Middle East And Africa Ophthalmology Market

Taille du marché en milliards USD

TCAC :

%

USD

3.12 Billion

USD

4.42 Billion

2024

2032

USD

3.12 Billion

USD

4.42 Billion

2024

2032

| 2025 –2032 | |

| USD 3.12 Billion | |

| USD 4.42 Billion | |

|

|

|

Middle East and Africa Ophthalmology Market Segmentation, By Products (Device, Drugs, and Others), Diseases (Cataract, Refractive Disorders, Glaucoma, Age-Related Macular Degeneration, Inflammatory Diseases, and Others), Comprehensive Eye Examination (Refraction, Visual Acuity Test, Intraocular Pressure, Anterior Segment and Pupillary Examination, Visual Fields Test, Color Vision Test, and Others), End User (Clinics, Hospitals, Home Healthcare, and Others), Distribution Channel (Retail Sales, Direct Tender, and Others) - Industry Trends and Forecast to 2032

Middle East and Africa Ophthalmology Market Analysis

The Middle East and Africa ophthalmology market has evolved significantly over the centuries, beginning with ancient treatments for eye conditions in Egypt and Greece. The field began to take shape in the 17th and 18th centuries, with the development of more advanced surgical techniques and tools. In the 19th century, innovations like the ophthalmoscope transformed diagnostic capabilities. The 20th century saw breakthroughs such as cataract surgery and the invention of intraocular lenses, along with the advent of LASIK surgery in the 1990s. The 21st century brought continued growth driven by an aging population, technological advancements, and the development of specialized diagnostic and surgical devices, including optical coherence tomography (OCT) and retinal imaging systems. Recent trends focus on the increasing use of artificial intelligence, telemedicine, and biologic therapies, such as gene therapy and stem cell treatments, further shaping the market's growth. Today, the ophthalmology market continues to expand due to rising eye disease prevalence, new technologies, and evolving treatment options.

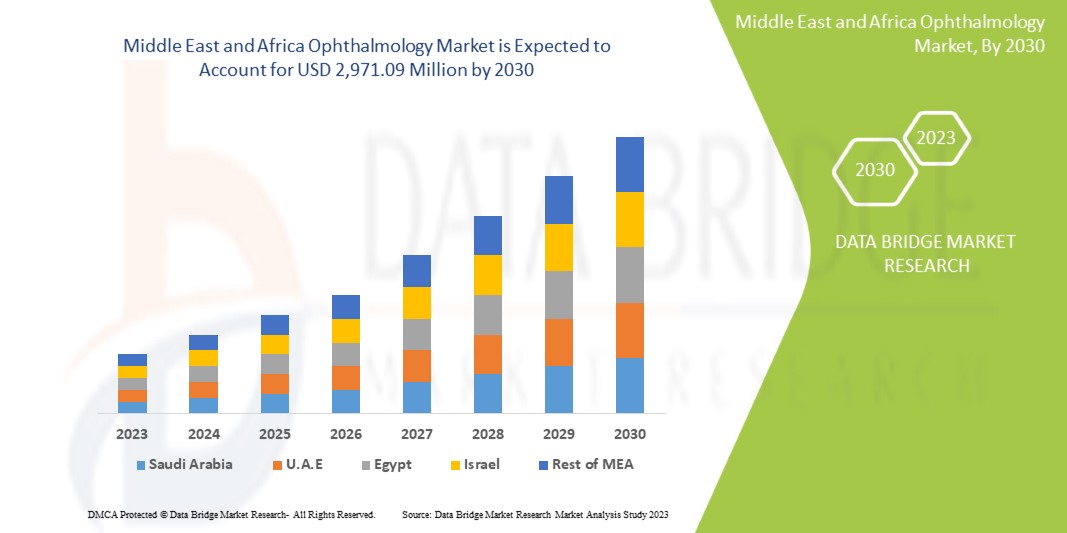

Middle East and Africa Ophthalmology Market Size

The Middle East and Africa ophthalmology market is expected to reach USD 4.42 billion by 2032 from USD 3.12 billion in 2024, growing at a CAGR of 4.5% in the forecast period of 2025 to 2032.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Middle East and Africa Ophthalmology Market Trends

“Enhanced Safety and Efficiency of Saline Prefilled Syringes”

The Middle East and Africa ophthalmology market is experiencing robust growth, driven by the rising prevalence of eye diseases, technological advancements, and an aging population. Increasing rates of conditions such as cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration are contributing to the rising demand for eye care treatments. The aging Middle East and Africa population is particularly impacting this trend, as older individuals are more prone to vision-related issues. Additionally, advancements in diagnostic technologies, such as optical coherence tomography (OCT), fundus cameras, and AI-powered systems, are improving the accuracy and efficiency of diagnoses. Minimally invasive surgical techniques, including laser treatments and robotic-assisted surgeries, are gaining popularity, offering faster recovery times and improved patient outcomes. Furthermore, the growth of personalized medicine in ophthalmology, with targeted therapies for conditions like retinal diseases, is also playing a pivotal role. The introduction of novel drug delivery systems, such as injectable biologics and sustained-release implants, is improving treatment efficacy, particularly for chronic conditions. Telemedicine is another growing trend in the ophthalmology market, as remote consultations and virtual screenings become more common, enhancing access to care in underserved regions. Key market players are focusing on research and development to expand their product portfolios, while emerging markets are seeing an increased demand for affordable, accessible eye care solutions. With a focus on innovation, improved patient care, and expanding healthcare access, the ophthalmology market is set for significant growth in the coming years.

