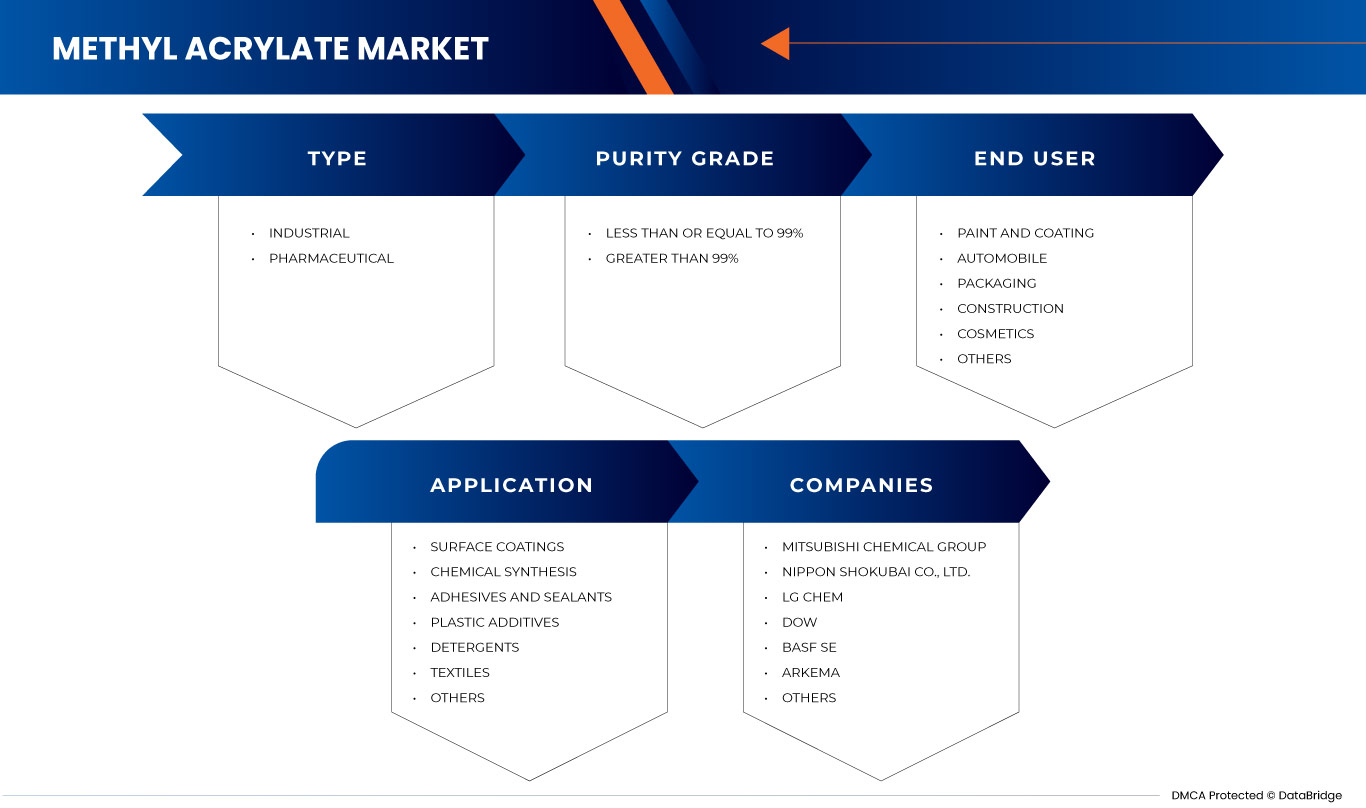

Marché de l'acrylate de méthyle au Moyen-Orient et en Afrique, par type (industriel et pharmaceutique), degré de pureté (inférieur ou égal à 99 % et supérieur à 99 %), application (revêtements de surface, synthèse chimique, adhésifs et produits d'étanchéité, additifs plastiques , détergents, textiles et autres), utilisateur final (peinture et revêtement, automobile, emballage, construction, cosmétiques et autres) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de l'acrylate de méthyle au Moyen-Orient et en Afrique

L'acrylate de méthyle est utilisé comme intermédiaire chimique dans la production d'autres produits chimiques tels que l'acide acrylique et l'acrylamide. Il est également utilisé comme solvant pour diverses résines, huiles et cires.

