Middle East And Africa Nut Oil Market

Taille du marché en milliards USD

TCAC :

%

USD

7.13 Billion

USD

13.69 Billion

2025

2033

USD

7.13 Billion

USD

13.69 Billion

2025

2033

| 2026 –2033 | |

| USD 7.13 Billion | |

| USD 13.69 Billion | |

|

|

|

|

Segmentation du marché des huiles de noix au Moyen-Orient et en Afrique, par type de produit (huile de noisette, huile d'amande, huile d'argan, huile de macadamia, huile de marula, huile de mongongo, huile de noix de pécan, huile de pistache, huile de pignon de pin, huile de noix et autres), utilisation finale (transformation alimentaire, cosmétiques et soins personnels, aromathérapie, peintures et vernis, produits ménagers et autres), nature (biologique et conventionnelle), canal de distribution (B2B et B2C), type d'emballage (pots, bouteilles, sachets et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché de l'huile de noix au Moyen-Orient et en Afrique ?

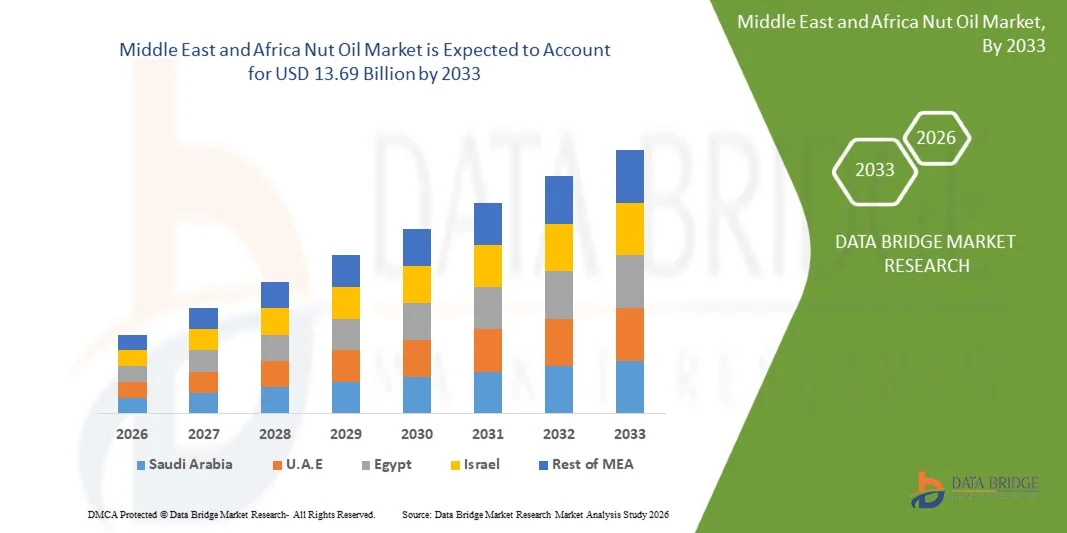

- Le marché des huiles de noix au Moyen-Orient et en Afrique était évalué à 7,13 milliards de dollars en 2025 et devrait atteindre 13,69 milliards de dollars d'ici 2033 , soit un TCAC de 8,5 % au cours de la période de prévision.

- La prise de conscience croissante des consommateurs en matière de santé, notamment concernant la cuisine saine, est un facteur essentiel de la croissance du marché. L'utilisation accrue de sous-produits de l'huile d'arachide dans l'industrie agroalimentaire, la meilleure connaissance des nombreux bienfaits des huiles de noix pour la santé (gestion du poids, amélioration de la santé cardiovasculaire et osseuse), ainsi que leur forte concentration en vitamines et antioxydants, et leur utilisation comme nettoyant, tonique pour la peau, hydratant et gel douche sont autant de facteurs qui stimulent le marché des huiles de noix au Moyen-Orient et en Afrique.

Quels sont les principaux enseignements du marché des huiles de noix ?

- L'augmentation de la population végétalienne, la montée en puissance des activités de recherche et développement et la modernisation croissante des nouveaux produits proposés sur le marché créeront de nouvelles opportunités pour le marché de l'huile de noix au Moyen-Orient et en Afrique.

- Toutefois, la problématique croissante du stockage des matières premières constitue un facteur majeur parmi d'autres freins à la croissance du marché de l'huile de noix au Moyen-Orient et en Afrique, et continuera de le complexifier au cours de la période prévisionnelle.

- L'Arabie saoudite a dominé le marché des huiles de noix au Moyen-Orient et en Afrique avec une part de marché de 32,4 % en 2025, grâce à une forte consommation d'huiles d'amande, d'argan et de noix dans l'alimentation, les cosmétiques et les produits de soins personnels.