Report Scope and Middle East and Africa Ophthalmology Market Segmentation

|

Attributes |

Middle East and Africa Ophthalmology Market Insights |

|

Segments Covered |

By Products: Device, Drugs, and Others By Diseases: Cataract, Refractive Disorders, Glaucoma, Age-Related Macular Degeneration, Inflammatory Diseases, and Others By Comprehensive Eye Examination: Refraction, Visual Acuity Test, Intraocular Pressure, Anterior Segment and Pupillary Examination, Visual Fields Test, Color Vision Test, and Others By End User: Clinics, Hospitals, Home Healthcare, and Others By Distribution Channel: Retail Sales, Direct Tender, and Others |

|

Region Covered |

South Africa, Saudi Arabia, U.A.E., Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Alcon (Switzerland), Bausch + Lomb (Canada), Carl Zeiss Meditec( Germany), Hoya Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), Essilor International (France), Topcon Corporation(Japan), Glaukos Corporation (U.S.), Haag-Streit Group (Switzerland), Nidek Co., Ltd (U.S.), Staar Surgical (California), Ziemer Ophthalmic Systems Ag (Switzerland), Cooper Companies (U.S.), Lumenis Be Ltd. (Israel), Reichert Inc. (New York), Bayer Ag (Germany), Novartis Ag (Switzerland), Abbvie Inc.(U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Dompé (Italy), Santen Pharmaceutical Co. (Japan), Ltd among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Ophthalmology Market Definition

Ophthalmology is a branch of medicine and surgery that focuses on the diagnosis, treatment, and prevention of eye disorders and diseases. It includes medical and surgical care for conditions affecting the eyes and visual systems, such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy.

Middle East and Africa Ophthalmology Market Definition Dynamics

Drivers

Drivers

- Increasing Prevalence of Eye Diseases

The increasing prevalence of eye conditions, such as cataracts, macular degeneration, and diabetic retinopathy, is a significant driver of the Middle East and Africa ophthalmology market. As the Middle East and Africa population ages, the incidence of these conditions is rise. Cataracts, which lead to blurred vision and blindness, demand an expanding market for surgeries and corrective treatments. Similarly, macular degeneration and diabetic retinopathy are contributing to the need for advanced diagnostic tools and specialized therapies. The growing number of affected individuals ensures sustained demand for eye care services, including surgeries, medications, and innovative diagnostic technologies. This surge in eye diseases directly drives market expansion, as healthcare providers and manufacturers strive to meet the growing need for effective treatments and solutions.

For instance,

- In July 2022, according to the article published by NCBI, The prevalence of blindness rises with age, increasing from 0.45% in those aged 50-59 to 11.62% in individuals 80 and older. Females (2.31%) and rural residents (2.14%) experience higher rates. Visual impairment also affects 26.68% of participants, showing similar trends. This growing burden of eye diseases, particularly among the elderly, drives demand for ophthalmic treatments and technologies, boosting the ophthalmology market

- In August 2023, according to the article published by WHO, Middle East and Africa, over 2.2 billion people suffer from vision impairment, with nearly 1 billion cases being preventable or untreated. This growing prevalence of vision issues highlights the increasing demand for eye care services, treatments, and corrective solutions. As more people seek medical attention for preventable or unresolved conditions, the rising burden of eye diseases acts as a significant driver for the ophthalmology market

The rising prevalence of age-related eye conditions like cataracts, macular degeneration, and diabetic retinopathy is fueling the Middle East and Africa ophthalmology market. As the population ages, these diseases become more common, increasing the demand for treatments, surgeries, and diagnostic tools. The need for advanced technologies and therapies grows as more people require care. This surge in eye conditions drives market growth, as healthcare providers and manufacturers aim to meet the rising demand for effective solutions.

- Focus on Preventative Eye Care

There is a growing emphasis on preventative eye care and early detection of vision-related issues, which is playing a significant role in driving the Middle East and Africa ophthalmology market. As awareness about the importance of eye health increases, more people are seeking routine eye checkups to detect conditions like glaucoma, diabetic retinopathy, and cataracts in their early stages. Early diagnosis allows for timely interventions, reducing the risk of vision loss and improving overall eye health. This proactive approach is not only improving patient outcomes but also fueling demand for ophthalmic services, diagnostic tools, and corrective treatments. The growing focus on preventative care is leading to a surge in investments in eye care technologies, ophthalmic devices, and services, thereby contributing to the market's expansion. This trend strongly acts as a driver for growth in the ophthalmology sector.

For instance,

- In October 2022, according to the article published by National Eye Institute, National Eye Health Education Program(NEHEP) collaborates with health professionals to promote awareness on early detection, treatment of eye diseases, and the benefits of vision rehabilitation. It also targets populations at high risk of eye disease and vision loss. This focus on preventative care encourages people to seek timely eye checkups and treatments, driving demand for ophthalmic services, diagnostic tools, and products, thereby fueling the ophthalmology market

- In October 2024, according to the article published by Directorate General of Health Services, The National Programme for Control of Blindness and Visual Impairment (NPCB&VI) aims to reduce blindness prevalence by identifying and treating curable blindness at all healthcare levels. By focusing on early detection and addressing avoidable blindness, the program highlights the importance of preventative care. This initiative drives demand for eye care services, diagnostic tools, and treatments, contributing significantly to the growth of the Middle East and Africa ophthalmology market

The increasing focus on preventative eye care and early detection is significantly driving the Middle East and Africa ophthalmology market. As awareness of eye health rises, more individuals are opting for routine eye exams to identify conditions like glaucoma and cataracts early. Early detection allows for effective treatments that prevent further vision loss. This proactive approach is driving demand for diagnostic tools, ophthalmic services, and corrective treatments. The growing importance of preventative care is prompting investment in advanced eye care technologies, thus contributing to the overall growth of the ophthalmology market and ensuring its continued expansion.

