Middle East And Africa Omega 3 For Food Application Market

Taille du marché en milliards USD

TCAC :

%

USD

43.26 Million

USD

80.86 Million

2025

2033

USD

43.26 Million

USD

80.86 Million

2025

2033

| 2026 –2033 | |

| USD 43.26 Million | |

| USD 80.86 Million | |

|

|

|

|

Marché des oméga-3 pour l'alimentation au Moyen-Orient et en Afrique : segmentation par type ( acide alpha-linolénique (ALA), acide eicosapentaénoïque (EPA), acide docosahexaénoïque (DHA) et EPA + DHA), source (marine, d'algues et végétale), forme (huile et poudre), application ( aliments fonctionnels , confiserie et chocolat, nutrition sportive, compléments alimentaires , préparations pour nourrissons et autres), fonction (enrichissement des aliments, santé des os et des articulations, santé de la peau, santé des cheveux, santé des ongles et autres) – Tendances et prévisions du secteur jusqu'en 2033

Quelle est la taille et le taux de croissance du marché des oméga-3 à usage alimentaire au Moyen-Orient et en Afrique ?

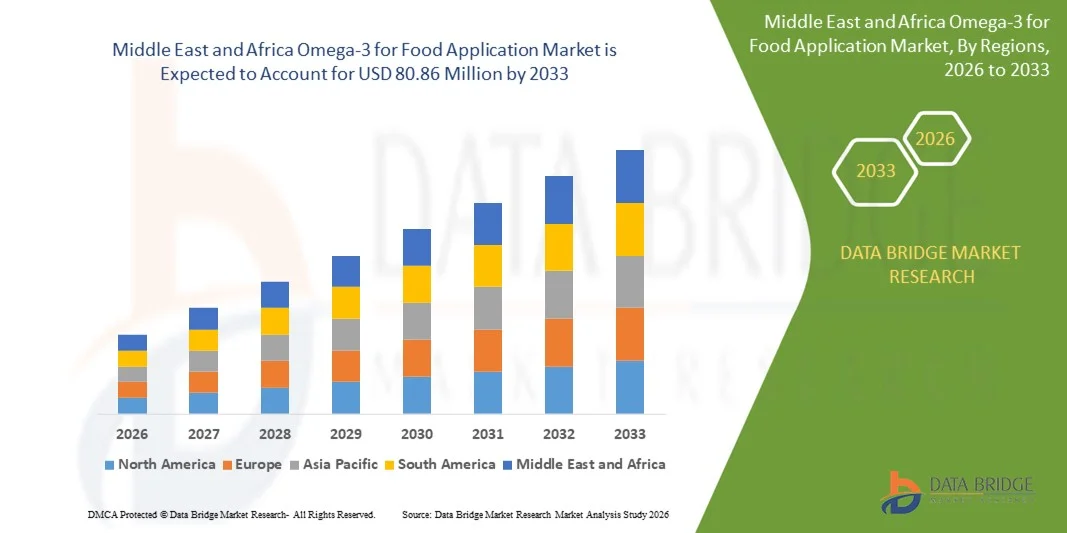

- Le marché des oméga-3 destinés à l'alimentation au Moyen-Orient et en Afrique était évalué à 43,26 millions de dollars en 2025 et devrait atteindre 80,86 millions de dollars d'ici 2033 , soit un TCAC de 8,0 % au cours de la période de prévision.

- La demande croissante des consommateurs pour des aliments fonctionnels, enrichis et axés sur la santé stimule la croissance du marché des oméga-3 dans l'alimentation. La sensibilisation accrue aux bienfaits des acides gras oméga-3 pour la santé cardiovasculaire, le soutien cognitif et les propriétés anti-inflammatoires incite les fabricants à intégrer ces ingrédients dans les produits de boulangerie, les produits laitiers, les boissons et les en-cas.

- La préférence croissante pour les produits alimentaires naturels et biologiques, conjuguée aux préoccupations liées à la consommation de sucre, à l'obésité et au diabète, accélère encore l'adoption des aliments enrichis en oméga-3. Leurs bienfaits fonctionnels, tels que leurs propriétés anti-inflammatoires, cardioprotectrices et leur soutien à la santé cérébrale, renforcent leur attrait sur les marchés du Moyen-Orient et de l'Afrique.

Quels sont les principaux enseignements du marché des oméga-3 pour les applications alimentaires ?

