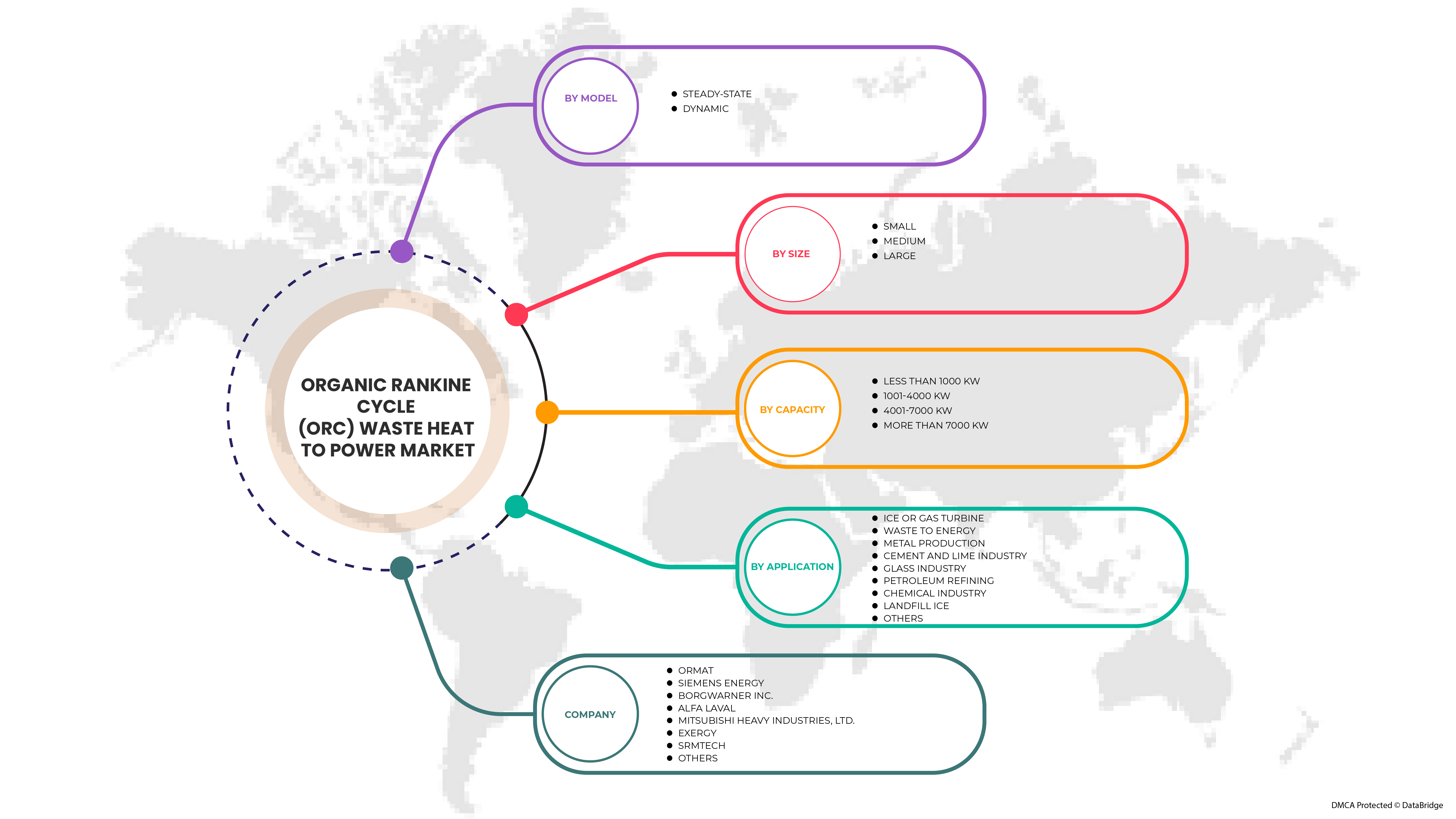

Le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique est segmenté en fonction de la taille, de la capacité, du modèle et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par taille

- Moyen

- Petit

- Grand

Sur la base de la taille, le marché du Moyen-Orient et de l'Afrique du cycle organique de Rankine (ORC) à partir de la chaleur résiduelle en électricité est segmenté en moyen, petit et grand.