Opportunities

- Rise in the Aging Population

The rise in the aging population presents a significant opportunity for the Middle East and Africa ophthalmology market, as older individuals are more susceptible to various eye disorders and diseases. Conditions such as cataracts, age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma are prevalent among the elderly, creating a substantial demand for ophthalmic care and treatments. As a result, healthcare systems and ophthalmic providers are poised to expand their services, enhance diagnostic and therapeutic options, and cater to the unique needs of this demographic. This growing patient base necessitates an array of solutions, from surgical interventions and advanced drug therapies to vision correction products, ensuring a steady and increasing demand for ophthalmic procedures and products.

For instance,

- In March 2023, according to an article published in the National Library of Medicine, Cataract is a leading cause of visual impairment in old age. Lens opacification is notoriously associated with several geriatric conditions, including frailty, fall risk, depression and cognitive impairment. Moreover, according to the same source, in 2020, the leading worldwide causes of blindness in patients aged 50 years and older were cataract, followed by glaucoma, under-corrected refractive error, age-related macular degeneration, and diabetic retinopathy

- In August 2022, according to an article published in the American Academy of Ophthalmology, AMD is a common eye disease, usually found in adults over the age of 50. Moreover, it is stated that Half of Americans over the age of 75 develop cataracts

Moreover, addressing the eye health needs of the aging population can stimulate further investments in research and development within the ophthalmology sector. Pharmaceutical companies and medical device manufacturers are focus on creating innovative solutions tailored specifically for age-related conditions, potentially leading to breakthroughs in treatment protocols and patient care. The integration of new technologies, such as tele ophthalmology and advanced imaging techniques, facilitate better management of eye health in older adults, making it easier to monitor and treat conditions remotely. Overall, the aging population amplifies the need for existing ophthalmic services and presents a fertile ground for innovation and growth within the Middle East and Africa ophthalmology market.

- Rise in Online Retail and E-Health Platforms

The rise of online retail and e-health platforms offers a significant opportunity for the Middle East and Africa ophthalmology market by providing consumers with easier access to a wide array of eye care products and services. With the increasing adoption of e-commerce, patients can conveniently purchase items such as prescription glasses, contact lenses, and over-the-counter eye care products from the comfort of their homes. This trend is especially appealing to younger, tech-savvy consumers and those in remote areas with limited access to traditional optical stores. The ability to compare prices, read reviews, and access a wider range of products online enhances customer satisfaction and encourages usage, thereby driving growth in the ophthalmic product segment.

For instance,

- In September 2023, according to a news article from The Times of India, the 'pink eye' outbreak led to a surge in sales of ophthalmology medicine. Sales jumped nearly 30% year-on-year for the second month in a row in August - outgrowing the overall market by almost five times. The rise reflects the massive incidence of conjunctivitis and eye-complications in the last few months across the country

- In April 2020, according to an article, ‘Patient views about online purchasing of eyewear’, online purchasing of contact lenses is on the rise: 10%–20% of contact lens wearers in Australia, U.S. and the UK have considered or researched the possibility of Internet purchasing

In addition to retail opportunities, e-health platforms facilitate telehealth services that allow patients to consult with eye care professionals remotely. Virtual consultations for routine eye examinations, follow-ups, and triaging for more serious conditions can significantly improve access to care, particularly for older adults or individuals with mobility challenges. These platforms enhance patient engagement and adherence to eye health recommendations and allow ophthalmologists to reach a broader patient base without the constraints of geographic boundaries. Furthermore, the integration of digital health tools, such as mobile apps for monitoring eye health or managing chronic conditions, can create a seamless patient experience and foster proactive eye care, further propelling growth in the ophthalmology market.

Restraints/Challenges

- Side Effects and Complications Related to Eye Surgeries

Despite the significant advancements in ophthalmology treatments, certain ophthalmic procedures, particularly surgical interventions, carry risks of side effects and complications such as infection, scarring, or vision impairment. These potential risks can deter patients from undergoing specific therapies, especially those that involve invasive procedures. The fear of adverse outcomes, such as reduced vision or prolonged recovery times, can lead to hesitancy in seeking treatment, limiting the overall adoption of certain therapies. Additionally, complications arising from surgeries might require additional treatments, further raising healthcare costs and impacting patient trust in advanced treatments. This reluctance to undergo treatments due to the potential for negative side effects restricts the overall growth of the ophthalmology market by slowing down the adoption of new technologies and therapies.