- La prise de conscience croissante des consommateurs en matière de santé, l'augmentation des revenus disponibles et l'évolution des préférences alimentaires sont des facteurs clés qui influencent positivement le marché des oméga-3 destinés aux applications alimentaires. De plus, les innovations produits et les nouvelles stratégies de formulation offrent des opportunités lucratives aux acteurs du marché.

- Le coût élevé des ingrédients riches en oméga-3 par rapport aux alternatives classiques, conjugué à la présence d'options d'enrichissement artificiel moins onéreuses, pourrait freiner leur développement. La faible sensibilisation des consommateurs des régions émergentes aux bienfaits des oméga-3 pour la santé devrait également constituer un obstacle à leur adoption généralisée.

- Malgré les difficultés, les efforts continus en matière de R&D, de diversification des produits et d'initiatives marketing devraient soutenir la croissance à long terme du marché des oméga-3 pour applications alimentaires au Moyen-Orient et en Afrique.

- L'Arabie saoudite a dominé le marché des oméga-3 à usage alimentaire au Moyen-Orient et en Afrique avec une part de revenus de 41,2 % en 2025, grâce à une sensibilisation croissante des consommateurs à la santé cardiaque, au développement cérébral et à la nutrition préventive dans des pays clés comme l'Arabie saoudite, l'Afrique du Sud et l'Égypte.

- L'Afrique du Sud devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 9,64 %, entre 2026 et 2033, grâce à une sensibilisation accrue à la santé cardiovasculaire, aux fonctions cognitives et à la supplémentation alimentaire. Les boissons enrichies en oméga-3, les produits laitiers et les en-cas enrichis gagnent en popularité.

- Le segment du DHA a dominé le marché avec une part de revenus de 51,6 % en 2025, grâce à son utilisation intensive dans les préparations pour nourrissons, les produits laitiers enrichis, les boissons pour la santé cérébrale et les compléments nutritionnels.

Portée du rapport et segmentation du marché des oméga-3 pour applications alimentaires

|

Attributs |

Oméga-3 pour applications alimentaires : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des oméga-3 pour les applications alimentaires ?

Demande croissante d'ingrédients alimentaires enrichis en nutriments et en multi-oméga-3

- Le marché des oméga-3 pour l'alimentation connaît une croissance significative, avec une tendance vers des formulations enrichies en nutriments, multifonctionnelles et à étiquetage clair, notamment des mélanges d'huiles végétales, d'extraits d'algues et de fibres alimentaires, afin d'améliorer la valeur nutritionnelle, le goût et les bienfaits fonctionnels.

- Les fabricants développent des solutions oméga-3 polyvalentes qui favorisent la santé cardiaque, les fonctions cognitives, possèdent des propriétés anti-inflammatoires et trouvent des applications plus larges dans les produits de boulangerie, les produits laitiers, les boissons et les produits de nutrition infantile.

- Les consommateurs recherchent de plus en plus des ingrédients oméga-3 naturels, sûrs et fonctionnels plutôt que des alternatives synthétiques, ce qui favorise leur adoption dans les secteurs de l'alimentation, des boissons et des produits nutraceutiques.

- Par exemple, des entreprises telles que DSM, BASF, Croda, ADM et Aker BioMarine ont élargi leur gamme de produits oméga-3 en introduisant des huiles microencapsulées, en poudre et mélangées, adaptées aux aliments et boissons enrichis.

- La sensibilisation croissante à la santé cardiovasculaire, à la nutrition infantile et à la consommation de produits à étiquetage clair accélère l'adoption sur les marchés du Moyen-Orient et de l'Afrique.

- Face à l'intérêt croissant des consommateurs pour la santé, la fonctionnalité et les ingrédients naturels, les oméga-3 destinés aux applications alimentaires devraient rester au cœur de l'innovation produit dans les secteurs de l'alimentation et des nutraceutiques.

Quels sont les principaux moteurs du marché des oméga-3 pour les applications alimentaires ?

- La demande croissante d'ingrédients oméga-3 fonctionnels, d'origine végétale et marine stimule fortement l'adoption des oméga-3 dans les applications alimentaires au Moyen-Orient et en Afrique.

- Par exemple, en 2025, DSM, BASF et Croda ont élargi leur gamme de produits oméga-3 microencapsulés et en poudre pour enrichir les produits laitiers, les boissons et les aliments pour nourrissons.

- La sensibilisation croissante à la santé cardiaque, au développement cérébral des nourrissons, aux bienfaits anti-inflammatoires et au soutien cognitif stimule la demande aux États-Unis, au Moyen-Orient et en Afrique.