Par capacité

- moins de 1000 KW,

- 1001-4000 kW,

- 4001-7000 kW,

- plus de 7000 KW

Sur la base de la capacité, le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique a été segmenté en moins de 1 000 kW, 1 001 à 4 000 kW, 4 001 à 7 000 kW et plus de 7 000 kW.

Par modèle

- État stable

- Dynamique

Sur la base du modèle, le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique a été segmenté en régime permanent et dynamique.

Par application

- ICE ou turbine à gaz

- Valorisation énergétique des déchets

- Production de métaux

- Industrie du ciment et de la chaux

- Industrie du verre

- Raffinage du pétrole

- Industrie chimique

- Glace de décharge

- Autres

Sur la base des applications, le marché de la conversion de la chaleur résiduelle en électricité à cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique a été segmenté en turbine à glace ou à gaz, valorisation énergétique des déchets, production de métaux, industrie du ciment et de la chaux, industrie du verre, raffinage du pétrole, industrie chimique, glace d'enfouissement et autres.

Analyse/perspectives régionales du marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique

Le marché de la chaleur résiduelle en cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique est analysé, et des informations et tendances sur la taille du marché sont fournies par pays, taille, capacité, modèle et application, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché de la chaleur résiduelle du cycle organique de Rankine (ORC) en électricité au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte, Bahreïn, Oman, le Koweït et le reste du Moyen-Orient et de l'Afrique.

L'Arabie saoudite devrait dominer le marché du cycle organique Rankine (ORC) pour la production d'électricité à partir de la chaleur résiduelle, car le pays connaît une augmentation des produits technologiques, de nouvelles directives et des investissements croissants dans les centrales électriques de la région, ainsi que la croissance du pays sur le marché du cycle organique Rankine (ORC) pour la production d'électricité à partir de la chaleur résiduelle.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du cycle organique de Rankine (ORC) pour la production d'électricité à partir de la chaleur résiduelle au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique fournit des informations sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de produits, la largeur et l'étendue des produits, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique.

Français Certains des principaux acteurs opérant sur le marché de la production d'électricité à partir de la chaleur résiduelle du cycle organique de Rankine (ORC) au Moyen-Orient et en Afrique sont MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, ElectraTherm Inc. (BITZER Group), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Steam Turbines, BorgWarner Inc.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SIZE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY

5.1.2 UPSURGE IN THE REDUCTION OF USAGE OF PRIMARY ENERGY IN INDUSTRIAL OPERATIONS

5.1.3 INCREASED FOCUS ON IMPROVING THE POWER PLANT EFFICIENCY

5.1.4 RISING STRINGENT EMISSION NORMS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE

5.2.2 SUPPLY DEFICIT OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RAPID INDUSTRIALIZATION AND CLIMATE CHANGE CONCERNS

5.3.2 RISE IN LARGE-SCALE ORC-BASED GEOTHERMAL POWER PROJECTS

5.3.3 GOVERNMENT INCENTIVES TO PROMOTE GREEN ENERGY CHANGES

5.3.4 INCREASE IN THE ADOPTION OF SUSTAINABLE TECHNOLOGIES ACROSS INDUSTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS ABOUT THE TECHNOLOGY

6 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE

6.1 OVERVIEW

6.2 MEDIUM

6.3 SMALL

6.4 LARGE

7 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 1000 KW

7.3 1001-4000 KW

7.4 4001 - 7000 KW

7.5 MORE THAN 7000 KW

8 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL

8.1 OVERVIEW

8.2 STEADY-STATE

8.3 DYNAMIC

9 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ICE OR GAS TURBINE

9.2.1 MEDIUM

9.2.2 SMALL

9.2.3 LARGE

9.3 WASTE TO ENERGY

9.3.1 MEDIUM

9.3.2 SMALL

9.3.3 LARGE

9.4 METAL PRODUCTION

9.4.1 MEDIUM

9.4.2 SMALL

9.4.3 LARGE

9.5 CEMENT AND LIME INDUSTRY

9.5.1 MEDIUM

9.5.2 SMALL

9.5.3 LARGE

9.6 GLASS INDUSTRY

9.6.1 MEDIUM

9.6.2 SMALL

9.6.3 LARGE

9.7 PETROLEUM REFINING

9.7.1 MEDIUM

9.7.2 SMALL

9.7.3 LARGE

9.8 CHEMICAL INDUSTRY

9.8.1 MEDIUM

9.8.2 SMALL

9.8.3 LARGE

9.9 LANDFILL ICE

9.9.1 MEDIUM

9.9.2 SMALL

9.9.3 LARGE

9.1 OTHERS

10 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 U.A.E.