For instance,

- In October 2024, according to the article published by Harvard Health, Modern eye surgeries, while effective in treating conditions like cataracts and glaucoma, often lead to complications such as dry eye disease, characterized by a burning, gritty, or itchy sensation. This side effect can be uncomfortable and discouraging for patients, leading some to hesitate or avoid eye surgeries. As a result, complications from treatments act as a restraint on the growth of the ophthalmology market

- In July 2021, according to the article published by Medical News Today, Up to 95% of individuals who undergo laser eye surgery may experience dry eyes, while 20% report visual disturbances like glare or halos. Additionally, 1 in 50 people may suffer from blurry vision or “sands of Sahara” syndrome. These side effects can discourage patients from opting for surgery, limiting the adoption of laser procedures and acting as a restraint on the ophthalmology market’s growth

Despite advancements in ophthalmology, some surgical treatments carry risks such as infection, scarring, or vision impairment. These complications can discourage patients from opting for certain therapies, particularly invasive procedures. The fear of adverse outcomes and additional treatment costs can hinder patient willingness to seek care, slowing the adoption of new treatments. This reluctance limits the growth of the Middle East and Africa ophthalmology market.

- Limited Access to specialized Ophthalmic Care in Rural Areas

Despite advancements in healthcare infrastructure, access to specialized ophthalmic care remains limited in rural and remote areas, significantly hindering the growth potential of the ophthalmology market in these regions. Many rural populations still face challenges such as a lack of trained eye care professionals, inadequate facilities, and limited access to advanced diagnostic and treatment technologies. As a result, individuals in these areas often struggle to receive timely diagnosis and treatment for eye conditions, leading to a higher incidence of preventable blindness and vision impairment. The limited availability of specialized care restricts market expansion by reducing the adoption of advanced eye care services and products. This barrier to access continues to act as a major restraint on the Middle East and Africa ophthalmology market’s overall growth.

For instance,

- In February 2023, according to the article published by NCBI, India's large rural population faces significant unmet eye care needs, with most facilities and professionals concentrated in urban and semi-urban areas. The disparity in access to eye care between rural and urban regions remains a challenge, limiting treatment availability. This unequal distribution of healthcare resources restricts the growth of the Middle East and Africa ophthalmology market by preventing widespread access to essential services in rural areas

- In March 2024, according to the article published by Research Gate, The lack of connectivity and trained staff in remote areas hampers access to continuous eye care, even after successful eye camps. Patients in these areas struggle to receive follow-up care or advanced treatments due to the absence of proper infrastructure. This gap in healthcare delivery limits the reach and effectiveness of eye care programs, acting as a restraint on the Middle East and Africa ophthalmology market's growth

L’accès aux soins oculaires spécialisés reste limité dans les zones rurales, malgré les progrès réalisés dans le domaine des soins de santé. La pénurie de professionnels de la vue, de technologies de pointe et d’installations médicales empêche un traitement et un diagnostic rapides, ce qui entraîne des taux plus élevés de cécité évitable. Cet accès limité freine la croissance du marché de l’ophtalmologie au Moyen-Orient et en Afrique en limitant l’adoption de traitements et de services avancés dans ces régions.

Portée du marché de l'ophtalmologie au Moyen-Orient et en Afrique

Le marché est segmenté en fonction des produits, des maladies, de l'examen oculaire complet, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par produits

- Appareil

- Dispositif chirurgical

- Dispositifs chirurgicaux pour la cataracte

- Dispositifs viscoélastiques ophtalmiques

- Dispositifs de phacoémulsification

- Lasers pour la chirurgie de la cataracte

- Injecteurs IOL

- Dispositifs chirurgicaux vitréo-rétiniens

- Appareils de vitrectomie

- Packs vitréo-rétiniens

- Lasers de photocoagulation

- Sondes de vitrectomie

- Dispositifs d'éclairage

- Dispositifs de chirurgie réfractive

- Lasers femtosecondes

- Lasers à excimère

- Autres lasers chirurgicaux réfractifs

- Dispositifs chirurgicaux pour le traitement du glaucome

- Dispositifs de drainage du glaucome

- Dispositifs de chirurgie micro-invasive du glaucome

- Systèmes laser pour le traitement du glaucome

- Appareil de diagnostic

- Scanners de tomographie par cohérence optique (OCT)