Cependant, l'acrylate de méthyle est un produit chimique dangereux qui doit être manipulé avec précaution. Il est inflammable et peut former des peroxydes explosifs au contact de l'air. Il peut également provoquer une irritation de la peau et des yeux et est toxique en cas d'ingestion ou d'inhalation.

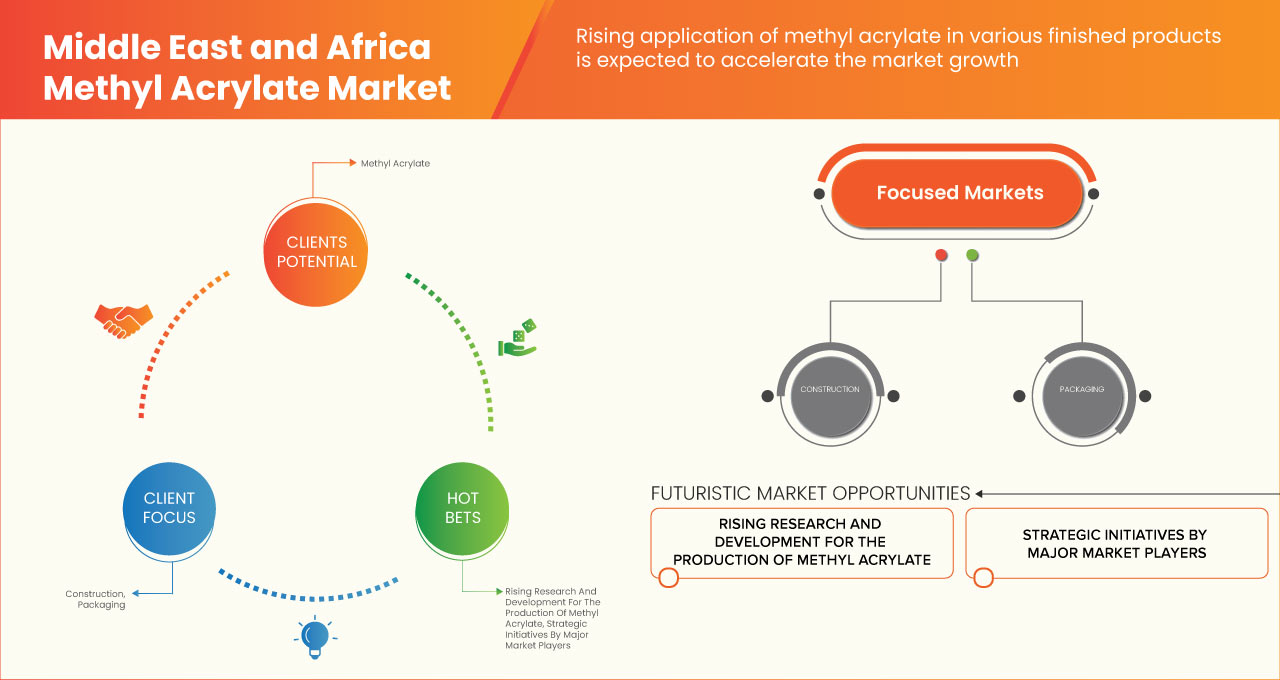

Le marché de l'acrylate de méthyle est principalement déterminé par la demande pour ses utilisations finales, en particulier dans les industries des revêtements et des adhésifs. Des facteurs tels que la disponibilité des matières premières, les politiques réglementaires et les avancées technologiques influencent également la demande d'acrylate de méthyle.