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 QATAR

10.1.6 KUWAIT

10.1.7 BAHRAIN

10.1.8 OMAN

10.1.9 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ORMAT

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS ENERGY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 BORGWARNER INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCTS PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ALFA LAVAL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MITSUBISHI HEAVY INDUSTRIES, LTD

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCTS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 CLIMEON

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCTS PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CORYCOS GROUP

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCTS PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CTMI - STEAM TURBINES

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCTS PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 DÜRR GROUP

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCTS PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 ENERBASQUE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 ENERTIME

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCTS PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ENOGIA

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCTS PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 EXERGY INTERNATIONAL SRL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCTS PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ELECTRATHERM (ACQUIRED BY BITZER)

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 INTEC ENGINEERING GMBH

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 KAISHAN USA

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCTS PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 OPEL ENERGY SYSTEMS PVT. LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCTS PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 ORCAN ENERGY AG

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCTS PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 RANK ORC, S.L.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCTS PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 STREBL ENERGY PTE LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCTS PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SRMTEC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 TMEIC

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCTS PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 TRIOGEN

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 ZUCCATO ENERGIA SRL.

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCTS PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 EXISTING WHP PROJECTS AND POWER GENERATION CAPACITY BY DIFFERENT INDUSTRIES IN THE U.S.

TABLE 2 ENERGY GENERATION POTENTIAL THROUGH WASTE HEAT IN DIFFERENT SECTORS IN INDIA

TABLE 3 WHP COST COMPARISON

TABLE 4 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA MEDIUM IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA SMALL IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA LARGE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA LESS THAN 1000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA 1001-4000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA 4001-7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA MORE THAN 7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA STEADY-STATE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA DYNAMIC IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LANDFILL ICE INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA OTHERS IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 47 SAUDI ARABIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 48 SAUDI ARABIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 49 SAUDI ARABIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 50 SAUDI ARABIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 SAUDI ARABIA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 52 SAUDI ARABIA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 53 SAUDI ARABIA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 54 SAUDI ARABIA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 55 SAUDI ARABIA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 56 SAUDI ARABIA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 57 SAUDI ARABIA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 SAUDI ARABIA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 59 U.A.E. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 60 U.A.E. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 61 U.A.E. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 62 U.A.E. ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 U.A.E. ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 U.A.E. WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 65 U.A.E. METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 U.A.E. CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 67 U.A.E. GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 U.A.E. PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 69 U.A.E. CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 70 U.A.E. LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH AFRICA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 83 EGYPT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 84 EGYPT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 85 EGYPT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 EGYPT ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 95 QATAR ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 QATAR ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 97 QATAR ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 98 QATAR ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 QATAR ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 100 QATAR WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 101 QATAR METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 102 QATAR CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 QATAR GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 104 QATAR PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 105 QATAR CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 106 QATAR LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 KUWAIT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 108 KUWAIT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 109 KUWAIT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 110 KUWAIT ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 KUWAIT ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 112 KUWAIT WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 113 KUWAIT METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 114 KUWAIT CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 115 KUWAIT GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 116 KUWAIT PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 117 KUWAIT CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 118 KUWAIT LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 119 BAHRAIN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 120 BAHRAIN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 121 BAHRAIN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 122 BAHRAIN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 BAHRAIN ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 124 BAHRAIN WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 125 BAHRAIN METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 126 BAHRAIN CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 127 BAHRAIN GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 128 BAHRAIN PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 129 BAHRAIN CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 130 BAHRAIN LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 131 OMAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 132 OMAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 133 OMAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 134 OMAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 OMAN ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 136 OMAN WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 137 OMAN METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 138 OMAN CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 139 OMAN GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 140 OMAN PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 141 OMAN CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 142 OMAN LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 143 REST OF MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MULTIVARIATE MODELING

FIGURE 11 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SIZE TIMELINE CURVE

FIGURE 12 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 13 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 14 MEDIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

FIGURE 16 REAL GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE OF INDIA

FIGURE 17 GEOTHERMAL POWER GENERATION IN THE NET ZERO SCENARIO, 2000-2030

FIGURE 18 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY SIZE, 2021

FIGURE 19 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY CAPACITY, 2021

FIGURE 20 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY MODEL, 2021

FIGURE 21 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY SIZE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.