- Autoréfracteurs et kératomètres

- Tonomètres

- Réfracteurs

- Rétinoscopes

- Ophtalmoscopes

- Lampes à fente

- Périmètres/Analyseurs de champ visuel

- Systèmes de topographie cornéenne

- Caméras de fond d'œil

- Systèmes d'imagerie ophtalmique par ultrasons

- A- Système d'imagerie par balayage

- Système d'imagerie B-Scan

- Pachymètres

- Biomicroscopes à ultrasons

- Frontofocomètres

- Aberromètres de front d'onde

- Systèmes de biométrie optique

- Microscopes spéculaires

- Projecteurs de cartes

- Accessoires pour chirurgie ophtalmique

- Instruments et kits chirurgicaux

- Pince ophtalmique

- Spatule Ophtalmique

- Embouts et poignées ophtalmiques

- Canules ophtalmiques

- Ciseaux Ophtalmiques

- Autres accessoires chirurgicaux

- Microscopes ophtalmiques

- Dispositif chirurgical

- Médicaments, sous-produits

- Médicaments anti-VEGF

- Ranibizumab

- Bévacizumab

- Médicaments contre les troubles rétiniens

- Médicaments contre le glaucome

- Analogues de la prostaglandine

- Latanoprost

- Bimatoprost

- Travoprost

- Tafluprost

- Latanoprostène

- Antagonistes bêta-adrénergiques

- Maléate de timolal

- Bétaxolol

- Agonistes alpha-adrénergiques

- Épinéphrine

- Dépivéprine

- Miotiques

- Pilocarpine

- Ésérine

- Analogues de la prostaglandine

- Médicaments contre la sécheresse oculaire

- Médicaments anti-inflammatoires

- Médicaments anti-inflammatoires stéroïdiens

- Médicaments anti-inflammatoires non stéroïdiens

- Médicaments contre la conjonctivite allergique

- Autres

- Médicaments anti-VEGF

- Médicaments, par type de médicament

- De marque

- Générique

- Médicaments, par ordonnance

- Ordonnance

- Sur le comptoir

- Médicaments, par voie d'administration

- Topique

- Gouttes pour les yeux

- Solution pour les yeux

- Crèmes et pommades

- Gel

- Autres

- Oculaire local

- Intravitréen

- Sous-conjonctival

- Rétrobulbaire

- Intracaméral

- Injectables

- Intramusculaire

- Intraveineux

- Autres

- Oral

- Comprimé

- Gélules

- Autres

- Autres

- Topique

- Autres

- Produits de soins de la vue

- Lunettes

- Lentilles de contact

- Lentilles de contact souples

- Lentilles de contact hybrides

- Lentilles rigides perméables au gaz

- Autres

- Produits de soins de la vue

Par maladies

- Cataracte

- Troubles de la réfraction

- Glaucome

- Dégénérescence maculaire liée à l'âge

- Maladies inflammatoires

- Autres

Par un examen complet de la vue

- Réfraction

- Réfractomètres automatiques

- Jeu de lentilles d'essai

- Médicaments cycloplégiques

- Cadre d'essai

- Rétinoscope auto-éclairé/miroir

- Cylindre croisé Jackson

- Test d'acuité visuelle

- Tableau de Snellen

- Cartes de vision de près

- Pression intraoculaire

- Tonomètres (Goldmann, Tono-Pen, Perkins, Shiotz)

- Autres

- Examen du segment antérieur et de la pupille

- Biomicroscope à lampe à fente

- Lampe torche

- Test des champs visuels

- Analyseur de champ visuel Humphrey à seuil complet Central 30-2

- Périmètre de doublage de fréquence

- Périmètre cinétique de Goldmann

- Test de vision des couleurs

- Autres

Par utilisateur final

- Cliniques

- Hôpitaux

- Soins à domicile

- Autres

Par canal de distribution

- Ventes au détail

- Commerces de détail

- Pharmacie de l'hôpital

- Pharmacie en ligne

- Appel d'offres direct

- Autres

Analyse régionale du marché de l'ophtalmologie au Moyen-Orient et en Afrique

Le marché est segmenté en fonction des produits, des maladies, de l’examen oculaire complet, de l’utilisateur final et du canal de distribution.

Les pays couverts sur le marché sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud devrait dominer le marché et connaître la croissance la plus rapide en raison de ses infrastructures de santé avancées, de ses dépenses de santé élevées et d'une population vieillissante avec une prévalence croissante des maladies oculaires. En outre, des investissements importants dans la recherche, le développement et l'adoption de technologies de pointe favorisent le leadership du marché dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Part de marché de l'ophtalmologie au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché de l'ophtalmologie au Moyen-Orient et en Afrique opérant sur le marché sont :

- Alcon (Suisse)

- Bausch + Lomb (Canada)

- Carl Zeiss Meditec (Allemagne)

- Hoya Corporation (Japon)

- Johnson & Johnson Services, Inc. (États-Unis)

- Essilor International (France)

- Topcon Corporation (Japon)

- Glaukos Corporation (États-Unis)

- Groupe Haag-Streit (Suisse)

- Nidek Co., Ltd (États-Unis)

- Staar Surgical (California)

- Ziemer Ophthalmic Systems Ag (Switzerland)

- Cooper Companies (U.S.)

- Lumenis Be Ltd. (Israel)

- Reichert Inc. (New York)

Latest Developments in Middle East and Africa Ophthalmology Market

- In October 2024, At the AAO 2024 meeting, Alcon showcased its innovations, including the Voyager DSLT for glaucoma treatment, UNIFEYE and UNIPEXY handheld gas delivery systems, and pivotal data for AR-15512, a dry eye treatment. These advancements aimed to improve outcomes and surgical efficiency

- In September 2024, EssilorLuxottica and Meta have extended their partnership, entering a long-term agreement to develop multi-generational smart eyewear products. Building on the success of Ray-Ban Meta glasses, the companies aim to shape the future of wearable technology together

- In OCTOBER 2024, Bausch + Lomb presented new scientific data and educational events at the 2024 AAO meeting in Chicago. Highlights included studies on the enVista Envy IOL, TENEO Excimer Laser, VYZULTA, and presentations on Blink Nutritears, MIEBO, and Xiidra

- In April 2024, AbbVie has completed its acquisition of Cerevel Therapeutics, enhancing its neuroscience portfolio. The acquisition includes Cerevel’s promising clinical-stage assets like Emraclidine for schizophrenia and Tavapadon for Parkinson's disease, strengthening AbbVie’s position in neurology and psychiatry

- In September, 2023, Novartis completed the divestment of its 'front of eye' ophthalmology assets to Bausch + Lomb for up to USD 2.5 billion, including USD 1.75 billion in upfront cash and potential milestone payments. The deal included Xiidra, SAF312, AcuStream, and OJL332. Novartis advanced its strategy to focus on prioritized therapeutic areas for future growth