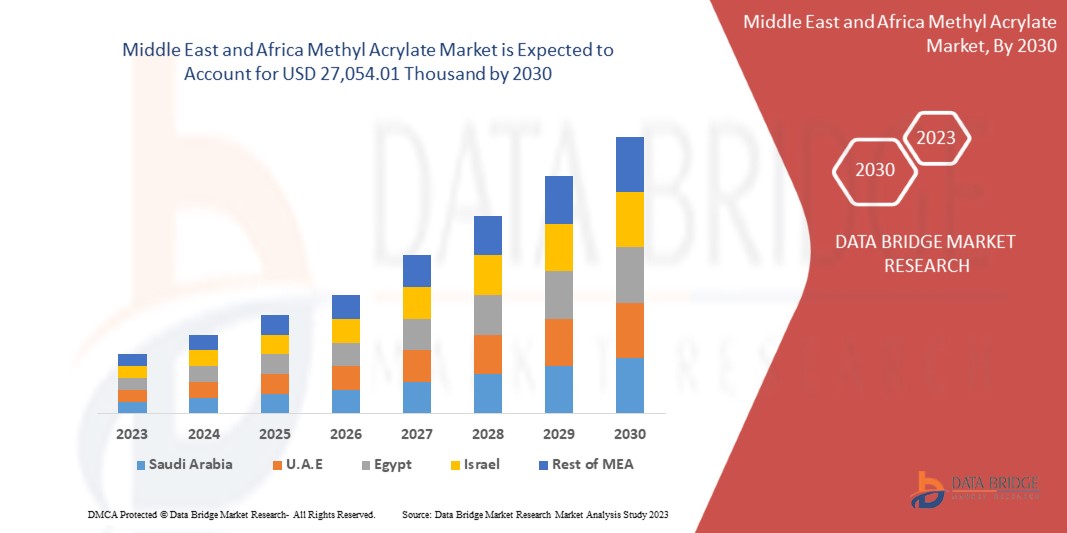

Selon les analyses de Data Bridge Market Research, le marché de l'acrylate de méthyle au Moyen-Orient et en Afrique devrait atteindre la valeur de 27 054,01 milliers USD d'ici 2030, à un TCAC de 3,7 % au cours de la période de prévision. Le segment de type représente le segment le plus important du marché en raison de l'utilisation croissante de l'acrylate de méthyle dans diverses applications industrielles.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en tonnes et prix en USD |

|

Segments couverts |

Par type (industriel et pharmaceutique), degré de pureté (inférieur ou égal à 99 % et supérieur à 99 %), application (revêtements de surface, synthèse chimique, adhésifs et produits d'étanchéité, additifs plastiques, détergents, textiles et autres), utilisateur final (peinture et revêtement, automobile, emballage, construction, cosmétiques et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su et SHANGDONG KAITAI PETROCHEMICAL Co., LTD., entre autres |

Définition du marché

L'acrylate de méthyle est un composé organique dont la formule chimique est CH2=CHCOOCH3. Il s'agit d'un ester d'acide acrylique et de méthanol, également connu sous le nom de propionate de méthyle. L'acrylate de méthyle est un liquide incolore à forte odeur piquante et hautement inflammable. Il est soluble dans la plupart des solvants organiques, y compris l'eau.

L'acrylate de méthyle est principalement utilisé comme élément de base dans la production de divers produits chimiques tels que les polymères, les revêtements, les adhésifs et les textiles. Il est utilisé dans la production de poly(acrylate de méthyle) et de poly(méthacrylate de méthyle), qui sont largement utilisés dans la production de peintures, d'adhésifs et de revêtements. Il est également utilisé comme agent de réticulation pour divers polymères.

L'acrylate de méthyle est un monomère réactif souvent utilisé dans la préparation de copolymères. Il est souvent copolymérisé avec d'autres monomères, tels que l'acrylate d'éthyle, l'acrylate de butyle ou le styrène, pour améliorer les propriétés du polymère obtenu, telles que la résistance et l'adhérence.

Dynamique du marché de l'acrylate de méthyle au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- Demande croissante de produits à base d'acrylate de méthyle

L'acrylate de méthyle stabilisé est un liquide volatil incolore à l'odeur piquante. Ses vapeurs peuvent irriter les yeux et le système respiratoire. Il est très toxique en cas d'inhalation, d'ingestion ou de contact avec la peau. Il est moins dense que l'eau (0,957 g/cm3) et peu soluble dans l'eau, il flotte donc sur l'eau. Ses vapeurs sont plus lourdes que l'air. C'est une matière première dans des applications telles que les fibres acryliques, les traitements des fibres, les résines de moulage, les adhésifs, les peintures, les revêtements et les émulsions.

L'acrylate de méthyle est utilisé dans de nombreux secteurs industriels, notamment les revêtements, les adhésifs, les textiles et les plastiques. La croissance de ces secteurs devrait accroître la demande en acrylate de méthyle.