- L'Inde devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,4 %, entre 2026 et 2033, grâce à la consommation croissante d'huiles d'amande, d'argan et de macadamia dans les domaines culinaire, des soins personnels et de l'aromathérapie.

- Le segment de l'huile d'amande a dominé le marché avec une part de revenus de 29,4 % en 2025, grâce à sa haute valeur nutritionnelle, sa polyvalence dans les applications culinaires et sa popularité dans les cosmétiques et les produits de soin de la peau.

Portée du rapport et segmentation du marché des huiles de noix

|

Attributs |

Huile de noix : principaux enseignements du marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des huiles de noix ?

« Demande croissante de produits à base d'huile de noix durables et de qualité supérieure »

- Le marché des huiles de noix connaît une tendance majeure : l’adoption croissante d’huiles durables, de haute qualité et riches en nutriments, issues de noix telles que les amandes, les noix et les noix de macadamia. Cette tendance est alimentée par une sensibilisation accrue des consommateurs à la santé, au bien-être et aux produits à étiquetage clair, notamment en Amérique du Nord et en Europe.

- Par exemple, des entreprises comme Wilmar International, ADM et Cargill élargissent leur gamme d'huiles de noix pressées à froid et biologiques pour répondre à la demande croissante d'options alimentaires bonnes pour le cœur et à base de plantes.

- La préférence croissante pour les huiles fonctionnelles enrichies en antioxydants, en acides gras oméga et en vitamines accélère l'adoption par le marché.

- Les fabricants intègrent des techniques d'extraction avancées, telles que le pressage à froid, le traitement sans solvant et les systèmes à haute pression, afin d'améliorer le rendement, la qualité et la durée de conservation.

- L'augmentation des investissements en R&D dans la préservation des saveurs, la stabilité des nutriments et les emballages écologiques stimule l'innovation produit.

- Alors que les consommateurs continuent de privilégier le bien-être, la durabilité et les huiles comestibles de haute qualité, les huiles de noix de première qualité devraient rester un élément central du marché mondial des huiles comestibles.

Quels sont les principaux moteurs du marché des huiles de noix ?

- L'intérêt croissant des consommateurs pour la santé cardiaque, l'immunité et les régimes alimentaires à base de plantes est un moteur majeur de l'expansion du marché.

- Par exemple, en 2025, Wilmar International et Cargill ont lancé des huiles de noix haut de gamme pressées à froid et enrichies, destinées aux consommateurs soucieux de leur santé dans le monde entier.

- La sensibilisation croissante aux huiles biologiques, sans OGM et à étiquetage clair favorise leur adoption en Amérique du Nord, en Europe, au Moyen-Orient et en Afrique.

- Les progrès technologiques en matière d'extraction, de filtration et de préservation des nutriments de l'huile améliorent la qualité du produit et son attrait pour les consommateurs.

- L'intégration croissante des pratiques d'approvisionnement durable, des systèmes de traçabilité et des emballages écologiques renforce la croissance du marché.

- Grâce à des investissements continus dans la R&D, le développement de produits fonctionnels et l'éducation des consommateurs, le marché des huiles de noix devrait maintenir une forte dynamique de croissance au cours des prochaines années.

Quel facteur freine la croissance du marché des huiles de noix ?

- Les coûts de production élevés associés à l'approvisionnement en noix de première qualité, à l'extraction par pression à froid et aux tests de qualité limitent l'accessibilité, notamment sur les marchés sensibles aux prix.

- Par exemple, entre 2024 et 2025, les fluctuations des prix des matières premières (noix), des coûts énergétiques et des composants d'emballage ont affecté les volumes de production et les prix des principaux acteurs.

- La conformité réglementaire en matière de sécurité alimentaire, d'étiquetage et de certifications biologiques accroît la complexité et les coûts opérationnels.

- Le manque de sensibilisation des consommateurs sur les marchés émergents aux huiles de noix fonctionnelles et de qualité supérieure freine leur adoption à grande échelle.

- La concurrence des huiles alimentaires traditionnelles, des huiles mélangées et des alternatives à bas coût exerce une pression sur les prix et affecte la pénétration du marché.

- Pour relever ces défis, les entreprises se concentrent sur un approvisionnement durable, des méthodes d'extraction rentables, des gammes de produits enrichis et des programmes d'éducation des consommateurs afin de proposer des huiles de noix de haute qualité, nutritives et haut de gamme.

Comment le marché des huiles de noix est-il segmenté ?

Le marché est segmenté en fonction du type de produit, de l'utilisation finale, de la nature, du canal de distribution et du type d'emballage .