- Les progrès réalisés dans les techniques de microencapsulation, d'extraction et de mélange ont permis d'améliorer la stabilité, le masquage du goût et la polyvalence d'application dans une large gamme d'aliments.

- La préférence croissante pour les produits alimentaires biologiques, sans OGM et à étiquetage clair soutient davantage l'expansion du marché, stimulée par des consommateurs soucieux de leur santé et de l'environnement.

- Grâce à des efforts continus en matière de R&D, au lancement de nouveaux produits, aux collaborations et à l'expansion de la distribution au Moyen-Orient et en Afrique, le marché des oméga-3 pour applications alimentaires devrait maintenir une forte croissance au cours de la période de prévision.

Quel facteur freine la croissance du marché des oméga-3 pour les applications alimentaires ?

- Les coûts élevés d'extraction, de purification et de stabilisation associés aux huiles oméga-3 d'origine marine et végétale limitent leur accessibilité dans les régions sensibles aux prix.

- Par exemple, entre 2024 et 2025, les fluctuations de la production d'huile de poisson et d'algues, de la disponibilité des matières premières et des coûts énergétiques ont eu un impact sur les volumes de production de plusieurs entreprises.

- Les exigences réglementaires strictes en matière d'approbation des nouveaux aliments, de sécurité alimentaire et de conformité de l'étiquetage ajoutent des complexités opérationnelles.

- Le manque de sensibilisation des consommateurs aux bienfaits des oméga-3 sur les systèmes cardiovasculaire et cognitif, ainsi que pour la nutrition infantile, dans les marchés émergents, freine leur adoption.

- La concurrence d'alternatives moins chères comme l'huile de lin, l'huile de chia et d'autres huiles végétales exerce une pression sur les prix et la différenciation.

- Les entreprises relèvent ces défis en se concentrant sur une extraction rentable, des formulations stables, l'harmonisation des réglementations et l'éducation des consommateurs afin d'accroître l'adoption d'oméga-3 de haute qualité pour les applications alimentaires au Moyen-Orient et en Afrique.

Comment le marché des oméga-3 pour applications alimentaires est-il segmenté ?

Le marché est segmenté en fonction du type, de la source, de la forme, des applications et de la fonction .

- Par type

Le marché des oméga-3 pour l'alimentation est segmenté en acide alpha-linolénique (ALA), acide eicosapentaénoïque (EPA), acide docosahexaénoïque (DHA) et EPA+DHA. Le segment du DHA dominait le marché en 2025, avec une part de revenus de 51,6 %, grâce à son utilisation répandue dans les préparations pour nourrissons, les produits laitiers enrichis, les boissons pour la santé cérébrale et les compléments alimentaires. Le DHA est largement plébiscité pour ses bienfaits avérés sur le développement cognitif, la santé oculaire et le fonctionnement neurologique. Sa grande stabilité sous forme microencapsulée et sa compatibilité avec les produits de boulangerie, les boissons et les formulations en poudre favorisent encore son adoption industrielle.

Le segment EPA+DHA devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de mélanges synergiques dans les aliments fonctionnels pour la santé cardiovasculaire, la nutrition sportive et les formulations anti-inflammatoires. La sensibilisation accrue à la nutrition préventive, l'augmentation de l'incidence des maladies cardiovasculaires et l'innovation produit à base de produits marins et d'algues continueront d'accélérer la demande sur les marchés du Moyen-Orient et d'Afrique.

- Par source

Le marché des oméga-3 destinés à l'alimentation est segmenté en trois catégories : oméga-3 d'origine marine, d'algues et végétale. En 2025, le segment des oméga-3 d'origine marine détenait la plus grande part de marché (58,3 %), grâce à l'abondance d'huile de poisson, d'huile de krill et de triglycérides marins concentrés utilisés dans les boissons enrichies, les produits laitiers, les pâtes à tartiner et les compléments alimentaires. Les oméga-3 d'origine marine demeurent la source la plus répandue en raison de leur teneur élevée en EPA et DHA et de leur large acceptation réglementaire dans les industries agroalimentaires du Moyen-Orient et d'Afrique.

Le segment des produits à base d'algues devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par une préférence croissante pour les alternatives végétales, durables, sans OGM et véganes, adaptées aux préparations pour nourrissons, aux boissons fonctionnelles, aux aliments à étiquetage clair et aux produits nutritionnels haut de gamme. L'augmentation des investissements dans la fermentation des microalgues, la production rentable et la durabilité environnementale favorisent encore davantage l'adoption de ces produits aux États-Unis, au Moyen-Orient et en Afrique.