Ainsi, l’augmentation de la demande de produits à base d’acrylate de méthyle agit comme un moteur de croissance du marché.

- Progrès technologique dans le processus de fabrication de l'acrylate de méthyle

L'acrylate de méthyle est souvent utilisé dans la production de polymères et de résines, notamment de fibres acryliques, de revêtements et d'adhésifs. Il est également utilisé comme matière première dans la synthèse de divers produits chimiques, notamment des produits chimiques agricoles, des médicaments et des parfums.

La méthode traditionnelle de fabrication de l'acrylate de méthyle implique la réaction de l'acide acrylique avec du méthanol en présence d'un catalyseur. La réaction est exothermique et nécessite généralement un refroidissement pour contrôler la température.

Ainsi, les progrès technologiques dans le processus de fabrication de l’acrylate de méthyle agissent comme un moteur de croissance du marché.

RETENUE

- Le coût fluctuant des matières premières utilisées dans la production d'acrylate de méthyle

L'acrylate de méthyle est principalement obtenu à partir de produits pétrochimiques, et toute fluctuation du prix du pétrole brut peut affecter considérablement les coûts de production de l'acrylate de méthyle.

L'une des matières premières les plus importantes pour la production d'acrylate de méthyle est le propylène, qui est obtenu à partir du pétrole brut ou du gaz naturel. Par conséquent, les fluctuations des prix de ces produits peuvent affecter considérablement le prix du propylène et donc le coût total de production de l'acrylate de méthyle.

Le pétrole brut est la principale matière première utilisée dans la production de nombreux produits chimiques, notamment le propylène, utilisé dans la production d'acrylate de méthyle. Par conséquent, les fluctuations du prix du pétrole brut peuvent affecter considérablement les coûts de production de l'acrylate de méthyle.

OPPORTUNITÉ

-

Demande croissante de produits durables et écologiques

Les tendances en matière de production de produits à base d’acrylate de méthyle durables et respectueux de l’environnement augmentent la demande d’acrylate de méthyle sur le marché.

L'utilisation croissante de produits à base d'acrylate de méthyle durables et respectueux de l'environnement reflète une prise de conscience croissante de l'importance de la durabilité environnementale dans la production chimique. En adoptant des pratiques plus durables et en développant des produits écologiques, l'industrie s'efforce de minimiser son impact environnemental et de répondre aux besoins changeants des clients.

La préoccupation croissante pour l'environnement accroît la demande de produits durables et respectueux de l'environnement. L'acrylate de méthyle est une alternative durable aux produits pétrochimiques traditionnels et peut offrir des opportunités de croissance dans ce domaine.

Ainsi, la demande croissante de produits durables et respectueux de l’environnement constitue une opportunité de croissance du marché.

DÉFI

- Réglementation gouvernementale stricte concernant l'utilisation de l'acrylate de méthyle

Les réglementations gouvernementales concernant l'utilisation de l'acrylate de méthyle varient selon les pays et les régions. Cependant, certaines juridictions ont imposé des réglementations strictes en raison des préoccupations concernant les effets potentiels du composé sur la santé et l'environnement.

Conformément au règlement REACH, les entreprises qui produisent ou importent plus d'une tonne d'acrylate de méthyle par an doivent l'enregistrer auprès de l'Agence européenne des produits chimiques (ECHA). Le processus d'enregistrement consiste à fournir des informations sur les propriétés et les utilisations de la substance, ainsi que sur le danger potentiel qu'elle peut présenter pour la santé humaine ou l'environnement.

En général, la réglementation REACH relative à l'acrylate de méthyle vise à garantir que sa production, son importation et son utilisation sont sûres et ne présentent aucun risque pour la santé humaine ou l'environnement. Les entreprises qui utilisent ou produisent de l'acrylate de méthyle dans l'UE doivent se conformer à cette réglementation pour éviter d'éventuelles sanctions juridiques et financières.

Par conséquent, les réglementations gouvernementales strictes concernant l’utilisation de l’acrylate de méthyle constituent un défi à la croissance du marché.

Développement récent

- En juin 2020, Merck KGaA a reçu l'approbation de BAVENCIO, une thérapie à base de cellules NK ciblant PD-L1 pour le traitement du carcinome urothélial localement avancé ou métastatique. Cette approbation a permis à l'entreprise d'améliorer son portefeuille de produits pour le traitement du cancer.