• Par type de produit

Le marché des huiles de noix est segmenté, selon le type de produit, en huiles de noisette, d'amande, d'argan, de macadamia, de marula, de mongongo, de noix de pécan, de pistache, de pignon de pin, de noix et autres. En 2025, le segment de l'huile d'amande dominait le marché avec une part de revenus de 29,4 %, grâce à sa haute valeur nutritionnelle, sa polyvalence en cuisine et sa popularité dans les cosmétiques et les produits de soin de la peau.

L'huile de macadamia devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, alimentée par la demande croissante d'huiles spéciales dans la cuisine gastronomique, les soins de la peau haut de gamme et les formulations cosmétiques anti-âge.

• Par utilisation finale

Selon l'utilisation finale, le marché est segmenté en transformation alimentaire, cosmétiques et soins personnels, aromathérapie, peintures et vernis, produits ménagers et autres. Le segment de la transformation alimentaire a dominé le marché en 2025 avec une part de revenus de 34,6 %, grâce à la préférence croissante des consommateurs pour les huiles de cuisson saines, riches en acides gras insaturés et en oméga-3.

Le secteur des cosmétiques et des soins personnels devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, soutenu par l'essor des produits de beauté naturels et à base de plantes incorporant des huiles de noix pour l'hydratation de la peau et leurs bienfaits anti-âge.

• Par nature

Selon leur nature, le marché des huiles de noix se divise en deux segments : biologiques et conventionnelles. Le segment conventionnel dominait le marché en 2025 avec 61,2 % des parts de marché, grâce à sa large disponibilité, son prix abordable et son utilisation dans les industries agroalimentaire et cosmétique.

On prévoit que les huiles de noix biologiques connaîtront le taux de croissance annuel composé le plus rapide entre 2026 et 2033, sous l'effet d'une sensibilisation accrue des consommateurs aux huiles sans produits chimiques et issues de sources durables, ainsi que d'une demande croissante de produits à étiquetage clair.

• Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en B2B et B2C. Le segment B2B a dominé avec une part de revenus de 53,5 % en 2025, alimentée par les achats à grande échelle des fabricants de produits alimentaires, des marques de cosmétiques et des entreprises nutraceutiques cherchant à s'approvisionner en huiles de noix en gros.

Le segment B2C devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à l'expansion des plateformes de commerce électronique, aux ventes directes aux consommateurs et aux livraisons par abonnement d'huiles de noix biologiques et de spécialité.

• Par type d'emballage

Le marché des huiles de noix est segmenté selon le type de conditionnement : pots, bouteilles, sachets et autres. Le segment des bouteilles a dominé le marché en 2025 avec 47,8 % des parts de marché, grâce à leur facilité de stockage, leur large acceptation par les consommateurs et leur adéquation aux applications commerciales et industrielles.

On prévoit que les sachets connaîtront le taux de croissance annuel composé le plus rapide entre 2026 et 2033, grâce à des solutions d'emballage légères, écologiques et pratiques répondant aux besoins des consommateurs modernes et aux initiatives de produits durables.

Quelle région détient la plus grande part du marché des huiles de noix ?

- L'Arabie saoudite a dominé le marché des huiles de noix au Moyen-Orient et en Afrique avec une part de marché de 32,4 % en 2025, grâce à une forte consommation d'huiles d'amande, d'argan et de noix dans l'alimentation, les cosmétiques et les produits de soins personnels.

- La prise de conscience croissante en matière de santé, la préférence pour les huiles végétales et biologiques, ainsi que les investissements dans des installations modernes d'extraction et de conditionnement renforcent la position de leader du marché. L'urbanisation, l'augmentation des revenus disponibles et la demande d'huiles fonctionnelles et naturelles accélèrent encore leur adoption.

Analyse du marché de l'huile de noix aux Émirats arabes unis

Les Émirats arabes unis devraient connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 7,9 %, entre 2026 et 2033, grâce à la popularité des huiles de noix de qualité supérieure telles que la macadamia, l'argan et la pistache dans les cosmétiques, l'alimentation et l'aromathérapie. L'expansion des circuits de distribution, l'essor du commerce électronique et la sensibilisation croissante à la santé soutiennent la croissance du marché. Les investissements dans les technologies de pression à froid, les emballages durables et l'importation d'huiles de haute qualité favorisent la pénétration du marché et répondent à la demande croissante d'huiles de noix naturelles et fonctionnelles.