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET : REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF EYE DISEASES

6.1.2 FOCUS ON PREVENTATIVE EYE CARE

6.1.3 GOVERNMENT EYECARE INITIATIVES

6.1.4 INNOVATIONS IN OPHTHALMIC SURGICAL TECHNIQUES

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS AND COMPLICATIONS RELATED TO EYE SURGERIES

6.2.2 LIMITED ACCESS TO SPECIALIZED OPHTHALMIC CARE IN RURAL AREAS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE AGING POPULATION

6.3.2 RISE IN ONLINE RETAIL AND E-HEALTH PLATFORMS

6.3.3 ENHANCED PATIENT EDUCATION

6.4 CHALLENGES

6.4.1 RISING COSTS OF OPHTHALMIC TREATMENTS

6.4.2 SHORTAGE OF EYE CARE PROFESSIONALS

7 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKETMIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 DEVICE

7.2.1 SURGICAL DEVICE

7.2.1.1 CATARACT SURGICAL DEVICES

7.2.1.2 OPHTHALMIC VISCOELASTIC DEVICES

7.2.1.2.1 PHACOEMULSIFICATION DEVICES

7.2.1.2.2 CATARACT SURGICAL LASERS

7.2.1.2.3 IOL INJECTORS

7.2.1.3 VITREORETINAL SURGICAL DEVICES

7.2.1.3.1 VITREORETINAL PACKS

7.2.1.3.2 VITRECTOMY MACHINES

7.2.1.3.3 VITRECTOMY PROBES

7.2.1.3.4 PHOTOCOAGULATION LASERS

7.2.1.3.5 ILLUMINATION DEVICES

7.2.1.4 REFRACTIVE SURGICAL DEVICES

7.2.1.4.1 FEMTOSECOND LASERS

7.2.1.4.2 EXCIMER LASERS

7.2.1.4.3 OTHER REFRACTIVE SURGICAL LASERS

7.2.1.5 GLAUCOMA SURGICAL DEVICES

7.2.1.5.1 GLAUCOMA DRAINAGE DEVICES

7.2.1.5.2 GLAUCOMA LASER SYSTEMS

7.2.1.5.3 MICRO INVASIVE GLAUCOMA SURGERY DEVICES

7.2.2 DIAGNOSTIC DEVICE

7.2.2.1 OPTICAL COHERENCE TOMOGRAPHY (OCT) SCANNERS

7.2.2.2 AUTOREFRACTORS & KERATOMETERS

7.2.2.3 TONOMETERS

7.2.2.4 PHOROPTERS

7.2.2.5 RETINOSCOPES

7.2.2.6 OPHTHALMOSCOPES

7.2.2.7 SLIT LAMPS

7.2.2.8 PERIMETERS/VISUAL FIELD ANALYZERS

7.2.2.9 CORNEAL TOPOGRAPHY SYSTEMS

7.2.2.10 FUNDUS CAMERAS

7.2.2.11 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

7.2.2.11.1 A- SCAN IMAGING SYSTEM

7.2.2.11.2 B-SCAN IMAGING SYSTEM

7.2.2.11.3 PACHYMETERS

7.2.2.11.4 ULTRASOUND BIOMICROSCOPES

7.2.2.12 LENSMETERS

7.2.2.13 WAVEFRONT ABERROMETERS

7.2.2.14 OPTICAL BIOMETRY SYSTEMS

7.2.2.15 SPECULAR MICROSCOPES

7.2.2.16 CHART PROJECTORS

7.2.3 OPHTHALMIC SURGICAL ACCESSORIES

7.2.3.1 SURGICAL INSTRUMENTS & KITS

7.2.3.2 OPHTHALMIC FORCEPS

7.2.3.3 OPHTHALMIC SPATULA

7.2.3.4 OPHTHALMIC TIPS AND HANDLES

7.2.3.5 OPHTHALMIC CANNULAS

7.2.3.6 OPHTHALMIC SCISSORS

7.2.3.7 OTHERS SURGICAL ACCESSORIES

7.2.4 OPHTHALMIC MICROSCOPES

7.3 DRUGS

7.3.1 ANTI-VEGF DRUGS

7.3.1.1 RANIBIZUMAB

7.3.1.2 BEVACIZUMAB

7.3.2 ANTI-GLAUCOMA DRUGS

7.3.2.1 PROSTAGLANDIN ANALOGS

7.3.2.1.1 LATANOPROST

7.3.2.1.2 BIMATOPROST

7.3.2.1.3 TRAVOPROST

7.3.2.1.4 TAFLUPROST

7.3.2.1.5 LATANOPROSTENE

7.3.2.2 BETA ADRENERGIC ANTAGONISTS

7.3.2.2.1 TIMOLAL MALEATE

7.3.2.2.2 BETAXOLOL

7.3.2.3 ALPHA ADRENERGIC AGONISTS

7.3.2.3.1 EPINEPHRINE

7.3.2.3.2 DEPIVEPRINE

7.3.2.4 MIOTICS

7.3.2.4.1 PILOCARPINE

7.3.2.4.2 ESERINE

7.3.3 ANTI-INFLAMMATION DRUGS

7.3.3.1 STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.3.2 NON-STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.4 RETINAL DISORDER DRUGS