Portée du marché de l'acrylate de méthyle au Moyen-Orient et en Afrique

Le marché de l'acrylate de méthyle au Moyen-Orient et en Afrique est segmenté en quatre segments notables tels que le type, le degré de pureté, l'application et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par type

- Industriel

- Pharmaceutique

Sur la base du type, le marché est segmenté en industriel et pharmaceutique.

Par degré de pureté

- Inférieur ou égal à 99 %

- Plus de 99%

Sur la base du degré de pureté, le marché est segmenté en inférieur ou égal à 99 % et supérieur à 99 %.

Par application

- Revêtements de surface

- Adhésifs et produits d'étanchéité

- Textiles

- Additifs plastiques

- Synthèse chimique

- Détergents

- Autres

En fonction des applications, le marché est segmenté en revêtements de surface, synthèse chimique, adhésifs et produits d'étanchéité, additifs plastiques, détergents, textiles et autres.

Par utilisateur final

- Peinture et revêtement

- Automobile

- Conditionnement

- Construction

- Produits de beauté

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en peinture et revêtement, automobile, emballage, construction, cosmétiques et autres.

Analyse/perspectives régionales du marché de l'acrylate de méthyle au Moyen-Orient et en Afrique

Le marché de l’acrylate de méthyle au Moyen-Orient et en Afrique est segmenté en quatre segments notables en fonction du type, du degré de pureté, de l’application et de l’utilisateur final.

Les pays couverts dans ce rapport de marché sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël et le reste du Moyen-Orient et de l’Afrique.

L’Arabie saoudite domine le marché en raison de l’augmentation des progrès technologiques dans les produits à base d’acrylate de méthyle.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'acrylate de méthyle au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché de l'acrylate de méthyle au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché de l'acrylate de méthyle au Moyen-Orient et en Afrique sont Mitsubishi Chemical Group, NIPPON SHOKUBAI CO., LTD., LG Chem, Dow, BASF SE, Arkema, DuPont, EVONIK, Merck KGaA, Solventis, Shanghai Huayi Acrylic Acid Co., Ltd., SIBUR INTERNATIONAL, Nouryon, Jurong Group Su et SHANGDONG KAITAI PETROCHEMICAL Co., LTD. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 RAW MATERIAL COVERAGE

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 TRADE SCENARIO

4.3.1 OVERVIEW

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.5 PORTER’S FIVE FORCES

4.6 VENDOR SELECTION CRITERIA

4.7 PESTEL ANALYSIS

4.8 REGULATION COVERAGE

4.9 EXCLUSIVE LIST OF POTENTIAL BUYERS

4.1 EXCLUSIVE PRODUCTS LIST MADE FROM METHYL ACRYLATE WITH ESTIMATED %

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 PRICE INDEX

7 SUPPLY CHAIN ANALYSIS

8 PRODUCTION CAPACITY OVERVIEW

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS

9.1.2 TECHNOLOGICAL ADVANCEMENT IN THE MANUFACTURING PROCESS OF METHYL ACRYLATE

9.1.3 GROWING AWARENESS REGARDING PROPERTIES OF METHYL ACRYLATE

9.2 RESTRAINTS

9.2.1 FLUCTUATING COST OF RAW MATERIALS USED IN METHYL ACRYLATE PRODUCTION

9.2.2 AVAILABILITY OF SUBSTITUTES FOR METHYL ACRYLATE

9.3 OPPORTUNITIES

9.3.1 INCREASING DEMAND FOR SUSTAINABLE AND ECOFRIENDLY PRODUCTS

9.3.2 DEVELOPMENT OF NEW APPLICATIONS USING METHYL ACRYLATE

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING THE USE OF METHYL ACRYLATE