Analyse du marché de l'huile de noix en Afrique du Sud

L'Afrique du Sud contribue de manière constante à la croissance régionale, portée par la demande croissante d'huiles de noix, de marula et d'amande dans les produits alimentaires et cosmétiques. Les consommateurs privilégient de plus en plus les huiles biologiques et fonctionnelles, incitant les fabricants à investir dans des formulations à valeur ajoutée, des emballages haut de gamme et un approvisionnement durable. La croissance de la population urbaine et la prise de conscience accrue des enjeux de santé favorisent également l'adoption de ces huiles. Les partenariats stratégiques et les opportunités d'exportation d'huiles de noix de haute qualité devraient consolider la position du pays sur le marché du Moyen-Orient et de l'Afrique.

Analyse du marché de l'huile de noix en Égypte

L'Égypte s'impose comme un marché clé, portée par les secteurs culinaire, cosmétique et nutraceutique. La sensibilisation croissante aux bienfaits des huiles et l'augmentation des importations d'huiles d'amande, de macadamia et de pistache stimulent la consommation. Le développement de la distribution, la multiplication des magasins spécialisés et la pénétration du e-commerce facilitent l'accès à des huiles de qualité supérieure et fonctionnelles. Les consommateurs privilégient de plus en plus les huiles biologiques, végétales et pressées à froid, ce qui alimente la demande de produits haut de gamme. Les investissements dans les infrastructures de transformation devraient favoriser une croissance durable du marché dans la région.

Analyse du marché de l'huile de noix au Maroc

Le Maroc est un contributeur majeur, notamment pour les huiles d'argan et d'amande utilisées en cosmétique et en cuisine. Les investissements dans une agriculture durable, des techniques modernes d'extraction et une production orientée vers l'exportation renforcent le potentiel du marché. L'urbanisation croissante, l'augmentation des revenus disponibles et la préférence pour les huiles végétales, biologiques et fonctionnelles stimulent leur adoption. Le soutien gouvernemental à la production locale et au commerce international contribue à l'expansion des marchés. Le positionnement haut de gamme des huiles d'argan et d'amande sur les marchés mondiaux consolide la position du Maroc dans le secteur des huiles de noix au Moyen-Orient et en Afrique.

Quelles sont les principales entreprises du marché des huiles de noix ?

L'industrie des huiles de noix est principalement dominée par des entreprises bien établies, notamment :

- Caloy Company, LP (États-Unis)

- Wilmar International Ltd (Singapour)

- Commerce équitable international (Allemagne)

- ADM (Archer Daniels Midland) (États-Unis)

- Bunge Limited (Suisse)

- FUJI OIL CO., LTD. (Japon)

- Gustav Heess Oleochemische Erzeugnisse GmbH (Allemagne)

- Huiles naturelles internationales Inc (États-Unis)

- Cargill, Incorporated (États-Unis)

- CHS Inc. (États-Unis)

- Mazola (États-Unis)

- Biofinest (États-Unis)

- Natural Sourcing, LLC (États-Unis)

- Liberty Vegetable Oil Company (États-Unis)

Quels sont les développements récents sur le marché de l'huile de noix au Moyen-Orient et en Afrique ?

- En octobre 2024, Texas A&M Agri Life Research, l'un des plus importants organismes de recherche et de développement technologique du Texas, a annoncé la mise au point d'une variété d'arachide à haute teneur en huile afin d'accroître la production d'arachides à haute teneur en huile, marquant ainsi une étape importante dans l'innovation agricole.

- En septembre 2024, Fassoum Peanut Oil, une entreprise nigériane spécialisée dans les huiles et les produits dérivés, a rejoint le programme LaunchUp de FasterCapital, une société de capital-risque basée à Dubaï, afin de soutenir les jeunes entreprises, d'améliorer leurs opérations et de renforcer leur présence mondiale, contribuant ainsi à la croissance de l'industrie de l'huile d'arachide.

- En mai 2023, Singireddy Niranjan Reddy, ministre de l'Agriculture du Telangana, a lancé l'huile d'arachide de marque Vijaya en présence du président de la Fédération des producteurs d'huile et d'autres personnalités, promouvant ainsi la production locale d'huile d'arachide de haute qualité.

- En avril 2022, Gemini Edibles and Fats India Ltd. (GEF India) a lancé un bidon de cinq litres d'huile d'arachide sous sa marque Freedom, offrant une saveur de noisette très appréciée pour la préparation de pickles dans toute l'Inde, confortant ainsi le choix des consommateurs pour les huiles de cuisson traditionnelles.

- En mars 2020, Dhara, une marque indienne populaire d'huile de cuisson, a lancé la campagne « Moulue en Inde » afin d'encourager les consommateurs à choisir des huiles filtrées locales telles que l'huile d'arachide Kachi Ghani et l'huile de moutarde, soulignant ainsi l'importance des huiles produites localement.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.