7.3.5 DRY EYE DRUGS

7.3.6 ALLERGIC CONJUCTIVITIS DRUGS

7.3.7 OTHERS

7.3.7.1 BRANDED

7.3.7.2 GENERIC

7.3.7.3 PRESCRIPTION

7.3.7.4 OVER THE COUNTER

7.3.7.5 TOPICAL

7.3.7.6 LOCAL OCULAR

7.3.7.7 INJECTABLES

7.3.7.8 ORAL

7.3.7.9 OTHERS

7.3.7.10 EYE DROPS

7.3.7.11 EYE SOLUTION

7.3.7.12 CREAM & OINTMENTS

7.3.7.13 GEL

7.3.7.14 OTHERS

7.3.7.15 INTRAVITREAL

7.3.7.16 SUBCONJUNCTIVAL

7.3.7.17 RETROBULBAR

7.3.7.18 INTRACAMERAL

7.3.7.19 INTRAMUSCULAR

7.3.7.20 INTRAVENOUS

7.3.7.21 OTHERS

7.3.7.22 TABLET

7.3.7.23 CAPSULES

7.3.7.24 OTHERS

7.4 OTHERS

7.4.1 VISION CARE PRODUCTS

7.4.1.1 SPECTACLES

7.4.1.2 CONTACT LENSES

7.4.1.2.1 SOFT CONTACT LENSES

7.4.1.2.2 HYBRID CONTACT LENSES

7.4.1.2.3 RIGID GAS PERMEABLE LENSES

7.4.2 OTHERS

8 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISEASES

8.1 OVERVIEW

8.2 CATARACT

8.3 REFRACTIVE DISORDERS

8.4 GLAUCOMA

8.5 AGE-RELATED MACULAR DEGENERATION

8.6 INFLAMMATORY DISEASES

8.7 OTHERS

9 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION

9.1 OVERVIEW

9.2 REFRACTION

9.2.1 AUTOMATED REFRACTOMETERS

9.2.2 SET OF TRIAL LENSES

9.2.3 CYCLOPLEGIC DRUGS

9.2.4 TRIAL FRAME

9.2.5 SELF-ILLUMINATED/ MIRROR RETINOSCOPE

9.2.6 JACKSON CROSS CYLINDER

9.3 VISUAL ACUITY TEST

9.3.1 SNELLEN'S CHART

9.3.2 NEAR VISION CHARTS

9.4 INTRAOCULAR PRESSURE

9.4.1 TONOMETERS (GOLDMANN, TONO-PEN, PERKINS, SHIOTZ)

9.4.2 OTHERS

9.5 ANTERIOR SEGMENT AND PUPILLARY EXAMINATION

9.5.1 SLIT LAMP BIOMICROSCOPE

9.5.2 TORCH LIGHT

9.6 VISUAL FIELDS TEST

9.6.1 CENTRAL 30-2 FULL THRESHOLD HUMPHREY VISUAL FIELD ANALYZER

9.6.2 FREQUENCY DOUBLING PERIMETER

9.6.3 GOLDMANN KINETIC PERIMETER

9.7 COLOR VISION TEST

9.8 OTHERS

10 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICS

10.3 HOSPITALS

10.4 HOME HEALTHCARE

10.5 OTHERS

11 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 RETAIL SHOPS

11.2.2 HOSPITAL PHARMACY

11.2.3 ONLINE PHARMACY

11.3 DIRECT TENDER

11.4 OTHERS

12 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ALCON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON SERVICES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ESSILOR LUXOTTICA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BAUSCH + LOMB

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 REVENUE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBVIE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BAYER AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARL ZEISS MEDITEC AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COOPER COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.1 DOMPÉ

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 F. HOFFMANN-LA ROCHE LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 GLAUKOS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 HAAG-STREIT

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HOYA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LUMENIS BE LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NIDEK CO.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 REICHERT, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SANTEN PHARMACEUTICAL CO.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 STAAR SURGICAL

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TOPCON CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 ZIEMER OPHTHALMIC SYSTEMS AG