9.4.2 HEALTH AND SAFETY CONCERNS ASSOCIATED WITH THE USE OF METHYL ACRYLATE

10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE

10.1 OVERVIEW

10.2 INDUSTRIAL

10.3 PHARMACEUTICAL

11 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE

11.1 OVERVIEW

11.2 GREATER THAN 99%

11.3 LESS THAN OR EQUAL TO 99%

12 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SURFACE COATINGS

12.3 ADHESIVES AND SEALANTS

12.4 TEXTILES

12.5 PLASTIC ADDITIVES

12.6 CHEMICAL SYNTHESIS

12.7 DETERGENTS

12.8 OTHERS

13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY END USER

13.1 OVERVIEW

13.2 PAINT AND COATING

13.2.1 GREATER THAN 99%

13.2.2 LESS THAN OR EQUAL TO 99%

13.3 AUTOMOBILE

13.3.1 GREATER THAN 99%

13.3.2 LESS THAN OR EQUAL TO 99%

13.4 PACKAGING

13.4.1 GREATER THAN 99%

13.4.2 LESS THAN OR EQUAL TO 99%

13.5 CONSTRUCTION

13.5.1 GREATER THAN 99%

13.5.2 LESS THAN OR EQUAL TO 99%

13.6 COSMETICS

13.6.1 GREATER THAN 99%

13.6.2 LESS THAN OR EQUAL TO 99%

13.7 OTHERS

14 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UNITED ARAB EMIRATES

14.1.3 SOUTH AFRICA

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MITSUBISHI CHEMICAL GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BASF SE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 LG CHEM

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 NIPPON SHOKUBAI CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ARKEMA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 DOW

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 DUPONT

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 EVONIK

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 JURONG GROUP SU

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 MERCK KGAA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 NOURYON

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGDONG KAITAI PETROCHEMICAL CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SHANGHAI HUAYI ACRYLIC ACID CO. LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 SIBUR INTERNATIONAL

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SOLVENTIS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 LIST OF TRADERS

TABLE 2 POTENTIAL BUYERS OF METHYL ACRYLATE

TABLE 3 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, ESTIMATED SHARE BY APPLICATION, 2022

TABLE 4 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021 AND 2022 (ASP IN TONS)

TABLE 5 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 7 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (ASP IN TONS)

TABLE 8 MIDDLE EAST & AFRICA INDUSTRIAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA GREATER THAN 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA LESS THAN OR EQUAL TO 99% IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SURFACE COATINGS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA ADHESIVES AND SEALANTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA TEXTILES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA PLASTIC ADDITIVES IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CHEMICAL SYNTHESIS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA DETERGENTS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN METHYL ACRYLATE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY COUNTRY, 2021-2030 (USD TONS)

TABLE 35 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 37 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 45 SAUDI ARABIA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 47 SAUDI ARABIA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 55 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 57 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 58 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 UNITED ARAB EMIRATES METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 60 UNITED ARAB EMIRATES PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 61 UNITED ARAB EMIRATES AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 62 UNITED ARAB EMIRATES PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 63 UNITED ARAB EMIRATES CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 64 UNITED ARAB EMIRATES COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SOUTH AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 67 SOUTH AFRICA METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH AFRICA METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 SOUTH AFRICA METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH AFRICA PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH AFRICA AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 77 EGYPT METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 83 EGYPT CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 84 EGYPT COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 85 ISRAEL METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 ISRAEL METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD TONS)

TABLE 87 ISRAEL METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 88 ISRAEL METHYL ACRYLATE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 89 ISRAEL METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 90 ISRAEL PAINT AND COATING IN METHYL ACRYLATE MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 91 ISRAEL AUTOMOBILE IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 92 ISRAEL PACKAGING IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 93 ISRAEL CONSTRUCTION IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 94 ISRAEL COSMETICS IN METHYL ACRYLATE MARKET, BY PURITY GRADE, 2021-2030 (USD THOUSAND)

TABLE 95 REST OF MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET

FIGURE 2 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR METHYL ACRYLATE-BASED PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET

FIGURE 17 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 19 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 20 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2022

FIGURE 22 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, 2023-2030 (USD THOUSAND)

FIGURE 23 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, CAGR (2023-2030)

FIGURE 24 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY PURITY GRADE, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, 2022

FIGURE 26 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 27 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 28 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, 2022

FIGURE 30 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 31 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: SNAPSHOT (2022)

FIGURE 34 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2022)

FIGURE 35 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 MIDDLE EAST AND AFRICA METHYL ACRYLATE MARKET: TYPE (2023-2030)

FIGURE 38 MIDDLE EAST & AFRICA METHYL ACRYLATE MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.