- Par formulaire

Le marché est segmenté en deux catégories : huiles et poudres. Le segment des huiles a dominé le marché en 2025, représentant 67,2 % des revenus, grâce à son utilisation fréquente dans les boissons enrichies, les produits laitiers, les préparations pour nourrissons et les applications culinaires. Les huiles offrent une absorption supérieure, un haut niveau de pureté et une plus grande polyvalence dans les systèmes alimentaires traditionnels. Les huiles d’oméga-3 d’origine marine et algale demeurent la référence du secteur pour l’enrichissement en EPA et DHA, notamment dans les produits alimentaires et nutraceutiques haut de gamme.

Le segment des poudres devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à son adoption croissante dans les produits de boulangerie, les gommes à mâcher, les confiseries, les préparations sèches, les substituts de repas et les boissons en poudre. Les oméga-3 en poudre offrent une meilleure stabilité, un goût moins prononcé, une durée de conservation plus longue et une mise en mélange facile, ce qui les rend idéaux pour une utilisation industrielle à grande échelle et les fabricants d'aliments d'origine végétale.

- Par le biais des candidatures

Le marché des oméga-3 pour l'alimentation est segmenté en aliments fonctionnels, confiseries et chocolats, nutrition sportive, compléments alimentaires, préparations pour nourrissons et autres. Le segment des aliments fonctionnels dominait le marché en 2025 avec une part de revenus de 36,4 %, porté par la demande croissante d'aliments bénéfiques pour la santé cardiovasculaire, de boissons stimulant les fonctions cognitives, d'alternatives laitières enrichies, de pâtes à tartiner, de céréales et de barres énergétiques. L'intérêt grandissant des consommateurs pour une nutrition préventive et axée sur le mode de vie soutient la croissance continue de ce marché.

Le segment de la nutrition sportive devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, grâce à un intérêt croissant pour les bienfaits anti-inflammatoires, la récupération musculaire, l'amélioration de l'endurance et le soutien de la santé articulaire. La consommation accrue de poudres protéinées, de gels, de boissons hydratantes et d'aliments énergétiques enrichis en oméga-3 alimente une croissance rapide en Amérique du Nord, au Moyen-Orient et en Afrique.

- Par fonction

Le marché est segmenté en enrichissement alimentaire, santé des os et des articulations, santé de la peau, santé des cheveux, santé des ongles et autres. Le segment de l'enrichissement alimentaire a dominé le marché en 2025 avec une part de revenus de 44,8 %, grâce à l'incorporation croissante d'oméga-3 dans les produits laitiers, les boissons, les produits de boulangerie, les préparations pour nourrissons, les céréales et les en-cas nutritionnels. L'intérêt croissant des gouvernements pour l'amélioration de la nutrition, les formulations à étiquetage clair et la prévention en matière de santé favorise une adoption industrielle généralisée.

Le segment de la santé de la peau devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la demande croissante de produits de beauté naturels, d'aliments fonctionnels anti-âge, de mélanges de collagène et de produits nutritionnels validés dermatologiquement. Le rôle des oméga-3 dans l'hydratation, la réduction de l'inflammation et la réparation de la barrière cutanée favorise leur intégration dans les en-cas, les boissons et les confiseries fonctionnelles enrichis.

Quelle région détient la plus grande part du marché des oméga-3 destinés aux applications alimentaires ?

- L'Arabie saoudite a dominé le marché des oméga-3 à usage alimentaire au Moyen-Orient et en Afrique avec une part de revenus de 41,2 % en 2025, grâce à une sensibilisation croissante des consommateurs à la santé cardiaque, au développement cérébral et à la nutrition préventive dans des pays clés comme l'Arabie saoudite, l'Afrique du Sud et l'Égypte.

- L'adoption massive d'aliments enrichis, de compléments alimentaires, de boissons fonctionnelles et de produits de nutrition infantile favorise l'inclusion d'oméga-3 dans les produits laitiers, les céréales, les barres énergétiques et les formulations de nutrition sportive.

- L'augmentation des revenus disponibles, l'urbanisation et l'expansion des circuits de distribution organisés et du commerce électronique continuent d'accélérer l'adoption dans diverses catégories alimentaires.

Aperçu du marché des oméga-3 pour applications alimentaires aux Émirats arabes unis

Les Émirats arabes unis affichent une croissance soutenue, portée par une forte demande en aliments enrichis de qualité supérieure, en boissons fonctionnelles et en produits de nutrition infantile. Le niveau élevé des revenus disponibles, les modes de vie urbains et l'intérêt croissant pour la santé préventive favorisent l'intégration des oméga-3 dans les boissons lactées, les barres nutritionnelles et les boissons prêtes à consommer. L'innovation continue en matière de goût, de stabilité et de biodisponibilité contribue à une large diffusion sur le marché.

Analyse du marché sud-africain des oméga-3 pour applications alimentaires

L'Afrique du Sud devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 9,64 %, entre 2026 et 2033, grâce à une sensibilisation accrue à la santé cardiovasculaire, aux fonctions cognitives et aux compléments alimentaires. Les boissons enrichies en oméga-3, les produits laitiers et les en-cas enrichis gagnent en popularité. Le développement des plateformes de commerce électronique, la disponibilité accrue en points de vente et l'intérêt des consommateurs pour les ingrédients naturels et de qualité favorisent une adoption rapide dans les zones urbaines et périurbaines.

Analyse du marché égyptien des oméga-3 pour applications alimentaires

L'Égypte contribue de manière significative à la croissance régionale, portée par un intérêt croissant pour la nutrition fonctionnelle, les préparations pour nourrissons et les aliments enrichis. La sensibilisation accrue à la santé, la demande de soutien cognitif et cardiovasculaire et l'adoption de compléments alimentaires favorisent une consommation plus élevée d'oméga-3. Les fabricants privilégient les solutions d'EPA et de DHA d'origine végétale et algale, des profils gustatifs améliorés et le respect des normes de sécurité et de qualité alimentaires afin d'élargir leur part de marché.

Quelles sont les principales entreprises du marché des oméga-3 pour applications alimentaires ?

Le secteur des oméga-3 destinés à l'alimentation est principalement dominé par des entreprises bien établies, notamment :

- DSM (Pays-Bas)

- BASF SE (Allemagne)

- Croda International Plc (Royaume-Uni)

- Aker BioMarine (Norvège)

- ADM (Archer Daniels Midland Company) (États-Unis)

- Cellana Inc. (États-Unis)

- HUTAI Biopharm Resource Co. Ltd (Chine)

- AlaskOmega (États-Unis)

- KinOmega Biopharm Inc. (États-Unis)

- Pharma Marine AS (Norvège)

- GC Rieber VivoMega AS (Norvège)

- Sanmark LLC (États-Unis)

- Arjuna Natural Pvt Ltd (Inde)

- ConnOils LLC (États-Unis)

- Kingdomway Nutrition, Inc. (Chine)

- Polaris Inc. (États-Unis)

- Biosearch Life (Espagne)

Quels sont les développements récents sur le marché des oméga-3 à usage alimentaire au Moyen-Orient et en Afrique ?

- En mars 2025, Natac a lancé son produit Omega-3 Star, fabriqué à partir d'huile de poisson de première qualité et formulé pour des applications dans les secteurs de l'alimentation, des nutraceutiques et de la nutrition animale. Ce lancement renforce la position de l'entreprise sur le marché en pleine expansion des solutions oméga-3.

- En octobre 2023, dsm-firmenich a lancé life's OMEGA O3020 sur le marché nord-américain, présentant le premier oméga-3 d'origine algale unique dont le rapport EPA/DHA est identique à celui de l'huile de poisson standard, tout en offrant une efficacité supérieure. Ce produit devrait accélérer l'adoption des alternatives végétales aux oméga-3.

- En mai 2023, Nuseed Moyen-Orient et Afrique a lancé Nuseed Nutriterra, une huile végétale enrichie en oméga-3, spécialement conçue pour répondre aux besoins évolutifs des secteurs de la nutrition humaine et des compléments alimentaires. Cette innovation améliore la disponibilité de sources d'oméga-3 durables et non marines.

- En mars 2023, Epax a investi 40 millions de dollars dans des technologies de distillation moléculaire visant à améliorer la production et la pureté d'ingrédients oméga-3 hautement concentrés. Cet investissement souligne l'engagement de l'entreprise à développer des solutions oméga-3 de haute qualité.

- En octobre 2022, Nature's Bounty a lancé un nouveau complément alimentaire d'oméga-3 d'origine végétale, formulé avec 1 000 mg d'huile d'algues végétales pour favoriser la santé du cœur, des articulations et de la peau. Ce lancement témoigne de la demande croissante des consommateurs pour des oméga-3 naturels et végétaliens.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.