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA ANTI INFLAMMATION DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA CATARACT IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA REFRACTIVE DISORDERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA GLAUCOMA IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA AGE-RELATED MACULAR DEGENERATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA INFLAMMATORY DISEASES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA REFRACTION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA COLOR VISION TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA CLINICS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA HOSPITALS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA HOME HEALTHCARE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA DIRECT TENDER IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 98 SOUTH AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 99 SOUTH AFRICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 100 SOUTH AFRICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 101 SOUTH AFRICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 102 SOUTH AFRICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 103 SOUTH AFRICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 104 SOUTH AFRICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 105 SOUTH AFRICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 106 SOUTH AFRICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 107 SOUTH AFRICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 108 SOUTH AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 109 SOUTH AFRICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 110 SOUTH AFRICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 111 SOUTH AFRICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 112 SOUTH AFRICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 113 SOUTH AFRICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 114 SOUTH AFRICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 115 SOUTH AFRICA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 116 SOUTH AFRICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 117 SOUTH AFRICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 118 SOUTH AFRICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 119 SOUTH AFRICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 120 SOUTH AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 121 SOUTH AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 122 SOUTH AFRICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 123 SOUTH AFRICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 124 SOUTH AFRICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 125 SOUTH AFRICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 126 SOUTH AFRICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 127 SOUTH AFRICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 128 SOUTH AFRICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 129 SOUTH AFRICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 130 SOUTH AFRICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 131 SOUTH AFRICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 132 SOUTH AFRICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 133 SOUTH AFRICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 134 SOUTH AFRICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 135 SOUTH AFRICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 136 SAUDI ARABIA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 137 SAUDI ARABIA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 138 SAUDI ARABIA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 SAUDI ARABIA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 140 SAUDI ARABIA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 141 SAUDI ARABIA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 142 SAUDI ARABIA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 143 SAUDI ARABIA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 144 SAUDI ARABIA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 145 SAUDI ARABIA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 146 SAUDI ARABIA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 147 SAUDI ARABIA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 148 SAUDI ARABIA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 149 SAUDI ARABIA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 150 SAUDI ARABIA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 151 SAUDI ARABIA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 152 SAUDI ARABIA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 153 SAUDI ARABIA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 154 SAUDI ARABIA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 155 SAUDI ARABIA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 156 SAUDI ARABIA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 157 SAUDI ARABIA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 158 SAUDI ARABIA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 159 SAUDI ARABIA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 160 SAUDI ARABIA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 161 SAUDI ARABIA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 162 SAUDI ARABIA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 163 SAUDI ARABIA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 164 SAUDI ARABIA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 165 SAUDI ARABIA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 166 SAUDI ARABIA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 167 SAUDI ARABIA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 168 SAUDI ARABIA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 169 SAUDI ARABIA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 170 SAUDI ARABIA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 171 SAUDI ARABIA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 172 SAUDI ARABIA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 173 SAUDI ARABIA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 174 U.A.E OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 175 U.A.E DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 176 U.A.E SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 U.A.E OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 178 U.A.E VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 179 U.A.E REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 180 U.A.E GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 181 U.A.E DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 182 U.A.E OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 183 U.A.E OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 184 U.A.E DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 185 U.A.E ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 186 U.A.E ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 187 U.A.E PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 188 U.A.E BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 189 U.A.E ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 190 U.A.E MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 191 U.A.E ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 192 U.A.E OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 193 U.A.E VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 194 U.A.E CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 195 U.A.E OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 196 U.A.E DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 197 U.A.E DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 198 U.A.E DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 199 U.A.E TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 200 U.A.E LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 201 U.A.E INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 202 U.A.E ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 203 U.A.E OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 204 U.A.E REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 205 U.A.E VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 206 U.A.E INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 207 U.A.E ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 208 U.A.E VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 209 U.A.E OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 210 U.A.E OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 211 U.A.E RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 212 EGYPT OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 213 EGYPT DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 214 EGYPT SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 215 EGYPT OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 216 EGYPT VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 217 EGYPT REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 218 EGYPT GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 219 EGYPT DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 220 EGYPT OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 221 EGYPT OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 222 EGYPT DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 223 EGYPT ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 224 EGYPT ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 225 EGYPT PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 226 EGYPT BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 227 EGYPT ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 228 EGYPT MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 229 EGYPT ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 230 EGYPT OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 231 EGYPT VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 232 EGYPT CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 233 EGYPT OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 234 EGYPT DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 235 EGYPT DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 236 EGYPT DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 237 EGYPT TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 238 EGYPT LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 239 EGYPT INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 240 EGYPT ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 241 EGYPT OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 242 EGYPT REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 243 EGYPT VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 244 EGYPT INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 245 EGYPT ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 246 EGYPT VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 247 EGYPT OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 248 EGYPT OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 249 EGYPT RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 250 ISRAEL OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 251 ISRAEL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 252 ISRAEL SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 253 ISRAEL OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 254 ISRAEL VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 255 ISRAEL REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 256 ISRAEL GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 257 ISRAEL DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 258 ISRAEL OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 259 ISRAEL OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 260 ISRAEL DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 261 ISRAEL ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 262 ISRAEL ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 263 ISRAEL PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 264 ISRAEL BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 265 ISRAEL ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 266 ISRAEL MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 267 ISRAEL ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 268 ISRAEL OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 269 ISRAEL VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 270 ISRAEL CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 271 ISRAEL OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 272 ISRAEL DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 273 ISRAEL DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 274 ISRAEL DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 275 ISRAEL TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 276 ISRAEL LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 277 ISRAEL INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 278 ISRAEL ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 279 ISRAEL OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 280 ISRAEL REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 281 ISRAEL VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 282 ISRAEL INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 283 ISRAEL ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 284 ISRAEL VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 285 ISRAEL OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 286 ISRAEL OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 287 ISRAEL RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 288 REST OF MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET, BY PRODUCTS

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING INCIDENCE OF EYE DISORDERS IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET FROM 2025 TO 2032

FIGURE 15 THE PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2024

FIGURE 18 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2025-2032 (USD MILLION)

FIGURE 19 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 20 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 21 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISEASES, 2024

FIGURE 22 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISEASES, 2025-2032 (USD MILLION)

FIGURE 23 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISEASES, CAGR (2025-2032)

FIGURE 24 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 25 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2024

FIGURE 26 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2025-2032 (USD MILLION)

FIGURE 27 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, CAGR (2025-2032)

FIGURE 28 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY END USER, 2024

FIGURE 30 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 31 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 32 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL ,2024

FIGURE 34 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 35 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 36 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET SNAPSHOT

FIGURE 38 MIDDLE EAST AND AFRICA OPHTHALMOLOGY MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche